What is the Advanced Lead Acid Battery Market Size?

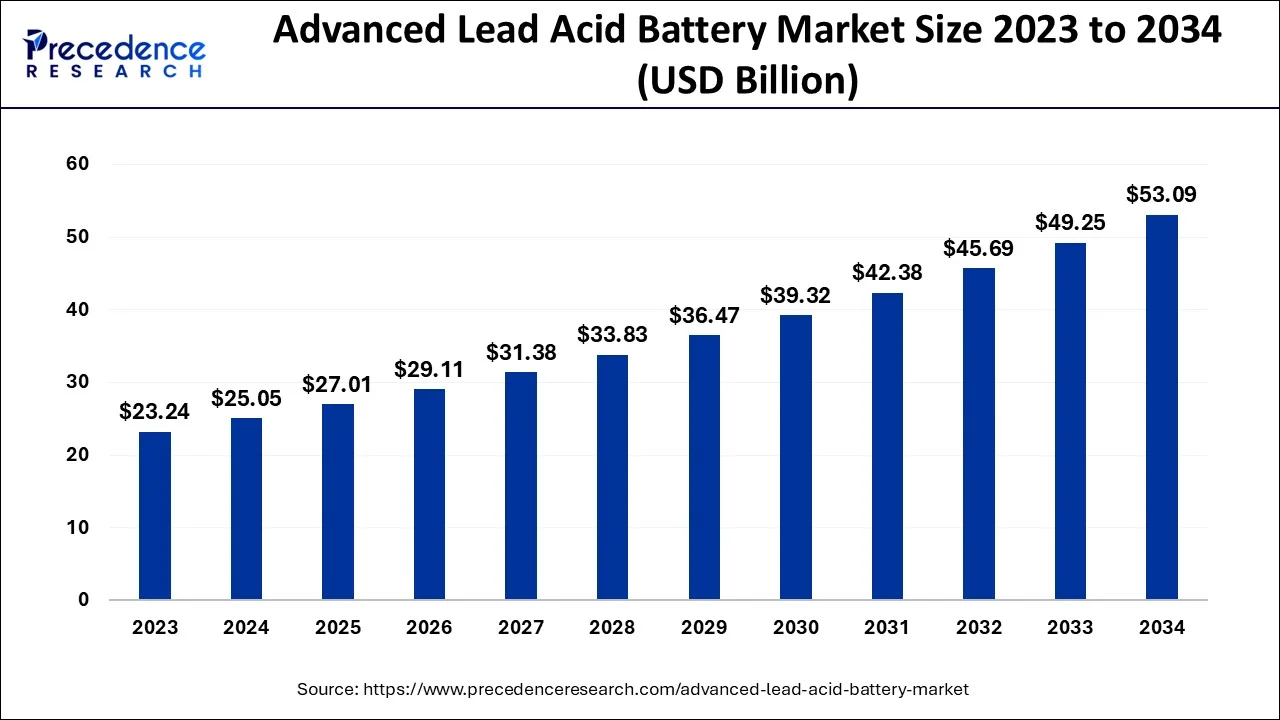

The global advanced lead acid battery market size is accounted at USD 27.01 billion in 2025 and predicted to increase from USD 29.11 billion in 2026 to approximately USD 56.74 billion by 2035, representing a CAGR of 7.71% from 2026 to 2035.

Market Highlights

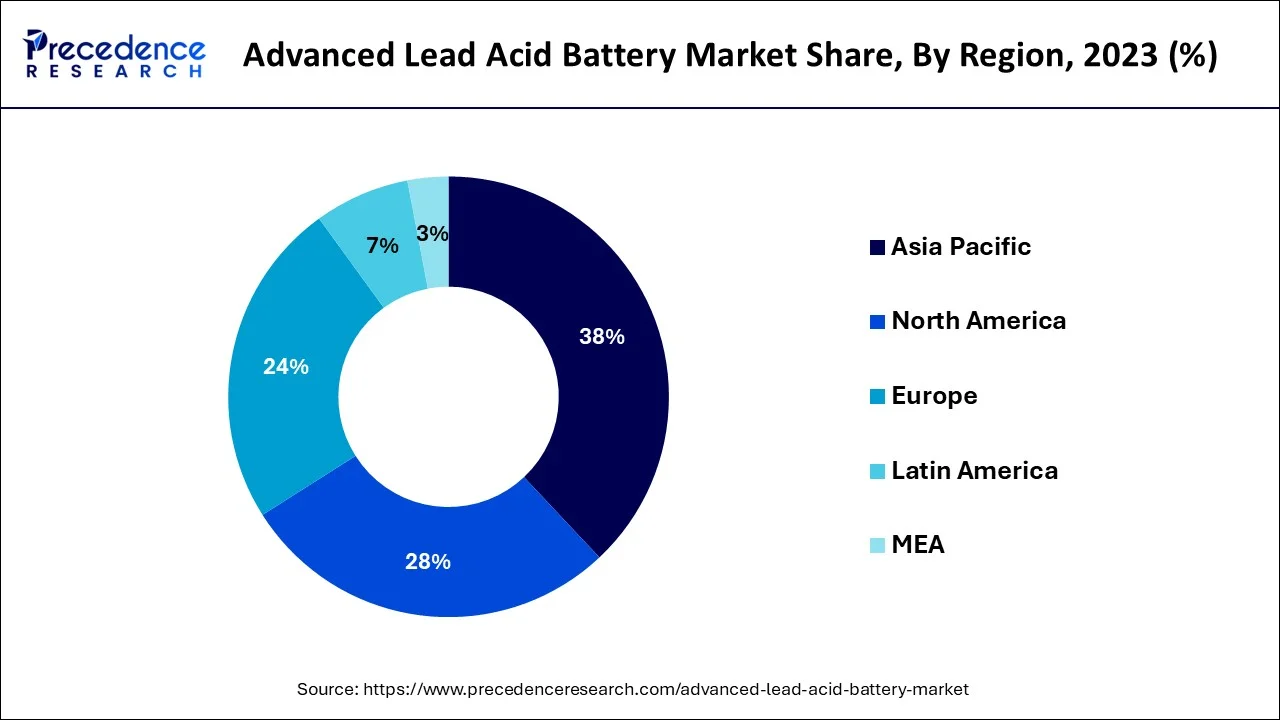

- Asia Pacific dominated advanced lead acid battery market in 2025.

- By type, the stationary segment led the market during the forecast period 2026 to 2035.

- By construction, the valve regulated lead acid battery segment led the market during the forecast period 2026 to 2035.

- By end user, the utility segment will gain a significant market share over the forecast period.

Market Overview

Advanced lead acid batteries are cost competitive energy storage solution which can be easily recycled. They are in great demand when compared with lithium-ion batteries. As the advanced lead acid batteries are cost effective, they are driving the market growth. Advanced lead acid batteries are used in various industries. They are used across utility, transportation industries and also in the commercial and residential places. During the pandemic due to a shortage of the workforce and restrictions in the supply chain logistics led to the unavailability of material which had slowed down the growth of the industry. The largest advanced lead acid battery manufacturer is China across the world. China is also a major supplier of the lead acid battery materials and parts across the world. Due to a disruption in the supply chain logistics China has seen a slowdown in the growth of this market.

Advanced Lead Acid Battery Market Growth Factors

Advanced lead acid batteries can be easily decomposed compared to other battery systems. The neutralization process helps in turning the acid into water. The acid is also processed and converted into other chemical components. Lead acid batteries are easily recycled into a new battery. About 98% of all the advanced lead acid batteries undergo recycling and reprocessing and hence all these factors are expected to drive the market during the forecast period. Doesn't increasing demand for battery storage across the data centers. Lead acid battery systems are used in UPS. These lead acid batteries cater to the backup power needs of various industries. It is extremely crucial for data centers in case of any power disruptions or inconsistencies. Increased installation of data centers is expected to drive the advanced lead acid battery market in the future.

Advanced Lead Acid Battery Market Outlook

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 27.01 Billion |

| Market Size in 2026 | USD 29.11 Billion |

| Market Size by 2035 | USD 56.74 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.71% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Construction Method, End User, and Geography |

Advanced Lead Acid Battery Market Segment Insights

Type Insights

On the basis of the type, the stationary segment of the advanced lead acid battery is expected to have the largest market share during the forecast. these batteries are extensively used as they offer smooth power integration across solar PV systems. With an accurate capacity of the battery bank the system is expected to run well. For energy, telecommunication, hospitals and other industries use stationary batteries as a standby power supply. Due the growth of the telecom sector across the developing as well as the developed nations across the globe is driving the market for this segment. There is rapid industrialization across all the developing countries which are in turn creating a great demand for this segment. Owing to all of these reasons the stationary segment is expected to grow well during the forecast period.

Construction Method Insights

On the basis of the construction method, the valve regulated lead acid battery segment is expected to have the largest market growth during the forecast period. This segment has grown well in the recent years in terms of value. The valve regulated advanced lead acid battery is the improved version of the semi concentric sulfuric acid electrolyte battery. These batteries are zero maintenance batteries and they do not require an addition or water to the cells. These batteries are known as zero maintenance batteries as they do not require any regular maintenance. Due to all of these reasons the VRLA advanced lead acid battery segment is expected to grow well during the forecast period.

End User Insights

On the basis of the end user, the utility segment is the fastest growing market segment. The utility segment shall grow well during the forecast period. As there is an increase in the renewable input and the demand to optimize electricity generated from these renewables the energy storage concept is becoming critical day by day. For all of these concerns advanced lead acid batteries are cost effective solutions which are reliable. Advanced lead acid batteries are also affordable for the utility sector. Therefore there is a growth in the power consumption in various countries across the globe which is driving the demand for these lead acid batteries and the utility segment shall grow well during the forecast period.

Advanced Lead Acid Battery Market Regional Insights

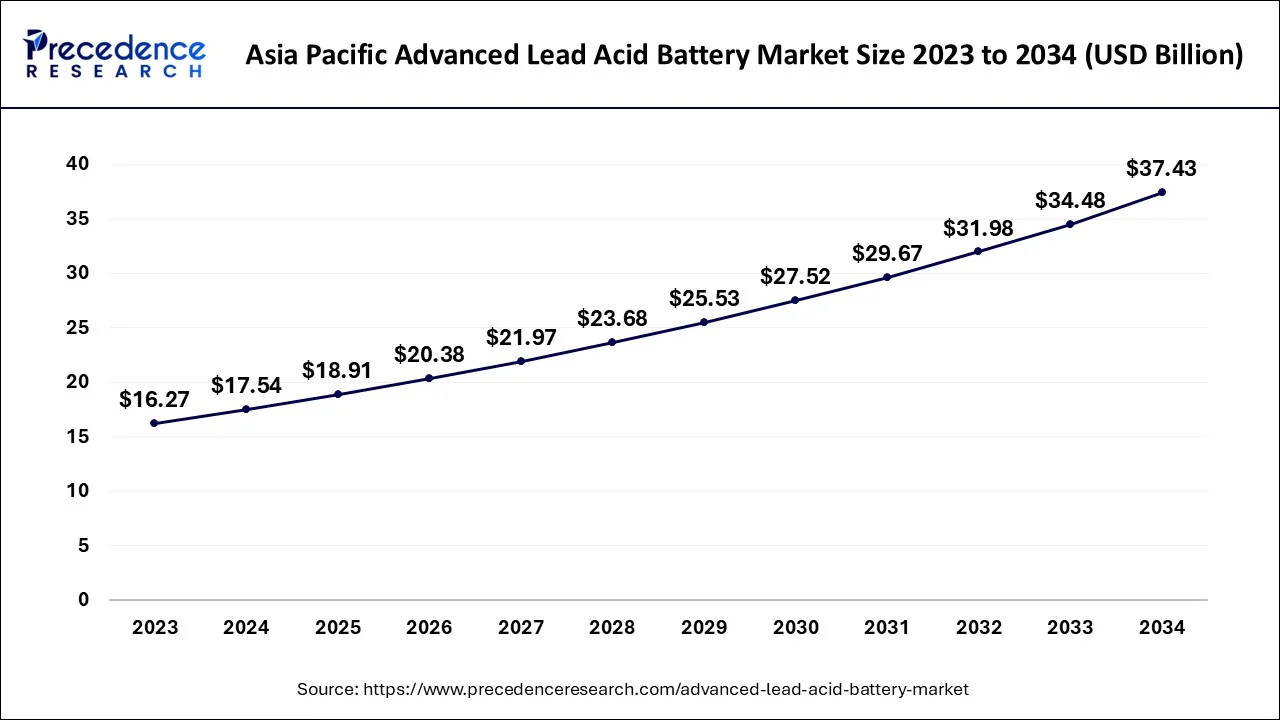

The Asia Pacific advanced lead acid battery market size is evaluated at USD 18.91 billion in 2025 and is predicted to be worth around USD 40.08 billion by 2035, rising at a CAGR of 7.80% from 2026 to 2035.

Many initiatives are taken by the governments of the developing nations to limit the adverse effects of the energy sector. In order to fulfill the demand of energy by the use of fossil fuels it is extremely advisable to store this energy in the battery system. All of these factors are leading to a growth in the deployment of battery energy storage systems across various industries. It is extremely useful for public utility applications as well as the residential application in the Asia Pacific region. China Japan South Korea and India are the key countries in the Asia Pacific region which dominate the region's growth.

The Asia Pacific market had the largest share followed by the North American region. Asia Pacific market shall have a good growth in terms of value during the forecast period for the advanced lead acid battery market. Increasing population in this region is creating greater demands for energy. There's an increase in the demand for energy across many rural regions in the Asia Pacific area. The countries like China, India, and others countries art focusing on minimizing the adverse effects of the energy sector on the environment. Governments are making policies in order to cut down greenhouse gas emissions.

In India, the market is driven by the growing adoption of electric vehicles (EVs), along with government initiatives supporting clean energy. In February 2025, India planned to strengthen renewable energy storage with 10 GWh of battery manufacturing capacity. The India Energy Storage Alliance (IESA) urged the Indian government to take action to boost India's battery recycling ecosystem. The Ministry of Mines launched an INR 1,500 crore incentive scheme to support recyclers of lithium-ion batteries, e-waste, and end-of-life vehicles.

North America is expected to grow rapidly in the upcoming period, driven by the expansion of industrial infrastructure, rising renewable energy integration, and high adoption of electric vehicles. In October 2024, the DOE committed up to USD 670 million in loans for the safety of electric vehicle batteries. This initiative is likely to boost the production capacity of EV thermal barriers in North America and strengthen the electric vehicle battery supply chain in the U.S. The growing demand for reliable, cost-efficient energy storage solutions, particularly in the automotive and renewable energy sectors, is expected to drive market growth.

The U.S. is a major contributor to the North American market. Government incentives and regulations promoting clean energy and energy storage are boosting the market in the country. Furthermore, the presence of leading battery manufacturers and continuous innovation in battery design and efficiency are contributing to market growth.

- In September 2024, the U.S. planned to allocate $3 billion to 25 projects in the battery manufacturing sector. In December 2024, the U.S. Department of Energy (DOE) selected 11 projects to further domestic manufacturing of next-generation batteries.

Europe is a significant market due to its strong focus on sustainable energy solutions and environmental regulations. The five revolutionary EV battery cell projects secured €643 million through the 2024 battery innovation fund. In July 2025, the European Union invested €852 million in six innovative EV battery projects. In December 2024, the European Commission and the European Investment Bank (EIB) formed a new partnership to support investments in the European battery manufacturing value chain. Such initiatives also contribute to market growth in the region.

Germany Advanced Lead Acid Battery Market Analysis

The market in Germany is growing due to increasing integration of renewable energy sources, such as solar and wind, which require reliable and cost-effective energy storage solutions. Rising demand for backup power in telecommunications, UPS systems, and automotive applications further drives market adoption. Additionally, technological improvements in battery efficiency and lifespan are supporting wider usage across industrial and commercial sectors.

The market in Latin America is driven by increasing demand for energy storage solutions, particularly in off-grid and renewable energy applications. Latin American government initiatives focus on energy storage, particularly lithium-ion battery systems, given the region's rich lithium resources. Countries like Argentina, Brazil, and Chile are leading these efforts. There is a strong focus on enhancing grid stability and efficiency through large-scale energy storage. Additionally, rising adoption of electric vehicles and government incentives to promote clean energy are fueling the demand for advanced lead-acid batteries.

Chile Advanced Lead Acid Battery Market Analysis

Chile's market is growing due to increasing renewable energy adoption, particularly solar and wind projects, which require reliable and cost-effective energy storage solutions. Rising demand for backup power in industrial, commercial, and telecommunications sectors, along with government support for clean energy initiatives, is further driving market growth.

The Middle East & Africa (MEA) presents immense opportunities for the advanced lead acid battery market, driven by the expanding automotive sector and the need for reliable backup power. Existing energy transition initiatives also support market growth. Government initiatives and incentives aimed at promoting electric mobility, energy transition, and sustainable transport solutions open new opportunities in the market.

The market in the region is also driven by the expansion of telecom infrastructure that relies on batteries for backup power at base stations to ensure network reliability. The region's increasing solar and wind energy projects are creating demand for utility-scale energy storage, where advanced lead-acid batteries provide cost-effective solutions for grid stability.

UAE Advanced Lead Acid Battery Market Analysis

The market in the UAE is growing due to increasing demand for energy storage solutions and stringent government regulations aimed at reducing carbon emissions. The expansion of the automotive industry and rising awareness of sustainable transportation are further fueling adoption, highlighting the country's shift toward cleaner and more efficient energy and mobility solutions.

Advanced Lead Acid Battery Market Value Chain Analysis

This stage involves the procurement of raw materials such as lead, sulfuric acid, and other components required for battery production.

Key Players: Clarios, EnerSys, Exide Industries Ltd, GS Yuasa Corporation.

This process includes the assembly of lead plates, acid filling, and the construction of battery cells.

Key Players: Exide Technologies, Leoch International Technology Ltd., C&D Technologies.

Distribution involves getting the finished batteries into the hands of OEMs, retailers, and end users.

Key Players: GS Yuasa Corporation, Clarios, EnerSys, East Penn Manufacturing Co.

Advanced Lead Acid Battery Market Companies

- HOPPECKE Batterien

- Hitachi Chemical Energy Technology

- Crown Battery

- East Penn Manufacturing

- Exide

- EnerSys

- HOPPECKE Batterien

- GS Yuasa

- Leoch

- Narada Power Source

- Furukawa Battery

- Ritar Power

- Amara Raja

- Trojan

- Coslight

Recent Developments

- In March 2025, Clarios announced a $6 billion investment to expand American manufacturing and strengthen battery supply chains essential for energy and critical mineral innovation.

(Source: https://www.clarios.com) - In February 2025, EnerSys planned to showcase its latest battery solutions called ODYSSEY at the 2025 annual meeting of the Technology and Maintenance Council.

(Source: https://www.odysseybattery.com) - In January 2024, India-based IPower Batteries launched its graphene series lead-acid batteries, which have received Type Approval Certification (TAC) from ICAT after successful testing for AIS0156.(Source:https://www.graphene-info.com)

Advanced Lead Acid Battery Market Segments Covered in the Report

By Type

- Stationary

- Motive

By Construction Method

- Flooded

- VRLA

- Others

By End User

- Automotive and Transportation

- Energy and Power

- Industrial

- Commercial

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting