What is the Construction Accounting Software Market Size?

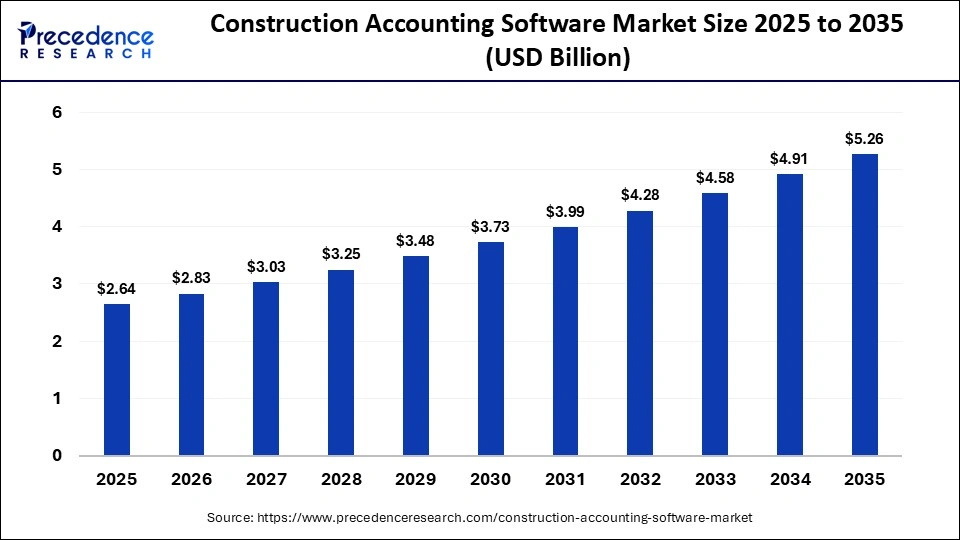

The global construction accounting software market size accounted for USD 2.64 billion in 2025 and is predicted to increase from USD 2.83 billion in 2026 to approximately USD 5.26 billion by 2035, expanding at a CAGR of 7.13% from 2026 to 2035. Construction accounting software enables construction firms to efficiently manage financial processes, including billing, job costing, payroll, accounts payable/receivable, and financial reporting, within their construction projects.

Market Highlights

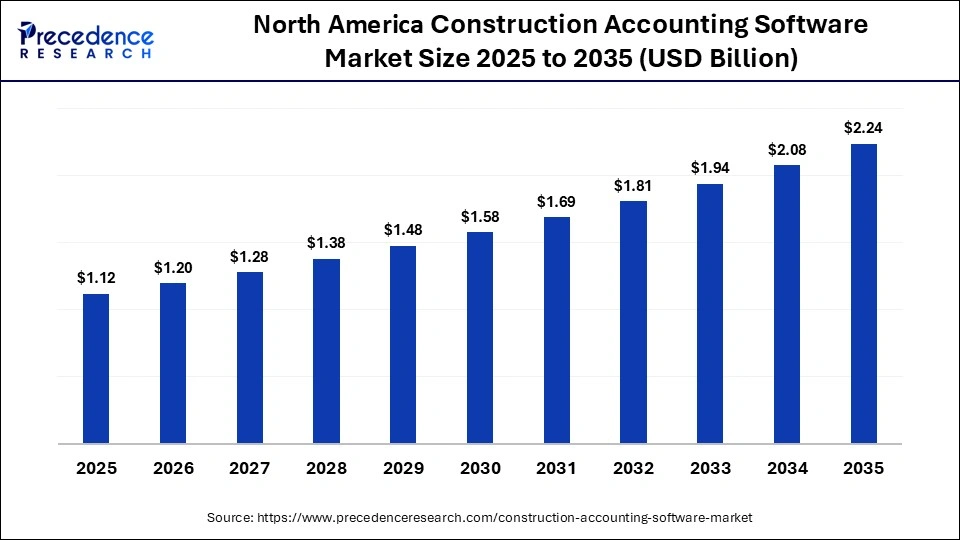

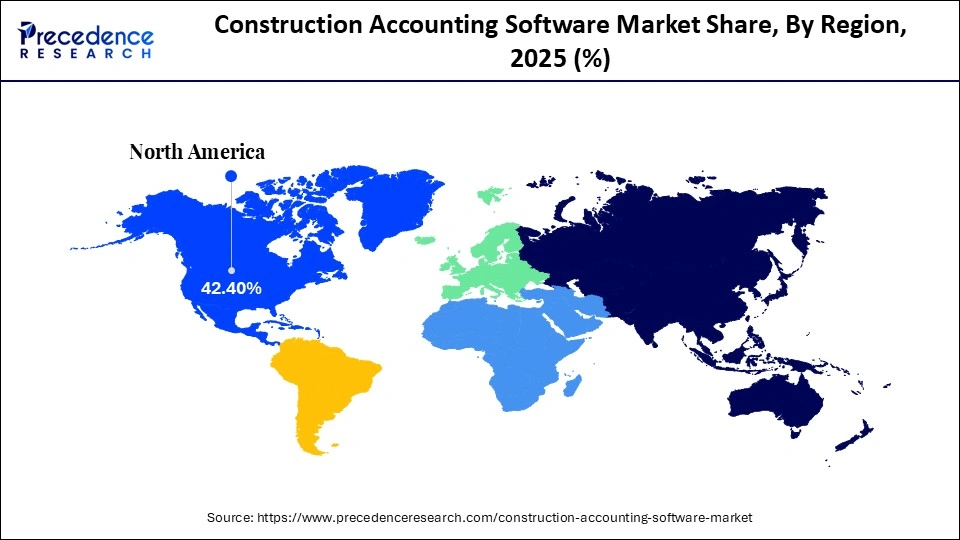

- North America dominated the market, holding a 42.4% market share in 2025.

- The Asia Pacific is projected to grow at a significant CAGR of 9.0% from 2026 to 2035.

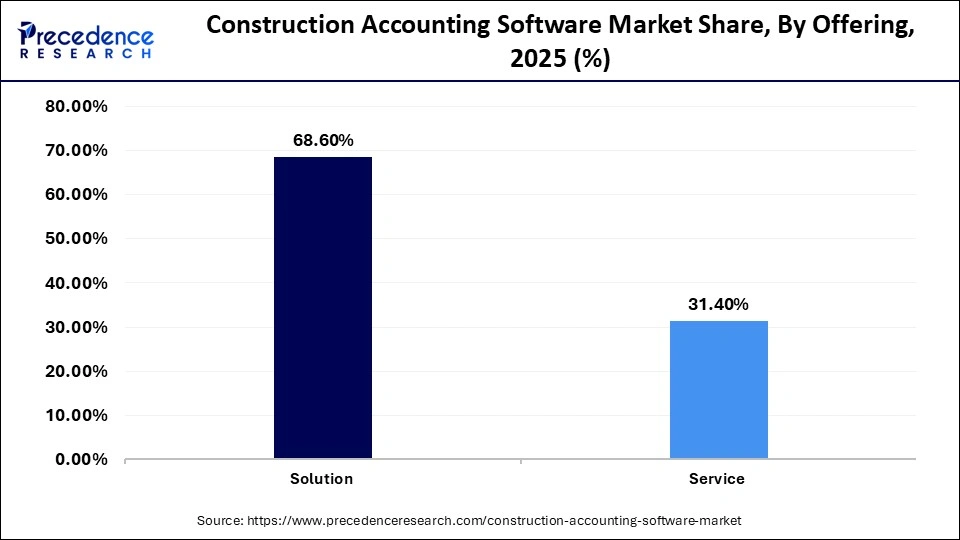

- By offering, the solution segment led the market while holding the largest share of 68.6% in 2025.

- By offering, the cloud segment is expected to grow at a CAGR of 8.1% from 2026 to 2035.

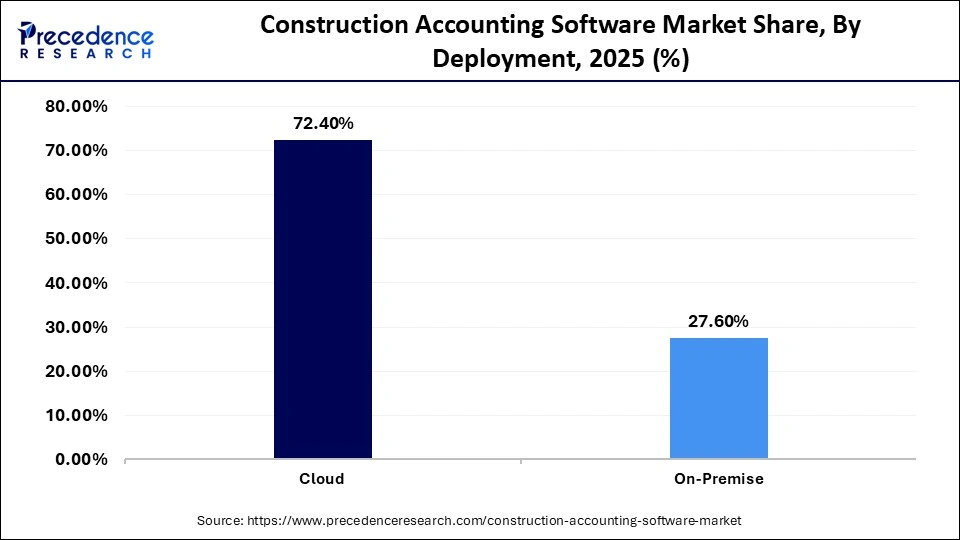

- By deployment, the cloud segment led the market while holding the largest share of 72.4% in 2025 and is expected to grow by 8.2% of CAGR from 2026 to 2035.

- By functionality, the accounts payable & receivable segment contributed the biggest market share of 54.4% in 2025.

- By functionality, the project costing/analytics segment is growing at a CAGR of 8.1% between 2026 and 2035.

- By company size, the small and medium enterprises segment accounted for the largest market share of 67.8% in 2025.

- By company size, the large enterprise solutions segment is expected to growing at a solid CAGR of 7.8% from 2026 to 2035.

What is the construction accounting software market?

Construction accounting software enables construction firms to manage core financial processes in alignment with project execution, covering functions such as billing, job costing, payroll, accounts payable and receivable, budgeting, and financial reporting. Unlike general accounting systems, these solutions are purpose-built to handle the complexities of construction projects, including progress-based billing, retention management, change orders, and multi-project cost tracking.

By integrating accounting functions directly with project workflows, construction accounting software improves cash flow visibility, cost control, and financial accuracy across the project lifecycle. Real-time tracking of labor, materials, equipment, and subcontractor costs allows firms to compare actual spending against budgets, identify cost overruns early, and support more informed decision-making across multiple stakeholders.

These solutions are delivered through both on-premise and cloud-based deployment models, allowing firms to choose based on data control requirements, scalability needs, and IT capabilities. Cloud-based platforms increasingly enable remote access, automated updates, and collaboration between project teams, finance departments, and external partners, which is particularly valuable for geographically distributed construction operations.

Key Technological Shifts in the Construction Accounting Software Market?

One major technological shift in construction accounting is the move away from on-premise, office-based systems toward cloud-based platforms and subscription-driven online services. Cloud deployment allows construction firms to access real-time financial data across active projects, improving visibility into costs, cash flow, and budget utilization without being limited by location or internal IT infrastructure.

The increasing use of intelligence and machine learning capabilities is further improving financial management. These technologies support cost forecasting, early identification of budget overruns, anomaly detection, and proactive financial risk management. By analyzing historical and real-time project data, construction accounting software can highlight potential issues before they escalate, enabling more informed and timely decision-making.

Automation is also transforming day-to-day financial operations. Automated payroll processing, invoicing, expense tracking, and financial reporting reduce manual effort and minimize errors associated with repetitive data entry. This not only improves accuracy but also frees up finance and project teams to focus on higher-value activities such as financial planning, compliance oversight, and strategic project analysis.

Key Market Trends in the Construction Accounting Software Market?

- People in the construction business really need to know how much money they are making on each job.

- So, there is a demand for job costing and keeping track of money spent on projects. This is helping medium-sized construction companies make more money. They like that they can pay a fee each month to use this software.

- Construction companies also must follow a lot of rules and pay their taxes. They need software that can help them with this. Some construction jobs require a lot of workers, so this software is very important.

- Nowadays, construction companies want to see how their business is doing. They want to be able to look at reports and graphs on their computer to see if they are making money.

- The people who make this software are trying to make it easier to use. They are letting construction companies customize it to fit their needs. They are doing this because each construction company does things a little differently.

- Job costing and project-based financial tracking are important for construction companies. Strategic partnerships between software providers and construction technology firms are further shaping market growth.

Construction Accounting SoftwareMarket Outlook

- Industry Outlook: The construction accounting software market is poised for rapid growth from 2025 to 2034, driven by drivers. The construction accounting software business is getting bigger fast. This is because companies want to know what is going on with their money now. They also want to keep their costs under control and use computers for everything.

- Major investments: Companies like Sage, Procore, and Oracle are the construction accounting software companies. More companies are starting to use construction accounting software because it is easy to use from anywhere, even on a phone. It is also getting better because it uses intelligence to analyze information, and it is on the cloud.

- Global expansion: Global expansion of the construction accounting software market is being fueled by increasing digital adoption across construction industries worldwide.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.64 Billion |

| Market Size in 2026 | USD 2.83 Billion |

| Market Size by 2035 | USD 5.26 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.13% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Offering, Deployment, Functionality, Company Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Offering Insights

Why is Solution Leading the Consortium in the Construction Accounting Software Market?

Solution: This segment dominated the construction accounting software market, holding a share of 68.6% in 2025, due to its comprehensive functionality and scalability. These platforms provide integrated modules for job costing, payroll, billing, compliance, and financial reporting. Construction firms prefer complete solutions to ensure centralized data management across multiple projects. Cloud-enabled solutions offer real-time visibility and seamless collaboration between field and office teams.

Service: The service segment is at a notable CAGR of 8.1% between 2026 and 2035, driven by services that include consulting, customization, training, and technical support. Increased complexity of systems causes demand for integration services of specialization. Managed services are important to firms to comply with the regulations and to guarantee the reliability of the system. This demand is further boosted by cloud migration projects. The adoption process is still accelerating, providing service offerings with increased force.

Deployment Insights

Why is Cloud leading the consortium in the construction accounting software market?

The cloud segment is dominating the construction accounting software market, holding a 68.6% share, and is also set to be the fastest-growing segment, with a growth rate of 8.2%. This dominance is largely driven by the reduced initial capital expenditure associated with cloud deployment, as subscription-based pricing models eliminate the need for costly on-premise hardware, complex installations, and ongoing infrastructure maintenance.

Cloud-based construction accounting software enables secure, real-time access to financial data across multiple job sites, offices, and remote work locations. This remote accessibility is particularly valuable for construction firms managing geographically dispersed projects, as it allows project managers, finance teams, and executives to monitor costs, billing, and cash flow without delays or data silos.

Functionality Insights

Why Accounts Payable & Receivable Is Dominating the Construction Accounting Software Market?

Accounts Payable & Receivable: The accounts payable and receivables are dominating the construction accounting software market by holding a share of 54.4%, due to their imperativeness in the management of cash flows. These modules are important in construction companies to manage the payment of their vendors and billing of clients. Invoicing automation saves on administrative cost and minimizes errors. Banking and ERP systems integration improve financial precision. Payments are tracked in time, which enhances suppliers' relations. The latter features render AP and AR essential.

Project Costing/Analytics: This segment is expected to grow at a solid CAGR of 8.1%, thanks to its being more concerned with profitability and cost management. Budget overruns are pointed out in real time. Combining with scheduling and project management tools increases accuracy. High-tech analytics enhance the prediction and decision-making. The existence of competition in the construction markets increases the need to be more accurate on cost management. Therefore, the adoption of project costing is increasing rapidly.

Application Insights

Why are Small & Mid-Sized Enterprises Dominating the Construction Accounting Software Industry?

Small & Mid-Sized Enterprise: The segment is dominating the construction accounting software industry by holding a share of 67.8%, driven by lower SaaS costs that allow small companies to use sophisticated applications. Automation of accounting and compliance benefits SMEs. Cloud solutions reduce IT infrastructure requirements. Better project management is gained with increased financial visibility. These are the reasons that lead to high adoption among SMEs.

Large Enterprise: This segment is growing at a CAGR of 7.8% between 2026 and 2035, as it requires high-level personalization and assimilation. Software upgrades are embraced by multi-entity accounting and compliance. Scalability in the cloud is enterprise-wide. Strategic decisions are based on data analytics and reporting. This pressure increases the expansion of big businesses.

Regional Insights

How Big is the North America Construction Accounting Software Market Size?

The North America construction accounting software market size is estimated at USD 1.12 billion in 2025 and is projected to reach approximately USD 2.24 billion by 2035, with a 7.18% CAGR from 2026 to 2035.

Why Is North America Dominating the Construction Accounting Software Market?

North America is dominating the construction accounting software market, holding a 42.4% share, supported by early adoption of construction technologies and the presence of a highly developed IT and cloud infrastructure. Construction firms across the region were among the first to digitize project accounting, job costing, and financial reporting, which has accelerated the uptake of specialized accounting platforms capable of managing complex, multi-project environments.

A growing number of companies use construction accounting software to coordinate projects, track multiple cost centers, manage subcontractor payments, and maintain real-time financial visibility across job sites. This is particularly important in large-scale commercial, residential, and infrastructure projects where tight cost control and accurate forecasting are critical to profitability.

What is the Size of the U.S.Construction Accounting Software Market?

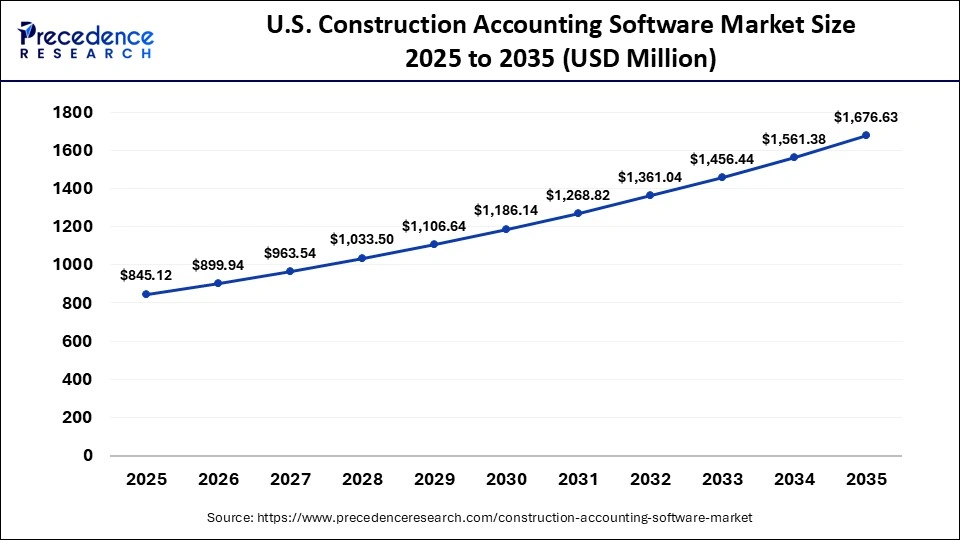

The U.S. construction accounting software market size is calculated at USD 845.12 million in 2025 and is expected to reach nearly USD 1,676.63 million in 2035, accelerating at a strong CAGR of 7.09% between 2026 and 2035.

U.S. Construction Accounting Software Market Trends

The United States is performing strongly in this market due to the scale of building construction activity and the widespread adoption of SaaS-based accounting solutions across the construction sector. Large commercial developments, residential projects, and infrastructure works require robust financial systems that can handle high project volumes, complex cost structures, and multi-location operations.

Construction firms in the U.S. increasingly require software that supports detailed job costing, payroll and labor compliance, and advanced financial analytics. Compliance with federal, state, and local labor regulations, certified payroll requirements, and tax reporting obligations has made automation a priority. As a result, companies are upgrading legacy systems to cloud-based construction accounting platforms that provide real-time cost tracking, automated compliance reporting, and consolidated financial visibility.

Why is Asia Pacific Dominating the Construction Accounting Software Market?

Asia Pacific is dominating the construction accounting software market, holding a 9.0% share, driven by rapid urbanization and large-scale infrastructure development that is generating a high volume of construction projects requiring robust financial management capabilities. Expanding residential, commercial, and public infrastructure activity across the region is increasing the need for software that can manage job costing, billing, payroll, and multi-project financial oversight with greater accuracy and efficiency.

Adoption is further accelerated by rising use of digital technologies such as cloud computing and mobile-enabled platforms. Construction firms are increasingly moving away from manual or fragmented accounting processes toward cloud-based solutions that provide real-time financial visibility across multiple sites. Medium-sized construction companies, in particular, are embracing digital accounting tools to improve cost control, streamline compliance, and support faster decision-making as project complexity increases.

China Construction Accounting Software Industry Trends

China leads the region. It is constructed extensively and involves the use of computers in assisting the construction work. India is also developing at a rapid pace, constructing houses and roads, and companies are employing software to assist them in their operations. Japan is also doing quite well by adopting advanced computer systems in handling finances. South Korea is expanding, and construction companies are willing to take advantage of technology. Computer programs are also implemented in Australia to monitor projects and cost control.

What is the reason Europe is the fastest growing in the construction accounting software market?

Construction accounting software is seeing strong expansion across Europe as construction firms place greater emphasis on operational efficiency, regulatory compliance, and financial transparency. Companies increasingly rely on specialized accounting platforms to manage complex financial workflows while ensuring compliance with stringent tax regimes, labor regulations, and reporting standards that vary across countries and project types.

Demand is further supported by sustained renovation activity and large-scale infrastructure projects across the region. Public and private investment in transport networks, energy-efficient buildings, and urban redevelopment requires accurate job costing, progress-based billing, and tight budget control, all of which are supported by construction-specific accounting software.

Integration is a key adoption driver in Europe. Construction accounting platforms are increasingly deployed alongside project management and building information modeling systems, allowing financial data to align closely with project schedules, resource planning, and design changes. This integrated approach improves coordination between finance teams, project managers, and external stakeholders, reducing delays and cost overruns.

Germany Construction Accounting Software Industry Trends

Germany is doing very well, as there is widespread building construction and the need to have an integrated accounting system. France is as well putting up these systems to modernize infrastructure and meet regulations. The UK is a rising nation, which consumes more construction accounting software and SaaS. Italy monitors funds on the projects of the public works. Spain enjoys new housing and building constructions. High digital maturity helps European countries to grow slowly and steadily. Digital technology is especially effective in use in Northern European countries, which contribute to the overall growth.

Construction Accounting Software Market Value Chain

- Testing and Certification

Construction accounting software testing and certification require specialized validation processes, including functional testing for job costing, payroll, AIA billing, and regulatory compliance, along with performance and load testing to ensure system reliability. Comprehensive security audits are conducted to meet data protection and privacy requirements such as GDPR.

Key players: CMiC, Sage, Procore, and QuickBooks.

- Component Fabrication and Machining

Software that efficiently handles both construction accounting and the specific requirements of component fabrication and machining generally belongs to comprehensive Enterprise Resource Planning (ERP) systems or integrated construction management platforms.

Key Players: Oracle NetSuite ERP

Construction Accounting Software Market Companies

- Oracle Construction and Engineering

- Intuit (QuickBooks)

- Sage Group

- Procore Technologies

- Viewpoint (Trimble)

- Deltek

- Foundation Software

- Jonas Construction Software

- Xero

- ConstructConnect

- CMiC

- CoConstruct

- B2W Software

- e-Builder

- Corecon Technologies

Recent Development

- In December 2025, businesses are fast adopting ERP technology. It simplifies the operations, consolidates organizational data, provides real-time visibility, reduces costs, and contributes to the management of complex processes in a more efficient way. ERP gives a single smart platform to project planning, financial management, procurement, and workforce operations in construction. The platform will have accurate cost tracking, effective scheduling, and effective utilization of resources.

Segment Covered in Report

By Offering

- Solution

- Service

By Deployment

- Cloud

- On-Premise

By Functionality

- Accounts Payable & Receivable

- Audit Reporting

- Project Costing

- Others

By Company Size

- Small & Mid-Sized Enterprise

- Large Enterprise

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting