List of Contents

What is the Unmanned Aerial Vehicle Market Size?

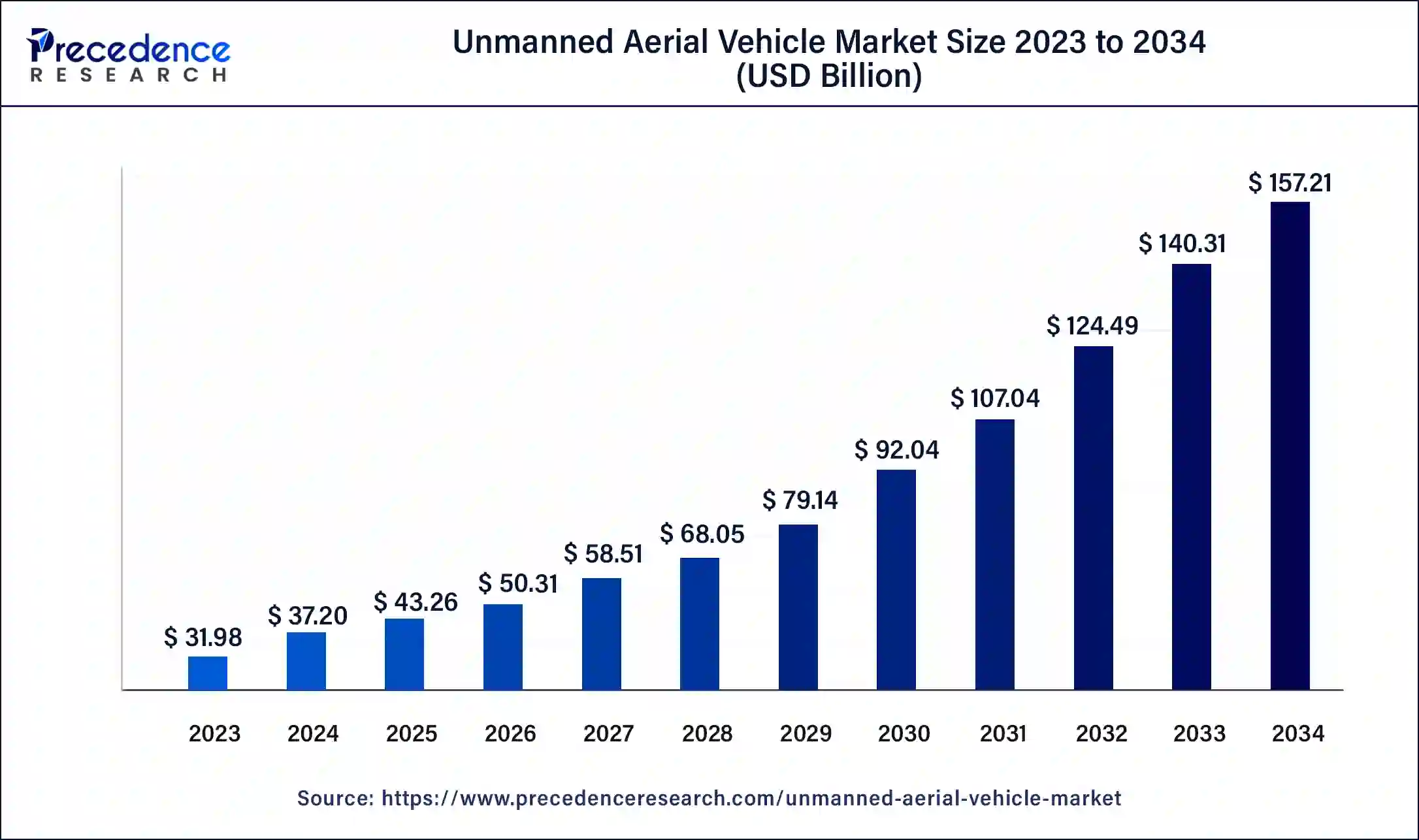

The global unmanned aerial vehicle (UAV) market size accounted at market size is valued at USD 43.26 billion in 2025 and is predicted to increase from USD 50.31 billion in 2026 to approximately USD 157.21 billion by 2034, expanding at a CAGR of 15.50% from 2025 to 2034.

Unmanned Aerial Vehicle Market Key Tackeways

- In terms of revenue, the unmanned aerial vehicle (UAV) market is valued at $43.26 billion in 2025.

- It is projected to reach $157.21 billion by 2034.

- The unmanned aerial vehicle (UAV) market is expected to grow at a CAGR of 15.50% from 2025 to 2034.

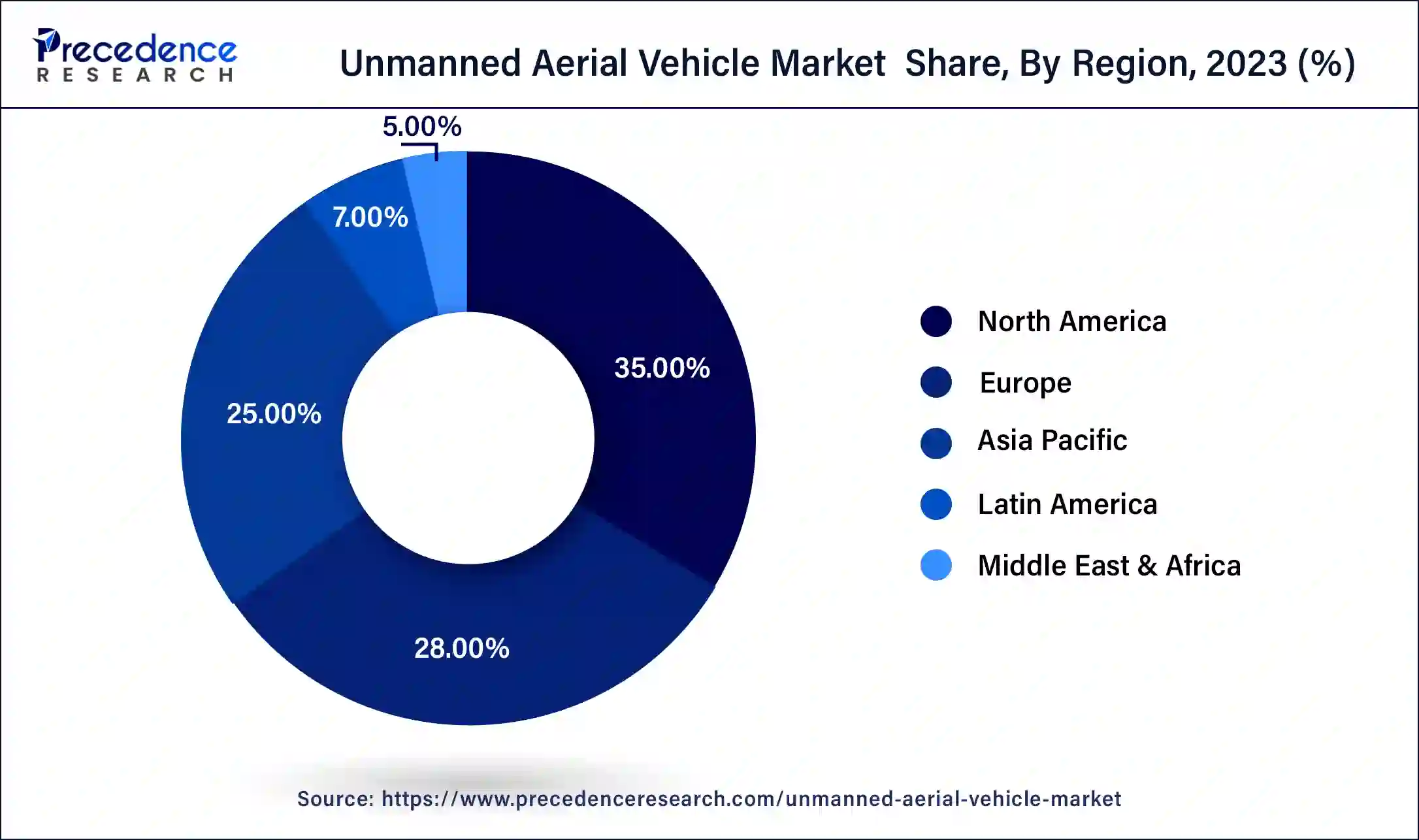

- The UAV market in North America dominated global revenue share.

- By Technology Analysis, the fully-autonomous technology segment is poised to experience rapid growth in 2024 To 2034.

- By Application, military segment anticipated to hold the major revenue share during the forecast period.

How is the Market Desiring Prominent Expansion?

Unmanned Aerial Vehicles (UAVs) commonly recognized as drone are equipped with internal computers that can be controlled from ground. Their advanced aerodynamic structures are designed with a vision to perform multiple functions using the desired navigation system. Initially, the technology was designed for dangerous military mission to save human life from risk. UAVs specifically designed for the military applications are well equipped with missiles in order to hit the specific targets when operated from high altitude.

Prominent growth of construction industry across the globe is one of the key factors likely to propel the market growth for Unmanned Aerial Vehicle (UAV) during the upcoming years. As per the report published by PwC in the year 2018, the global construction sector predicted to grow by 85% in terms of volume and estimated to reach US$ 15.5 trillion by the year 2030. In addition, 57% of the volume share analyzed to be contributed by key countries that include China, U.S., and India across the overall industry growth.

Moreover, the construction industry has greater significance in planning and design before heading towards the major construction and infrastructure projects. Hence, there is strong requirement for map designing and surveying for collection data of complex surface area. This requires prominent amount of time and money as well as man power to accomplish the mapping and surveying of such larger construction areas, whereas commercial UAVs can do this in seconds and also saves millions of dollars.

The global pandemic because of COVID-19 has greatly affected the construction as well as various other industries and disrupted their supply chain model. Because of ineffective supply of raw materials and other products the market faces various challenges to continue with the same rate and witnessed a steep decline in their sales and operations. However, as per the post-COVID analysis the markets across the globe expected to flourish steadily.

Market Outlook

- Market Growth Overview: Between 2025 and 2034, the UAV market will expand rapidly, driven by logistics, surveillance, agriculture, regulation improvements, and declining hardware costs globally.

- Startup Ecosystem: Startups proliferate across delivery, inspection, autonomy, battery-tech, and sensing; accelerators, incubators, and corporate partnerships fuel rapid innovation market adoption waves.

- Major Investors: Major investors include venture capital, corporates, sovereign funds; strategic bets on autonomy, eVTOL, logistics, and software platforms accelerate scaling globally.

Unmanned Aerial Vehicle (UAV) Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 157.21 Billion |

| Market Size in 2026 | USD 50.31 Billion |

| Market Size in 2025 | USD 43.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.50% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Class, Technology, System, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Technology Analysis

Which Technology Type Dominated the UAV Market in 2024?

The remotely operated UAVs capture the majority of the global UAV market revenue share in the year 2024 and are likely to retain their hold during the analysis time frame. This is mainly attributed to the wide range of UAV products operated by remote sensing technology due to easy accessibility and monitoring. The remote sensing technology has larger applications across various commercial sectors to gather a crucial set of information, such as forest monitoring, agriculture, and aerial mapping.

Based on technology, the fully-autonomous technology segment expected to grow at the fastest rate over the forthcoming period because it offers fully controlled operation without any control from ground. The flight planning system and command delivery system helps to decide the flight range and route earlier from its operation. These are mission critical UAVs and seeks prominent demand from military sector.

The remotely operated UAVs capture the majority of the global UAV market revenue share in the year 2023 and likely to pertain its hold during the analysis time frame. This is majorly attributed to wide range of UAV products operated by remote sensing technology. The remote sensing technology has larger applications across various commercial sectors to gather crucial set of information such as forest monitoring, agriculture, and aerial mapping.

Application Insights

How did the military segment dominate the unmanned aerial vehicle market in 2024?

In 2024, the military segment is expected to hold the major revenue share during the upcoming years, as this is due to a significant rise in the demand for strategic and tactical UAVs in the military sector. Several countries have also increased their purchase of particular UAVs for special missions such as High-Altitude Long Endurance (HALE) UAV and Medium-Altitude Long Endurance (MALE) UAV. Hence, the rising demand for special-purpose UAVs for military operations is likely to boost the segment's growth over the forecast period.

In terms of application, the unmanned aerial vehicle (UAV) market is classified into commercial, military and recreational. In 2023, the military segment anticipated to hold the major revenue share during the upcoming years owing to significant rise in the demand for strategic and tactical UAVs in military sector. Several countries have also increased their purchase for particular UAVs for special missions such as High Altitude Long Endurance (HALE) UAV and Medium Altitude Long Endurance (MALE) UAV. Hence, the rising demand for special purpose UAVs for military operation are likely to boost the segment growth over the forthcoming years.

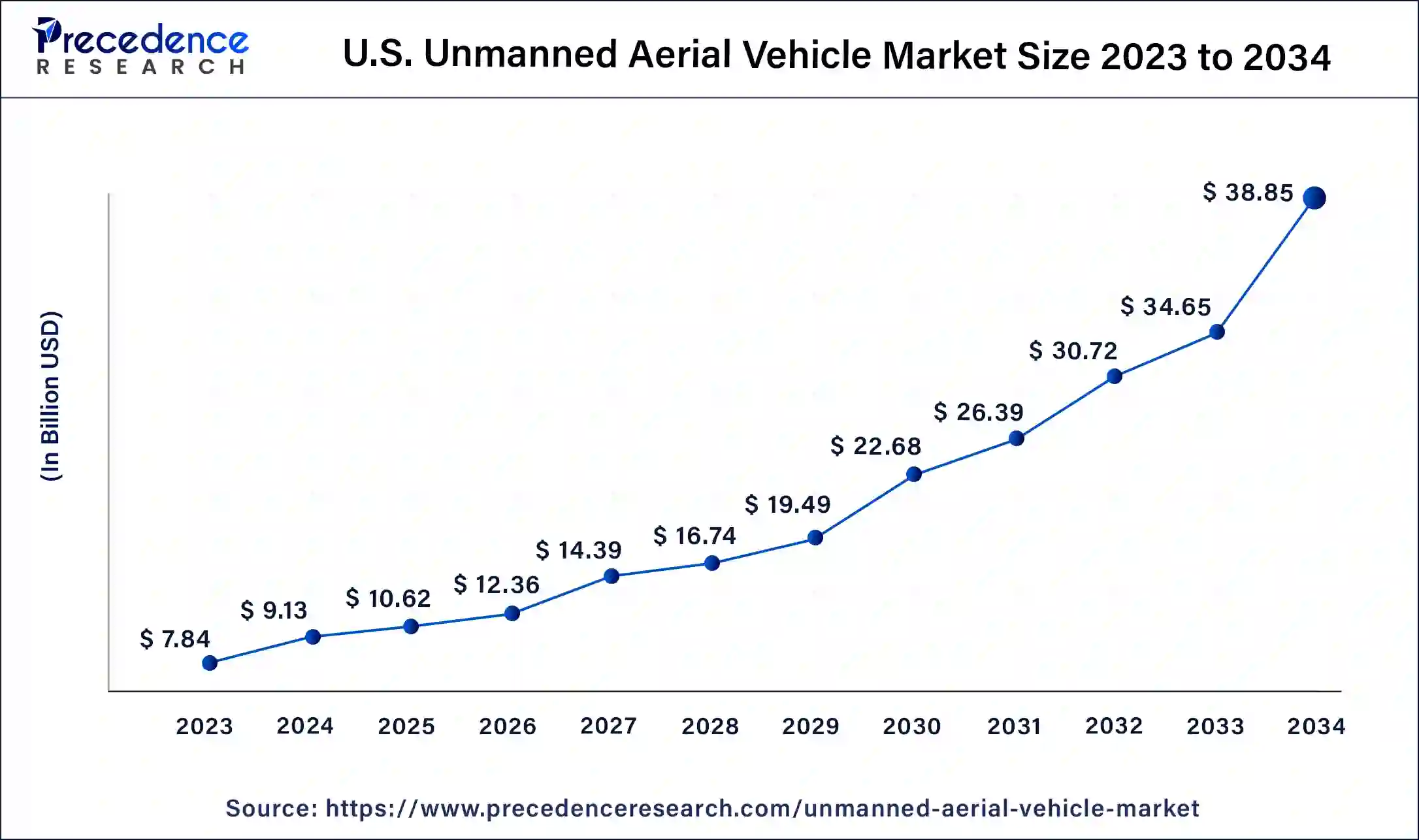

U.S. Unmanned Aerial Vehicle Market Size and Growth 2024 to 2034

The U.S. unmanned aerial vehicle (UAV) market size was valued at USD 10.60 billion in 2025 and is expected to be worth around USD 39.35 billion by 2034, at a CAGR of 15.76% from 2025 to 2034.

Regionally the UAV market is classified into North America, Europe, Asia-pacific, Latin America, Middle East and Africa. The Asia pacific region is expected to account highest growth rate in the forecast period of 2025 to 2034. In china military UVA market hit largest revenue share.

North America market for UAVs captured the majority of revenue share across the globe and anticipated to maintain the same trend over the forecast time frame owing to significant application of UAVs in aerial mapping, surveying, military operations, and forest monitoring. The U.S. is the front-runner across the North America region and is one of the prominent manufacturers of military UAVs that also exports its UAVs to several other countries. This is mainly because the country spends significantly on the defense sector and armaments. For instance, military spending or defense budget in the U.S. recorded to be US$ 731.75 billion in the year 2019 witnessing a rise of 7.22% from the past year. Further, the strong presence of key market players in the regions also supports the positive outlook for the market growth.

Asia Pacific is expected to experience the highest growth in the unmanned aerial vehicle market; the growth is driven by the growing advancement in technology and increasing demand for military UAVs for monitoring and surveying. The growth is also seen due to rapid growth in the manufacturing sector and high investment from the country in the defence system of the country. These factors help in the growth and expansion of the market in the country.

Widespread Technological Advances & Regulatory Steps are Impacting Europe

Europe is experiencing a notable growth in the unmanned aerial vehicle (UAV) market, due to the emerging technological breakthroughs. This mainly comprises novelty in battery life, sensor technology, and communication systems, which further boost operational capabilities. On the other hand, the emergence of the EU Drone Strategy 2.0 offers a comprehensive framework to simplify commercial and regulatory usage across member states, allowing BVLOS (Beyond Visual Line of Sight) operations and the progression of a unified U-space (UAV traffic management) system.

- In May 2025, Origin Robotics launched BLAZE, an autonomous drone interceptor designed to showcase the rising threat posed by fast-moving unmanned aerial vehicles.

Robust Regulatory Landscape Revolutionizing South America

Nowadays, South America is putting efforts into the development of a major regulatory framework. Such as, Brazil and Argentina have evolved systems requiring registration for most drones and certain permits for commercial or complex operations (e.g., beyond visual line of sight or over crowds). Usually, these regulations, handled by national civil aviation authorities (like ANAC in Brazil and Argentina), are significant for managing the rising volume of drone traffic and ensuring safety.

Exploration of Modular Payloads & Counter-Drone Systems is Leveraging the MEA

Specifically, a prominent driver involved in the unmanned aerial vehicle (UAV) market in MEA is the evolving next-gen UAVs feature modular designs, which enable feasible swapping of multi-sensor payloads (EO/IR, LiDAR, multispectral imagers) for numerous missions. Moreover, the MEA is expanding counter-drone systems, i.e. malicious or unauthorized drone activities have spurred the fastest growth, mainly in the GCC countries and South Africa.

Value Chain Analysis

Raw Material Sourcing - It mainly allows procurement of high-performance materials, like advanced composite materials (such as carbon, glass, and aramid fibers), various metal alloys (aluminium, titanium, magnesium), and specialized materials for electronics, power systems, and propulsion.

- Key Players: Hexcel Corporation, Toray Industries, Gurit, etc.

Vehicle Assembly and Integration - This process involves assembling the airframe, propulsion system (motors, propellers, and electronic speed controllers), power system (batteries), and the flight control and navigation systems (flight controller, GPS, IMU, and other sensors).

- Key Players: General Atomics Aeronautical Systems, Northrop Grumman Corporation, DJI, etc.

Aftermarket Services and Spare Parts - Particularly, facilitates maintenance, repair, and overhaul (MRO), training, data analysis, and spare parts supply.

- Key Players: AAR Corp., Lufthansa Technik, SIKA Aerospace & Defence, etc.

Unmanned Aerial Vehicle Market Companies

| Company | Key Offerings | Contributions | Technology Focus | Recent Developments |

| Boeing | Offers autonomous aerial systems like MQ-25 and ScanEagle | Advances UAV defense and commercial systems integration | Focuses on AI-driven flight control | Strengthens partnerships for advanced drone operations |

| Airbus | Provides Zephyr solar-powered UAVs | Pioneers high-altitude pseudo-satellite technology | Focuses on endurance and connectivity solutions | Expanding UAV-based surveillance services |

| Amazon | Develops Prime Air Drones | Revolutionizes last-mile drone delivery | Focuses on safe autonomous navigation | Began drone deliveries in select U.S. regions |

| DHL | Operates Parcelcopter delivery UAVs | Enhances logistics efficiency in remote areas | Focuses on payload optimization | Expanding drone logistics trials globally |

| Uber | Invests in Uber Elevate UAV program | Promotes urban air mobility innovation | Focuses on aerial ridesharing models | Collaborating on eVTOL network development |

Segments Covered In Reports

By Class

- Tactical UAVs

- Small UAVs

- Strategic UAVs

By Technology

- Fully-autonomous

- Semi-autonomous

- Remotely Operated

By System

- UAV Payloads

- UAV Airframe

- UAV Avionics

- UAV Software

- UAV Propulsion

By Application

- Commercial

- Military

- Recreational

By Regional Outlook

- North America

- US

- Rest of North America

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client