What is the Accounting Software Market Size?

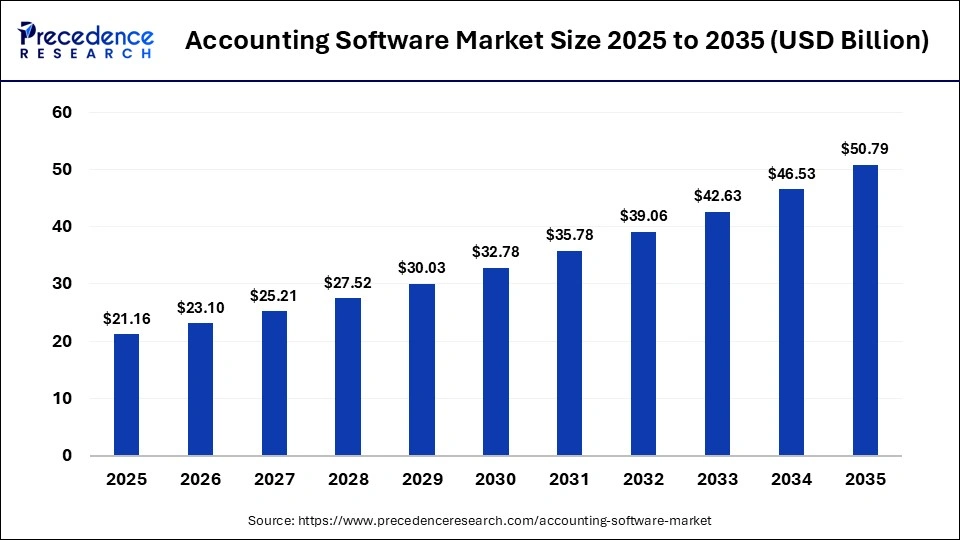

The global accounting software market size was calculated at USD 21.16 billion in 2025 and is predicted to increase from USD 23.1 billion in 2026 to approximately USD 50.79 billion by 2035, expanding at a CAGR of 9.15% from 2026 to 2035. The accounting software market is driven by the rising adoption of cloud-based software by large organizations, along with the rapid expansion of the software industry in developed nations. Moreover, the increasing demand for payroll management software from the corporate sector, as well as the surging use of enterprise accounting software in the manufacturing sector, has played a prominent role in shaping the industrial landscape.

Market Highlights

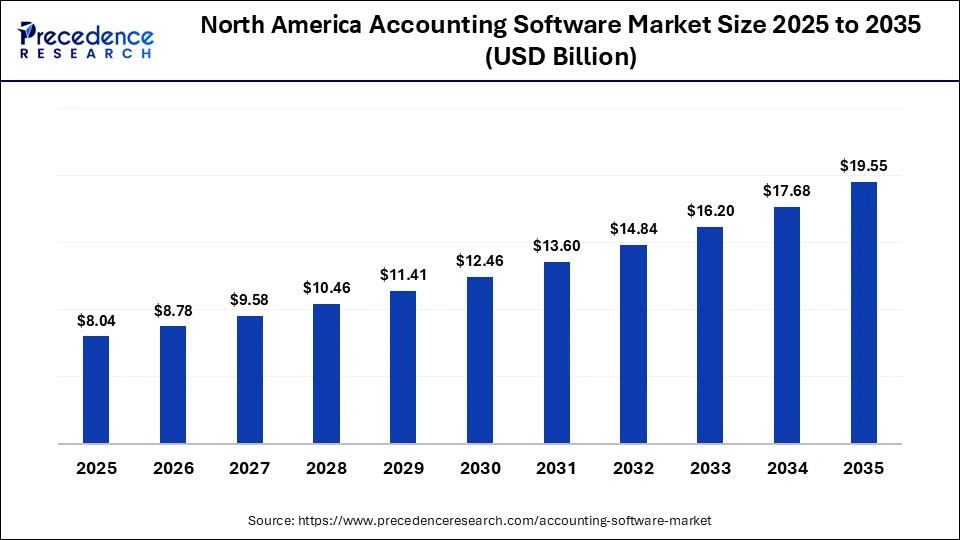

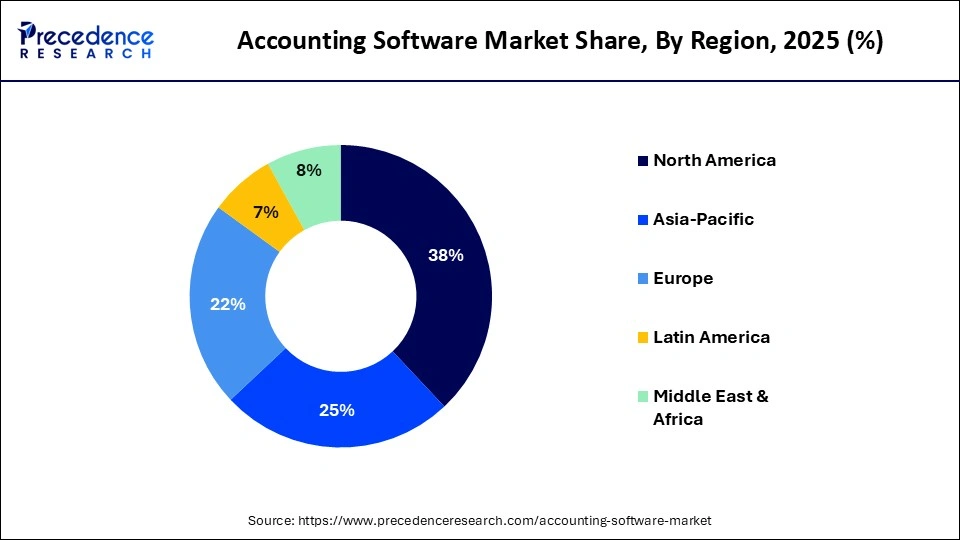

- North America dominated the accounting software market, holding a share of 38% in 2025.

- Asia Pacific is expected to expand with the highest CAGR of 9.5% from 2026 to 2035.

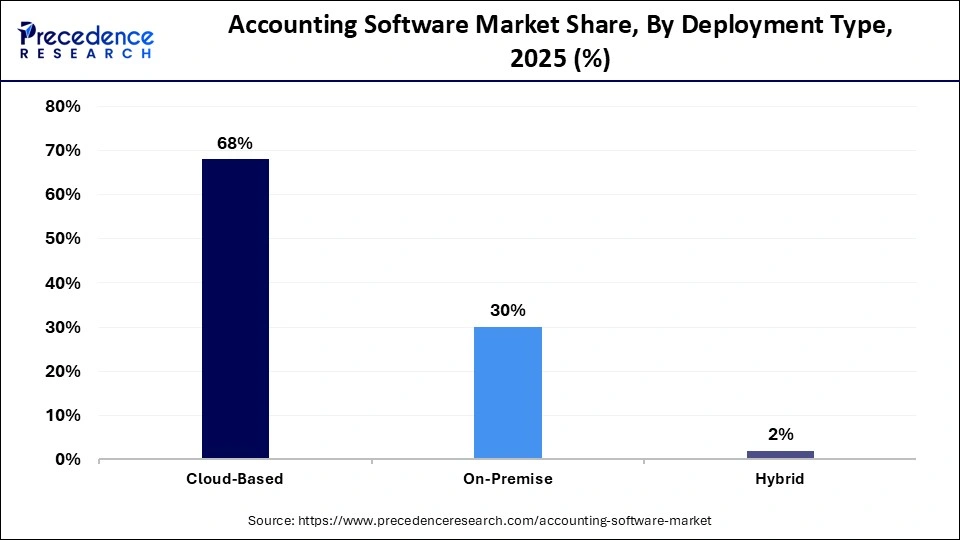

- By deployment type, the cloud-based segment held the largest market share, accounting for 68% in 2025.

- By deployment type, the on-premises segment is expected to grow at a remarkable CAGR of 8.3% between 2026 and 2035.

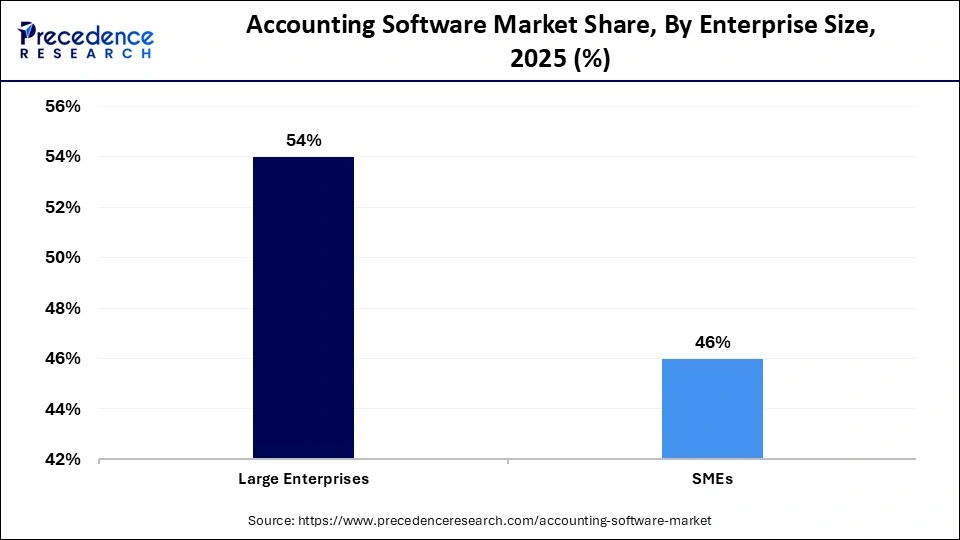

- By enterprise size, the large enterprises segment held the largest share of 54% of the market in 2025.

- By enterprise size, the SMEs segment is growing at a strong CAGR of 8.8% between 2026 and 2035.

- By application/vertical, the payroll management segment held the largest share of 29% in the industry and is also expected to see

- the highest growth rate of 8.4% between 2026 and 2035.

- By application/vertical, the billing & invoicing segment is expected to grow with a significant CAGR during the forecasted period.

- By industry vertical, the BFSI segment dominated the market with a share of 24%.

- By industry vertical, the IT & telecom segment is expanding a highest CAGR of 8.5% during the forecast period.

What is the Scenario of the Accounting Software Market?

The accounting software market is a prominent branch of the software industry. This industry deals in the designing and distribution of advanced accounting software in different parts of the world. There are several types of software developed in this sector, comprising commercial accounting software, enterprise accounting software, billing & invoice software, payroll management software, custom accounting software, and spreadsheets. These software solutions are deployed through several modes, such as cloud and on-premises. It finds application in large enterprises and small & medium enterprises. The end-users of accounting software include BFSI, retail, manufacturing, IT & telecom, government & public sector, energy & utilities, media & entertainment, pharmaceutical & healthcare, and others. This market is expected to expand significantly with the global rise of the ICT sector.

What is the Role of AI in the Accounting Software Market?

The advancements in AI have a significant impact on the software industry. In the software sector, AI helps in enhancing several features, including automating coding, software testing, and checking faults. Nowadays, the accounting software developers have started integrating AI in their platforms for automation of repetitive tasks, increasing accuracy, lowering errors, forecasting, and fraud detection. Thus, AI has played a prominent role in positively shaping the accounting software industry.

- In November 2025, Zeni launched an AI-enabled Accounting Agent automation solution. This AI-based solution is designed to manage complex accounting workflows, including reconciliations, transaction processing, flux analysis, and receipt matching.

Accounting Software Market Trends

- Partnerships: Several market players are partnering with sports organizations to deploy accounting software for managing the workloads of accountants. For instance, in July 2025, Sage partnered with EFL. Through this partnership, Sage will deliver accounting software to EFL to enhance the football experience.

- Deployment of Cloud Solutions by Accounting Firms: The accounting firms have started deploying cloud-based accounting software to enhance workflow efficiency. For instance, in September 2025, Wolters Kluwer launched Capego Practice Management. Capego Practice Management is a cloud-based accounting solution designed for accounting firms.

- Increasing use of Accounting Software in the BFSI sector: The BFSI companies are using advanced accounting software to reduce the dependency on manual accountants. For instance, in February 2025, BMO launched BMO Sync. BMO Sync is an advanced accounting software that finds application in the BFSI sector.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 21.16Billion |

| Market Size in 2026 | USD 23.1 Billion |

| Market Size by 2035 | USD 50.79Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.15% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment Type, Enterprise Size,Application, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Deployment Type Insights

Why did the Cloud-Based Segment Dominate the Accounting Software Market?

The cloud-based segment dominated the accounting software market with a share of 68% in 2025, due to the growing adoption of cloud-based accounting software by manufacturing companies to enhance expense tracking has boosted the market expansion. Also, the rapid deployment of cloud-enabled invoicing software in the e-commerce sector is playing a prominent role in shaping the industrial landscape. Moreover, numerous advantages of cloud-based accounting software, including real-time financial insights, enhanced security, and cost-effectiveness, are expected to drive the growth of the accounting software market.

The on-premises segment is expected to rise at a remarkable CAGR of 8.3% between 2026 and 2035, as surging deployment of on-premises accounting software by the retail companies to improve billing activities has driven the market growth. Additionally, the rapid investment by corporate organizations to deploy on-premises payroll management solutions for lowering the workload on the accounts team is positively impacting the industry. Several benefits of on-premises accounting software, such as enhanced data control and less dependency on external sources, easy integration capabilities, and remote access is expected to boost the growth of the accounting software sector.

Enterprise Size Insights

What Made the Large Enterprises Segment Lead the Accounting Software Market?

The large enterprises segment leads the accounting software market with a share of 54% in 2025, as the growing adoption of payroll management software by large organizations to manage the pay cycle of several employees has boosted the market expansion. Also, collaborations among corporate companies and software brands to deploy on-premises accounting software in their systems to enhance workflow efficiency are expected to foster the growth of the accounting software market.

The SMEs segment is expected to expand at the highest CAGR of 8.8% between 2026 and 2035, becausr of the rise in the number of small and medium enterprises in various developing nations, including India, Vietnam, Thailand, and Cambodia, has increased the demand for accounting software, thereby driving the market growth. Moreover, the rapid investment by the government for digitalizing the SME sector is expected to propel the growth of the accounting software industry.

Application/Vertical Insights

Why Did the Payroll Management Segment Hold the Largest Share of the Accounting Software Market?

The payroll management segment held the largest share of 29% in the industry due to surging adoption of payroll management by corporate companies to automate salary calculation and ensure timely employee payments, which has boosted the market expansion. Additionally, the rapid investment by software companies in designing AI-based payroll management solutions is expected to drive the growth of the accounting software market.

The segment is also expected to grow the fadtest with an 8.4% expected CAGR. Rising regulatory complexity around taxation, labor compliance, and reporting is increasing reliance on integrated payroll platforms to reduce errors and compliance risks. In parallel, growing demand from small and mid-sized enterprises for cloud-based payroll solutions is supporting sustained segment expansion.

The billing & invoicing segment is expected to rise with a significant CAGR between 2026 and 2035. The rising deployment of billing software in retail outlets for lowering dependency on sales executives has boosted the market growth. Moreover, the growing adoption of invoicing software solutions by e-commerce companies to generate digital invoices is expected to propel the growth of the accounting software industry.

Industry Vertical Insights

The BFSI segment leads the accounting software market with a share of 24%. The increasing adoption of AI-based accounting software by the BFSI companies to enhance their accounting capabilities has boosted the market expansion. Also, the rapid investment by BFSI brands to deploy advanced technologies for lowering errors is playing a vital role in shaping the industrial landscape. Moreover, partnerships among government banks and software developers to design advanced accounting software for the BFSI sector are expected to proliferate the growth of the accounting software market.

The IT & telecom segment is expected to expand with the highest CAGR of 8.5% during the forecast period. The surging adoption of cloud-based accounting software by telecom providers for managing their daily expenses has driven the market growth. Additionally, the rapid investment by software companies for developing a wide range of payroll management solutions to cater to the needs of the IT industry is positively contributing to the industry. Moreover, collaborations among IT companies and tech providers to deploy accounting platforms in IT offices are expected to drive the growth of the accounting software market.

Regional Insights

How Big is the North America Accounting Software Market Size?

The North America accounting software market size is estimated at USD 8.04 billion in 2025 and is projected to reach approximately USD 19.55 billion by 2035, with a 9.29% CAGR from 2026 to 2035.

Why Did North America Dominate the Accounting Software Market in 2025?

North America dominated the accounting software market with a share of 38% in 2025, as the increasing deployment of on-premises accounting software in the manufacturing sector across the U.S., Canada, and Mexico for improving accounting workflows has boosted the market expansion. Additionally, the surging adoption of enterprise accounting software by the BFSI industry, as well as the rapid digitalization of the healthcare sector, is positively contributing to the industry. Moreover, the presence of various accounting software development companies, such as Intuit, Inc., Oracle Corporation, Microsoft Corporation, and Sage, is expected to propel the growth of the accounting software market in this region.

- In October 2025, Intuit launched Intuit Accountant Suite. Intuit Accountant Suite is an AI-enabled accounting software designed to streamline various processes within an accounting firm in North America.

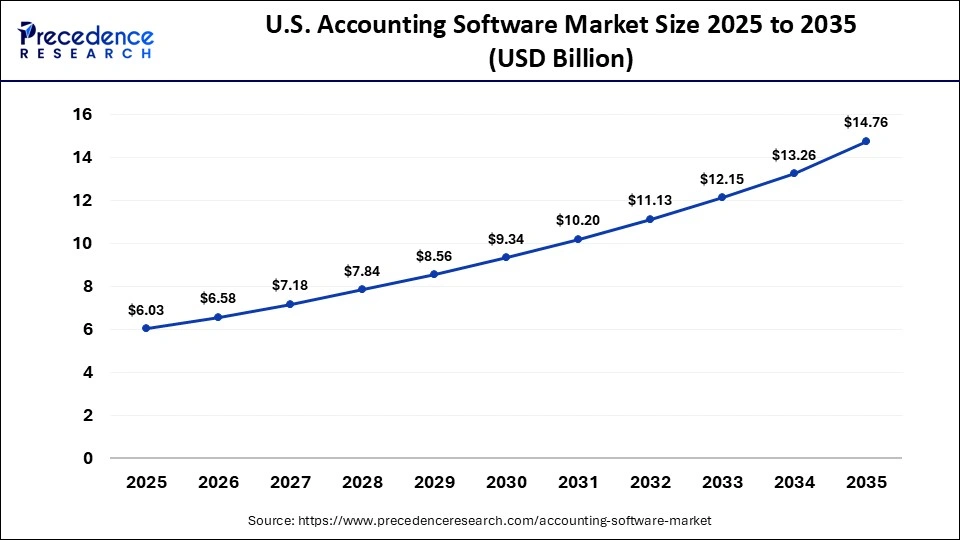

What is the Size of the U.S. Accounting Software Market?

The U.S. accounting software market size is calculated at USD 6.03 billion in 2025 and is expected to reach nearly USD 14.76 billion in 2035, accelerating at a strong CAGR of 9.36% between 2026 and 2035.

U.S. Accounting Software Market Analysis

The growing adoption of billing and invoice software by retail shops for reducing the dependency on manual workers, along with technological advancements in the pharma industry, has bolstered the market expansion. Also, the increasing demand for AI-based accounting solutions from the IT sector is playing an important role in shaping the industrial landscape.

Rising preference for cloud-based accounting platforms is enabling real-time financial visibility, remote access, and scalability for small and mid-sized enterprises. Increasing regulatory requirements around tax compliance, audit trails, and financial reporting are driving upgrades to advanced accounting systems. In parallel, integration of accounting software with ERP, payroll, and inventory management tools is improving operational efficiency across U.S. businesses.

Why Asia Pacific Is Growing With the Highest CAGR in the Accounting Software Market?

Asia Pacific is expected to expand with the highest CAGR of 9.5% during the forecast period. The rising adoption of cloud-based accounting software by the retail sector across various countries, including India, China, Japan, and South Korea, has driven the market expansion. Also, the increasing focus of governments on deploying custom accounting software in offices, as well as the rise in the number of software startups, is playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Xero, Tally, Qiqi Technology and Autocount have driven the growth of the accounting software market in this region.

- In September 2025, Xero launched the Ask Xero (JAX) agent in the APAC region. Ask Xero (JAX) is an advanced software that helps in automating various tasks, such as data entry and bank reconciliation.

China Accounting Software Market Trends

The rapid adoption of payroll management software by corporate organizations for managing the payments of their employees, along with the surging adoption of AI-integrated accounting solutions in the pharmaceutical sector, is driving the market expansion. Moreover, collaborations among automotive brands and software developers to deploy accounting software in their showrooms is positively impacting the industry. Increasing digitalization among small and medium-sized enterprises is accelerating demand for cloud-based and subscription-driven accounting platforms. In parallel, government-led initiatives promoting enterprise digital transformation and tax compliance are reinforcing sustained adoption of advanced accounting software across China.

Who are the Major Players in the Global Accounting Software Market?

The major players in the accounting software market include Infor, Inc., Intuit, Inc., Patriot Software LLC, Microsoft Corporation, Oracle Corporation, Tally Solutions Pvt Ltd., Workday, Sage Group Plc, Zoho Corporation, Xero Ltd.

Recent Developments

- In November 2025, Thomson Reuters launched a new range of AI-based solutions. These solutions are designed for enhancing accounting workflows.(Source: https://www.thomsonreuters.com)

- In June 2025, Digits launched Digits Accounting Agents. Digits Accounting Agents is an AI-enabled accounting platform designed for the industrial sector.(Source: https://www.globenewswire.com)

- In June 2025, Sage launched high-performance finance software. This software is designed for medium- and small-sized businesses around the world.(Source: https://www.sage.com)

Segments Covered in the Report

By Deployment Type

- Cloud-Based

- On-Premise

- Hybrid

By Enterprise Size

- Large Enterprises

- SMEs

By Application

- Payroll Management

- Billing & Invoicing

- Expense Tracking

- Tax Management

- Others

By Industry Vertical

- BFSI

- IT & Telecom

- Manufacturing

- Retail & E-commerce

- Healthcare

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting