What is the Weight Loss Services Market Size?

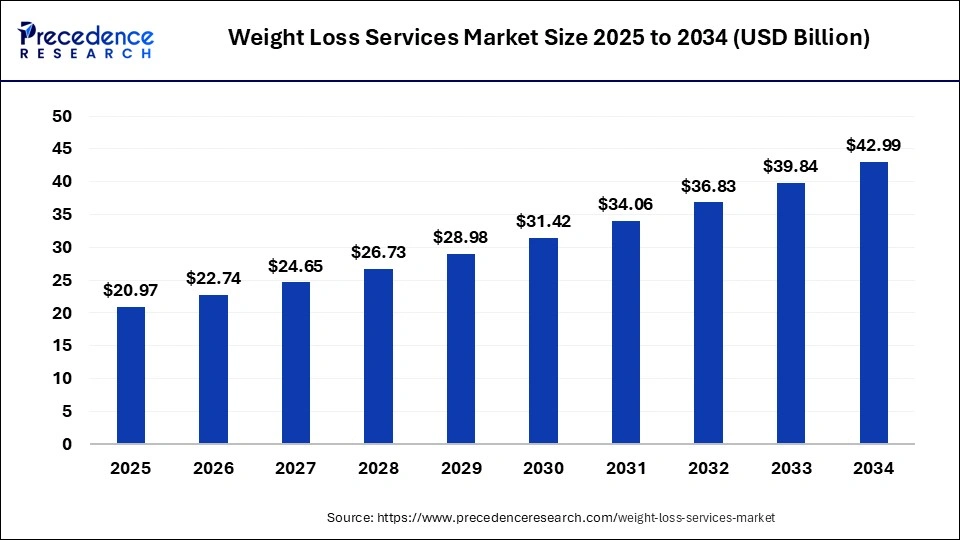

The global weight loss services market size accounted for USD 20.97 billion in 2025 and is predicted to increase from USD 22.74 billion in 2026 to approximately USD 42.99 billion by 2034, expanding at a CAGR of 8.32% from 2025 to 2034. The increasing awareness for the nutritional based diet, exercises, and maintaining body shape and weight that boosting the growth of the market.

Weight Loss Services Market Key Takeaways

- North America led the weight loss services market with the largest market share in 2025.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

- By payment, the private insurance segment dominated the market during the forecast period.

- By equipment, the fitness equipment segment dominated the market in 2025.

- By equipment, the surgical equipment segment is expected to show significant growth in the market during the forecast period.

- By services, the consulting services segment is expected to have the fastest growth in the market during the predicted period.

Market Overview

The weight loss services market is the industry that offers services and solutions to help in the management and reduction of weight in people who are overweight or obese. It helps reduce the overall body weight and manage it in the ideal state. Weight loss services help to decrease weight through various processes like changing the consumer's diet plan, increasing physical activities, medication, surgeries, and others. The overall aim of weight loss services is to manage overweight and obesity and reduce the risk of chronic diseases.

The rising number of obese people globally, those more likely to be prone to chronic illnesses like diabetes, high blood pressure, and cardiovascular disorders, are driving the demand for weight loss services for maintaining their weight. The rising awareness of the body and health is also boosting the growth of the market.

Weight Loss Services Market Growth Factors

- The rising cases of obesity worldwide due to changing lifestyle habits, eating junk, and lack of physical activities cause overweight problems in people that drive the demand for the weight loss services market.

- Overweight obesity is one of the major reasons for severe health conditions like cardiovascular diseases, diabetes, cancer, and others, and the increasing awareness about these health conditions positively influences the growth of the market.

- The increasing awareness about physical fitness to meet societal body standards and the rising awareness about healthcare are driving the growth of weight loss services.

- The increasing availability of several weight loss service providers with effective diet plans that come with monthly or annual subscription plans and the rising competition in weight loss services drive the growth of the market.

- With the increasing prevalence of chronic diseases like diabetes, heart disease, and others, weight loss therapies and services efficiently help in the treatment of those diseases. Lowering weight can help manage disorders, which accelerated the growth of the weight loss services market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.32% |

| Market Size in 2025 | USD 20.97 Billion |

| Market Size in 2026 | USD 22.74 Billion |

| Market Size by 2034 | USD 42.99 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Payments, Equipment, Services, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Increasing cases of obesity

The rising obesity cases in the world are due to changes in lifestyle, and increasing consumption of junk food, alcohol, and smoking is causing an increased number of obese patients. Obese people are more likely to be prone to severe chronic diseases such as cardiovascular diseases, diabetes, high blood pressure, and others. They need to go through various treatment procedures, which also drive awareness regarding obesity and overweight problems in people and impact the growth of weight loss services.

The weight loss services help the consumers with the proper and maintained diet plans, exercises, and physical activities that help maintain the consumer's health and reduce obesity or overweight problems. Weight loss services are minimally invasive procedures or plans that the patient does not need to go through painful surgical procedures. Thus, the rising incidence of obesity worldwide is driving the growth of the weight loss services market.

- For instance, as per the survey, it is stated that half of the world's population will be affected by obesity by 2035.

- As per the World Obesity Federation's 2023, it is expected that 51% of the global population, that is more than 4 billion people, will be diagnosed with obesity by the next 12 years.

- Childhood obesity will be doubled by 175 million and 208 million in girls and boys, respectively, by 2035.

- The cost of health conditions associated with obesity will be more than $4 trillion annually by 2035 or 3% of the total global GDP.

Restraint

Expensive diet plans

The high-cost diet given by nutritionists for maintaining weight and reducing obesity. Low-calorie foods are more expensive than normal food, and the high cost of services or the subscription of services is unaffordable for a large segment of people in society, which limits the expansion of the weight loss services market. Such high-cost services are prone to create a limitation in adoption for underdeveloped areas.

Opportunity

Integration of technologies in weight management

The integration of technologies in healthcare and weight management is revolutionizing the wellness industry. Combining technologies such as AI-powered coaching and intervention designs can provide personalized nutritional plans and recommendations to people who are suffering from overweight or obesity problems. Artificial intelligence and machine learning tools help in assessing, recommending, and intervening in design that enhances the usability and value of the product. There are various nutritional and health assessment programs that use AI and ML for hyper-personalization.

- For instance, CGM, smart scale, metabolites, and air analysis are used for the assessment devices. Digital diaries and logs for the self-reporting, and others. Thus, the technological advancements in weight management drive the opportunity for the growth of the weight loss services market.

Payment Insights

The private insurance segment will dominate the weight loss services market during the forecast period. The increasing number of obesity cases globally and the rising acceptance of invasive surgical processes for fat reduction drive the growth of the private insurance segment. Private insurance may cover fat reduction surgeries like gastric sleeves, gastric bypass, and lap band surgeries. Private insurance is allowed to cover the treatment of obesity.

Equipment Insights

The fitness equipment segment dominated the market in 2025. The segment's growth is attributed to the rising awareness regarding physical health, which boosts demand for it. Technological developments in weight loss equipment and wearable technologies further contribute to the segment's expansion. Fitness equipment includes strength training equipment, cardiovascular equipment, infrared light therapy, and others.

The surgical equipment segment is expected to grow significantly during the forecast period. The surgical equipment is further divided into bariatric surgical equipment and non-invasive surgical equipment, which the non-invasive surgical equipment is gaining significant popularity in the market. The growth of the non-invasive surgical process due to the instant recovery after the surgery and fewer side effects are driving the segment's expansion. The advances in the production process and technologies added to the non-invasive surgical procedure are further propelling the segment's growth.

Services Insights

The consulting segment is expected to have the fastest growth rate in the market during the predicted period. The increasing awareness about obesity and health and the cost-effective services offered with the different packages are driving the growth of fitness centers and consulting services in weight loss management. Major market players are interventions that are accelerating the growth of consulting services. The increasing competition in health consulting services is driving the opportunities for low-cost and budget-friendly consulting services that also boost the adoption of the consulting services segment.

Regional Insights

North America led the weight loss services with the largest market size in 2025. The growth of the market in the region is increasing due to the rising number of obese people due to the shifting lifestyle habits, rising consumption of fast foods, and lesser physical activities that cause overweight problems in the people. The rising awareness regarding health and growing obesity in the population drives the demand for weight loss services.

The rising integration of technologies in nutritional services is also boosting the adoption of the market. Additionally, the rising market competition in the wellness industry is accelerating the growth of the weight loss services market in the region. In North America, the U.S. is majorly responsible for the market's growth due to the large number of obese people, awareness about the risks associated with obesity, government support, and technological advancements.

- For instance, according to the CDC, in 2022, there was a 35% or above prevalence of obesity in 22 states of the U.S., which was 19 states in 2019. In the case of adults, 42% of adults were obese in 2023.

Asia Pacific is expected to witness the fastest growth in the market during the forecast period. The growth of the region is due to the rising change in lifestyle due to the rising per capita income in the people and rising adoption of junk food, alcohol, smoking, etc., which impact the health of humans and the higher cause of obesity in people that are also contributing in creating a big marketplace for the weight loss services in the region.

The surging expenditure on healthcare and body maintenance by the population is also driving the growth of the weight loss services market in the region. India is among the top country that is dealing with obesity issues in the Asia Pacific region. It is essential for the Indian government to take steps to reduce the obesity rates. Various key players are also launching their products in the Indian market, which can boost the growth of the market in the Asia Pacific region.

- For instance, In February 2024, when Mounjaro, the immensely popular obesity treatment and blockbuster diabetes medication, passes an ongoing regulatory evaluation, American pharmaceutical company Eli Lilly plans to introduce it in India as early as next year.

Weight Loss Services Market Companies

- Atkins Nutritionals, Inc

- Nutrisystem, Inc.

- Herbal Life International, Inc.

- Apollo Endosurgery, Inc.

- Johnson Health Tech

- WW International, Inc.

- Kellogg Co.

- Amer Sports

- Cynosure, Inc.

- Diet Health, Inc.

Recent Developments

- In September 2023, the Wegovy weight loss jab is launched in the UK. Weight management drug also known as semaglutide in the United Kingdom. The Wegovy is got the approval for NHS by the National Institute for Care and Excellence (Nice).

- In May 2024, Wegovy, the weight loss drug, will be launched in Canada. The Novo Nordisk's weight loss weekly injection got approval for patients who are diagnosed with obesity.

- In January 2024, the American pharmaceutical business Eli Lilly will start providing a range of healthcare services, such as free prescription shipment and access to independent telehealth providers. The corporation announced the introduction of LillyDirect, which is described as an "end-to-end digital healthcare experience." The program is intended for people who suffer from diabetes, migraines, and obesity.

Segments Covered in the Report

By Payments

- Government

- Private Insurance

- Out of Pocket

By Equipment

- Fitness Equipment

- Cardiovascular Equipment

- Strength Training Equipment

- Infrared Light Therapy Equipment

- Others

- Surgical Equipment

- Bariatric Surgery Equipment

- Non-invasive Surgical Equipment

By Services

- Fitness Centers

- Slimming Centers

- Consulting

- Surgery

- Other

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting