Wide Body Aircraft MRO Market Size and Forecast 2025 to 2034

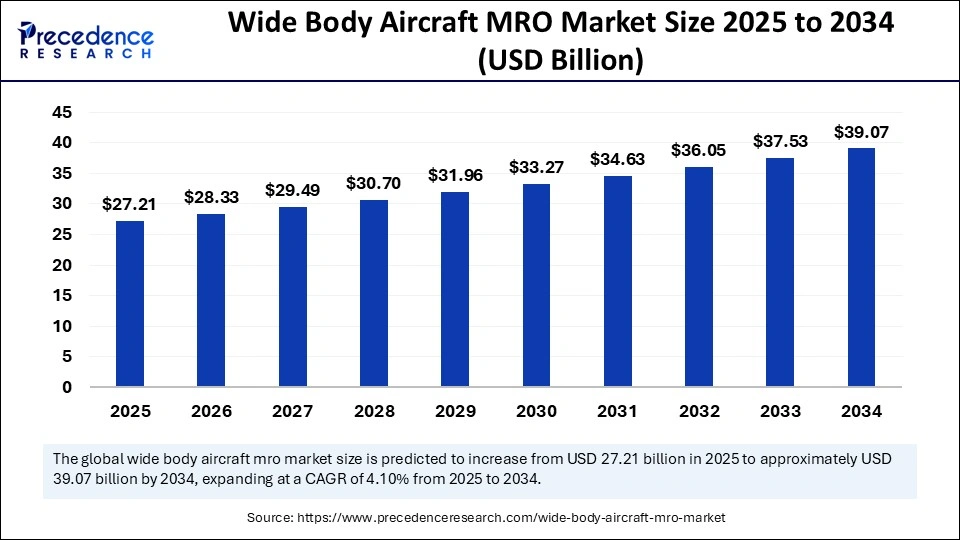

The global wide body aircraft MRO market size accounted for USD 26.14 billion in 2024 and is predicted to increase from USD 27.21 billion in 2025 to approximately USD 39.07 billion by 2034, expanding at a CAGR of 4.10% from 2025 to 2034. The market growth is attributed to the increasing demand for long-haul flights and the rising number of aging aircraft fleets, driving the need for specialized MRO services.

Wide Body Aircraft MRO Market Key Takeaways

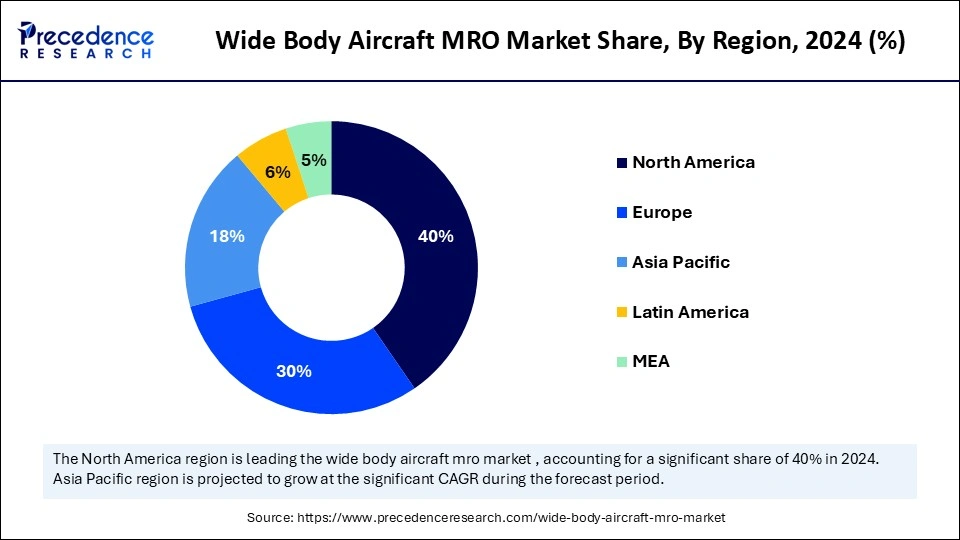

- North America dominated the market by holding more than 40% shares in 2024.

- Europe is anticipated to grow at the fastest rate in the market during the forecast period.

- By service type, the airframe maintenance segment held the significant share of the market in 2024.

- By service type, the engine maintenance segment is expected to grow at the fastest rate between 2025 and 2034.

- By maintenance type, the line maintenance segment accounted for a considerable share of the market in 2024.

- By maintenance type, the heavy maintenance segment is expected to grow at the highest CAGR over the studied years.

- By end user, in 2024, the commercial operators segment led the global market in 2024.

- By end user, the military operators segment is projected to expand rapidly in the market in the coming years.

- By component type, the landing gear segment dominated the market in 2024.

- By component type, the electrical systems segment is projected to grow at the fastest rate in the upcoming period.

Impact of Artificial Intelligence on the Wide Body Aircraft MRO Market

The wide-body aircraft MRO sector is experiencing rapid transformation through artificial intelligence (AI). AI enhances operational efficiency while decreasing maintenance durations and improving the precision of inspections. MRO providers have incorporated AI-driven predictive maintenance systems to process aircraft sensor data in real-time and predict potential failures, allowing for proactive maintenance and reducing downtime of aircraft. This method reduces unplanned flight cancellations and supports extended operation of components. Additionally, AI-powered drones can be used to automate inspection methods, enabling better structural damage identification and improving accuracy.

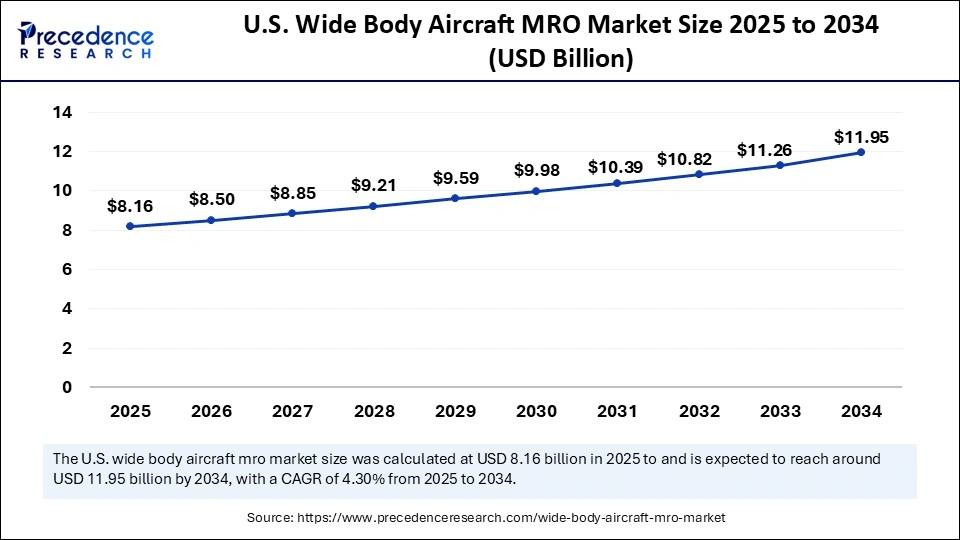

U.S. Wide Body Aircraft MRO Market Size and Growth 2025 to 2034

The U.S. wide body aircraft MRO market size was evaluated at USD 7.84 billion in 2024 and is projected to be worth around USD 11.95 billion by 2034, growing at a CAGR of 4.30% from 2025 to 2034.

North America led the wide body aircraft MRO market by capturing the largest share in 2024. The region possesses a well-established aviation sector that simultaneously enhances fleet maintenance strategies. North America hosts major airlines, including Delta, American Airlines, and United Airlines, which operate the largest wide body aircraft fleet in the world. The increased demand for long-distance flights between transatlantic and transpacific regions increases the necessity for maintenance services. In addition, increased air traffic bolstered the growth of the market in the region.

Europe is anticipated to witness the fastest growth during the forecast period. The growth of the market in the region is attributed to its well-developed aviation infrastructure and the increasing demand for long-haul international flights. European airlines are focusing on sustainable operations, influencing regional market growth. Moreover, the rising production of aircraft is likely to contribute to market growth. The European Union Aviation Safety Agency (EASA) 2024 report indicates that maintenance service requirements increase substantially, as aircraft production includes newer Airbus A350 and Boeing 787 models, while older fleet maintenance requires more frequent checks.

Asia Pacific is expected to witness notable growth in the coming years. The growth of the wide body aircraft MRO market in Asia Pacific can be attributed to the rising air travel demand. China, India, Japan, and Southeast Asia have expanded their airline operations in the last few years, which significantly boosts the demand for MRO services. The International Civil Aviation Organization (ICAO) and the Ministry of Civil Aviation, Government of India, predict that by 2035, the region is expected to account for over 40% of global air traffic, with nearly 3.5 billion passengers traveling annually.

Market Overview

The wide body aircraft MRO market is witnessing rapid growth due to the rising demand for long-haul routes and the rising number of wide-body aircraft fleets. The growing worldwide air traffic, particularly in Asia Pacific and North America, is encouraging airlines to maintain their fleets to ensure efficient and safe operations. This leads to increased demand for maintenance, repair, and overhaul services. According to the Passenger Traffic Report, Trends, and Outlook published by Airports Council International (ACI) World and the International Civil Aviation Organization (ICAO) in January 2025, global air passenger traffic is expected to surpass 12 billion by 2030. This highlights the need for MRO services to maintain aircraft fleets.

Wide Body Aircraft MRO Market Growth Factors

- Growing Aging Fleet: The rising number of older wide-body aircraft in operation is anticipated to increase the need for frequent and specialized MRO services.

- Advancements in Aircraft Technology: The integration of next-generation technologies, such as fuel-efficient engines and lightweight materials, is likely to spur demand for advanced MRO solutions.

- Expansion of Low-Cost Carriers: The growth of low-cost carriers operating long-haul flights is expected to drive the need for cost-effective and efficient MRO services for wide body fleets.

- Increasing Focus on Fleet Optimization: Airlines' focus on improving fleet performance and reducing operational costs is projected to lead to a rise in demand for high-quality MRO services.

- Rising Fuel Prices: The increasing cost of fuel is anticipated to push airlines to invest in aircraft maintenance solutions that optimize fuel efficiency and reduce emissions.

- Regulatory Compliance Pressure: Stricter aviation safety regulations and environmental standards are expected to drive the demand for high-quality and compliant MRO services.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 39.07 Billion |

| Market Size in 2025 | USD 27.21 Billion |

| Market Size in 2024 | USD 26.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.10% |

| Dominated Region | North America |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Maintenance Type, End User, Component Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing Global Air Passenger Traffic

The increasing global air passenger traffic is a key factor driving the growth of the wide body aircraft MRO market. The continuous rise in worldwide air passenger traffic creates a high demand for wide-body aircraft maintenance and repair services. Aerial travel between distant international destinations has grown steadily, encouraging airlines to maintain their wide-body aircraft to ensure maximum efficiency. The International Civil Aviation Organization (ICAO) reports that wide-body aircraft execute most major routes in the Asia Pacific, the Middle East, and North America while air traffic continues to increase at a steady pace. According to the International Civil Aviation Organization (ICAO), passenger air traffic levels increased by 2% in the first quarter of 2024 than in 2019. The continuous increase in global air travel significantly drives the demand for more wide-body aircraft and MRO services.

Restraint

High Maintenance Costs

High maintenance costs are anticipated to restrict the growth of the wide body aircraft MRO market. Since maintaining wide-body aircraft requires skilled technicians, expensive spare parts, and special tools, it increases the overall maintenance costs. Operators must invest substantial money for heavy checks and engine overhauls. Furthermore, the increasing cost burden drives airlines to delay important repairs and seek more affordable maintenance options, reducing the need for MRO services at main hubs.

Opportunity

Sustainable Aviation Practices

Adopting sustainable aviation practices is expected to create significant opportunities in the wide body aircraft MRO market. Several airlines are adopting eco-friendly materials to upgrade their wide-body aircraft, complying with environmental regulations. The aviation sector chooses maintenance providers that provide environmentally compliant repair processes in addition to green retrofitting services. Airlines have also set their emission reduction targets. The International Civil Aviation Organization (ICAO) 2024 report shows the aviation sector remains on course to reduce carbon emissions by 50% by 2050. Furthermore, the increasing environmental concerns drive MRO services, which are focused on sustainability.

Service Type Insights

The airframe maintenance segment dominated the wide body aircraft MRO market with the largest share in 2024. This is mainly due to safety regulatory compliance and structural health verification. Aircraft safety relies heavily on airframe maintenance, as it ensures the proper condition of fuselage wings, landing gear, and other structural components. Furthermore, the expanding international passenger travel sustained airframe maintenance as the dominant segment in the market.

The engine maintenance segment is expected to grow at the fastest rate in the future years due to the rising airlines' emphasis on optimizing engine performance. Engine overhaul and repair needs are rising, with airlines actively operating newer wide-body aircraft models, including the Boeing 787 and Airbus A350, that feature fuel-efficient engines. According to the U.S. Federal Aviation Administration (FAA) 2024 report, engines need better maintenance practices while being equipped with advanced diagnostic systems. Furthermore, the rising air passenger traffic creates the necessity for increased engine maintenance services, fuelling the segment's growth.

Maintenance Type Insights

The line maintenance segment held a considerable share of the wide body aircraft MRO market in 2024, as aircraft need quick inspections and brief repairs to maintain flight readiness. Aircraft operational readiness between flights depends on line maintenance services, which encompass standard checks such as system diagnostics, oil changes, and tire replacements. Airlines require these services frequently for fast turnarounds and minimal aircraft downtime, mainly on their important routes, bolstering segmental growth.

The heavy maintenance segment is expected to grow at the highest CAGR over the studied years, owing to the rising number of aging fleets. Aging fleets often require deep inspection to comply with evolving regulatory standards. Heavy maintenance comprises thorough examinations of fleets, leading to enhanced aircraft performance for longer periods and minimized downtime. The rising regulations regarding aircraft safety further boost the need for complex checks and maintenance services.

End User Insights

The commercial operators segment dominated the wide body aircraft MRO market. Many commercial airlines operate wide-body aircraft that require frequent maintenance for their longer operation. The rise in the air travel demand further bolstered the segmental growth. According to the International Air Transport Association (IATA) 2024 report, air passenger traffic forecasts rise 4.4% yearly until 2028. This highlights the need for wide-body aircraft maintenance services.

The military operators segment is projected to expand rapidly in the market in the coming years, owing to the rising focus on modernizing military infrastructure. The expanding defense budget is likely to support segmental growth. Modern defense forces around the world are investing in advancing wide-body aircraft to meet their needs for strategic airlifts. Additionally, the military aircraft complexity drives the need for better diagnostic and maintenance services.

Component Type Insights

The leading gear segment held the largest share of the wide body aircraft MRO market in 2024. The landing gear is an essential system that provides safety in aircraft takeoff as well as landing operations and ground movement. Flight decks represent one of the plane's most critical stress areas because aircraft must undergo frequent assessment, periodic maintenance, and replacement to maintain operational safety. The demand for landing gear maintenance increased due to the increased concerns about aircraft and passenger safety, bolstering the segment's growth.

The electrical systems segment is projected to grow at the fastest rate in the upcoming period due to the rising demand for electronic components and automated systems for smooth operation of aircraft. To achieve operation, wide-body aircraft need electrical systems, such as power distribution and avionics, flight control systems, and aircraft lighting. The rising number of electric-powered aircraft further fuels the growth of the segment.

Wide Body Aircraft MRO Market Companies

- Air France Industries KLM Engineering & Maintenance

- Airbus

- Boeing

- General Electric

- Honeywell

- Lockheed Martin

- Lufthansa Technik

- MRO Holdings

- MTU Aero Engines

- Northrop Grumman

- Pratt and Whitney

- Safran

- ST Aerospace

- Textron

LatestAnnouncement by Industry Leader

- In Aprill 2025, MTU Maintenance has signed an exclusive agreement with Air Canada for the maintenance, repair, and overhaul (MRO) of CF6-80C2 engines that power the airline's Boeing 767 cargo fleet. This contract extends the longstanding partnership between the two companies, with MTU Maintenance serving as Air Canada's exclusive MRO provider for these engines for more than 25 years. Josh Vanderveen, Vice President of Maintenance at Air Canada, emphasized the importance of this collaboration, stating that MTU's expertise is vital for ensuring the reliability of their freighter operations, which are crucial to the airline's cargo network strategy. He also highlighted the added value of supporting the aerospace industry in British Columbia and across Canada by conducting the MRO work domestically. The renewed partnership is expected to strengthen Air Canada's operational capabilities and reinforce its commitment to delivering consistent service to cargo customers.

Recent Developments

- In November 2024, Tata-owned Air India partnered with Bengaluru Airport City Limited (BACL), a subsidiary of Bangalore International Airport Limited (BIAL), to establish an 86,000-square-foot Aircraft Maintenance Engineering (AME) training facility at Bengaluru Airport City. Scheduled to begin operations by mid-2026, the facility supports Air India's strategy to create a Basic Maintenance Training Organisation (BMTO) accredited by India's Directorate General of Civil Aviation (DGCA), addressing the growing maintenance requirements of its expanding fleet.

- In September 2024, Fokker Services Asia, a subsidiary of Fokker Services Group (FSG), secured designation as an Embraer Authorized Service Center following the final contract signing at the Aviation Week MRO Asia Pacific 2024 event in Singapore. The certification allows Fokker Services Asia to provide maintenance services for Embraer's E-Jets first-generation family, particularly focusing on the E190 model, significantly strengthening Embraer's support network in the rapidly expanding Asia Pacific market.

- In August 2022, Aspire MRO commenced operations in Fort Worth, Texas, aiming to become a key player in wide-body aircraft maintenance, repair, and overhaul (MRO). The company launched heavy maintenance and passenger-to-freighter (PTF) conversion services for wide-body aircraft from an 840,000-square-foot facility previously operated by GDC Technics at Fort Worth Alliance Airport. Aspire MRO plans to run six maintenance bays dedicated to heavy wide-body services and Boeing 777 PTF conversions.

Segments Covered in the Report

By Service Type

- Airframe Maintenance

- Component Maintenance

- Engine Maintenance

- Modification and Upgrade

By Maintenance Type

- Base Maintenance

- Heavy Maintenance

- Line Maintenance

By End User

- Cargo Operators

- Commercial Operators

- Military Operators

By Component Type

- Avionics

- Electrical Systems

- Fuel Systems

- Landing Gear

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting