What is the Synthetic Polymers Market Size?

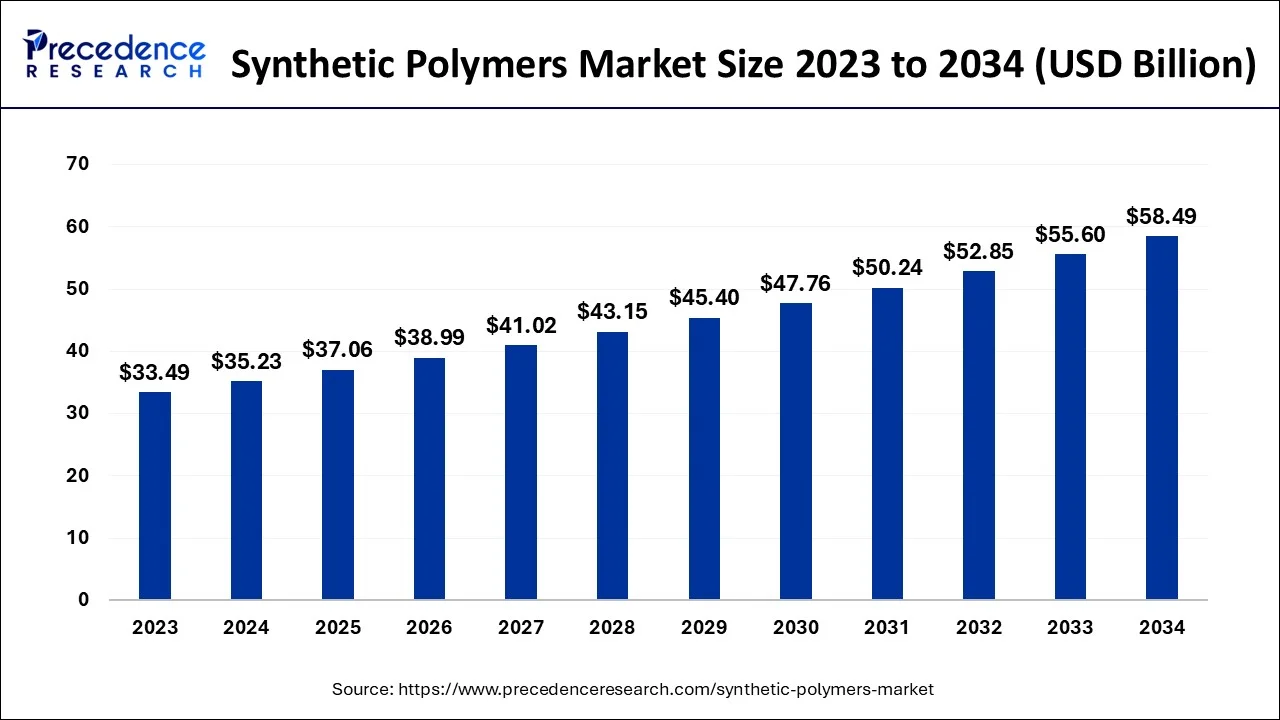

The global synthetic polymers market size is calculated at USD 37.06 billion in 2025 and is predicted to increase from USD 38.99 billion in 2026 to approximately USD 61.29 billion by 2035, expanding at a CAGR of 5.16% from 2026 to 2035.

Synthetic Polymers Market Key Takeaways

- By type, the styrene acrylic segment has previously controlled the market with the biggest revenue share and is projected to have the largest market share from 2026 to 2035.

- By application, the paints and coatings segment has dominated the market and will continue to expand strongly in terms of revenue.

- By end user, the construction segment has the largest market from 2026 to 2035.

- The Asia-Pacific region is projected to remain one of the most enticing markets

Market Overview

The structural and chemical characteristics of the chain dictate the distinguishing properties of finished materials, which is whypolymersare viewed as collections of monomer units in chains. Chemically produced synthetic latex is a material with outstanding strength, flexibility, and water resistance. Synthetic latex polymers can alter the mechanical properties and molecular weight of other substances. The primary industries using synthetic polymers include aircraft, architecture, healthcare, and automobiles, according to an examination of their basic applications. The recent increase in residential and commercial building drives the requirement for polymer paints and varnishes. A rise in viral and infectious diseases also increases demand for medical supplies such catheters, surgical gloves, wraps, bandages, and stethoscopes.

Synthetic Polymers Market Growth Factors

Fiber, latex, and rubber are examples of synthetic polymers, however recent developments indicate that synthetic latex polymers will soon rule the market. Styrene acrylics, a subtype of synthetic latex, are being used more frequently in building construction and roof coatings, which has raised their demand. The majority of the materials used in the electronic and architectural industries are made of synthetic latex, which is also used in paints, coatings, paper, adhesives & sealants, and carpets.

- The growing end users demand.

- Increasing demand for paper drives styrene butadiene.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 37.06 Billion |

| Market Size in 2026 | USD 38.99 Billion |

| Market Size by 2035 | USD 61.29 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.16 % |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

|

| Regions Covered |

|

Market Dynamics

Key Market Drivers

- Rising demand among end users - The primary driver of the increase in demand for styrene butadiene (SB) latex worldwide is the strong demand from Asia Pacific and Europe, which is brought on by the high demand for paper & paperboard, carpets, adhesives, and fibers in the building and packaging industries. Furthermore, as a result of the ban on plastic bags in countries in Europe and the Asia-Pacific region, more cardboard and paper are being used as packing materials. Additionally, the forecast period will see an increase in the consumption of SB latex due to the growing need for pressure-sensitive adhesives, paints, mortar additives, and coatings in the construction industry.

- Rising demand for polymer's end product - The market for synthetic polymers is expected to experience significant expansion during the projected period as a result of an increase in commercial and residential construction activities as well as increased product demand for coatings and paints. Additionally, it is anticipated that as research and development efforts increase, the market for synthetic polymers will grow. Demand for synthetic polymers is anticipated to increase due to the production of latex-based surgical gloves, catheters, electrode pads, stethoscopes, elastic bandages, and wraps, which is anticipated to impede the market growth.

- Rising demand for the healthcare industry - Polymers have been employed for a huge range of medical purposes outside of drug delivery systems. In more recent years, synthetic polymers have shown to be flexible and have been used to develop light-activated adhesive materials that aid in resealing blood arteries during vascular surgery. In order to integrate with human tissue as a sealant, adhesive, or the base of 3D-printed implants, the polymers used in the surgical glue were intended to be programmed for multiple functions and ultimately integrate with human flesh.

Key Market Challenges

- Damaging impact on the environment - Governments' attention is shifting from the rising usage of synthetic polymers, which are non-degradable and contain hazardous compounds, to environmental anomalies and climate change. Governments are enacting new laws and regulations and spending money on research to find a degradable replacement for synthetic polymers.

Key Market Opportunities

- Increasing opportunities in the cosmetic industry - the increase in investment in the personal care and cosmetics sector will likely create additional chances for the market for synthetic polymers to expand during the next few years. Numerous personal care and cosmetic items frequently use polymers. The applications add special benefits to their formulations by utilizing the varied features of these polymers. The variety of properties is as diverse as the class of polymers that have been used. Cosmetic chemists can develop high-performance products using polymers.

Segment Insights

Type Insights

The styrene acrylics category, which has previously controlled the market with the highest revenue share, is anticipated to have the largest market share in the upcoming years. This segment will also continue to expand well. This coating of styrene acrylic is utilized in building and construction to give concrete and roofing applications that are more flexible, heat sealable, salt stable, and water resistant. Chemically speaking, styrene acrylic is simply a modified acrylic polymer that has been added to boost the polymer's resistance to weathering. Roofs and other construction components that are directly exposed to the outside atmosphere have longer lifespans thanks to styrene acrylic coating. Buildings and homes covered in styrene acrylic are fashionable because to the acceleration of global warming. With the rise in demand for weatherproof coating, it is projected that the styrene acrylic market will expand over the course of the forecast period.

The increase in demand from the construction and automotive industries will drive the styrene butadiene market during the forecast period. Additionally, the increased demand for paper is fueling the styrene butadiene industry's expansion. Additionally, it is predicted that the market for styrene butadiene latex would grow in tandem with the expansion of the carpet sector. On the other hand, it is further projected that the concerns about the increase in feedstock costs will restrict the expansion of the styrene butadiene latex market in the timeframe period. In the upcoming years, the market for styrene butadiene latex may also experience development due to the increased demand for carpet and fiber products.

Application Insights

The paints and coatings category, which has dominated the market and will continue to expand strongly in terms of revenue, is anticipated to have the biggest market share by application in the upcoming years. Due to urbanization, the paints and coatings market is expanding rapidly. Indian paint producers keep expanding their plant capabilities to keep up with the rising demand. Asian Paints announced a $53 million investment to construct paint manufacturing facilities in 2018. Additionally, Kansai Nerolac intends to build two additional factories in India. One of the most important driving the expansion of the synthetic polymers market is the increasing demand for paints and coatings from different regions of the world.

End User Insights

Construction is predicted to have the largest market share by the end user in the upcoming years; historically, this segment has dominated the market with the highest revenue share and will continue to increase. The government's increased investment in infrastructure development projects has fueled the expansion of the construction industry. To speed up these initiatives, they are also utilizing private-public models, which is increasing demand in emerging markets. Construction polymers are being used more frequently as paints and coatings for building materials.

Regional Insights

Geographically, Asia-Pacific is anticipated to remain one of the most enticing markets and will account for the bulk of the market's revenue share over the course of the projection period. Asia-Pacific nations have a competitive advantage over other regions because they have substantial supplies of the raw ingredients needed to make synthetic polymers. They also hold the biggest market share for synthetic polymers, and due to urbanization and rapid development, it is anticipated that they will continue to maintain their dominance in the years to come.

The cheap availability of raw materials used to make plastics will also help the synthetic polymers market grow in the region over the course of the projected period.

India Synthetic Polymers Market Analysis

India's market is growing due to rapid industrialization, increased construction activity, and higher demand from the automotive, packaging, and healthcare sectors. Rising urbanization, greater disposable incomes, and expanding manufacturing capacity are driving consumption. Additionally, the increase in medical products, infrastructure projects, and government initiatives supporting local production further speeds up market growth.

What Potentiates the North American Synthetic Polymers Market?

The North American market is driven by a strong demand from automotive, packaging, construction, and electronics industries, along with advancements in high-performance and sustainable polymer technologies. Increasing adoption of lightweight materials, rising healthcare needs, and continuous innovation in recycling and bio-based polymers further fuel regional expansion. Additionally, well-established manufacturing infrastructure and R&D investments support steady market growth.

U.S. Synthetic Polymers Market Analysis

The U.S. synthetic polymers market is growing due to strong demand from the automotive, aerospace, healthcare, packaging, and electronics sectors. Growth in advanced manufacturing, increasing adoption of lightweight and high-performance materials, and greater use of polymers in medical devices and sustainable packaging drive the market. Government support for innovation and robust R&D capabilities further support market growth.

Europe: A Notably Growing Area

Europe is expected to grow at a notable rate in the market due to rising demand for sustainable, high-performance materials across the automotive, construction, packaging, and electronics sectors. Strong regulatory push for recyclable and bio-based polymers encourages innovation. Expanding electric vehicle production, upgrading infrastructure, and advancing healthcare applications further boost consumption. Additionally, Europe's focus on circular economy solutions accelerates the development of polymer technologies and market expansion.

UK Synthetic Polymers Market Anaysis

The UK market is expanding because of increasing demand from healthcare, automotive, construction, and packaging industries, along with a strong shift toward sustainable and recyclable materials. Greater investment in advanced manufacturing, medical devices, and lightweight automotive parts further drives growth. Additionally, government efforts to promote green materials and circular economy practices speed up innovation and polymer adoption across various sectors.

Value Chain Analysis

- Chemical Synthesis and Processing

Synthetic polymers are formed through polymerization, where monomers bond to create long-chain structures. Their performance depends on the selected monomers, production technique, and processing environment.

Key Players: BASF, Dow, SABIC, LyondellBasell, and Reliance Industries. - Compound Formulation and Blending

Polymer compounding involves mixing raw polymers with additives, fillers, or reinforcements in a molten state to enhance their performance for specific applications. This process is vital for industries such as automotive, medical devices, and electronics.

Key Players: Avient Corporation, BASF, DuPont, Celanese, and Covestro - Quality Testing and Certification

Quality assessment of synthetic polymers involves standardized testing to evaluate their mechanical, thermal, chemical, and physical properties, ensuring they meet safety and regulatory standards. Certification is usually performed by independent testing agencies.

Key Players: SGS, Intertek, UL, TÜV SÜD, and Bureau Veritas.

Synthetic Polymers Market Companies

- 3M: It offers advanced polymer materials, adhesives, films, and performance additives used in electronics, automotive, medical devices, and industrial applications, providing high durability and specialized functionality.

- LG Chem: It provides a wide range of petrochemical-based polymers, including PE, PP, ABS, and specialty materials for automotive, electronics, batteries, and construction industries.

- Dow: It offers polyethylene, elastomers, polyurethane systems, and specialty polymers supporting packaging, construction, automotive, and consumer goods with high-performance, sustainable material solutions.

- Trinseo: It supplies engineered plastics, latex binders, and rubber polymers for automotive, medical, packaging, and industrial applications, with a focus on performance, recyclability, and material innovation.

Other Major Key Players

- Alberdingk Boley

- Celanese Corporation

- Asahi Kasei Corporation

- BASF SE

- Wacker Chemie AG

- Lubrizol Corporation

- Apcotex Industries Limited

- Arkema, Arlanxeo

- OMNOVA Solutions Inc.

Recent Developments

- In January 2018 –The Synthomer Leuna GmbH production facility in Sachsen-Anhalt, Eastern Germany, has been taken over by Alberdingk Boley GmbH. Alberdingk Boley firmly secures the growth strategy for its polyurethane and acrylate dispersions by taking over the new site in Leuna.

Segments Covered in the Report

By Type

- Styrene Acrylic

- Styrene Butadiene

- Acrylic

- Vinyl Acetate Copolymer

- Polyvinyl Acetate

- Vinyl Acetate Ethylene

- Others

By Application

- Paints and Coatings

- Adhesives and Sealants

- Nonwovens

- Carpets, Paper and Paperboard

- Others

By End User

- Construction

- Automotive

- Electronics

- Textile

- Healthcare

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting