What is the Tuberculosis Diagnostics Market Size?

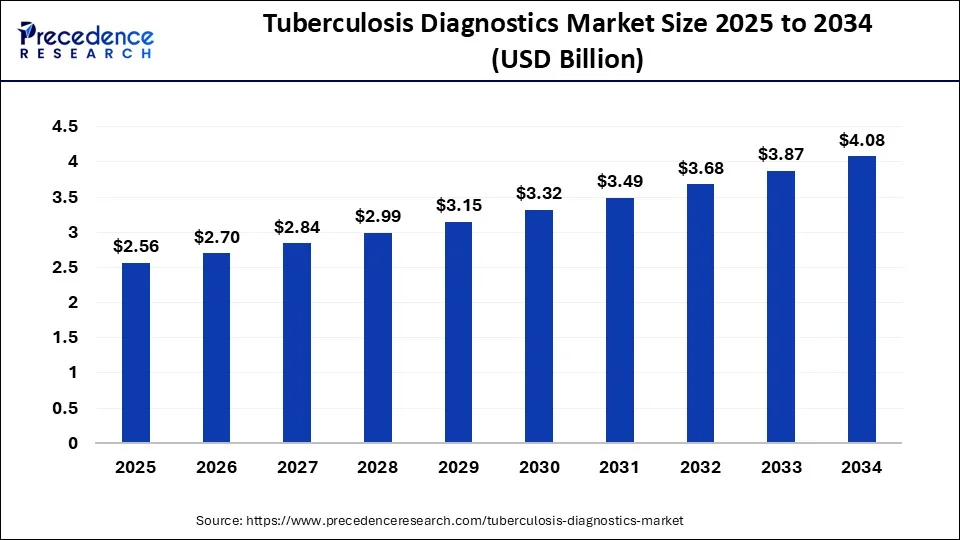

The global tuberculosis diagnostics market size is valued at USD 2.56 billion in 2025 and is predicted to increase from USD 2.70 billion in 2026 to approximately USD 4.08 billion by 2034, expanding at a CAGR of 5.32% from 2025 to 2034.

Tuberculosis Diagnostics Market Key Takeaways

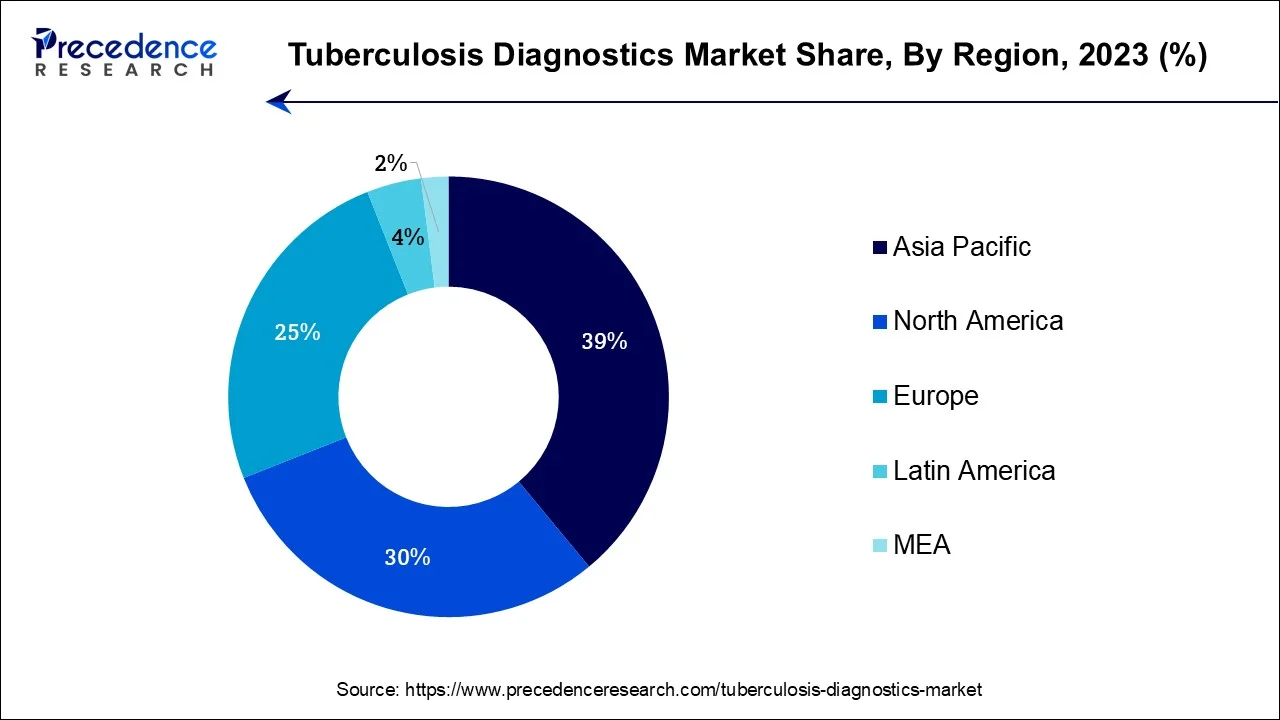

- Asia-Pacific contributed more than 39% of revenue share in 2024

- North America is projected to grow at a notable CAGR of 8.1% during the forecast period.

- By Test Type, the diagnostic laboratory segment has held the major revenue share of 42% in 2024.

- By Test Type, the cytokine detection assay segment is anticipated to grow at a CAGR of 7.7% during the projected period.

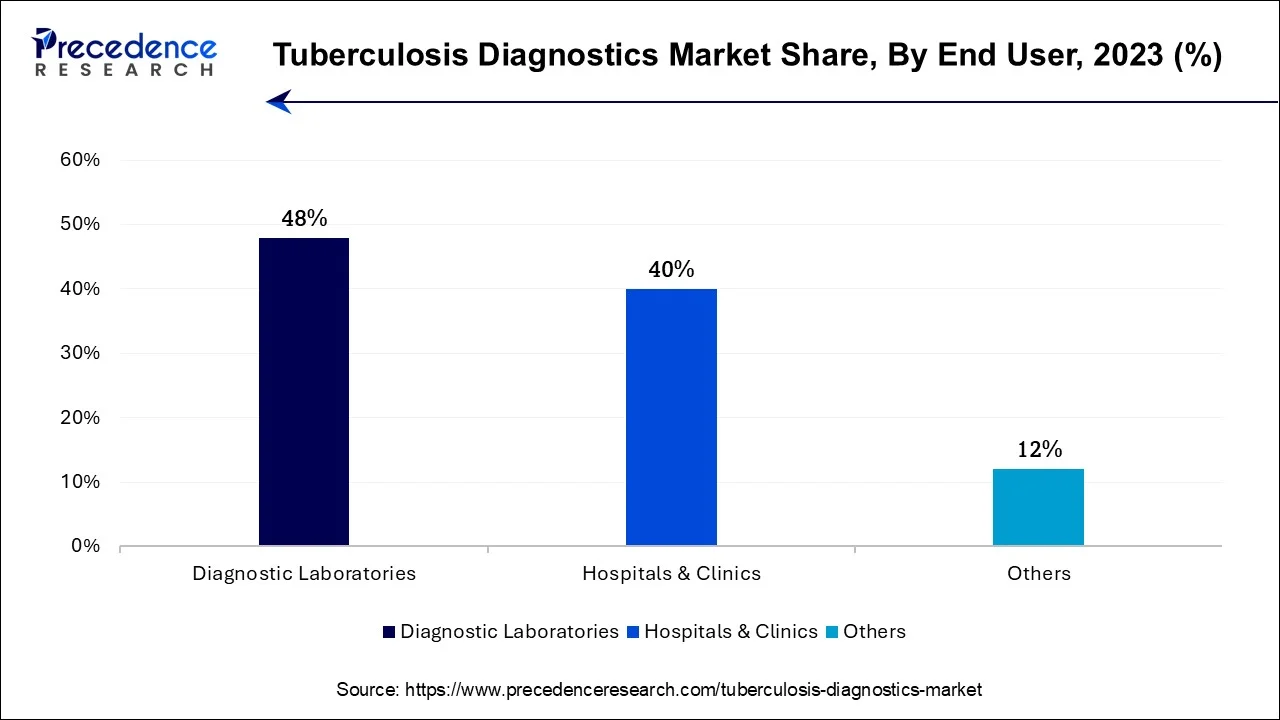

- By End-use, the diagnostic laboratories segment accounted more than 48% of revenue share in 2024.

- By End-use, the hospitals and clinics segment is estimated to expand at the fastest CAGR over the projected period.

What are Tuberculosis Diagnostics?

The tuberculosis diagnostics market is a healthcare sector focused on the development, production, and distribution of diagnostic tools and tests for tuberculosis (TB) detection. It encompasses various technologies such as molecular diagnostics, serological tests, and radiography. The market has experienced significant growth due to the global prevalence of TB and the need for early and accurate diagnosis. Factors driving this market include increasing awareness, government initiatives, and advancements in diagnostic technologies. Competition among key players, government funding, and research collaborations are key dynamics. The market is expected to continue expanding as TB remains a major global health concern.

Market Outlook

- Industry Growth Overview:

The tuberculosis diagnostics market is growing, driven by increasing worldwide TB burden, growing demand for early and precise detection, and technological development such as molecular diagnostics and AI-driven tools. - Global Expansion:

The tuberculosis diagnostics market is increasing globally, driven by rising TB cases, development in technology, and government spending. TB leftovers a significant infectious disease, driving the requirement for efficient diagnostic devices. Asia Pacific is dominant in the market due to increasing disease burden and strong government initiatives to increase diagnostic infrastructure in countries such as India and China. - Major investors:

The major investors are the large multinational diagnostics companies, as well as significant investments from public-private partnerships (PPPs), non-governmental organizations (NGOs), and regulatory bodies

Tuberculosis Diagnostics Market Growth Factors

The tuberculosis diagnostics market is a critical sector within healthcare, focusing on the development and deployment of diagnostic tools and tests for the detection of tuberculosis (TB). This market has witnessed substantial growth in recent years due to the persistent global prevalence of TB and the imperative for early, precise diagnosis.

A prominent trend within the tuberculosis diagnostics market is the escalating adoption of molecular diagnostics. Molecular techniques such as polymerase chain reaction (PCR) have revolutionized TB detection, offering rapid and accurate outcomes, which are paramount for effective disease management. Furthermore, there is a notable surge in point-of-care testing, facilitating quicker diagnosis and the prompt initiation of treatment, especially in resource-constrained environments. Additionally, government initiatives and funding allocated to TB control initiatives, coupled with the increasing recognition of TB's global impact, have served as substantial drivers of market growth.

The market's growth is further propelled by technological advancements in diagnostic methods. Innovations in TB diagnostic devices and assays, such as nucleic acid amplification tests (NAATs) and serological assays, are opening new avenues for businesses. Furthermore, the rise in public-private partnerships for TB control programs presents promising business opportunities for companies involved in diagnostics. Expansion into emerging markets and collaborations with healthcare organizations in developing countries can be strategic moves for industry players.

While there are substantial opportunities, the tuberculosis diagnostics market is not without its challenges. One major hurdle is the affordability and accessibility of advanced diagnostic tools in low-income regions, which continue to bear a significant TB burden. Ensuring the scalability of cost-effective diagnostic solutions remains a complex challenge. Additionally, the emergence of drug-resistant TB strains necessitates continuous innovation in diagnostic technologies to identify resistance patterns accurately.

In conclusion, the tuberculosis diagnostics market is witnessing steady growth driven by advancements in diagnostic technologies, government support, and increased awareness. The industry's future growth is contingent on addressing challenges related to affordability and drug resistance while seizing opportunities in emerging markets and forging partnerships to enhance global TB control efforts. Companies operating in this sector must navigate these dynamics to contribute to the fight against TB effectively.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.32% |

| Market Size in 2025 | USD 2.56 Billion |

| Market Size in 2026 | USD 2.70 Billion |

| Market Size by 2034 | USD 4.08 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Test Type and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Global TB burden

The global tuberculosis (TB) burden serves as a compelling driver behind the growth of the tuberculosis diagnostics market. Despite significant strides in healthcare, TB continues to impose a substantial public health challenge worldwide. This enduring global prevalence of TB necessitates effective diagnostic solutions to identify and manage cases promptly, thus driving market growth. The sheer magnitude of TB cases, especially in high-burden regions, underscores the urgent need for innovative diagnostic tools and technologies. Governments, international organizations, and healthcare providers are compelled to invest in robust diagnostic infrastructures to combat the disease effectively.

Moreover, the persistent threat of TB outbreaks and the potential for drug-resistant strains further emphasize the importance of accurate and timely diagnosis. This global health security concern intensifies efforts to enhance TB diagnostics, promoting research, development, and investment in the sector. In summary, the relentless global TB burden acts as a catalyst, propelling the tuberculosis diagnostics market forward by emphasizing the critical role of diagnostic tools in curbing the spread of this infectious disease and improving patient outcomes on a global scale.

Restraints

Stigma and patient engagement

Stigma associated with tuberculosis (TB) and challenges related to patient engagement pose significant obstacles to the growth of the TB diagnostics market. TB has historically carried a social stigma, fear, and prejudice, dissuading individuals from seeking diagnostic services. This stigma can result in delayed diagnoses and heightened disease transmission, thereby hindering market expansion. Patient engagement is another pivotal factor. Limited awareness and insufficient education about TB can lead to suboptimal healthcare-seeking behavior. Many individuals may fail to recognize TB symptoms or grasp the significance of early diagnosis, leading to missed opportunities for TB screening.

Moreover, in certain cases, patients may avoid healthcare facilities due to concerns regarding stigma or privacy. Resolving these issues necessitates not only technological advancements in diagnostics but also comprehensive public health campaigns aimed at mitigating TB-related stigma and enhancing awareness about the critical importance of timely diagnosis and treatment. Overcoming these challenges is imperative for achieving more effective TB control and promoting growth within the diagnostics market.

Opportunities

Drug-resistant TB detection

The emergence of drug-resistant tuberculosis (TB) strains, such as multidrug-resistant TB (MDR-TB) and extensively drug-resistant TB (XDR-TB), is giving rise to notable prospects within the tuberculosis diagnostics market. Primarily, the growing occurrence of these drug-resistant TB variants underscores the pressing demand for advanced diagnostic solutions capable of precisely identifying resistance patterns. Companies that pioneer and offer dependable tests for drug resistance are well-positioned to fulfill a critical requirement in TB management, securing a competitive advantage in the market.

Additionally, the intricacies involved in diagnosing drug-resistant TB call for more sophisticated and specialized diagnostic methodologies, creating fertile ground for the development of innovative technologies and diagnostic assays. This environment encourages robust research and development efforts within the industry.

Moreover, as global health entities escalate their endeavors to combat drug-resistant TB, there is a heightened allocation of funding and support for the advancement and deployment of these diagnostics. The augmented emphasis on drug-resistant TB as a public health menace amplifies the array of opportunities available to companies engaged in the TB diagnostics market, propelling growth and innovation within this vital sector.

Segment Insight

Test Type Insights

The diagnostic laboratory sector has held a 42% revenue share in 2024. The "diagnostic laboratories methods" segment holds a major share in the tuberculosis diagnostics market due to its reliability and accuracy in TB detection. These methods, which include culture-based tests and molecular assays like PCR, are considered gold standards for diagnosing TB. They provide highly specific and sensitive results, critical for effective TB management. Moreover, diagnostic laboratories offer controlled environments and trained personnel, ensuring the quality of tests. This segment's prominence is also driven by the need for centralized testing, especially in regions with high TB prevalence, where laboratory infrastructure is well-established.

The cytokine detection assay sector is anticipated to expand at a significantly CAGR of 7.7% during the projected period. The Cytokine Detection Assay segment holds a significant growth in the tuberculosis diagnostics market because it plays a pivotal role in detecting TB infection by measuring the levels of specific cytokines in the patient's blood. This method offers several advantages, including early detection, accuracy, and the ability to assess the immune response to TB. As TB diagnosis becomes more precise and critical, cytokine detection assays are increasingly adopted, making them a major player in the market. Additionally, their versatility allows them to be utilized in research and clinical settings, further contributing to their prominence growth.

End-use Insights

In 2024, the diagnostic laboratories sector had the highest market share of 48% on the basis of the end-user. Diagnostic laboratories hold a major share in the tuberculosis diagnostics market due to their specialized expertise and infrastructure. These labs offer a controlled environment for performing intricate TB tests, ensuring high accuracy and reliability in results.

Additionally, they often have access to advanced diagnostic technologies and skilled personnel, making them a preferred choice for healthcare providers. Moreover, diagnostic laboratories play a pivotal role in large-scale screening programs and research initiatives related to TB, further solidifying their dominance in the market's end-use segment. Their comprehensive services and ability to handle diverse patient populations contribute to their significant market share.

The hospitals and clinics segment is anticipated to expand at the fastest rate over the projected period. The "hospitals and clinics" segment holds a significant growth in the tuberculosis diagnostics market due to several factors. Hospitals and clinics serve as primary healthcare facilities for patients, making them central points for TB diagnosis and treatment. They typically have well-established diagnostic infrastructure and trained medical staff capable of conducting various TB tests.

Moreover, patients often turn to these facilities for respiratory issues and general health concerns, increasing the likelihood of TB diagnoses in such settings. As a result, the hospitals and clinics segment remains a major contributor to the TB diagnostics market's growth and revenue.

Regional Insights

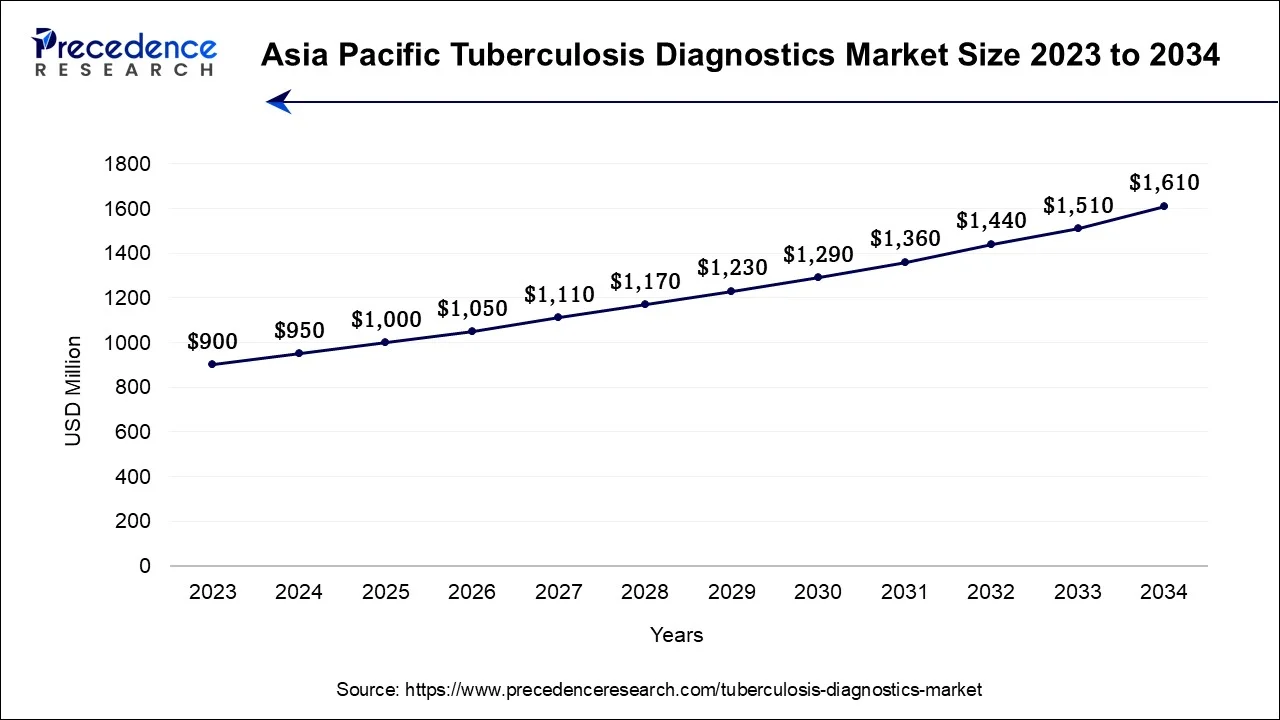

Asia Pacific Tuberculosis Diagnostics Market Size and Growth 2025 to 2034

The Asia-Pacific tuberculosis diagnostics market size accounted for USD 1,000 million in 2025 and is expected to be worth around USD 1,610 billion by 2034, registering a CAGR of 5.42% from 2025 to 2034.

High TB Burden Drives Asia Pacific Diagnostics

Asia-Pacific has held the largest revenue share 39% in 2024. Asia-Pacific commands a significant share in the tuberculosis diagnostics market primarily due to the region's high TB burden. Several factors contribute to this dominance, including a large population at risk for TB, limited healthcare access in some areas, and densely populated urban centers. Government initiatives and increased awareness have spurred the adoption of TB diagnostic tools. Additionally, partnerships with international organizations and investments in healthcare infrastructure have driven market growth. The region's dynamic market expansion is a reflection of the pressing need to address TB in populous countries, making Asia-Pacific a major player in the global TB diagnostics market.

India: Rapid industrialization and infrastructure growth

In India, the diagnostic organization is increasing its potential to replicate the success of the Indian medical care sector in offering affordable, advanced-quality generic products. India influences a modern digital infrastructure for its National Tuberculosis Elimination Programme (NTEP), containing the real-time surveillance system Ni-kshay and AI-based devices for reading digital thoracic x-rays, which drives the growth of the market.

High Awareness Drives Strong TB Diagnostics Growth in North America

North America is estimated to observe the fastest expansion with the highest CAGR of 8.1% during the forecast period. North America commands a significant growth in the tuberculosis diagnostics market primarily due to its advanced healthcare infrastructure, robust research and development capabilities, and high awareness of infectious disease control. The region benefits from well-established diagnostic facilities, enabling efficient TB testing and diagnosis. Moreover, governmental initiatives and funding support research and diagnostic programs, driving market growth. Additionally, a proactive approach to disease surveillance, stringent healthcare regulations, and a focus on innovation contribute to North America's leadership in the tuberculosis diagnostics sector, making it a key player in the global market.

U.S.: Technological advancements

The U.S. has a classy medical care system with an increasing network of diagnostic laboratories and hospitals that are well-developed to adopt and utilize advanced diagnostic techniques. The U.S. actively leverages advanced diagnostic methods, like interferon-gamma release assays (IGRAs) and nucleic acid amplification tests (NAATs). There is a high level of professional and public awareness regarding TB in the U.S.

Europe: Growing innovation in green technology

Europe is significantly growing in the market as progressive healthcare infrastructure, vigorous surveillance systems, substantial R&D investment, and a significant focus on high-quality, often costly, diagnostic tools to address the particular complexities of drug-resistant TB. Most European Union (EU) and European Economic Area (EEA) countries have well-recognized, integrated health systems with the capacity to invest in TB control programs, which contribute to the growth of the market

UK: Technological and regulatory advantages

The UK is a high-income region with a well-organized National Health Service (NHS), the UK has the infrastructure to contrivance and research advanced diagnostic techniques. The UK has conducted detailed research and developed national strategies on the affordable various screening approaches, specifically for latent TB infection in new immigrants.

Tuberculosis Diagnostics Market- Value Chain Analysis

R&D:

Major R&D processes are the discovery and preclinical testing, followed by different phases of medical evaluation and employment research. The aim is to develop highly specific, sensitive, rapid, and accessible tests, specifically at the point-of-care.

- Key Players: Abbott Laboratories and Becton

Clinical Trials:

The clinical trial process for tuberculosis (TB) diagnostics contributes a structured assessment framework that varies somewhat from traditional drug trials, focusing on diagnostic precision, sensitivity, and specificity, operative characteristics, and prognostic performance.

- Key Players: Dickinson and Company (BD), and BioMérieux SA

Patient Services:

Patient services include comprehensive healthcare evaluation and different support mechanisms intended to confirm precise diagnosis, suitable treatment, and patient well-being.

- Key Players: Thermo Fisher Scientific Inc. and Cepheid

Top Vendors in the Tuberculosis Diagnostics Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

United States |

Robust research and development (R&D) capabilities |

In August 2025, Abbott, the worldwide medical care leader, got government approval for the first denosumab biosimilar in Thailand, increasing access to advanced therapies for osteoporosis and cancer-associated bone loss. |

|

|

Basel, Switzerland |

Integrated pharmaceuticals and diagnostics divisions |

Roche's cobas MTB-RIF/INH test to identify resistance to antibiotics in tuberculosis DNA. |

|

|

Thermo Fisher Scientific Inc. |

United States |

Strong investment in innovation |

VersaTREK Myco media utilize a unique growth matrix, through cellulose sponges, to offer better detection of all Myco-bacteria species. |

|

BioMérieux SA |

France |

World Leader in In Vitro Diagnostics: |

bioMérieux provides services for diagnosing both active and latent tuberculosis to avoid the progression of active tuberculosis and stop the spread of tuberculosis.

|

|

Hain Lifescience GmbH |

Germany |

Specialized expertise in tuberculosis (TB) diagnostics |

Hain Lifescience's main TB diagnostic devices, the GenoType MTBDRplus and GenoType MTBDRsl assays |

Other Key Players

- QIAGEN GmbH

- Cepheid

- Hologic, Inc.

- BD

Recent Developments

- In June 2023, QIAGEN underscored the distinctive merits of its proprietary TB blood testing technology, the QuantiFERON-TB Gold Plus test. This innovative interferon-gamma release assay (IGRA) empowers the detection of CD4 T-cell responses in TB1 blood collection tubes and CD8 T-cell responses in TB2 blood collection tubes, enhancing its diagnostic capabilities.

- In February 2023, QuantiFERON-TB Gold Plus had achieved CE-marking compliance with the European Union's In Vitro Diagnostic Medical Devices Regulation (IVDR), affirming its adherence to stringent quality and safety standards.

- In February 2023, Thermo Fisher Scientific secured licensing rights from the Central Drugs Standard Control Organization (CDSCO) for the Applied Biosystems TaqPath PCR kits. These kits encompass various infectious diseases, including M. tuberculosis complex (MTB) and multi-drug-resistant tuberculosis (MTB MDR), bolstering Thermo Fisher's offerings in the realm of infectious disease diagnostics.

Segments Covered in the Report

By Test Type

- Radiographic Method

- Diagnostic Laboratory Methods

- Nucleic Acid Testing

- Phage Assay

- Detection of Latent Infection (Skin Test & IGRA)

- Cytokine Detection Assay

- Detection of Drug Resistance (DST)

- Other Methods

By End-use

- Diagnostic Laboratories

- Hospitals & Clinics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting