What is the Hearing Aids Market Size?

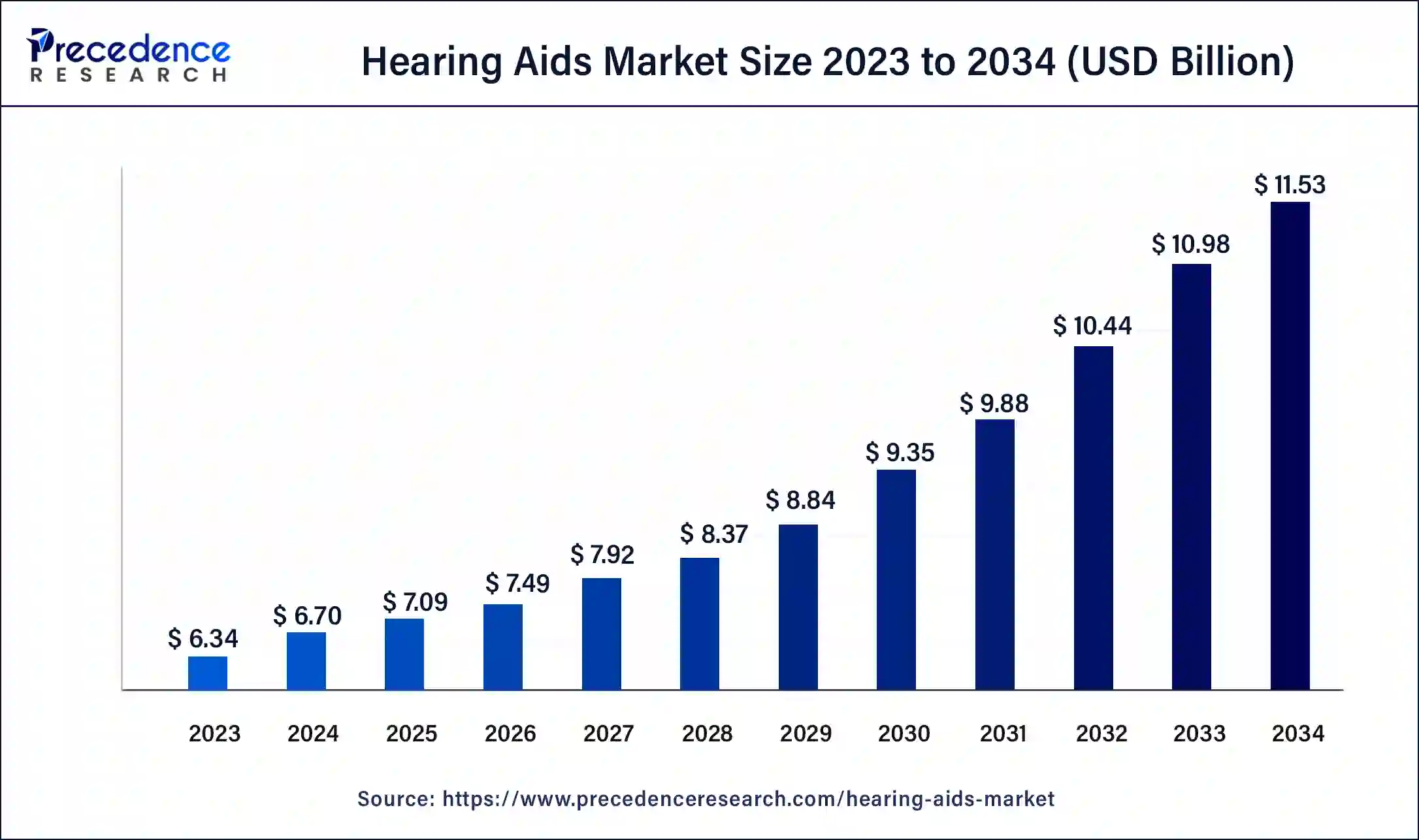

The global hearing aid market size accounted for 7.09 billion in 2025, and is anticipated to hit around USD 7.49 billion by 2026, and is predicted to reach around USD 12.07 billion by 2035, growing at a CAGR of 5.46% from 2026 to 2035.

Hearing Aids Market Key Takeaway

- In terms of revenue, the market is valued at $7.09 billion in 2025.

- It is projected to reach $12.07billion by 2035.

- The market is expected to grow at a CAGR of 5.58% from 2026 to 2035.

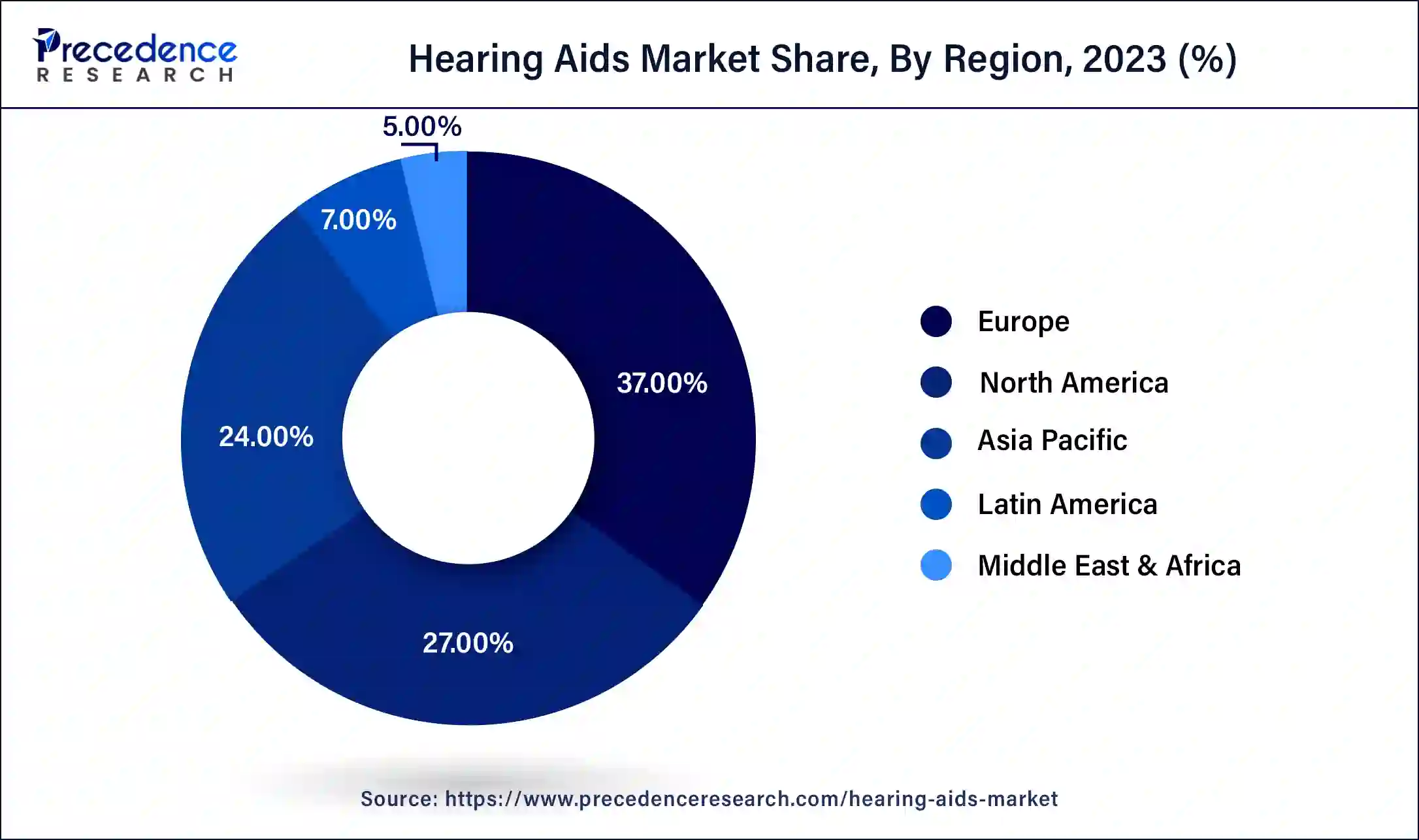

- Europe market has dominated in 2023 with a revenue share of around 37%.

- By product type, the behind-the-ear (BTE) hearing aids segment has held the largest revenue share of 41.6% in 2025.

- By technology, digital devices have generated a revenue share of 91% in 2025.

- By sales channel, the retail sales segment has captured a revenue share of over 71% in 2025.

Market Overview

Deafness can have a significant impact on life, from employment to mental health. Hearing aids can make a huge difference to the world, if you choose the right hearing aids and get help in adapting them. Conduction hearing loss is a type of hearing loss caused by abnormalities with the ear canal or middle ear. In the vast majority of situations, medical intervention can help. If you have an open ear canal and a relatively normal external ear, a hearing aid may help. Due to market being extremely technologically driven with unique devices such as smart hearing devices, undetectable hearing devices, and AI- Wirelessly hearing device that can be linked to Ios or android gaining traction.

Hearing aid manufacturers are adding new features and technologies to improve patients' experiences, which is projected to drive market growth in the forthcoming years. Furthermore, roughly 15% of individuals aged 18 and up in the United States have hearing loss. In October 2021, for example, the FDA proposed a plan to establish a new type of low-cost over the counter hearing aids. This introduces a unique revenue stream for companies wanting to break into the over the counter hearing aid industry. Government and regulatory support of this magnitude is expected to have a long-term beneficial impact for the hearing aids industry in the United States.

Recent Advancements in Invisible Hearing Aids Solutions

Digital Signal Processing (DSP)

Digital Signal Processing (DSP) in hearing aids?allows for real-time analysis and manipulation of audio signals to improve clarity, reduce noise, and enhance the overall listening experience.?DSP algorithms within the hearing aid process incoming sound, enhancing specific frequencies and tailoring amplification based on the individual's hearing profile.?DSP allows for more precise manipulation of the sound signal, making speech easier to understand, especially in noisy environments.?DSP algorithms help minimize background noise and eliminate whistling sounds, improving comfort, and listening experience.?DSP-based hearing aids can be made smaller and more efficient, reducing battery consumption.?

Invisible Hearing Aids

Invisible hearing or Invisible-in-the-Canal (IIC) or Completely-in-the-Canal (CIC) models, are?small, discreet devices designed to fit deep within the ear canal which make them virtually invisible to the naked eye.?They are custom-fitted to the individual's ear canal and utilize advanced digital technology to amplify sound, all while remaining hidden within the ear.?Their small size and location within the ear make them difficult to see, offering a high degree of discretion.?Despite their small size, they incorporate advanced digital technology for clear and natural sound amplification.?They use the natural resonance of the ear canal to help enhance sound localization and clarity.?They are generally well-suited for individuals with mild to moderate hearing loss.?

AI in the Market

The hearing aid market is being revolutionized by artificial intelligence, which offers adaptive, intelligent, and personalized listening experiences. Sounds from the environment are being analyzed by AI algorithms that then, automatically, change the settings of the device for the user to enjoy maximum clarity and comfort. AI noise reduction is one of the features that greatly enhances the comprehension of speech by separating it from the surrounding noises. The technology not only allows for predictive adjustments but also learns the preferences of the user over time, making the auditory experience very personal. Besides, AI is the backbone of remote diagnostics and real-time device optimization, which in turn helps to reduce the frequency of physical consultations. By way of continuous data collection and analysis, manufacturers, among other things, are able to improve device design, power efficiency, and user satisfaction, thus making AI a major player in the hearing solutions of the future.

Hearing Aids MarketGrowth Factors

The rise in the senior population, the use of smart hearing devices, and the increased number of sound induced hearing impairment are all driving market expansion. Hearing loss is becoming more common around the world, making it critical to monitor and assess hearing abilities. As a result of the COVID-19 pandemic, more people are opting for monitoring system. This situation has brought a new era in hearing healthcare that needs a fundamental reassessment of audiology service delivery. For audiology patients, low- and no-touch procedures now are required. At a compound annual growth rate of around 7.74%, the market is expected to accelerate its growth velocity.

In Europe, the primary markets for hearing aids are Germany, the United Kingdom, and France. Hearing aid market expansion in Europe would be aided by the ageing population and the increase of hearing problems throughout the forecast period. In terms of product, the hearing aids category accounted for the greatest market share in 2022, and it will continue to do so throughout the projected period. Depending on the kind of deafness, the hearing industry is fragmented into sensorineural or congenital loss of hearing. The sensorineural hearing loss sector held the greatest proportion in 2022. The expansion of the Europe market can be ascribed to rising life expectancy, a growing geriatric population, and an increased prevalence of deafness as a result.

- The worldwide demand for hearing aids is greatly influenced by the rapidly aging population and the corresponding rise in hearing loss cases.

- Global market growth is further fueled by the growing acceptance of smart and internet-connected hearing devices that offer high-end sound processing and personalization.

- The manufacturers' technology breakthroughs in making smaller devices, connecting wirelessly, and using rechargeable batteries are not only revolutionizing product performance but also enhancing the entire user experience.

- People are becoming more aware of hearing-related issues, and there is better access to low-cost hearing solutions, thus the market is gradually being filled up more and more.

- A strong healthcare system, state policies that favor the hearing aid industry, and never-ending product innovations by manufacturers are the factors behind the continuous growth of the market.

Recent Trends

Aging Population and Rising Hearing Loss

The number of older adults worldwide is expanding quickly and the incidence of hearing loss is rising due to prolonged exposure to noise or workplace dangers. One of the main factors driving the market for hearing aids is this demographic trend. Demand is being further increased by early diagnosis and increased awareness of hearing health. To ensure seniors comfort and usability manufacturers are concentrating on solutions designed to address age-related hearing decline.

Over the Counter (OTC) & Direct-to-Consumer Sales

Regulatory changes in several regions now allow OTC hearing aids for mild-to-moderate hearing loss. This reduces dependency on audiologists and improves accessibility for a wider population. Direct-to-consumer channels, including e-commerce, are growing rapidly. Lower barriers and more convenient access encourage early adoption and routine use of hearing aids

- The growing popularity of over-the-counter (OTC) hearing aids means that there is less need to purchase these from an audiologist, and more new users will enter the market due to this new type of product.

- The rising usage of artificial intelligence (AI) in the hearing industry enables hearing aids to adjust to their users' sound environments in real time and allows users to create personalized hearing profiles.

- Tele-audiology is expanding in scope to accommodate remote diagnostic services, remote tuning of hearing aids, and remote after-market services for customers in rural areas.

- An increased emphasis on designing hearing aids that are discreet, minutely sized, and aesthetically pleasing has helped reduce the stigma attached to the use of hearing aids.

- Hearing aids are becoming a multifunctional smart lifestyle device through the merging of the smartphone and wearable ecosystems into one cohesive whole.

- Demand for affordable digital hearing solutions in emerging markets is being driven by the characteristics of the local healthcare system.

- Sustainability initiatives with the use of recyclable materials and energy-efficient rechargeable devices are gaining momentum.

Market Outlook

- Industry Growth Overview: Innovation in digital hearing technology and increased accessibility through online sales channels are driving industry growth. To appeal to younger consumers, top manufacturers are concentrating on comfort and compactness. Global increased device adoption is also being supported by government healthcare programs and insurance coverage.

- Sustainability Trends: Sustainability is gaining attention in the hearing aids industry through eco-friendly materials, energy-efficient components, and recyclable packaging. Companies are also introducing rechargeable models to reduce battery waste and environmental impact. The focus on long-lasting, repairable devices aligns with global sustainability and circular economy goals.

- Startup Ecosystem: Affordable, technologically advanced solutions for both developed and emerging markets are being introduced by startups in the hearing aid industry. For increased accessibility, many are incorporating AI-powered customization and smartphone-based hearing tests. These innovators are expanding more quickly thanks to partnerships with healthcare providers and investor support.

Hearing Aids Market Trade Analysis

- The worldwide production of hearing aids is highly dependent on global supply chains for the microelectronics, sensors, and acoustic parts used to make them, so disruptions in semiconductor supplies or logistics can impact trade.

- High-income regions export most of the higher-end premium digital hearing aids, while lower-cost markets tend to depend primarily on imports for these products.

- The price structure of hearing aids and their subsequent trade movement between different regions is impacted by regulatory requirements for getting a hearing aid approved for sale, duties applied to imported products, and the classifications of medical devices.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 12.07Billion |

| Market Size in 2026 | USD 7.49 Billion |

| Market Size in 2025 | USD 7.09 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.46% |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Technology, Patient Type, Sales Channel, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

In-the-ear (ITE) hearing aids

ITE aids are tailored and made to wear in the ear canal. They are made from an impression chosen to take by your hearing care expert during your hearing aid appointment. To fit in with the outer ear, these styles are usually found in a wide range of skin tones. Some ITE hearing aids are made to fit deep inside the ear canal, whereas some are designed to fit closest to the outer ear. The majority of the components are housed in a tiny plastic shell which sits behind the ears, with a portion of clear tubing connecting this to an earpiece. Such form is popular with young kids since it accommodates a variety of earmold styles that will have to be changed as when the child gets older. The BTE devices are very simple to clean & manage, and being relatively durable.

Behind-the-ear audio implants

The behind-the-ear (BTE) hearing aids segment has garnered market share of around 41.6% in 2024. BTE aids are placed beneath or on top of the ear, with tubing sliding down further into ear canal through a custom-fit hearing aid or a dome type that doesn't completely cover the ear canal opening. The electronic components are kept hidden behind the ear in a casing. The audio passes first from hearing aid to the ear via the hearing aid. BTE implants are used by persons of all ages who suffer from moderate to severe deafness. Hearing aids is housed inside small casings which can partially or fully slide in to ear canal. They're the tiniest hearing devices on the market, with some visual and auditory benefits. But, for certain individuals, its size makes it hard to manage and adjust.

Open fit

Auditory devices which do not restrict your eardrum are known as open-fit hearing aids. Open-fit cochlear implants are really not new, despite their resurgence in terms of popularity. One significant cause they're making a comeback would be that its primary flaw - feedback – is no longer an issue. Only the most basic cochlear implants now include complex feedback techniques that identify and delete input before it touches your ears. A behind-the-ear cochlear implant with a narrow passage or a recipient or receiver-in-the-ear hearing aid with an accessible cupola inside the ear is known as an open-fit hearing aid. This design leaves the ear canal wide open, allowing low-frequency sound to enter naturally while high-frequency sounds are boosted by the hearing aid. This tends to make the style an excellent investment for individuals with decent hearing and mild to moderate high-frequency deafness.

TechnologyInsights

Hearing aid technology has advanced dramatically in recent years, but hearing devices have always had 4 essential components: a sensor, a transmitter, a receiver, and a power source. The sensor collects up noises from your surroundings and sends them to the processor. The processor boosts the signal and sends it to the receiver, which amplifies it and sends it to the inner ear. The system is powered by a power generator, such as a battery. Depending on the complexity of the processor, hearing aid system can be categorized as sophisticated or basic. Even today's most basic digital hearing aids provide significantly greater advantage than earlier decades' greatest hearing aids. Some high-end hearing devices have artificial intelligence (AI), that enables devices to analyze sounds using a deep convolutional neural network. Wearable devices can start to make such modifications automatically whenever the environment is recognised by logging control valve setting and programme choices for particular sound settings. Digital technologies led the industry in 2022, accounting for over 90.0 percent of total revenue, and thus are expected to grow at the quickest Annual growth rate . With such a relatively slow rate than its electronic equivalents, analogue gadgets are now on the point of becoming outdated. Despite this, producers strive to produce analogue hearing aids due to their low cost and a small number of consumers' aversion to switching to digital. The idea of analog circuits is to increase the strength of continual sound waves. These devices provide equal enhancement of all sounds, including voice and noises.

ApplicationInsights

Medical IoT includes real-time tracking, connectivity, and information technologies on the customer site, data storage, and big data methods will be used to gather, evaluate, and transmit the patient's condition parameter signal & supervision data to other technologies in the future. A good example of such a health service is the EVOTION platforms. Body Area Sensor Networks (BASNs) and Body Area Networks (BANs), as well as its subcategory of Wireless Sensor Networks, have seen tremendous advancement in healthcare IoT in recent times (WSN). Such systems have aided the rapid growth of telemedicine services that allow individuals and their essential parameters to be monitored remotely. While transmitting health information from the BASNs, BANs, and WSNs, security mechanisms are embedded to protect confidentiality, security, and reliability. There seem to be a wide range of hearing-related mobile applications accessible, including sound level apps which inform you how loud it is around. Other applications can do a basic checkup and some even allow you to "teach" your mind with listening exercises. Applications can very often tell users how long your hearing aids' batteries last, so you'll know when they have to be refilled or changed. Apps frequently include information, such as how many hours you've worn your cochlear implants each day.

Regional Insights

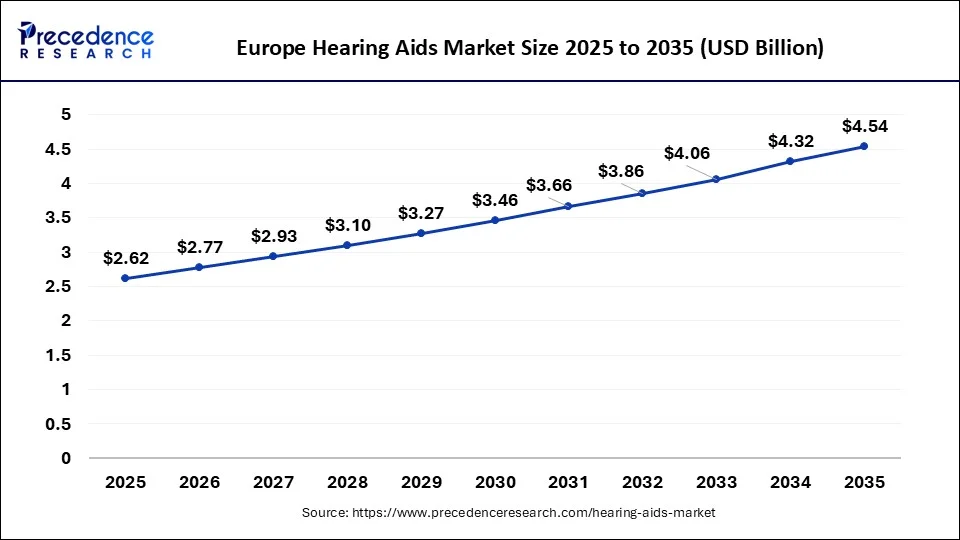

Europe Hearing Aids Market Size and Growth 2026 to 2035

The Europe hearing aid market size is calculated at USD 2.62 billion in 2025 and is expected to be worth around USD 4.54 billion by 2035, at a CAGR of 5.65% from 2026 to 2035.

Europe will have the highest market share 37% in 2025. The expansion of the Europe market could be ascribed to rising life expectancy, a growing geriatric population, and an increase in the prevalence of hearing loss as a result. Based on the patients, the hearing aids are broken up into two categories: adults and kids. During the projection period, the elderly patients segment grew just at fastest pace. Adult make up a significant portion of the overall patient group due to their increased sensitivity to deafness. As the outcome, the sustained and increased need for hearing devices will be ensured by the rise of this particular sector.

Over the forecast timeframe, North America is anticipated to have massive development. The United States is expected to earn a large proportion of the North American market during the projection timeframe, owing to its high estimated incidence of deafness and rising usage of hearing devices.

Value Chain Analysis

- R&D: The market for hearing aids depends heavily on research and development which aims to increase comfort connectivity and sound clarity. To improve user experience businesses are making significant investments in wireless technology miniaturization and AI driven sound processing. Manufacturers are able to satisfy a variety of patient needs thanks to ongoing advancements in rechargeable batteries and digital customization.

- Formulation and Final Dosage Preparation: In the hearing aids industry, formulation and final product preparation involve assembling precision components such as microphones, receivers and signal processors into compact devices. Manufacturers ensure high quality testing and calibration to provide consistent sound performance. The integration of Bluetooth and mobile app connectivity has transformed these devices into smart, user friendly healthcare tools.

- Patient Support & Services: To increase the uptake and satifaction of hearing aids patient support and post purchase services are crucial to guarantee comfort and usability businesses offer new users training remote adjustments and customized fittings. Worldwide patient accessibility and ongoing care are being further improved bby digital platforms and tele audiology services.

Hearing Aids Market Companies

- Demant A/S

- Starkey Laboratories, Inc.

- Cochlear Ltd.

- RION Co., Ltd

- Microson

- GN Store Nord A/S

- Sonova Group

Recent developments

- On September 26, 2025, Starkey Hearing Technologies earned three 2025 Hearing Technology Innovator Awards for its Edge AI receiver-in-canal hearing aid. This aids uses on-board artificial intelligence to adapt to real-world sound environments while delivering optimized sound performance and wellness monitoring features.

(Source:starkey.com ) - In March 2025, NewSound launched advanced prescription-grade hearing aids and remote-fitting on World Hearing Day 2025, designed for individuals with moderate to severe hearing loss.

(Source: prnewswire.com) - In January 2025, Elehear launched new AI-powered hearing device at CES 2025 having the beyond pro offers improved sound clarity, real-time AI translation, customizable tinnitus relief, and seamless Bluetooth streaming. (Source: hearingreview.com )

- In February 2025, GN introduces ReSound Vivia, ‘world's smallest' AI powered hearing aid, designed to streamline clinic workflow, improve fitting accuracy, and ultimately enhance the user experience.

(Source:med-techinsights.com) - In January 2025, Android announced new hearing aid and screenreader connectivity for Galaxy and Pixel.

(Source: mashable.com) - Sonova Holding AG finalised the purchase of Sennheiser electronic GmbH & Co. KG's Consumer Division early March 2022. Sonova's appealing product line will benefit from it, as well as its networking presence and customer base. GN Store Nord A/S introduced a new ReSound Key early February 2021, a complete hearing aid range which expands worldwide access to enhanced listening technology. The company would be able to extend its product portfolio and reach a bigger customer base as a result of this release. Starkey (US) and OrCam Technologies (Israel) joined on Oct 2020 to deliver assistive devices to deaf / visually challenged individuals. In combination with Starkey's Livio Edge AI hearing devices, OrCam was able to use the sophisticated machine learning algorithms that were created to relay the visual world through audio.

- In August 2024, Sonova Holding AG announced launch of the “Sphere Infinio” hearing‑aid platform, the first global device built on real‑time AI sound processing under the Audeo brand.

(Source:reuters.com )

Segments covered in this report

By Type

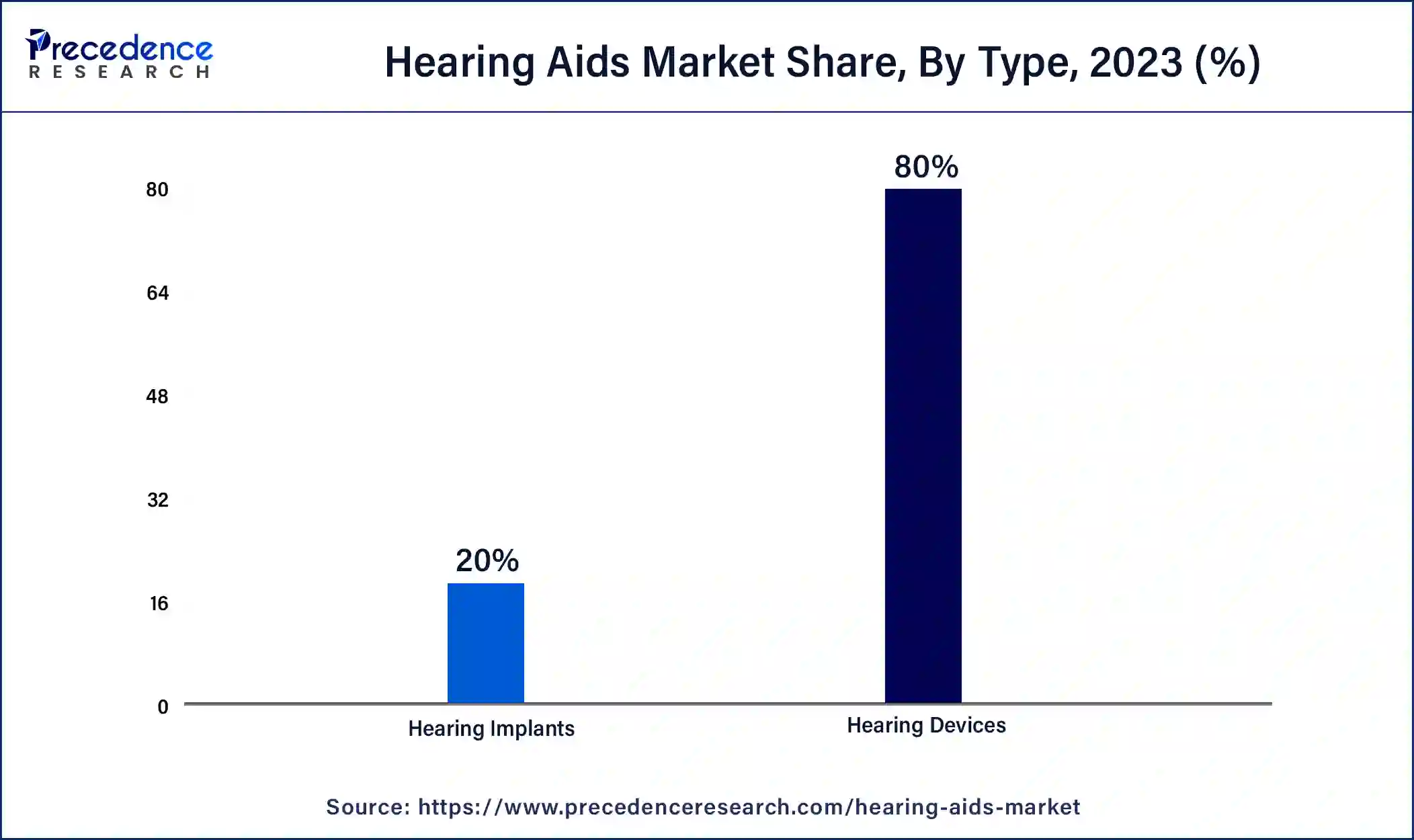

- Hearing Devices

- Behind-the-Ear (BTE)

- In the Ear (ITE)

- Receiver in the Canal (RIC)

- Completely in the Canal (CIC)

- Others (Invisible in the Canal, and others)

- Hearing Implants

- Cochlear Implants

- Bone Anchored Implants

By Application

- Body Area Sensor Networks

- Wireless Sensor Networks

By Type of Hearing Loss

- Sensorineural Hearing Loss

- Conductive Hearing Loss

By Technology

- Analog

- Digital

By Patient Type

- Adults

- Pediatrics

By Sales Channel

- Retail Sales

- Government Purchases

- E-commerce

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting