Polio Vaccine Market Size and Forecast 2025 to 2034

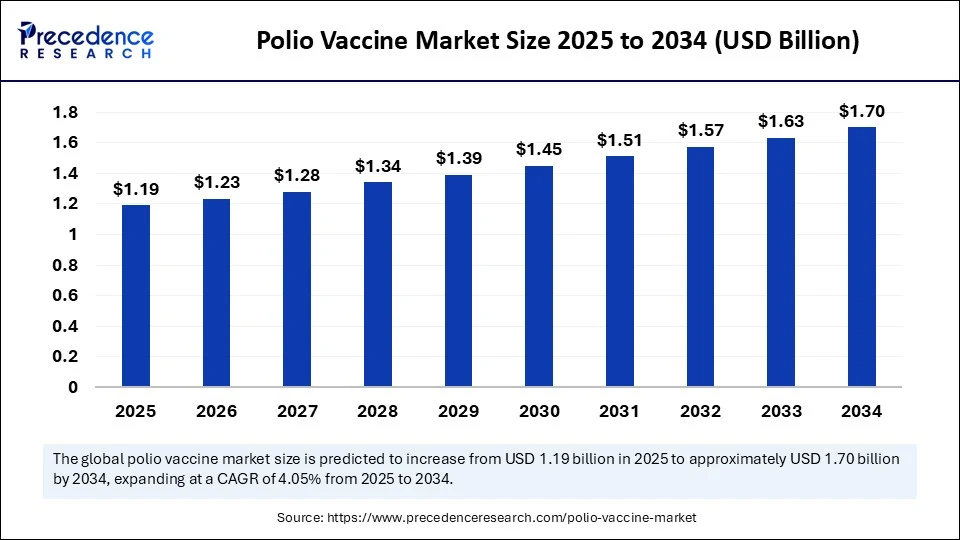

The global polio vaccine market size accounted for USD 1.14 billion in 2024 and is predicted to increase from USD 1.19 billion in 2025 to approximately USD 1.7 billion by 2034, expanding at a CAGR of 4.05% from 2025 to 2034. The growth of the polio vaccine market is driven by rising government initiatives, vaccination programs, health awareness campaigns, and global eradication initiatives.

Polio Vaccine Market Key Takeaways

- The global polio vaccine market was valued at USD 1.14 billion in 2024.

- It is projected to reach USD 1.7 billion by 2034.

- The market is expected to grow at a CAGR of 4.05% from 2025 to 2034.

- North America dominated the polio vaccine market with the largest market share in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By type, the inactivated polio vaccine segment held a significant share in 2024.

- By type, the oral polio vaccine segment is anticipated to show considerable growth over the forecast period.

- By application, the public segment capture the biggest market share in 2024.

- By application, the private segment is anticipated to show considerable growth over the forecast period.

- By end-user, the hospitals & clinics segment accounted for the major market share in 2024.

- By end-user, the public services segment is anticipated to show considerable growth over the forecast period.

How is AI Transforming the Polio Vaccine Market?

Artificial Intelligence and Machine Learning are transforming the polio vaccine market by improving operations, predicting outbreaks, and enhancing immunization strategies. AI's predictive analytics capabilities can identify more efficient supply chains, forecast vaccine demand, minimize waste, and optimize delivery to remote or underserved areas. AI also facilitates the monitoring of vaccination outcomes, allowing researchers and policymakers to evaluate the effectiveness of different vaccination approaches and make informed decisions. AI also used to analyze side effects associated with vaccines and identify unique responses related to specific populations and vaccines.

Market Overview

Polio Immunizations are essential immunizations that are used to prevent the onset of poliomyelitis, which is a highly contagious viral infection that affects the discharge of nervous system, leading to permanent paralysis or even death. There are two main types of immunizations, namely, the Oral Polio Vaccine, which includes a weakened poliovirus and is given orally, and the Inactivated Polio Vaccine, which contains a killed virus and is given by injections.

Global vaccination programs are supported by organizations like WHO, UNICEF, and the Global Polio Eradication Initiative. Widespread vaccination is also driven by public awareness of the importance of immunizing children and the affordability of polio vaccines. Advances in technology and increased investment in research and development for improved vaccine formulations and delivery systems will further enhance their effectiveness and safety.

What are the Major Factors Fueling the Growth of the Polio Vaccine Market?

- Global Eradication Initiatives: The Global Polio Eradication Initiative and similar projects have significantly expanded vaccination efforts worldwide. These initiatives, supported by WHO, UNICEF, and international donors, focus on preventing polio in endemic regions through mass immunization programs, disease surveillance, and outbreak management.

- Policies and Government Support: Countries all over the world have adopted effective immunization policies that require polio vaccines within their country's health care programs. These policies are usually financed by the government.

- Public Health Awareness and Education: Increased awareness among parents and caregivers about the risks of polio has significantly increased vaccine uptake. Health education campaigns by NGOs, governments, and health organizations boosts the demand for vaccination.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1.7 Billion |

| Market Size in 2025 | USD 1.19 Billion |

| Market Size in 2024 | USD 1.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.05% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Types, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Number of Infants to Boost Demand for Polio Vaccines

The number of infants is rising every year; thus, there is a need for immunizations, especially against life-threatening diseases, like poliomyelitis. Countries with huge and expanding populations like India, Nigeria, and Pakistan, which have traditionally been polio-endemic, are making efforts to achieve comprehensive vaccine coverage for all newborns. International initiatives like the Global Polio Eradication Initiative collaborate with local governments to raise awareness, improve access to medical services in underserved areas, and ensure all children in need are vaccinated. Furthermore, the rise in births often leads to increased healthcare spending and improvements in public health infrastructure, especially in emerging economies.

Government Initiatives and Vaccination Programs

Government initiatives and nationwide campaigns are major drivers in the global polio vaccine market, as they strongly influence the scope of immunization, national health policies, and the process of disease eradication. India's robust programs, such as the Universal Immunization Program (UIP), have been crucial in achieving and maintaining its polio-free status. Mass vaccination campaigns, like National Immunization Days, regularly immunize millions of children in collaboration with international agencies such as the World Health Organization (WHO), UNICEF, and the Global Polio Eradication Initiative (GPEI). These campaigns not only increase vaccination numbers but also enhance public awareness and trust in immunization.

- In January 2024, the World Health Organization (WHO) prequalified the novel type 2 oral polio vaccine (nOPV2), which was a major milestone in the global polio eradication initiative. This prequalification is especially prominent because it is the first time that a vaccine is prequalified and used in an Emergency Use Listing (EUL) of the WHO.

(Source: https://www.path.org)

Restraint

Side Effects Associated with IPV and logistical Challenges

The global polio vaccine market is currently striving to meet eradication targets; however, several constraints are limiting its potential. One factor is vaccine hesitancy due to the fear of side effects, especially with the inactivated polio vaccine (IPV). While IPV is recognized as safe and widely used, some mild side effects, such as rash, itching, fever, and injection site soreness, have been reported. Logistical challenges, including poor cold chain infrastructure, limited healthcare access, and supply chain issues, also hinder proper immunization. Additionally, the higher production and distribution costs of IPV compared to OPV can strain healthcare budgets, especially in low-income countries.

Opportunity

Advancements in Vaccine Technology

Improvements in vaccine technology create immense opportunities in the polio vaccine market. Innovations such as next-generation inactivated polio vaccines (IPVs) enhance safety profiles and reduce the risk of vaccine-derived poliovirus (VDPV), thereby increasing public acceptance and trust. The development of thermostable vaccines is also a breakthrough, especially in areas with limited cold chain infrastructure.

Furthermore, innovative delivery methods like microneedle patches and needle-free injectors are revolutionizing vaccine delivery. These easy-to-administer, painless methods are particularly appealing for immunizing children, improving compliance, and reducing vaccine hesitancy. Rapid production cycles, quality, and scalable vaccine production methods are also being achieved through cell-based production, recombinant vaccine manufacturing, and other innovative approaches.

Type Insights

Why Did the Inactivated Polio Vaccine (IPV) Segment Dominate the Market in 2024?

The inactivated polio vaccine segment dominated the market with the largest revenue share in 2024. This is mainly due to the increased demand for safer and more effective immunization. IPV, an inactivated (killed) virus administered via injection, eliminates the risk of the virus-causing disease because it stimulates an immunological response. The global trend towards safer immunization procedures and the use of a sequential IPV immunization schedule, as recommended by the World Health Organization, have further boosted the adoption of this segment. Major pharmaceutical manufacturers are increasingly establishing partnerships, research collaborations, and strategic programs in public health to enhance the production and distribution of IPV.

- In June 2024, Sanofi and Biovac announced a partnership to improve polio vaccination manufacturing capacity in Africa. Consequently, this partnership is unique in that it will be the first local production of Inactivated Polio Vaccines (IPV) on the continent, expected to cover the needs of more than 40 African nations.

(Source: https://www.sanofi.com)

The oral polio vaccine segment is expected to grow at the fastest CAGR over the forecast period. OPV is a live-attenuated vaccine that is administered orally and can replicate in the intestines to produce both systemic and intestinal immunity. OPV is administered in large-scale immunization campaigns and emergency interventions because it is logistically convenient and effective. The rising development of new OPV forms, e.g., novel OPV2 (nOPV2), to minimize the risk of VDPV emergence further boosts the growth of the segment.

- In April 2024, Bharat Biotech unveiled a partnership with Bilthoven Biologicals B.V. (BBio), a wholly owned subsidiary of Serum Institute of India Private Limited based in the Netherlands, to boost the production and supply of Oral Polio Vaccines (OPV).

(Source: https://www.seruminstitute.com)

Application Insights

How Does the Public Segment Dominate the Market in 2024?

The public segment dominated the market with a major revenue share in 2024. This is mainly due to the increased public immunization programs as a result of public health concerns. Initiatives led by the World Health Organization (WHO), UNICEF, and the Vaccine Alliance have increased large-scale immunization rates, particularly in lower and middle-income countries. Mass distribution occurs through schools, community outreach programs, and rural health clinics. There is a strong focus on disease surveillance and rapid response systems, which contributes to the early identification and control of potential epidemics.

Continuous national immunization days, additional vaccination efforts, and increased awareness about immunization among the population are also crucial factors supporting segmental growth. With the government paying greater attention to infrastructure and equity in vaccinations against polio, the initiative is predicted to continue relying on the public segment for the development of immunization programs across the globe.

The private segment is expected to grow at the fastest rate in the coming years, driven by rising health awareness, increased disposable incomes, and the availability of high-tech healthcare services. In urban areas, immunization rates in the private sector are increasing due to better facilities and care delivery. The growing demand for inactivated polio vaccines (IPV), which are generally considered safer, also favors the private segment, as they are more accessible in private hospitals and clinics.

End-User Insights

What Made Hospitals & Clinics the Dominant Segment in the Market?

The hospitals & clinics segment dominated the polio vaccine market with the largest revenue share 2024. This is mainly due to the active participation of public hospitals in achieving immunization rates. Hospitals and clinics, as frontline healthcare providers, plays a crucial role in administering both inactivated and oral vaccines in standard immunization programs. They have the infrastructure for cold chain systems, trained staff, and adequate documentation to ensure effective and safe vaccine distribution.

Furthermore, hospitals and clinics often serve as the center for pediatric vaccination programs, catch-up immunization initiatives, and travel vaccination facilities, which helps to increase coverage rates. As healthcare systems invest in new facilities, digital health records, and employee training, hospitals and outpatient clinics will remain front-runners in the polio eradication process.

The public segment Is expected to grow at a substantial rate in the upcoming period. Government and international health organizations significantly influence mass immunization programs. Local health departments, community-based mobile health units, and vaccination support programs are public services, especially in remote, underserved, and high-risk areas. These services often collaborate with organizations like the WHO, and UNICEF, which provide technical and financial aid for vaccine procurement, transportation, and training. The increasing importance of uniform healthcare access and disease monitoring solidifies the role of public services in global eradication efforts.

Region Insights

What Made North America the Dominant Segment in the Polio Vaccine Market in 2024?

North America registered dominance in the polio vaccine market by holding the biggest share in 2024. This is mainly due to its well-developed health infrastructure. Increased concerns over public health and aggressive vaccination measures further bolstered the market growth. There is a well-developed system of public health organizations, maintained by the government in the form of the Centers for Disease Control and Prevention (CDC) in the U.S. and the Public Health Agency of Canada. Such institutions are important in the management of national vaccination programs, as well as the surveillance of the disease and funding of immunization programs.

The fast-tracking of multidose vaccine formulations and novel combination products thrives on public-private partnerships and advanced supply chain processes with an efficient cold chain infrastructure. Moreover, the region has increased campaigns related to education and awareness to underline the necessity of vaccination. North America also plays a strategic role in eradicating polio globally since the continent provides funding and logistical support to international organizations like UNICEF, WHO, and Gavi.

What are the Major Factors Boosting the Growth of the Polio Vaccine Market within Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period, primarily due to demographic shifts, the ongoing prevalence of diseases, and substantial investments in healthcare. Polio remains a significant public health concern in several Asian countries, making the implementation of vaccination programs a governmental priority. Furthermore, heightened awareness of the importance of immunization, driven by national and international educational initiatives, has led to greater participation in vaccination campaigns.

Governments around the region are strongly supporting immunization efforts by expanding routine programs, establishing national immunization days, and implementing supplementary immunization activities. Due to demographic pressures, disease prevalence, active public health initiatives, and increased research and development efforts, the region is considered the most dynamic and rapidly developing market globally.

In April 2024, Sanofi received approval for its new alternative to inactivated polio vaccine, IMOVAX-Polio, in India. The company discontinued its old vaccine, ShanIPV. This decision comes in response to concerns about a potential shortage of polio vaccines following Sanofi's announcement to discontinue ShanIPV due to operational challenges at its manufacturing facilities.

(Source: https://www.thehindu.com)

What Are the Key Trends in the European Polio Vaccine Market?

Europe is considered to be a significantly growing area. The growth of the market is driven by its strong commitment to eradicating polio. Key market trends include increased investment in surveillance infrastructure and the enhancement of laboratory networks to swiftly identify and respond to threats. Pan-European immunization programs are supported by the European Centre for Disease Prevention and Control. Furthermore, the government's campaign to raise public awareness is likely to boost vaccine demand.

Recent Developments

- In February 2025, A five-day mass polio immunization campaign in Gaza immunized around 603,000 children with the new type 2 of the oral polio vaccine (nOPV2) to prevent poliovirus outbreak.

- In October 2024, Ghana launched its 2024 National Oral Polio Vaccine Type 2 (NOPV2) National immunization campaign. The program launched in Koforidua with the slogan of “Kick Polio out of Ghana” is an important move in the continued war on polio in Ghana.

- In January 2024, UNICEF provided Ukraine with 340,000 doses of the oral polio vaccine (OPV), supporting the country's National Immunization Program to eradicate polio.

(Source: https://www.who.int)

(Source: https://www.datelinehealthafrica.org)

(Source: https://www.unicef.org)

Polio Vaccine Market Companies

- Sanofi

- GSK

- Bibcol

- Serum Institute

- Tiantan Biological

- IMBCA

- Panacea Biotec Ltd

- Bio-Med

- Halfkin Bio-Pharmaceuticals

- GlaxoSmithKline

- Merck & Co

- CSL Limited

Segments Covered in the Report

By Types

- Inactivated Polio Vaccine (IPV)

- Oral Polio Vaccine (OPV)

By Application

- Public

- Private

By End-User

- Hospitals & clinics

- Public services

- Others

By Region

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting