What is the 4K Set-Top Box Market Size?

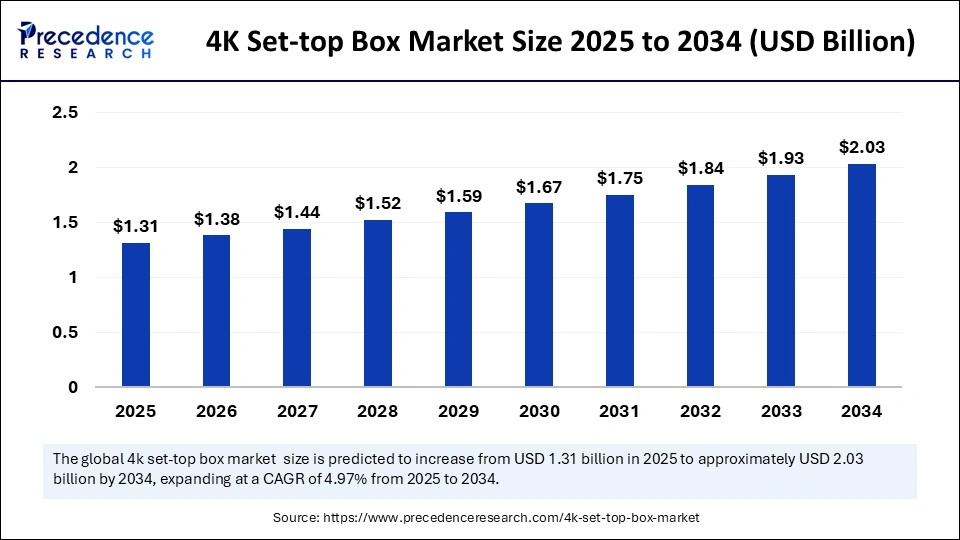

The global 4K set-top box market size is valued at USD 1.31 billion in 2025 and is predicted to increase from USD 1.38 billion in 2026 to approximately USD 2.03 billion by 2034, expanding at a CAGR of 4.97% from 2025 to 2034. The market grows because consumers continue to require HD content and streaming platforms.

4K Set-Top Box Market Key Takeaways

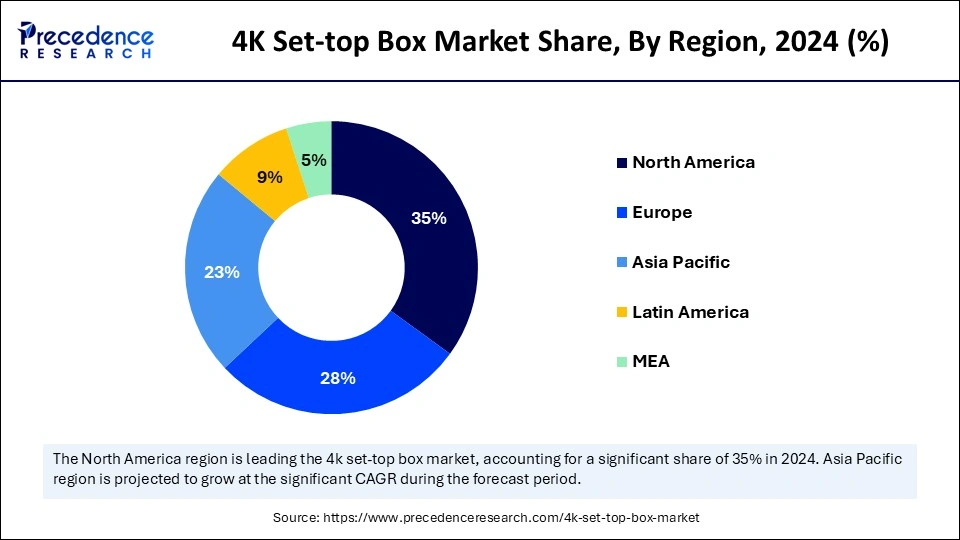

- North America dominated the largest market share of 36% in 2024.

- The Asia Pacific market is anticipated to witness the fastest growth during the forecasted years.

- Europe emerged as a significant player in the global market.

- By product, the DTT segment contributed the biggest market share in 2024.

- By product, the satellite segment is anticipated to show substantial growth in the forecast period.

- By application, the residential segment held a significant market share in 2024.

- By application, the commercial segment is anticipated to show considerable growth over the forecast period.

Artificial Intelligence Integration (AI) in 4K Set-Top Boxes

The implementation of artificial intelligence enhances the 4K set-top box market experience through multiple intelligent features. AI algorithms optimize picture settings in real-time using environmental information and content types to deliver the absolute best visual quality. Through artificial intelligence, users can access intelligent features that automatically arrange content, improve search capabilities, and activate voice-controlled virtual assistants that learn from user interactions.

Market Overview

The 4K set-top box enables users to stream television content at a UHD resolution level of 3840 x 2160 pixels for an excellent viewing experience. Users benefit from online streaming platform accessibility through their Ethernet or Wi-Fi internet connection. The foundation of contemporary home entertainment systems depends on 4K set-top-boxes since these devices present features including voice command through virtual assistants, and they offer both gaming entertainment and live TV service at high definition resolutions. The increasing adoption of smart home technology, along with consumer interest in advanced tech systems, leads to a surge in 4K STB demand across the market.

The demand in the market for high-quality audio-visual entertainment is the primary force attracting modern viewers. The expansion of the 4K set-top box market stems from rapid urbanization and improved living standards in different areas because consumers now possess enough money to buy advanced technology products. The rising number of connected home devices and smart devices results in a growing system that makes 4K STBs seamlessly integrate with household environments.

4K Set-Top Box Market Growth Factors

- Rising demand for high-quality content: The demand for streaming services consists of offering remarkable video and audio quality standards. The 4K set-top box market technologies keep their streaming features crucial because customers need 4K content while expecting future advancements toward 4K display resolution.

- Expansion of streaming services: The rise of online video streaming platforms leads to an increasing market need for 4K set-top boxes produced by companies like Netflix, Amazon Prime, and Disney. New device purchases become necessary for users since video content companies allocate more funds to 4K content, which degrades regular device quality.

- Adoption of smart homes and IoT devices: The 4K set-top box market grows substantially because people adopt smart home technologies while increasing their networked device usage. 4K set-top boxes are popular because consumers need devices that unite smart technologies efficiently. These devices offer voice commands, smart connectivity, and better user experiences.

4K Set-Top Box Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to the rapid expansion of the telecom sector coupled with technological advancements in the media and 0TT platforms globally.

- Major Investors: Numerous market players are actively entering this market, drawn by partnerships, R&D and joint ventures. Several set-top box companies such as Arion Technology Ltd., EchoStar Corporation, HUMAX Electronics Co., Ltd, and some others have started investing rapidly developing high-quality 4K set-top boxes in different parts of the world.

- Sustainability Trends: The electronic industry has started adopting sustainable materials for lowering the rate of emission. Moreover, numerous government initiatives aimed at rising the use of eco-friendly materials in the electronics sector is an ongoing trend in this industry.

- Startup Ecosystem: Various startup brands are engaged in manufacturing 4K set-top boxes for the end-users. The prominent startup companies dealing in 4K set-top box consists of Telecab, Remix, Lumio and some others.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.03 Billion |

| Market Size in 2025 | USD 1.31 Billion |

| Market Size in 2026 | USD 1.38 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.97% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product , Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing digitisation of cable TV networks

The digital broadcasting technology continues advancing while DTH service adoption and smart TV penetration spread across the market landscape. Consumers are moving towards digital TV services as a result of fast-paced urban growth, rising personal financial capabilities, and a better way of living. Advanced 4K STBs experience increased demand because consumers want on-demand entertainment content such as movies, music, and OTT media platforms. Manufacturers provide consumers with products that have flexible storage capabilities that offer streaming service access and social media utilization. Modern digital entertainment requires 4K STBs because of their features, such as web browsing, video calling, and cost-effective subscription plans.

Growing demand for high-quality content

The market is driven because users seek premium video entertainment that delivers superior visual quality. Users obtain better home entertainment value from 4K picture quality, so they replace their existing entertainment systems with upgraded versions. Modern fast internet availability through broadband infrastructure eliminates buffering frustrations so users can access 4K content smoothly. This market shows quick global expansion because of better content standards and enhanced user needs, combined with improving telecommunications networks.

Restraint

Higher cost

The 4K set-top box market expansion faces significant challenges from 4K technology since it carries a high price tag. Modern operational costs remain high because 4K content production and distribution demand greater bandwidth resources throughout the process. Cost-sensitive consumers remain excluded from 4K STB products as well as subscription services due to their high initial prices. A reliable, high-speed internet connection in rural areas prohibits customers from purchasing 4K streaming devices because reliable 4K connectivity is a fundamental prerequisite for streaming 4K content fluidly.

Opportunity

Developing markets and technological advancements

Ultra-HD content demand is increasing in emerging economies to create a strong market potential for the 4K set-top box market. The combination of cheap 4K TVs and advanced internet networks creates new market opportunities for 4K STBs since content creators and streaming platforms develop and invest in local 4K content. The government's support for digital technology advancement and network improvements has made the 4K STB market more favorable, leading customers to choose these products due to their AI recommendation features, along with voice assistance and smart home capabilities.

Product Insights

The DTT segment dominated the 4K set-top box market in 2024. Users can access 4K broadcasts through their antenna by using a 4K DTT set-top box that converts digital signals into superior resolution images and enhanced audio. The need for high-definition content from consumers drives viewers to switch from standard-definition to 4K DTT set-top boxes because these devices deliver an improved viewing experience.

The number of customers interested in DTT set-top boxes rises because broadcasters are presenting more 4K content, thus leading to better customer satisfaction and increased adoption of digital television services. Governments worldwide continue to support digital broadcast expansion, thus increasing superior digital television delivery across the globe.

The satellite segment is anticipated to show substantial growth in the forecast period. Users connect satellite STB systems to watch brand-new programs from various worldwide sources through multiple domestic and international channels. Advanced satellite set-top boxes provide consumers with multiple features, including live program recording, video on demand, and interactive multimedia services, which increases their market appeal.

The segment grows because enhanced satellite technology brings improvements to signal quality, with more available channels and enhanced performance capabilities. The satellite technology improvements and multiple external factors will fuel the growth of the satellite STB market while attracting increasing demand from end users

Application Insights

The residential segment held a significant 4K set-top box market share in 2024 due to the high number of television access in households as audiences opted for digital entertainment like films and television series. As households increasingly favored digital media such as films and television programs, the adoption of 4K set-top box devices rose significantly. The market grew as governments supported digital TV broadcasting, making high-quality services more accessible. During long periods of staying home, more people chose digital TV, which led to a big rise in the sales of set-top boxes.

- In February 2024, ZTE Corporation introduced a new 4K DVB Zapper Set-Top Box at MWC Barcelona 2024. This device aims to serve viewers who want better UHD TV experiences. ZTE continues to be committed to building home media solutions while continuing to search with global operators to help drive innovations in the smart home space.

The commercial segment is anticipated to show considerable growth over the forecast period. The market growth stems from growing commercial adoption of these devices by restaurants, bars, hotels, and entertainment facilities. The economic advantages of STB installations influence their popularity in commercial environments since they present a budget-friendly solution to stream content throughout multiple displays equally effectively. Businesses offering high-definition sports, movies, and live events. Companies can gain an edge by providing premium options that attract more viewers and more customers. This enables commercial settings to develop competitive advantages by providing premium service options to attract more customers.

Regional Insights

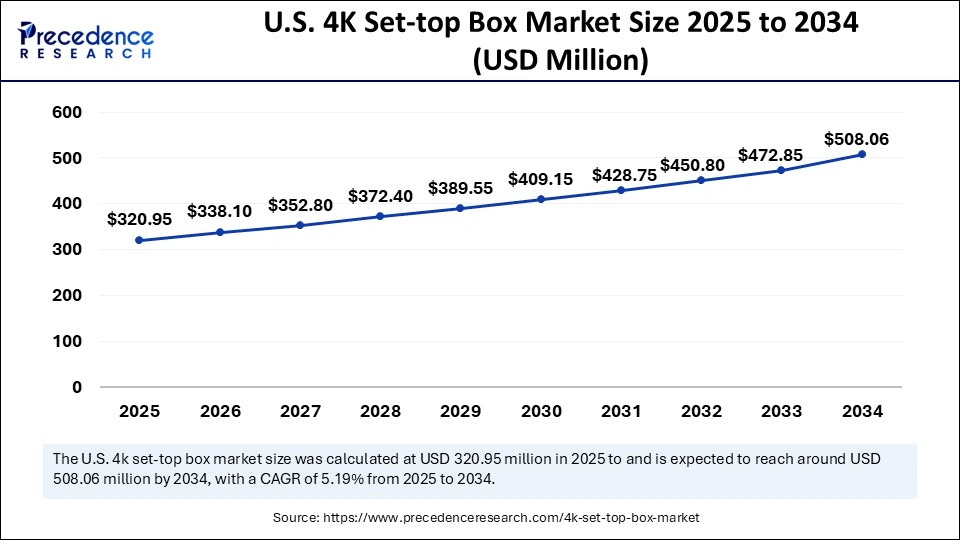

U.S. 4K Set-Top Box Market Size and Growth 2025 to 2034

The U.S. 4K set-top box market size is exhibited at USD 320.95 million in 2025 and is projected to be worth around USD 508.06 million by 2034, growing at a CAGR of 5.19% from 2025 to 2034.

North America accounted for the largest share of the 4K set-top box market in 2024. Enhanced household income levels in the United States and Canada drive citizens to purchase high-end entertainment systems. This region benefits from rapid internet because its people rapidly embrace modern technology. This widespread internet access enables 4K streaming capabilities.

The market demand for high-quality video content, as well as advanced technological interfaces, motivates customers to upgrade their devices to 4K standards. Broadcast service providers across the region enhance their content offerings with 4K programming, which drives up the market demand for set-top boxes. The adoption of 4K technology has received additional momentum since government digital TV broadcasting initiatives have been established.

The Asia Pacific 4K set-top box market is anticipated to witness the fastest growth during the forecasted years. There are several factors driving demand for high-quality entertainment in this region, such as high population size, growing purchasing power, and rapid urbanization. The rising middle class and cheap smart TV costs have led to widespread use of 4K set-top boxes in the market.

The market continues expanding rapidly because viewers demand better ultra-HD channels with high-quality video content, especially in the emerging markets. Modern digital technology improvements and improved broadband infrastructure indicate that the Asia Pacific market will experience ongoing growth throughout the years.

Europe emerged as a significant player in the global 4K set-top box market because the digital infrastructure developed, and consumer preferences changed. The region observes an important trend where streaming services have been directly added to set-top boxes to meet the growing consumer need for on-demand streaming options with traditional broadcast services. Public initiatives from government entities continue to spur digital broadcast progress and increase internet speed networks throughout the city and countryside areas

What made Latin America to hold a considerable share of the market?

Latin America held a considerable share of the industry. The growing popularity of TV serials in several countries including Argentina, Brazil, Peru, Venezuela and some others has boosted the market expansion. Additionally, rapid investment by government for strengthening the telecom sector is expected to proliferate the growth of the 4K set-top box market in this region.

How did Middle East and Africa held a notable share of the industry?

The Middle East and Africa held a notable share of the market. The increasing consumer preference to enjoy thriller OTT series in various nations such as UAE, Saudi Arabia, South Africa and some others has driven the market growth. Also, technological advancements in the media and entertainment sector coupled with rapid investment by market players for developing AI-integrated set-top boxes is expected to drive the growth of the 4K set-top box market in this region.

Key Players: Delivering 4K set-top box in different parts of the world

- Arion Technology Ltd: Arion Technologies a tech company based in South Korea that manufactures digital broadcasting receivers.

- EchoStar Corporation: EchoStar Corporation is an American telecommunications company that provides a range of satellite, wireless, and video services through its subsidiaries, including DISH Network, Boost Mobile, Sling TV, and

- Hughes Network Systems:The company specializes in satellite and wireless communications technology, and offers pay TV, broadband internet, mobile telephony, and hardware products to consumer, enterprise, and government clients worldwide.

- HUMAX Electronics Co., Ltd: HUMAX Electronics Co., Ltd. is a South Korean company founded in 1989 that develops and manufactures a wide range of digital technology and electronics. The company has expanded its portfolio to include automotive electronics, smart home devices, EV chargers, and various network solutions for telecommunications and mobility services.

- Infomir Group: Infomir Group is a Ukrainian company founded in 2001 that specializes in industrial and consumer electronics, particularly IPTV/OTT set-top boxes, including the MAG series, and the Ministra TV platform. This company is vertically integrated, handling research and development, manufacturing, and distribution.

- Inspur Group: Inspur Group is a Chinese multinational company that provides IT products and services for cloud computing and big data. Headquartered in Jinan, Shandong, the company offers a wide range of solutions including servers, storage, cloud operating systems, and enterprise software, operating in over 120 countries and regions.

- Roku, Inc.: Roku, Inc. is an American streaming technology company that designs and manufactures streaming devices, offers a TV streaming platform, and provides digital advertising services. This brand designs and manufactures consumer electronics for streaming and operates a TV streaming platform.

- Sagemcom Group: Sagemcom Group is a French multinational technology company headquartered in Bois-Colombes, France, that designs and manufactures high-value communication terminals and solutions. Its business focuses on three main markets: broadband solutions (e.g., internet boxes), audio-video solutions (e.g., set-top boxes), and smart energy.

4K Set-Top Box Market Companies

- Amazon.com, Inc.

- Arion Technology Ltd.

- EchoStar Corporation

- HUMAX Electronics Co., Ltd

- Infomir Group

- Inspur Group

Roku, Inc. - Sagemcom Group

- Techniolcor SA (Vantiva SA)

- Vestel Group (TVS Regza Corporation)

- ZTE Corporation

Recent Developments

- In March 2025, TOD announced its strategic alliance with STB technology leader Skyworth during the Web Summit Qatar 2025 conference. The technological combination brings together TOD premium content through QVWi 4K set-top box capabilities from Skyworth.

- In September 2024, STB 4K AI, launched by ZTE Corporation at the 2024 IBC Show, established a new era of home entertainment by uniting STB and soundbar features. STB functions as a complete system that offers premium sound quality, operates as a center for voice and gesture commands, and works as a sophisticated control point for IoT management.

- In March 2024, ZTE Corporation announced, through a partnership with Telecab in Brazil, the commercial release of the B866V2FA set-top box. A set-top box operating under Android TV features 4K resolution capabilities, which delivers deep TV immersion to users.

- In September 2025, Saima Telecom partnered with ZTE. This partnership is done for launching a new 4K set-top box in Kyrgyzstan.

(Source: https://www.zte.com) - In September 2025, ZTE Corporation collaborated with TELE System. This collaboration is done for launching a 4K Google TV set-top box in the U.S.

(Source: https://www.mobileworldlive.com) - In March 2025, TOD announced partnership with Skyworth. This partnership is aimed at launching a 4K set top box in the MENA region.

(Source: https://www.broadcastprome.com)

Segments Covered in the Report

By Product

- Internet Protocol Television (IPTV)

- Satellite

- Cable

- Digital terrestrial (DTT)

- Over the top (OTT)

- Hybrid

By Application

- Residential

- Commercial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting