What is the Unmanned Ground Vehicles Market Size?

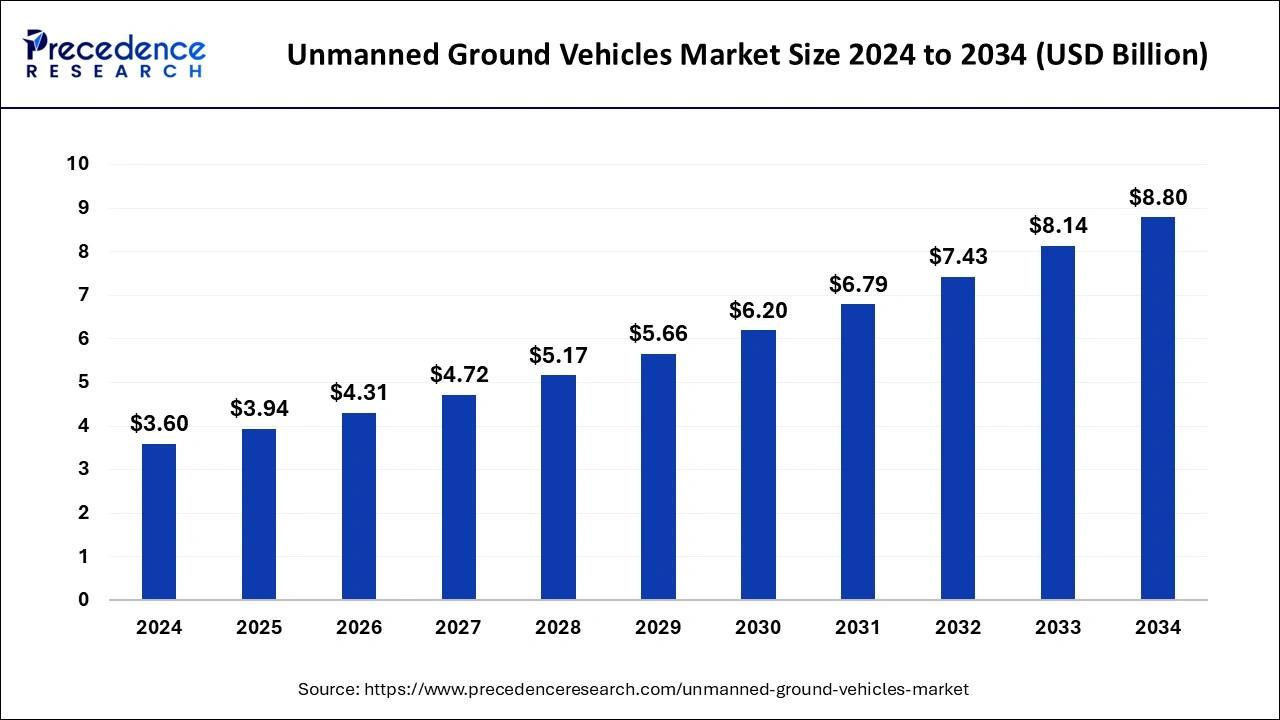

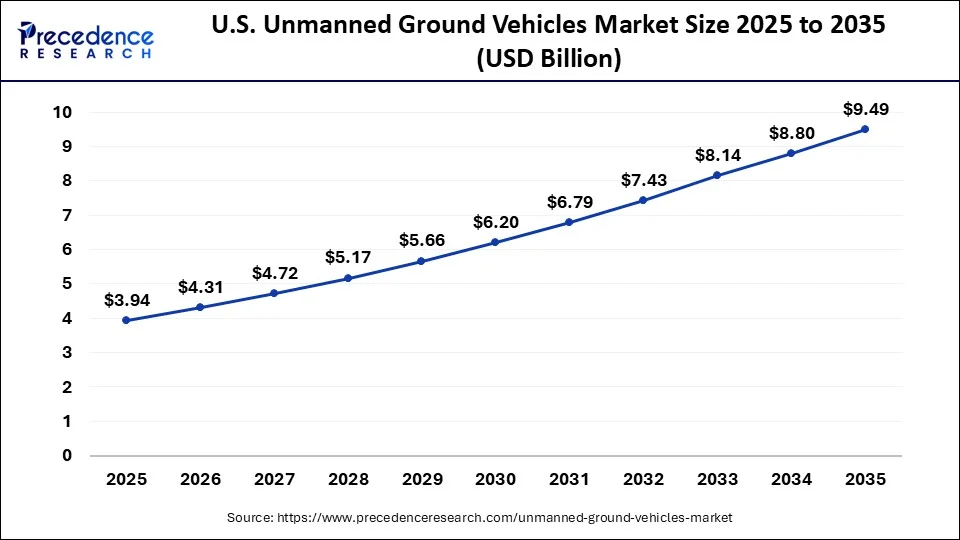

The global unmanned ground vehicles market size is valued at USD 3.94 billion in 2025 and is predicted to increase from USD 4.31 billion in 2026 to approximately USD 9.49 billion by 2035, expanding at a CAGR of 9.19% from 2025 to 2034.

Unmanned Ground Vehicles Market Key Takeaways

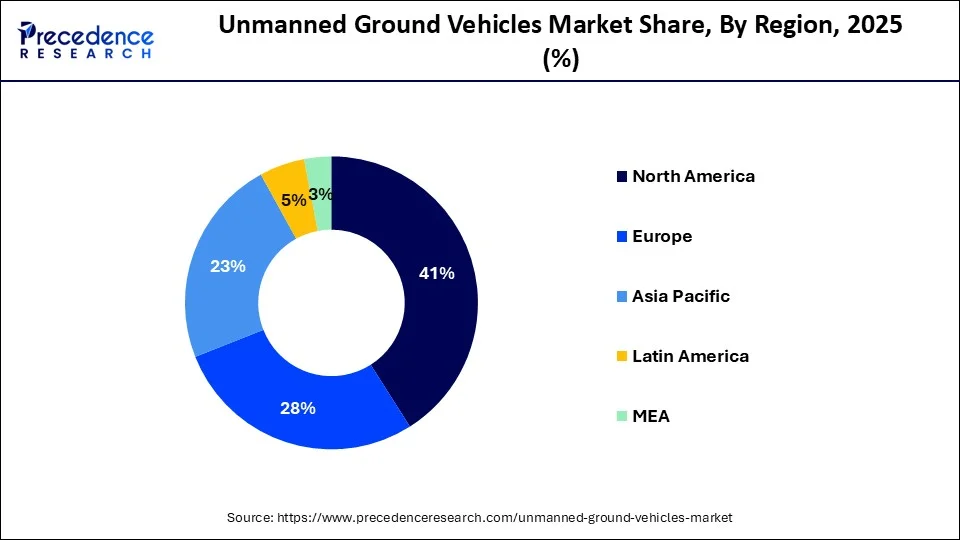

- North America region generated the highest revenue share of over 41% in 2025.

- Asia Pacific region is growing at a CAGR of 9.19 from 2026 to 2035.

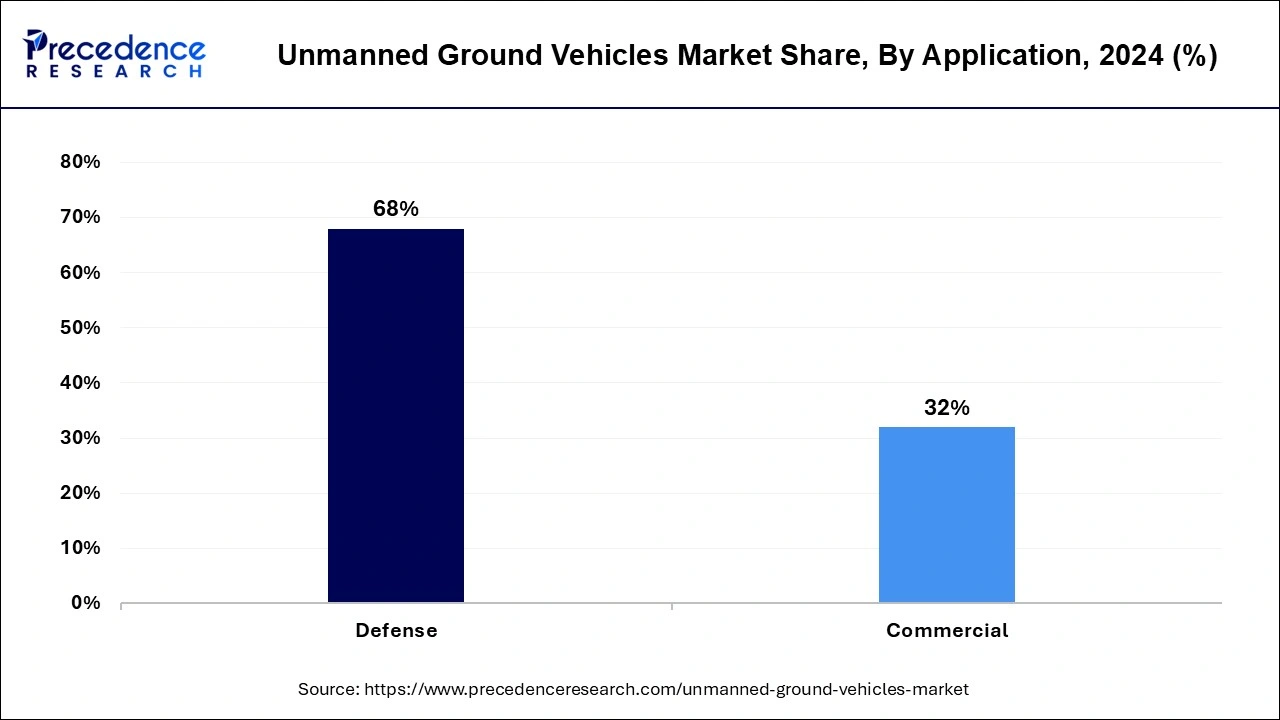

- By application, the defense segment held a 68% market share in 2025.

- By size, the small segment accounted for 58% of the market share in 2025.

- By mode of locomotion, the tracked segment hit 65% market share in 2025.

- By operation, the teleoperated segment has garnered 81% market share in 2025.

Market Overview

Unmanned ground vehicle (UGV) is a robotic vehicle that operates on the ground without presence of an onboard human. These vehicles are remotely controlled with the help of a fixed or handheld control station, or operate autonomously. It is mainly developed to enhance human capability in civilian and military activities in an open terrain that is unpleasant or hazardous to humans and for tasks that are dull, difficult, or poses intolerable risks. The UGV requires wireless communications technologies for remote operation and to relay video footage or other sensor data. It is usually equipped with a range of payloads and sensors such as chemical & explosives sensors, manipulator arms, thermal cameras, and weapons systems among others.

In past few years, UGVs are seeing rapid demand from civic applications including crowd control, urban search and rescue, nuclear plant operations, firefighting, and agricultural spraying & harvesting. Also, there is wide adoption of UGVs in defense sector for equipment carrying, manned-unmanned teaming, mobile weapons platforms, and forward reconnaissance. On the other hand, integration of advanced technologies in UGVs has further ensured an intelligent execution of tasks. For instance, the evolution of UGVs with advanced technologies such as AI, ML, Virtual Reality, Augmented Reality, Data Science, Cloud Computing, and Internet of Things (IoT) is anticipated to play the prominent role in future battlefields.

Unmanned Ground Vehicles Market Growth Factors

Growing demand forautonomous vehiclesin defense sector has significantly contributed to growth of unmanned ground vehicles market. Also, the global defense sector is seeing abundant research for advanced UGVs development to execute numerous missions such as transportation, rescue, reconnaissance, combat operations, extended tunnel mapping, distribution of medication & supplies in isolated areas, acquisition of targets, and more. For instance, in January 2022, The South Korean military initiated deployment of multi-purpose UGVs post six-month trials. These UGVs are developed by Hyundai Rotem and are capable to detect images up to 4 kilometers in real-time with the help of cameras. Also, the Seoul International Aerospace and Development Exhibition (ADEX) concluded in October 2021 showcased the increasing ability of defense industry in South Korea with a mounting push towards development of unmanned and autonomous systems for use on-air, land, and sea.

In addition, there is an increasing use of robots in regions that are affected by the chemical, biological, radiological, nuclear,and explosive (CBRNE) attacks. Rescue missions in CBRNE incidents are extremely risky and often it is nearly impossible for rescuers to perform. In such scenarios, AGVs helps in sample collection, detection, and marking of CBRN contaminated regions by eliminating the risk of exposing personnel. For example, Viking, the multirole UGV is manufactured by Horiba Mira, the UK-based provider of automotive research, engineering, and test services. This UGV is mainly designed to reduce risk in CBRN threat detection missions. Also, this vehicle is capable of performing operations including last-mile logistics support, target acquisition, security & surveillance, intelligence, soldier support, surveillance, and reconnaissance.

On the other hand, emerging research and development in fully autonomous UGVs is expected to create lucrative growth opportunities for the global unmanned ground vehicles market in upcoming years. Currently, a number of market players are actively working of the development of fully autonomous AGVs by usingartificial intelligence (AI) & machine learning (ML) techniques. For instance, in October 2021, Otokar, a Turkish bus and military vehicle manufacturer signed a partnership agreement with Milrem Robotics, an Estonian robotic vehicle manufacturer to combine their resources and experience for application and development for military UGVs. Also, both of the companies will work together on introduction of innovative systems by developing encryption, intelligent functions, and safety features along with environmental awareness.

Market Outlook

- Industry Growth Overview

The global unmanned ground vehicles (UGV) market continues to exhibit prospects for sustained growth. This growth will be driven primarily by three trends in the global marketplace today: increased use of autonomous technology, improved use of artificial intelligence to provide navigation assistance for UGVs, and burgeoning modernization efforts associated with defence procurements. - Sustainability Trends

To mitigate greenhouse gas emissions and reduce their overall carbon footprint, UGV manufacturers are now shifting their focus toward developing UGVs based on renewable energy, electric-powered propulsion methods, and recyclable materials. Developing sustainable UGVs not only produces less pollution but also facilitates “greener” military and industrial operations. - Global Expansion

As more countries experience an increase in UGV production through international collaboration between defence alliances and the growth of commercial partnerships, the global deployment and innovation of UGVs continue to increase, as more UGVs are designed for use around the world. - Startup Ecosystem

To fuel the UGV market and foster technological advancements within UGV manufacturing, an influx of new robotics startups with highly-advanced AI capabilities have entered the marketplace, offering compact autonomous UGV platforms designed to serve niche industrial applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.94 Billion |

| Market Size in 2026 | USD 4.31 Billion |

| Market Size by 2035 | USD 9.49 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.19% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, Mobility, Size, Mode of Operation, and System, |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Unmanned Ground Vehicles Market Segment Insights

Application Insights

Depending upon the application, the military segment accounted highest revenue share in 2025. In the defense sector, various military functions ranging from area recognition to equipment and supplies provisioning makes use of UGV systems. These systems are helping military personnel to determine unsafe zones for soldiers, carry supplies, deliver surveillance information, and explosive activation. Hence, demand for UGVs in such critical military applications is mainly fueling growth of this segment.

In addition, growing defense budgets is further contributing to development of UGVs. According to Stockholm International Peace Research Institute (SIPRI), United States, China, India, the United Kingdom and Russia are the top five countries accounting for about 62% of global military spending. Countries also needs to invest in R&D for the development of essential technologies to enable robotic and unmanned systems to perform efficiently. Therefore, increasing number of countries are focusing on research and development of UGVs for military applications, creating a lucrative growth opportunity for this segment. For instance, in past several years, U.S. has been a largest R&D spender in defense with significant investment in disruptive technologies.

On the other hand, commercial segment is expected to witness highest CAGR during the forecast period due to increasing demand for UGVs in urban search and rescue, firefighting, nuclear plant operations, and agricultural spraying & harvesting applications. Also, rising development trend of commercial UGVs is projected to be opportunistic for growth of the segment. For instance, in December 2021, XAG Co., the Chinese company launch drones and robots for precision agriculture applications. This launch included the updated XAG R150 unmanned ground vehicle (UGV).

The military & defense segment accounted for the dominating share of 71.30% in 2024, owing to the increasing demand for UGVs in such critical military applications. In the defense sector, various military functions ranging from area recognition to equipment and supplies provisioning make use of unmanned ground vehicles. These systems assist military personnel in determining unsafe zones for soldiers, carrying supplies, delivering surveillance information, and detecting explosive activation.

Mode of Operation Insights

Depending upon the mode of operation, the autonomous segment dominated the market in 2025. The autonomous mode of operation in UGVs enables them to perform aspects of their operations by eliminating the need for direct human inputs. These vehicles are equipped with technologies for allowing the machine to be self-regulating and self-acting. Rise in demand for more tactical vehicles to assist in surveillance or improvised explosive device (IED) search-and-destroy missions. Growing number of nations are being aware of autonomous UGVs and its merits as combat vehicles and force enabler.

Furthermore, autonomous UGVs are rapidly being developed by companies to meet rising demand for effective defense equipment by countries. For instance, in March 2020, HORIBA MIRA, one of the leaders in advanced vehicle engineering received a £2.3m contract to supply VIKING, the autonomous to the Defense Science and Technology Laboratory (Dstl), an executive agency of the Ministry of Defense of the UK.

The tele-operated / remotely operated segment registered its dominance with 58.10% over the global unmanned ground vehicles market in 2024. The growth of the segment is driven by the rising use of tele-operated systems in defense, disaster response, and hazardous industrial environments. In addition, a surge in government investments in remotely operated military systems has led to an increasing adoption of UGVs for crucial civilian operations.

Mobility Insights

The wheeled segment held a dominant presence in the market in 2025, with 47.60%. Wheeled UGVs are more energy-efficient compared to other mobility types and their simplicity in design, leading to lower maintenance costs. These vehicles are most widely utilized in commercial applications like logistics, warehousing automation, and deliveries, as well as in areas such as urban surveillance and inspection.

Size class Insights

The medium segment held the major market share of 34.80% in 2025, owing to the increasing demand for UGVs in defense and commercial applications in areas like logistics, agriculture, and inspection. Medium-sized UGVs are utilized for more varied and robust tasks, including intelligence, surveillance, explosive ordnance disposal (EOD), reconnaissance (ISR), and others. Moreover, a surge in defense budgets, rising border security concerns, and the expansion of infrastructure automation projects are likely to support the need for medium-sized UGVs capable of operating in complex environments.

Power Source Insights

The electric battery segment contributed the biggest market share of 49.20% in 2025. The growth is attributed to the rapid advancements in battery and power transmission technology. An electric battery has low noise, simplified maintenance, and is generally ideal for shorter and specific tasks, such as warehouse automation or inspection. Lithium-ion batteries are the most common type for electric unmanned ground vehicles (UGVs). They offer long-lasting power and play a crucial role in military, surveillance, and industrial applications

Unmanned Ground Vehicles Market Regional Insights

The U.S. unmanned ground vehicles market size is estimated at USD 1.13 billion in 2025 and is predicted to be worth around USD 2.58 billion by 2034, at a CAGR of 9.62% from 2025 to 2034. The highest market share and dominant position in the unmanned ground vehicles market belongs to North America during the forecast period. Growth of the market in this region is mainly attributed to increasing defense spending and R&D activities in UGVs sector coupled with the significant presence of key market players.According to latest Stockholm International Peace Research Institute (SIPRI) data, defense spending by the U.S. has seen increase of $22 billion from 2020 to 2021. Also, the U.S. Department of Defense (DoD) has allocated around $7.5 billion in financial year of 2021 for a range of robotic platforms and associated technologies. This huge spending by DoD on unmanned systems technologies is projected to boost growth of North America unmanned ground vehicles market. Also, the U.S. military is actively acquiring advanced UGVs to deal with chemical, biological, radiological, and nuclear (CBRN) threats. For instance, in May 2021, the U.S. armed forces acquired 600 additional Centaur unmanned ground vehicles (UGVs) from FLIR Systems, one of the leading technology companies. An authorized army personnel can attach different payloads and sensors to these UGVs to deal with CBRN threats. This demand for UGVs in U.S. to deal with CBRN threats is anticipated to be opportunistic for growth of the market.

Europe has been regarded as the epicentre for future UGV innovation. This is due primarily to the decreased funding for, and advancements in, robotics; and the ongoing large-scale modernization of (European) military forces. Additionally, the European Commission has developed multiple avenues to support robotics R&D through European defence programmes and public-private partnerships. The majority of the European companies that are currently providing UGVs to the European military include Rheinmetall, BAE systems and QinetiQ who have accelerated the technical evolution of UGV Technologies for European end-users.

Asia-Pacific is considered as highest growing region in unmanned ground vehicles market. This region includes China, India, Japan, South Korea, and rest of the world. Huge defense spending in China, India, and Japan is one of the major factor contributing to growth of Asia-Pacific unmanned ground vehicles market. Also, these countries are actively developing indigenous defense systems to strengthen their defense equipment manufacturing capabilities. For instance, in April 2022, Defense Research and Development Organisation (DRDO) of India announced to develop an innovative combat unmanned ground vehicle (UGV) to strengthen country's position on the western borders. This system will make use of an Indigenous Geographic Information System (INDIGIS) to help UGV pilot with a visual perspective of the platform's location as well as operational terrain.

A growing emphasis on border patrol surveillance and improving the defense budget for many countries within Latin America, along with an increased emphasis on automated, and robotic industrial processes, have created significant areas of investment by many Latin American Countries in UGV. As a result of these areas of investment, the UGV's in Latin America have expanded to include not just defense applications, but also agriculture, mining and security applications.

The continued fight against illegal trafficking as well as the focus on developing better disaster response capability has resulted in UGV going from simply being used for unmanned reconnaissance and hazardous operations to being viewed as an integral part of any modern defence force in the region today. Latin America has also teamed with some of the larger Western Defence giants, such as Thales Group and Northrop Grumman. Through these partnerships many Latin American militaries are receiving access to the latest technologies available within their respective countries.

Value Chain Analysis

- Component Development & Robotics Engineering: The Component Development phase of the UGV value chain involves the manufacturing of the sensors, power systems, autonomous navigation capability, and communication modules necessary for all UGV technology as we know it today.

- System Integration & Testing: The System Integration phase of the UGV Value Chain is the stage in which organizations such as QinetiQ and Rheinmetall bring the various component parts of the UGV together and conduct field testing and verification to validate the UGV will meet mission-specific operational requirements both within military, industrial, and commercial environments.

- Deployment, Support & Lifecycle Services: The deployment phase of the UGV value chain includes maintenance and modifications, fleet management and support, and training and operational support Activities to ensure long-term sustainability and adaptability of UGV technology for real-world applications.

Unmanned Ground Vehicles Market Companies

- BAE Systems

- QinetiQ

- Rheinmetall AG

- Teledyne FLIR

- ECA Group

- Lockheed Martin

- General Dynamics

- Leonardo S.p.A.

- Autonomous Solutions Inc.

- Northrop Grumman

Recent Developments

- In April 2022, UnmannedSystemsTechnology.com (UST) announced a collaboration with BAE Systems to encourage and facilitate engagement among the SMEs to develop advanced technologies for unmanned systems applications.

Segments covered in the report

By ApplicationÂ

- Military & Defense

- Explosive Ordnance Disposal (EOD) / Bomb Disposal

- Intelligence, Surveillance, and Reconnaissance (ISR)

- Combat Support

- Mobile Weapon Platforms

- Border Security

- Special Missions

- Civil and Commercial

- Logistics & Transportation

- Agriculture

- Mining

- Construction

- Law Enforcement & Public Safety

- Urban Search and Rescue (USAR)

- Firefighting

- Nuclear Response

- Crowd Control

- Inspection & Maintenance

- Healthcare

By MobilityÂ

- Wheeled

- Tracked

- Legged

- Hybrid

By Size Class (Payload Capacity/Weight)

- Micro

- Small

- Medium

- Large

- Very Large / Heavy

By Mode of OperationÂ

- Tele-operated / Remotely Operated

- Autonomous

- Tethered

By Power SourceÂ

- Electric Battery

- Hybrid-Electric

- Internal Combustion Engine

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting