What is Wear Parts Market Size?

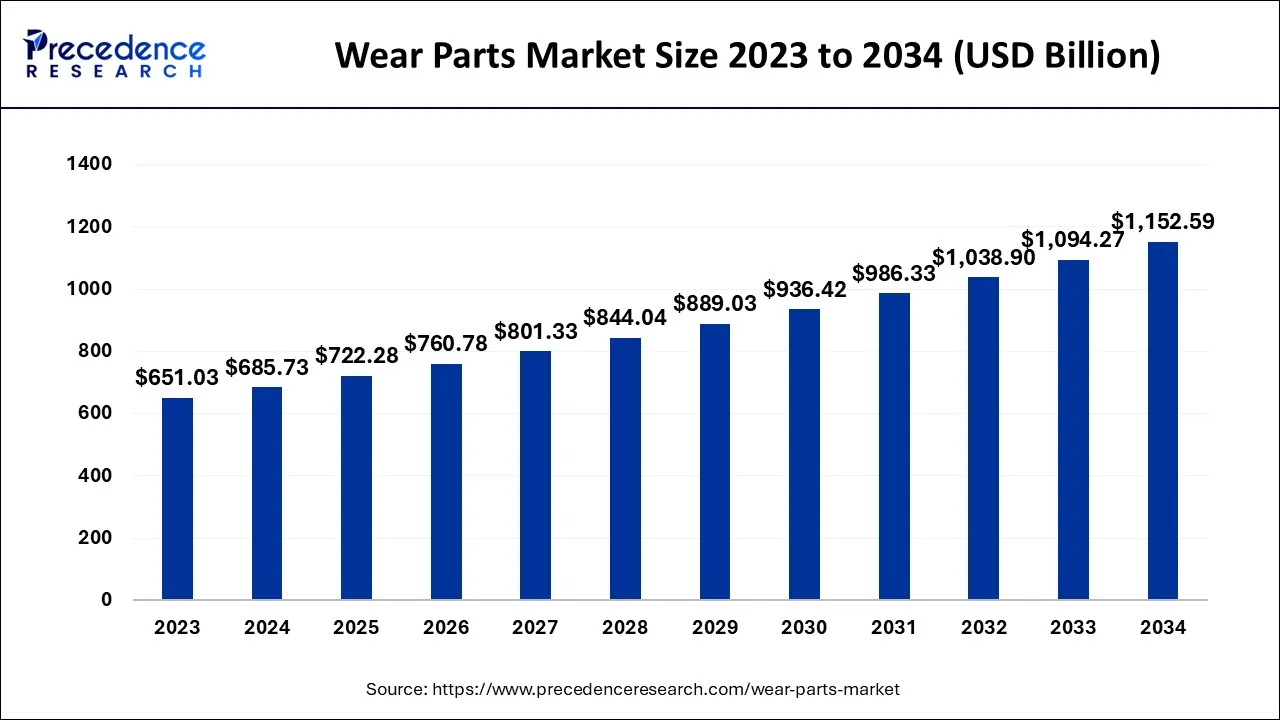

The global wear parts market size is calculated at USD 722.28 billion in 2025 and is predicted to increase from USD 760.78 billion in 2026 to approximately USD 1,208.94 billion by 2035, expanding at a CAGR of 5.29% from 2026 to 2035.

What are the Extensive Advantages of Wear Parts in the Machining Industry?

Wear parts are a variety of components that are used to replace worn or damaged parts in machines. These parts are important for ensuring that the machines perform well and last a long time. They include engine parts, transmission and drivetrain parts, brake system parts, suspension parts, electrical parts, body and interior parts, and exhaust system parts.

In the machining and manufacturing industry, wear parts are crucial because they need to be precise, durable, and reliable. They are designed to withstand heavy use and provide optimal performance for long periods of time. These parts are used in a wide range of components and equipment in machining and manufacturing applications.

The choice of wear parts in machining and manufacturing applications is influenced by various factors, including specific process needs, material compatibility, expected workload, and desired lifespan. The quality and durability of wear parts directly affect the efficiency, productivity, and cost-effectiveness of machining and manufacturing operations. It is important to regularly inspect, maintain, and replace wear parts to ensure optimal performance and avoid machine downtime. Manufacturers and machining professionals rely on high-quality wear parts to meet their production goals and consistently deliver high-quality products to customers.

Wear Parts Market Growth Factor

The wear parts market is growing significantly in various industries. One industry experiencing notable growth is mining, which is driven by increased exploration and the need for minerals and resources. Mining operations heavily rely on wear parts for machinery like excavators, loaders, and crushers. Another growing industry is manufacturing, where wear parts are crucial components in machinery used for production processes. With the expansion of manufacturing activities globally, especially in emerging economies, the demand for wear parts is increasing. The construction, automotive, and energy sectors also contribute to the growth of the wear parts market as they require reliable and durable components for their equipment and infrastructure projects.

Wear Parts Market Outlook

- Industry Growth Overview: The wear parts market is expected to experience significant growth between 2025 and 2034, driven by rising industrialization, expanding infrastructure development, and increasing mining activities worldwide. There is a high demand for wear parts in emerging regions due to large-scale construction projects, mining operations, and steel production. Furthermore, recurring replacement needs and the high cost of unplanned equipment downtime are expected to support long-term market expansion.

- Sustainability Trends: Environmental sustainability has become a key concern, encouraging companies to reduce material waste, energy consumption, and environmental impact. Manufacturers are investing in technologies such as hardfacing, thermal spray coatings, and composite wear materials to extend component lifespans, thereby reducing resource usage and emissions from frequent replacements. In addition, predictive wear analysis and condition-monitoring solutions are increasingly integrated into industrial equipment, enabling operators to plan replacements more efficiently and minimize material waste.

- Global Expansion: Leading wear parts manufacturers are strategically expanding their operations in emerging regions to meet the growing demand. Companies such as Metso Outotec, Hensley Industries, and Columbia Steel have established production and service centers in Southeast Asia, Latin America, and Eastern Europe, regions with significant mining, construction, and steel-making activities. These firms are also developing wear parts tailored to local conditions, such as the highly abrasive ores in South America or the wet-clay soils in Southeast Asia, to ensure optimal performance.

- Major Investors:Major investors in the market include private equity and strategic investment firms such as KKR, Carlyle Group, and Bain Capital. They contribute to the market by funding companies that provide high-margin engineered wear solutions, enabling expansion, R&D, and adoption of advanced technologies. Their investments help drive innovation, support sustainability initiatives, and enhance the overall competitiveness of the industry.

- Startup Ecosystem: The startup ecosystem is evolving rapidly, with a strong focus on materials science, additive manufacturing, and IoT-based predictive solutions. Startups are introducing high-performance composites, modular wear parts, and sensor-integrated products that enable real-time monitoring of equipment health, reducing downtime and operational costs. This dynamic environment fosters competition, pushing established players to enhance both product performance and service offerings.

Trends & Future Outlook of the Wear Parts Market

- Optimizing Customization & Performance

Particularly, personalized wear parts for specific applications, shifting beyond standard sizes to escalate effectiveness in mining, construction, and even consumer electronics. - Rising Demand for Advanced Materials & Coatings

Currently, the market is experiencing a massive demand for ceramics, high-strength alloys, and specialized coatings to eliminate extreme wear, friction, and impact in harsh conditions. - Exceptional Advances in Automation & Robotics

In the future, researchers will emphasize specialized, durable wear parts that can be employed in automated and robotic machinery across manufacturing and other sectors to ensure greater accuracy and effectiveness in these advanced systems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 722.28 Billion |

| Market Size in 2026 | USD 760.78 Billion |

| Market Size by 2035 | USD 1,208.94Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.29% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type, By Application, and By Material, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Replacement and maintenance requirements

Replacement and maintenance needs are key factors driving the wear parts market. Over time, machinery and equipment experience wear and tear, resulting in the need for replacement and maintenance. Wear parts are specifically designed to address the challenges of regular usage and ensure the continued operation of the machinery. As machines age, there is an increased demand for wear parts. These parts are crucial for replacing worn-out components and restoring the equipment to its optimal functioning. Whether it's a worn bearing in a conveyor system, a damaged blade in a cutting tool, or a worn-out brake pad in a vehicle, wear parts are essential for maintaining and extending the lifespan of machinery in various industries.

Regular maintenance and replacement cycles are necessary to ensure optimal performance, productivity, and safety. By replacing worn or damaged components with new wear parts, machine operators can improve the efficiency and reliability of their equipment. This helps minimize downtime, maximize uptime, and prevent costly breakdowns or accidents. Furthermore, regular maintenance and replacement of wear parts contribute to the safety of operators and workers. Faulty or worn-out components can compromise the integrity and safety of the machinery, posing risks to personnel and the overall operation. By following maintenance schedules and replacing worn parts, companies prioritize the well-being of their employees and create a safer working environment.

Restraint

The wear parts market is highly competitive and often becomes saturated

The wear parts market is highly competitive and often becomes saturated with many suppliers and manufacturers trying to gain market share. This intense competition can lead to pricing pressures and lower profit margins for industry players. With so many options available to customers, companies need to find ways to stand out in the crowded marketplace. One effective strategy for companies to combat market saturation is to focus on providing high-quality wear parts. Customers value reliability, durability, and performance when it comes to machinery components. By ensuring that their products are of superior quality, companies can establish a reputation for delivering wear parts that meet or exceed customer expectations. Quality becomes a distinguishing factor that sets companies apart from their competitors.

Innovation is another crucial aspect that can help companies remain competitive in the wear parts market. By investing in research and development, companies can introduce innovative wear parts that offer improved performance, longevity, and efficiency. This can involve advancements in material technologies, design enhancements, or the inclusion of smart features for monitoring wear and performance.

In addition to quality and innovation, companies can differentiate themselves through value-added services. This can include providing comprehensive technical support, offering customized solutions, and maintaining strong customer relationships. Overall, in a saturated wear parts market, companies must prioritize quality, innovation, and value-added services to distinguish themselves from competitors. By doing so, they can position themselves as preferred suppliers, build customer trust, and maintain profitability in the face of intense competition.

Opportunity

The trend towards more efficient and sustainable manufacturing process

The wear parts market has a major opportunity in the growing trend towards more efficient and sustainable manufacturing processes. Companies are actively seeking ways to reduce their environmental impact and improve productivity, leading them to invest in new equipment and machinery that is energy-efficient and requires less maintenance. This creates a favourable situation for companies specializing in manufacturing and supplying wear parts for these types of equipment.

One of the main drivers behind this trend is the increasing awareness of the environmental consequences of manufacturing processes. Many companies are actively looking for ways to reduce their carbon footprint and minimize their impact on the environment. Investing in energy-efficient equipment and machinery is an effective strategy to achieve these goals, as it reduces energy consumption and can result in significant cost savings over time.

In addition to being environmentally friendly, energy-efficient equipment and machinery also offer long-term cost benefits. By reducing energy consumption, companies can lower their operating costs and improve profitability. This creates a win-win situation for both the company and the environment.

Another advantage of investing in energy-efficient equipment and machinery is that they often require less maintenance. These systems are designed to operate efficiently and are less prone to wear and tear. As a result, companies can save money on maintenance costs over time, as they will need to replace wear parts less frequently. Overall, the trend towards more efficient and sustainable manufacturing processes presents a significant opportunity for companies specializing in manufacturing and supplying wear parts. By offering high-quality wear parts that are compatible with energy-efficient and low-maintenance equipment, these companies can help their customers reduce their environmental impact, increase productivity, and generate revenue for their own business growth.

SWOT Analysis of the Wear Parts Market

Strength

- AS they are established from tough, wear-resistant materials, like hardened steel, tungsten carbide, which facilitates greater friction and stress, making them last longer.

The prevention of breakdowns and ensuring machines work effectively further enhances resource extraction and output.

Weakness

- When material gets detached from the surface as a result of wear (wear debris) can contaminate lubrication systems or, the circumstances, finally lead to further abrasion or clogging filters.

Opportunity

- The market is focusing on the progression of co-friendly materials, closed-loop systems (recycling used parts as raw materials), and remanufacturing to fulfil net-zero goals.

- The worldwide accelerating urbanization, renewable energy projects, and vast construction are impelling demand for high-performance wear parts in crushers, excavators, and conveyors.

Segment Insights

Type Insights

Ceramic wear parts are created using ceramic materials like alumina, zirconia, silicon carbide, or boron carbide. These parts are highly valued for their exceptional hardness, ability to withstand high temperatures, and excellent resistance to wear and corrosion. Compared to steel wear parts, ceramic wear parts can last up to 100 times longer, making them a desirable choice for applications that require high durability. Ceramic wear parts are essential in heavy industries like mining, cement, and steel production due to their exceptional hardness, wear resistance, and resilience to harsh environments. The increasing demand for minerals, construction materials, and steel products drives the need for reliable ceramic wear parts, leading to market growth.

Metal wear parts are a type of wear parts that are made from different metals or metal alloys, such as steel, cast iron, stainless steel, or high-speed steel. They are typically used in heavy-duty applications where there is a high impact, abrasion, or mechanical stress Metal wear parts serve a wide range of industries, including mining, construction, and manufacturing. As global industrialization and construction activities increase, the demand for metal wear parts also rises. Their strength, toughness, and versatility in various applications make them a crucial component for industrial machinery, further driving market growth.

Polymer wear parts are manufactured using synthetic polymers or plastic materials like polyethylene, polyurethane, or PTFE (polytetrafluoroethylene). These parts have several advantages, including low friction, excellent resistance to chemicals, and good dimensional stability. They are widely used in industries that require self-lubrication, noise reduction, and non-magnetic properties. Polymer wear parts are gaining popularity due to their lightweight, corrosion-resistant properties, and ability to be melded into complex shapes. Industries such as aerospace, food processing, and material handling benefit from these advantages, leading to an increased demand for polymer wear parts. Additionally, the growing focus on environmental regulations and sustainability encourages the shift towards eco-friendly polymer wear parts, boosting market expansion.

Application Insights

The Machine and Manufacturing segment encompasses industries that rely on machines and equipment for their manufacturing processes. Wear parts are crucial components in machinery that experience wear and tear over time due to continuous operation. Examples of industries in this segment that use wear parts include:

- Automotive: Wear parts are used in engine components, transmission systems, braking systems, and other vehicle parts.

- Industrial Machinery: Wear parts are employed in heavy machinery, such as construction equipment, agricultural machinery, and material handling equipment.

- Electronics Manufacturing: Wear parts are utilized in automated assembly lines and machinery used for the production of electronic components.

- The Mining industry involves the extraction of minerals and resources from the earth. Mining operations often involve heavy-duty equipment and machinery that experience significant wear and require wear parts for maintenance and replacement. This segment includes:

- Surface Mining: Wear parts are used in machinery like excavators, loaders, and haul trucks used for open-pit mining.

- Underground Mining: Wear parts are utilized in machinery such as drill rigs, tunnelling machines, and continuous miners used in underground mining operations.

- Mineral Processing: Wear parts are employed in crushers, mills, screens, and other equipment used to process mined materials.

Material Insights

Steel is a versatile material that is widely used in the wear parts market because of its exceptional strength and toughness. It is capable of withstanding heavy loads and abrasive environments, making it suitable for various applications such as construction machinery, mining equipment, and agricultural machinery. Steel wear parts are commonly found in components like buckets, blades, cutting edges, and crusher liners. However, it is important to note that steel wear parts are not as hard as tungsten carbide or ceramic wear parts. This means that they may experience faster wear and tear and may require more frequent replacement.

Tungsten carbide is a compound consisting of tungsten and carbon. It is well-known for its exceptional hardness, resistance to wear, and high melting point. Industries such as oil and gas, mining, and metalworking extensively utilize tungsten carbide wear parts. These parts are used in various applications including drilling tools, cutting tools, wear plates, nozzles, and other high-wear situations where hardness and resistance to abrasion are crucial. Compared to steel wear parts, tungsten carbide wear parts can last up to 10 times longer, making them a cost-effective solution in the long term.

Ceramics are materials that are not made of metal and are known for being hard, resistant to heat, and good at insulating electricity. In the market for parts that are used to resist wear, ceramics are used in industries like automotive, aerospace, and chemical processing. Ceramic wear parts are used in places where there are high temperatures, corrosive substances, and conditions that cause wear. The ceramic industry is expected to grow at a moderate rate because ceramics are very resistant to wear and last a long time. Ceramic wear parts are commonly used in industries like aerospace, automotive, and medical equipment, where precision and low friction are important. Ceramic wear parts can last up to 100 times longer than steel wear parts, which makes them a good choice for applications that are very valuable.

Regional Insights

North America Wear Parts Market Analysis

The U.S. leads the North American wear parts market, driven by growing investments in mining, construction, and heavy machinery. Demand for replacements is expected to rise with ongoing infrastructure development and the modernization of industrial equipment. Additionally, industrial automation, predictive maintenance, and the adoption of advanced operational practices are reducing downtime, further fueling market growth.

North America-U.S. & Canada Wear Parts Market Trends

North America, which includes the United States and Canada, is a significant market for Wear Parts. The presence of well-established industries such as manufacturing, mining, construction, and automotive contributes to the demand for wear parts. Furthermore, the region's focus on technological advancements and innovation drives the adoption of wear-resistant materials and advanced wear parts.

Europe Wear Parts Market Analysis

Europe is another important market for Wear Parts. Countries like Germany, the United Kingdom, France, and Italy have a strong industrial base, including manufacturing, mining, and automotive sectors. The emphasis on efficient and sustainable manufacturing processes, along with strict quality standards, drives the demand for high-quality wear parts in the region.

Europe-Germany Wear Parts Market Trends

Germany maintains a stronghold in the market in Europe, supported by its strong industrial base, particularly in mining, steel, and cement production. Rising labor costs and stricter environmental regulations are encouraging businesses to adopt long-lasting solutions, boosting market demand. In addition, sustainability policies and circular economy initiatives are expected to further promote procurement, while the country's advanced industrial ecosystem and high technology adoption reinforce its market leadership.

Asia Pacific Wear Parts Market Analysis

The Asia Pacific region, particularly China, Japan, India, and South Korea, represents a significant market for Wear Parts. The rapid industrialization, infrastructure development, and expanding manufacturing sectors in these countries contribute to the demand for wear parts. Additionally, the mining industry in Australia and other resource-rich countries in the region also drives market growth.

China Wear Parts Market Trends

China is a major contributor to the Asia Pacific wear parts market due to rapid urbanization, large-scale infrastructure projects, and expansive mining operations. There is high demand for wear parts due to the government's growing focus on expanding the industrial sector. Rapid industrialization, along with growing construction activity, significantly contributes to market growth.

Middle East and Africa Wear Parts Market Analysis

The Middle East and Africa region offer potential growth opportunities for the Wear Parts market. The mining sector, particularly in countries like South Africa and Saudi Arabia, drives the demand for wear parts. Additionally, the development of infrastructure, including construction projects and industrial expansion, also contributes to market growth in this region.

South African Wear Parts Market Trends

South Africa plays a significant role in the Middle East and Africa markets, fueled by rising mining activities and large-scale infrastructure projects. The demand for wear parts is rising nationwide, driven by increased investment in industrial modernization and mechanization. South Africa's focus on improving industrial capabilities and sustainability is likely to drive long-term market growth.

Latin America Wear Parts Market Analysis

Brazil Wear Parts Market Trends

Brazil is expected to lead the Latin American market due to its substantial mining sector, including iron ore and copper extraction, along with growing infrastructure development. High levels of extraction activity and industry growth are likely to boost demand for replacements. Government grants for industry mechanization and infrastructure development are anticipated to support further expansion.

Wear Parts Market - Value Chain Analysis

- Raw Material Sourcing

The foundation of the wear parts industry lies in the extraction and supply of high-quality metals and alloys such as manganese steel, chromium, tungsten carbide, and other wear-resistant materials.

Key Players: ArcelorMittal, Outokumpu, Sandvik Materials Technology, BHP Group. - Material Processing & Alloying

Raw metals are processed into specialized alloys and hardened materials to meet the demanding wear-resistance and strength requirements of industrial components.

Key Players: Carpenter Technology, Böhler-Uddeholm, Hitachi Metals. - Component Fabrication / Machining

Processed alloys are machined, cast, or formed into wear parts such as crusher liners, excavator teeth, bucket lips, hammers, and mill liners. Advanced CNC and casting technologies are used for precision and durability.

Key Players: Castolin Eutectic, Metso Outotec, Palbit, Hensley Industries. - Surface Treatment & Coating

Wear parts undergo hardfacing, thermal spraying, or other surface treatments to enhance abrasion and impact resistance, extending service life under extreme operational conditions.

Key Players: Castolin Eutectic, Borox, Spokane Industries, Miller Carbide. - Assembly & Distribution

Finished wear parts are distributed to equipment OEMs, service providers, and end-users across industries such as mining, construction, cement, steel, and agriculture.

Key Players: Metso Outotec, Columbia Steel, Redexim, Hensley Industries. - Aftermarket Services & Replacement

Replacement and maintenance services are a critical part of the wear parts ecosystem, including installation, repair, and recycling programs to optimise operational uptime for end users.

Key Players: ESCO Group, Hensley Industries, Sandvik, Metso Outotec.

Key Players in Wear Parts Market and their Offerings

- Castolin Eutectic: A Swiss provider of welding, brazing, coating, and wear plate solutions aimed at extending component life in heavy industry.

- Metso Outotec (Parts & Wear Solutions): Supplies spare and engineered wear parts (e.g., manganese steel liners) for crushers and mineral processing plants.

- Palbit S.A.: A Portuguese manufacturer of high-performance carbide cutting tools and specialised wear parts for heavy industry applications.

- Hensley Industries: US-based maker of heavy abrasion-resistant wear parts, including teeth, lips, bucket adapters, and bolt-on segments for mining & earth-moving equipment.

- Redexim B.V.: (Note: primarily a turf maintenance equipment company) Supplies parts and accessories rather than heavy industrial wear parts.

- Spokane Industries: US manufacturer of high chrome and ceramic composite wear parts for VSI/HSI impact crushers and mining applications.

- Borox International AB: Swedish producer of premium wear strips and edges (“BOROX”) for buckets, graders, and snow ploughs, built for heavy-abrasion use.

- Miller Carbide: Specialised in custom-engineered tungsten carbide wear parts and sintered components for wear-intensive industrial applications.

- Columbia Steel Casting Co., Inc.: U.S. manufacturer of replacement crusher wear parts (jaw, cone, gyratory) and tailored alloy wear components for heavy industry.

Recent Developments

- Graphene-reinforced polymers. Graphene is a two-dimensional material that is very strong and has excellent wear resistance. In 2020, a study published in the journal Advanced Materials showed that graphene-reinforced polymers can reduce wear by up to 42.3%. [2020, Advanced Materials]

- Stripfilms are thin films that form on surfaces during wear. They can provide a protective layer that helps to reduce wear. In 2021, a study published in the journal Nature Materials showed that tribofilms can be engineered to have specific properties that make them even more wear-resistant.

Segments Covered in the Report

By Type

- Ceramic Wear Parts

- Metal Wear Parts

- Polymer Wear Parts

- Composite Wear Parts

By Application

- Mining

- Machining & Manufacturing

- Construction

- Automotive

- Aerospace

- Chemical & Petrochemical

- Others

By Material

- Steel

- Tungsten Carbide

- Ceramics

- Polymers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting