5G in Healthcare Market Size and Forecast 2025 to 2034

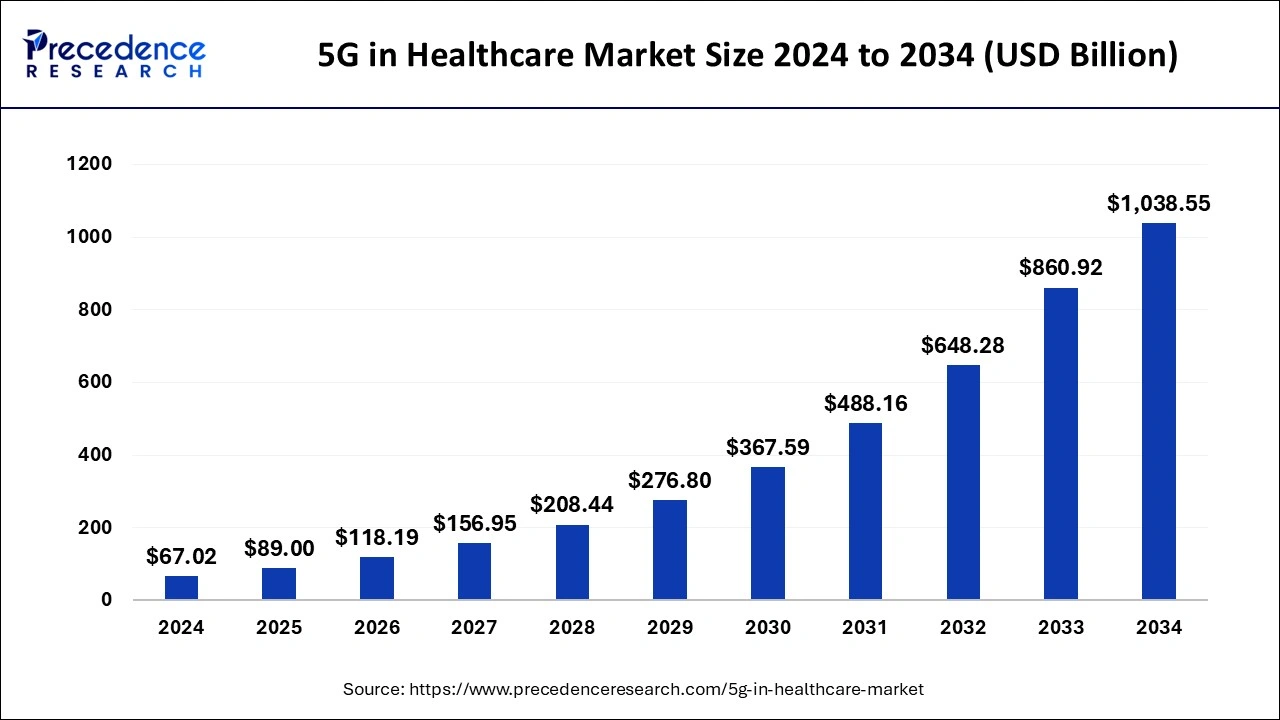

The global 5G in healthcare market size was accounted for USD 67.02 billion in 2024, and is expected to reach around USD 1,038.55 billion by 2034, expanding at a CAGR of 32.80% from 2025 to 2034. The growing adoption of surgical robots and advanced medical devices and technologies are major factors boosting the growth of the market.

5G in Healthcare Market Key Takeaways

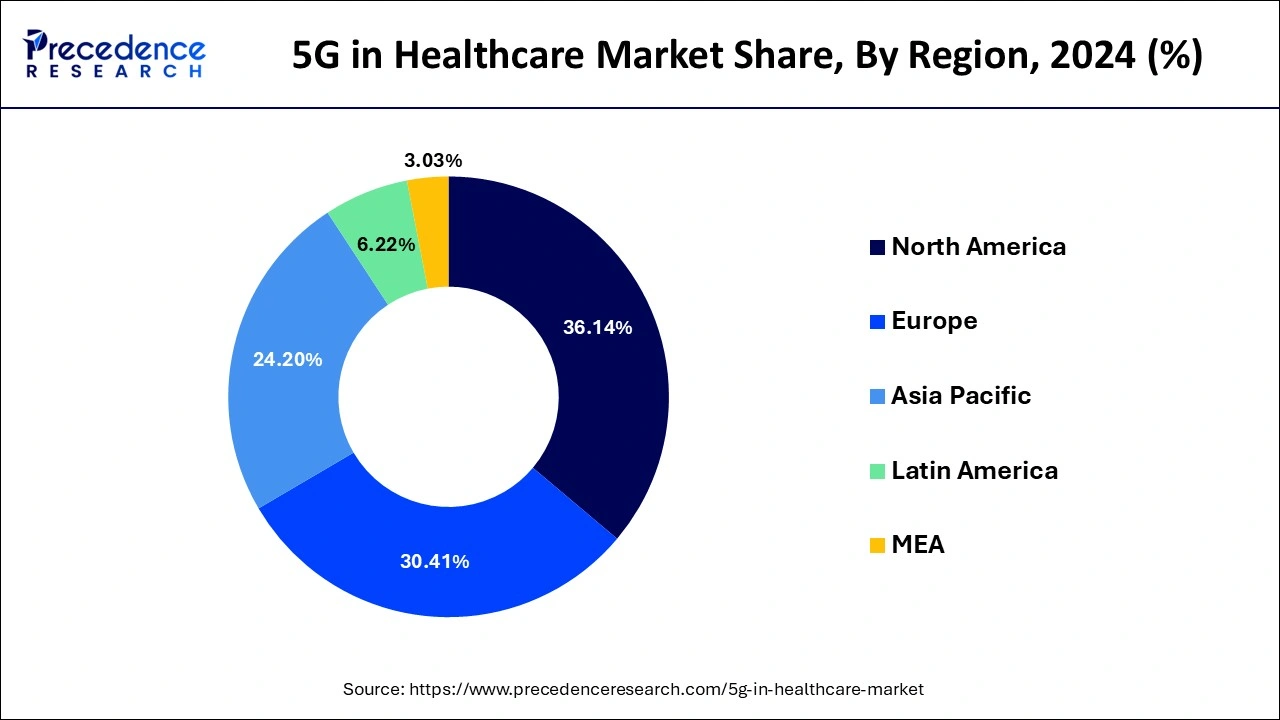

- North America led the global market with the highest market share of 36.14% in 2024.

- The Asia Pacific 5G in healthcare market is projected to grow at a registered CAGR of 36.8% during the forecast period.

- By component, the hardware segment has captured a revenue share of 71% in 2024.

- The services segment is expanding at a CAGR of 35.9% over the forecast period.

- By application, the remote patient monitoring segment has contributed a revenue share of 61% in 2024.

- The connected medical devices segment is growing at a CAGR of 36.4% during the forecast period.

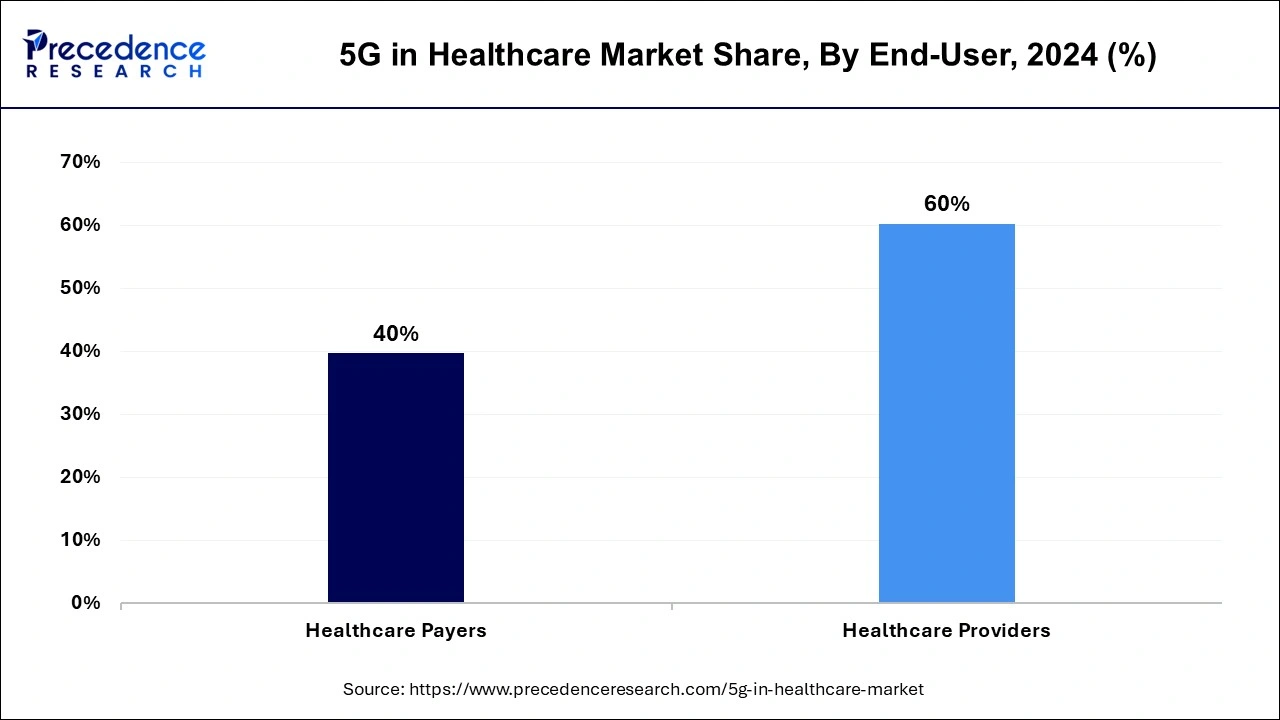

- By end-user, the healthcare providers segment has accounted revenue share of 62% in 2024.

- The healthcare payers segment is expanding at a CAGR of 35.4% during the forecast period.

Impact of AI on the 5G in Healthcare Market

The emergence of AI technologies is revolutionizing the market. AI enhances the reliability of 5G-enabled medical devices that require real-time data transmission. AI analyzes large data volumes and allows immediate communications between medical devices. It also enables real-time data transmission and communication. Furthermore, AI algorithms can effectively identify anomalies in the network, further reducing data breaches.

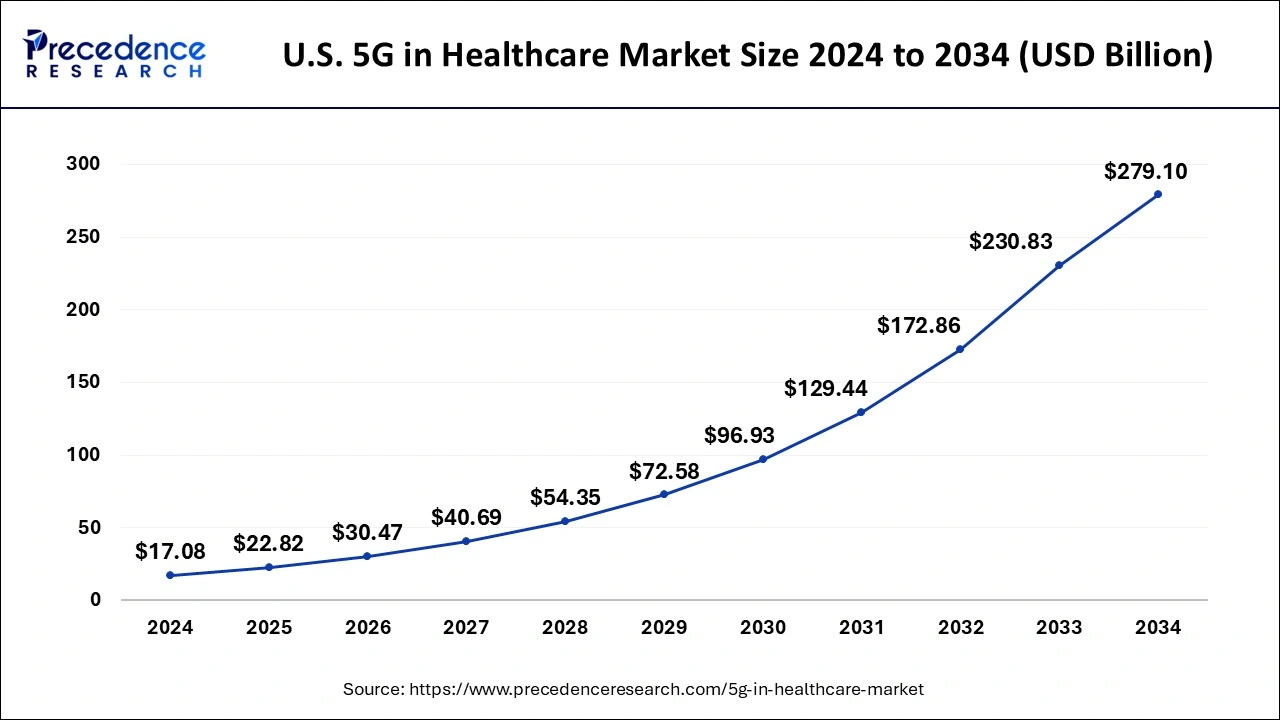

U.S. 5G in Healthcare Market Size and Growth 2025 to 2034

The U.S. 5G in healthcare market size was estimated at USD 17.08 billion in 2024 and is predicted to be worth around USD 279.10 billion by 2034, at a CAGR of 33.50% from 2025 to 2034.

The North America region accounted the market revenue share of 36.14% in 2024. Numerous variables, such as the rising incidence of coronary artery diseases (CAD), the growing aging population, and the development of novel products by significant market rivals, are having an impact on the area industry's growth. As the benefits of embedding 5G technology into healthcare products and services become more widely known, the adoption of the technology will quicken.

Because of crucial lifestyle issues, the number is progressively rising every year. Innovative and reliable remote patient monitoring technologies are needed, driving regional industry trends, for better, continuous, and effective supervision of these patients.

Market Overview

The fundamental components of healthcare could all be changed and enhanced by 5G networks. Over the past several years, the use of 5G networks in healthcare has increased, and their applications have been strengthened by advancements in robotics, IoT, and AI that will change healthcare systems into a new connected ecosystem. The main challenge faced by healthcare systems is the fastest transmission of data.

The healthcare industry produces a vast amount of data. One patient may generate hundreds of gigabytes of data every day, which may include everything from patient medical records to the enormous image files generated by Magnetic resonance imaging, CAT, or PET scans. When the network capacity is constrained, the transfer of those massive data is slow or fails, which significantly slows the delivery of patient care.

The availability and capability of care can be improved by integrating high-speed 5G networks into current designs to help promptly and reliably move big data files of medical pictures. Therefore, the rising adoption of 5G networks in healthcare systems is expected to be the main driver of market growth in the next years.

5G in Healthcare Market Growth Factors

- With the rising digitization in the healthcare industry, there is a high demand for 5G networks.

- The rising adoption of Internet of Medical Things (IoMT) devices contributes to market expansion. 5G network enables seamless transmission of data between these devices.

- The increasing demand for rapid and more reliable data transmission solutions is likely to fuel the growth of the market.

- The growing need to handle large volumes of data efficiently further boosts the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 89.00 Billion |

| Market Size by 2034 | USD 1,038.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 32.80% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segment Covered | Component, Application, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Rapid Transition to Smart Healthcare from Conventional Healthcare Systems

Distributed patient-focused solutions are fast replacing the old hospital-focused smart healthcare systems. The shift in the healthcare sector has accelerated due to numerous technological advancements. Smart healthcare systems use new diagnostic technologies to provide patients with cutting-edge therapies and improve the bar of care by providing real-time information. It enables remote check-up services that reduce treatment times and costs and aid medical personnel in reaching patients outside of their local area. Better network performance and broader cellular coverage are required to support a mix of IoT devices and 5G capable smart healthcare equipment. 5G networks, that are being developed to satisfy the various communication needs of healthcare applications, will support these devices.

Growing Demand for Dependable and Quick Data Transmission

The healthcare industry is growing at the fastest pace due to the rise in the number of applications and their reliance on the network. Numerous types of data are being used and that come in various sizes and formats, this will result in complex demands being placed on the network in terms of bandwidth, data rate, and latency, among other things. The 5G technology fills many new demands for connectivity services among healthcare providers. These include the ability to guarantee the quality of service (QoS) necessary to create new use cases, as well as increased connection density, faster speeds, lower latency, and decreased lag. Due to the advancement of new 5G technologies, IT applications, and services for the healthcare industry are anticipated to be more connected than before. Cellular technology will dramatically increase the speed, coverage, and responsiveness of wireless networks in the healthcare industry. As a result, market growth in the coming years is expected to be driven by the growing demand for faster and more reliable data transmission in the healthcare sector.

Restraint

High Deployment Cost

Deploying a 5G network required substantial investment in infrastructure. This, in turn, creates a burden on healthcare facilities, especially smaller ones, and limits the adoption of 5G, thus hampering the market growth. In addition, medical devices equipped with 5G technology are expensive, and not everyone can afford them, which is restraining the market growth.

Opportunity

Growing Emphasis on Remote Care

A strong emphasis on deploying remote care/telehealth services to prevent future health crises creates immense opportunities in the market. Healthcare organizations are heavily utilizing innovative technologies that support remote healthcare. With the increasing adoption of medical consultations that incorporate real-time video conferencing and image transmission, the demand for high-speed networks is rising. With 5G networks, reliable and high-bandwidth data connectivity services are possible. The low latency and high connection density provided by 5G networks, which enable seamless, error-free interactions and speedy transmission of vital medical data, are extremely advantageous to any connected medical devices.

Component Insights

The hardware segment accounted for the largest revenue shareholder segment comprising around 71% market share in 2024. This is attributed to the requirement for continuous technology upgrades or replacements in order to avail the best possible advantage of the market's latest technology. In addition to this, the growing adoption of ultra-high bandwidth, ultra-low latency, and technological advancements are anticipated to expand the growth opportunities in the hardware segment.

The service segment is projected to register the fastest growth with a CAGR of 35.9% over the forecast period. The increasing demand for quicker and more reliable data transfer options, the rising demand for a better connection for medical devices, and the need for enhanced mobile broadband and higher frequencies offered by 5G are some of the prominent factors prospering the growth of the service segment.

Application Insights

AR/VR, Virtual Consultations

Virtual reality is utilized for trauma crisis simulation and paramedic emergency training. Surgical guidance using augmented reality for working on human body regions AR-based surgical support for the use of appropriate surgical instruments for surgeons and their support staff using virtual reality for human anatomy research and dissection experiments.

A marketing tool for hospitals' medical facilities based on virtual reality Tto give their patients a more engaging and delightful experience of a fantasy world that they appreciate as a distraction from the therapeutic setting, several hospitals use virtual reality. Virtual reality is used in hospitals to help trauma victims overcome phobias like a fear of heights, being in public, etc.

Pediatricians include VR content in their gaming and use it to administer shots to newborns and young toddlers.

It is also feasible to use VR in the instruction and training of medical students. Through VR, they will be able to gain knowledge about previously inaccessible subjects. Furthermore, they are not required to work on the actual problem to obtain exposure. With the aid of the internet, remote surgeries are currently conceivable, but with the advent of AR, surgeons would have a far better comprehension of the topic.

Remote Patient Monitoring

The remote patient monitoring segment has contributed a revenue share of 61% in 2024. RPM, or remote patient monitoring, is a word used to describe a style of healthcare delivery in which patient data is gathered outside of traditional healthcare settings using the most modern advancements in information technology.

In this exclusive video, Care Innovations COO Marcus Grind staff describes how remote patient management involves moving more healthcare into people's homes and places where they often live, work, and play. It also involves using technology to connect the traditional physical locations for treatment with the daily lives that people desire to lead.

But don't be misled by the emphasis on technology: The most effective remote patient monitoring systems, such as Care Innovations' own Health Harmony platform, rely on modern, consumer-friendly personal tech products rather than the sterile, alienating, wire-laden medical devices of the past.

The Health Harmony RPM platform uses technology in a way that encourages patients to take an active role in managing their health. It is similar to the smartphones and tablets that are popular nowadays among the users of all ages, including elders.

Naturally, this comfort increases their levels of participation, and led to remote patient monitoring further help in improving the quality of care. Patients are encouraged to take a more active role in their health because of the comfort of excellent RPM models, and physicians are better equipped to understand and manage their patients' health conditions because a more continuous stream of data creates a clearer picture of the patient's health.

Connected Ambulance

The 5G linked ambulance provides a creative new way to connect patients, ambulance staff, and distant medical specialists in real-time owing to a collaboration between Ericsson, University Hospital Birmingham NHS Foundation Trust (UHB), and King's College London.

Using a live 5G network in Birmingham that is maintained by BT, healthcare practitioners have finished the first remote diagnostic procedure through 5G in the UK. The trial shows that clinicians and paramedics may collaborate haptically even when they are hundreds of kilometers apart thanks todue to the advent of 5G technology.

By enabling crucial efficiencies and eliminating the need for patients to visit A&E, this innovative 5G application has the potential to transform healthcare in the future.

Smart wearables

The next generation of mobile communications networks, known as 5G, promises faster data transfers, more bandwidth, and the ability to connect a significant number of devices to the internet. Worldwide mobile network operators are now putting it into practice. This will enable devices to get smaller while enhancing their functionality, revolutionizing wearable technology. Particularly in the health and wellness industry, people will be able to receive real-time feedback on everything from exercise routines to chronic medical conditions. However, not all of this will take place simultaneously worldwide. The capability and accessibility of 5G vary widely from nation to nation. However, it appears that the wait will be worthwhile.

End-User Insights

Healthcare processes can be seamlessly digitalized thanks to 5G gear

The healthcare providers segment has accounted revenue share of 62% in 2024. The idea of remote patient monitoring caught on among hospitals because of the beginning of COVID-19 pandemic's travel and mobility limitations in 2024. It encouraged the use of the 5G connection. A few examples of 5G gear are Wi-Fi, network equipment, and 5G small cells. A few uses for 5G hardware include data transport, telediagnosis, wearable technology, and telerobotic surgery.

The healthcare payers segment is expanding at a CAGR of 35.4% during the forecast period.

5G virtual consultations will increase the accessibility of healthcare services

The World Health Organization (WHO) advised medical institutions to conduct virtual consultations and use telemedicine as a key practice since the COVID-19 pandemic offers numerous challenges. Since then, several administrations have used motivating strategies to start public dialogues. For instance, according to the U.S. Office of Health Policy, telehealth visits increased significantly in 2021; a significant number of those visits were funded by Medicare, which was not a common practice before the pandemic.

5G In Healthcare Market Companies

- AT&T Inc.

- Verizon Communications

- NEC Corporation

- Cisco Systems, Inc.

- SK Telecom Co., Ltd.

- Fibocom Wireless Inc.

- Qualcomm

- Ericsson

- Nokia Corporation,

- Huawei Technologies Co., Ltd.

- China Mobile Limited

- Samsung Electronics Co., Ltd.

- BT Group

- Deutsche Telekom AG

- Vodafone

- China Mobile Limited

- China Unicom

- Saudi Telecom Company (STC) and

- T-Mobile

Recent Developments

- In November 2024, Red.Health and Medanta Hospital, Lucknow, India, partnered to launch first 5G ambulance to boost emergency care in Lucknow. The 5G ambulances deployed in Lucknow will be staffed by skilled paramedics and equipped with advanced life-saving equipment, real-time patient monitoring systems, and a direct communication link with Medanta's emergency specialists.

- In September 2024, Tata Elxsi opened its 'xG-Force' lab in Bengaluru. This state-of-the-art facility aims to accelerate 5G innovation by providing ready-to-use infrastructure, cutting-edge tools, and an integrated partner ecosystem for diverse applications across healthcare, transportation, Industry 4.0, media, and communication sectors.

Segments Covered in the Report:

By Component

- Hardware

- Services

By Application

- AR/VR

- Virtual Consultations

- Remote Patient Monitoring

- Connected Medical Devices

- Connected Ambulance

- Home Healthcare

- Telemedicine

- Smart Wearables

- Others

By End-User

- Healthcare Providers

- Healthcare Payers

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting