What is the Virtual Event Platform Market Size?

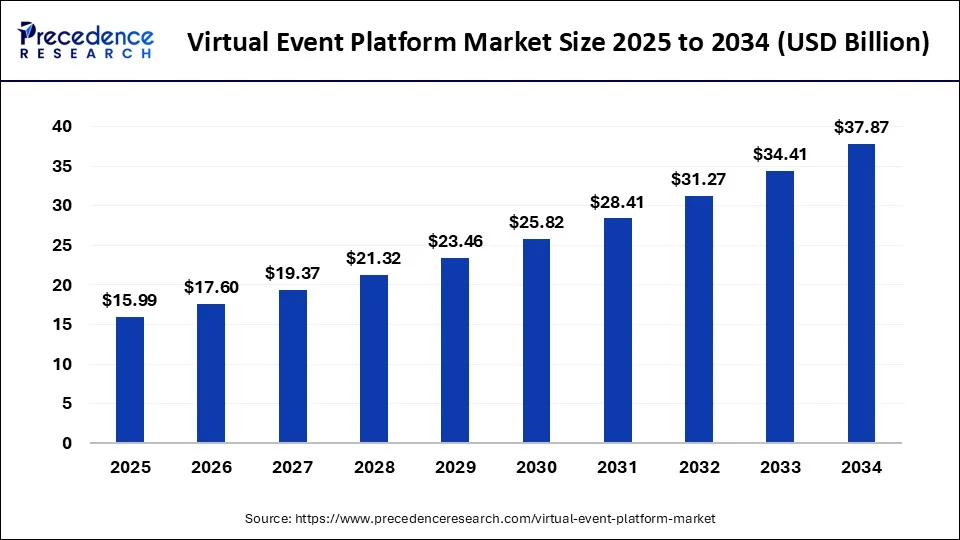

The global virtual event platform market size is calculated at USD 15.99 billion in 2025 and is predicted to increase from USD 17.60 billion in 2026 to approximately USD 41.12 billion by 2035, expanding at a CAGR of 9.91% from 2026 to 2035.

Virtual Event Platform Market Key Takeaways

- In terms of revenue, the market is valued at $15.99 billion in 2025.

- It is projected to reach $41.12billion by 2035.

- The market is expected to grow at a CAGR of 9.91% from 2025 to 2035.

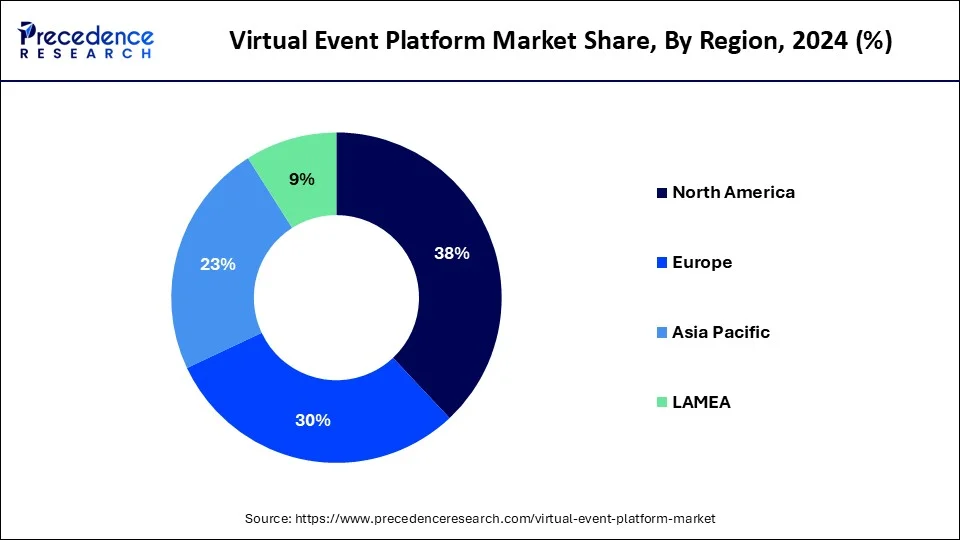

- North America dominated has contributed more than 38% of market share in 2025.

- Asia Pacific is expected to host the fastest-growing market during the projected period.

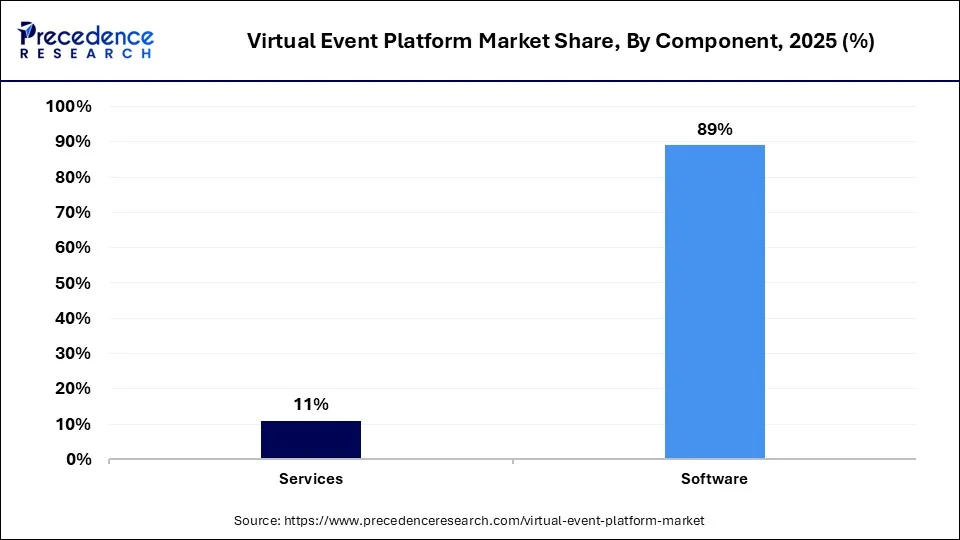

- By component, the software segment accounted for the biggest market share of 89% in 2025.

- By component, the services segment is anticipated to grow at the fastest rate in the market during the study period.

- By organization size, the medium enterprise segment dominated the market in 2025.

- By organization size, the small enterprise segment is expected to grow at the fastest rate in the market over the forecast period.

Market Overview

A virtual event platform is a digital platform created to host and maintain online events like trade shows, webinars, conferences, and meetups. It offers a virtual atmosphere where members can interact and engage in communication activities. Also, can consume global content from anywhere in the world by utilizing their mobile devices and computers. These platforms include different features like virtual booths, live streaming, and chat functionalities to mimic and improve the experience of physical events in a digital environment.

How is AI Revolutionizing the Virtual Event Platform Market?

Artificial intelligence (AI) and virtual reality (VR) are transforming the virtual event platform market by improving interaction and engagement along with user experience systems that can unlock user data to offer particular experiences. AI can recommend booths, programs, and networking opportunities based on guests' interests, which makes the user experience more fruitful. Additionally, AI can help attendees search for improved matches solely based on their hobbies, goals, and profiles.

- In June 2024, ON24 marks the next chapter of its innovation strategy with the launch of its next-generation intelligent engagement platform. With AI-powered intelligence at the core, ON24 will now enable enterprises to continuously engage audiences through hyper-personalized experiences that deliver connected insights and drive cost-efficient revenue growth.

Virtual Event Platform Market Growth Factors

- The increasing globalization and interconnectedness among businesses are expected to drive the virtual event platform market growth shortly.

- The scalability and customization provided by the virtual event platforms can fuel the virtual event platform market growth further.

- The analytics and data insights provided by virtual event platforms are important for businesses, and they can boost the virtual event platform market growth shortly.

Key Factors Influencing Future Market Trends

- Increased demand for hybrid events: The demand for systems that can seamlessly combine offline and online engagements, expand event reach, and enhance attendee engagement will define the future of such systems.

- Enhanced personalization and AI integration: AI exploitation brings vendor support in the form of personalized content, session recommendations, and networking opportunities, ensuring a major increase in attendee participation. The integration of AI and machine learning will make the virtual event platforms flexible and more personalised to the preferences of the audiences, which will enhance a higher engagement of audiences.

- Intensified real-time interaction: The virtual events need to have facilities such as live chats, Q&A, polls, etc., to succeed. With the increasing need for real-time communication, platforms will also have to improve to provide more interactive components to evoke audience participation and thus add to the participatory and lively nature of virtual meetings.

List of countries by size of the labor force status (2022)

| Rank | Country/Region | Labor force | Date of information |

| 1. | China | 781,808,000 | 2022 est. |

| 2. | India | 554,145,000 | 2022 est. |

| 3. | United States | 168,190,000 | 2022 est. |

| 4. | Indonesia | 138,099,000 | 2022 est. |

| 5. | Brazil | 108,751,000 | 2022 est. |

| 6. | Pakistan | 78,863,000 | 2022 est. |

| 7. | Bangladesh | 73,862,000 | 2022 est. |

| 8. | Russia | 73,799,000 | 2022 est. |

| 9. | Nigeria | 73,389,000 | 2022 est. |

| 10. | Japan | 69,114,000 | 2022 est. |

Technological Advancement

Virtual event organizers can use the platform functions to model personalized spaces that support their brand image or event aspirations. Adding live chats and polls as well as Q&A sessions is becoming a full-fledged practice, allowing for a direct connection between speakers and guests when it comes to in-the-moment activities. Furthermore, there is the opportunity for personalisation of experiences at events through the use of AI through the use of attendee data to recommend sessions and networking, and content. These technological changes are revolutionizing corporate events, conferences, trade shows, and social spaces, and allowing those participating in said events to interact with dynamic immersion, convenience, and show from anywhere on the planet.

Virtual Event Platform Market Outlook

The virtual event platform market is expected to grow steadily from 2025 to 2030 due to the rising adoption of hybrid and fully digital events across corporate training, healthcare, education, and large trade shows. Increasing demand for seamless global connectivity and remote collaboration is driving organizations to invest in platforms that offer high-quality video streaming, interactive networking, and advanced event analytics.

The market is growing worldwide as organizations increasingly adopt hybrid and digital events to enhance global reach, reduce costs, and improve attendee engagement. Emerging regions present strong opportunities due to expanding internet penetration, rising digital literacy, and growing demand for virtual training, education, and business collaboration solutions.

Major investors in the market include technology giants, venture capital firms, and enterprise software companies that fund platform development, scalability, and advanced features like AI-driven analytics and immersive experiences. Their investments accelerate innovation, support global expansion, and enable platforms to deliver more secure, interactive, and high-performance digital event solutions.

The virtual event platform startup ecosystem is rapidly evolving, with new companies focusing on niche areas like AI matchmaking, gamification, immersive 3D environments, and low-latency streaming solutions. Startups such as Ubivent (Germany), Airmeet (India), and smaller regional firms in Asia-Pacific are gaining momentum by offering highly customizable, interactive, and engaging event experiences.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 41.12 Billion |

| Market Size in 2025 | USD 15.99 Billion |

| Market Size in 2026 | USD 17.60 Billion |

| Market Growth Rate from 2025 to 2035 | CAGR of 10.05% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Organization Size, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Live streaming of events

The live streaming of multiple events globally has increased significantly, particularly in the media and sports industry. This surge especially gained traction during the COVID-19 pandemic because there was no other way to attend such an event in person. Moreover, the rising popularity of 5G networks with good internet infrastructure is expected to propel the virtual event hosting platform requirements over the forecast period. Hence, Live streaming can play an important role in the deployment of these digital event platforms soon, thus driving the virtual event platform market.

- In October 2022, the video conferencing platform Zoom launched, ‘Zoom Events,' which enables users to produce immersive and engaging virtual experiences on one platform in India. Zoom Events provides the features of Zoom Webinars, Zoom Meetings, and Team Chat in one platform to offer a comprehensive solution to event organizers. It is designed to help facilitate and manage an event from start to finish, be it a company meeting, large conference, or trade show.

Restraint

Lack of physical presence and limitations in replication

A lack of physical presence and personal connections in virtual space can be an obstacle. Some investors, especially in industries that depend on face-to-face interactions like sales and networking, might prefer conventional events for interactions. Also, Limitations in mimicking the sensory experience of physical events like spontaneous interactions and engagement can influence market growth negatively, which can further hamper the virtual event platform market growth.

Opportunity

Growing popularity of virtual education

The utilization of virtual classrooms to change education methods is now gaining more popularity, even in conventional educational institutions. This kind of training gives study lessons to students anytime and anywhere. Students can also get free educational sessions, which can reduce expenses and enhance their knowledge. Furthermore, advancements in exhibition organizing are anticipated to fuel market growth throughout the forecast period because they enable more engaging educational interactions among the users. This creates new opportunities for the key players in the virtual event platform market.

- In November 2024, Jugo, a technology company committed to redefining digital communication and collaboration, announced the launch of Jugo Spaces, its cloud-based communication platform that transforms the virtual meeting experience, moving beyond the traditional video conference to create immersive, multi-sensory environments that embrace the human presence not just voice and two-dimensional visuals.

Virtual Event Platform Market Segment Insights

Component Insights

The software segment led the virtual event platform market in 2025. The software allows virtual communication from distant locations by building technologies such as 3D simulation and augmented reality to create in-person experiences. Moreover, most people can share information in real-time due to the software's interactive abilities, including live polls, chat boxes, and one-to-one video-audio chats.

- In April 2024, Notified, a globally trusted technology partner for investor relations, public relations, and marketing professionals, announced the sale of its virtual events and webinar business to Brandlive, the leader in enterprise webinars, events, and global town halls. The decision reflects Notified's sharpening focus on investor relations and public relations solutions.

The services segment is anticipated to grow at the fastest rate in the virtual event platform market during the study period. It includes various services like customization, event planning, system integration, and management. As organizations convert to virtual events, they might need assistance setting up and integrating the virtual event platform with other systems. The segment is likely to experience significant growth because organizations seek specialized support to expand the virtual event platforms.

Organization Size Insights

The medium enterprise segment dominated the virtual event platform market in 2025. This can be attributed to the rising demand for large companies to utilize digital platforms. The increasing tendency of big companies to adhere to local initiatives with employees, clients, and other business stakeholders spread across various geographic regions ultimately has raised the need for the industry in this field.

The small enterprise segment is expected to grow at the fastest rate in the virtual event platform market over the forecast period. Small businesses emphasize capturing a large market share and serving consumers through different growth opportunities, which has resulted in extensive use of the cloud. As compared to large organizations, these enterprises face more sales and marketing challenges with low budgets. However, small businesses benefit from these platforms because they decrease the overall cost of hosting meetings.

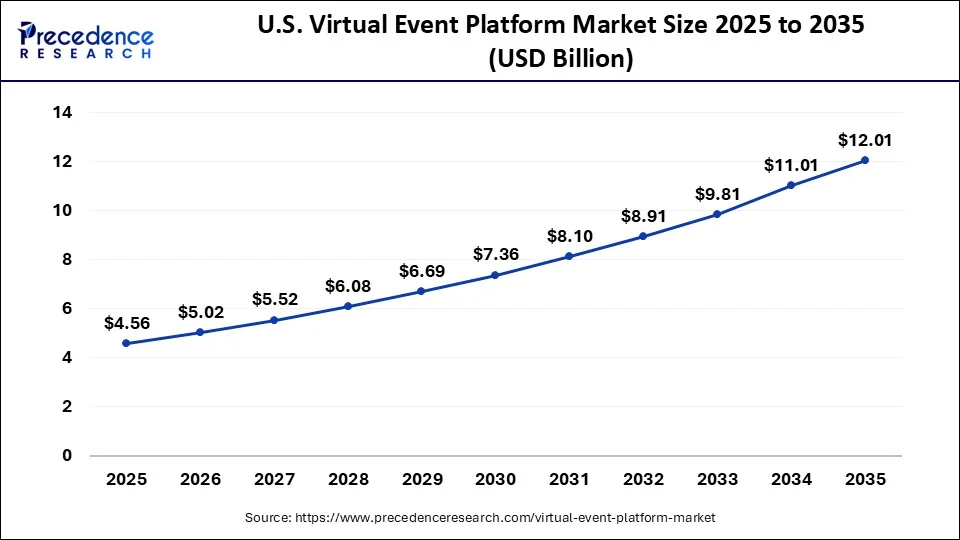

Virtual Event Platform Market Regional Insights

The U.S. virtual event platform market size was exhibited at USD 4.56 billion in 2025 and is projected to be worth around USD 12.01 billion by 2035, poised to grow at a CAGR of 10.17% from 2025 to 2035.

North America dominated the virtual event platform market in 2025. This is due to the U.S. and Canada's technical breakthroughs, innovative digital infrastructure, and stable economies. North America is always seen as a business hub with a greater rate of adoption of advanced technologies. For many years, companies like Microsoft, Cisco Systems Inc., and Apple. have been at the top of the North American market. Additionally, these companies offer innovative and complex virtual platforms with greater bandwidth and stability.

U.S. Virtual Event Platform Market Trends

In the U.S., the market growth is driven by widespread adoption of hybrid and fully digital events across corporate, educational, and healthcare sectors. Organizations increasingly use virtual platforms for conferences, training, and webinars that blend in-person and online interactions, while ongoing digital transformation initiatives and high corporate IT budgets help maintain the country's market leadership.

Asia Pacific is expected to host the fastest-growing virtual event platform market during the projected period. This is due to the region's increasing digital landscape, rising Internet connectivity, and the majority population of tech-savvy users propelling the adoption of virtual event platforms. Furthermore, Organizations in countries like Japan, China, and India are using these platforms to connect with a greater pool of their audience and extend their reach. The growing importance of online marketing is expected to boost market growth further.

- In May 2024, VOSMOS, a tech start-up that specializes in Metaverse and virtual experiences, launched VOSMOS. Events, a DIY or user-created virtual events platform. VOSMOS.Events empower individuals and organizations to create both small and large-scale virtual events that are dynamic and secure. Developed by VOSMOS in India, the platform offers a subscription-based model that enables users to create virtual events ranging from 100 to more than 1 lakh participants.

India Virtual Event Platform Market Trends

India is leading the charge in Asia Pacific due to rapid digital transformation, increasing internet penetration, and rising enterprise IT budgets. Corporations, educational institutions, and professional associations are leveraging virtual and hybrid platforms for conferences, trade shows, and training programs, while a young, tech-savvy workforce with widespread smartphone usage supports strong platform adoption and engagement.

The European market is driven by the increasing adoption of hybrid and digital events across corporate, educational, and healthcare sectors, fueled by the need for cost-effective, scalable, and globally accessible solutions. Strong investments in digital infrastructure, high internet penetration, and a focus on innovative attendee engagement technologies, such as AI-powered analytics and interactive networking, further support market growth across the region.

Germany Virtual Event Platform Market Trends

Germany is a major player in the market, with growth supported by strong digital infrastructure and the early adoption of hybrid and virtual formats by enterprises, educational institutions, and trade associations. Corporate interest in cost-effective engagement tools and analytics-driven decision-making accelerates platform usage. Sustainability and ease-of-access are also boosting adoption, as many organizations value reduced travel, lower carbon footprint, and flexible remote‑attendance options when planning events.

Virtual Event Platform Market Value Chain Analysis

Core technologies such as streaming engines, cloud infrastructure, AI, and security frameworks are developed to support scalable virtual event environments. Companies focus on ensuring stability, low latency, and seamless integrations with third-party business and communication tools.

Key Players: Zoom Video Communications, Microsoft Azure, AWS, Agora.

Platforms are configured with registration systems, ticketing tools, analytics dashboards, sponsor modules, and networking features. This stage focuses on tailoring the event structure, permissions, and workflows based on client objectives.

Key Players: Swapcard, Brella, Bizzabo.

The event goes live with support for real-time streaming, attendee engagement, virtual booths, and tech assistance. Organizers monitor performance, resolve issues instantly, and facilitate smooth interactions between presenters and participants.

Key Players: Zoom Events, Webex Events, Airmeet.

After the event, platforms generate insights such as attendee behavior, engagement levels, lead scores, and content performance. Organizers use these metrics to improve future events, nurture leads, and repurpose sessions for long-term monetization.

Key Players: On24, Hubilo, Kaltura.

Virtual Event Platform Market Companies

6Connex offers a cloud-based virtual event platform enabling immersive online experiences, including webinars, virtual trade shows, and hybrid events with analytics-driven engagement tools.

BigMarker provides a comprehensive webinar and virtual event platform designed for marketing, lead generation, and interactive attendee engagement, with live, automated, and on-demand formats.

Hubilo delivers an AI-powered virtual and hybrid event platform focusing on attendee engagement, networking, and customizable event experiences for enterprises and associations.

Intrado offers a scalable virtual event solution supporting webinars, town halls, and large-scale digital conferences, integrating interactive tools and analytics for event optimization.

Intrado offers a scalable virtual event solution supporting webinars, town halls, and large-scale digital conferences, integrating interactive tools and analytics for event optimization.

Livestorm provides a browser-based platform for webinars, online meetings, and virtual events, emphasizing ease of use, marketing integrations, and detailed performance analytics.

Other Major Key Players

- Microsoft

- Ubivent GmbH

- Zoom

- Cisco

- Others

Recent Developments

- In September of 2024, Vosmos Events launched a series of AI-based solutions to change the virtual events landscape and facilitate planning, managing, and engaging audiences. Each product supports instant playback and distributed engagement features, visible in familiar tools like VIRSA with smart matching, VosmosGPT with instant setup, and vClip with instant video creation.

- In September of 2024, Zoom Video Communications, Inc. and Mitel announced a strategic partnership to enhance communication solutions for their business clients, specifically enhancing the integration of Zoom's virtual meeting and event platform and Mitel's communication systems into a platform that optimizes connectivity and improves user experiences in virtual meetings and events.

- In July 2024, Martiz Holdings, Inc. acquired Convention Data Services (CDS), a registration and lead services provider, from Freeman. The acquisition is intended to solidify the company's position in the events industry and create a broader portfolio of offerings to prospective clients in trade shows and associations.

- In March 2023, Zoom Video Communications launched Zoom Events, a comprehensive platform for hosting virtual and hybrid events. Zoom Events integrates seamlessly with Zoom Meetings and Webinars, offering features like registration management, networking lounges, and interactive exhibitor booths.

- In July 2022, Hopin acquired Attendify, a leading provider of event management and mobile app solutions. This acquisition enhances Hopin's capabilities in attendee engagement and event personalization, expanding its market presence in the virtual event platform sector.

- In June 2022, the most recent additions to Cisco's arsenal of API-first tools and solutions, Panoptica and Calisti, were announced by the company. They enable organizations to provide amazing digital experiences by giving customers contemporary application connectivity, security, and observability. At Cisco Live, the leading networking and security conference, the news was made.

- In June 2022, the Zoom Apps SDK has been made generally available by Zoom Video Communications, Inc. It offers programmers the tools and infrastructure to create Zoom Apps for the Zoom client. Developers may access Zoom clients by utilizing the Zoom Applications SDK, and users can find and add new apps inside the same client they already use daily.

Segments Covered in the Report

By Component

- Software

- Services

By Organization Size

- Small Enterprises

- Medium Enterprises

- Large Enterprises

By End-User

- Corporate & Business

- Healthcare

- Technology & IT

- Entertainment & Media

- Trade Shows & Exhibitions

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting