What is the Wide Body Aircraft Market Size?

Discover latest analysis on the Wide Body Aircraft Market including size, share, opportunities, and future outlook across key regions. The growth of the market is driven by the rising demand for advanced aircraft, stringent safety regulations for aviation sector, and the growth in international travelling.

Wide Body Aircraft MarketKey Takeaways

- North America dominated the global wide body aircraft market by holding maximum revenue share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- By type, the airframe and modification segment held the major market share in 2024.

- By type, the metal engine segment is projected to grow at the highest CAGR during the forecast period.

- By service, the maintenance services segment held the largest market share in 2024.

- By service, the modification services segment is expected to grow at the fastest CAGR in the coming years.

Strategic Overview of the Global Wide Body Aircraft Industry

The wide body aircraft market is expanding at a significant rate as it offers unprecedented safety, service, and performance for commercial aircraft. Wide-body aircraft have maximum passenger-carrying capabilities. Significant technological advancements like enhanced engine performance and aerodynamics are improving the efficiency of wide-body aircraft and optimizing fuel efficiency. The market is proliferating due to the growing number of flights across the world and increasing demand for aftermarket services. As the network of airlines is increasing along with long-haul operations, it positively impacts solutions for efficient maintenance of aircraft. Some of the renowned wide-body aircraft models are Airbus A330, Boeing 787 Dreamliner, and Boeing 777. According to the data, Airbus 330 delivered nearly 32 flights in 2023 and 2024. In addition, Boeing 777 delivered 14 flights in 2024 and 26 flights in 2023.

On the other hand, decreasing fuel costs has supported airlines to keep flying for a long time, which can be applicable for older aircraft bodies as well to keep them preserved. Such initiatives are fuelling the growth of wide body aircraft market. Third-party providers offer innovative technologies like predictive maintenance, digital diagnostics, and AI-powered data analytics, which minimizes frequent maintenance of aircraft. Also, organizations like the European Union Aviation Safety Agency and the Federal Aviation Administration have set compliances for aircraft safety.

How Does AI Impact the Wide Body Aircraft Market?

The incorporation of artificial intelligence within wide body aircraft manufacturing is set to revolutionize the market due to its unparalleled expertise. The integration of AI can offer autonomous piloting technologies to support decision-making processes. AI systems work on huge amounts of data, enabling real-time data collection and analysis. Furthermore, AI-powered systems with autonomous piloting allow aircraft to make decisions in a split second, which surpasses human capacity to make decisions. It further increases flight safety and improves overall operational effectiveness. AI-driven predictive maintenance forecasts potential component failures, minimizing downtime.

Market Outlook

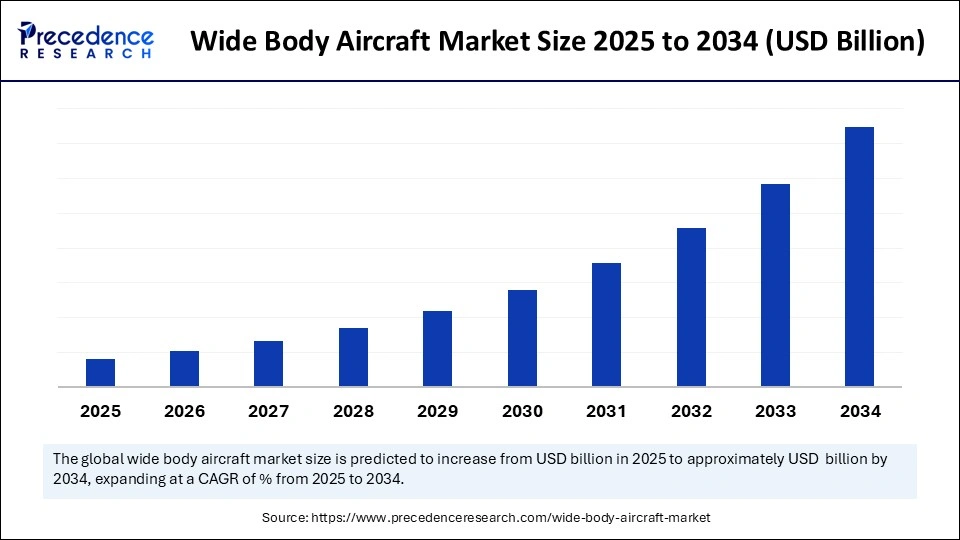

- Market Growth Overview: The Wide Body Aircraft market is expected to grow significantly between 2025 and 2034, driven by the surging long-haul travel, rising cargo and E-commerce demand, and Airlines are replacing older, less-efficient aircraft with modern, more fuel-efficient wide-body jets to reduce operating costs and meet environmental targets.

- Sustainability Trends: Sustainability trends involve sustainable aviation fuels adoption, fleet modernization and fuel efficiency, and alternative propulsion system research & development.

- Major Investors: Major investors in the market include Airbus S.A.S., The Boeing Company, Lufthansa Group, Emirates, Qatar Airways, AerCap, Air Lease Corporation, Standard Chartered, and Bank of India (financing deals).

- Startup Economy:The startup economy is focused on niche, high-impact technologies, a disruptive innovation model, and digitalization and AI.

Wide Body Aircraft MarketGrowth Factors

- Increasing airline activities across the globe and the growing need to enhance comfort for travelers are boosting the growth of the wide body aircraft market.

- The growing number of wide-body aircraft in operation, along with the focus on improving safety and operational efficiency, significantly contributes to market growth.

- Increasing disposable income in highly developed and economically emerging countries facilitates the growth of the market.

- Increasing demand for long-haul journeys around the world positively impacts the market's growth.

- The rising modernization of existing fleets contributes to market expansion.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Service, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market dynamics

How is Advanced Engine Technology Reshaping the Wide Body Aircraft Market?

The market for wide-body aircraft has been witnessing a significant growth rate due to the rising adoption of advanced engine technology, contributing to enhanced fuel efficiency and low carbon emission. Leading aircraft manufacturers are sought after advanced and intricate engines that can support large planes to keep their flying pace constant for the long run and reduce carbon footprints. Such advancements are showcasing the commitment of the aviation industry to environmental sustainability.

Manufacturers are building wide body aircraft by enhancing aerodynamics to minimize drag and fuel consumption. Innovation in wing designs and winglets are examples of the advancement in wide-body aircraft for more efficient flight and reducing GHG emissions. Furthermore, highly trailblazing computer simulation with wind tunnel testing supports refined aerodynamics design while enhancing every aspect of the aircraft to achieve its highest efficiency, lower fuel consumption, and environmental compliances.

Restraint

Supply Chain Challenges

Despite many advantages and offerings, the wide body aircraft market faces some challenges, like supply chain disruptions, which impede the growth of the market. Amidst strong demand for wide-body aircraft, commercial aerospace original equipment manufacturers and suppliers are dealing with many barriers like quality control regulation issues, shortages of highly skilled professionals in aviation manufacturing and designing, and volatile geopolitical concerns. However, to resolve this problem, many leading companies are finding suppliers that are below the first-tier vendor to obtain a clear picture of supply chain movements in the market. Moreover, MRO services can be costly, which deters some airlines from investing in maintenance programs.

Opportunity

How Will Nanostructured Materials Create Lucrative Opportunities for the Market?

The significant opportunity that wide body aircraft market holds is the incorporation of nanostructured materials in the aviation manufacturing industry. To achieve precise control over the properties of nanomaterials, these materials are engineered at the nanoscale level, which further exhibits high tensile properties like enhanced hardness, strength, and wear resistance in comparison with traditional materials used for aviation manufacturing.

Similarly, many advanced materials like carbon Fiber composites, silicon carbide Ceramics, graphene, and carbon fiber composites are some of the environmentally friendly materials that can be further added for aircraft manufacturing, allowing engineers to design more fuel-efficient, safer, and eco-friendly aircraft. These materials are popular for their excellent strength-to-weight ratio, resistance to corrosion, and durability. These materials offer innovative ways to reduce aircraft weight and enhance designs.

Type Insights

How Does the Airframe and Modification Segment Dominate the Wide Body Aircraft Market in 2024.

The airframe and modification segment dominated the market with the largest share in 2024. The segment's dominance is reinforced by stringent regulations regarding aircraft safety and verification of structure. Aircraft safety majorly depends on the status of fuselage wings, landing gear, and various outer structures of the aircraft. Keeping these components in good condition is essential, boosting segmental growth.

The metal engine segment is projected to grow at the highest CAGR during the forecast period. The segment growth is attributed to the increasing emphasis on airlines to optimize engine performance. Airlines are actively operating with wide-body aircraft where engine overhaul and repair needs are increasing. This segment's growth is further attributed to the rising awareness about the critical role of engines in enhancing aircraft safety. Also, increasing air passenger traffic requires regular engine maintenance services to enhance passenger experience.

Segment Insights

Service Insights

What Made Maintenance Services the Dominant Segment in 2024?

The maintenance services segment dominated the wide body aircraft market with the highest share in 2024. This is mainly due to various factors, including the need for early fault detection, meeting regulatory standards, prevention of expensive repairs, and operational continuity. Highly maintained aircraft would work properly and efficiently, minimizing the chances of accidents or breakdowns and providing robust security. Also, authorities like EASA and FAA mandate stringent safety protocols that the aviation industry should follow. Noncompliance can lead to hefty fines, denial of certifications or licenses, and other legal consequences. The rising need to modernize aging fleets is boosting the need for maintenance services.

The modification services segment is expected to grow at the fastest CAGR in the coming years. Modification services deal with the alteration or upgrades of aircraft's structure, components, internal systems, and others. Transformation in interiors also changes consumer's experience, monitoring capabilities, and navigation accuracy, which helps to enhance aircraft's performance. Modification services also include engine upgrades, aerodynamics improvements, and fuel efficiency enhancement. These services play a critical role in complying with new regulations set by authorities. The growing need to enhance passenger comfort further supports segmental growth.

Regional Insights

What Factors Contributed to North America's Dominance in 2024?

North America registered dominance in the wide body aircraft market by generating the largest revenue share in 2024. The region's dominance is mainly attributed to the increase in the number of wide-body aircraft fleets in operation. The region is home to some of the leading aircraft and component manufacturers, such as Boeing Company, GE Aviation, Honeywell Aerospace, and Pratt & Whitney, leading to innovations in the market. With the increased disposable income, there is a high demand for air travel. The region has witnessed increased travel and tourism rates and technological advancements in aircraft manufacturing methods. All these factors contributed to the region's dominance.

The U.S. plays a major role in the North American wide body aircraft market. This is mainly due to its well-established aerospace industry, along with the large number of wide-body fleets in operations. The U.S. aerospace industry is focusing on modernizing its fleets by integrating modern technologies to improve passenger comfort. In addition, the rising air passenger traffic is likely to drive market growth.

What Opportunities Exist in the Wide Body Aircraft Market Within Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR in the foreseeable period. The rapid expansion of the aerospace industry is a major factor contributing to the growth of the market. With the rising air travel demand, airlines in the region are investing in wide-body aircraft. Domestic airlines are focusing on regional connectivity, opening up new avenues in the market. In addition, the rising maintenance of older aircraft influences the market. The rising air cargo demand further contributes to regional market growth. According to the report published by the International Air Transport Association in 2023, Asia Pacific airlines witnessed a 7.6% surge in international cargo demand in October 2023.

China Wide Body Aircraft Market Trends

China's soaring demand for long-haul travel, Chinese airlines are expanding their fleets to meet burgeoning domestic and international demand. Rapid growth of domestic aviation, domestic production and COMAC's role, and the booming e-commerce sector and growth in global logistics are significantly increasing the need for efficient air freight solutions.

Germany Wide Body Aircraft Trends

Germany's wide-body aircraft market is fleet modernization and simplification, environmental regulations, and the high cost of fuel are accelerating the adoption of modern, fuel-efficient wide-body jets. Strong domestic MRO, innovation in advanced technologies to improve effectiveness, including the application of AI in MRO, the use of advanced avionics, and the development of sustainable aviation technologies to enhance operational efficiency.

Wide Body Aircraft Market Value Chain Analysis

Research, Design, and Development (R&D)

This initial stage involves significant investment in research to conceptualize new aircraft models and develop innovative technologies for efficiency, safety, and sustainability.

- Key Players: Airbus, Boeing, COMAC, German Aerospace Center (DLR), engine R&D divisions (GE Aviation, Rolls-Royce, Pratt & Whitney).

Raw Material and Component Manufacturing

This stage involves a vast, global supply chain where various suppliers manufacture the numerous complex systems and parts that constitute a wide-body aircraft, including airframes, engines, avionics, landing gear, and interiors.

- Key Players: Spirit AeroSystems (aerostructures), Collins Aerospace (avionics, interiors), Honeywell Aerospace (avionics, systems), MTU Aero Engines, Safran (engines, interiors), Woodward (engine components), Leonardo S.p.A. (aerostructures).

Final Assembly and Testing

Original Equipment Manufacturers (OEMs) bring together all components for final assembly, integration, rigorous ground and flight testing, and certification by aviation authorities.

- Key Players: Airbus (Hamburg, Toulouse facilities), Boeing (Everett, North Charleston facilities), COMAC (Shanghai facilities).

Sales, Financing, and Leasing

Once manufactured, aircraft are sold or leased to airlines. Aircraft lessors play a crucial role in financing these multi-million dollar assets, with airlines often leasing a significant portion of their fleets to manage capital costs.

- Key Players: Airlines (Lufthansa Group, China Eastern, Emirates), Aircraft Lessors (AerCap, Air Lease Corporation), financial institutions.

Airline Operations & Service

Airlines operate the aircraft to provide passenger and cargo transport services, generating revenue through ticket and freight sales.

- Key Players: Airlines (e.g., Lufthansa, Air China, Qatar Airways), Airports, Air Navigation Service Providers (ANSPs), ground service companies, fuel producers.

Wide Body Aircraft Market Companies

- GE Aviation (US): GE Aviation is a major supplier of engines for wide-body aircraft, powering a large portion of global fleets and contributing significantly to the market through engine sales and long-term MRO service agreements.

- Honeywell Aerospace (US):Honeywell provides a wide range of avionics, auxiliary power units (APUs), and other critical systems for wide-body jets, enhancing their operational efficiency and safety features.

- Lufthansa Technik (Germany):As a leading MRO provider, Lufthansa Technik offers extensive maintenance, repair, and overhaul services for wide-body aircraft, ensuring their airworthiness and extending their operational lives for airlines worldwide.

- Pratt & Whitney (US): This company designs and manufactures advanced engines for wide-body aircraft, contributing to fuel efficiency and performance through innovative technologies like the geared turbofan.

- Rolls-Royce (US/UK): Rolls-Royce supplies advanced engine technologies for various wide-body platforms, playing a critical role in the market through engine production and comprehensive aftermarket service support.

- Abu Dhabi Aircraft Technologies (UAE):ADAT provides MRO services primarily in the Middle East, supporting the large wide-body fleets operated by regional carriers and contributing to regional aviation infrastructure.

- Air France Industries KLM Engineering and Maintenance (France):A major European MRO provider, AFI KLM E&M offers extensive maintenance and modification services for wide-body aircraft fleets, supporting global airline operations.

- MTU Aero Engines (Germany): Germany's leading engine manufacturer and a key partner in various engine programs, MTU contributes significantly to the wide-body market through component supply and MRO specialization.

- Singapore Technologies Aerospace (Singapore):ST Engineering is a major MRO player in the Asia-Pacific region, providing comprehensive services for wide-body aircraft and also involved in passenger-to-freighter conversions.

- Airbus S.A.S. (France):As one of the two dominant global OEMs, Airbus designs, manufactures, and sells a range of wide-body aircraft (A330, A350, A380) to airlines worldwide.

- Boeing Company (US): Boeing is the other primary OEM, designing and producing iconic wide-body aircraft such as the 747, 777, and 787 Dreamliner, capturing a major share of the global market.

- Embraer S.A. (Brazil): While primarily known for regional jets, Embraer contributes to the broader aviation ecosystem with some larger platforms and MRO support, though less directly in the main wide-body passenger market compared to Boeing and Airbus.

- Korean Air (South Korea):As a major airline and an MRO provider, Korean Air operates a large wide-body fleet and also offers third-party MRO services, leveraging its extensive operational experience.

- Turkish Technic (Turkey): The MRO arm of Turkish Airlines, Turkish Technic supports a growing fleet of wide-body aircraft with MRO services at its strategically located hub, catering to both in-house and third-party needs.

- China National Aviation Corporation (CNAC) (China): As a key player in China's state-owned aviation sector, CNAC influences the market through fleet purchasing decisions for airlines like Air China and support for domestic aircraft development programs.

Recent Developments

- In May 2025, Qatar Airways and Boeing announced the carrier will purchase up to 210 widebody jets, which sets new records as the largest widebody order for Boeing, including the largest order for 787 Dreamliners and Qatar Airways largest-ever order. This purchase, which also includes additional orders for Boeing's new 777-9, will support approximately 400,000 jobs in the U.S. and position the award-winning Middle Eastern airline for further international expansion.

(Source:https://investors.boeing.com)

- In April 2024, India's most preferred airline, IndiGo strengthened its position by launching wide body aircraft. IndiGo agreed to place an order for 30 Firm A350-900 aircraft, which will enable IndiGo to spread its wings further and expand its network. IndiGo enters the wide-body space with an order for 30 Firm Airbus A350-900 aircraft

- In February 2025, Indigo is taking three more wide-body aircraft on damp lease from Norse Atlantic Airways aiming to fly directly to Europe continent. With Europe on its mind, IndiGo to add three more wide-body jets on damp lease in 2025 | Business News - The Indian Express

Segments Covered in the Report

By Type

- Airframe and Modification

- Component

- Engine

- Line Maintenance

By Service

- Maintenance Services

- Engineering Services

- Technical Training

- Inventory Management

- Freight Conversions

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting