What is the Wireless Infrastructure Market Size?

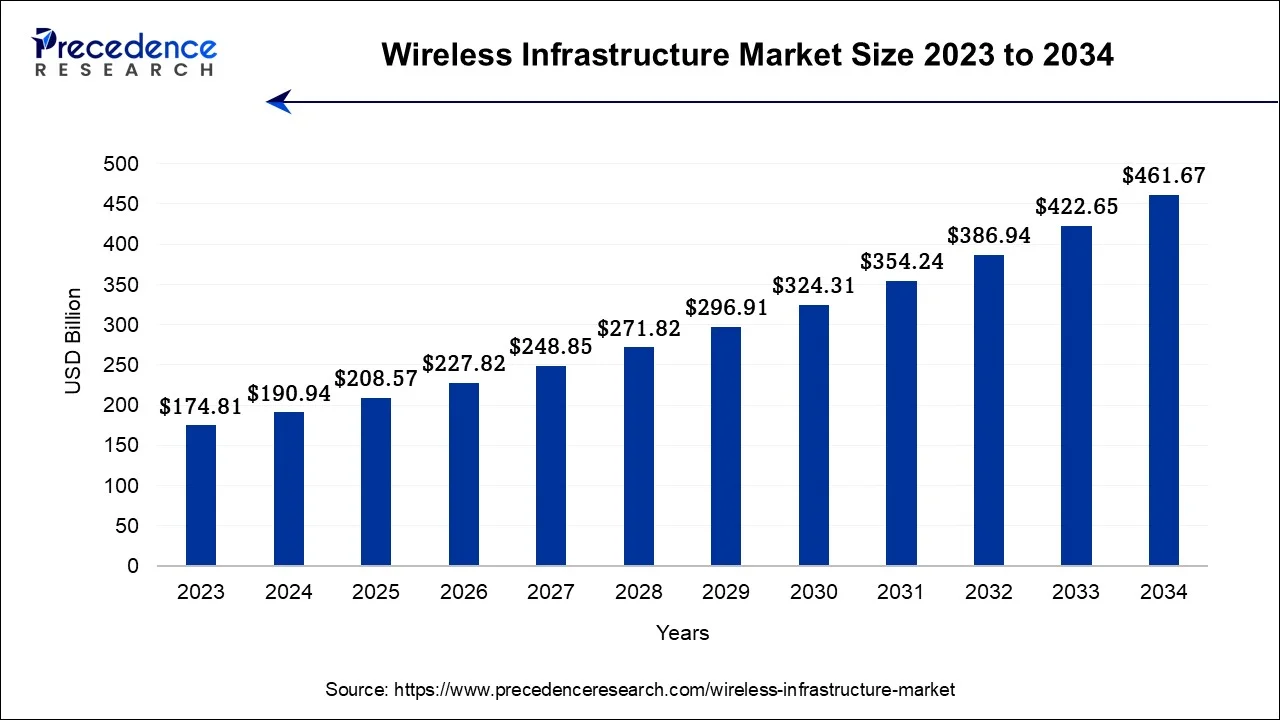

The global wireless infrastructure market size is calculated at USD 208.57 billion in 2025 and is predicted to increase from USD 227.82 billion in 2026 to approximately USD 500.69 billion by 2035, expanding at a CAGR of 9.15% from 2026 to 2035. The market is driven by the global expansion of 5G networks, fueled by the demand for lower latency and faster data transfer speeds. The rising use of Internet of Things (IoT) devices across industries and the development of smart cities further drives market growth.

Wireless Infrastructure Market Key Takeaways

- North America (NA) led the global market with the highest market share in 2025.

- By Platform, the commercial segment held the maximum market share in 2025.

- By Type, the 4G segment is estimated to expand at the fastest CAGR during the forecast period till 2035.

- By Infrastructure, the distributed area network segment captured the highest revenue share in 2025.

Market Overview

Wireless infrastructure refers to a collection of numerous connectivity standards, communication devices, and connectivity solutions that function together to offer wireless networks. Some of the common examples of wireless infrastructure include wireless local area networks (WLANs), cell phone networks, satellite communication networks, wireless sensor networks, and terrestrial microwave networks.

Technologies such as Wear Your Own Device (WYOD) and Bring Your Own Device (BYOD) are becoming increasingly popular in various developed countries. The development of such technologies is enhancing the requirement for speedier connectivity and high-speed data in the commercial communication domain.

Market Outlook

- Industry Growth Overview: The expansion of the wireless infrastructure industry has been fuelled by the unprecedented speed of 5 G deployment, an explosion in mobile data traffic, a move towards digitalizing the enterprise, and increased capital expenditures on densifying networks in urban and suburban areas around the globe.

- Sustainability Trends: Operators are increasingly focused on enhancing their sustainability practices by using more energy-efficient base stations; utilizing green solutions for towers, deploying renewable energy sources to power sites; and implementing AI to optimize energy use to reduce carbon footprints and achieve their sustainability goals long term.

- Global Expansion: The wireless infrastructure industry in developing markets, such as Asia-Pacific, Latin America, and Africa, is ramping up quickly due to government initiatives to connect people through technology, spectrum auctions by the respective governments, and increasing penetration of smart devices.

Market Scope

| Report Coverage | Details |

| Market Size in 2035 | USD 500.69 Billion |

| Market Size by 2025 | USD 208.57 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.15% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Platform, Type, Infrastructure, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

As per our research, the global 5G Infrastructure market is predicted to be worth around $98.57 billion by 2030 from about $5.82 billion in 2021. Our analysis indicates that the global 5G infrastructure market will grow at a compounded annual growth rate (CAGR) of 36.94% during the forecast period till 2030.

The smartphone penetration across the world rate was around 68% in 2022, up from 65% in 2016. This penetration rate is estimated to grow with the increasing population all over the world. As of April 2023, the number of internet users across the globe was nearly 5.18 billion. This accounted for 64.6% of the total global population. Increasing smartphone and internet penetration rates are creating remarkable opportunities for the global wireless infrastructure market.

In order to enhance the wireless infrastructure, respective companies can consider acquisition, collaboration, partnership, and joint ventures. Furthermore, evolving wireless connectivity technology tends to make the existing technology obsolete very soon. Technology evolvement is expected to intensify the market competition among the significant market players.

Since the count of wireless service providers is very less in comparison to the count of buyers, the bargaining power of suppliers is considerably higher as compared to the bargaining power of buyers. Owing to promising profit margins, the threat of new entrants in the wireless infrastructure market is found to be moderate as of now.

Our wireless infrastructure market report includes a detailed analysis of the current market situation. The report includes relevant developments including key market players, the latest trends, regional analysis, and competitive landscape. The analytical research on the impact of the COVID-19 pandemic helps in realizing the respective effects on the demand and supply side. The segmental analysis offers an in-depth overview of the types of wireless infrastructures.

Segment Insights

Platform Insights

Based on the platform, the global wireless infrastructure market is segmented into defense, government, and commercial. The commercial segment held the largest market share in 2023. The commercial segment is predicted to grow with the highest compounded annual growth rate (CAGR) during the study period.

The consumer electronics wireless infrastructure market in India is forecast to account for $9,043.3 million in 2023. The Indian consumer electronics wireless infrastructure market is predicted to grow at a compound annual growth rate of 8.4% and reach a value of $12,479.7 million by 2027. In 2023, the global fashion wireless infrastructure market is anticipated to reach $820 billion. By 2027, this market's value can amount to over $1.2 trillion.

Type Insights

Based on type, the global wireless infrastructure market is segmented into Satellite, 2G & 3G, 4G, and 5G. The 4G segment had the highest revenue share in 2023. The 4G segment is estimated to grow with the highest compounded annual growth rate (CAGR) during the forecast period till 2032.

Japan is one of the biggest wireless infrastructure markets in the world. Japan's wireless infrastructure market is?characterized by a growing emphasis on business-to-consumer (B2C) sales, dominance of business-to-businesses (B2B) transactions, and an emerging consumer-to-consumer (C2C) market. The business-to-consumer (B2C) wireless infrastructure market in Japan has more than doubled in the last decade.

Infrastructure Insights

Based on infrastructure, the global wireless infrastructure market is segmented into small and macro cells, radio access networks, mobile core, distributed area networks, and satellite communications (SATCOM). The distributed area network segment had the highest revenue share in 2022. The distributed area network segment is estimated to grow with the highest compounded annual growth rate (CAGR) during the forecast period till 2032.

Regional Insights

The wireless infrastructure market is spread across North America, Europe, Asia Pacific (APAC), the Middle East and Africa, and Latin America. North America (NA) held a high share of the global wireless infrastructure market in 2025. In 2025, the U.S. had the largest share followed by Canada and Mexico. Considering the presence of nations with early adoption of the latest communication technologies, better financial policies, and high gross domestic product (GDP), the North American wireless infrastructure market is expected to grow notably during the study period.

The European wireless infrastructure market is segmented into France, Germany, the United Kingdom (UK), Italy, and the Rest of Europe. Germany is predicted to hold the largest share of the European wireless infrastructure market during the forecast period.

The wireless infrastructure market in the Asia Pacific (APAC) region is segmented into China, India, Japan, South Korea, and the rest of the Asia Pacific (APAC) region. In 2023, China dominated the Asia Pacific (APAC) wireless infrastructure market followed by Japan and India.

Being the region with the highest population, Asia-Pacific (APAC) has the largest count of internet users across the world. In 2022, the count of internet users in the Asia-Pacific region grew drastically to over 2.6 billion. Around half of these users are from India and China. As per GSMA, the adoption rate of smartphones in the Asia Pacific reached 74% in 2021. This rate is projected to rise to 84% by 2025.

Latin America, Middle East, and African (LAMEA) wireless infrastructure market is segmented into South Africa, Saudi Arabia, North Africa, Brazil, Argentina, and the Rest of LAMEA. The Latin America region is expected to account for considerable growth in the wireless infrastructure market during the forecast period.

U.S. Market Trends

The U.S. wireless infrastructure market is growing due to the rapid deployment of 5G networks, increasing mobile data consumption, and rising demand for high-speed connectivity. Investments by telecom operators in small cells, fiber backhaul, and network densification are further accelerating growth. Additionally, the expansion of IoT, smart cities, and cloud-based services is driving the need for robust and reliable wireless infrastructure.

China Market Trends

China's wireless infrastructure market is expanding rapidly, driven by massive 5G adoption, surging mobile data usage, and strong government support for digital transformation. The country is heavily focused on advancing 5G, Wi-Fi 6/7, IoT integration, and smart city technologies, with domestic players such as Huawei playing a dominant role amid global competition. Looking ahead, continued investments in fiber networks, data centers, and early 6G development are expected to sustain long-term market growth.

Brazil Wireless Infrastructure Market Trends

Brazil's market is witnessing strong growth, driven by increasing mobile data consumption and rapid expansion of 4G and 5G networks. Rising smartphone penetration and growing demand for high-speed connectivity are encouraging telecom operators to invest in network densification and modernization.

The UAE Wireless Infrastructure Market Trends

The UAE market is experiencing rapid growth, fueled by increasing adoption of 5G networks and rising demand for high-speed mobile connectivity. Significant investments by telecom operators in network densification, fiber backhaul, and small cell deployment are enhancing coverage and capacity across urban centers.

Value Chain Analysis of the Wireless Infrastructure Market

- Component Manufacturing & Technology Development: Component manufacturing and technology development are being influenced by a range of factors, including new materials, massive MIMO technology, and software-defined radios (SDRs).

Key Players: Qualcomm, Broadcom, Intel, Murata Manufacturing, and Skyworks Solutions. - Network Equipment & System Integration: Network equipment manufacturers integrate hardware with advanced software to create integrated wireless solutions (end-to-end), including base stations, core network solutions, network virtualisation, and cloud-native architectures.

Key Players: Ericsson, Nokia, Huawei Technologies, Samsung Networks, and ZTE Corporation. - Deployment, Operations & Managed Services: As networks become more complex, network operators have begun to use managed services to help them reduce operational costs and improve uptime by automating operations and performing predictive maintenance on their existing assets.

Key Players: American Tower, Crown Castle, SBA Communications, Tech Mahindra.

Top Companies Operating in the Wireless Infrastructure Market & Their Offerings

- NEC CORPORATION: It offers a comprehensive suite of products and services, mainly focusing on Open RAN (Radio Access Network) solutions, 5G core networks, along with associated system integration and automation services.

- NXP Semiconductors: NXP Semiconductors provides a comprehensive portfolio of RF, processing, and connectivity solutions, primarily aimed at enabling 4G, 5G, and emerging 6G network deployments.

- Cisco Systems, Inc.: Cisco Systems provides a comprehensive portfolio of wireless infrastructure products along with solutions for enterprises and even service providers, aiming for secure, scalable, and AI-powered connectivity.

- D-Link Corporation: It provides networking and wireless infrastructure solutions, including routers, switches, access points, and Wi-Fi systems for enterprise and consumer markets.

- Huawei Technologies Co., Ltd.: It offers end-to-end wireless infrastructure solutions, including 5G base stations, core networks, antennas, and cloud-enabled connectivity systems.

Wireless Infrastructure Market Companies

- Qualcomm Technologies Inc.

- ZTE Corporation

- Fujitsu Ltd.

- Mavenir

- Samsung

Recent Developments:

- On November 21, 2025, a Notice of Proposed Rulemaking was adopted by the Federal Communications Commission (FCC), proposing to make between 100 and 180 megahertz of the Upper C band available for commercial wireless services. This action aligns with the One Big Beautiful Bill Act, which directs the Commission to auction the spectrum by July 4, 2027. (Source:https://www.mintz.com )

- In January 2023, E-commerce giant Amazon announced its cargo service ‘Amazon Air' in India with 2 cargo aircraft. These cargo aircraft are expected to have a carrying capacity of 20,000 packages. Each Amazon Air aircraft will be shipping thousands of packages each day and fly across Bengaluru, Hyderabad, Delhi, and Mumbai. Amazon Air facilitates the faster shipment of goods from respective fulfillment centers to last-mile deliveries. Thus, faster shipments are estimated to support the wireless infrastructure market substantially.

- In September 2022, Ashwini Vaishnaw, the Telecom Minister of India announced that the country would be investing $30 billion to ensure that every village has access to 4G and 5G services. This announcement made at the Global Fintech Fest is aimed at creating a complete ecosystem of village entrepreneurs and providing high-speed data connectivity.

- In November 2025, NXP Semiconductor, a firm that designs purpose-built, rigorously tested technologies that enable devices to sense, think, connect, and even act intelligently, declared an OpenChain ISO/IEC 5230 conformant program.

Segments Covered in the Report

By Platform

- Defense

- Government

- Commercial

By Type

- Satellite

- 2G & 3G

- 4G

- 5G

By Infrastructure

- Small and Macro Cells

- Radio Access Networks

- Mobile Core

- Distributed Area Network

- SATCOM

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting