What is the Water Heater Market Size?

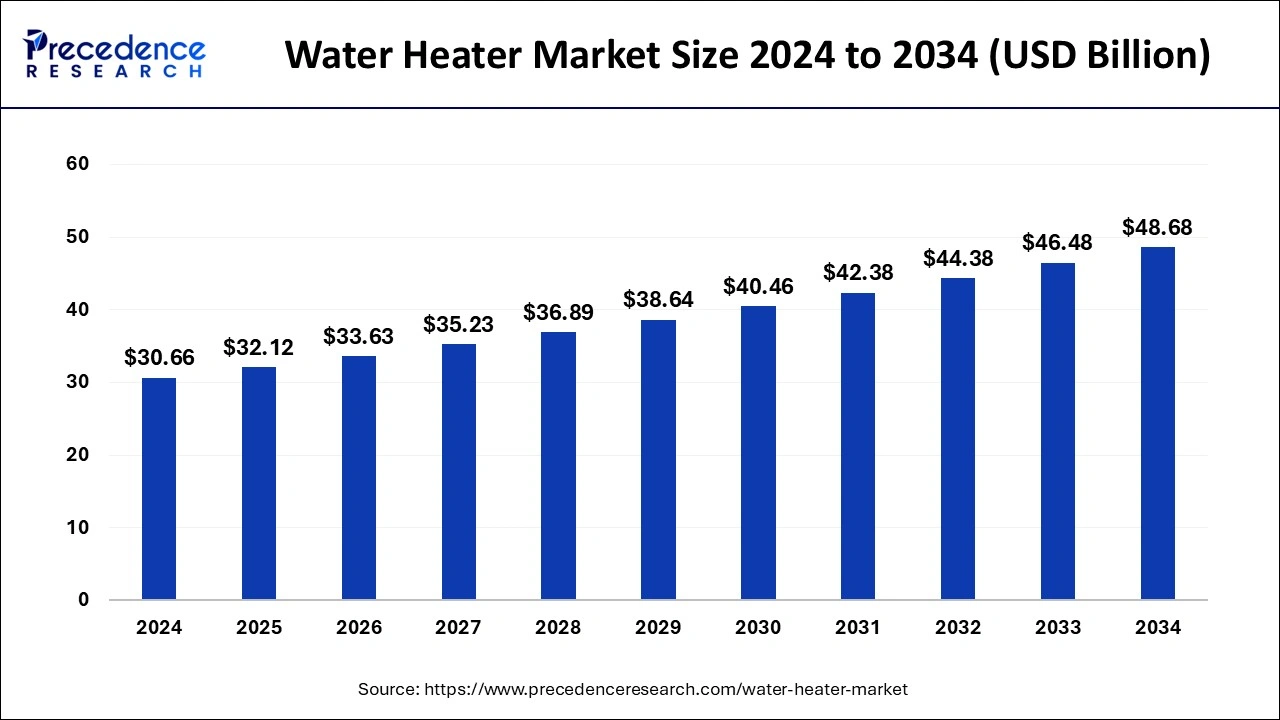

The global water heater mmarket size is calculated at USD 32.12 billion in 2025 and is predicted to increase from USD 33.63 billion in 2026 to approximately USD 50.81 billion by 2035, expanding at a CAGR of 4.69% from 2026 to 2035.

Water Heater Market Key Takeaways

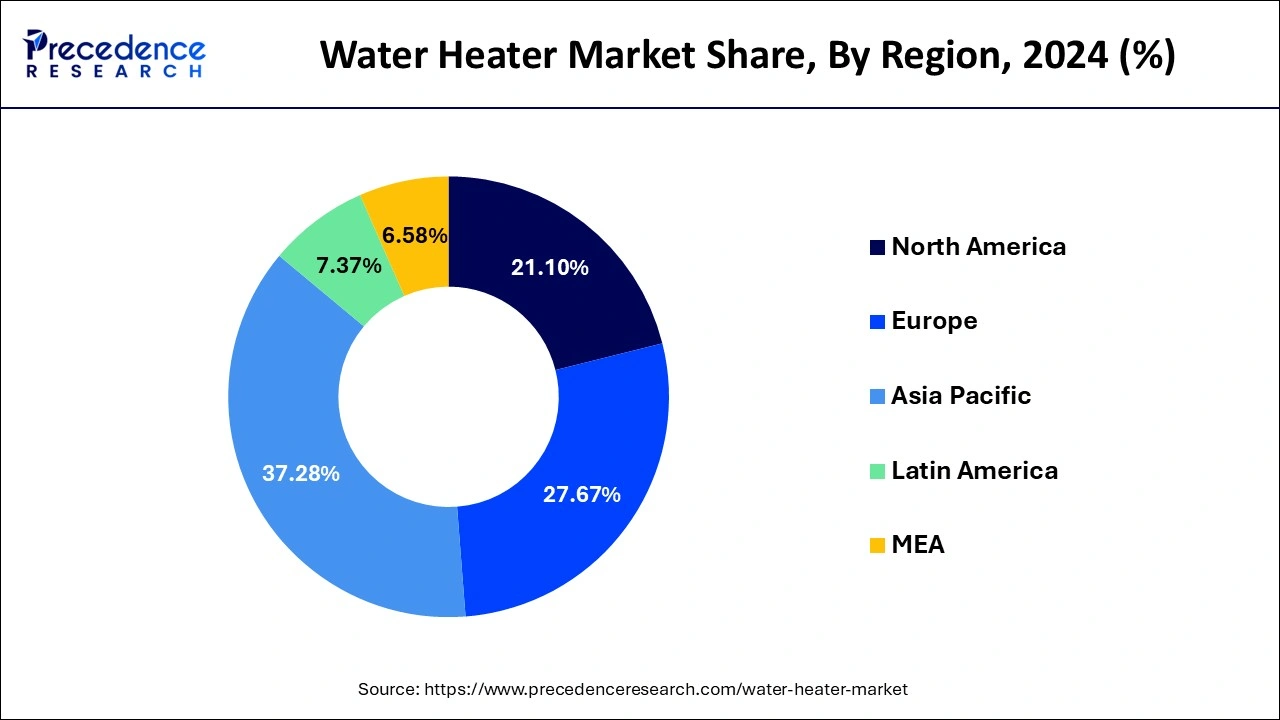

- Asia Pacific dominated the global market with the largest market share of 37.28% in 2025.

- North America is projected to expand at a notable CAGR during the forecast period.

- By product type, the electric segment contributed the highest market share in 2025.

- By product type, the solar segment is expected to grow at a significant CAGR from 2026 to 2035.

- By technology, the storage segment captured the biggest market share in 2025.

- By capacity, the 30–100 liter segment held the largest market share in 2025.

- By application, the residential segment is expected to hold the largest market share in 2025.

Market Overview

A water heater, sometimes known as a storage water heater, is a residential device used to heat water. It employs a hot water storage tank to maximize its heating capability and deliver quick hot water anytime it is required. Oil, electricity, propane, natural gas, and oil are among the fuels used by conventional storage water heaters.

AI Integration in Water Heater

Smart water heaters are water heaters that are reinforced with Machine Learning and connected systems to optimize heating. These systems pick a few things from their use, for instance, the hot water usage pattern or the desired temperature. The water heaters can be managed and controlled by the homeowners remotely, and send notifications regarding maintenance required or the development of significant problems. This maintenance will also take time which will also save money, it will assist in preventing the water heater from requiring constant repairs.

- In November 2024, Wondrwall launched its AI air-source residential heat pump. Built to integrate seamlessly with the Wondrwall artificial intelligence HEMS, this monobloc air source heat pump revolutionizes low-carbon heating efficiency by reducing energy demand, reducing operating costs, and enabling more flexibility for the grid.

Water Heater Market Growth Factor

The rising need for hot water for different domestic uses, such as cooking, washing, bathing, and cleaning, is predicted to drive the worldwide water heater market. As various states and towns around the nation pursue legislative initiatives to reduce greenhouse gas emissions as well as energy usage in buildings, green technology and sustainability are becoming increasingly important. The demand for intelligent water heating as well as energy-efficient systems for heating water is expected to rise in the next years as a result of stricter building standards and regulations. It is projected that the market for water heaters run by solar energy would expand as a consequence of effective actions to enhance air quality as well as raise public awareness of the use of renewable solutions. Moreover, it is anticipated that the market growth will be pushed by the continuous industry competition as well as the growing attention that different market players are paying to product design. The demand for the product is expected to be fueled by the rising usage of a wide range of water heaters in the industrial and commercial sectors. A surge in hot water usage, mostly from healthcare facilities and hotels, is anticipated to boost the market. Since the product is utilized in several industrial industries, including the production of food and drinks industries, the need for water heaters is also anticipated to increase. Significant expenditures in product development and innovation are anticipated to drive the market for electric water heaters. Leading manufacturers take part in the release of cutting-edge products and technologies that enhance customer experience and save operational expenses.

- The commercial and residential sectors' demand for hot water is anticipated to drive market expansion.

- Growing demand for energy-efficient heating equipment as a result of excessive energy use and rising power costs

- The growing use of quick heating technology due to the major benefits that water heaters provide.

- The market will be driven by rising disposable income and robust GDP growth across emerging economies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 32.12 Billion |

| Market Size in 2026 | USD 33.63 Billion |

| Market Size by 2035 | USD 50.81 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.69% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Technology, Capacity, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Water Heater MarketDynamics

Key Market Drivers

Easy installation and maintenance

- Storage water heaters help to increase heating capacity by employing hot water storage tanks. Storage heaters are produced in a variety of sizes to meet market demand. Storage heaters are easier to maintain and repair than various forms of water heaters, and their installation is less expensive. Because storage heaters have a history of bursting, vendors are focusing on providing frequent water heater services.

- Additionally, storage heaters require space for the tank, thus manufacturers are focusing on making storage heaters smaller in order to address the space issue. It has also lately become increasingly common to use conventional storage heaters that operate on different fuels, such as fuel oil and natural gas.

Key Market Challenges

Higher installation and maintenance cost

- In order to meet the anticipated efficiency rate and calculate the total lifetime cost, which includes the initial cost, operating cost, and unit replacement cost, the water heating system must always be installed in compliance with the minimum applicable mechanical, plumbing, electrical, and other codes. Commercial water heater adoption is hampered by high upfront running costs brought on by greater costs for unit replacement or maintenance. The location of the water heater has a significant influence on this heater's running costs, particularly if the unit is inadequately insulated.

Key Market Opportunities

Increasing demand for instantaneous heaters

- Instant heating technology use is expected to rise as a result of its primary benefits, which include low standby losses and high supply output compared to traditional storage units. Increased demand for commercial applications due to sophisticated monitoring features, including Wi-fi among others, will favorably impact the size of the global water heater market.

Ongoing infrastructure investments

- The market for commercial water heaters is anticipated to increase at a rate of over 6% through 2027 as a result of the service sector's strong expansion and the continued construction of high-rise structures in new cities. The construction of new shopping centers and offices, hotels, and academic buildings will enhance the business environment. The market statistics will be enhanced by strict building efficiency regulations and rules paired with an increase in smart city development initiatives.

Segment Insights

Product Type Insights

Due to the market's dominance by electric water heaters and their 51.3% revenue share in 2025, primarily in the nations of the Asia Pacific and Africa, growing electrification rates and improved consumer accessibility were major factors. Energy efficiency increased environmental sustainability, and temperature control is predicted to be the main drivers of product demand throughout the projection period.

Due to the growing demand from consumers for water heating systems that are both environmentally friendly and energy efficient, the solar category is predicted to grow at a CAGR of 5.1% during the projection period. Industry expansion is anticipated to be boosted by the growing focus of different product producers on creating new systems and technologies that operate more efficiently. Demand for solar goods is expected to increase as a result of strict government regulations to minimize greenhouse gas emissions and a growing focus on energy conservation due to the swift depletion of nonrenewable resources.

Furthermore, it is anticipated that rising environmental consciousness for both developed and emerging countries will fuel demand. During the projected period, it is anticipated that gas water heaters would be used extensively as a result of the growth of piped gas networks in several developing countries. Additionally, it is anticipated that increased emphasis on product innovation and distinctiveness would increase demand for gas water heaters, supporting the expansion of the entire sector.

- In March 2025, Nexol Photovolthermic AG unveiled a new hybrid solar water heater for residential use, offering 1.5 kW of heating output and sizes ranging from 80 to 300 liters. The new launches are particularly important for larger households or demanding applications.

Technology Insights

Due to the significant potential for energy conversion and minimal maintenance requirements of the product, the storage segment led the market for water heaters and contributed 55% of worldwide revenue in 2025. Demand for the device is also being fueled by an increase in industrial and commercial applications being installed in various chilly areas throughout the world. Due to product benefits such as quick hot water delivery and minimal standby heating losses, the tankless category is predicted to grow at a CAGR of 4.8% between 2024 and 2033. Tankless devices also consume less energy than storage water heaters, which will increase their appeal over the next years.

Products without tanks provide benefits such as better temperature control, more energy efficiency, and more environmental sustainability. Demand for these items is anticipated to increase throughout the projection period as a result of rising product acceptance across several business sectors due to improved operational advantages. Due to major product features like providing cooling and heating from a single unit, the hybrid category is predicted to have increasing demand. These devices are more energy-efficient than electric ones because they don't generate power directly; instead, they use electricity to move heat from one place to another.

Capacity Insights

Due to its widespread suitability for use in both residential and commercial settings, including banks, healthcare facilities, hotels, government institutions, hotels, and shopping centers, the 30–100 liter capacity segment dominated the water heater market in 2025 and accounted for 29.4% of total revenue. Demand for the 100-250 liter sector is anticipated to increase as a result of increasing urbanization and ongoing migration to metropolitan areas. The product's availability in a variety of applications satisfies a variety of consumer requests, including its usage in kitchens, swimming pools, and restrooms, so promoting market expansion.

Due to the growing deployment of low-capacity heating systems, particularly in residential settings, the market for water heaters with a capacity of fewer than 30 liters is predicted to grow at a CAGR of 4.2% during the projected period. Additionally, the installation of water heaters with a capacity of fewer than 30 liters is anticipated to increase in the upcoming years due to the growing usage of storage tanks. Due to a variety of industrial applications, both alone and in conjunction with heat exchangers, the demand for water heaters with a capacity exceeding 400 liters increased at a CAGR of 5.2% over the predicted period. Growth in this market is anticipated to be aided by the ability of water heaters with a capacity of more than 400 liters to pair heat pumps with thermal solar systems.

Application Insights

The residential sector is expected to lead the market for water heaters and account for 55% of the revenue share in 2025. Market growth is anticipated to be fueled by the rising need for dependable, affordable, and environmentally friendly water heating technologies, notably in the industrial and residential sectors. Additionally, it is anticipated that the ability of water heaters to operate at lower costs up to 75% less expensive in the summer and 30% to 40% less expensive in the winter will increase product demand throughout the course of the projection period. Construction, food & beverage, pharmaceutical, power, and agricultural industries all utilize water heaters, which is expected to drive the industry's expansion. Water heaters are used for producing steam, preventing frost, and heating water in the construction sector.

- According to the United States Census Bureau, Total U.S. construction spending reached USD 486 billion in Q1 2025, up 3% from USD 472 billion in Q1 2024. Private construction spending grew 2% year-over-year to USD 384 billion, with residential up 3% to USD 205 billion. Commercial public buildings (+44%) also recorded strong growth.

Due to increased government expenditure on the construction of healthcare facilities, which in turn would greatly increase the number of water heater installations, the product demand in the commercial sector is anticipated to increase at a CAGR of 4.6% over the projection period. Furthermore, the market is anticipated to grow because of the rising use of tankless solutions in commercial settings.

Regional Insights

What is the Asia Pacific Water Heater Market Size?

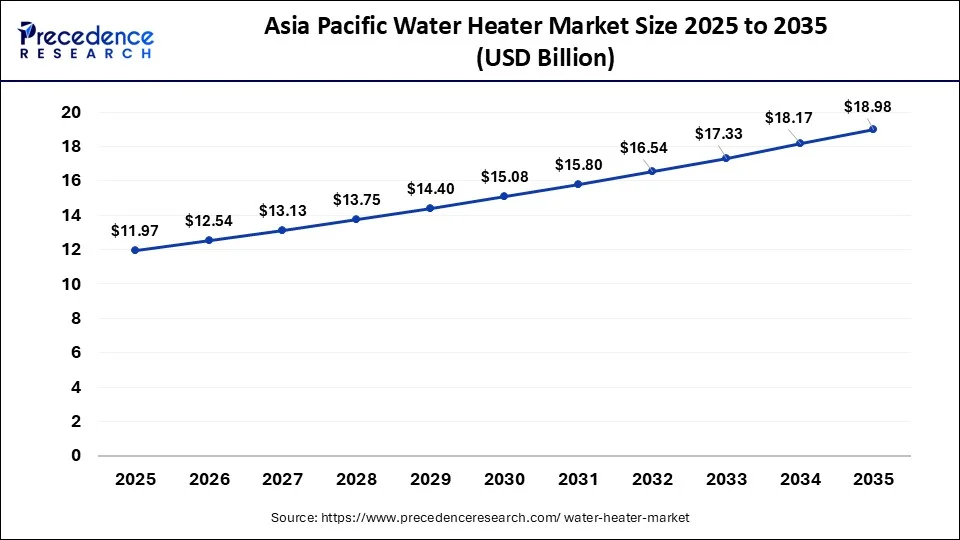

The Asia Pacific water heater market size was evaluated at USD 11.97 billion in 2025 and is predicted to be worth around USD 18.98 billion by 2035, rising at a CAGR of 4.72% from 2026 to 2035.

The growing availability of gas and power in rural areas, rising infrastructure investment, brisk growth in the building sector, and industrial expansion in South Asian and South East Asian countries are all factors driving the need for water heaters in the Asia Pacific region. Additionally, it is anticipated that the focus on carbon neutrality and energy-efficiency regulations would accelerate market growth.

- According to the IBEF report, FDI in construction development (townships, housing, built-up infrastructure, and construction development projects) and construction (infrastructure) activity sectors stood at INR 1,32,601.17 crore and INR 2,50,628.61 crore, respectively, between April 2000 and September 2024.

Increasing investment and innovation in the building industry, funding for R&D, and the adoption of mandatory CO2 emission reduction measures are the primary factors driving the demand for water heaters in China and will continue to do so throughout the course of the forecast period. The increasing need for better and dependable water heaters from various commercial and industrial end-users is what is driving the expansion of water heaters in the European area. Additionally, the region's extremely cold weather and the consequent requirement for hot water to maintain the necessary environmental conditions are projected to increase product demand.

- In January 2025, F.W. Webb Co. announced the expansion of the partnership with Rheem to distribute the complete HVAC product line to its extensive inventory. F.W. Webb now distributes Rheem's unitary equipment and parts to HVAC professionals across the Northeast.

Asia Pacific Water Heater Market Trends

- Increased investment in the extension of gas and electricity to rural areas is fueling the need for water heaters in the region.

- With the growth in infrastructure developments in the Asia Pacific region, demand for water heaters particularly in construction and industry is on the rise.

- The increasing industrialization across the Asia Pacific will open further markets for energy-efficient water heaters in various industrial segme

Decarbonization Trends in the Water Heater Market Industry in North America

North America is the fastest growing market during the forecast period. It is driven by the government authorities who have started strict guidelines and even provisions for installing heating systems across commercial along with residential properties. The low-cost storage units have considered most of the market growth owing to features including ready-to-install designs that are greatly adaptable and provide a range of products suitable for multiple heating applications, thus driving the industry landscape.

What are the Advancements in the Water Heater Industry in Europe?

Europe's market shows significant growth during the forecast period. It is driven by the need for eco-friendly, responsible technology is at an all-time high. Europe's energy goals have tightened, with the EU incorporating stricter standards to curb emissions and enhance overall efficiency in residential energy consumption.

Germany Water Heater Market Trends: The country has been actively working to reduce carbon emissions and improve energy efficiency. Regulations and initiatives aimed at promoting sustainable practices and reducing the carbon footprint are gaining traction, boosting the adoption of energy-efficient water heaters.

What are the Key Trends in the Water Heater Industry in Latin America?

Latin America's market shows notable growth during the forecast period. It is driven by rising disposable incomes, increasing urbanization in the region, and a shift towards energy-efficient solutions. Evolving user preferences favor cost-effective, technologically advanced, and environmentally friendly heating options.

Brazil Water Heater Market Trends: Several government initiatives in the country are playing a crucial role in driving market growth. Policies promoting energy efficiency, environmental sustainability, and the use of clean technologies are encouraging the adoption of advanced and eco-friendly water heaters.

How is the Middle East and Africa Region Growing in the Water Heater Industry?

MEA's market shows rapid growth during the forecast period. It is driven by escalating urbanization, growing disposable incomes, and increasing user awareness of energy efficiency and smart home integration. Currently featured by nascent adoption levels, the market is poised to transition into a high-expansion phase as technological advancements, regulatory incentives, and even infrastructure investments accelerate deployment.

Saudi Arabia Water Heater Market Trends: Factors such as population growth and urbanization are driving the expansion of commercial spaces, leading to a higher demand for water heaters in various sectors and applications such as hospitality, healthcare, and education. Demand for tankless and on-demand water heater systems is rising because of their space-saving design and improved energy efficiency.

Value Chain Analysis for the Water Heater Market

- Raw Material Sourcing: It is a strategic supply chain function aimed at procuring metals, insulation, and even components required to manufacture storage and tankless units.

Key Players: Rheem Manufacturing Company, Bosch Thermotechnology, Haier Smart Home Co., Ltd., Ariston Thermo Group - Component Fabrication and Machining: It includes a precise, largely automated, multi-stage production process designed to create durable, corrosion-resistant, and even thermally efficient heating units.

Key Players: Theeta Electricals Pvt Ltd, Magma Technologies, Telford Copper & Stainless Cylinders, Duggal Brothers

Water Heater Market Companies

- A. O. Smith: The company is known for its innovative water heater designs. It offers a variety of electric, gas, and tankless water heaters. They also have a history of developing energy-efficient models and have received ENERGY STAR certification for their products.

- Rheem: Rheem Manufacturing is a global company with its headquarters in the United States. It is a leading provider of heating, cooling, and water heating products for residential and commercial applications.

- Potterton: Potterton, a British-based brand, has been innovating water heaters for over 150 years. They offer a range of gas and oil-fired models and are well known for their durability and performance.

- Bradford White: Bradford White is a Canadian brand that offers a variety of electric, gas, and tankless water heaters. They are widely recognized for their quality and have a strong reputation in the industry.

- Rinnai: Rinnai is a Japanese company that specializes in the manufacturing of gas appliances, including tankless water heaters. They are known for their energy-efficient and innovative water heating solutions.

Other Major Key Players

- Robert Bosch LLC

- Ariston Thermo SpA

- NORITZ Corporation

- Whirlpool Corporation

- Westinghouse Electric Corporation

- Bajaj Electricals Ltd.

- Haier Inc.

- Havells India Ltd

- Lennox International Inc.

- FERROLI S.p.A

- Kenmore

Key Player Announcement

- In August 2024, Cala Systems unveiled a $5.6m seed funding and the commercial launch of its product heat pump water heaters.

- Michael Rigney, CEO and co-founder of Cala Systems said “Heat pump water heaters are launched to grow rapidly because of their vast savings and greenhouse gas reductions”.

Recent Developments

- In April 2025, Essency, the prominent manufacturer of the award-winning Essency EXR water heater, announced a partnership with The Blumenauer Corporation as its new manufacturer's representative for the state of Florida. The Blumenauer Corporation now adds Essency's category-defying EXR water heater to their exclusive lineup.

- In October 2024, Nyle Water Heating Systems announced the launch of the Pyroclast Commercial Integrated Heat Pump Water Heater, developed in collaboration with Htec Packaged Systems and Controls. This revolutionary system incorporates advanced Phase Change Material (PCM) technology for thermal storage and will drastically reduce installation times, complexity, and mistakes.

- In December 2024, Surya Roshni, the most trusted brand in electrical appliances, steel, and PVC pipes, proudly announced the launch of its latest electric water heater series, the Qube+ range, for the winter season. Surya Roshni's new line promises to deliver efficiency, reliability, and advanced functionality for households and businesses alike.

- In January 2025, South Korea's Samsung unveiled new residential air-to-water heat pumps for heating and domestic hot water (DHW) in multi-unit homes, apartments, new-builds, and retrofits.

- In December 2024, Surya Roshni, announced the launch of its electric water heater series, the Qube+ range, for the winter season. Popular for its pledge to innovation and quality, Surya Roshni's new line potential to deliver efficiency, reliability, and advanced functionality for households and businesses.

- In May 2024, Voltas expanded its portfolio with the introduction of Water Heaters in India. Introduces of Water Heater range with the revolutionary Quartzline Technology.

Segment Covered in the Report

By Product

- Electric

- Solar

- Gas

By Technology

- Tankless

- Storage

- Hybrid

By Capacity

- Below 30 Liters

- 30 - 100 Liters

- 100 - 250 Liters

- 250 - 400 Liters

- Above 400 Liters

By Application

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting