Venous Leg Ulcer Market Size and Forecast 2025 to 2034

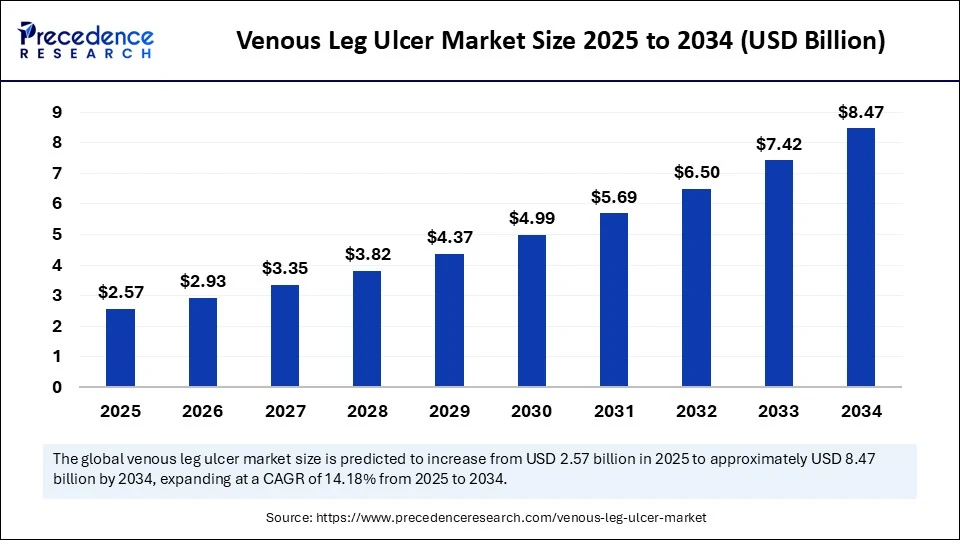

The global venous leg ulcer market size accounted for USD 2.25 billion in 2024 and is predicted to increase from USD 2.57 billion in 2025 to approximately USD 8.47 billion by 2034, expanding at a CAGR of 14.18% from 2025 to 2034. The market is experiencing substantial growth driven by the rising prevalence of chronic venous insufficiency (CVI) and an aging population, creating the need for effective wound care solutions. Advancements in compression therapies, bioactive therapies, and regenerative treatments are improving healing outcomes and reducing recurrence rates, thereby supporting market growth.

Venous Leg Ulcer MarketKey Takeaways

- In terms of revenue, the global venous leg ulcer market was valued at USD 2.25 billion in 2024.

- It is projected to reach USD 8.47 billion by 2034.

- The market is expected to grow at a CAGR of 14.18% from 2025 to 2034.

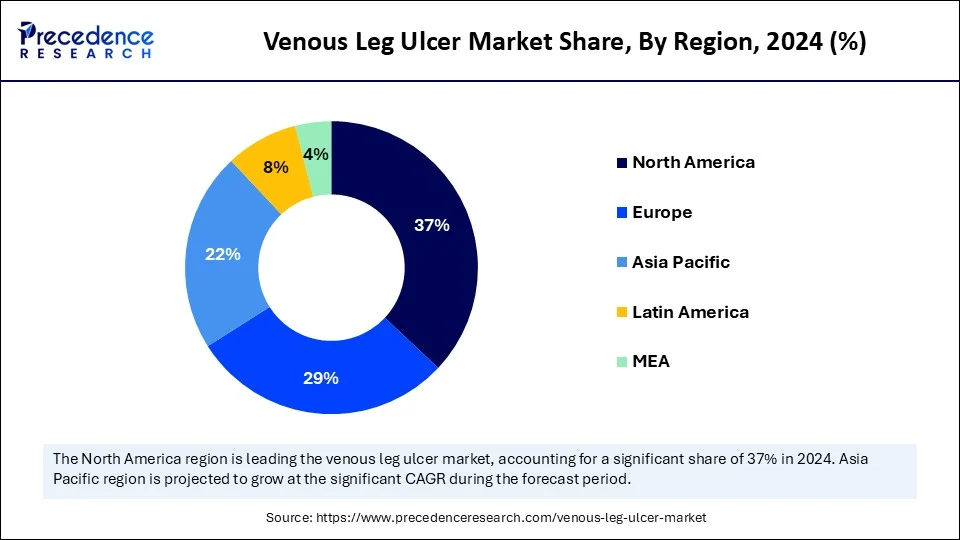

- North America dominated the venous leg ulcer market with the largest market share of 37% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By treatment type, the compression therapy segment contributed the biggest market share of 40% in 2024.

- By treatment type, the active wound care segment is expected to grow at the fastest CAGR in the coming years.

- By ulcer stage, the uncomplicated/initial VLU segment held the significant market share of 45% in 2024.

- By ulcer stage, the infected/recurrent VLU segment is anticipated to grow rapidly in upcoming period.

- By end user, the hospitals segment generated the major market share of 50% in 2024.

- By end user, the ambulatory surgical centers segment is projected to grow at the highest CAGR between 2025 and 2034.

- By distribution channel, the direct tenders segment captured the highest market share of 60% in 2024.

- By distribution channel, the online pharmacies segment is expected to grow at a significant CAGR from 2025 to 2034.

How is AI Transforming the Venous Leg Ulcer Market?

Artificial Intelligence (AI) is revolutionizing the market through improved diagnostics, personalized treatment planning, and remote monitoring. AI algorithms analyze medical images, patient data, and other relevant information to predict healing times, detect subtle abnormalities, and tailor treatment strategies. AI also monitors ulcer progression, identifies healing patterns, and forecasts possible complications. Current advances include AI-powered tools for wound measurement, tissue classification, and predictive models linking ulcer features to patient data.

U.S. Venous Leg Ulcer Market Size and Growth 2025 to 2034

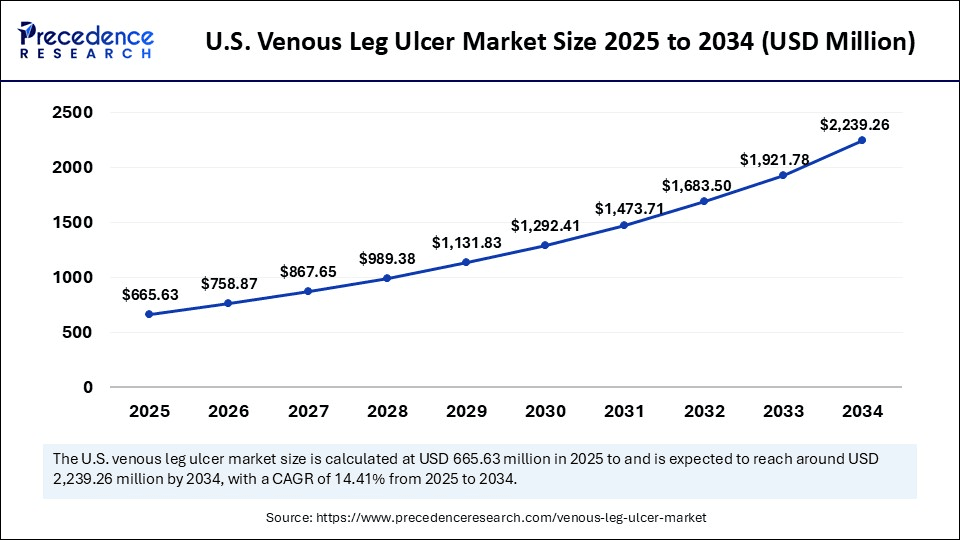

The U.S. venous leg ulcer market size was exhibited at USD 582.75 million in 2024 and is projected to be worth around USD 2,239.26 million by 2034, growing at a CAGR of 14.41% from 2025 to 2034.

What Made North America the Dominant Region in the Market in 2024?

North America dominated the venous leg ulcer market by capturing the largest share of 37% in 2024. This is primarily due to its advanced healthcare infrastructure, high healthcare spending, and a growing elderly population, which leads to more cases of chronic conditions like venous insufficiency. The region also emphasizes chronic wound management and has well-established wound care centers. Strong reimbursement policies for wound care treatments, including compression therapy, dressings, and other adjunct therapies, support the market. North America is also a leader in adopting advanced wound care technologies, including biologically active dressings, automatic compression systems, and smart bandages, which help accelerate healing and improve patient outcomes. Furthermore, the high healthcare expenditure allows for greater investment in research, development, and treatment options for venous leg ulcers.

- In January 2023, Convatec announced the U.S. launch of ConvaFoam™, an advanced foam dressing designed to meet the needs of healthcare providers and their patients. ConvaFoam™ can be used on a variety of wound types at any stage of healing, making it a versatile choice for wound management and skin protection by providing more than just a dressing.

(Source: https://www.convatecgroup.com)

U.S. Venous Leg Ulcer Market Trends

The U.S. is a significant contributor to the North American market, serving as a major treatment hub and shaping trends worldwide. The rising prevalence of diabetes and advancements in wound care technologies are driving the growth of the market. The U.S. is a hub for research and development in wound care, continually working to develop new therapies and enhance existing ones. The availability of advanced treatment options and the increasing demand for personalized care plans are contributing to market growth.

What Makes Asia Pacific the Fastest-Growing Region in the Venous Leg Ulcer Market?

Asia Pacific is emerging as the fastest-growing market. This is mainly due to the high prevalence of diabetes and an aging population, leading to increased rates of VLU. The growing awareness of the availability of wound care solutions supports market growth. Additionally, the improvements in healthcare infrastructure and rising focus on chronic disease management contribute to market growth. Conditions like diabetes and vascular diseases, which often lead to VLUs, are becoming more common, especially in countries like China and India. As a result, public awareness about early treatment and management of chronic wounds is increasing, fueling market growth. Many governments are also supporting programs for the prevention and management of chronic diseases, which include promoting wound care solutions.

China Venous Leg Ulcer Market Trends

China plays a significant role in the market, supported by its large and growing patient base, increasing awareness, and advancements in both Western medicine and Traditional Chinese Medicine (TCM). The market features a dual approach, with modern medical practices and TCM both used for managing and treating VLUs. The increasing number of older individuals also contributes to the higher incidence of VLUs, which significantly drives the market's growth.

Why is Europe Considered a Notable Region in the Venous Leg Ulcer Market?

Europe is considered to be a notable region. The high prevalence of VLUs, substantial healthcare burden, and ongoing advances in treatment and management drive the growth of the market in Europe. The region's aging population, combined with issues like venous insufficiency, results in a high rate of VLUs. Europe has also launched various initiatives and collaborations aimed at improving VLU care, including government programs, research projects, and the development of specialized clinics. These efforts explore new therapies, such as hyperbaric oxygen therapy, advanced wound dressings, and other innovative methods to accelerate healing and reduce recurrence.

Latin America Venous Leg Ulcer Market Trends

Latin America is a rapidly growing region in the market. This growth is driven by the high prevalence of chronic venous insufficiency (CVI) and related complications like VLUs. An aging population and increased access to advanced wound care technologies, including specialized dressings, compression therapies, and other innovative solutions that enhance healing and reduce complication rates, are likely to drive market growth. Several Latin American countries have also implemented national programs focused on managing chronic diseases, including those leading to VLUs, such as diabetes and CVI. These programs often feature public awareness campaigns, early detection initiatives, and improved healthcare access for managing chronic conditions.

Middle East & Africa Venous Leg Ulcer Market Trends

The market in the Middle East & Africa is expected to grow at a steady rate throughout the forecast period due to rising elderly population, higher rates of chronic diseases like diabetes and obesity, which often lead to venous ulcers, and increasing demand for affordable treatment options. The adoption of advanced wound dressings, including antimicrobial dressings, alginate dressings, foam dressings, and hydrocolloid dressings, is increasing, resulting in improved healing outcomes and reduced infection risks. The rising focus on developing new therapies for venous leg ulcers, including biologics and autologous platelet-rich plasma, further supports regional market growth.

Market Overview

The venous leg ulcer market pertains to the industry focused on diagnosing, treating, managing, and preventing chronic wounds caused by improper functioning of venous valves, usually in the lower limbs between the knee and ankle. Venous leg ulcers (VLUs) are the most common type of chronic leg ulcers, frequently affecting older adults and patients with chronic venous insufficiency, obesity, or a history of deep vein thrombosis, along with the costs of care and reduced quality of life. The market encompasses a wide range of products and services, such as compression therapy, wound dressings, biologics, devices, advanced therapies, diagnostics, home care services, and outpatient wound care centers.

What are the Key Trends in the Venous Leg Ulcer Market?

- Aging Population: Older individuals are more susceptible to venous diseases and venous leg ulcers, and as the global population ages, the number of at-risk individuals increases. Factors such as obesity, sedentary lifestyles, and deep vein thrombosis contribute to the rising incidence of chronic venous insufficiency, which is a primary cause of VLUs.

- Advancements in Wound Care:Innovations in wound care products, such as advanced dressings and negative pressure wound therapy, are improving treatment outcomes and driving market growth. New technologies, including growth factors and skin substitutes, are enhancing treatment effectiveness and expanding market opportunities.

- Growing Awareness and Diagnosis:Increased awareness of VLUs and advancements in diagnostic tools are leading to earlier diagnoses and treatments, contributing to market expansion. Greater awareness among healthcare professionals and the public about venous diseases and their complications is facilitating earlier intervention.

- Rising Healthcare Expenditure:Growing healthcare spending, particularly in developed countries, is supporting the adoption of advanced VLU treatments. In some regions, favorable reimbursement policies for VLU treatments are further boosting market growth.

- Focus on Patient Quality of Life:There is a growing emphasis on enhancing patient outcomes to address the negative impact of VLUs on the quality of life of patients, particularly in terms of pain, mobility, and social participation, which has led to an increased demand for effective and convenient treatment options.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 8.47 Billion |

| Market Size in 2025 | USD 2.57 Billion |

| Market Size in 2024 | USD 2.25 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.18% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Treatment Type, Ulcer Stage, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of Venous Leg Ulcers

The main driving force in this market is the increasing prevalence of venous leg ulcers, driven by increasing rates of chronic diseases, such as diabetes. These conditions, often linked to venous insufficiency, lead to open sores on the legs that are slow to heal. Many companies have launched new, advanced wound dressings specifically designed for venous leg ulcers, with ongoing efforts focused on developing new therapies that target the root causes of venous ulcers and improve healing rates. Moreover, the growing aging population is expected to drive the growth of the venous leg ulcer market as the prevalence of venous leg ulcers increases with age.

Restraint

High Cost of Treatment and Limited Awareness of Available Options

The main restraint in the venous leg ulcer market is the high cost of treatment and limited awareness of available options, especially in less-developed regions. Additionally, reliance on older technologies and the lack of consistent guidelines for advanced therapies pose challenges. Managing venous leg ulcers can be costly, involving various therapies, dressings, and possible surgical procedures, which can hinder access, particularly in resource-limited settings. The absence of clear, universally accepted guidelines for advanced VLU treatments can also restrict their widespread adoption.

Opportunity

Development and Acceptance of Advanced Wound Care Products and Therapies

A promising future opportunity in the venous leg ulcer market lies in the development and acceptance of advanced wound care products and therapies that aim to promote faster healing and prevent recurrence. This includes innovative dressings, topical agents, and adjunctive therapies addressing the underlying causes of these ulcers and the challenges in managing chronic wounds. Furthermore, therapies such as low-level laser therapy (LLLT), negative pressure wound therapy, and hyperbaric oxygen therapy are being investigated as adjuncts to standard treatments, including compression therapy, to enhance wound healing. The rising development of bioactive and antimicrobial dressings is opening up new growth avenues.

Treatment Type Insights

What Made Compression Therapy the Dominant Segment in the Venous Leg Ulcer Market in 2024?

The compression therapy segment dominated the market with the largest revenue share of 40% in 2024. This is mainly due to its effectiveness and high acceptance as a first-line treatment supported by clinical evidence and guidelines. Compression therapy works by applying external pressure to the leg, improving venous blood flow, reducing swelling, and promoting ulcer healing. It includes bandages, stockings, and wraps, with multi-layer systems, such as four-layer bandages, being more effective than single-layer options. Consequently, compression therapy is widely recognized as the primary and most effective method for managing VLU, as guidelines from many countries recommend it as the initial treatment.

The active wound care segment is experiencing rapid growth, under which the skin substitutes sub-segment is leading the charge. This is primarily because it promotes faster healing and offers a more advanced approach to wound management compared to traditional methods. Skin substitutes serve as a temporary skin layer, protecting the wound from infection, fluid loss, and further damage while creating a healing-friendly environment that can accelerate closure rates compared to standard therapies. They are particularly useful for chronic wounds, such as venous leg ulcers, which often resist conventional treatments. Ongoing research into areas such as 3D bioprinting and growth factors continues to enhance the effectiveness and accessibility of skin substitutes.

Ulcer Stage Insights

How Does the Uncomplicated/Initial VLU Segment Dominate the Venous Leg Ulcer Market in 2024?

The uncomplicated/initial VLU segment dominated the market with a major share of 45% in 2024. This early-stage ulcer is more prevalent, easier to treat, and responds well to initial interventions. Early diagnosis and treatment, primarily through compression therapy and direct wound care, can lead to quicker healing and fewer complications. Most uncomplicated VLUs heal within 4-6 weeks, reinforcing the importance of early detection and treatment, which supports this segment's market lead.

The infected/recurrent VLU segment is expected to grow at the fastest rate during the projection period. The growth of the segment is attributed to the high recurrence rates and increased risk of infection. Factors like incomplete healing, poor patient compliance with preventative measures, and the progression of venous disease contribute to this trend. Older age, obesity, and poor venous circulation can hinder full wound closure, thereby increasing the risk of recurrence. Chronic venous insufficiency can worsen, causing new or recurring ulcers. Emerging therapies, such as antimicrobial dressings and surgical options, are being developed to address these issues, with collaborations focused on innovative treatments on the rise.

End User Insights

Why Did the Hospitals Segment Dominate the Venous Leg Ulcer Market in 2024?

The hospitals segment dominated the market with share of 50% in 2024. This is primarily because hospitals serve as the primary point of care for complex wound management, housing specialized wound care units and providing access to advanced treatment options that allow for personalized care plans for patients. Hospitals utilize cutting-edge technologies and therapies for treating VLUs, including stem cell therapy, advanced dressings, and negative pressure wound therapy. Additionally, the collaborative environment within hospitals, comprising surgeons, nurses, and other specialists, ensures a comprehensive approach to patient care.

The ambulatory surgical centers segment is likely to expand at the fastest CAGR in the upcoming period. This is primarily due to their cost-effectiveness, efficiency, and focus on minimally invasive procedures. Patients and insurers are increasingly opting for these services for VLU treatment, as they offer high-quality care at lower costs compared to traditional hospitals. Additionally, advancements in minimally invasive techniques and technologies, such as endovenous laser ablation (EVLA) and sclerotherapy, are well-suited for these settings, offering less pain, scarring, and quicker recovery times for VLU patients, which further boosts the growth of this segment.

Distribution Channel Insights

How Does the Direct Tenders Segment Dominate the Venous Leg Ulcer Market in 2024?

The direct tenders segment led the market while holding the largest share of 60% in 2024. This is primarily due to the growing demand for efficient and cost-effective procurement of specialized medical products, particularly for hospital use. This strategy enables hospitals to tailor product specifications and negotiate directly, ensuring they obtain the right products at the best prices, which is crucial for managing this chronic condition. Direct tendering enables hospitals to prioritize patient needs and select products that are most effective in managing venous leg ulcers, considering factors such as wound size, chronicity, and patient demographics, making it a preferred procurement method.

The online pharmacies segment is expected to grow at a significant CAGR in the market, mainly due to their convenience, accessibility, and potential for cost savings. Digital platforms enable patients to easily order medications and supplies, often with home delivery, which is particularly beneficial for those with limited mobility or residing in remote areas. These platforms also offer features such as prescription reminders and medication management tools, which enhance adherence to treatment plans, a key aspect of VLU management. There is a clear trend toward increased digital adoption in healthcare, with both patients and providers becoming more comfortable using online services for medication management.

Venous Leg Ulcer Market Companies

- Smith+Nephew plc

- 3M (Acelity/KCI)

- Mölnlycke Health Care AB

- ConvaTec Group plc

- Coloplast A/S

- Organogenesis Holdings Inc.

- MiMedx Group, Inc.

- Integra LifeSciences Corporation

- Medline Industries, LP

- HARTMANN Group

- Derma Sciences (Integra subsidiary)

- Essity AB (BSN Medical)

- URGO Group

- Medtronic plc

- B. Braun Melsungen AG

- Sanara MedTech Inc.

- Advancis Medical

- Hollister Incorporated

- Reapplix A/S

- Covalon Technologies Ltd.

Recent Developments

- In February 2025, MediWound announced a Phase III trial for EscharEx, a treatment for venous leg ulcers. The treatment showed promise in prior Phase II trials for effective tissue removal. Since venous leg ulcers affect a significant portion of the elderly population, there is a critical need for effective treatments. The trial will evaluate EscharEx's efficacy and safety in wound preparation for healing.

(Source:https://www.reuters.com)

- In April 2024, TF Biologics introduced AlloPatch Pliable Meshed, a new acellular human reticular dermal allograft. AlloPatch is designed for treating wounds such as diabetic foot ulcers and venous leg ulcers by addressing the challenges of treating high-risk patients with chronic, non-healing wounds. Their comprehensive portfolio of dermal, placental, and adipose tissues aims to empower clinicians to treat a variety of patients.

(Source:https://www.medicaldevice-network.com)

- In March 2023, Coloplast announced its plan to acquire Kerecis, a prominent player in biologics wound care, for up to USD 1.3 billion. This move aims to strengthen Coloplast's position in the U.S. biologics segment by leveraging Kerecis's patented fish skin technology to enhance wound healing, as demonstrated by favorable clinical trial results.

(Source:https://portalvhds1fxb0jchzgjph.blob.core.windows.net)

- In January 2023, MiMedx Group, a leader in placental biologics, announced a partnership with Gunze Medical to distribute EPIFIX in Japan. This collaboration follows regulatory approval and seeks to improve physician education and key opinion leader (KOL) engagement in a market with strong demand for advanced wound care solutions.

(Source:https://mimedx.gcs-web.com)

Segments Covered in the Report

By Treatment Type

- Compression Therapy

- Multi-layer compression bandages

- Compression stockings

- Intermittent pneumatic compression devices

- Advanced Wound Dressings

- Hydrocolloids

- Hydrogels

- Foam dressings

- Alginate dressings

- Antimicrobial dressings (e.g., silver or iodine-based)

- Active Wound Care (Advanced Biologics)

- Skin substitutes (bioengineered tissue)

- Growth factors

- Platelet-rich plasma (PRP)

- Cell-based therapy

- Negative Pressure Wound Therapy (NPWT)

- Portable NPWT devices

- Hospital-based systems

- Surgical & Debridement Procedures

- Sharp/surgical debridement

- Enzymatic debridement

- Autolytic and mechanical debridement

By Ulcer Stage

- Uncomplicated/Initial VLU

- Infected or Recurrent VLU

- Non-healing or Chronic VLU

By End User

- Hospitals

- Home Healthcare Settings

- Wound Care Centers/Clinics

- Long-Term Care Facilities

- Ambulatory Surgical Centers

By Distribution Channel

- Direct Tenders (Hospital Procurement

- Retail Pharmacies

- Online Pharmacies

- Distributor/Wholesaler Channels

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting