What is Compression Therapy Market Size?

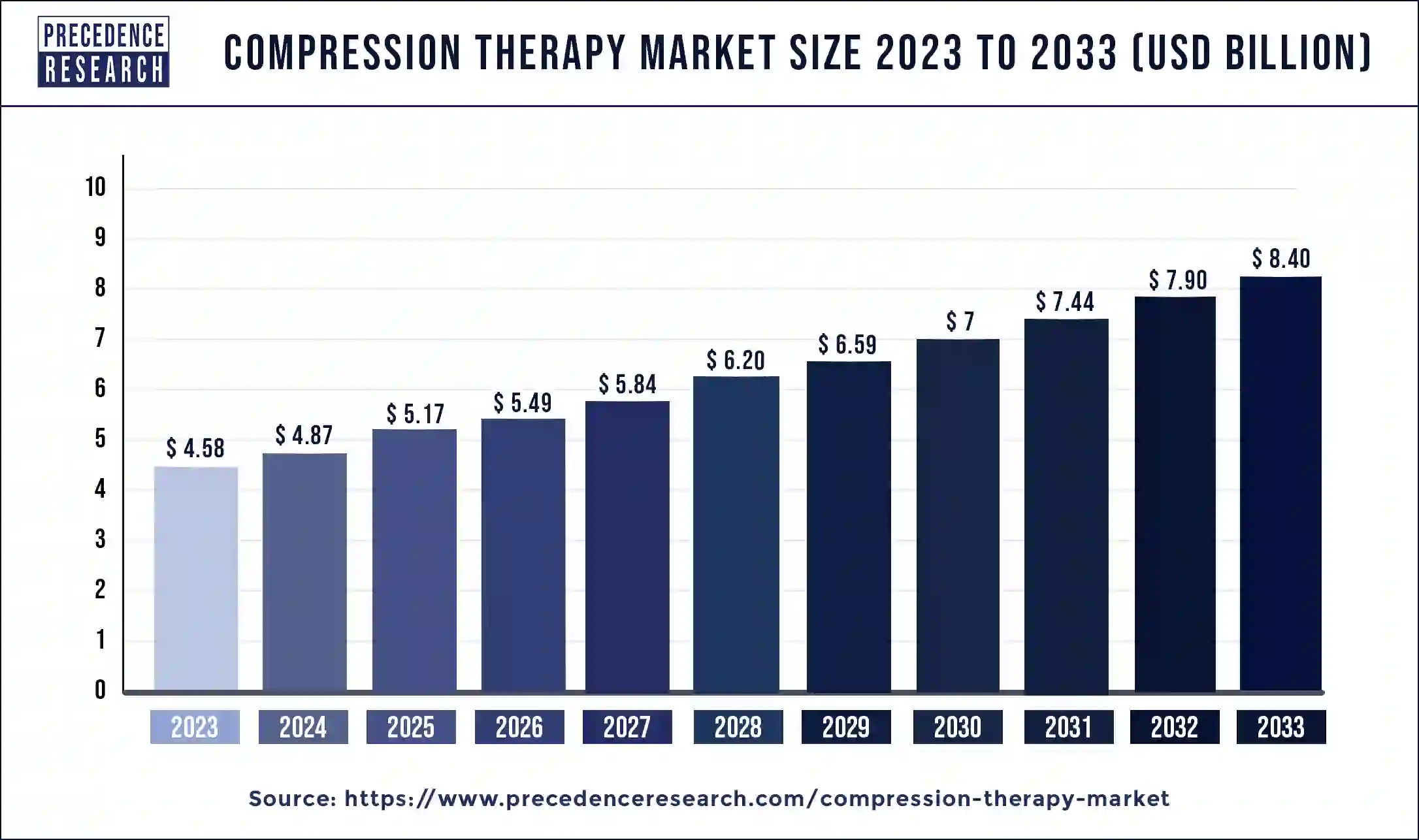

The global compression therapy market size reached USD 5.17 billion in 2025 and is estimated to hit around USD 8.92 billion by 2034 with a CAGR of 6.25% from 2025 to 2034

Market Highlights

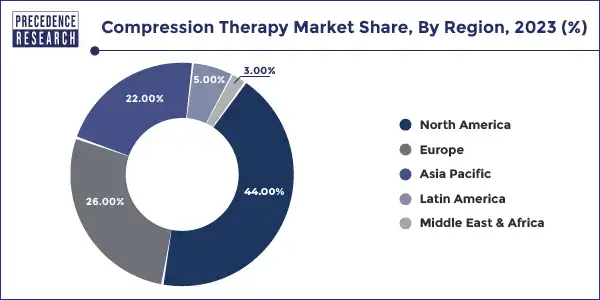

- North America dominated the market with the major market share of 44% in 2024.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

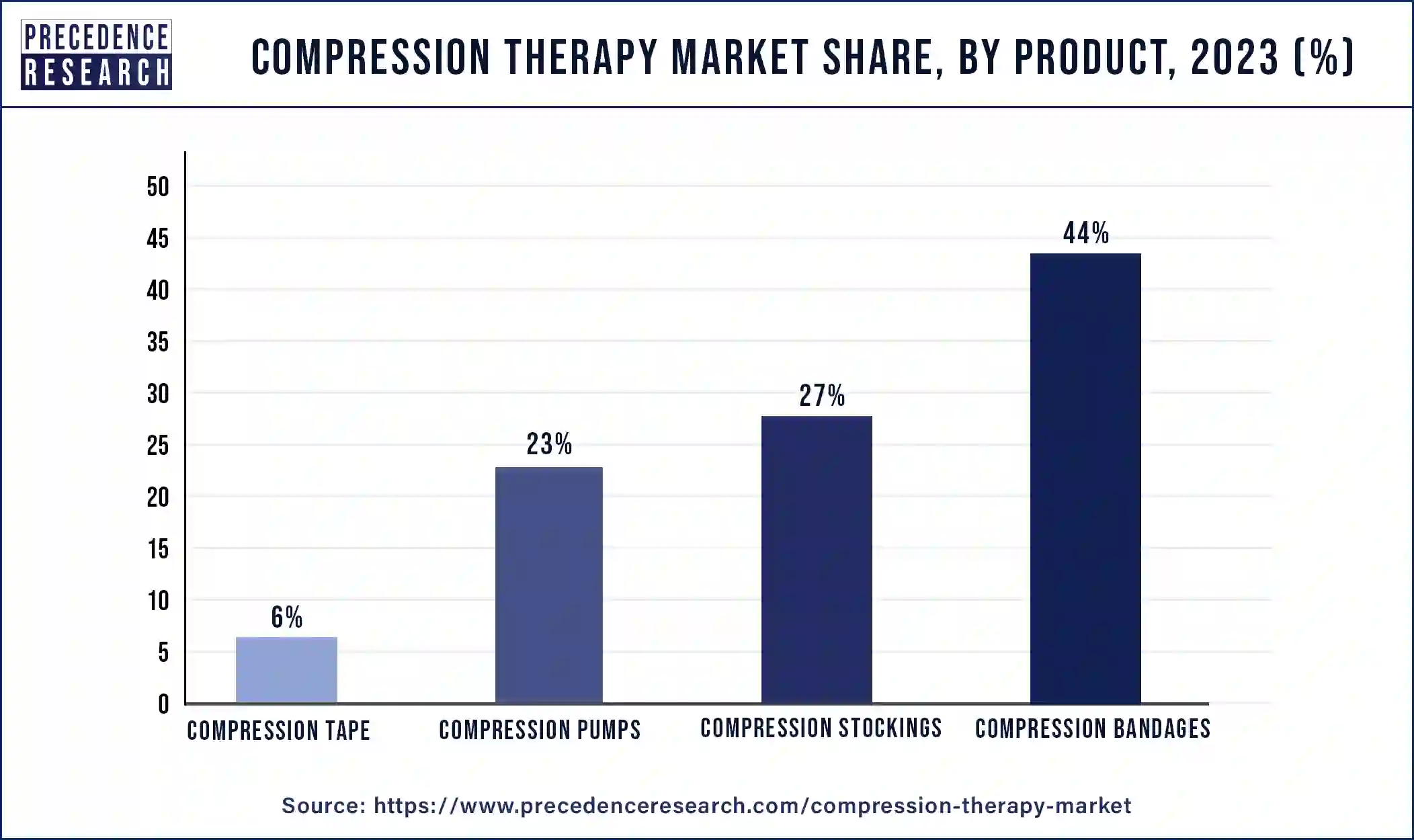

- By product, the compression bandages segment has accounted for the largest market share of 44% in 2024.

- By product, the compression pumps segment is expected to witness the fastest rate of growth during the forecast period.

- By technology, the static technology segment held the biggest market share of 66% in 2024.

- By technology, the dynamic technology segment is expected to grow at a significant rate during the forecast period.

What are the Significances of Compression Therapy?

The compression therapy market services associated with effective treatment to help improve blood flow in your lower legs. Such services are often associated with varicose veins and compression products and devices that provide relief to the patient. This therapy uses the technique of controlled pressure to increase blood flow in the legs which in turn helps to improve blood flow to the heart, support veins, and reduce swelling in the lower extremities.

Compression therapy involves the use of socks, stockings, and bandages which are specially designed to provide compression on legs, ankles, and feet as well as support veins to increase blood circulation in the legs. Compression therapy can treat swelling and when there is more than enough or extra fluid in the legs, compression assists the body to absorb it.

Growth Factors

- The increasing prevalence of various vein-related disorders such as deep vein thrombosis, lymphedema, varicose veins, leg ulcers, and blood clots is estimated to accelerate the market's expansion during the forecast period.

- The increasing popularity of stockings and bandages to treat chronic venous diseases is projected to boost the market growth.

- The emerging need for preventive care & rehabilitation increases demand for compression therapy products, while promoting the expansion of the compression therapy market.

- The rapid technological advancements in wound management coupled with several advantages associated with compression therapy are anticipated to spur the demand for compression therapy in the coming years.

- The rapid rise in the aging and obese population are projected to offer significant opportunities for the market's expansion.

Compression Therapy Market Outlook:

- Global Expansion: A prominent driver is a rise in the number of surgical procedures and the increasing awareness of compression therapy's benefits for post-operative recovery and chronic conditions.

- Major Investors: Essity AB, 3M Company, Cardinal Health, Inc., and other giant companies are heavily investing in innovative technologies and rigorous distribution.

- Startup Ecosystem: Anatomech, an Indian startup, unveiled static compression products and is establishing a wearable, tech-enabled device.

Compression Therapy Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.17 Billion |

| Market Size in 2026 | USD 5.49 Billion |

| Market Size in 2034 | USD 8.92 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.25% |

| Dominating Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product and By Technology, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver: The increasing burden of sports injuries and accidents

The rising number of sports injuries and accidents is expected to fuel the growth of the compression therapy market during the forecast period. Compression therapy is increasingly becoming popular due to the rising cases of sports injuries and traffic accidents. Sports injuries and road accident victims often suffer from mild to severe injuries. Compression therapy assists in supporting veins and improves blood circulation in the legs.

- For instance, according to a study presented at the 2023 American Academy of Orthopaedic Surgeons (AAOS) Annual Meeting. The study, “Epidemiology of Sports Injuries Among High School Athletes in the United States,” found that an estimated 5,228,791 sports injuries occurred nationally. The study marks the first time epidemiologic data has been updated since 2006.

In addition, football has reported the highest number of injuries, at over 1.5 million each year. 40 percent of all football injuries are sprains and strains. In addition, the increasing demand for Compression therapy is driven by the rising cases of road accidents. Such supportive factors are contributing to the market's growth during the forecast period.

Restraint: Lack of awareness

The lack of awareness is anticipated to restrain the compression therapy market's expansion during the forecast period. Less awareness of compression therapy among people as well as regarding the benefits of compression therapy particularly in underdeveloped countries. In addition, the availability of alternative therapies may result in restricting the expansion of the market.

Opportunity: Increasing demand for advanced therapies and new product launches

The rapidly rising demand for advanced therapies along with the new product launches is projected to offer a lucrative opportunity for the growth of the compression therapy market during the forecast period. Several key market players are constantly investing in innovating advanced therapies and technologies for managing the treatment of venous diseases. The use of compression therapy can help to improve the quality of life and it is also an effective form of treatment for various medical conditions such as improving blood flow, reducing swelling in the legs, lessening the risk of blood clots, aiding in healing leg ulcers, and effective treatment for varicose veins. Additionally, the rise in new product launches is projected to create significant opportunities for the market's growth during the forecast period.

- For instance, In January 2022, AIROS Medical, Inc., a manufacturer, and distributor of compression therapy devices, and Fist Assist Devices, LLC (Fist Assist), an innovative medical device company, announced the launch of an e-commerce website, for the sale of the Fist Assist FA-1 compression device.

Segment Insights

Product Insights

The compression bandages segment accounted for the dominating segment in the compression therapy market share of 44% in 2024.owing to the increasing adoption for treatment of Edema, Chronic Venous Insufficiency (CVI), and Deep Vein Thrombosis (DVT). Compression bandages are mainly classified into types elastic and inelastic. Compression bandages are extensively used for the treatment of venous diseases as well as to prevent their re-occurrence during compression therapy. Compression bandages can be wrapped around a sprain or strain. The gentle pressure of the bandage helps to reduce swelling in the injured area. The aforementioned factors will accelerate the segment's growth.

- In October 2022, KOB GmbH announced the expansion product portfolio of compression bandages with VisioCompress2 Lite. VisioCompress2 Lite is used when a lower compression pressure is required. It consists of a padding bandage and a permanently elastic non-woven bandage.

The compression pumps segment is observed to witness a significant rate of growth in the compression therapy market over the forecast period. The segment is growing due to the increasing cases of lymphedema and other venous disorders. Compression pumps are advanced, user-friendly, and have adjustable pressure settings to cater to specific patient needs as per the severity of the disorder. Thereby, boosting the growth in the market.

- In April 2022, Koya Medical announced the U.S. commercial availability of its Dayspring active compression system for the treatment of lymphedema and venous diseases in the lower extremities. Dayspring is the first non-pneumatic active dynamic compression treatment cleared by the U.S. Food and Drug Administration (FDA). It is specifically designed for patient mobility and is wearable.

Technology Insights

The static technology segment held the largest share of the compression therapy market in 2023, the segment is expected to sustain the position throughout the forecast period. Static technology has convenience and user-friendly attributes. The benefits associated with static technology help in treating edema and sports-related injuries to alleviate pain. Static technology is highly preferred by physicians for treating deep vein thrombosis, lymphedema, and chronic venous insufficiency (CVI).

The dynamic technology segment is expected to grow at a significant rate in the compression therapy market during the forecast period. The growth of the segment is driven by improvements in technology. Dynamic compression therapy helps to improve performance and reduce muscle recovery time. Smart features provide real-time feedback and facilitate personalized treatment facilities, and resulting in better patient results. The rising acceptance of sophisticated healthcare solutions is projected to accelerate the segment's growth.

Regional Insights

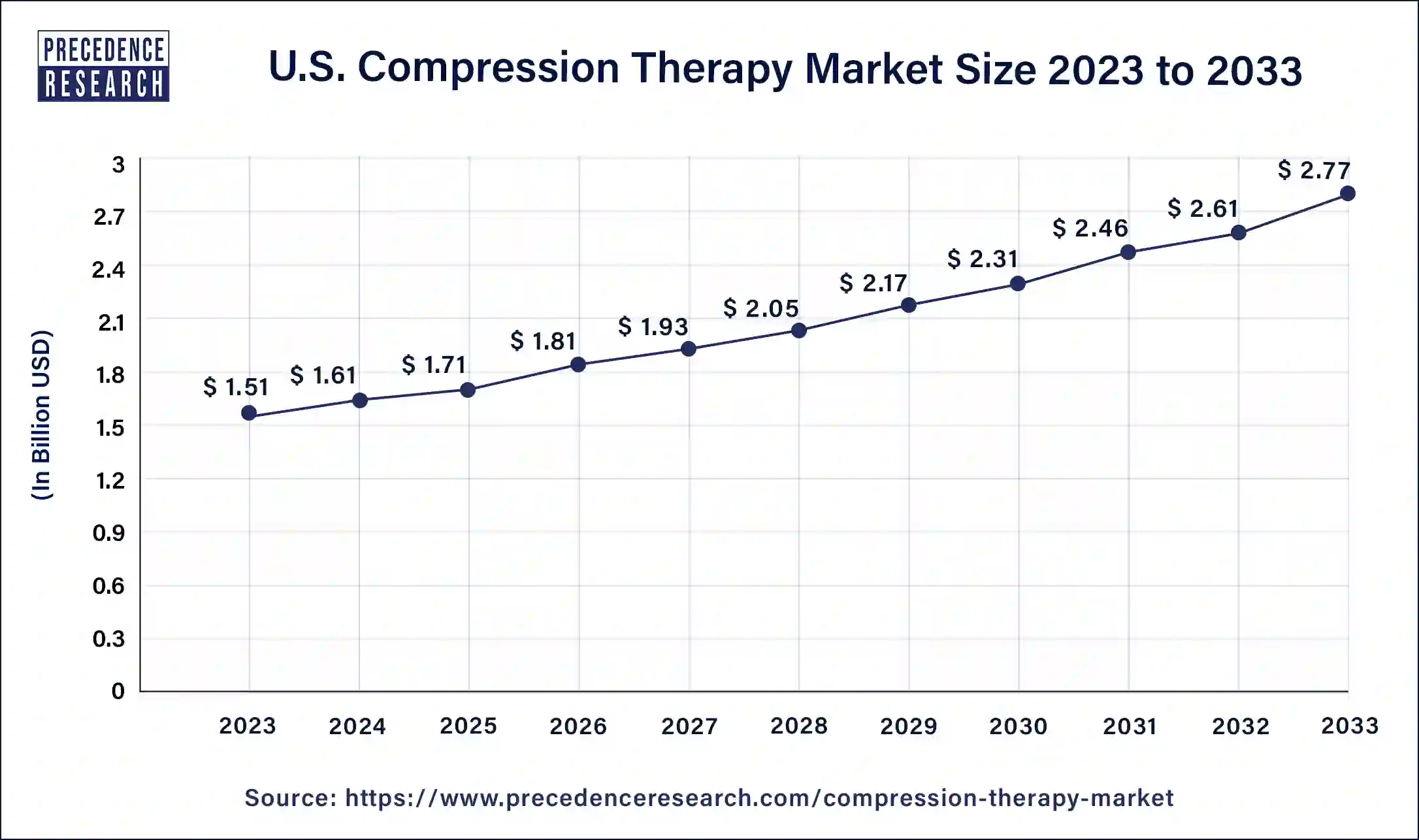

Compression Therapy Market Size in the U.S. 2025 to 2034

The U.S. compression therapy market size is estimated at USD 1.71 billion in 2025 and is anticipated to reach around USD 2.95 billion by 2034, poised to grow at a CAGR of 6.33% from 2025 to 2034

Why did America Dominate the Market in 2024?

North America held the largest market share of 44% in 2024. The region is observed to sustain its position in the upcoming years. The growth of the North American region is attributed to the sophisticated healthcare infrastructure, rising investments in research and development activities and rising awareness of the significance of compression therapy.

Moreover, the rising healthcare expenditure, rising, geriatric population, growing healthcare awareness, and rising prevalence of chronic disorders such as deep vein thrombosis (DVT), lymphedema, peripheral artery disease (PAD), and chronic venous disease (CVD) also promote the expansion of the market in the region.

Chronic Venous Disease (CVD) refers to the medical conditions related to or caused by veins that become diseased or abnormal. According to the report published by the National Institutes of Health (NIH) in April 2023, Varicose veins afflict more than 25 million people in the United States, and more than 6 million harbors severe venous disease, making CVD a prevalent health condition. The most common signs of CVD are telangiectases, reticular veins, varicose veins, and venous ulcerations.

In North America, the United States is observed to remain as the largest contributor to the compression therapy market due to the presence of major compression therapy product manufacturers, favorable government reimbursement policies, and increasing awareness regarding early diagnosis of venous ulcers, arthritis, and others. Moreover, the rising number of road accidents and sports injuries has resulted in the increasing adoption of compression therapy for the healing of injuries. Furthermore, companies are engaged in strategic approaches such as partnership or collaboration, acquisitions, mergers, and product launches.

- In June 2022, Mueller Sports Medicine, partnered with Mego Afek, a leader with over 40 years of experience in sequential compression therapy, to offer athletes and consumers a treatment for improved circulation and recovery.

- In March 2023, Aspen Medical Products, a pioneer in solutions for mobility and pain management, and NICE Recovery Systems (NICE), a well-known provider in the sports and injury recovery space, announced a strategic partnership that aims to bring more precise recovery and pain management solutions to patients and medical professionals alike. The partnership leverages NICE's advanced cold compression technology with Aspen's effective bracing solutions to deliver pain management and post-operative care to patients recovering from surgery or injury.

Increasing Cases of CVD & Other Sever Health Issues are impacting the Asia Pacific

Asia Pacific is expected to witness the fastest growth in the compression therapy market during the forecast period. The growth of the region is attributed to the increasing investment in the healthcare infrastructure and, robust focus on wellness resulting in rising product adoption, an increase in the number of road accidents, an increasing burden of chronic vein disorders (CVD) adult population, increasing sport injuries, rising innovation in product development, and growing geriatric and obesity population. In addition, the market has witnessed the sales of compression therapy products growing through e-commerce. Online pharmacies are leveraging on offering doorstep delivery and discounts which are quite appealing to the end-users.

Accelerating Home-based & Remote Therapy: Leverages the Chinese Market

Day by day, China is encouraging an extensive emergence of home-based and remote solutions, such as Tactile Systems Technology, Inc., in partnership with hospitals in China deployed pneumatic compression systems for home-based lymphedema management. Also, they are putting efforts into an integrated telehealth platform for enhancing patient accessibility and enabling remote monitoring and patient support.

Exploration of Novel Materials & Other Foci are Fueling Latin America

Specifically, the Latin American compression market possesses a notable growth, with raised emphasis on the development of advanced, comfortable materials, particularly breathable, moisture-wicking, and hypoallergenic fabrics to lower skin irritation and boost long-term patient compliance. Besides this, revolutionary demand for performance and recovery-oriented compression sleeves and wraps is also assisting the market beyond traditional medical applications.

Robust Clinical Research Efforts: Drives Brazilian Market

Recent clinical studies, like in Rio de Janeiro, compared the efficiency and affordability of self-adjusting garments (e.g., the ReadyWrap system) with traditional multi-layer bandaging for treating lymphedema in breast cancer patients. As well as they have expanded the application of pneumatic compression versus manual massage for sports recovery, with the IPC intervention in one study using a locally available device referred to as the Reboot Go.

Compression Therapy Market: Value Chain Analysis

- R&D

The market is fostering research activities in biomechanics and materials science, design and prototyping, clinical evaluation, and regulatory approval.

Key Players: Medi GmbH & Co. KG, Sigvaris Group, Tactile Medical, etc. - Clinical Trials & Regulatory Approvals

Many leaders are bolstering clinical studies of compression therapy in venous leg ulcers and lymphedema, with a significant step by the U.S. Food and Drug Administration (FDA) in overall approvals.

Key Players: Indiana University, University Hospital Erlangen, Western Vascular Institute, Ireland, etc. - Patient Support & Services

Firms are focusing on professional guidance, education, proper fitting of garments/devices, and continuous monitoring.

Key Players: Bio Compression Systems, Absolute Medical, AdaptHealth, etc.

Recent Developments

- In May 2020, AIROS Medical, Inc., a medical technology manufacturer specializing in compression therapy products that treat cancer-related lymphedema and venous complications, announced the launch of its updated AIROS 6 Sequential Compression Therapy device and Arm Plus garments following multiple regulatory approvals.

- In June 2022, Stryker has launched a new research & development facility in India, covering an extensive area of 150,000 square feet. The facility's primary objective is to foster innovation within India and on a global scale, reinforcing the company's commitment to enhancing healthcare worldwide.

- In February 2022, Therabody unveiled its latest product, the second generation of Recovery Air pneumatic compression boots. These boots feature cutting-edge technology, enabling more efficient post-recovery for users. With advanced pneumatic compression, the boots aid in improving blood circulation and reducing muscle soreness and swelling, ensuring an effective and accelerated recovery process for individuals.

- In September 2021, Arjo announced that it has received 510(k) clearance from the US Food and Drug Administration (FDA) for WoundExpress, an intermittent pneumatic compression (IPC) solution for accelerating healing of venous leg ulcers. The FDA clearance follows several recent studies showing that WoundExpress can significantly improve lower leg wound management.

- in January 2022, AIROS Medical, Inc., a designer, manufacturer, and distributor of compression therapy devices, and Fist Assist Devices, LLC (Fist Assist), an innovative medical device company, launched an e-commerce website, www.fistassistusa.com, for the sale of the Fist Assist FA-1 compression device in the United States. This will increase sales of compression therapies via online platforms, driving market growth in this region.

Key Players inCompression Therapy Market and Their offerings

- Smith & Nephew PLC- A leading company that facilitated the PROFORE multi-layer compression bandaging system.

- Medline Industries, Inc.- They primarily offer diverse multi-layer compression bandage systems, reusable garments with adjustable pressure, and anti-embolism hosiery.

- Cardinal Health- A prominent provision is the Kendall SCD Smartflow Compression System, to prevent deep vein thrombosis (DVT) using sequential pneumatic compression.

- Julius Zorn GmbH- It usually explores different compression stockings, tights, sleeves, gloves, wraps, and bandages.

- Hartmann AG- A major company introduced short-stretch bandages, including the Pütterbinde and Pütter Flex, multi-layer systems.

Segments Covered in the Report

By Product

- Compression Pumps

- Compression Stockings

- Compression Bandages

- Compression Tape

By Technology

- Static Compression Therapy

- Dynamic Compression Therapy

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content