Wegovy Market Size and Forecast 2025 to 2034

The global wegovy market size accounted for USD 2.44 billion in 2024 and is predicted to increase from USD 3.07 billion in 2025 to approximately USD 24.53 billion by 2034, expanding at a CAGR of 25.96% from 2025 to 2034. The market is experiencing significant growth due to rising global obesity rates and effective clinical outcomes in weight loss and cardiovascular risk reduction. The rising demand for GLP-1 therapy to manage diabetes and obesity further supports market growth.

Wegovy MarketKey Takeaways

- In terms of revenue, the global wegovy market was valued at USD 2.44 billion in 2024.

- It is projected to reach USD 24.53 billion by 2034.

- The market is expected to grow at a CAGR of 25.96% from 2025 to 2034

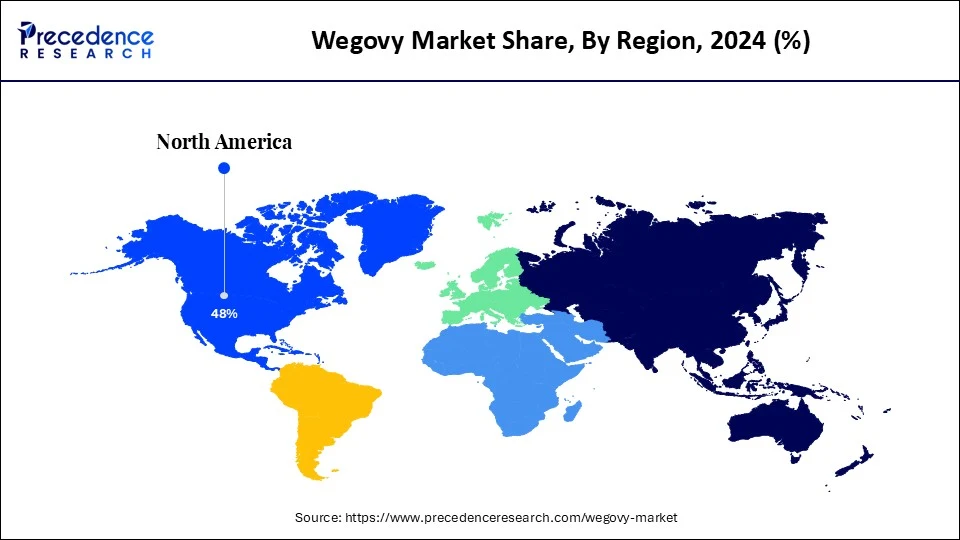

- North America dominated the wegovy market with the largest share of 48% in 2024.

- Asia Pacific is expected to grow at the highest CAGR from 2025 to 2034.

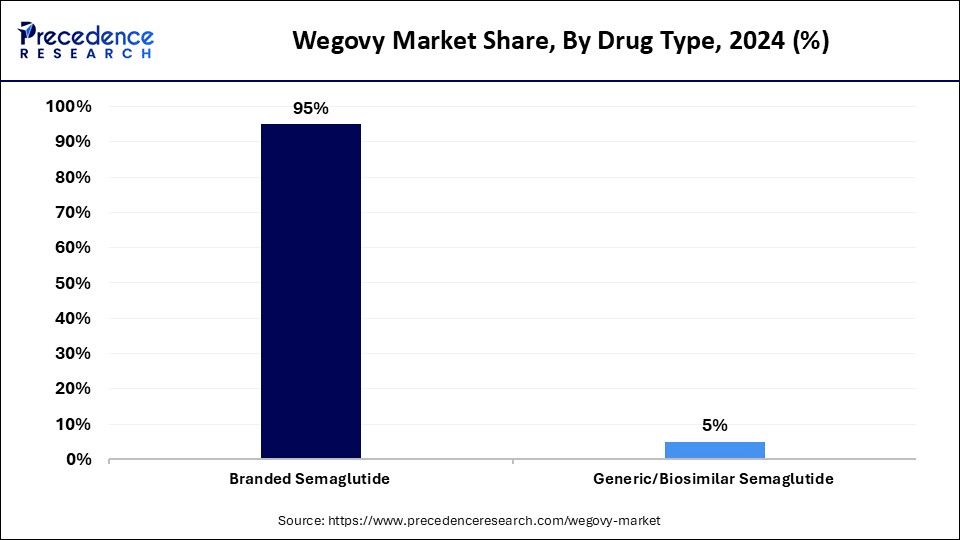

- By drug type, the branded semaglutide segment captured the biggest market share of 95% in 2024.

- By drug type, the biosimilar semaglutide segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By route of administration, the subcutaneous injection segment held the highest market share of 100% in 2024.

- By route of administration, the oral formulations segment is expected to expand at a significant CAGR from 2025 to 2034.

- By dosage strength, the 2.4 mg/week segment held the highest market share of 45% in 2024.

- By dosage strength, the 1.7 mg/week segment is projected to grow at the fastest CAGR between 2025 and 2034.

- By patient demographics, the adults (18-65 years) segment generated the major market share of 70% in 2024.

- By patient demographics, the adolescents (12–17 years) segment is expected to grow at a significant CAGR over the projected period.

- By BMI category, the BMI ≥30 (obese) segment held the biggest market share 65% in 2024.

- By BMI category, the BMI 27-29.9 with comorbidity segment is likely to expand at a significant CAGR during the forecast period.

- By distribution channel, the retail pharmacies segment captured the highest market share of 48% in 2024.

- By distribution channel, the online pharmacies segment is anticipated to grow rapidly in the forecast period.

- By application, the obesity management segment led with a market share of 60% in 2024.

- By application, the cardiovascular risk reduction segment is anticipated to grow at the fastest CAGR between 2025 and 2034.

- By end user, the hospitals segment captured the major market share of 40% in 2024.

- By end user, the weight management clinics segment is expanding at a significant CAGR during the forecast period.

- By pricing tier, the high-income market segment generated the highest market share of 60% in 2024.

- By pricing tier, the middle-income market segment is expected to grow at the fastest CAGR during the projected timeframe.

How Does AI Transform the Wegovy Market?

Artificial intelligenceplays an increasingly important role in the Wegovy market, particularly in drug discovery, clinical trials, and market analysis. AI helps identify new drug candidates, predict their efficacy and safety, and customize treatment plans for individuals with obesity. AI algorithms can analyze large biological datasets to identify potential drug candidates, predict their effectiveness, and refine their molecular structures. This capability can greatly speed up drug development, potentially leading to new and improved therapies for obesity and related conditions. AI-driven tools also track market trends, identify unmet needs, and project demand for Wegovy and other anti-obesity medications.

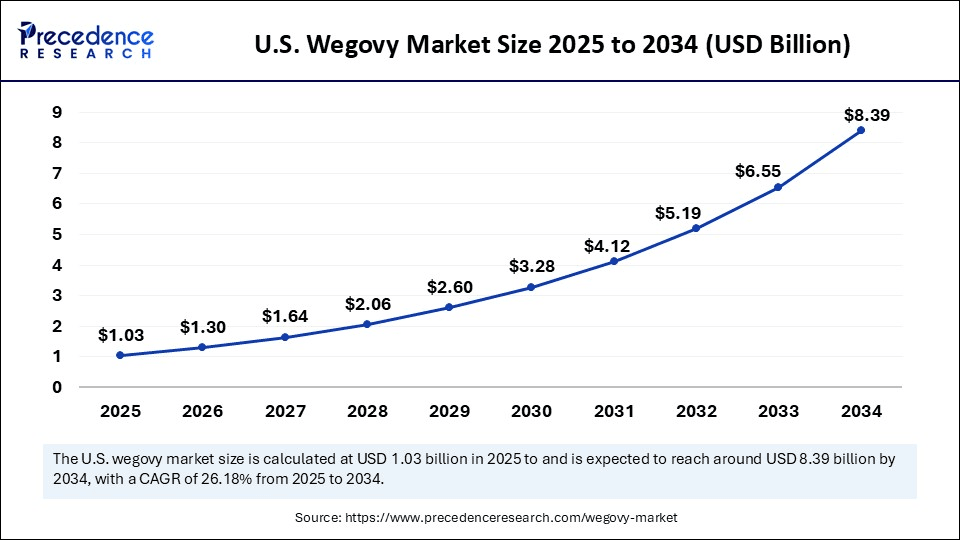

U.S. Wegovy Market Size and Growth 2025 to 2034

The U.S. wegovy market size was exhibited at USD 0.82 billion in 2024 and is projected to be worth around USD 8.39 billion by 2034, growing at a CAGR of 26.18% from 2025 to 2034.

How Did North America Lead the Wegovy Market in 2024?

North America led the Wegovy market while holding the largest share of 48% in 2024, primarily due to high obesity rates, a robust healthcare infrastructure, and widespread awareness of innovative obesity treatments. The region has an established healthcare system with improved access to specialists and advanced therapies, such as Wegovy. There is a high awareness of the risks linked to obesity and the benefits of weight loss medications, both among medical professionals and the public. Additionally, North America is a hub for pharmaceutical innovation, with significant investments in developing new and improved anti-obesity drugs. Companies like Novo Nordisk, which manufactures Wegovy, have actively promoted the drug and its advantages in this market.

U.S. Wegovy Market Trends

The U.S. remains the largest and most significant market for Wegovy, owing to its robust healthcare infrastructure, high prevalence of obesity-related conditions, and increasing awareness of innovative treatments like Wegovy. A significant portion of Wegovy's global sales originates from the U.S. Novo Nordisk has made substantial investments in the U.S., including the expansion of production facilities to meet demand. The recent approvals have significantly strengthened Wegovy's market position and growth prospects in the region.

- In July 2025, WW International, Inc., a U.S.-based company focused on weight management and wellness programs, announced an expanded partnership with Novo Nordisk to increase access to the FDA-approved Wegovy (semaglutide) injection through WeightWatchers Clinic. This collaboration underscores WeightWatchers' commitment to sustainable, science-backed weight management, making it one of the few companies to prescribe only FDA-approved medications, along with comprehensive lifestyle support, to ensure lasting health outcomes.

(Source: https://corporate.ww.com)

What Makes Asia Pacific the Fastest-Growing Area in the Wegovy Market?

Asia Pacific is emerging as the fastest-growing area in the market, driven by the rapid increase in obesity and overweight cases in countries like China, India, and Japan. This creates a large pool of patients in need of effective weight management options such as Wegovy. Many countries are increasing healthcare spending and focusing more on chronic diseases linked to obesity, including type 2 diabetes and cardiovascular issues. Novo Nordisk is actively expanding its presence in the region by launching Wegovy in multiple countries and forming strategic partnerships. The region also experiences advancements in healthcare infrastructure and the growing adoption of digital health solutions, such as telemedicine and health apps.

- In July 2025, Novo Nordisk launched Wegovy in India, marking its expansion into the country's obesity treatment market. Wegovy, a weekly injectable containing semaglutide, is designed to curb appetite and has demonstrated effectiveness in clinical trials when used in conjunction with lifestyle changes. The launch addresses rising obesity rates in India.

(Source: https://www.geneonline.com)

Why is Europe Considered a Notable Region in the Wegovy Market?

Europe is considered to be a notably growing area. The region plays a significant role in the global market due to its large population, high prevalence of obesity, and well-developed healthcare systems. Many European countries have solid healthcare infrastructure, which facilitates the adoption and reimbursement of new drugs like Wegovy. Novo Nordisk's recent collaboration with WeightWatchers to distribute Wegovy underscores its proactive strategy to reach a broader patient base.

How Will Latin America Surge in the Wegovy Market?

Latin America is also experiencing significant growth in the global market due to increasing awareness of the drug's efficiency, rising obesity rates, and a growing medical tourism sector. The region is gaining popularity as a destination for affordable, high-quality healthcare, including obesity treatments. Initiatives such as the Partnership for Primary Health Care, which involves the World Bank, PAHO, and IDB, aim to improve access to healthcare services, including innovative medications.

What Factors Contribute to the Wegovy Market in the Middle East & Africa?

The Middle East & Africa is expected to witness steady growth in the market, driven by rising obesity rates, growing awareness of weight management solutions, and strategic partnerships aimed at expanding access to these medications. Governments in the region are prioritizing the enhancement of healthcare infrastructure and improving access to treatments for chronic diseases, including obesity. This includes initiatives designed to strengthen healthcare systems and promote preventative care.

Market Overview

The Wegovy market refers to the commercial landscape surrounding Wegovy (semaglutide), an FDA- and EMA-approved GLP-1 receptor agonist indicated for long-term weight management in obese or overweight individuals. The market encompasses the production, distribution, prescription, and use of Wegovy for obesity treatment, as well as related developments in GLP-1-based anti-obesity drugs and biosimilars. This market is experiencing substantial growth driven by rising obesity rates and increased awareness of associated health risks. Additionally, the effectiveness of the drug in promoting weight loss, its convenience as a once-weekly injection, and the growing recognition of obesity as a chronic condition needing medical intervention are driving the market expansion.

What are the Key Trends in the Wegovy Market?

- Growing Demand for Effective Weight Management Solutions:The rising prevalence of obesity-related diseases, such as diabetes and heart disease, has led to an increased demand for effective weight management strategies. These strategies are also essential for reducing cardiovascular risk in individuals who are overweight or obese.

- Increased Awareness and Acceptance of Obesity Treatment:There is a growing recognition of obesity as a chronic disease that requires medical intervention. This recognition has contributed to a higher demand for effective and acceptable pharmacological solutions, such as Wegovy.

- Effectiveness and Safety:Wegovy has shown significant weight loss in clinical trials, which enhances patient adherence and clinician confidence in its effectiveness. The drug helps achieve and maintain weight loss by reducing calorie consumption, and its once-weekly injection regimen offers greater convenience for patients.

- Positive Clinical Trial Results:Clinical trials have demonstrated Wegovy's efficacy in reducing cardiovascular risk factors and promoting weight loss. Ongoing research into the mechanisms of action and potential benefits of semaglutide, the active ingredient in Wegovy, contributes to market growth.

- Market Expansion into Pediatric Patients:The approval of Wegovy for use in adolescents with obesity (ages 12 years and older) expands its potential market and addresses a growing public health need. The rapid adoption and commercial formulary access for Wegovy, along with efforts to increase supply, have contributed to its market dominance.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 24.53 Billion |

| Market Size in 2025 | USD 3.07 Billion |

| Market Size in 2024 | USD 2.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 25.96% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Route of Administration,Dosage Strength, Patient Demographics, BMI Category, Distribution Channel, Application/Indication, End User, Pricing Tier and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Global Rise in Obesity Prevalence and the Related Health Risks

The global rise in obesity prevalence and the related health risks are the primary drivers of the Wegovy market. According to the World Health Organization (WHO), Worldwide adult obesity has more than doubled since 1990, and adolescent obesity has quadrupled. About 1 in 8 people in the world were living with obesity in 2022. Approximately 35 million children under the age of 5 were overweight in 2024. There is increasing awareness and acceptance of prescription weight management medications. Heightened understanding among the general population and healthcare professionals regarding the necessity and effectiveness of pharmaceutical interventions for weight management, particularly treatments like Wegovy, which offer significant weight loss and cardiovascular benefits, further drives the market's growth.

Restraint

Supply Chain Challenges and High Cost

A key restraint in the Wegovy market has been supply chain constraints and manufacturing capacity limitations. The high demand for Wegovy, a GLP-1-based weight-loss drug, has often outstripped supply, resulting in shortages in various markets. Currently, Wegovy is the only medication approved for long-term weight management that also reduces cardiovascular risk. This high demand has posed considerable challenges for manufacturers. Moreover, the high costs associated with Wegovy may potentially limit access for some patients, which hampers market growth.

Opportunity

Expanding Applications Beyond Weight Management

The key future opportunity for Wegovy lies in expanding its application beyond weight management to include broader health benefits, particularly related to cardiovascular disease and chronic kidney disease, as well as potential cognitive health benefits. Leveraging Wegovy's ability to reduce cardiovascular risks, such as heart attack and stroke, could extend its use beyond weight loss for patients with existing cardiovascular conditions. Additionally, clinical trials have indicated a reduction in the progression of chronic kidney disease in type 2 diabetes patients using semaglutide. The development of combination therapies with other medications targeting obesity or metabolic disorders is another promising area of research.

Drug Type Insights

How Did the Branded Semaglutide Segment Dominate the Wegovy Market in 2024?

The branded semaglutide segment dominated the market with the largest share of 95% in 2024. This is due to its proven efficacy in clinical trials and the increased global concern about obesity and its health complications. As a GLP-1 receptor agonist, it has shown significant and sustained weight loss in clinical studies, making it a preferred choice for managing obesity beyond lifestyle changes. The increasing prevalence of obesity worldwide, coupled with greater awareness of its health risks, boosts demand for effective weight management solutions like Wegovy. Furthermore, the FDA approval of branded semaglutide for long-term weight management in adults and children with obesity bolsters segmental growth.

The biosimilar semaglutide segment is expected to grow at the fastest rate during the projection period due to its potential to provide a more affordable alternative to branded medications, along with the rising demand for weight management solutions and the increasing prevalence of type 2 diabetes. Biosimilar semaglutide's proven effectiveness in managing type 2 diabetes, demonstrated through its Ozempic brand, has also contributed to overall demand. This makes biosimilars an attractive option for patients and healthcare systems looking to lower costs related to weight management and diabetes treatment while also expanding clinical indications.

Route of Administration Insights

What Made Subcutaneous Injection the Dominant Segment in the Wegovy Market in 2024?

The subcutaneous injection segment dominated the market with a major revenue share of 100% in 2024, mainly because of increased demand for once-weekly injectable formulation, which is vital for effective long-term weight management and reducing cardiovascular risks. Wegovy is specifically designed for subcutaneous injection, meaning it is administered under the skin, typically in the abdomen, thigh, or upper arm. This route is chosen for its ability to provide sustained medication release, which is essential for controlling appetite and promoting weight loss. Over time, this primary route of administration continues to reinforce this segment's dominance in weight management.

The oral formulations segment is expected to expand at the fastest CAGR over the projection period, driven by patient preference for non-injectable options. Although Wegovy is currently an injectable, the development and potential approval of oral semaglutide formulations are expected to significantly expand the market. Many patients prefer oral medications over injections due to ease of use, pain avoidance, and better adherence. This preference is a key driver of oral formulation growth. The success of oral semaglutide (Rybelsus) has encouraged other pharmaceutical companies to develop and test their own oral GLP-1 receptor agonists for weight management, further fueling market expansion.

Dosage Strength Insights

How Does the 2.4 Mg/Week Segment Dominate the Wegovy Market in 2024?

The 2.4 mg/week segment led the market while holding a significant share of 45%in 2024. This is primarily because it is the most effective and clinically proven approach to long-term weight management, with the added benefit of reducing cardiovascular risks. Clinical studies show that patients on the 2.4 mg/week dose achieve greater and more sustained weight loss compared to lower doses. The National Institutes of Health (NIH) reports a higher percentage of patients reaching significant weight loss at this dosage compared to lower doses and placebo. The 2.4 mg dose is the highest FDA-approved maintenance dose of Wegovy, specifically indicated for long-term obesity treatment.

The 1.7 mg/week (dose escalation) segment is expected to experience rapid growth in the upcoming years, driven by the established practice of dose escalation and the positive clinical outcomes seen with this dosage. Treatment with Wegovy usually involves gradually increasing the dose, starting from lower strengths (like 0.25 mg) and escalating to higher doses such as 1.7 mg and 2.4 mg, which are considered maintenance levels. This stepwise approach minimizes side effects and helps patients adjust to the medication. Clinical trials indicate that patients reach their optimal weight loss potential when they maintain the highest doses.

Patient Demographics Insights

Why Did the Adults (18-65 Years) Segment Dominate the Market in 2024?

The adults (18-65 years) segment dominated the Wegovy market with the largest share of 70% in 2024 because of the higher rates of obesity and overweight conditions in this age group compared to younger populations. This is often linked to metabolic changes, lifestyle factors, and the cumulative effects of weight gain over time. Obesity in adults is frequently associated with health complications, such as type 2 diabetes, cardiovascular diseases, and other weight-related conditions. Wegovy is commonly prescribed to address these issues, which explains the higher prescription rates among adults.

Meanwhile, the adolescents (12–17 years) segment is expected to grow at the fastest rate over the projection period, driven by a significant increase in obesity rates among youngsters worldwide. This rise has heightened the need for effective treatments for this age group. Additionally, the FDA approved Wegovy for treating obesity in adolescents aged 12 and older, providing an important treatment option beyond traditional diet and exercise. As awareness and acceptance of pharmacological interventions grow, medications like Wegovy are becoming more widely accepted for use in adolescents.

BMI Category Insights

What Made BMI≥30 (Obese) the Dominant Segment in the Wegovy Market in 2024?

The BMI ≥30 (obese) segment maintained a dominant position in the market with share of 65% in 2024. This is primarily driven by the high prevalence of obesity and its associated health risks, coupled with Wegovy's demonstrated efficacy in treating obesity. Obesity is a widespread global health concern, with a significant portion of the population falling into the obese category (BMI ≥30). Increasing recognition that obesity is a chronic disease requiring long-term management makes medications like Wegovy a crucial part of treatment strategies. Additionally, the FDA approved Wegovy for chronic weight management in adults with obesity or overweight with at least one weight-related condition.

The BMI 27-29.9 with comorbidity segment is anticipated to experience the fastest growth during the forecast period. This is due to the efficacy of the drug in this specific population and the growing awareness of the link between overweight and obesity with various health conditions. Individuals with a BMI in the 27-29.9 range are at an increased risk of developing obesity-related comorbidities such as type 2 diabetes, hypertension, and cardiovascular disease. The presence of these comorbidities significantly elevates the risk of serious health issues, driving demand for effective treatments like Wegovy.

Distribution Channel Insights

How Does the Retail Pharmacies Segment Dominate the Wegovy Market in 2024?

The retail pharmacies segment led the market with the largest market share of 48% in 2024. This is due to their accessibility, convenience, and established infrastructure for prescription fulfillment. Consumers often prefer the familiarity and ease of access provided by local pharmacies when seeking prescription medications for weight management. Retail pharmacies are widely available, making it easy for patients to pick up their prescriptions without needing to travel long distances or rely on specialized facilities. Furthermore, they have well-established processes for handling prescriptions, insurance claims, and patient counseling, streamlining the dispensing of Wegovy. They also have established infrastructure managing the cold chain requirements for certain medications.

The online pharmacies segment is expected to experience the fastest growth during the forecast period. This growth is driven by increasing consumer preference for digital healthcare solutions and the convenience of home delivery. Online pharmacies offer a convenient way for individuals, especially those with mobility issues or living in remote areas, to access Wegovy. They also provide competitive pricing or discounts, especially for people without insurance coverage. Some consumers may prefer the privacy and discretion of online pharmacies when purchasing medications for weight management.

Application Insights

Why Did the Obesity Management Segment Lead the Wegovy Market in 2024?

The obesity management segment captured the largest market share of 60% in 2024. This is mainly due to the increased prevalence of obesity and related health issues, along with the proven efficacy of Wegovy in clinical trials and its role as a GLP-1 receptor agonist. Obesity is linked to numerous chronic conditions like diabetes and cardiovascular disease, which increases the need for effective treatments. Growing awareness of the health risks associated with obesity and the availability of medically approved treatments, such as Wegovy, has fueled segmental growth.

The cardiovascular risk reduction segment is expected to grow at the fastest rate in the market. This growth is attributed to the Wegovy's proven ability to lower the risk of major adverse cardiovascular events like heart attacks and strokes, especially in individuals with obesity and existing heart conditions. As Wegovy provides dual benefits, weight loss, and a significant reduction in cardiovascular risk, it is highly desirable for this patient group. Positive results from the SELECT trial and subsequent FDA approval have increased awareness and acceptance of Wegovy as a cardiovascular risk reduction therapy, leading to greater adoption by patients and healthcare providers.

End User Insights

What Made Hospitals the Dominant Segment in the Wegovy Market in 2024?

The hospitals segment led the market with share of 40% in 2024. This dominance is driven by the increased prevalence of obesity and related health complications, as well as heightened awareness and acceptance of obesity treatments among healthcare professionals and patients. Hospitals are central in managing these conditions, making them key points of access for patients seeking effective weight management solutions to initiate, monitor, and manage complex treatments like Wegovy. Additionally, hospitals are well-equipped to handle these cases, providing comprehensive care that integrates Wegovy with other treatments. Hospitals also play a crucial role in educating patients, initiating treatment, and ensuring proper usage.

The weight management clinics segment is expected to experience the fastest growth during the forecast period. This is mainly due to rising obesity rates, increased awareness of health risks, and the proven efficacy of Wegovy as a weight-loss medication. Many individuals prefer the structured environment and personalized attention offered by clinics, which leads to increased demand for this care model. These clinics provide a structured setting for patients to receive Wegovy under medical supervision, including lifestyle guidance and ongoing support, which enhances adherence and promotes positive outcomes.

Pricing Tier Insights

What Made High-Income Market the Leading Segment in the Wegovy Market in 2024?

The high-income market segment dominated the market with the maximum share of 60% in 2024. This is mainly because of the drug's high price, making it unaffordable for many without substantial insurance coverage. Although insurance coverage has improved, it remains inconsistent, and those with higher incomes are more likely to have the disposable income or comprehensive insurance needed to afford it. Healthcare systems tend to prioritize treating adults, who are more likely to have a stronger link between obesity and related health issues, a demographic more common in higher-income populations.

The middle-income segment is experiencing the fastest growth. This is due to rising obesity rates, increasing awareness of health and wellness, and the availability of more affordable options within the premium pricing tier. Wegovy has demonstrated significant weight loss results in clinical trials and has shown positive effects on cardiovascular health and liver function. This provides strong clinical justification for its use and encourages more people to consider it as a treatment option, prompting greater demand for effective weight management solutions.

Wegovy Market Companies

- Novo Nordisk (Denmark) – Wegovy, Ozempic

- Eli Lilly and Co. (USA) – Zepbound, Mounjaro (tirzepatide)

- Pfizer Inc. – Pipeline oral GLP-1s

- Amgen Inc. – GLP-1/GIP dual agonists in trial

- Sanofi S.A.

- AstraZeneca plc

- Roche Holding AG

- Boehringer Ingelheim

- Hanmi Pharmaceutical

- Structure Therapeutics

- Oramed Pharmaceuticals

- Cytodyn Inc.

- Altimmune Inc.

- Innovent Biologics

- Zealand Pharma

- Gubra ApS

- BioAge Labs

- Sciwind Biosciences

- Terns Pharmaceuticals

- China Meheco

Recent Developments

- In March 2024, Wegovy received FDA approval for reducing cardiovascular risks in adults with obesity or overweight and cardiovascular disease. This marked a significant advance in obesity treatment, addressing major health concerns in the U.S., where 70% of adults are affected by these issues.

(Source:https://www.fda.gov)

- In February 2024, Novo Holdings agreed to acquire Catalent, Inc. for $16.5 billion to improve the supply of popular weight loss drug Wegovy. As part of the deal, Novo plans to purchase three manufacturing sites, located in Italy, Belgium, and Indiana, that employ 3,000 people to help increase Wegovy's supply. These facilities are expected to meet the high demand for the drug.

(Source: https://www.pharmexec.com)

Segments Covered in the Report

By Drug Type

- Branded Semaglutide

- Wegovy (Novo Nordisk)

- Generic/Biosimilar Semaglutide

- Pipeline biosimilars (2027 onward)

By Route of Administration

- Subcutaneous Injection

- Oral Formulations

By Dosage Strength

- 0.25 mg/week

- 0.5 mg/week

- 1 mg/week

- 1.7 mg/week

- 2.4 mg/week

By Patient Demographics

- Adults (18–65 years)

- Elderly (>65 years)

- Adolescents (12–17 years)

By BMI Category

- BMI 27–29.9 (Overweight, with comorbidity)

- BMI ≥30 (Obese)

By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

- Specialty Clinics

By Application/Indication

- Obesity Management

- Type 2 Diabetes with Obesity

- Cardiovascular Risk Reduction

- Metabolic Syndrome

By End User

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Weight Management Clinics

- Home Care Settings

By Pricing Tier

- High-Income Market (Cash Pay or Reimbursed)

- Middle-Income Market (Insurance Dependent)

- Low-Income Market (Access-Limited, Emerging demand)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting