Hearing Loss Disease Treatment Market Size and Forecast 2025 to 2034

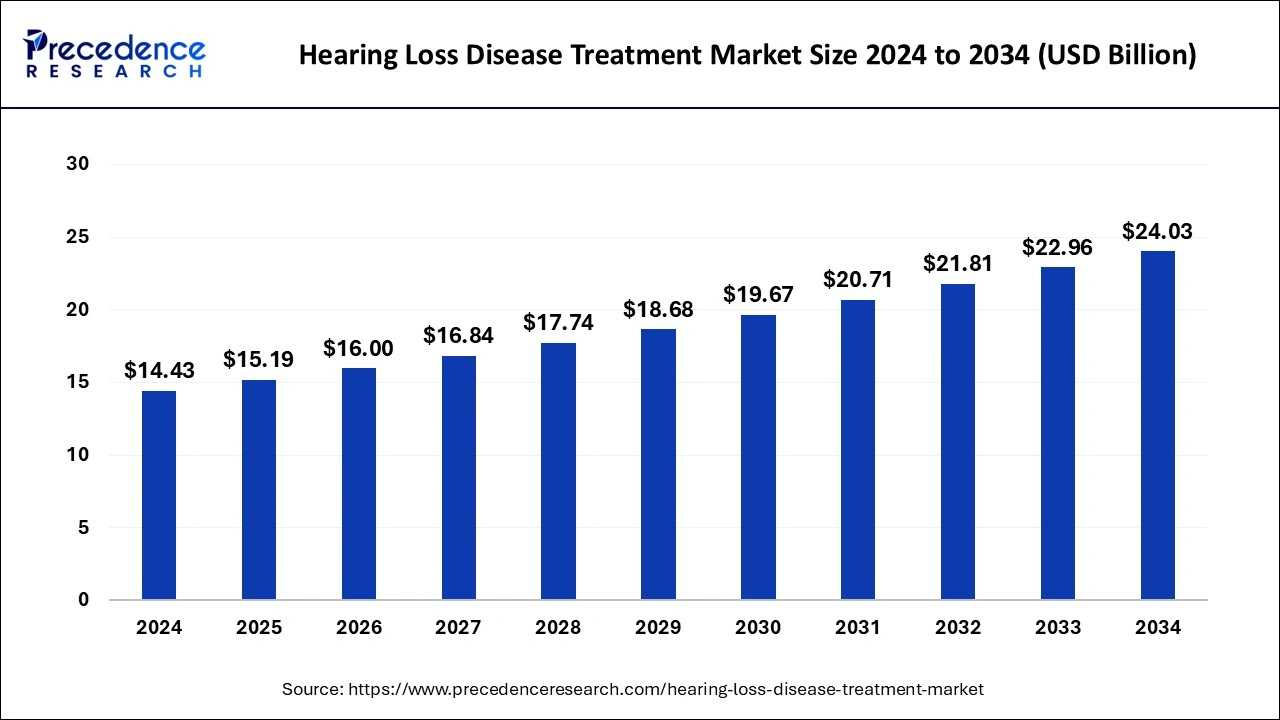

The global hearing loss disease treatment market size was estimated at USD 14.43 billion in 2024 and is predicted to hit around USD 24.03 billion by 2034 with a CAGR of 5.23% from 2025 to 2034. The aging population is prone to hearing, due to which the hearing loss disease treatment market is growing.

Hearing Loss Disease Treatment Market Key Takeaways

- In terms of revenue, the global hearing loss disease treatment market was valued at USD 14.43 billion in 2024.

- It is projected to reach USD 24.03 billion by 2034.

- The market is expected to grow at a CAGR of 5.23% from 2025 to 2034

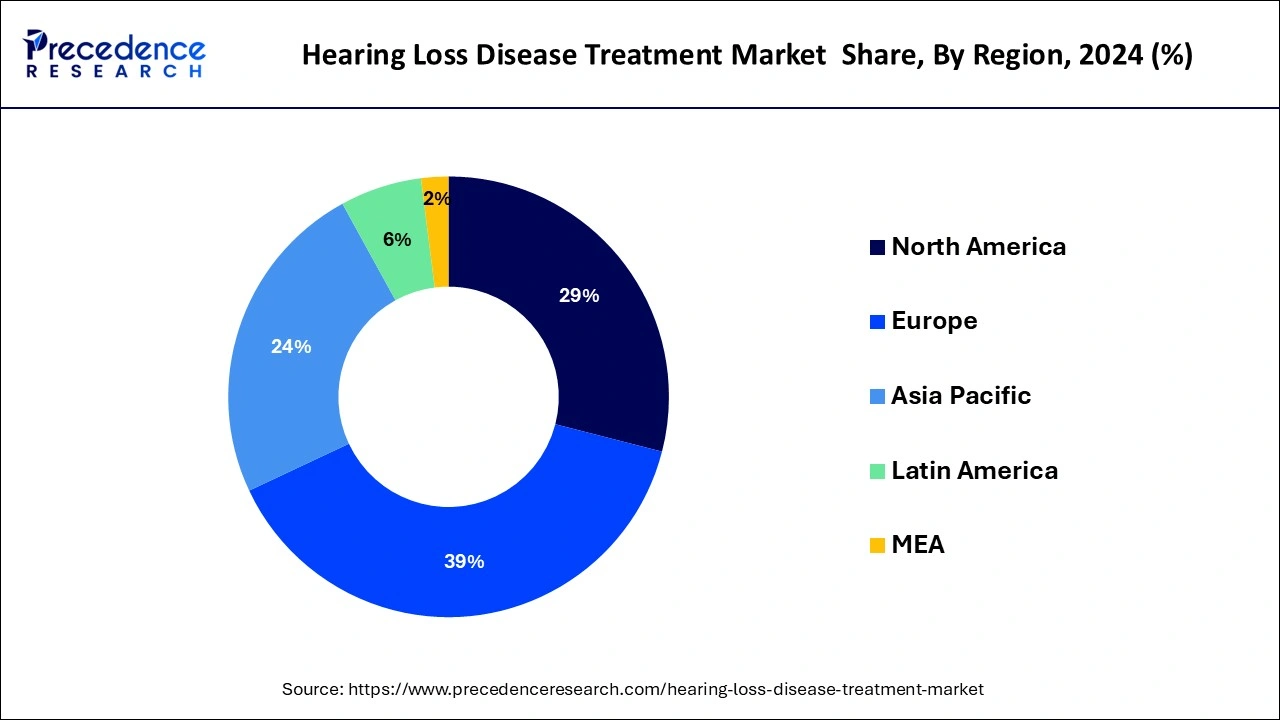

- Europe contributed for the largest market share of 39% in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR during the forecast period.

- By product, the devices segment held the largest market share of 91% in 2024.

- By product, the drugs segment is anticipated to grow at a remarkable CAGR during the forecast period of 2025-2034.

- By disease type, the sensorineural hearing loss segment has generated the largest market share of 59% in 2024.

- By disease type, the conductive hearing loss segment is expected to expand at the fastest CAGR over the projected period.

- By end-user, the otology clinics segment dominated the market with the largest market share of 47% in 2024.

- By end-user, the hospitals segment is expected to expand at the fastest CAGR over the projected period.

How is AI impacting the market?

By improving early diagnosis, creating individualized rehabilitation programs, and integrating electronic health records for more efficient patient care, machine learning (ML), a branch of artificial intelligence, has the potential to completely transform audiology. Automated, precise hearing exams are made possible by "computational audiology," which is the use of machine learning in audiometry. Large data sets may be processed by AI algorithms, which can also provide comprehensive audiograms and help with the early diagnosis of hearing abnormalities.

Studies demonstrate the efficacy of machine learning (ML) in automated audiometry, audiogram classification, and genetic and noise exposure-based hearing loss prediction. These developments imply that AI has the potential to improve the efficiency and accessibility of audiological diagnosis and therapy. The smooth integration of AI technology is key to the future of audiology. To overcome obstacles, cooperation between AI specialists, audiologists, and people with hearing loss is crucial.

Europe Hearing Loss Disease Treatment Market Size and Growth 2025 to 2034

The Europe hearing loss disease treatment market size was valued at USD 5.63 billion in 2024 and is anticipated to reach around USD 9.38 billion by 2034, poised to grow at a CAGR of 5.24% from 2025 to 2034.

Europe led the market with the biggest market share of 39% in 2024. due to factors such as a well-established healthcare infrastructure, high awareness about hearing health, and a growing aging population. The region's robust support for research and development in audiology, coupled with favorable reimbursement policies, contributes to the prevalence of advanced hearing care solutions. Moreover, a proactive approach by European countries in implementing hearing health initiatives and incorporating innovative technologies positions the region as a key player in addressing the needs of individuals with hearing impairment.

Asia-Pacific is poised for rapid growth in the hearing loss disease treatment market due to a combination of factors. The region's large and aging population, coupled with an increasing awareness of hearing health, creates a substantial market demand. Additionally, improving healthcare infrastructure, rising disposable incomes, and a growing emphasis on technological advancements contribute to the expanding market opportunities. As governments in the Asia-Pacific region prioritize healthcare, there is a significant potential for increased accessibility to hearing healthcare services, making it a key growth area for the hearing loss disease treatment market.

Meanwhile, North America is experiencing notable growth in the hearing loss disease treatment market due to several factors. The region has a large aging population, contributing to a higher prevalence of age-related hearing issues. Additionally, technological advancements, increased awareness, and favorable reimbursement policies drive the adoption of advanced hearing aids and related services. Robust research and development activities, along with a proactive healthcare approach, position North America as a key market for hearing loss solutions, fostering significant growth and innovation in the industry.

Market Overview

Hearing loss is a condition where a person experiences a reduced ability to hear sounds. This can happen gradually over time or suddenly and may affect one or both ears. Various factors contribute to hearing loss, including aging, exposure to loud noises, genetic factors, infections, and certain medications. Common symptoms of hearing loss include difficulty understanding conversations, asking people to repeat themselves, and turning up the volume on electronic devices.

Treatment options depend on the cause and severity of the hearing loss, ranging from hearing aids and cochlear implants to medical interventions. Regular hearing check-ups and protective measures, such as wearing earplugs in loud environments, can help prevent or manage hearing loss. The rising emphasis on early detection of diseases and presence of advanced technologies for the same promote the expansion of the hearing loss disease treatment market.

Hearing Loss Disease Treatment Market Growth Factors

- The global increase in the aging population is a significant driver for the hearing loss disease treatment market. As people age, the prevalence of hearing loss tends to rise. According to the World Health Organization (WHO), over one-third of people above the age of 65 experience some degree of hearing loss.

- Growth in exposure to loud environments and increased use of personal audio devices contribute to noise-induced hearing loss. The rise in occupational and recreational noise exposure, particularly among younger individuals, fuels the demand for hearing loss prevention and management solutions.

- Ongoing advancements in hearing aid technology, including digital signal processing, Bluetooth connectivity, and miniaturization, stimulate market growth. These innovations enhance the performance, comfort, and accessibility of hearing aids, encouraging adoption among individuals with hearing impairment.

- Rising awareness about the importance of early detection and treatment of hearing loss promotes market growth. Education campaigns, both by healthcare organizations and hearing aid manufacturers, contribute to changing attitudes toward seeking help for hearing issues.

- Conditions such as diabetes and cardiovascular diseases are associated with an increased risk of hearing loss. As the global prevalence of chronic diseases continues to rise, the demand for interventions addressing associated hearing impairment also increases.

- Supportive government policies, healthcare initiatives, and reimbursement programs for hearing aids contribute to market growth. These measures reduce financial barriers to accessing hearing healthcare services, making interventions more accessible to a broader population.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.23% |

| Market Size in 2025 | USD 15.19 Billion |

| Market Size by 2034 | USD 24.03 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Disease Type, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Noise-Induced Hearing Loss (NIHL)

- The WHO estimates that 1.1 billion young people (12–35 years) are at risk of hearing loss due to exposure to unsafe noise levels from personal audio devices, concerts, and other recreational activities.

The surge in Noise-Induced Hearing Loss (NIHL) significantly boosts the demand for products and services in the hearing loss disease treatment market. With the widespread use of personal audio devices, exposure to loud environments, and occupational noise, more people, especially the younger population, are at risk of developing hearing issues. This increased prevalence of NIHL has created a higher demand for hearing aids, protective devices, and hearing health services. As NIHL continues to affect individuals across various age groups, the market responds by providing innovative solutions to prevent, diagnose, and manage hearing loss. The demand for advanced hearing protection measures and the development of cutting-edge hearing aid technologies are driven by the growing awareness of the impact of noise on hearing health. This surge in demand not only addresses the immediate needs of those already affected by NIHL but also underscores the importance of proactive measures to prevent hearing loss in a noisy world.

Restraint

Inadequate insurance coverage

Inadequate insurance coverage acts as a significant restraint on the market demand for hearing loss disease solutions. Many individuals with hearing impairment face barriers in accessing necessary interventions due to limited or absent insurance support. The high cost associated with hearing aids and related services becomes a substantial financial burden for those without adequate coverage. This financial constraint prevents a considerable portion of the population from obtaining the essential tools and treatments needed to address their hearing issues.

Moreover, when insurance coverage for hearing aids is lacking, individuals may postpone seeking professional help or opt for suboptimal solutions, potentially exacerbating their hearing problems over time. The limited financial assistance provided by insurance programs hampers the overall market growth by restricting the potential customer base. Addressing these insurance coverage gaps is crucial to ensuring that more people can afford and access the necessary hearing healthcare, thereby fostering greater demand for products and services in the hearing loss disease treatment market.

Opportunity

Global awareness campaigns

Global awareness campaigns play a pivotal role in creating significant opportunities within the hearing loss disease treatment market. As awareness about the impact of hearing loss grows worldwide, there is an increased demand for hearing health solutions and interventions. These campaigns contribute to changing societal attitudes, encouraging more individuals to seek early diagnosis and treatment for hearing issues. As a result, the expanding awareness acts as a catalyst for market growth by fostering a larger customer base for hearing aids, assistive devices, and related services.

Moreover, companies engaged in the hearing loss disease treatment market can actively participate in and support global awareness initiatives. By aligning with these campaigns, businesses not only contribute to the betterment of public health but also position themselves as advocates for hearing health. This dual benefit enhances their brand image, establishes trust, and creates opportunities for increased market penetration. As awareness continues to rise, the market is poised for expansion, with companies at the forefront of these campaigns well-positioned to capitalize on the growing demand for hearing healthcare solutions.

Product Insights

The devices segment held the highest market share in 2024. In the hearing loss disease treatment market, the devices segment encompasses a range of products designed to address hearing impairment. This includes hearing aids, cochlear implants, and assistive listening devices. Recent trends indicate a shift towards technologically advanced hearing aids, with features like Bluetooth connectivity and artificial intelligence for personalized experiences. Cochlear implants continue to evolve, offering improved speech perception. The devices segment reflects a growing emphasis on innovation to enhance user experience, fostering greater accessibility and acceptance of hearing solutions.

The drugs segment is anticipated to witness rapid growth at a significant CAGR of 6.3% during the projected period. In the hearing loss disease treatment market, the "drugs" segment refers to pharmaceutical interventions aimed at treating or managing hearing loss. While traditional treatments primarily focus on devices like hearing aids, recent trends indicate a growing interest in drug-based therapies. Ongoing research explores medications that may have a positive impact on hearing health, such as those targeting neuroprotection or regeneration of auditory cells. These emerging drug therapies signify a promising direction for the industry, providing potential alternatives or complementary options for individuals dealing with various forms of hearing impairment.

Disease Type Insights

The sensorineural hearing loss segment held the largest share in the hearing loss disease treatment market in 2024. Sensorineural hearing loss is a type of hearing impairment caused by damage to the inner ear or the auditory nerve. This often results from aging, exposure to loud noises, or certain medical conditions. In the hearing loss disease treatment market, the sensorineural hearing loss segment focuses on developing solutions like advanced hearing aids and cochlear implants. The trend involves continuous advancements in technology to enhance the effectiveness of these devices, providing improved sound quality and better integration with modern communication and entertainment systems.

The conductive hearing loss segment is anticipated to witness rapid growth over the projected period. Conductive hearing loss refers to a type of hearing impairment caused by issues in the ear canal, eardrum, or middle ear that disrupt sound transmission. Common causes include ear infections, earwax blockage, or abnormalities in the ear's structure. In the hearing loss disease treatment market, the conductive hearing loss segment focuses on developing interventions such as surgical procedures, medications, or hearing aids to address these specific issues. Trends indicate a growing emphasis on minimally invasive surgical techniques and advanced hearing aid technologies, offering more effective and patient-friendly solutions for those with conductive hearing loss.

End-user Insights

The otology clinics segment held the largest share of the hearing loss disease treatment market in 2024. Otology clinics are specialized healthcare facilities focusing on the diagnosis and treatment of ear-related disorders, including hearing loss. In the hearing loss disease treatment market, the otology clinics segment caters to individuals seeking comprehensive ear care services. Trends indicate a rising preference for these clinics due to their expertise in addressing hearing issues. Patients benefit from specialized care, including diagnostic assessments, hearing aid fittings, and surgical interventions. The otology clinics segment reflects a growing recognition of the importance of targeted and specialized healthcare for effective management of hearing loss.

The hospitals segment is anticipated to witness rapid growth over the projected period. In the hearing loss disease treatment market, the hospitals segment refers to healthcare institutions that provide diagnostic, treatment, and rehabilitation services for individuals with hearing impairment. Trends in this segment include an increasing focus on comprehensive hearing care services within hospital settings. Hospitals are adopting advanced technologies for audiological assessments, offering a one-stop solution for hearing health. Additionally, collaborative efforts between hospitals and hearing aid manufacturers are enhancing accessibility and promoting early intervention, aligning with the broader goal of improving overall patient outcomes.

Hearing Loss Disease Treatment Market Companies

- Cochlear Limited

- Sonova Holding AG

- GN Store Nord A/S

- Starkey Hearing Technologies

- William Demant Holding A/S (now Demant A/S)

- Widex A/S (part of WS Audiology)

- MED-EL

- Sivantos Group (now part of WS Audiology)

- Oticon Inc.

- ReSound (part of GN Store Nord A/S)

- Phonak (part of Sonova Holding AG)

- Siemens Healthineers (now part of Siemens AG)

- Amplifon S.p.A.

- Natus Medical Incorporated

- Otometrics (part of Natus Medical Incorporated)

Recent Developments

- In November 2024, a novel surgical technique to deliver therapies directly to the nerve that connects the inner ear to the brain was disclosed by Rinri Therapeutics, a business dedicated to creating new treatments for hearing loss via regenerative cell therapy.

- In March 2024, the first study of a treatment intended to repair hearing loss was successfully finished by researchers at UCL and UCLH.

- In January 2024, in a few European nations, the French biotechnology firm Sensorion declared that it had received approval to begin a Phase I/II clinical study of their gene therapy SENS-501 for gene-mediated hearing impairment.

Segments Covered in the Report

By Product

- Devices

- Drugs

By Disease Type

- Conductive Hearing Loss

- Sensorineural Hearing Loss

- Mixed (Conductive and Sensorineural)

By End-user

- Hospitals

- Otology clinics

- Ambulatory clinics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting