What is Packaged Water Treatment Market Size?

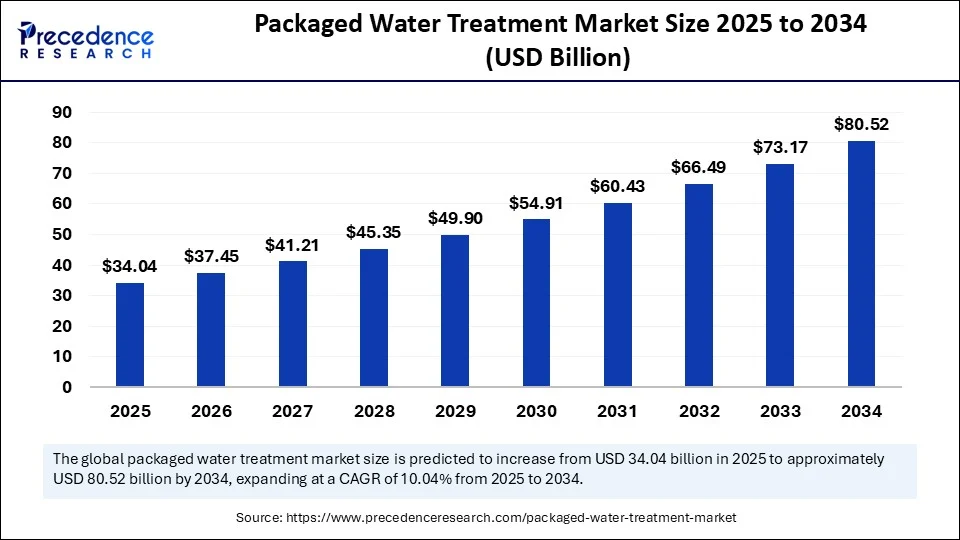

The global packaged water treatment market size is estimated at USD 34.04 billion in 2025 and is predicted to increase from USD 37.45 billion in 2026 to approximately USD 80.52 billion by 2034, expanding at a CAGR of 10.04% from 2025 to 2034. The growth of the market is attributed to the rising water scarcity and the increasing demand for sophisticated water treatment solutions.

Market Highlights

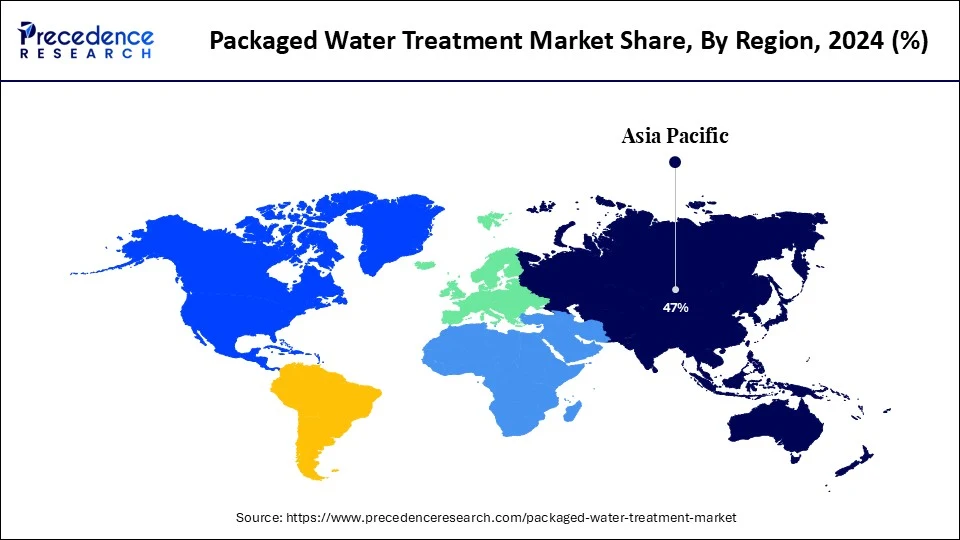

- Asia Pacific dominated the packaged water treatment market with the largest market share of 47% in 2024.

- Middle East & Africa is expected to expand at the fastest CAGR during the forecast period of 2025-2034.

- By technology, the membrane filtration segment captured the biggest market share of 44% in 2024.

- By technology, the biological treatment segment is expected to expand at the fastest CAGR during the forecast period.

- By capacity, the 100–500 m³/day segment contributed the highest market share of 40% in 2024.

- By capacity, the >1,000 m³/day segment is expected to grow at the fastest CAGR in the upcoming period.

- By type, the packaged wastewater treatment plants segment generated the major market share of 52% in 2024.

- By type, the hybrid (drinking + wastewater) segment is expected to expand at the fastest CAGR during the forecast period.

- By deployment mode, the skid-mounted units segment held the largest market share of 46% in 2024.

- By deployment mode, the mobile and containerized units segment is likely to grow at the fastest CAGR in the coming years.

- By application, the effluent and sewage treatment segment accounted for significant market share of 38% in 2024.

- By application, the remote and rural water supply segment is expected to expand at the fastest CAGR during the forecast period.

- By end-user, the municipal utilities segment captured the highest market share of 41% in 2024.

- By end-user, the oil & gas sector segment is expected to expand at the fastest rate over the projected period.

Market Overview: Strategic Overview of the Global Packaged Water Treatment Industry

The packaged water treatment market includes modular, factory-assembled treatment systems designed for decentralized or small-to-medium-scale water and wastewater treatment applications. These systems are pre-engineered and containerized, providing plug-and-play solutions with reduced installation time and operational complexity. They are widely used in municipal, industrial, residential, and remote areas where centralized infrastructure is not feasible or cost-effective. Key technologies include membrane filtration, reverse osmosis (RO), dissolved air flotation (DAF), sequencing batch reactors (SBR), and ultraviolet (UV) disinfection.

Artificial Intelligence: The Next Growth Catalyst in Packaged Water Treatment

Artificial Intelligence significantly impacts the packaged water treatment market by offering enhanced efficiency, improved water quality, and sustainable practices. AI-powered systems are capable of predictive maintenance, which reduces downtime and optimizes the lifespan of equipment. AI analyzes data from sensors to detect anomalies and predicts potential failures before they occur, allowing for proactive maintenance. AI and advanced data analytics tools enable real-time monitoring of multiple wastewater treatment plants from a centralized location, leveraging smart sensors and IoT devices. This integration provides valuable insights and predictive analytics, such as advanced predictions of potential equipment failures based on historical data, allowing for proactive measures to reduce downtime and ensure seamless operation.

AI facilitates the automation of essential processes in wastewater and other water treatment plants, allowing for adjustments to various system calibrations. AI-based optimization helps conserve energy without compromising treatment quality and plant efficiency. Machine learning aids in analyzing complex datasets, identifying patterns that enable operators to take appropriate actions, ensuring water quality standards and consistency. Internet of Thingssmart sensors play a crucial role in artificial intelligence, providing synergy in water treatment technology by acquiring accurate data through high-quality sensors and AI-powered advanced analytical tools.

Packaged Water Treatment Market Growth Factors

- The escalating population and urbanization, especially in rapidly growing nations like China and India, are driving the demand for potable water, which significantly boost the growth of the market.

- Stringent government regulations, prompted by environmental concerns, are driving the industrial sector's need for effective water treatment solutions.

- Growing awareness of clean drinking water is significantly increasing market demand.

- Technological advancement boosts the growth of the market. Innovation in areas like membrane technology, IoT-based monitoring, and energy-efficient designs can drive market growth.

Market Outlook

- Market Growth Overview: The packaged water treatment market is expected to grow significantly between 2025 and 2034, driven by increasing population and urbanization leading to higher demand, stringent global regulations on water quality, technological advancements, such as IoT, AI, MBR, and RO, and growing need for water reuse due to security.

- Sustainability Trends: Sustainability trends involve energy-efficient technologies, renewable energy integration, and reduced carbon footprint.

- Major Investors: Major investors in the market include The Vanguard Group Inc., BlackRock Inc., State Street Corp, SOSV, Imagine H2O, and Warburg Pincus.

- Startup Economy: The startup economy is focused on decentralized and modular systems, bio-based remediation, sustainable water generation, and innovative technologies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 34.04 Billion |

| Market Size in 2026 | USD 37.45 Billion |

| Market Size by 2034 | USD 80.52 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.04% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Capacity, Type, Application, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Concerns Over Water Quality

Due to the increased industrialization, many natural water sources have become contaminated with chemicals and metallic pollutants. This leads to various health problems if consumed without treatment. Consequently, there is high demand for water treatment solutions, which drives the growth of the packaged water treatment market. Packaged water treatment systems offer a solution to treat available water sources. There is a strong demand in both centralized government plants and at the domestic level, including residential and commercial areas like hotels and food & beverage manufacturing plants, driving market growth. Moreover, increasing awareness of waterborne diseases and the importance of clean drinking water further drives market growth.

Restraint

Substantial Upfront Capital Requirement

Substantial capital investment is required to establish packaged water treatment systems, which create barriers for some users. Membrane filtration, including reverse osmosis and UV sterilization, requires regular maintenance and replacement of filters and membranes, contributing to ongoing costs. Finding skilled labor for maintenance is a significant challenge this market faces. As a result, market growth is hindered in many regions lacking capital for water treatment system and plant development. Moreover, packaged systems may have limited treatment capacity compared to large-scale water treatment plants, restricting their use in high-demand applications.

Opportunity

Significant Growth Opportunity due to Growing Global Water Demand

Increasing global population and climate change are leading to water scarcity in many regions. This necessitates finding effective ways to utilize available water, with water reuse after treatment being a practical solution to meet rising demands. Industrial growth increases the need for wastewater treatment as governments worldwide have imposed stringent regulations on water quality and wastewater discharge. Moreover, growing interest in water reuse and recycling creates immense opportunities for packaged systems to treat wastewater for various applications.

Segment Insights

Technology Insights

Why Did the Membrane Filtration Segment Dominate the Packaged Water Treatment Market in 2024?

The membrane filtration segment dominated the market with the largest share in 2024. The segment's dominance stems from its superior ability to remove various water contaminants and its suitability for applications like desalination and industrial wastewater treatment. This technology's production of high-quality water, coupled with its environment-friendly nature and low maintenance needs, primarily drives growth. Reverse osmosis effectively removes salt, bacteria, viruses, and other impurities up to 99.9%, especially in seawater treatment. Ultrafiltration (UF) removes larger particles, colloids, and microorganisms, serving as a pre-treatment for reverse osmosis or a standalone treatment in specific situations.

The biological treatment segment is expected to expand at the fastest CAGR during the forecast period, under which MBR (membrane bioreactor) and MBBR (moving bed biofilm reactor) segments are leading the charge. These technologies are highly adaptable in water reuse and industrial waste treatment due to their diverse applications and superior effluent quality. Advancements in membrane technology further contribute to segmental growth.

Capacity Insights

How Does the 100–500 m³/day Segment Dominate the Market in 2024?

The 100–500 m³/day segment dominated the packaged water treatment market in 2024. This segment's dominance is attributed to its balance and cost-effectiveness in treatment facilities, making it ideal for various applications like smaller-scale industrial needs, municipal requirements, and other affordable applications. This capacity range is highly adaptable, providing energy-efficient technologies and helping reduce overall establishment costs.

The >1,000 m³/day segment is expected to grow at the fastest CAGR in the upcoming period. The growth of the segment is attributed to the continuously increasing demand for large-scale water treatment solutions, fueled by industrialization, urbanization, and stringent environmental regulations due to growing environmental concerns. The growing focus on treating large water bodies further supports segmental growth.

Type Insights

What Made Packaged Wastewater Treatment Plants the Dominant Segment in the Market in 2024?

The packaged wastewater treatment plants segment dominated the packaged water treatment market with a major revenue share in 2024. This is mainly due to the increased industrial wastewater treatment regulations and the need for water reuse. Packaged systems offer a cost-effective alternative to building large water treatment plants. Their flexibility, scalability, and ease of installation make them suitable for wastewater treatment plants. The growing need for decentralized solutions is met by this category, offering improved sanitation and environmental management. The hybrid (drinking + wastewater) segment is likely to grow at the highest CAGR over the forecast period. This is mainly due to the growing scarcity of drinking water. Hybrid systems are capable of handling both drinking water and wastewater treatment. The growing demand for clean water, along with the need for effective wastewater solutions, supports segmental growth.

Deployment Mode Insights

Why Did the Skid-Mounted Units Segment Dominate the Packaged Water Treatment Market in 2024?

The skid-mounted units segment dominated the market in 2024. These pre-fabricated modular systems are easily transportable and deployable, driving their popularity in industrial and municipal applications. They offer quick integration into existing infrastructure and require lower upfront costs, leading to increased adoption. These units can be customized for various treatment technologies, which make them suitable for a wide range of applications like wastewater and industrial process water treatment.

The mobile & containerized units segment is expected to grow at the highest CAGR in the upcoming period due to quick deployment, flexibility, and suitability for urgent water needs in disaster relief and remote locations. Designed for rapid setup and relocation, they are ideal where immediate access to clean water is needed. These units are also useful in construction or industrial sites to fulfill temporary water requirements.

Application Insights

How Does the Effluent & Sewage Treatment Segment Dominate the Market in 2024?

The effluent & sewage treatment segment dominated the packaged water treatment market in 2024. The segment's growth is mainly attributed to the increased demand for efficient water management in urban areas. This is further driven by the need to comply with strict environmental regulations and the public's growing awareness of water pollution and its health effects. Releasing untreated sewage into water bodies greatly increases the risk of contamination, leading to various waterborne diseases. Effective sewage treatment systems help reduce the risk of such diseases spreading through contaminated water, ensuring public health safety.

The remote & rural water supply segment is likely to grow at the fastest rate over the projected period. This is mainly due to the rising demand for decentralized water treatment systems. Packaged systems are ideal for providing clean water in remote and rural areas where centralized water treatment infrastructure is lacking. These systems provide mobile and easily deployable clean water solutions in areas with underdeveloped infrastructure or during emergencies like disaster relief and remote locations.

End-User Insights

What Made Municipal Utilities the Dominant Segment in 2024?

The municipal utilities segment dominated the packaged water treatment market with the largest share in 2024. This is due to the critical need for municipalities to ensure fresh drinking water availability and manage wastewater treatment, driven by urban population growth. Increased sanitation service requirements and water scarcity further fuel the segment's growth. Municipalities often need large-scale water treatment facilities to provide clean and safe drinking water to cities and towns, making water treatment a significant focus.

The oil & gas sector segment is expected to expand at the highest CAGR in the coming years. This is primarily due to the industry's increasing demand for water treatment solutions in remote locations. This is driven by the continuous expansion of oil and gas operations, coupled with stringent government regulations concerning environmental protection and the proper disposal of wastewater.

Regional Insights

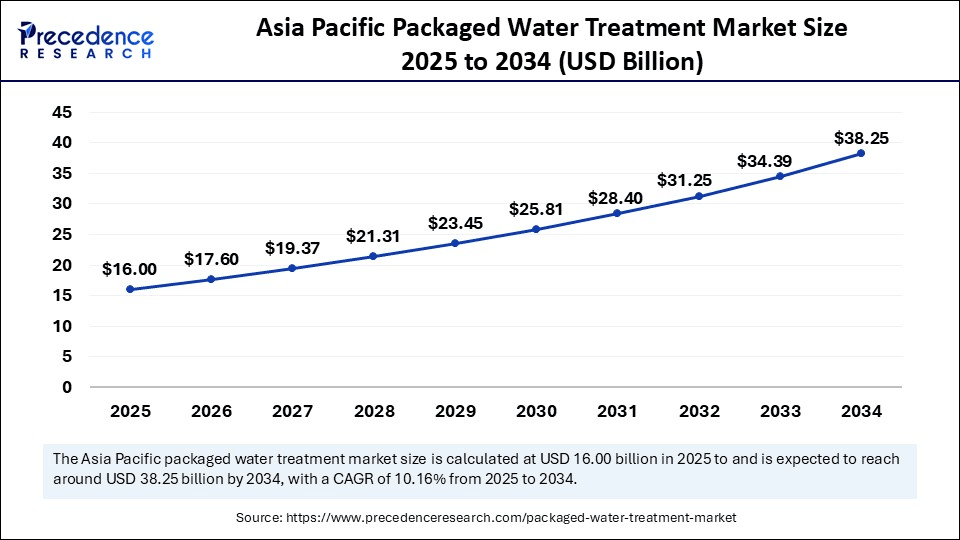

Asia Pacific Packaged Water Treatment Market Size and Growth 2025 to 2034

The Asia Pacific packaged water treatment market size is evaluated at USD 16.00 billion in 2025 and is projected to be worth around USD 38.25 billion by 2034, growing at a CAGR of 10.16% from 2025 to 2034.

What Factors Contribute to Asia Pacific's Dominance in the Packaged Water Treatment Market in 2024?

Asia Pacific registered dominance in the market by capturing the largest share in 2024. This is mainly due to rapid industrialization, urbanization, and population growth, which led to increased demand for clean water. Government safety regulations and increased public awareness of high-quality water, coupled with rising disposable incomes due to economic growth, contribute to market growth. Innovations in membrane filtration, disinfection, and automation have made packaged water treatment systems more efficient and cost-effective, increasing their adaptability to different needs. Moreover, urbanization leads to higher water consumption and the need for efficient water treatment solutions, contributing to market growth.

Asia Pacific: China Packaged Water Treatment Market Trends

China's packaged water treatment market growth is driven by the increasing need for high-purity water in specialized industries like semiconductors and a shift towards viewing industrial wastewater as a valuable resource for biogas and nutrient recovery. The market is trending towards smart, modular, and energy-efficient solutions like MBR and RO systems.

Middle East & Africa Packaged Water Treatment Market Trends

Middle East & Africa is expected to grow at the fastest CAGR during the forecast period. This is primarily due to industrialization and urbanization, coupled with limited freshwater resources and arid climates. High scarcity of safe and clean water drives the focus on efficient resource utilization and the deployment of water treatment solutions. Government investments in water treatment infrastructure development and the promotion of water conservation and sustainable water management practices, along with the adoption of advanced technologies like membrane filtration and reverse osmosis, are key drivers. Economic growth in the region also enables investment in sophisticated water treatment solutions, further boosting market growth.

North America Packaged Water Treatment Market

North America is expected to experience significant growth in the market due to stringent environmental regulations, established industrial infrastructure, and growing demand for clean and safe water management solutions. The region's focus on technological advancement and innovation, particularly in energy-efficient systems, is leading to exponential growth. North America is a pioneer in water treatment technology innovations, such as membrane bioreactors and reverse osmosis, which are continuously evolving and fueling market growth. Various industries, including oil and gas, food processing, chemical manufacturing, and mining, have diverse water treatment needs, driving the demand for tailored solutions. Changing lifestyles and increased health awareness is driving the demand for bottled water, contributing to market growth.

Middle East & Africa: Saudi Arabia Packaged Water Treatment Market Trends

Saudi Arabia has severe water scarcity and a heavy reliance on desalination to meet its water needs in an arid climate. The government's ambitious Vision 2030 initiative, which prioritizes water security, sustainable water management, and significant investment in large-scale municipal and industrial water infrastructure projects, further drives market growth. The rapid urbanization and industrial expansion in the country have increased the demand for scalable and quickly deployable packaged water treatment solutions in both urban and remote areas.

North America: U.S. Packaged Water Treatment Market Trends

The U.S. is expanding, needs to upgrade aging municipal infrastructure, and meet stricter water quality regulations. The fastest growth is seen in industrial applications, particularly among industries like food and beverage, pharmaceuticals, and oil and gas, which require advanced, modular systems for water reuse and regulatory compliance. Technological innovations, including the integration of IoT for remote monitoring and the increased use of advanced membranes like MBRs, are key drivers for market efficiency.

Value Chain Analysis of the Packaged Water Treatment Market

- Raw Material Suppliers

This stage involves the companies that supply the basic components and raw materials needed to manufacture the packaged water treatment systems.

Key Players: Kemira Oyj and Ecolab Inc. provide crucial treatment chemicals, Hydranautics (Nitto Group) - Equipment Manufacturing

This stage focuses on the design, engineering, and assembly of the packaged water treatment units.

Key Players: Veolia Environnement, Xylem Inc., Pentair plc, Evoqua Water Technologies, and Smith & Loveless Inc. - Service Providers

This stage involves companies that offer a range of services beyond just manufacturing the equipment.

Key Players: Veolia and Xylem, and Ecolab - Distribution

The distribution stage involves getting the packaged systems from the manufacturer to the end-user.

Key Players: Veolia and Xylem - End-User

The final stage of the value chain is the end-user, which includes municipal, industrial, commercial, and residential customers.

Top Companies in the Packaged Water Treatment Market & Their Offerings:

- Veolia Environment: Veolia contributes to the packaged water treatment market by providing comprehensive, integrated solutions spanning system design, equipment supply (e.g., packaged filtration and MBR units), operation, and maintenance services.

- Toray Industries: Toray is a key supplier of high-performance membrane technologies, including reverse osmosis (RO), nanofiltration (NF), ultrafiltration (UF), and microfiltration (MF) membranes, which are critical components within packaged water treatment systems.

- Pentair: Pentair contributes significantly with a broad portfolio of residential, commercial, and industrial water treatment solutions, including pumps, filtration systems, and various water purification components used in packaged units.

- Mitsubishi Chemical Corporation: Mitsubishi Chemical is a major supplier of membrane technologies and various water treatment chemicals, supporting the market with high-quality components necessary for effective water purification processes.

- Pall Corporation: As part of Danaher Corporation, Pall supplies advanced filtration, separation, and purification technologies, particularly high-margin systems for the pharmaceutical, biotech, and microelectronics industries requiring ultra-pure water.

- GE Water and Process Technologies (now part of SUEZ and Lanxess): Formerly a significant entity, its intellectual property and components now contribute to other companies like SUEZ and Lanxess, who continue to supply advanced separation technologies and process water treatment solutions.

- Danaher Corporation: Through its water companies, including Hach and Pall Corporation, Danaher contributes by providing essential components and analytical instruments for monitoring and ensuring water quality within packaged systems.

- Grundfos: Grundfos is a leading supplier of pumps and pumping systems, which are crucial mechanical components for water movement and pressure management within all types of packaged water treatment units.

- Xylem: Xylem offers a comprehensive suite of water treatment technologies, analytical instrumentation, and pumps designed for the transport, treatment, and testing of water in both municipal and industrial packaged systems.

- Aqua America (now Essential Utilities): Primarily a water utility company, Essential Utilities contributes by investing in and operating water and wastewater infrastructure, often utilizing packaged treatment systems to serve small and remote communities efficiently.

- Hydronova: (Assuming this refers to a smaller, specialized company) Hydronova likely contributes by providing niche, specialized packaged water treatment solutions tailored to specific industrial or environmental challenges. Their value lies in offering highly specific expertise and customized, agile systems to meet unique client needs.

- SUEZ: SUEZ contributes significantly by designing, building, and operating a wide array of municipal and industrial water treatment plants, including modular and packaged systems designed for efficient deployment and resource recovery.

- Lennox International: Lennox International is generally a leader in climate control solutions (HVAC/refrigeration) and is not a direct participant in the water treatment market. Their contribution is outside of the packaged water treatment value chain.

- Culligan: Culligan is a major provider of point-of-use and point-of-entry water treatment systems, including packaged solutions for residential, commercial, and industrial applications globally. They specialize in softening, filtration, and reverse osmosis systems that ensure high-quality water for personal and business use.

- Evoqua Water Technologies: Evoqua specializes in providing a vast range of water treatment solutions, technologies, and services for industrial, municipal, and recreational water, with a strong focus on packaged and modular systems.

Recent Developments

- In July 2025, H2O America announced that its regulated Texas water and wastewater utility, The Texas Water Company, Inc. (“TWC”), along with its affiliate Texas Water Operation Services, LLC (“TWOS”), and Quadvest, a regulated investor-owned water and wastewater utility operating in the Houston metro area, acquired all of the assets owned by Quadvest. This transaction marks a transformative milestone for H2O America, TWC, TWOS, and Quadvest, positioning the combined company to grow faster, operate at greater scale, and better serve communities across Texas.(Source:https://www.globenewswire.com)

- In May 2024, Smart Ops launched a groundbreaking biotechnology solution to improve access to clean water in India. The Smart Ops SCR System, which has been verified by the Ministry of Water (Jal Shakti), represents a pioneering advancement in water treatment and rejuvenation technology.(Source: https://www.thehindubusinessline.com)

Segments covered in the Report

By Technology

- Membrane Filtration

- Microfiltration (MF)

- Ultrafiltration (UF)

- Nanofiltration (NF)

- Reverse Osmosis (RO)

- Disinfection Systems

- UV Disinfection

- Ozone Treatment

- Chlorination Systems

- Clarification & Sedimentation

- Dissolved Air Flotation (DAF)

- Tube Settlers

- Biological Treatment

- Sequencing Batch Reactors (SBR)

- Moving Bed Biofilm Reactor (MBBR)

- Membrane Bioreactors (MBR)

- Sludge Treatment

- Sludge Drying Beds

- Mechanical Dewatering Units

By Capacity

- <100 m³/day

- 100–500 m³/day

- 501–1,000 m³/day

- >1,000 m³/day

By Type

- Packaged Drinking Water Treatment Plants

- Packaged Wastewater Treatment Plants

- Hybrid (Drinking + Wastewater)

By Deployment Mode

- Mobile & Containerized Units

- Skid-Mounted Units

- Underground/Compact Stationary Systems

By Application

- Municipal Drinking Water Supply

- Industrial Process Water Treatment

- Effluent & Sewage Treatment

- Remote & Rural Water Supply

- Emergency & Disaster Relief

By End-User

- Municipal Governments & Utilities

- Oil & Gas Sector

- Construction & Mining Camps

- Military & Defense

- Hotels, Resorts & Institutions

- Food & Beverage Industry

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East &Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting