What is the Workflow Management System Market Size?

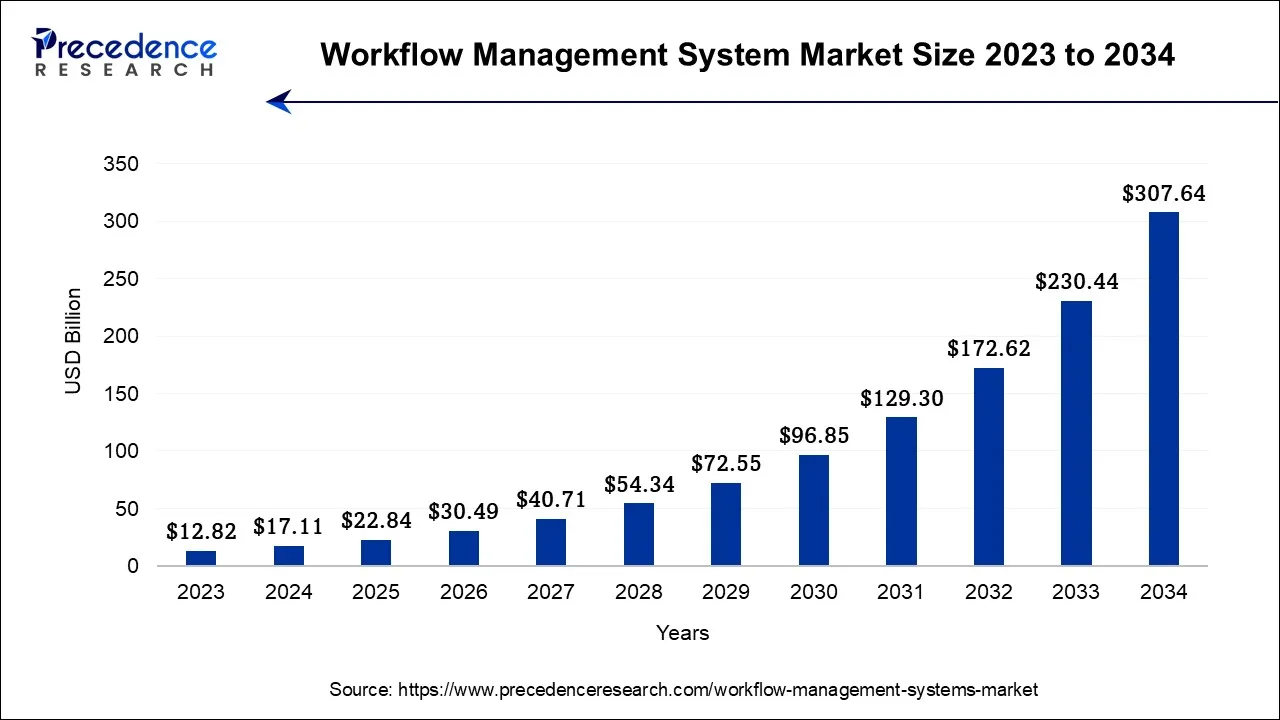

The global workflow management system market size is calculated at USD 22.84 billion in 2025 and is predicted to increase from USD 30.49 billion in 2026 to approximately USD 371.92 billion by 2035, expanding at a CAGR of 32.18% from 2026 to 2035.

Workflow Management System Market Key Takeaways

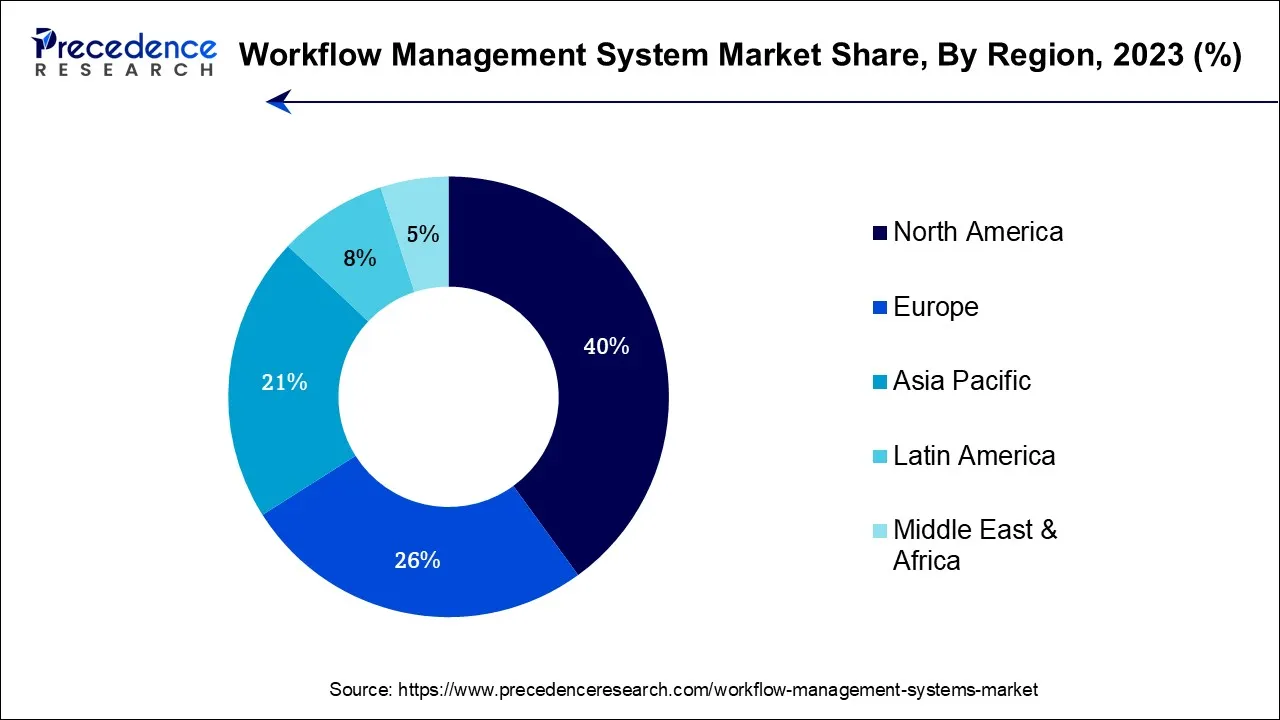

- North America region has accounted revenue share of 40% in 2025.

- By component, the software segment has accounted revenue share of 66.4% in 2025.

- By software, the production workflow system segment generated a revenue share of 36.3% in 2025.

- By service, the consulting segment has held a revenue share of 40.9% in 2025.

- By deployment, the cloud segment accounted for a market share of 67.9% in 2025.

- By vertical, the BFSI segment has captured a revenue share of around 32.8% in 2025.

Market Overview

A workflow management system (WFMS) is a specialized software tool utilized to establish, oversee, and execute workflows within organizations. This approach integrates both software programs and human resources into a cohesive process structure. By enhancing efficiency and cutting operational expenses, workflow management systems offer valuable business process management capabilities. These systems typically streamline workflows, processes, and automation.

The surge in demand for workflow management systems can be ascribed to the increasing necessity for corporate process modernization. Additionally, the ongoing digital transformation across industries has been a major driver for the adoption of WMS solutions. Organizations strive to modernize their processes and become more efficient, thus they are increasingly turning to WMS to automate workflows, reduce manual tasks, and improve overall productivity.

Workflow Management System Market Growth Factors

Workflow management systems offer robust process automation capabilities, allowing businesses to streamline their operations and achieve higher levels of efficiency. With automation, organizations can eliminate bottlenecks, reduce errors, and accelerate task completion, leading to cost savings and enhanced competitiveness. The growing popularity of cloud-based solutions has provided significant opportunities for the WMS market. Cloud-based WMS offers greater flexibility, scalability, and cost-effectiveness, making it accessible to businesses of all sizes. It also facilitates remote access, enabling organizations to manage workflows from anywhere, which became even more critical during the COVID-19 pandemic and the rise of remote work.

Furthermore, the implementation of workflow management software is expected to drive market growth, primarily due to its associated benefits, such as cost efficiency, improved resource utilization, and enhanced business processes. As businesses expand and encounter changes in their operations, the increased handling of larger data volumes and additional functionalities creates a demand for workflow management software. These factors are set to fuel the continued growth of the workflow management system market. Also, the integration of AI and machine learning technologies into WMS platforms offers opportunities for intelligent process automation, predictive analytics, and continuous improvement, further enhancing the value proposition of these systems.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 22.84Billion |

| Market Size in 2026 | USD 30.49 Billion |

| Market Size by 2035 | USD 371.92 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 32.18% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment, Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing need for transforming customer and employee experience

Undoubtedly, once individuals experience the convenience of mobile apps they become unwilling to revert to the old ways. As a result, expectations for interfaces and overall service excellence escalate, necessitating companies to adapt to stay competitive. Surveys show that 84% of organizations that prioritize enhancing customer experience observe a subsequent increase in revenue. It is no surprise that customer experience has become the new battleground, with 89% of businesses soon expected to compete primarily based on this factor, according to Gartner surveys. Additionally, meeting employee expectations is equally crucial, as failing to do so can lead to reduced loyalty, increased turnover, and related expenses.

Companies recognize the importance of structured onboarding programs, as employees who undergo such programs are 58% more likely to remain with the organization for three years. In response to new employee expectations, many companies are implementing automated onboarding processes, supported by workflow management software, to streamline and expedite employee assessment, hiring, training, and onboarding workflows. Furthermore, employees expect a unified platform for accessing IT, procurement, HR, and other internal services. This trend revolves around integrating user-friendly interfaces, customer mapping, multi-device accessibility, artificial intelligence, and various other features to continuously enhance services for both customers and employees. When selecting a workflow management tool, it is essential to ensure its capacity to support service improvement initiatives. However, workflow management systems is significant in this transformation by automating and optimizing workflows, allowing organizations to deliver faster, more personalized, and efficient services to their customers.

Restraints

Data privacy and security issues

Amidst the emergence of a new breed of online criminals during the pandemic, many business leaders continue to rely on manual processes to safeguard against online data theft. By depending solely on physical security measures, they may avoid the need to adapt to ever-evolving hacking techniques. However, while manual workflows may offer short-term protection, they do not absolve businesses of potential risks, including data loss and potential downtime. To address these challenges, it is imperative to select a workflow automation tool equipped with advanced security features to safeguard the collected data.

A prudent approach involves opting for a solution with top-tier workflow automation features, such as database encryption, password protection, and workflow tracking. By ensuring these innovative security measures are in place, businesses can gain real-time insight into the status of their workflows, promptly identify any threats, and swiftly take action to resolve them. Embracing such a security-focused workflow automation tool empowers organizations to proactively protect their data and defend against evolving cyber threats, ensuring a more robust and secure operational environment.

Opportunities

Collaboration of RPA and workflow management

The collaboration of RPA and workflow management is likely to offer growth opportunities for the workflow management system market in the years to come. The adoption of RPA (Robotic Process Automation) is rapidly increasing due to the efficiency of bots in handling low-level and repetitive tasks, often replacing human involvement. Early adopters in shared services and administrative organizations have already experienced significant benefits from RPA implementation. According to the 2018 Deloitte Global RPA Survey, 53% of respondents had embarked on their RPA journey, with substantial improvements observed across various dimensions, including enhanced compliance (92%), improved quality/accuracy (90%), increased productivity (86%), and cost reduction (59%).

However, it is essential to recognize that bots are limited when dealing with implicit processes, a capability humans possess. As a result, many businesses are adopting a combined approach, leveraging both RPA and workflow management technologies. In this model, bots and humans collaborate to complete workflow tasks, with task assignment and flow control managed by the workflow management solution. This integrated approach is gaining popularity, and it is foreseeable that future scenarios will require close cooperation between humans and bots. Therefore, it is crucial for businesses to ensure that their workflow management software offers an open API for seamless integration with RPA systems and supports effective human-bot collaboration.

Segment Insights

Product Insights

On the basis of software, the production workflow system segment held a considerable revenue share in 2025. Implementing production workflow software leads to reduced overhead costs, time savings, increased profitability, and improved visibility into the production processes within the business. It significantly reduces overhead costs by streamlining and automating production processes, eliminating the need for excessive manual interventions and optimizing resource allocation. This reduction in overhead expenses allows businesses to allocate their financial resources more efficiently, thereby enhancing overall financial health and sustainability.

As businesses seek to optimize their production workflows, they are turning to advanced software solutions that streamline operations, reduce manual interventions, and enhance overall efficiency. These factors are likely to create opportunities for the segment growth of the workflow management system market during the forecast period.

Application Insights

Based on the application, the BFSI segment held the largest market share in2025. Utilizing workflow management software enables the banking industry to streamline and optimize various processes. Traditional credit card application processing often consumes significant time, leading to customer dissatisfaction. However, with the implementation of hyper-automation, banks can expedite this workflow. By collating and verifying information, running background checks, and assessing customer eligibility within a few hours, the workflow management software facilitates faster credit card processing, ultimately enhancing customer satisfaction and retention.

Furthermore, ensuring accurate and up-to-date general ledgers is crucial for effective financial information tracking in banks. Hyperautomation proves instrumental in improving the accuracy and efficiency of general ledger management. Equipped with predefined rules, the workflow management software automates the process of updating liabilities, assets, expenses, and revenue in the general ledger. This reduction in manual data entry and automated calculations results in maintaining error-free general ledgers with an impressively quick turnaround time. Embracing hyper-automation in this aspect significantly contributes to improved financial reporting and regulatory compliance, solidifying the overall efficiency and reliability of banking operations.

Regional Insights

U.S. Workflow Management System Market Size and Growth 2026 to 2035

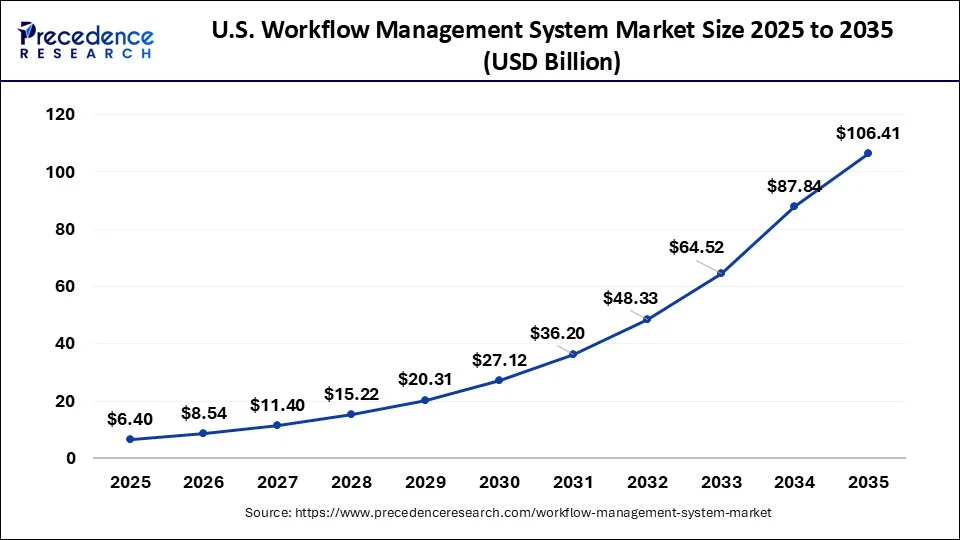

The U.S. workflow management system market size is accounted for USD 6.40 billion in 2025 and is projected to be worth around USD 106.41 billion by 2035, poised to grow at a CAGR of 32.46% from 2026 to 2035.

North America held the largest revenue share in 2025. The US dominated the North America region in2023. The increasing adoption of digital transformation strategies along with rapid integration of process automation in the region has created a favorable environment for the growth of the workflow management system market during the forecast period. Furthermore, the increasing focus on data security is also likely to support the regional growth of the market. During the transition from legacy to new-age technologies, a workflow management system solution is significant in ensuring the security and safety of data.

U.S. Market Analysis

The U.S. dominates the North American workflow management system market due to widespread digital transformation, high adoption of cloud-based solutions, and strong demand for business process automation. Advanced IT infrastructure, presence of leading software providers, and the need for efficiency and cost reduction across enterprises further drive market growth.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. The regional growth of the workflow management system market is expected to be boosted during the forecast period due to the rising demand for eliminating task redundancies and promoting productivity and efficiency. Furthermore, the region is witnessing economic growth as well as industrial development creating an environment for the adoption of advance technologies. This is also expected to support the growth of the market within the estimated timeframe. Additionally, the rising need for collaboration and communication along with growing IT infrastructure is also anticipated to contribute to the growth of the market in the region.

India Market Analysis

India's workflow management system market is growing rapidly due to increasing digitalization across industries, rising adoption of cloud-based and SaaS solutions, and the need for streamlined business processes. Government initiatives supporting digital transformation, expanding IT and manufacturing sectors, and growing awareness of automation benefits among SMEs and large enterprises further accelerate the demand for WFMS solutions.

Europe: A Notably Growing Region

Europe is expected to grow at a notable rate during the forecast period due to the increasing adoption of automation and digital transformation across industries. Strong focus on regulatory compliance, efficiency improvement, and process optimization drives demand. Additionally, the presence of established software vendors, growing cloud-based solution adoption, and initiatives to modernize enterprise operations contribute to steady market growth in the region.

UK Market Analysis

The market in the UK is growing steadily due to rising digital transformation initiatives, demand for process automation, and increasing adoption of cloud-based solutions. Organizations aim to enhance operational efficiency, reduce manual tasks, and ensure regulatory compliance. Strong IT infrastructure, government support for digitalization, and the presence of key software providers further drive market expansion.

Workflow Management System Market Companies

- Microsoft Corporation: Offers cloud-based workflow solutions through Power Automate, enabling process automation, integration with Microsoft 365, and enhanced productivity across enterprises.

- IBM Corporation: Provides IBM Cloud Pak for Business Automation, supporting workflow automation, AI-driven decision-making, and enterprise process optimization.

- SAP SE: Delivers SAP Workflow Management and Business Process Intelligence tools for automated workflows, analytics, and digital process transformation.

- Oracle Corporation: Offers Oracle Cloud Applications with workflow automation, process optimization, and integration for enterprise efficiency and scalability.

- Salesforce.com, Inc.: Provides Salesforce Flow for automating business processes, improving customer engagement, and enhancing operational efficiency within CRM platforms.

- ServiceNow, Inc.: Offers Now Platform with workflow automation, digital process transformation, and enterprise service management capabilities.

- PegaSystems Inc.: Delivers Pega Platform for dynamic workflow automation, customer engagement, and intelligent process management across industries.

Other Major Key Players

- Nintex Global Ltd.

- Appian Corporation

- Zoho Corporation Pvt. Ltd.

- Software AG

- Xerox Corporation

Recent Developments

- In July 2023, FPT Software launched FezyFlow, a no-code workflow platform designed to support AI-driven digital transformation by enabling organizations to leverage non-IT resources efficiently.

(Source: fptsoftware.com ) - In January 2023, CenTrak launched WorkflowRT, a scalable cloud-based platform that automates workflows and communications, minimizing manual documentation throughout clinical care processes.

(Source: centrak.com ) - In May 2023, Monday.com Ltd. unveiled monday dev, an innovative product that consolidates software development tracking in one unified platform, fostering seamless collaboration among developers, engineers, and administrators. Through monday dev's integration with Work OS, product and development teams can effortlessly collaborate with other departments, enabling them to effectively strategize product roadmaps, manage sprints, plan releases, gather customer feedback, and handle backlogs. This integration is anticipated to empower organizations to channel their development efforts and resources towards achieving product success.

- In November 2021, Harbinger Group entered into a strategic partnership with Workato, a prominent intelligent integration and automation platform. This collaboration aims to expedite integration processes and automate intricate HR and business workflows for enterprise and software product companies. In the realm of HRTech, this partnership will facilitate seamless connections with over 60+ HCM platforms, streamlining customer acquisition with embedded integrations.

Segments Covered in the Report

By Component

- Software

- Production Workflow Systems

- Messaging-based Workflow Systems

- Web-based Workflow Systems

- Suite-based Workflow Systems

- Others

- Service

- Consulting

- Integration

- Training & Development

By Deployment

- Cloud

- On-premise

By Vertical

- IT & Telecommunication

- BFSI

- Healthcare

- Retail

- Transportation

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting