What is Synthetic Leather Market Size?

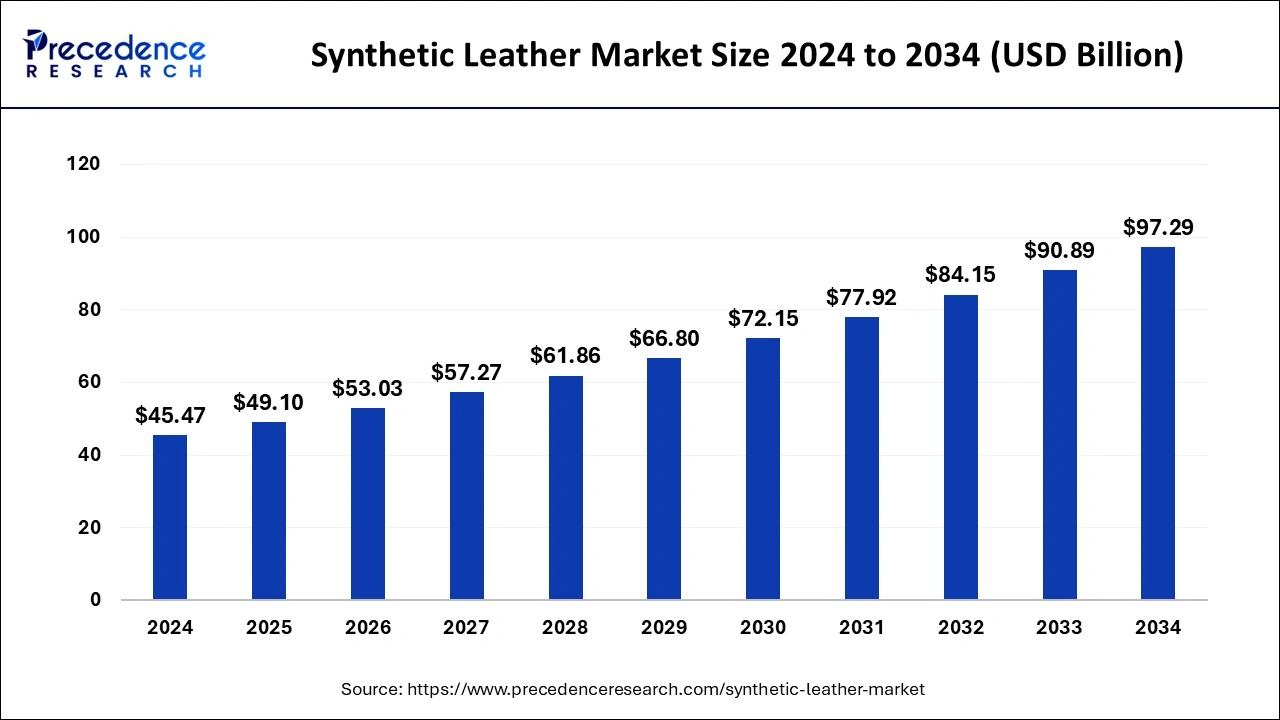

The global synthetic leather market size is valued at USD 49.10 billion in 2025 and is anticipated to reach around USD 103.91 billion by 2035, growing at a CAGR of 7.78% from 2026 to 2035

Market Highlights

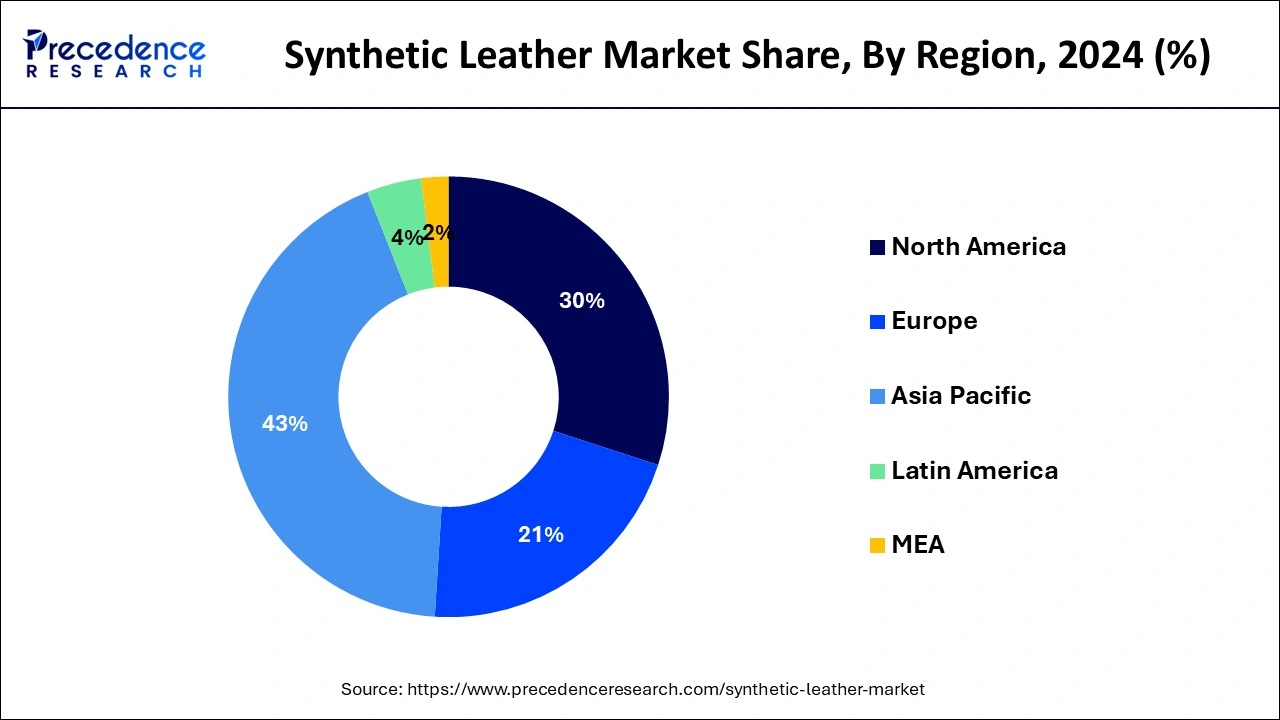

- Asia Pacific held market share of 43% in 2025.

- By product, the polyurethane (PU) synthetic leather segment registered a maximum market share of 53% in 2025.

- By application, the footwear segment is expected to captured the biggest revenue share of 31% in 2025.

Market Overview

The synthetic leather market is expected to grow significantly over the forecast period owing to the rising demand for synthetic leather in footwear and automotive applications. Synthetic leathers are blends of polyurethane and polyvinyl chloride. At present, several market players are also engaged in the introduction of bio based materials for leather. Increasing demand for synthetic leather in the footwear industry owing to cheaper prices is expected to fuel the market growth over the forecast period. However, the outbreak of the COVID-19 pandemic is expected to impact the demand for synthetic leather in applications such as automotive, footwear, furnishing, and others in the short-term.

Synthetic leather has been replacing genuine leather at a steady rate. The market is expected to gain considerable market share in the footwear segment in the coming years on account of rising usage of artificial leather grades in boots, sneakers, women's sandals, and men's formal shoes. Moreover, increasing per capita disposable income is expected to boost the demand for synthetic leather in various application segments.

Increasing market penetration of synthetic leather materials in automotive interior applications is expected to be a critical factor for growth. Car manufacturers are adopting synthetic leather materials owing to their high durability, wear resistance, and cost-effective production. Passenger vehicles targeted primarily at the middle income class consumer group are the major end user of faux leather in automotive segment. Faux leather is affordable and easier to maintain as compared to real leather, which aids in attracting a large number of consumers. Utilization of artificial leather reduces the overall cost of the vehicle, thereby assisting manufacturers in achieving stable economies of scale.

Synthetic Leather Market Growth Factors

Increasing demand of footwear expected to be a major factor that propels the overall market growth for synthetic leather. Synthetic leather is a suitable alternative as it comprises of a cloth base that is coated with synthetic resins. Thus, synthetic leather completely serves the purpose of real leather by offering a leather-like finish, thereby anticipated to augment its demand across wide application area that includes footwear, fabrics, upholstery, clothing, and others. The production process of synthetic leather has evolved over the past few years to curb down the rate of hunting and protect the animal life.

The global demand for leather materials has seen a paradigm shift owing to its increasing application across automotive, furnishing, bags, clothing, and many others. Manufacturers have been focusing significantly to shit their sources for raw materials towards the Asian suppliers for example Vietnam and China because of low cost of labor & fright along with an abundance of raw material in the region. However, the recent spread of corona virus across the globe has drastically impacted the demand for synthetic leather because of several preventive measures undertaken by the governments of various regions to control the spread of the pandemic. This has resulted in sudden fall in the trade and demand of synthetic leather across the globe projected to have a negative impact on the growth of the market over the near future.

Market Outlook

- Market Growth Overview: The synthetic leather market is experiencing strong growth due to rising demand from automotive, footwear, furniture, and fashion industries. Moreover, increasing consumer preference for animal-free products, sustainability trends, and innovations in high-performance and eco-friendly synthetic leather materials drive market growth.

- Global Expansion: The market is expanding globally as industries seek cost-effective, durable, and versatile alternatives to natural leather. Emerging regions such as Asia-Pacific, Latin America, and the Middle East & Africa offer significant opportunities due to rapid urbanization, growing middle-class populations, and increasing adoption of synthetic leather in automotive, footwear, and furniture sectors.

- Sustainability Trend: The sustainability trend is reshaping the market as manufacturers increasingly adopt eco-friendly materials, such as bio-based PU and recycled polymers, to reduce environmental impact. This shift not only meets growing consumer demand for cruelty-free and sustainable products but also drives innovation in durable, high-performance, and low-carbon synthetic leather solutions.

- Major Investors: Major investors in the market include multinational chemical and material companies, private equity firms, and fashion and automotive OEMs that invest in sustainable material development. Their contributions support R&D, production capacity expansion, eco-friendly product innovation, and wider distribution networks for synthetic leather products.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 49.10 Billion |

| Market Size in 2026 | USD 53.03 Billion |

| Market Size by 2035 | USD 103.91 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.78% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand from Footwear Sector

Footwear was the largest application segment for synthetic leather in 2022. The footwear industry has witnessed a significant growth in recent years owing to the rising demand from emerging markets, as consumer spending in the U.S. and some countries in Europe has slowed down slightly owing to the global recession.

Increasing investment by foreign players will further propel industry penetration in emerging economies in the near future. Luxury brands have been among the first to respond to the shift in global consumer spending. In 2016, brands like Prada have opened 27 new stores in Asia Pacific, which amounts to approximately 35% of the total number of stores of the brand. Such initiatives are expected to play a crucial role in improving the market penetration of synthetic leather brands over the next few years.

International players also have to adjust their pricing strategies as per the local competition in developing economies. This will be a key challenge for multinational players. In addition, the influx of new customer groups will put some pressure on product development channels to meet diverse needs and preferences. Footwear brands have to take into consideration the rising middle class, which is expected to be the major growth driver for the overall market in the near future.

Viable Alternative to Natural Leather

Natural leather is obtained from animals, which has resulted in animal killings. There have been various guidelines and laws established by various countries in order to protect animal rights. Animal right laws have become a major hurdle for natural leather manufacturers in several countries. Manufacturing activities of natural leather, especially tanning, lead to pollution of the nearby surroundings. This is another major reason leading to the shift in preference toward synthetic leather. Stringent environmental laws and government regulations have been influential in promoting the demand for synthetic leather.

PVC leather is another crucial type of synthetic leather and has witnessed increased market penetration primarily on account of its wide range of applications, including shopping bags, wallets, cosmetic bags, wallets, suitcases, handbags, and travel bags. Several manufacturers have ramped up their production of PVC leather owing to its cost-effectiveness.

India is among the world's top five producers of leather. However, the Central government of India has banned the slaughter of cows for meat and leather, which has adversely affected the leather industry in the country. Most of India's leather and meat industry comprises unorganized players, owing to which a reduction in the annual production from these industries is not feasible to estimate. The market situation has widened the demand-supply gap of genuine leather, which is expected to supplement the India PU synthetic leather market's growth over the forecast period.

Restraint

Damaging Effects 0f pvc. and PU

PVC is derived from plastic sources and, like most plastics, it contains carcinogens and other toxic chemicals that can transfer to the user's skin through contact. Furthermore, PVC has a very slow rate of biodegradation and therefore has a negative impact on the environment. Similar toxicity concerns do not apply to PU, as it is only toxic during its production and, once dried and sealed, does not represent a threat as with PVC.

The production of polyurethane fabrics can be toxic for factory workers, as it releases harmful chemicals. The production process involves the use of solvents mostly used for painting the polyurethane in liquid form on a fabric backing. Solvents required in this process are highly toxic. However, new polyurethane versions use waterborne coatings, which do not have the same kind of damaging impact on the environment as exhibited by other grades. This is expected to be a key aspect in terms of overall product development and sustainability. In addition, synthetic leather made from PU or PVC cannot be remade into leather products, as it does not recycle very well and cannot be reused when it is worn out.

On account of the aforementioned harmful impact on the environment, the demand for PU synthetic leather is likely to be restrained over the forecast period. Most consumers prefer genuine leather owing to properties that enable it to age finely and make it more durable as compared to faux leather. Genuine leather is also biodegradable in nature, unlike PU leather. These advantages of genuine leather may pose a threat to the PU leather market's growth over the forecast period.

Segment Insights

Product Insights

Polyurethane (PU) synthetic leather segment captured the largest value share of more than 53% in the year 2023. Further, the segment witnesses promising growth over the upcoming years owing to the product quality, yield, and variety. PU is softer, waterproof, and lighter than real and other types of synthetic leather; in addition, it can be dry cleaned as well as torn easily than real hides. It also does not get affected from the sunlight. In addition, the product type does not emit dioxins that make it an eco-friendly substitute for the vinyl-based products. Collectively all the above-mentioned factors expected to further augment the product demand.

Besides this, the PVC product segment expected to register slow growth over the analysis period. It was the very first type of synthetic leather that was initially produced using carcinogenic chemicals. It was proved to be an ideal material for furnishing and household applications. PVC was unable to maintain the body heat as well as gave a sticky feel when touched; while PU proved to be beneficial in these terms. Hence, the market demand for PVC decreased particularly in bags and clothing sectors.

Bio-based product expected to witness prominent growth over the forthcoming years owing to presence of polyester polyol that has 70% to 75% renewable content. Further, it is softer as well as has better scratch resistance properties compared to PU and PVC.

Application Insights

Footwear accounted for the maximum revenue share of more than 31% in 2023. Increasing income levels along with economic growth, especially in the developing countries has fueled the demand for footwear. In addition, the segment is also driven by the changing climatic conditions of different regions that require different types of footwear.

Rising athleisure trend of including athletic shoes in daily lifestyle also projected to flourish the growth of the segment. Further, the price of faux leather footwear is three times less compared to ones made from animal hide that again boosts the growth of the segment. In addition, furnishing industry is also one of the prime applications of synthetic leather because of its lower price than animal hides. However, Polyurethane (PU) is widely used in the automotive sector because of its non-sticky and soft touch properties compared to other products.

Regional Insights

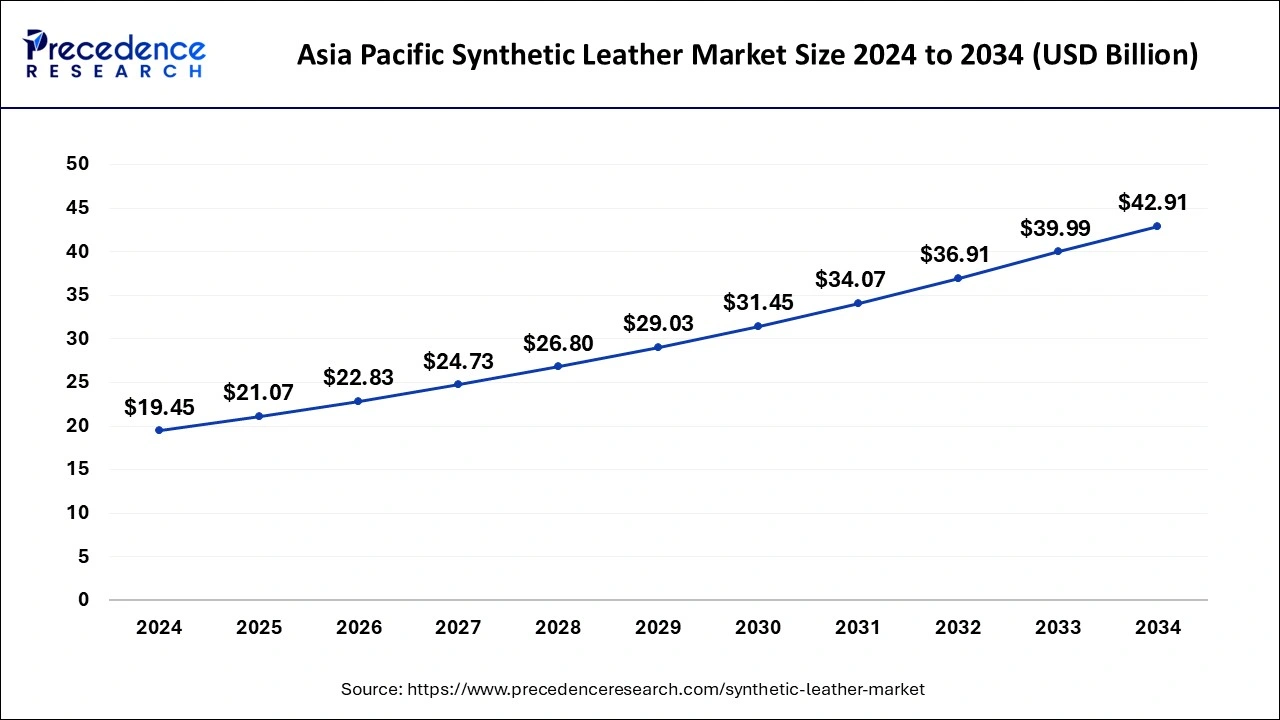

Asia Pacific Synthetic Leather Market Size and Growth 2026 to 2035

The Asia Pacific synthetic leather market size is estimated at USD 21.07 billion in 2025 and is predicted to be worth around USD 45.93 billion by 2035, at a CAGR of 8.1% from 2026 to 2035

The Asia Pacific encountered the largest value share of more than 43% in the year 2024 and expected to maintain the same trend over the analysis period. India, China, and South Korea are the major countries that drive the growth of the market in the region. Further, increasing disposable income along with rising population across the region offers numerous opportunities for the market growth.

North America and Europe witness sluggish growth owing to the maturity of the market. In addition, the ongoing trade war between China and the U.S. along with drastic decline in the cross-border trade with the spread of the coronavirus pandemic that originated in Wuhan, China, has initiated trust issues between the two countries that further expected to negatively impact market growth in the upcoming years.

What Makes North America a Significantly Growing Region in the Market?

North America is expected to grow significantly in the synthetic leather market during the forecast period. North America is experiencing a rise in the demand for the use of eco-friendly products. At the same time, the industries are also using advanced technologies for the development of cruelty-free products. Furthermore, their use in the development of shoes, bags, etc is growing, which in turn contributes to the same. Thus, all these factors enhance the market growth.

How is the Opportunistic Rise of Europe in the Market?

Europe is expected to show lucrative growth in the synthetic leather market during the forecast period. Due to growing awareness, the use of synthetic leather is increasing in Europe. At the same time, various alternatives for the development of synthetic leather are also being developed with the use of advanced technologies. This, in turn, increases the number of collaborations between various companies. Thus, with the use of these alternative materials, the automotive as well as the fashion industries are shifting towards the use of synthetic leather. This is further supported by the government as well. Thus, this results in enhancing the market growth.

North America and Europe witness sluggish growth owing to the maturity of the market. In addition, the ongoing trade war between China and the U.S. along with drastic decline in the cross-border trade with the spread of the coronavirus pandemic that originated in Wuhan, China, has initiated trust issues between the two countries that further expected to negatively impact market growth in the upcoming years.

What Potentiates the Synthetic Leather Market in Latin America?

The synthetic leather market in Latin America is potentiated by rising demand from the automotive, footwear, and furniture industries, which increasingly rely on cost-effective and durable alternatives to natural leather. Urbanization and expanding middle-class populations are further boosting demand for synthetic leather products. Brazil and Mexico, as leading regional manufacturers, are producing cruelty-free and affordable alternatives that appeal to both domestic and export markets. Additionally, ongoing investments in manufacturing infrastructure and technological advancements are enabling higher production efficiency and innovation, supporting long-term market growth.

What Opportunities Exist in the Middle East & Africa?

The Middle East & Africa (MEA) presents significant opportunities for the synthetic leather market due to rising demand from the automotive, footwear, and furniture industries, driven by urbanization and increasing disposable incomes. Sustainability trends are boosting interest in eco-friendly and bio-based synthetic leathers, particularly among younger, environmentally conscious consumers. Key markets like the UAE, Saudi Arabia, and South Africa offer potential for both import and local production, supported by economic diversification and expanding manufacturing sectors. Additionally, partnerships with regional fashion, automotive, and furniture brands help manufacturers capitalize on emerging consumer trends and reduce supply chain costs.

Value Chain Analysis

- Raw Materials & Polymers Sourcing: This stage involves sourcing core chemicals and polymers used to manufacture synthetic leather, such as PU, PVC, and bio‑based alternatives.

Key Players: Huntsman Corporation and BASF SE - Manufacturing & Processing: This stage focuses on adding value through surface finishing, embossing, coloring, and performance enhancements like abrasion resistance, breathability, and eco‑friendly coatings.

Key Players: Kuraray Co., Ltd., Teijin Limited, Toray Industries, Inc., San Fang Chemical Industry Co., Ltd., and Mayur Uniquoters Ltd. - OEM Integration & End‑Use Application: This stage involves OEMs and converters who source synthetic leather for incorporation into finished products like car seats, footwear uppers, furniture upholstery, and fashion accessories.

Synthetic Leather Market Companies

- R. Polycoats Pvt. Ltd.

- Kuraray Co., Ltd.

- Alfatex Italia SRL

- Yantai Wanhua Synthetic Leather Group Co., Ltd.

- San Fang Chemical Industry Co., Ltd.

- Filwel Co., Ltd.

- Nan Ya Plastics Corporation

- Teijin Limited

- Zhejiang Hexin Industry Group Co., Ltd.

Recent Developments

- In April 2025, a collaboration between VML, Lab-Grown Leather Ltd. and The Organoid Company was announced to develop the world's first T-Rex leather with the use of advanced technologies. They will combine creative innovation, tissue cultivation, and genome engineering. Furthermore, to develop eco-friendly and cruelty-free leather for the luxury market is the main goal of this collaboration. (Source: https://www.moneycontrol.com)

- In January 2025, a collaboration between Toyoda Gosei and ASICS was announced for the development of sustainable sneakers. The remnants of leather from the manufacturing of the steering wheel were gathered and used in their development. (Source: https://www.soapcentral.com)

Segments Covered in the Report

By Product

- PVC

- PU

- Bio Based

By Application

- Automotive

- Furnishing

- Footwear

- Clothing

- Bags & Wallets

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content