What is the Vaccine Contract Manufacturing Market Size?

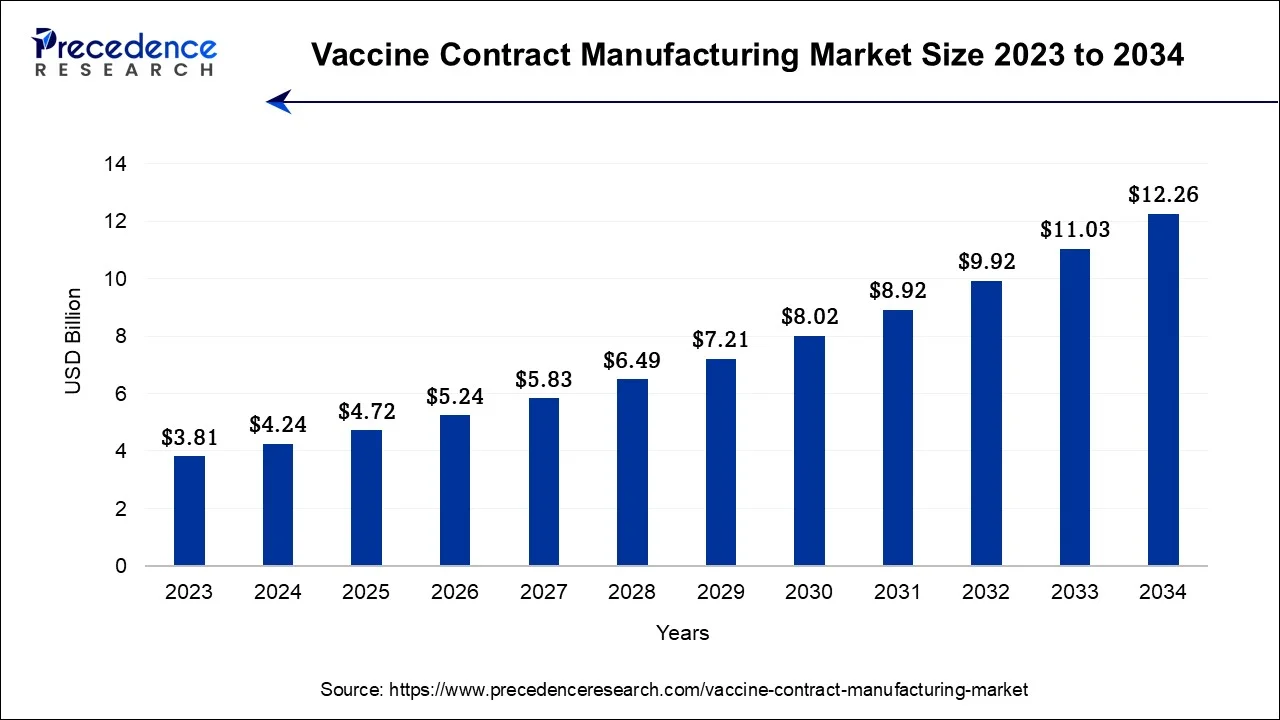

The global vaccine contract manufacturing market size is valued at USD 4.72 billion in 2025 and is predicted to increase from USD 5.24 billion in 2026 to approximately USD 12.26 billion by 2034, expanding at a CAGR of 11.20% from 2025 to 2034.

Vaccine Contract Manufacturing Market Key Takeaways

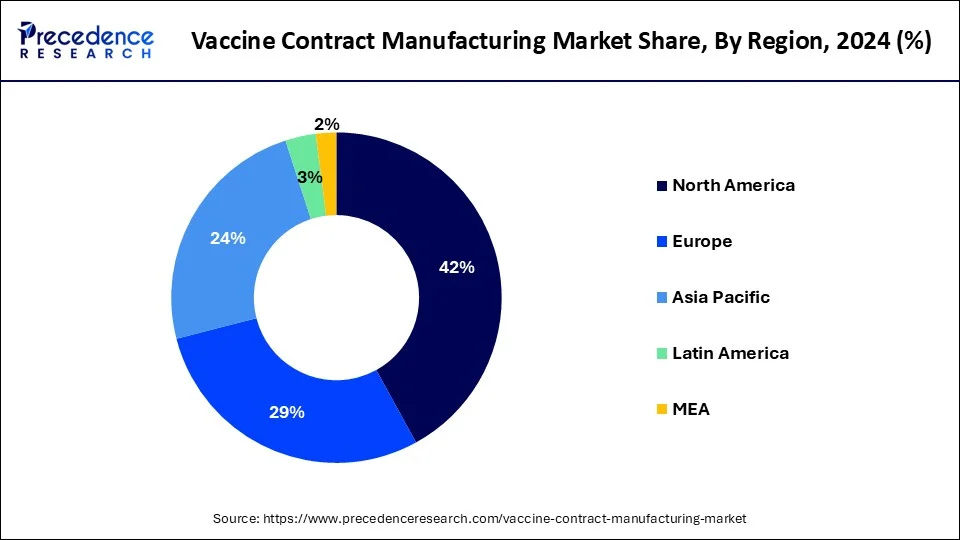

- North America led the market with the highest market share of 42% in 2024.

- Asia-Pacific is expected to grow at the fastest CAGR during the forecast period.

- By Vaccine Type, the attenuated vaccines segment has held the largest revenue share of 28% in 2024.

- By Vaccine Type, the inactivated inoculations segment is projected to expand at a remarkable CAGR of 12.7% during the projected period.

- By Workflow, the downstream segment generated more than 68% of revenue share in 2024.

- By Workflow, the upstream segment is anticipated to grow at the fastest CAGR over the projected period.

- By Application, the human-use segment held the major revenue share of 69% in 2024.

- By Application, the veterinary segment is estimated to grow at a noteworthy CAGR of 13.3% over the predicted period.

Market Overview

The vaccine contract manufacturing sector pertains to the domain where pharmaceutical firms enlist the services of external contract manufacturing entities for the production ofvaccines. These contract manufacturing organizations (CMOs) possess the requisite infrastructure, specialized know-how, and dedicated facilities to manufacture vaccines on behalf of the original developers. This marketplace has witnessed substantial expansion recently, driven by rising vaccine demand, notably during global health emergencies such as the COVID-19 pandemic. It provides vaccine manufacturers with adaptability, scalability, and cost-effectiveness, allowing them to efficiently fulfill production requirements while upholding stringent quality standards and regulatory adherence.

Vaccine Contract Manufacturing Market Outlook

- Industry Growth Overview: The vaccine contract manufacturing market is projected for significant growth from 2025 to 2034, fueled by increasing global demand for vaccines, the rising occurrence of infectious diseases, and the strategic outsourcing of production by pharmaceutical and biotech companies for new mRNA and viral vector vaccines, as well as fill-finish operations and services for preclinical development.

- Digitalization and Manufacturing Efficiency: The rapid digitalization and optimization of production processes to boost efficiency and consistency contribute to market growth. This trend involves widespread adoption of advanced technologies like AI and automation to streamline complex bioprocessing workflows. This strategic shift aims to improve workflows, increase efficiency, lower costs, and maintain consistent quality control in complex bioprocessing environments.

- Major Investors:The market attracts significant investments from large pharmaceutical companies and venture capital firms, motivated by stable, recurring revenue from long-term contracts and high technical barriers to entry. Major players like Lonza, Catalent, and Samsung Biologics are strategically investing in R&D and capacity expansions, offering comprehensive, end-to-end services.

- Startup Ecosystem:The startup ecosystem is growing, especially in niche areas like innovative vaccine platforms, mRNA, DNA, and advanced manufacturing technologies. New companies attract funding by providing flexible, quick-response solutions and specialized skills to ramp up production and manage the complex regulatory environment.

Vaccine Contract Manufacturing Market Growth Factors

The vaccine contract manufacturing market has evolved as a critical component of the pharmaceutical industry. It involves pharmaceutical companies outsourcing the production of vaccines to specialized contract manufacturing organizations (CMOs). This outsourcing model allows vaccine manufacturers to leverage the expertise and infrastructure of CMOs, enabling efficient vaccine production while maintaining stringent quality and regulatory standards.

The vaccine contract manufacturing market has experienced remarkable growth due to several key trends and growth drivers. First and foremost, the COVID-19 pandemic underscored the importance of rapid vaccine development and manufacturing, driving increased demand for contract manufacturing services. Additionally, advancements in vaccine technology, such as mRNA-based vaccines, have opened new avenues for contract manufacturing. Furthermore, governments and global health organizations are increasingly investing in vaccine manufacturing infrastructure, fostering industry growth.

Despite its growth, the vaccine contract manufacturing industry faces significant challenges. One major obstacle is the complex regulatory landscape, which varies across regions and requires meticulous adherence to quality and safety standards. Supply chain disruptions, as seen during the pandemic, also pose challenges. Additionally, ensuring equitable access to vaccines worldwide remains a persistent challenge, as does addressing the potential for intellectual property disputes in vaccine manufacturing partnerships.

The vaccine contract manufacturing market presents lucrative business opportunities. Contract manufacturers can capitalize on the growing demand for vaccines by offering flexible and scalable production solutions. Moreover, investing in cutting-edge vaccine manufacturing technologies and infrastructure can position CMOs as industry leaders. Collaborations with vaccine developers, especially for emerging diseases, offer substantial growth potential. Diversification into vaccine formulation and packaging services can further enhance CMOs' value proposition.

In summary, the vaccine contract manufacturing market is witnessing robust growth driven by the urgency for vaccine production, technological advancements, and increased funding. However, it also faces challenges related to regulatory compliance, supply chain resilience, and equitable access. Businesses in this sector can thrive by focusing on innovation, strategic partnerships, and diversification, as the world continues to emphasize the critical role of vaccines in public health.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 12.26 Billion |

| Market Size in 2026 | USD 5.24 Billion |

| Market Size in 2025 | USD 4.72 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.20% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vaccine Type, Workflow, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing global vaccine demand

Increasing global vaccine demand is a pivotal driver propelling the growth of the vaccine contract manufacturing market. This surge in demand is primarily attributed to several factors, including the urgent need to respond to global health crises like the COVID-19 pandemic and the ongoing efforts to combat infectious diseases on a broader scale. Firstly, the COVID-19 pandemic underscored the critical importance of vaccine availability and accessibility on a global scale.

The need for rapid vaccine development and production reached unprecedented levels, leading vaccine developers to seek the support of contract manufacturing organizations (CMOs) to meet the surging requirements swiftly and efficiently. Furthermore, beyond pandemics, routine vaccination programs and an increased emphasis on preventative healthcare have fueled the consistent growth in vaccine demand.

As a result, pharmaceutical companies are turning to CMOs to enhance their production capabilities and ensure a reliable supply of vaccines to meet the healthcare needs of populations worldwide. In essence, increasing global vaccine demand acts as a potent catalyst for the expansion of the vaccine contract manufacturing market, highlighting its crucial role in addressing pressing public health challenges and sustaining a robust vaccine supply chain.

Restraints

Quality assurance and supply chain risk

Quality assurance and supply chain risk act as substantial impediments to the expansion of the vaccine contract manufacturing market. Upholding consistent vaccine quality stands as a paramount concern, given vaccines' critical role in safeguarding public health. Any deviations from established quality standards could result in product recalls, regulatory repercussions, and damage to the reputation of contract manufacturing organizations (CMOs).

The quest for the highest levels of safety and effectiveness demands rigorous oversight and continual investments in quality assurance protocols, which can prove resource-intensive and time-demanding. Furthermore, the vaccine supply chain remains susceptible to an array of vulnerabilities, encompassing shortages of essential raw materials, interruptions in transportation networks, and unforeseen global occurrences like pandemics or geopolitical tensions. These hazards can induce delays in vaccine production and distribution, consequently affecting CMOs' capacity to meet the escalating demand.

As the world's dependence on contract manufacturing for vaccines intensifies, the imperative of mitigating these risks takes on paramount significance for market expansion. CMOs must allocate resources to develop resilient supply chain management strategies, ensuring the dependable and punctual delivery of vaccines.

Opportunities

Diversification of services

Diversification of services within the vaccine contract manufacturing market is unlocking significant opportunities for growth and expansion. Beyond traditional vaccine production, contract manufacturing organizations (CMOs) are broadening their offerings to include vaccine formulation, fill-and-finish processes, packaging, and distribution services. This diversification enhances CMOs' appeal to vaccine developers by providing a one-stop solution for their manufacturing needs. It streamlines the supply chain and reduces the complexity of managing multiple partners, resulting in cost savings and improved efficiency.

Additionally, it offers comprehensive services that allow CMOs to cater to a broader range of vaccine types, including those with specific storage and administration requirements, such as gene-based vaccines like mRNA and viral vectors. This adaptability positions CMOs as versatile partners capable of addressing diverse vaccine development projects.

Moreover, as global vaccine distribution efforts expand, having the capacity to handle various aspects of vaccine manufacturing and logistics positions CMOs to play a pivotal role in ensuring equitable vaccine access worldwide. Consequently, diversification of services is a strategic move that not only strengthens CMOs' market presence but also contributes to addressing global health challenges.

Vaccine Type Insights

According to the vaccine type, the attenuated vaccines sector has held a 28% revenue share in 2024. The attenuated vaccines segment holds a significant share in the vaccine contract manufacturing market due to several factors. Attenuated vaccines, which contain weakened forms of pathogens, require specialized expertise and facilities for safe and effective production. Contract manufacturing organizations (CMOs) with experience in handling live, attenuated strains are in high demand.

Additionally, attenuated vaccines often have a long history of efficacy, making them essential for preventing various diseases. The established market for these vaccines drives consistent demand for manufacturing services, contributing to the segment's substantial share in the contract manufacturing market.

The inactivated inoculations segment is anticipated to expand at a significant CAGR of 12.7% during the projected period. The dominance growth of the inactivated inoculations segment in the vaccine contract manufacturing market is attributed to its long-standing reputation for safety and effectiveness. Inactivated vaccines have a well-established history of use, making them a preferred option for vaccine developers. Contract manufacturing organizations (CMOs) possess extensive know-how and proficiency in producing inactivated vaccines, instilling trust in their capacity to comply with stringent regulatory requirements.

Furthermore, inactivated vaccines play a vital role in combatting various infectious diseases, such as influenza and polio, ensuring a consistent demand for manufacturing services and reinforcing the segment's commanding position within the market.

Workflow Insights

In 2024, the downstream segment had the highest market share of 68% on the basis of the Application. The downstream segment holds a major share in the vaccine contract manufacturing market because it encompasses critical processes like formulation, fill-and-finish, packaging, and distribution. These stages are essential for ensuring vaccine safety, efficacy, and accessibility. Vaccine developers often rely on contract manufacturing organizations (CMOs) to handle these complex downstream tasks, as they require specialized equipment, expertise, and regulatory compliance. By outsourcing these crucial steps to CMOs, vaccine developers can streamline their operations, reduce costs, and expedite vaccine production, making the downstream segment a pivotal and dominant component of the vaccine contract manufacturing market.

The upstream is anticipated to expand at the fastest rate over the projected period. The Upstream segment holds a major share in the vaccine contract manufacturing market primarily because it encompasses the crucial early stages of vaccine production. Upstream processes involve cell culture, fermentation, and initial vaccine development, which are complex and resource-intensive phases. These processes are essential for generating the primary vaccine substance or antigen.

As the foundation of vaccine manufacturing, any efficiency improvements or technological advancements in the upstream segment have a significant impact on overall production capacity and quality. Hence, it plays a pivotal role in the vaccine manufacturing process and holds a major share in the market.

Application Insights

The human-use segment held the largest revenue share of 69% in 2024. The human-use segment holds a major share in the vaccine contract manufacturing market due to the significant and consistent demand for human vaccines. Vaccination is a cornerstone of public health programs globally, addressing various infectious diseases and preventing their spread. Consequently, pharmaceutical companies and governments regularly require contract manufacturing services to meet the production needs of human vaccines. This consistent demand, along with the need for specialized expertise in human vaccine manufacturing, drives the dominance of the human-use segment within the vaccine contract manufacturing market.

The veterinary sector is anticipated to grow at a significantly faster rate, registering a CAGR of 13.3% over the predicted period. The veterinary segment commands a substantial portion of the vaccine contract manufacturing market share due to the escalating focus on animal well-being and the increasing requirement for vaccines to safeguard livestock and companion animals from diseases. This sector gains traction from the growing recognition of diseases that can transmit between animals and humans, highlighting the importance of vaccination in both spheres. Furthermore, the regulatory pathways for veterinary vaccines often involve quicker and less intricate approval processes than those for human vaccines, making them an appealing avenue for contract manufacturing firms. Consequently, the veterinary vaccine domain continues its robust expansion, contributing significantly to the overall market landscape.

Regional Insights

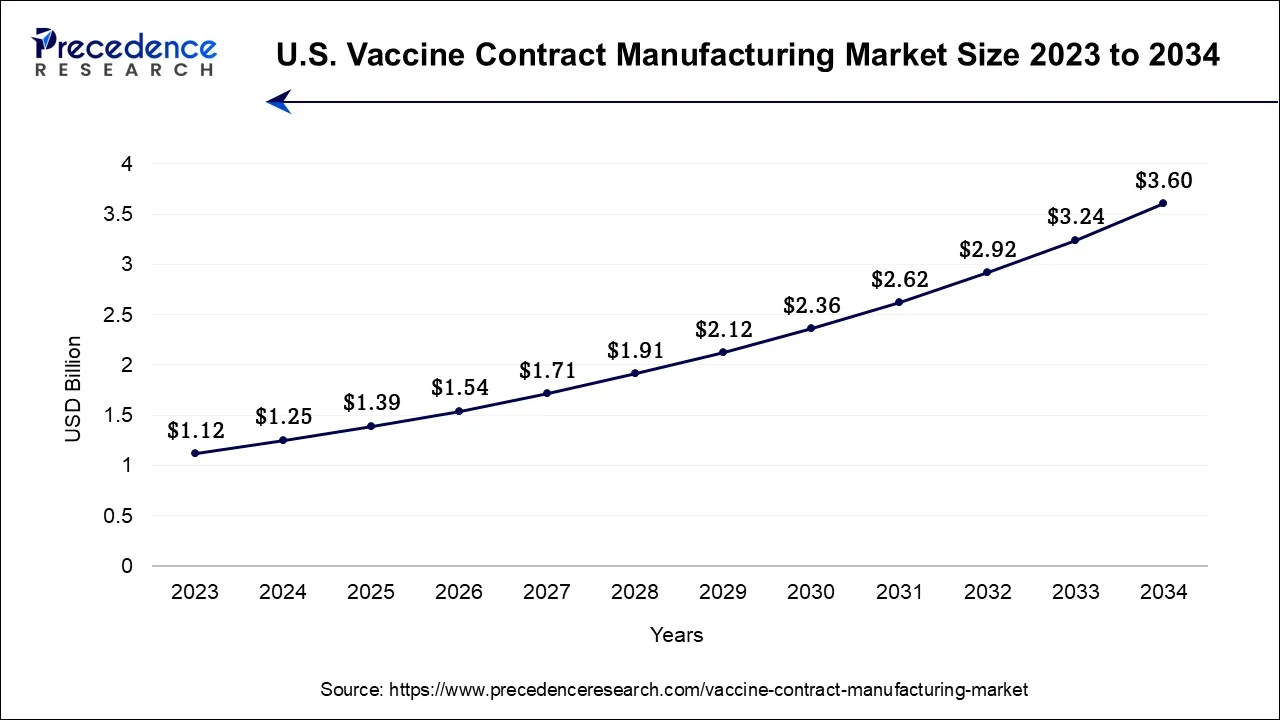

U.S. Vaccine Contract Manufacturing Market Size and Growth 2025 to 2034

The U.S. vaccine contract manufacturing market size is accounted at USD 1.39 billion in 2025 and is estimated to be worth around USD 3.60 billion by 2034, growing at a CAGR of 11.30% from 2025 to 2034.

North America has held the largest revenue share 42% in 2024. North America commands a substantial share in the vaccine contract manufacturing market due to several factors. It benefits from a mature pharmaceutical and biotechnology industry, with a high demand for vaccines driven by a large population and a strong focus on healthcare. Additionally, the region boasts advanced manufacturing infrastructure, well-established regulatory frameworks, and a skilled workforce, making it an attractive hub for contract manufacturing organizations (CMOs).

The presence of major vaccine developers and government initiatives to promote vaccine manufacturing further solidify North America's dominant position in the market, positioning it as a key contributor to the industry's growth.

Asia-Pacific is estimated to observe the fastest expansion. The Asia-Pacific region commands significant growth in the vaccine contract manufacturing market due to several key factors. Firstly, it boasts a large and growing population, leading to increased demand for vaccines. Secondly, Asia-Pacific has a robust pharmaceutical and biotechnology industry, attracting global vaccine developers who seek cost-effective manufacturing solutions. Additionally, the region benefits from a skilled workforce and advanced manufacturing capabilities. Furthermore, favorable regulatory environments and lower labor costs make it an attractive destination for vaccine contract manufacturing. As a result, Asia-Pacific continues to be a major contributor to the global vaccine contract manufacturing market growth.

Why United States is Epicenter of Vaccine Contract Manufacturing Market?

For example, large-scale vaccine manufacturers such as Catalent and Thermo Fisher Scientific were both capable of, and successfully supported, the roll-out of a variety of vaccines during COVID-19, including mRNA platforms. Initiatives like Operation Warp Speed and the public-private partnership surrounding COVID-19 demonstrated rapid scalability to meet surges in demand. For example, Catalent's manufacturing and fill and finish operations in Indiana were critical for developing and producing the Johnson and Johnson vaccine and were a prime example of U.S. capabilities and capacity to produce vaccines to meet global demand in urgent situations.

How India has Emerge as a Powerhouce in Vaccine Contract Manufacturing In APAC?

India is perhaps the key vaccine contract manufacturing hub for the Asia Pacific region, providing cost-efficient and high-volume production. With the Serum Institute of India, the world's largest vaccine producer by volume, manufacturing vaccines for global companies such as AstraZeneca and Novavax, India is having a significant impact on global vaccine equity. India's global impact especially popularized through COVAX and India's role in highlighting the centrality of producing and distributing Covishield vaccines worldwide. Regulatory compliance, a relatively high rate of a skilled workforce, and increasing investment in biotech and CDMO facilities within India all make it an appealing alternative international vaccine contract outsourcing option.

How Crucial is the Role of Europe in the Vaccine Contract Manufacturing Market?

Europe plays a significant role in the market, defined by its advanced biopharmaceutical infrastructure and strict regulatory environment (EMA). The market hosts several major contract manufacturing organizations (CMOs) and is driven by an aging population, rising R&D investments by pharmaceutical firms, and demand for innovative vaccine technologies such as mRNA and viral vector platforms. European CMOs provide high-quality, specialized services throughout the entire process, from R&D support to fill-finish operations, and are essential partners for global pharmaceutical companies.

Germany Vaccine Contract Manufacturing Market Trends

Germany is a key leader and the largest market in Europe, with a strong legacy in vaccine innovation and a robust, high-quality manufacturing ecosystem. Major global players like Merck KGaA and IDT Biologika contribute to its status, and the country acts as a major production hub for worldwide supply. The German government's strong support for research activities and its focus on advanced technologies and quality standards ensure its leading position in global markets.

A Look at Latin America's Emerging Vaccine Contract Manufacturing Market

Latin America plays a vital role in the vaccine contract manufacturing market and is a region with significant growth potential, driven by a rising focus on achieving vaccine self-sufficiency and enhancing public health. Governments in key countries actively promote local production through partnerships and technology transfers to ensure a stable and fair supply of vaccines, especially for routine immunization programs and pandemic preparedness. The region is appealing to global manufacturers due to its diverse population for clinical trials and lower operational costs.

Brazil Vaccine Contract Manufacturing Market Trends

Brazil leads the market in Latin America, with a well-established biomanufacturing infrastructure and a robust regulatory agency (ANVISA) that adheres to international GMP standards. The market benefits from government initiatives, including funding for R&D and partnerships between public institutes like Fiocruz and Butantan and international collaborators, which have enabled the local production of vaccines such as the AstraZeneca and Sinovac COVID-19 vaccines.

What Potentiates the Growth of the Middle East and Africa Vaccine Contract Manufacturing Market?

The Middle East and Africa vaccine contract manufacturing market is rapidly growing, driven by the urgent need to address high disease burdens and reduce dependence on imports. Many countries have little or no large-scale domestic manufacturing capacity, leading to efforts to develop local production hubs through strategic partnerships and government incentives. These initiatives focus on strengthening supply chain resilience and ensuring fair access to vaccines across the continent.

Saudi Arabia Vaccine Contract Manufacturing Market Trends

Saudi Arabia is leading the vaccine contract manufacturing industry in the MEA. The country is heavily investing in local production capabilities to improve national health security and to establish itself as a regional biotech hub, reducing reliance on imports. A key step is the $133 million investment in a new manufacturing plant in Sudair City, a joint venture that will produce various vaccines for local use and export to the Gulf and MEA regions.

Value Chain Analysis

- Biologics & Antigen Production

This involves manufacturing the active components of a vaccine using highly specialized biomanufacturing processes like cell culture and virus cultivation.

Key Players: Catalent, Lonza Group, Charles River Laboratories, and the Serum Institute of India. - Adjuvant and Excipient Supply

This provides critical ingredients that stabilize the vaccine or boost the immune response.

Key Players: Merck KGaA, BASF, and Thermo Fisher Scientific. - Fill-Finish Operations

This involves putting the bulk vaccine product into its final sterile container (vials or syringes) using aseptic filling and packaging processes.

Key Players: Catalent, Lonza Group, and Vetter Pharma International. - Packaging, Logistics, and Cold Chain Management

This ensures the safe and efficient distribution of the packaged vaccines, requiring strict temperature controls.

Key Players: Logistics specialists like DHL, FedEx, and UPS. - Quality Control (QC) & Regulatory Compliance

This is a pervasive stage across the entire chain, ensuring adherence to global safety and efficacy standards through extensive testing and documentation.

Key Players: Internal QC teams of CDMOs, regulatory bodies like the FDA, EMA, WHO, and Charles River Laboratories.

Top Companies in the Vaccine Contract Manufacturing Market and Their Offerings

- Lonza: Leading global CDMO providing services for novel vaccine modalities like mRNA and viral vectors, including drug substance and fill-finish.

- Catalent, Inc.:Major player in end-to-end vaccine manufacturing, with a focus on large-scale sterile fill-finish operations and packaging.

- FUJIFILM Diosynth Biotechnologies U.S.A., Inc.: Offers end-to-end development and manufacturing for various biologics, including viral vectors and vaccine components.

- IDT Biologika GmbH:Specializes in the full development and manufacturing cycle for viral vaccines, gene therapies, and sterile fill-finish capabilities.

- Merck KGaA:Primarily a supplier of essential materials, technologies (e.g., single-use systems), and services that support third-party vaccine developers and manufacturers.

Other Key Players

- Ajinomoto Althea, Inc.

- Cytovance Biologics

- Albany Molecular Research, Inc.

- PRA Health Sciences

- ICON plc.

- Pharmaceutical Product Development, LLC

- Cobra Bio

- Paragon Bioservices, Inc.

Recent Developments

- In March 2025, Batavia Biosciences, a leading Contract Development and Manufacturing Organization (CDMO) specializing in development and manufacturing of vaccines and viral vectors, is excited to announce a strategic collaboration with Vaccine Biotechnology City (VBC) and MEVAC, two pioneering organizations in Egypt.

(Source: https://bataviabiosciences.com) - In December 2024, Danish biotech company Bavarian Nordic A/S has entered into an agreement with the Serum Institute of India, the world's largest vaccine manufacturer, to produce Mpox vaccine for the Indian market. Additionally, this collaboration will allow the Serum Institute to conduct contract manufacturing for Bavarian, increasing its global production capacity, according to a statement issued by Bavarian Nordic on.

(Source: https://www.business-standard.com) - In December 2024, IAVI, a nonprofit scientific research organization dedicated to addressing urgent global health challenges including HIV, tuberculosis, and emerging infectious diseases (EIDs), and the Institut Pasteur de Dakar (IPD), a non-profit foundation focused on equitable, sustainable, and affordable access to health in Senegal, Africa, and worldwide, have signed an agreement to formally collaborate for vaccine development, manufacturing, and access in Africa.

(Source: https://www.iavi.org) - In July 2023, Merck unveiled plans to expand its laboratory space and production capabilities in Lenexa, Kansas, USA. This expansion aimed to enhance its capacity for manufacturing cell culture media and accelerate the production of innovative dry powder media, crucial for processes like vaccine manufacturing and gene therapy.

- FUJIFILM Corporation, in June 2023, announced the establishment of a commercial office in Tokyo. This office was strategically positioned to offer improved sales and customer support services, particularly catering to Asia-based pharmaceutical and biotechnology firms, for their contract development and manufacturing needs in biologics and advanced therapies.

- Lonza made a significant move in June 2023by acquiring Synaffix B.V. This acquisition was focused on bolstering Lonza's bioconjugate capabilities through integration with Synaffix's technology, further strengthening their Center of Excellence dedicated to bioconjugate technology development.

- Lonza and Vertex Pharmaceuticals Incorporated, also in June 2023, entered into a strategic partnership to scale up manufacturing and support the commercial production of Vertex's T1D cell therapy portfolio. They additionally planned to jointly invest in the construction of a dedicated facility in Portsmouth, New Hampshire, USA.

- In April 2023, FUJIFILM Diosynth Biotechnologies announced its acquisition of 41 acres of adjacent land to its existing RTP campus in North Carolina. This expansion aimed to accelerate their production capabilities for biologics manufacturing and development.

- Cytovance Biologics, Inc. partnered with Phenotypeca Limited in March 2023to provide optimized strains of Saccharomyces cerevisiae for biopharmaceutical manufacturing. This collaboration enhanced Cytovance Biologics' leadership in the production of microbial-derived active pharmaceutical ingredients (API) and expanded Phenotypeca's market presence.

- IDT Biologika joined forces with CanVirex, a biotechnology company, to manufacture oncolytic measles virus-based therapeutics for anti-cancer treatment under cGMP conditions. IDT utilized its advanced manufacturing infrastructure for this collaboration.

- In January 2023, Ajinomoto Co., Inc. entered into a partnership with Exelixis, Inc. to jointly discover and develop novel Antibody-Drug Conjugates (ADCs) for cancer treatment. The collaboration leveraged Ajinomoto's AJICAP technology to create advanced ADCs with improved efficacy and reduced toxicity.

Segments Covered in the Report

By Vaccine Type

- Attenuated

- Inactivated

- Subunit-based

- Toxoid-based

- DNA-based

By Workflow

- Downstream

- Upstream

By Application

- Human Use

- Veterinary

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting