What is the Advanced Aerial Mobility Market Size?

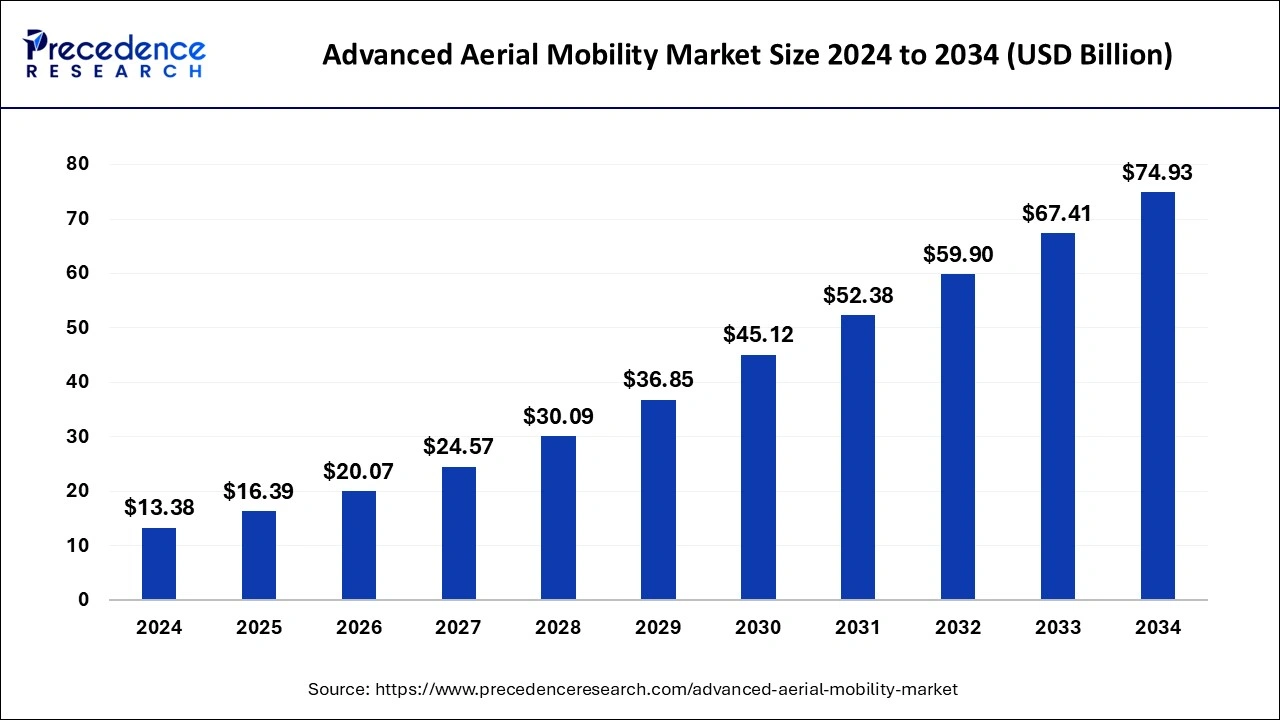

The global advanced aerial mobility market size is calculated at USD 16.39 billion in 2025 and is predicted to increase from USD 20.07 billion in 2026 to approximately USD 74.93 billion by 2034, expanding at a CAGR of 18.80% from 2025 to 2034.

Market Highlights

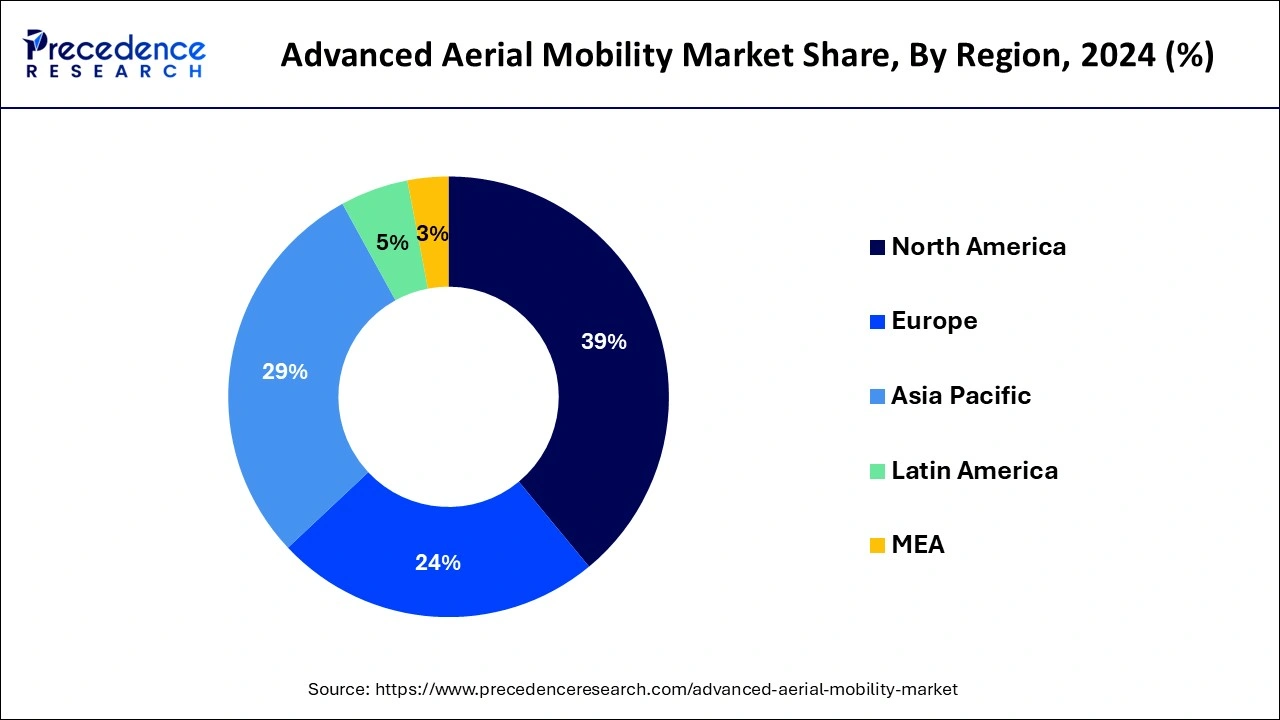

- North America dominated the market with the largest revenue share of 39% in 2024.

- By end user, the cargo segment has captured largest revenue share in 2024.

- The passenger segment has accounted biggest revenue share in 2024.

- By propulsion type, the electric segment has held maximum revenue share in 2024.

Market Size and Forecast

- Market Size in 2025: USD 16.39 Billion

- Market Size in 2026: USD 20.07 Billion

- Forecasted Market Size by 2034: USD 74.93 Billion

- CAGR (2025-2034): 18.80%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

To move individuals and goods in developing aircraft marketplaces, increasing air mobility aids in the development of secure, affordable air transportation networks. Enhanced aerial mobility will enable operators to do quiet, dependable, and secure vertical flights. Air transportation, which refers to a specific type of vehicle that can function on both the ground and the air depending on the situation, is regarded as a recent advance in urban transportation.

Unmanned systems are poised to become the next generation of transportation infrastructure thanks to recent technical advancements, which will alter the transportation industry's view in the nourish term. Improved aerial transportation has been significantly hampered by the COVID-19 pandemic's unexpected increase. Because of lockdowns and other limitations, the spreading of coronavirus in wealthy nations like the United States and the UK was anticipated to harm facilities for research and development for enhanced aerial transportation. Enhanced aerial movement remains in its early stages, and it is nearly difficult to foresee how COVID-19 infections will be controlled.

Leading market participants, meanwhile, are concentrating on strategic cooperation to begin testing and certification as quickly as possible. Considering the effects of the epidemic, the participants in the sophisticated airborne movement arena have demonstrated their capacity to adapt and develop in challenging circumstances. The next-generation commuting option is the flying automobile, which can serve as private transportation and a means of air travel.

Furthermore, because of operational and architectural constraints in the urban commuting system, the plurality of self-driving cars is anticipated to include vertically launching and landing technologies. Flying cars were anticipated to be employed on both a personal and professional level to accommodate shifting commuting needs, particularly in urban regions. In comparison to other forms of transport, flying vehicles and commercial drones have higher testing and development expenses since they call for the fusion of numerous advanced technologies.

Advanced Aerial Mobility Market Outlook

- Industry Growth Overview: The market is poised for exponential growth between 2025 and 2034, driven by rapid urbanization, rising traffic congestion, and demand for faster, more efficient transportation. High-growth segments include electric vertical take-off and landing (eVTOL) aircraft, particularly for urban air taxis and cargo drones, as well as the software and infrastructure required for their operation.

- Global Expansion: The market is expanding globally, with a primary focus on North America and Asia-Pacific. North America dominates the market due to a strong aerospace ecosystem and proactive regulatory frameworks. There is a significant potential for market expansion in Asia-Pacific, driven by significant government investment and rapid urbanization in countries like China, Japan, and India.

- Major Investors: Investment flows from a mix of well-known aerospace companies (Airbus, Boeing, Embraer), automotive firms (Hyundai), and venture capital investors. These investors are drawn by the potential for high-impact solutions, alignment with smart city projects, and the creation of new business models like air taxi and cargo services.

- Startup Ecosystem:The startup ecosystem is vibrant and quickly evolving, with innovators concentrating on technological progress in autonomous flight, advanced battery tech, and infrastructure growth. New companies like Joby Aviation, Archer Aviation, Lilium, and Volocopter are drawing significant investment and forming strategic alliances.

Advanced Aerial Mobility Market Growth Factors

The market for enhanced aerial transportation is expanding quickly on a global scale. One of the main factors driving the international industry's expansion is the increase in end-user demands for time-efficient courier companies and an expanding urban transportation perspective. The implementation of automation and robotics, customer preference for digitally enhanced technology, and technology advances in aircraft all aid in the expansion of the enhanced aerial transportation market across the globe.

Furthermore, as a result of rising ecological problems and road congestion, rapid urbanization and industrialization call for affordable and effective different transportation alternatives. Policies and guidelines must be passed by policymakers to support urban commuting alternatives. As a result, there is a growing market for airborne transportation, which will be very helpful in many places. Postal and courier businesses are permitted to use aircraft to speed up courier services by aviation agencies all over the world.

The market is anticipated to grow as more people embrace drone-based, based delivery technologies, that increase efficiency, and cut costs. Customers are increasingly demanding superior aerial movement for this same delivery service within the e-commerce sector, and they are also prepared to pay more for same-day shipping. Furthermore, the president's strict licensing requirements for pilots are predicted to impede the industry's expansion for sophisticated aircraft transportation.

Additionally, it is anticipated that growing worries about cyber security issues associated with drone operations may restrain market expansion. In addition, updated government regulatory frameworks and important players' growing emphasis on seizing Asia Pacific's untapped talent are anticipated to present profitable growth prospects for the sophisticated aerial transportation industry.

- Enabling VTOL aircraft development and testing in circumstances that call for specially constructed test ranges in constrained airspace.

- Using ground infrastructure to facilitate various flight-testing situations by monitoring and altering it.

- Effectively simplifying the procedure for certifying airplanes, which has developed over time to take into account more conventional modes of air transportation.

- Incorporating AAM activities securely at heavy traffic concentrations into the present aviation structure.

- Creating industry standards that are consistent globally.

- Setting up best practices for flight operations, security, communication, and ATM technologies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 16.39 Billion |

| Market Size in 2026 | USD 20.07 Billion |

| Market Size by 2034 | USD 74.93 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 18.80% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Mode of Operation, End-Use, Propulsion Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

There is an increasing need for alternative modes of transportation, especially advanced mobility

By 2037, the International Air Transportation Association (IATA) predicts that there will be 8.4 billion people using aircraft worldwide. By 2050, the UN predicts that 68% of people would reside in urban settings. Numerous congestion & accessibility challenges brought on by the increasing number of vehicles in cities are increasing the demand for alternate forms of transportation. In this sense, aircraft like VTOLs, eVTOLs, and STOLs had proven to be strong competitors. to prevent traffic, certain eVTOL airplanes were best suited for short-haul flights over busy places. Given these advantages, it is anticipated that AAM demand in advanced mobility applications would rise in the upcoming years.

It is anticipated that the demand for flying cars would fuel growth

Advanced mobility, which primarily consists of fuel-powered cars, is transitioning to digitally high-end technologies, combined with only an increase in the use of environmental transportation solutions, to create the very next robust and environmentally friendly transport network. In addition, the growing urbanization trend necessitates the development of alternative transportation strategies to address current transportation problems like heavy traffic and rising air pollution. Market participants for fighter jet alternatives are concentrating on developing electric or hybrid-driven vehicles that may be used on land and in the air. As a result, there is a growing desire for airborne automobiles, which will help to relieve road congestion. Self-driving cars are a reality and are currently being developed on a global scale on both a personal and professional level. During the projected period, the world market for enhanced airborne transportation is anticipated to develop as the need for hovering automobiles increases.

Key Market Challenges

- Concerns about cyber security: Because advanced aerial mobility depends on technology, security might be a serious weakness. Threats to board systems and software, intrusions into automotive controlling traffic satellite uplinks, and the insertion of hostile or erroneous data utilized for protection judgments and/or computer vision are just a few of the cybersecurity issues that enhanced aerial transportation faces. Improved airborne mobility's susceptibility will be dependent on the functionality of other intricate, operating system technologies like GPS, ATC, and different kinds of common communication networks. For urban air transportation to succeed, network security strategies that take modeling and engineering into account security are needed. However, R&D is required to create new methods to protect autonomous aircraft from hacking attempts. Mindset modifications that have advocated for assuring safety are equally applicable to computer security.

Key Market Opportunities

Growing environmental issues

- The industry with the second-highest level of pollution is transportation, which uses a lot of energy. The environment is being negatively impacted by this industry's substantial emissions of greenhouse gases. Such issues may have a realistic alternative in advanced aerial mobility, which employs autonomous unmanned landing and take-off aircraft. Cities' adoption of unmanned aerial systems for the next transport is likely to open up attractive growth potential for this industry.

- Achieving zero carbon emissions for the aviation sector by 2050 is among the IATA's goals. Sustainable alternative biofuels and cutting-edge new combustion technology would be used to accomplish such electricity and hydrogen. New engine technology, including hydrogen, might take up 13% of the industry, while efficient advancements will make up the remaining 3%, based on the IATA. All industry players are committed to reducing their ecological consequences by modifying their policies, goods, and activities by implementing practical steps with distinct deadlines in response to zero-emission expectations.

- The output of SAF is anticipated to reach in billion liters by 2035, according to an IATA report for Gross Carbon Dioxide emissions by 2050, which was released in Oct 2021. By 2040, SAF supply will reach in billion liters, and electrical and/or hydrogen airplanes for the market sector will be accessible. Given these patterns, the demand for environmentally friendly energy aircraft, such as Appropriate application airframes, will rise in the coming future due to rising environmental issues.

Segments Insights

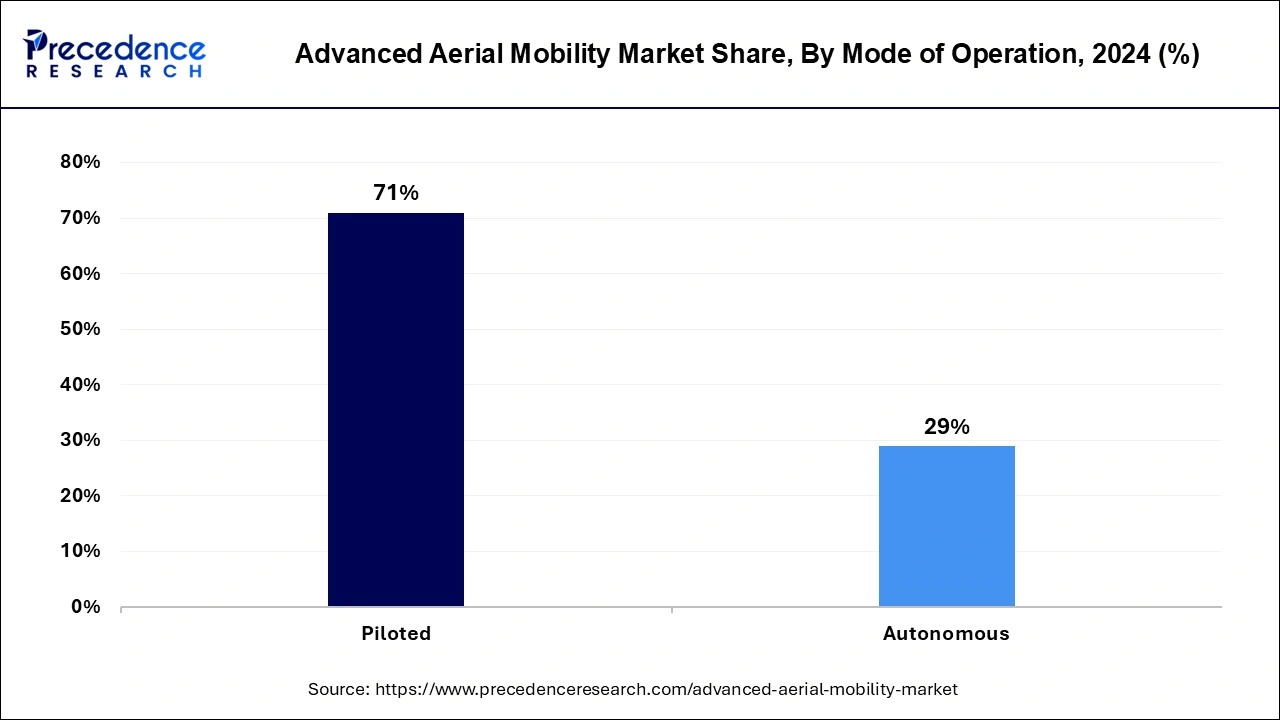

Mode of Operation Insights

More than multiple of the customer base is expected to be held by the piloted category in 2034, and it is anticipated that this share will remain dominant throughout the forecast timeframe. The automated segment is projected to exhibit the highest CAGR in the upcoming years, though.

End User Insights

Approximately 2/3 of the worldwide industry for sophisticated aerial transportation is predicted to be contributed by the cargo segment by 2030, and it is anticipated that this segment will continue to hold the top spot throughout the projected timeframe. However, it is anticipated that in the upcoming years, the passenger segment would increase at the highest CAGR.

Regional Insights

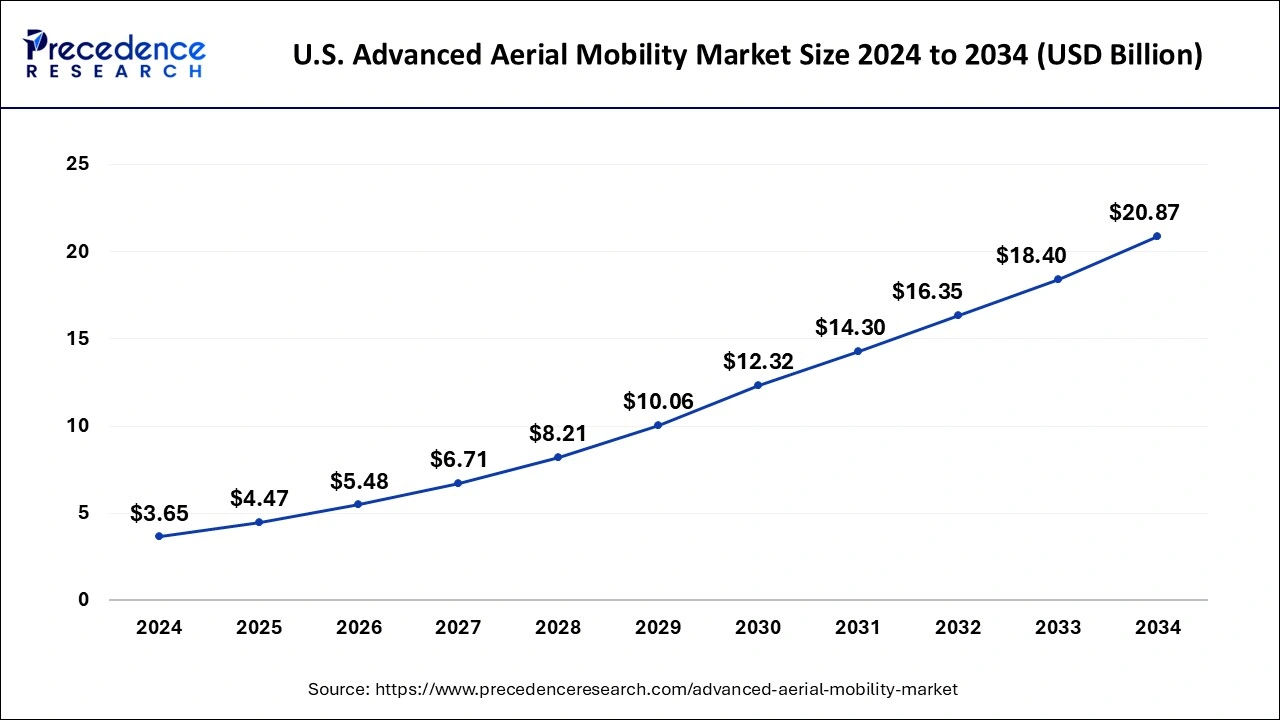

U.S. Advanced Aerial Mobility Market Size and Growth 2025 to 2034

The U.S. advanced aerial mobility market size is evaluated at USD 4.47 billion in 2025 and is predicted to be worth around USD 20.87 billion by 2034, rising at a CAGR of 19.05% from 2025 to 2034.

North America is anticipated to account for the biggest market position for sophisticated aerial transportation globally. The acceptance of expense aviation in both urban and rural settings, as well as the development of disruptive aviation technologies to move individuals and goods are driving the market's expansion in this area.

U.S. Advanced Aerial Mobility Market Trends

The U.S. is a leading force in the market, fueled by significant private investment and major eVTOL manufacturers like Joby and Archer. The FAA is actively creating regulatory frameworks and certification processes to safely integrate these aircraft into the airspace. Notable R&D in battery technology, AI, and autonomous systems, supported by partnerships with NASA and the U.S. Air Force, reinforces the U.S. role in pioneering this sector.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific region is anticipated to grow more quickly and provide a wealth of prospects for market expansion. Drone advanced technologies and an increase in the utilization of aircraft transportation for business purposes are among the reasons driving the market's expansion in this area.

India Advanced Aerial Mobility Market Trends

India is emerging as a key player, focusing on practical applications and local development. Supportive government policies, like the liberalized Drone Rules of 2021 and the Aatmanirbhar Bharat initiative, encourage domestic manufacturing and widespread drone use. Strategic partnerships, such as a joint venture between India's InterGlobe Enterprises and U.S.-based Archer Aviation, aim to improve urban and regional connectivity with AAM.

How is the Opportunistic Rise of Europe in the Advanced Aerial Mobility Market?

The market in Europe is mature in terms of regulatory development and research, driven by strong environmental goals and the presence of major aerospace companies. The European Union Aviation Safety Agency (EASA) is leading the way by setting certification standards for eVTOL aircraft and creating a clear pathway for development. There is a concentrated effort to establish a safe and integrated airspace for AAM operations, with many pilot projects in cities such as Paris and Hamburg. These initiatives focus on both passenger transport for events, like the Olympics, and essential medical delivery services.

Germany Advanced Aerial Mobility Market Trends

Germany leads the market in Europe, leveraging its engineering expertise and robust automotive and aerospace supply chains. The country is home to several prominent AAM startups and has a proactive government that supports research into electric flight and integrated urban mobility solutions. In Germany, the emphasis is on technical development, safety validation, and gauging public acceptance of vertical mobility. Pilot projects are underway to demonstrate the efficiency of AAM for regional connectivity and specialized logistics.

Why is Latin America Considered a key Force in the Advanced Aerial Mobility Market?

Latin America is a key force in the market, driven by growing interest in innovative transportation solutions, particularly in urban areas with congestion and limited infrastructure. Countries like Brazil and Mexico are investing in the development of electric vertical take-off and landing (eVTOL) technologies and drone-based logistics to address transportation challenges in remote or hard-to-reach areas. Additionally, supportive government policies and collaborations with global aerospace companies are positioning the region as a significant player in the global AAM ecosystem.

Brazil Advanced Aerial Mobility Market Trends

Brazil is a major contributor to the Latin American market, backed by a robust domestic aerospace industry, including notable companies like Embraer's Eve Urban Air Mobility subsidiary. The demand for eVTOL aircraft is expected to be high, especially in densely populated urban areas like São Paulo. Brazil is working with regulatory agencies such as ANAC to develop safety standards and infrastructure, including vertiports, positioning itself as a key player in aircraft manufacturing and operational services.

How Big is the Role of the Middle East and Africa (MEA) in the Growth of the Advanced Aerial Mobility Market?

The Middle East and Africa (MEA) hold a unique position in the global market, marked by ambitious government plans for future mobility and smart cities. Wealthier Gulf nations, especially the UAE and Saudi Arabia, are leading the charge with proactive regulations and major investments. Their goal is to make this a premium transportation option within their futuristic urban projects, taking advantage of the chance to build infrastructure from scratch. Projects like NEOM in Saudi Arabia and the flying taxis initiative in Dubai highlight the region's ambition to become global leaders.

Saudi Arabia Advanced Aerial Mobility Market Trends

Saudi Arabia is focusing on enhancing market accessibility as a core part of its diversification and smart city plans, especially through the NEOM project. The country is actively working with international eVTOL manufacturers to test and deploy air taxi services and logistics solutions. A major focus is on building a solid regulatory framework with the General Authority of Civil Aviation (GACA) and investing heavily in the infrastructure needed to create a sustainable and highly efficient advanced air transportation system.

Value Chain Analysis

- Research and Development (R&D) & Design

This stage focuses on innovating vehicle designs (e.g., eVTOLs), propulsion systems, and autonomous flight tech.

Key Players: Joby Aviation, Archer Aviation, Wisk Aero, Lilium. - Component and System Manufacturing

This stage involves producing specialized components like electric motors, batteries, sensors, avionics, and flight control systems.

Key Players: Honeywell Aerospace, Collins Aerospace, Safran, Eaton, Parker Hannifin. - Vehicle Assembly and Certification

In this stage, components are assembled, tested, and certified for airworthiness by regulatory bodies.

Key Players: Airbus and Boeing, plus regulatory bodies (FAA, EASA). - Infrastructure Development

Developing physical and digital infrastructure for AAM operations, including vertiports and air traffic management systems.

Key Players: Infrastructure firms investing in vertiports and tech providers developing UTM and charging solutions. - Operations and Service Delivery

Launching and scaling AAM services like urban air taxis and cargo transport.

Key Players: Joby Aviation and Archer Aviation, and cargo services like Zipline and Amazon Prime Air. - Maintenance, Repair, and Overhaul (MRO) & Aftermarket Services

Ensuring long-term safety through maintenance, repairs, upgrades, and providing training for pilots and technicians.

Key Players: FlightSafety International.

Top Companies for the Advanced Aerial Mobility Market and Their Offerings

- Airbus S.A.S.: Developing the CityAirbus NextGen, an electric vertical take-off and landing (eVTOL) aircraft for urban use, and working on the broader infrastructure and regulatory frameworks for AAM.

- The Boeing Company:Invests in autonomous eVTOL technology through its subsidiary Wisk Aero, which is developing self-flying air taxis and the necessary autonomous flight R&D.

- Volocopter GmbH:A pioneer in urban air mobility (UAM), it has a family of eVTOL aircraft, including the VoloCity for inner-city flights and VoloRegion for longer routes.

- Lilium GmbH: Developing the 7-seater Lilium Jet, an eVTOL aircraft designed for high-speed regional air mobility using proprietary Ducted Electric Vectored Thrust (DEVT) technology.

- Hyundai Motor Company:Established the Supernal division to develop an eVTOL vehicle with a focus on mass production and the creation of an integrated AAM ecosystem.

Other Key Players

- AeroMobil

- Flytrex

- Matternet

- PAL-V International B.V.

- Zipline

Recent Developments

- Spirit Aero-Systems and Airbus Acubed, a division of Boeing, inked a contract in March 2022 to build the sides for City Airbus, NextGen. Through this relationship, Airbus will be able to explore innovative aerospace while still adhering to the strictest standards.

- To co-develop Organizations willing in Malaysia, EHang and AEROTREE, the nation's top aviation corporation, engaged in a strategic agreement in March 2022. 60 units of commuter automated autonomous drones have been purchased by AEROTREE (AAVs).

- In Mar 2022, Lilium N.V. as well as NetJets Inc. entered into a Memorandum of Agreement alongside FlightSafety Worldwide, the industry pioneer in commercial aviation. Through the collaboration, NetJets would have the opportunity to buy more than 150 Lilium planes, giving NetJets shareholders more alternatives to supplement their current flying schedules.

- To create and certify flight dynamics training equipment that would be used to educate young captains of Joby's ground-breaking all-electric airplane, the company joined with CAE, a world leader in commercial aviation, in March 2022.

- Vertical and Leonardo began working together in January 2022 to construct the fuselage of Vertical's VX4 electric and hybrid. To fulfill Vertical's business which was before booking, the agreement is for an additional six certifying aircraft, but it may increase capacity to mass manufacturing of 2,000 VX4s annually.

Segments covered in the report

By Mode of Operation

- Piloted

- Autonomous

By End-Use

- Cargo

- Passenger

By Propulsion Type

- Parallel Hybrid

- Turboshaft

- Electric

- Turboelectric

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting