What is the 3D Printed Composites Market Size?

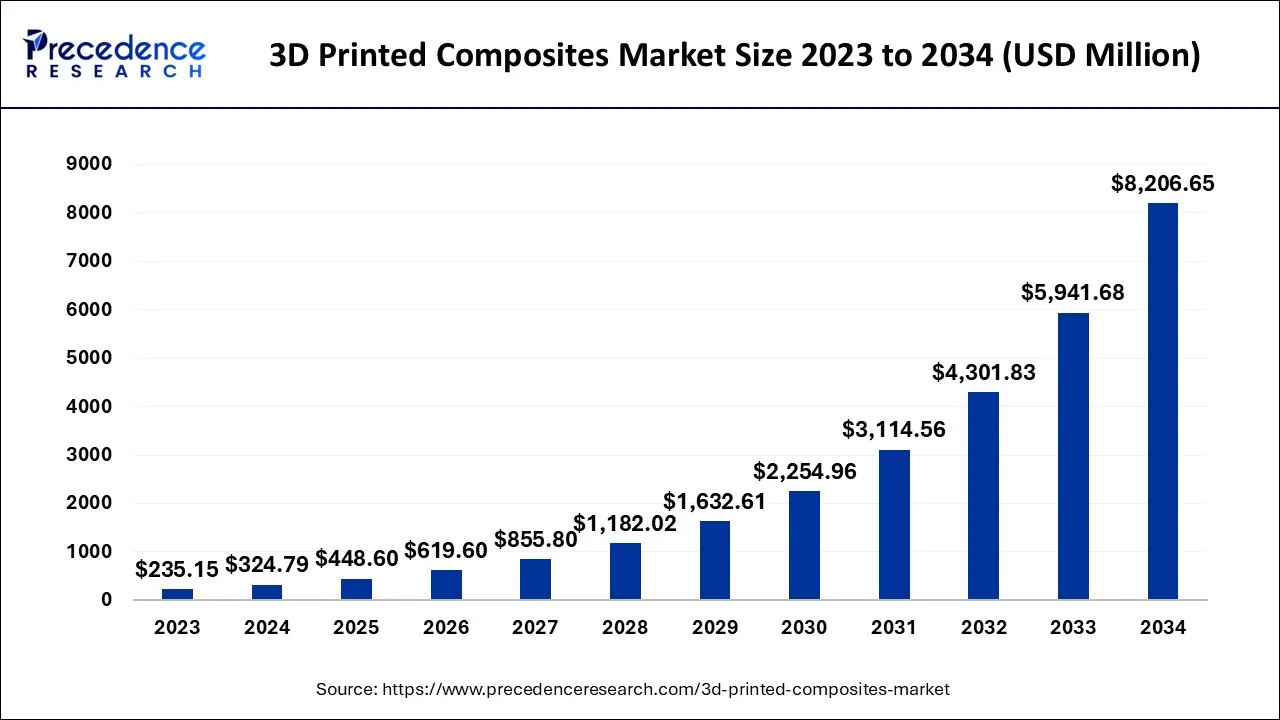

The global 3D printed composites market size is calculated at USD 448.60 million in 2025 and is predicted to increase from USD 619.60 million in 2026 to approximately USD 10,054.87 million by 2035, expanding at a CAGR of 36.47% from 2026 to 2035.

3D Printed Composites Market Key Takeaways

- North America is predicted to generate the highest market share between 2026 and 2035.

- Asia-Pacific region is expected to expand at the fastest CAGR between 2026 and 2035.

- By Composite Type, the carbon fiber composite segment is projected to expand at the fastest CAGR between 2026 and 2035.

- By End-User, the aerospace & defense segment is expected to grow at the biggest CAGR between 2026 and 2035.

- By Technology Type, the material extrusion technology segment is predicted to grow at the remarkable CAGR from 2026 and 2035.

Market Overview

The 3D printed composites market is a rapidly growing industry that involves the production of composite materials using additive manufacturing technology. Composites are materials that are made up of two or more different materials that combine to create a new material with improved properties. In the 3D printed composites market, composite materials are created using a combination of reinforcing material (such as carbon fiber, glass fiber, or Kevlar) and a thermoplastic or thermosetting polymer.

The use of 3D printing technology allows for the precise placement of the reinforcing material within the polymer matrix, resulting in composites with superior strength, stiffness, and durability. The 3D printed composites market is being driven by the increasing demand for lightweight and high-performance materials in industries like aerospace, automotive, and defense. These industries are looking to reduce weight and improve fuel efficiency while maintaining or improving the strength and durability of their products.

The market is anticipated to grow due to increasing demand for prototyping tools from various sectors and competitive research & development in 3D printing, mainly in the healthcare, aerospace, automotive, and defense sectors. The application of 3D printing in the industrial sector is described by the term additive manufacturing (AM). This process includes the incorporation of material to generate a 3D file. Composites have replaced metals and other components in a variety of applications due to their superior characteristics at a reduced weight.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 448.60Million |

| Market Size in 2026 | USD 619.60 Million |

| Market Size by 2035 | USD 10,054.87Million |

| Growth Rate from 2026 to 2035 | CAGR of 36.47% |

| Largest Market | North America |

| fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Composite Type, End-User, Technology Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Cost-effective

3D printing technology has revolutionized the manufacturing industry by reducing the overall cost of production. Using 3D printing, manufacturers are able to produce complex parts and structures in a single process, reducing the need for multiple components and assembly steps. The production cost of 3D printing is around 5.5 times less than PMMA and 10.2 times EM. The initial equipment cost for the additive manufacturing method is lower. Mainly in the aerospace industry, costly raw materials are used which have low weight and high performance. These high-performance materials are costly to machine down by using conventional manufacturing methods and are also costly to purchase.

Lightweight materials for aircraft

3D printed composites are lightweight and have high strength-to-weight ratios, making them ideal for use in aerospace, automotive, and other industries where weight is a critical factor. Engineering mostly opts for alternatives to reduce the consumption of fuel and enhance energy efficiency while building and designing aircraft. The implementation of 3D printing techniques assists in reducing the mass of aircraft by testing various high-strength and lightweight materials. Industrial 3D printers are mainly used to produce parts and components with minimal waste. Additionally, 3D printing technology assists in evaluating lightweight materials by printing various components on demand.

Restraints

High cost

The cost of 3D printing technology is high, and the cost of 3D-printed composites is even higher. This is a significant constraint for small and medium-sized enterprises that may not have the financial resources to invest in technology. The production cost is increased due to high-end instruments. The cost was a major hindrance during the COVID-19 period due to strict regulations and a lack of raw materials.

Limited materials and limited size

The range of materials that are used for 3D printing is limited. While some composite materials are used, the range of available options still needs to be narrow compared to traditional manufacturing processes. The size of the components that are 3D printed is currently limited, which is a constraint for industries including aerospace, where large components are required.

Opportunities

Aerospace and defense

The aerospace and defense industries are significant consumers of composite materials, and 3D-printed composites offer an efficient and cost-effective way to produce parts with high strength and low weight. 3D printing for composite materials in this industry helps reduce production time, minimize waste, and enable the creation of more precise and customized parts. For instance, companies such as NASA and SpaceX are working to develop societies by using 3D printing technology on other planets like Mars.

Construction industry

The construction industry is starting to explore the use of 3D-printed composites for building structures. Composite materials offer improved strength, durability, and resistance to environmental factors. 3D printing also enables the creation of complex geometries that improve building performance and reduce material waste.

Segment Insights

Composite Type Insights

Based on the composite type, the market is segmented into glass fiber composite, aramid & graphene fiber composite, and carbon fiber composite. The carbon fiber composite is anticipated to expand at the fastest CAGR from 2024 to 2034. The growth is due to the rising demand in the defense and aerospace sector. 3D printing with composites enables the production of lightweight parts with complex geometries, which significantly reduce the weight of aircraft and vehicles, leading to improved fuel efficiency and performance. Arevo developed a laser-based technique for 3D printing using carbon fiber.

The fiberglass sector is anticipated to grow at a remarkable pace from 2024 to 2034. Fiberglass is a strong, low-cost reinforcing substance with some flexibility. It increases the strength of parts over that of plastics and is an excellent starting place for printing with strengthening.

End-Use Insights

On the basis of the end-user, the 3D printed composite market is segmented into healthcare, automotive, aerospace & defense, as well as others. The aerospace & defense sector is anticipated to grow at the highest CAGR from 2024 to 2034. The aerospace and defense sector adopted composite materials for various uses, including interiors, engine components, body components, and others. The physical characteristics of components of aircraft have the advantage of decreasing the payload of aircraft.

The use of 3D printing techniques has enhanced the efficiency of generating components with high precision and low waste. Various 3D printing companies, such as Boeing and GE, are utilizing the technology to develop small parts with complex geometries, which is costly and time-consuming.

Furthermore, the healthcare sector is anticipated to grow at the fastest CAGR from 2024 to 2034. 3D-printed composites are used to create lightweight and durable prosthetic limbs, which are customized to fit the unique needs of each patient.

3D-printed composites are also used to create customized surgical tools, such as surgical guides, jigs, and fixtures. These tools are designed to fit the specific anatomy of a patient, which improves the accuracy and efficiency of surgeries. 3D-printed composites are used to create customized orthotics, such as braces and splints. These orthotics are designed to fit the specific needs of each patient, which improves their comfort and mobility.

Technology Insights

Based on technology, the 3D-Printed Composites market is segmented into powder bed infusion, material extrusion technology, and others. The material extrusion technology sector is anticipated to grow at the fastest rate from 2024 to 2034. Material extrusion technique has been extensively used in a variety of applications, including 3D printing composite materials. Furthermore, the material available for this sector is diverse, making it one of the most popular methods for printing composites. The use of powder bed infusion technology for composite material applications has seen major advancements recently.

The Fusion Bed Infusion sector is anticipated to grow at the fastest CAGR from 2026 to 2035. Fusion Bed Infusion (FBI) is a manufacturing process that combines 3D printing with a composite material infusion. In FBI, the 3D printed part acts as a mold into which a liquid composite material is infused, and the infused material then hardens and forms a solid composite part. The FBI process has several advantages over traditional composite manufacturing methods:

- It allows for the creation of complex shapes that are difficult or impossible to achieve with traditional methods.

- It reduces waste by using only the necessary amount of material, unlike traditional methods that require excess material to be trimmed away.

- FBI offers improved consistency and repeatability since the infusion process ensures a uniform distribution of the composite material.

Regional Insights

In 2025, North America held the largest share of the worldwide 3D printed composite materials market during the projected period. The North American 3D printing composite market has grown steadily in recent years due to the increasing adoption of 3D printing technology across various industries, including aerospace, automotive, healthcare, and consumer goods. The market is driven by the demand for lightweight, high-strength, and complex-shaped parts which are able to be produced using 3D printing with composites. The healthcare sector is also driving the demand for 3D printing composites in North America, particularly in the production of customized implants and prosthetics. The ability to produce patient-specific parts with complex geometries and high precision using 3D printing with composites has revolutionized the medical field, leading to better patient outcomes and reduced costs.

Asia-Pacific, on the other hand, is projected to grow at the fastest CAGR during the forecast period. Increasing spending on infrastructure as well as novel construction is anticipated to propel the market growth. The region has a booming manufacturing industry, including the automotive, aerospace, and electronics sectors, adopting 3D printing composites for various applications. The increasing investment in research and development and the growing awareness of 3D printing technology is expected to drive the market for 3D printing composites in Asia-Pacific.

Why Is the European 3D Printed Composites Market Experiencing Notable Growth?

The European 3D printed composites market is experiencing sustainable growth with the high adoption in the aerospace, automotive, and industrial manufacturing markets. Lightweight material, fuel economy, and reduced carbon emissions in Europe are encouraging more interest in additive manufacturing based on composites. The innovation of materials and processes is an ongoing process being driven by strong R&D ecosystems and supported by universities, research institutes, and government engagement via public-private partnerships.

The presence of large aerospace and automobile OEMs contributes to high demand for high-performance and customized composite parts. Use of 3D printed composite in tooling, in prototyping, and in final application is gaining flexibility in the production field and accelerating the lead time, and Europe is a leader in highly developed composite technologies in the world.

What Factors Are Supporting the Growth of the MEA 3D Printed Composites Market?

The MEA 3D printed composites market is a growing market at a quick pace as a result of rising investments in advanced manufacturing and industrial diversification. To promote localization and innovations, Gulf countries are implementing 3D printed composites in the aerospace and construction sectors, as well as in energy. An increase in lightweight and high-strength materials in defence and infrastructural developments is enhancing adoption in the market.

Increased production capacity in the regions is being encouraged by the growth of the innovation hubs, technology parks, and additive manufacturing centers. Growth is also being supported by the partnership with world technology suppliers and increased interest in quick prototyping and custom manufacturing.

Why Is the Latin American 3D Printed Composites Market Gaining Traction?

The 3D printed composites market has been on the rise in Latin America since the adoption of the additive manufacturing in the automotive, aerospace, and industrial market is on the rise. Brazil and Mexico are using 3D printed composites to enhance the flexibility in design and lower the cost of production. The increasing attention to localization in production and supply chain resilience is stimulating investments into the latest technologies in composites.

The market is also growing with the emergence of small and medium-sized manufacturers who are using 3D printing in tooling and functional parts. Moreover, alliances between research centers and manufacturers are also propelling material innovation.

3D Printed Composites Market – Value Chain Analysis

- Feedstock Procurement: The process involves the acquisition of base materials such as polymers, carbon fibers, glass fibers, and additives that are used in composites manufacturing. Regular procurement brings consistency of the materials and cost efficiency in the downstream processes.

Key Players: BASF SE, Arkema SA, Evonik Industries AG, Toray Industries, Solvay SA - Chemical Synthesis and Processing: Raw materials are manufactured by a synthetic process and processed into chemical materials to achieve the desired resin characteristics, thermal stability, and compatibility with the additive manufacturing technologies.

Key Players: Evonik Industries AG, BASF SE, Dow Inc., SABIC, Arkema SA - Compound Formulation and Blending: Composite materials are materials that are manufactured by a combination of polymers with reinforcing fibres and functional additives to enhance strength, flame resistance, or flexibility. There are developed formulations unique to the 3D printing process, which are FDM, SLS, and DLP.

Key Players: Arkema SA, BASF Forward AM, Solvay SA, DSM Engineering Materials, Victrex plc - Quality Testing and Certification: The materials are tested in terms of mechanical, thermal, and fire-resistance to meet the requirements of the industry and the state. It is certified to be suitable for aerospace, automotive, and industrial end-use.

Key Players: UL Solutions, TÜV SÜD, SGS, Bureau Veritas, Intertek

3D Printed Composites Market Companies

- 3D Systems Corp.

- Arkema SA

- AREVO Inc.

- BASF SE

- Cosine Additive Inc.

- CORE Industrial Partners LLC

- CRP Technology Srl

- General Electric Co.

- EOS GmbH Electro Optical Systems

- Graphite Additive Manufacturing Ltd.

- Koninklijke DSM NV

- Hoganas AB

Recent Developments

- In April 2025, the HP Development Company, L.P., announced that it would commercially offer HP 3D HR PA 12 FR, a flame-retardant and halogen-free polymer powder that is suitable for use in Multi Jet Fusion machines in collaboration with Evonik. The material is aimed at those applications that demand increased fire protection and high levels of mechanical performance and print reliability. (Source: https://www.hp.com )

- In February 2024, Evonik Industries AG released INFINAM FR 4100L, a flame-resistant photopolymer resin that can be used in DLP 3D printing technologies. Once cured, the resin is highly mechanically durable, and it holds the end-use components in strenuous industrial and electrical services. (Source: https://www.evonik.com )

- In March 2023, 3D Systems collaborated with TE Connectivity to come up with an integrated production workflow of electrical connectors. The collaboration has facilitated the digital design to complete parts, which made production quicker and more efficient. (Source: https://investor.3dsystems.com )

- CORE acquired GEM manufacturing in February 2023. GEM Manufacturing is a provider of mechanical assemblies and metal components.

- In March 2023, 3D Systems collaborated with TE Connectivity on an innovative solution to generate an entire production plan from design to finished electrical connectors.

- Laecoere and Graphite Additive Manufacturing partnered to develop the next generation of wing techniques using 3D printing methods in August 2022.

- In January 2022, CORE Acquired RE3DTECH 3D Printing Service with an aim to form a novel 3D printing platform.

Segments Covered in the Report

By Composite Type

- Carbon Fiber Composites

- Glass Fiber Composites

- Graphene and Aramid Fiber Composites

By End-User

- Aerospace & Defense

- Healthcare

- Automotive

- Others

By Technology Type

- Fusion Bed Infusion

- Stereolithography (SLA)

- Material Extrusion Technology

- Selective laser sintering (SLS)

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting