What is the Supply Chain Management Market Size?

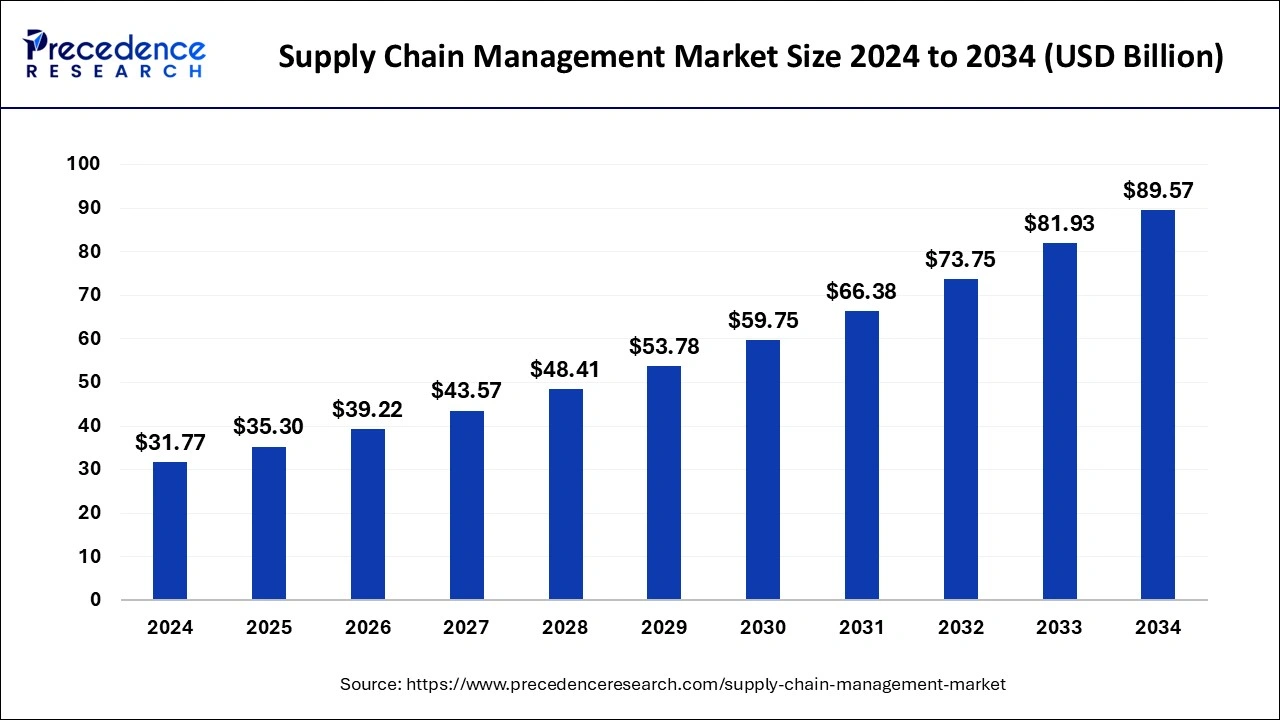

The global supply chain management market size is calculated at USD 35.30 billion in 2025 and is predicted to increase from USD 39.22 billion in 2026 to approximately USD 89.57 billion by 2034, expanding at a CAGR of 11.50% from 2025 to 2034.

Supply Chain Management Market Key Takeaways

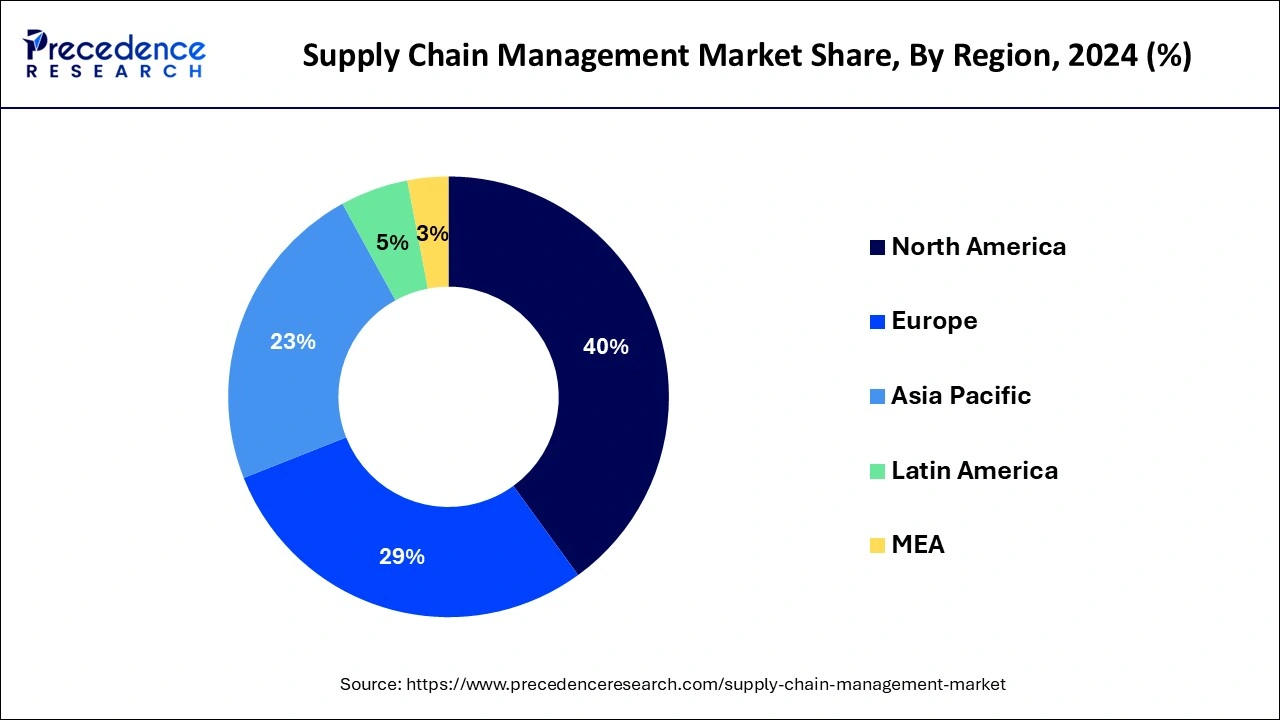

- North America generated the largest market share of 39.34% in 2024.

- By Component, the solution segment recorded the maximum market share in 2024.

- By Enterprise Size, the large enterprise segment contributed the highest market share in 2024.

- By Deployment Mode, the on-premises segment generated the largest market share in 2024.

Market Overview

The rise in demand and greater understanding of the advantages of SCM solutions, such as logistics management, transportation planning and analytics, predicting future accuracy, warehouse and inventory management, supply chain optimization, acquisition and sourcing, minimization of waste, manufacturing execution, and pertinent synthesis of business data, can be attributed to the growth of the SCM market. Also, the fast-expanding use of information systems and technological advancements supports and improves the entire supply chain, which helps the industry thrive.

The COVID-19 outbreak had a favourable effect on the intended audience. Due to the increased use of SCM to forecast and fulfil supply and demand requirements during the COVID-19 pandemic, a considerable increase has been seen.

Supply Chain Management Market Growth Factors

A supply chain is the collection of activities that include developing new goods or services, acquiring raw materials, processing those materials into semi-finished or finished goods, transporting those goods, and distributing or distributing them to customers. Supply chain management refers to the group of applications used to coordinate and integrate all the aforementioned actions in a seamless manner as well as to offer customer care after the sale (SCM). It is simply the coordinated oversight of the movement of commodities from the supplier to the user stage.

The links and connections in this chain connect each of the partners, including information technology vendors, vendors, independent contractors, carriers, and others. The global SCM market is expanding as a result of increased technical development, investments, and demand for supply chain administration services and software across various businesses and industries. Also, a rise in the use of SCM software by pharmaceutical and healthcare organisations has a beneficial effect on the expansion of the supply chain management market. However a lack of knowledge about supply chain management technology and a rise in privacy and security worries among companies are impeding the market's expansion.

On the other hand, it is anticipated that throughout the projected period, an increase in modern technology for communication and information would present lucrative chances for the advancement of the SCM market.

Supply Chain Management Market Outlook:

- Industry Growth Overview: The supply chain management market is expected to experience strong growth between 2025 and 2034, driven by rapid digital transformation and the need to enhance operational efficiency. Enterprises are prioritizing end-to-end, real-time monitoring to manage complex multi-tier supply networks effectively. The adoption of cloud-based and AI-enabled solutions is facilitating predictive analytics and dynamic decision-making, while omnichannel retail strategies and rising delivery demands are further accelerating market growth.

- Digitalization and Technology Innovations:Advanced technologies are revolutionizing supply chain functions, making them smarter, faster, and more resilient. Companies are leveraging AI, machine learning, IoT sensors, and advanced analytics to predict demand, optimize inventory, and boost operational efficiency. Blockchain is being adopted to enhance transparency, traceability, and compliance across supplier networks, particularly in industries like food, pharmaceuticals, and high-value manufacturing. Cloud-based solutions enable real-time collaboration among suppliers, manufacturers, and distributors, minimizing delays and bottlenecks.

- Global Expansion: Leading SCM solution vendors are actively expanding their global presence to tap into emerging markets and offer localized services to multinational clients. Regions such as Southeast Asia, Latin America, and Eastern Europe are attracting significant investments due to rising industrialization, booming e-commerce, and growing demand for digital logistics solutions. Companies like Oracle, Kinaxis, and Manhattan Associates are setting up regional offices and innovation hubs to ensure faster deployment, regulatory compliance, and customized solutions. Collaborations with local logistics providers and system integrators are further easing implementation in these new markets.

- Major Investors: Investments are focused on AI-powered planning, real-time visibility solutions, digital procurement platforms, and autonomous logistics technologies. Firms such as Silver Lake, Thoma Bravo, and Warburg Pincus are actively investing in SCM startups and mid-sized companies with strong growth potential.

- Ecosystem Startup:The SCM startup ecosystem is rapidly maturing, focusing on AI-driven predictive analytics, autonomous logistics, and cloud-based supply chain orchestration and risk management. Emerging companies such as FourKites (USA), Logically (UK), and Project44 (USA) are providing innovative solutions for real-time tracking, demand forecasting, and supplier risk monitoring. This dynamic startup environment ensures a continuous influx of new tools aimed at enhancing efficiency, visibility, and sustainability across the global supply chain network.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 35.30 Billion |

| Market Size in 2026 | USD 39.22 Billion |

| Market Size by 2034 | USD 89.57 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.50% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Solution Type, Deployment Mode, Enterprise Size, and Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing adoption of cloud supply chain management among SMEs

Contemporary organizations are heavily reliant on technology. While most startups and SMEs lack a functional IT department system on their own, large corporations have a dedicated IT department for managing and sustaining business processes. The rationale is that managing and sustaining an IT department is more expensive. Therefore, the majority of SMEs and startups choose to use a cloud-based SCM system so they may benefit from an IT department's services without having to hire additional people or incurring additional expenses. This enables internal staff to concentrate on ongoing business operations.

The scalability provided by the cloud-based SCM's flexibility in storage is crucial for SMEs and will aid them in coping with unforeseen growth during the first year of operation. Moreover, cloud-based SCM provides SMEs with strong inventory management that is very responsive to current business trends. When purchasing goods, for instance, the cloud-based SCM offers cost savings and an alluring pay-as-you-go model, such as real-time payment over the cloud, allowing SMEs to position themselves as effective and competitive competitors among other firms. The cloud-based SCM system can also be used by SMEs to create business initiatives that increase sales and profits.

Restraint

Growing security and privacy concerns among enterprises

Businesses using cloud-based SCM must deal with security and privacy concerns. Businesses have sensitive information that must be kept secure to prevent theft and data breaches, which could damage the companies' overall brand. Data leakage via the Internet and access by unauthorized users are concerned businesses are becoming more and more concerned about.

For instance, a multitenant architecture is required for the cloud-based transportation management system, which runs a single instance of the software on a server that is shared by several clients. Thus, there is a chance that customers of a business could see information about rivals. The enterprise's security of data and competitive market position will likely be threatened by these security issues involving unauthorized persons accessing the data. Due to the increased concern among businesses about security and privacy, the cloud SCM market's growth is being constrained over the projected period.

Opportunity

Advances in technologies are making evolution to the supply chain industry

The evolution of the supply chain is becoming increasingly feasible thanks to developments in technology for communication and information. Cloud computing, IoT, 5G, 3D printing, blockchain, AI, and robotics are just a few of the technologies that will be essential to the development of the future digital supply network. For instance, a functional distribution network must include critical components that enable real-time tracking, such as openness and accountability. Today's GPS monitors can track everything about a shipment, including its location and temperature, giving logistics professionals real-time information that helps them completely comprehend how their supply chains work.

For high-value products and items during the ongoing COVID-19 outbreak, real-time tracking is helpful. With IoT data and device check-ins, the whole chain of custody for a cargo can be shown and confirmed. One example of how IoT devices might help safeguard clients from ruined goods is by automatically flagging shipments that have left a proper temperature zone.

Component Insights

The global market is divided into services and solutions based on components. The solution category is further broken down into the following subcategories: planning and analytics, warehousing and inventory management system, procurement and sourcing, and factory execution system. Over the forecast period, the solution segment, which had the biggest share in 2023, is anticipated to rule the market. Quality control, supplier management, and logistics management are all handled by SCM solutions. SCM solutions offer advantages including improved visibility, efficiency, analytics, cost savings, increased agility, and increased compliance throughout the intricate supply chain. It helps automate complicated processes like order processing, billing, and order tracking, which saves time and money on administrative costs.

In 2024, the segment for transportation management systems had the biggest share. Freight movement is planned using a transportation management system, which also helps clients effectively plan and carry out transportation-related tasks throughout the supply chain. Because TMS have a significant impact on every stage of the supply chain, from planning and procurement to logistics and lifecycle management, demand for TMS has been growing quickly. Solutions for smart sensor technology and intelligent wireless communication are being used to give businesses precise information about automobiles. With the use of this technology, businesses can give customers real-time tracking information such as the delivery route, present location, and anticipated time of arrival, improving the supply chain process.

Enterprise Insights

The target market is anticipated to be dominated by the large enterprise segment, which had the greatest market share in 2023. Increased demand for automation features and continuous monitoring systems, including advanced shipment notification administration, customizable updates, in-transit newsfeeds, user-configurable visualisations, and visual supply chain maps, can be attributed to the growth in a number of significant industries. Large organisations can improve their business decisions, including supply planning, stock management, and distribution planning, by using SCM's access to precise significant freight analytics and flexibility in producing reports.

The market is expanding as a result of a significant growth in the demand for software in major businesses to gather crucial business data such inventory levels, anticipated sales data, supplier details, and others. For instance, Microsoft announced the debut of its supply chain platform in November 2022 and provided a demonstration of the platform through its supply chain centre.

The apps and data used in supply chains are compatible with Microsoft's supply chain centre. Agility and stability of the supply chain are directly correlated with how efficiently businesses integrate and coordinate their data across all major platforms. The Azure, Microsoft Teams, Power Platform, and Microsoft Azure supply chain platform lay the basis for large enterprises to create or independently adopt solutions for particular supply chain needs.

Deployment Insights

In 2024, the on-premises market category held the highest market share. Throughout the projection period, the cloud-based segment is anticipated to develop significantly at a CAGR. Businesses are implementing cloud-based technologies to improve the supply chain process's flexibility and adaptability. It also provides a number of advantages, including improved processing power, storage, cost-effective pricing models, and a decrease in administrative costs. These advantages are promoting market expansion.

- In order to implement its SCM software on Microsoft Azure Cloud, Blue Yonder and Microsoft teamed in February 2019. Commercial customers received greater flexibility and security from Blue Yonder. Blue Yonder concentrated on creating cutting-edge apps for clients and partners on the SCM platform by integrating Machine Learning (ML) and Artificial Intelligence (AI) technology.

Regional Insights

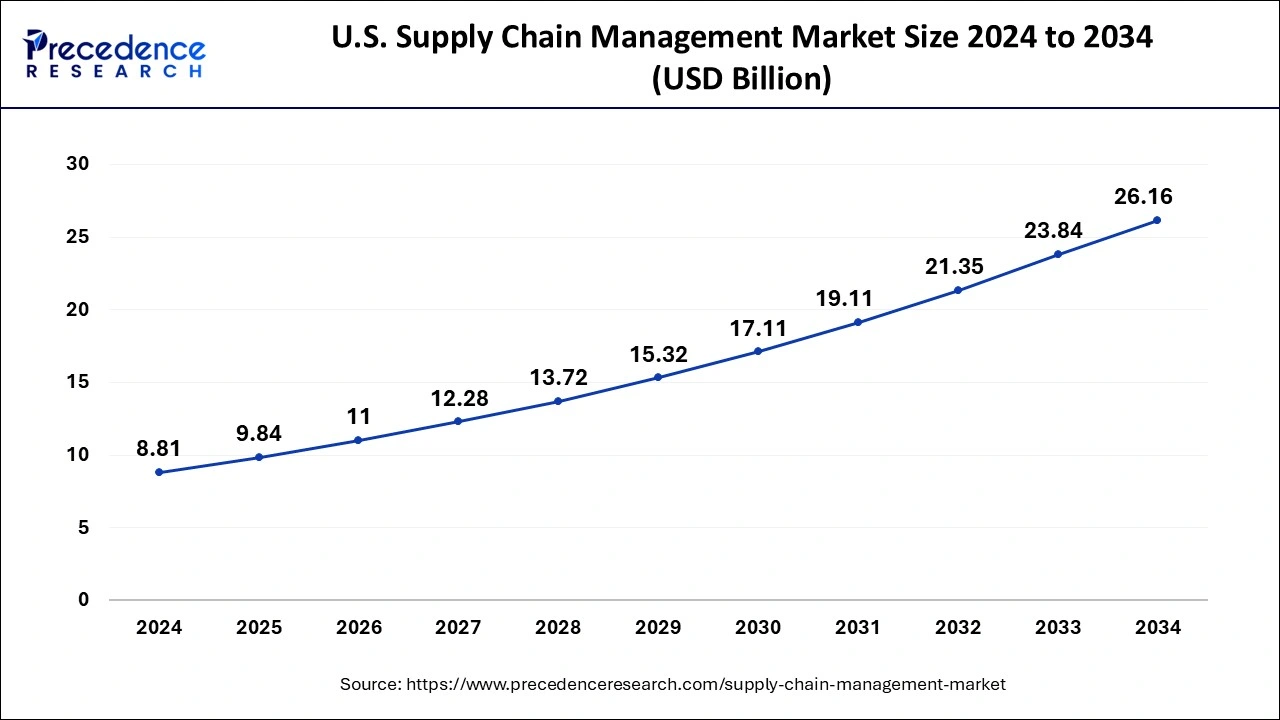

U.S. Supply Chain Management Market Size and Growth 2025 to 2034

The U.S. supply chain management market size is evaluated at USD 9.84 billion in 2025 and is projected to be worth around USD 26.16 billion by 2034, growing at a CAGR of 11.50% from 2025 to 2034.

In terms of SCM vendor presence, North America is the most developed technological region in the globe. SCM services and solutions are widely used in North America. Her SCM market is dominated by the United States in North America. Several sectors in the region, including BFSI, healthcare, retail, manufacturing, and retail, have embraced SCM services. The need for his SCM in the area has grown as a result of the expanding IoT trend and emphasis on improving the efficiency of supply chain operations such as logistics, warehousing, fulfilment, production, and transportation management.

U.S. Supply Chain Management Market Analysis

The U.S. dominates the North American supply chain management market due to its advanced logistics infrastructure and widespread adoption of digital supply chain platforms. Companies are leveraging solutions for demand forecasting, inventory management, and real-time shipment tracking to meet the growing needs of e-commerce. Additionally, investments in sustainability, carbon footprint monitoring, and regulatory compliance are driving demand for sophisticated SCM tools.

Huge investments in infrastructure by governments and private companies, especially in India and Indonesia, to facilitate mobility and improve infrastructure, are expected to boost the demand for SCM in the Asia-Pacific region. The latest trends in trucking, containerization, and computerization are increasing the scale of shipments and deliveries of raw materials, work-in-progress (WIP), and finished goods around the world, effectively controlling supply chain cost, quality, and delivery. Improving. For SCM software and services.

What Makes Europe a Significantly Growing Area?

Europe is expected to grow significantly in the supply chain management market during the forecast period. The growing digitalization in Europe is increasing the use of advanced technologies to enhance supply chain management. This, in turn, improves their use in various sectors such as healthcare, automotive, etc. Moreover, the increasing manufacturing of the products is also increasing their demand. At the same time, the regulatory bodies are providing their support to make them more transparent, increasing their acceptance rates. Thus, all these developments, along with the government support, are promoting the market growth.

China Supply Chain Management Market Analysis

China's supply chain management market growth is driven by massive manufacturing output, rapidly expanding e-commerce, and government initiatives promoting smart manufacturing and digital infrastructure. Future growth is expected to come from cloud-based procurement and supply chain orchestration platforms, which offer predictive demand forecasting, supplier risk management, and real-time visibility. Additionally, business organizations are paying more attention to agility and responsiveness to market changes and regulatory demands.

Germany Supply Chain Management Market Analysis

Germany's supply chain management market has been expanding due to its robust manufacturing and automotive sectors, which demand precise warehouse management, supplier coordination, and logistics planning. Companies are leveraging robotics, automated storage and retrieval systems, and advanced inventory optimization to maintain efficiency and reduce costs. The rise of omnichannel retail and digitalized manufacturing supply chains further drives the adoption of predictive analytics for scenario-based forecasting, while Germany's central location in Europe and strong IT infrastructure reinforce its role as a key SCM hub.

What Potentiates the growth of the Market in Latin America?

Latin America's supply chain market is growing, driven by rising e-commerce penetration, regional trade expansion, and the modernization of logistics infrastructure. Demand is increasing for integrated tracking, route optimization, and freight management tools as businesses seek to reduce operational inefficiencies. Investments in digital platforms are enhancing supply chain responsiveness by improving warehouse coordination and product monitoring, with countries like Brazil and Mexico expected to lead growth due to infrastructure upgrades and private-sector digital adoption.

Brazil Supply Chain Management Market Analysis

Brazil leads the market in Latin America due to increasing e-commerce, expanding cross-border trade, and modernizing logistics networks. Transportation and distribution optimization solutions are expected to play a leading role in the coming years. Companies have tried to reduce delays, improve route efficiency, and manage fragmented supply chains. Additionally, the adoption of SCM technology is likely to increase through investments in warehouse automation, real-time shipment visibility, and freight management software.

How is the Opportunistic Rise of the Middle East & Africa (MEA) in the Market?

The MEA offers significant opportunities in the supply chain management market due to increased logistics and trade activity, expansion of free trade zones, and the adoption of modern warehouse practices in the oil & gas, construction, and retail sectors. Achieving demand visibility, collaborating with suppliers, and managing risks are some ways companies are navigating geographically dispersed and complex supply networks. The adoption is supported by e-commerce growth, increased regional trade integration, and investment in smart ports and logistics corridors.

UAE Supply Chain Management Market Analysis

In the UAE, the market is growing due to strategic investments in logistics infrastructure, smart ports, and regional trade corridors, especially in Dubai and Abu Dhabi. The growth of e-commerce, regional trade agreements, and the free-zone logistics hubs strengthens the adoption of digital supply chain solutions. Organizations are increasingly focused on resilience, regulatory compliance, and operational optimization, which drives continued expansion in the marketplace.

Supply Chain Management Market – Value Chain Analysis

- Supply Chain Planning & Strategy

The foundation of SCM lies in planning, forecasting, and strategizing the end-to-end flow of goods, services, and information across suppliers, manufacturers, and distributors.

Key Players:SAP, Oracle, Kinaxis, Blue Yonder, Logility - Procurement & Supplier Management

Organizations source raw materials, components, or services and manage supplier relationships, contracts, and compliance. Advanced procurement software ensures cost optimization and supplier collaboration.

Key Players: Coupa, JAGGAER, SAP Ariba, Epicor - Inventory & Warehouse Management

Goods are stored, tracked, and managed in warehouses, ensuring optimal inventory levels, reducing carrying costs, and improving order fulfillment efficiency.

Key Players:Manhattan Associates, Körber, BluJay Solutions, IBM - Transportation & Logistics Management

Movement of goods across the supply chain involves routing, fleet management, and real-time tracking to ensure timely deliveries and lower logistics costs.

Key Players: Descartes, BluJay Solutions, SAP, Oracle - Order Fulfillment & Customer Service

Completed orders are processed, tracked, and delivered to end-customers, integrating order management systems with fulfillment operations for seamless customer experience.

Key Players: Manhattan Associates, Blue Yonder, Epicor, Kinaxis - Data Analytics & Supply Chain Optimization

Advanced analytics, AI, and machine learning enable predictive insights, risk management, and continuous optimization of supply chain processes.

Key Players:IBM, SAP, Kinaxis, Blue Yonder, Logility

Top Companies in the Supply Chain Management Market

- SAP (Germany): Provides integrated supply chain solutions including planning, logistics, and real-time analytics for global enterprises.

- Oracle (U.S.): Offers cloud-based SCM software covering procurement, inventory management, logistics, and order fulfillment.

- Infor (U.S.): Delivers industry-specific SCM software for manufacturing, distribution, and supply chain planning.

- Descartes (Canada): Specializes in logistics and transportation management solutions, including route planning and fleet optimization.

- Manhattan Associates (U.S.): Provides supply chain and omnichannel commerce solutions, including warehouse, transportation, and inventory management.

- IBM (U.S.): Offers AI-driven supply chain solutions, blockchain for traceability, and predictive analytics for end-to-end visibility.

- Logility (U.S.): Provides supply chain planning and demand forecasting software for manufacturing and retail industries.

- Kinaxis (Canada): Delivers cloud-based supply chain planning and risk management solutions for real-time decision-making.

- Blue Yonder (U.S.): Offers AI-powered supply chain and retail solutions, including demand planning, fulfillment, and logistics optimization.

- Körber (Germany): Provides supply chain execution software and warehouse automation solutions for global logistics operations.

- Coupa (U.S.): Focuses on procurement, spend management, and supplier collaboration to optimize supply chain costs.

- Epicor (U.S.): Offers supply chain management and ERP software solutions for manufacturing, distribution, and retail sectors.

- BluJay Solutions: Provides global trade and transportation management software for logistics, customs, and compliance.

- OMP (Belgium): Delivers advanced supply chain planning and optimization software for demand, production, and inventory.

- E2open (U.S.): Provides a connected supply chain platform integrating planning, execution, and collaboration across partners

Supply Chain Management Supply Chain Companys

- JAGGAER

- Zycus

- GEP

- Tive

- Calista

- MOST

- Freightify

- 4TiGo

- Trukky

- Lobb

Recent Development

- In June 2025, a collaboration to develop a new center for advancing logistics between FedEx and IIT Bombay was announced. To provide student entrepreneurship and innovative solutions for supply chain challenges will be the aim of this center, named the FedEx ALPHA Centre. Furthermore, real-world problem solving and data-driven approaches to promote future talent were highlighted in this initiative.

(Source:https://www.devdiscourse.com)

- In June 2025, a new extended warehouse facility was inaugurated by DKSH Brunei, which is a leading provider of Market Expansion Services in Asia and beyond in Brunei. This inauguration will help to support the resilience and growth of the healthcare supply chain of the nation and will solidify the capabilities of DKSH Brunei.

(Source:https://www.manilatimes.net)

- In May 2025, a new supply chain product as well as an expanded strategic partnership programme was launched by a Supply Chain Attack Surface Management (EASM) and Digital Asset Discovery expert, that is, ThingsRecon. To provide the government and organizations the next-generation, comprehensive security solutions and to support cybersecurity consultancies, managed security service providers (MSSPs), and application cybersecurity partners, the initiative will be utilized.

(Source:https://www.sourcesecurity.com)

- By releasing its new Planning in May 2022, Kinaxis revealed development in supply chain planning using sophisticated analytics. At Kinexions' 2022 annual supply chain innovation conference, an AI analytical technique will be presented. Planning is a component of the Kinaxis RapidResponse platform. The only concurrent planning method that can automatically identify and combine the ideal blend of heuristics, optimisation, and machine learning is artificial intelligence.

- Descartes' multi-carrier parcel and less-than-truckload (LTL) shipping solution, Descartes ShipRush, has been linked with its collection of e-commerce warehouse management solutions, the company announced in March 2022. (WMS). Using a consolidated solution, this connection enables customers to increase the efficiency of their shipping and warehouse operations.

Segment Covered in the Report

By Component

- Solution

- Service

By Solution Type

- Transportation Management System

- Warehouse Management System

- Supply Chain Planning

- Procurement And Sourcing

- Manufacturing Execution System

By Deployment Mode

- On-premise

- On-Demand/Cloud-Based

By Enterprise Size

- Large Enterprise

- SMEs

By Industry Vertical

- Retail and Consumer Goods

- Healthcare and Pharmaceuticals

- Manufacturing

- Food and Beverages

- Transportation and Logistics

- Automotive

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting