What is the Humanoid Robots in Construction Market Size?

The global humanoid robots in construction market is rapidly evolving with advanced automation, AI-driven capabilities, and rising demand for labor-efficient building solutions.The growing need for automated, labor-efficient, and high-precision construction processes drives the market for humanoid robots in construction.

Market Highlights

- Asia Pacific accounted for the largest share in 2025.

- The North America is anticipated to witness the fastest growth from 2026 to 2035.

- By application, the material handling & logistics segment held the largest market share in 2025.

- By application, the welding & heavy-trade tasks segment is growing at a strong between 2026 to 2035.

- By robot type/capability, the bipedal humanoids with manipulation suites segment contributed the highest market share in 2025.

- By robot type/capability, the tele-operated humanoids segment is expected to grow at a notable CAGR 2026 to 2035.

- By autonomy level, the semi-autonomous / tele-assist segment holding the highest market shar in 2025.

- By autonomy level, the task-level autonomous segment is expected to show considerable CAGR from 2026 to 2035.

- By deployment model, the pilot & contracted trials with the contractors/shipyards segment held a significant share in 2025.

- By deployment model, the asset-as-a-service / robot rental segment is expanding at a strong CAGR 2026 to 2035.

- By end user, the heavy industry & shipyards / large contractors segment captured the highest market share in 2025.

- By end user, the specialty trades (welding shops, façade installers) segment is growing at a healthy CAGR from 2026 to 2035.

Reimagining Construction Productivity: How Humanoid Robots Are Transforming On-Site Operations

Humanoid robots in construction robotics are human-shaped, bipedal, or anthropomorphic robots developed to perform labor-intensive, precision-oriented tasks across all building sites and heavy industrial settings. Such robots are equipped with robust perception systems, including computer vision, LiDAR mapping, multimodal sensing, and artificial intelligence-based decision-making. They can be employed for complex tasks such as masonry, welding, inspection, material handling, surveying, and surface finishing. Their ability to work in unstructured, dynamically evolving environments makes them a likely good fit for construction processes, which are traditionally based on manual craft labor and on-site adjustments.

Structural labour shortages, a global increase in infrastructure demand, and safety requirements on construction sites are driving the expansion of humanoid robots in construction market. Also, the growing concern about worker safety is hastening the demand for robots that may replace humans in dangerous, high-risk activities, including working at height, handling heavy loads, or operating in contaminated or disaster-prone areas. The potential adoption is due to rapid advancements in AI, battery, actuator efficiency, and cost-effective robotics production.

Key AI Integration in the Humanoid Robots in Construction Market

The deep-rooted aspect of humanoid robots development in the construction sector is the implementation of artificial intelligence that focuses on their ability to work safely, efficiently, and autonomously in the intricate conditions of the workplace. LiDAR and computer vision-based perception systems enable robots to identify materials, clear obstacles and understand dynamic site maps with centimeter-level precision, even in environments affected by dust, low lighting, or frequent layout changes. Deep neural networks continue to advance in their task-specific skills, such as welding, masonry, inspection, and handling materials, with human-level accuracy. These models are trained on large datasets collected from real construction sites, allowing robots to improve their manipulation abilities, grip strength regulation, tool usage, and recognition of safety-sensitive situations.

AI-based motion planning enables stable bipedal locomotion on irregular surfaces, scaffolding, and multistory buildings, and allows humanoid robots to remain flexible in responding to construction-specific challenges. Reinforcement learning and physics simulation tools help optimize balance control, foot placement and center of mass adjustment, enabling the robot to walk over debris, step across gaps, or navigate partially completed structures. Robots can also adjust to shifting loads, inclines and vibration from nearby machinery, improving overall site safety.

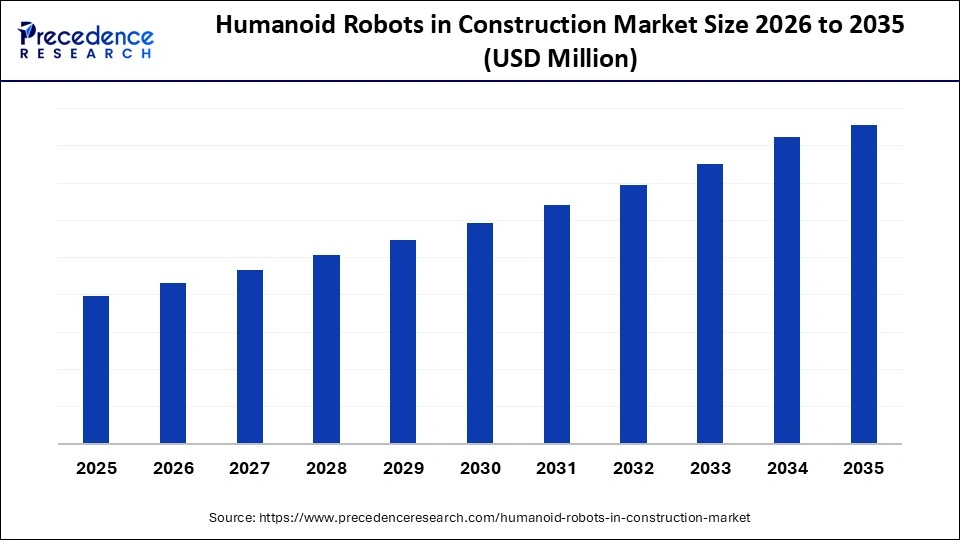

Humanoid Robots in Construction Market Outlook

The industry is in rapid growth owing to the invention of AI, locomotion, and manipulation ability, which augment humanoid robotics in unstructured environments. The rise in demand for automation to address labour shortages and safety concerns is also driving the adoption of humanoid robots in the construction market.

Adoption has been slowly gaining momentum in North America, Europe, and Asia-Pacific, where construction industries are actively investigating humanoid robots to build the infrastructure in high demand. Emerging markets are also becoming interested, as governments spend on automation to enhance construction productivity.

There is a robust startup ecosystem that is developing, which includes companies that are involved in building bipedal robots, tooling that is task-specific tooling, and AI-based perception systems when applied to construction settings. Partnerships with construction companies, universities, and robotics laboratories are also helping startups test, optimize, and implement their platforms more effectively.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, Robot Type/Capability, Autonomy Level, Deployment Model, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Humanoid Robots in Construction Market Segment Insights

Application Insights

Material Handling & Logistics: This segment dominated the humanoid robots in construction market, since this category is a good fit for the main capabilities of humanoid systems, including mobility, load-bearing capacity, and efficiency in repetitive tasks. Moving tools, components, and heavy materials across uneven, multi-level environments is required on construction sites, and humanoid robots can navigate them using their human-like locomotor behavior. With the labor shortage growing and project timelines shortening, businesses are increasingly integrating humanoids to ease on-site logistics.

Welding & Heavy-Trade Tasks: The welding and heavy-trade tasks division is set to grow rapidly as humanoid robots will be able to achieve the dexterity, accuracy, and power required to perform high-skill, labor-intensive manufacturing tasks. Such jobs tend to be hazardous, involve heat exposure, or require high levels of accuracy, which robots can greatly reduce risk without any drop in quality. The control systems may be enhanced with AI to provide robots with greater stability and consistency when working with welding torches, cutting tools, and industrial equipment, as industries struggle to find safer, more efficient replacements for traditional skilled labor and aim to minimize on-site accidents.

Masonry & Bricklaying (Robot-Assisted): Masonry and bricklaying with the assistance of robots are promising areas of application due to their repetitive nature and the precision of the work. With high consistency and reduced worker fatigue, humanoid robots with a sophisticated vision system and ergonomic manipulation can install bricks, apply mortar, and complete alignment tasks. These systems help maintain productivity in a tight labour market and minimise mistakes in structurally sensitive work.

Robot Type / Capability Insights

Bipedal Humanoids With Manipulation Suites: The humanoid bipeds with more advanced manipulation suites accounted for the largest revenue in 2024, as they offer a high degree of versatility across different construction work because they are highly similar to humans in terms of movement, flexibility, and dexterity. Their ability to walk over uneven surfaces, ascend stairs, traverse scaffolds, and use common tools enables them to be seamlessly integrated into existing workflows without necessitating a redesign of the site. Armed with multi-DOF arms, grippers, and AI-based perception, these robots can manage material movement, precision tasks, and dangerous tasks more effectively and safely.

Tele-Operated Humanoids: Tele-controlled humanoids are likely to experience booming growth because they offer a direct, sensible interface between full manual control and full autonomy. These systems allow remote human operators to perform skilled tasks in dangerous or otherwise unreachable locations, improving safety without interfering with human handling or skill. As the need to move further toward remote construction assistance, disaster response, and hazardous-site operations grows, teleoperation offers high reliability with a low risk of exposure.

Hybrid Humanoid + Mobile Base Platforms (Combining Wheeled Bases With Humanoid Arms): Humanoid manipulation arms are also being used with wheeled or tracked mobile bases to create hybrid systems that are increasingly attractive for tasks that demand strength, stability, and mobility on smoother surfaces. These websites reduce the complexity and energy required for full bipedal mobility while still allowing human-like abilities to use tools and perform precision tasks. As robotics is increasingly adopted in semi-structured construction processes, hybrid platforms are becoming more popular, combining affordability and durability with a high potential to adapt to various tasks.

Autonomy Level Insights

Semi-autonomous / Tele-assist: The semi-autonomous / tele-assist category overtook humanoid robots in construction market in 2024, as it offers the right balance of robot intelligence and human supervision. Construction sites are highly dynamic, unstructured environments, and full autonomy is still hard to come by; thus, tele-assist systems are more reliable and can be deployed in a timely manner. The robots can execute the main functions-handling of materials, inspection, and placing of components- which are controlled by AI, but allowing human operators to intervene when the situation is complicated or dangerous. Such a hybrid control model is less risky, more precise in its tasks, and quicker to adopt in the real world.

Task-Level Autonomous: The task-level autonomous part is likely to advance significantly as AI, perception, and control algorithms become increasingly capable of handling repetitive, well-defined construction tasks. Autonomous welders, material transport systems, or inspection systems are robots that deliver impressive productivity benefits without the need for a person to be constantly on the job. Task-level automation is one of the primary sources of efficiency as construction companies aim to standardize the processes and eliminate labor dependency. A greater incorporation of digital twins, site mapping, and predictive analytics will contribute to greater autonomy for robots.

Fully Autonomous General-Purpose Humanoids: The fully independent general-purpose humanoids segment is still in a longer-term period of development, as making complex, stable decisions in conditions of highly variable construction remains a pipeline dream. The robots will be used to accomplish a wide variety of tasks with limited human intervention and will require improvements in intelligence, flexibility, and real-time environmental awareness. Prototypes are promising, but they should be further developed to achieve AI cognition, advanced battery technologies, and safe autonomy models.

Deployment Model Inisghts

Pilot & Contracted Trials with Contractors / Shipyards: The pilot and contracted tests involving contractors and shipyards have generated the highest revenue in 2024, as most humanoid robots are at the initial stages of commercialization and pilot programs are the only means of testing and verification on the ground. These test alliances enable robotics firms to develop capabilities and generate considerable revenue through services. Moreover, large contractors are increasingly adopting structured pilot contracts to analyze ROI and business suitability, so that this deployment model can be dominant over the entire projected period.

Asset-as-a-Service/Robot Rental: The asset-as-a-service or robot rental segment will expand rapidly due to its lower initial cost and flexible, usage-based pricing structure. Most construction companies, and in particular mid-sized contractors, do not want to make large investments in early-stage technologies but will consider renting robots for a specific project or during peak labor-demand periods. This type of model enables firms to experiment without the risks of long-term ownership and, at the same time, reap the productivity gains immediately.

In-House Deployment by Large Contractors/Manufacturers: In-house deployment is becoming the new trend, with large construction firms and industrial manufacturers increasingly considering humanoid robots as part of their long-term automation plans. These organizations possess the capital, technical expertise, and scope of operation needed to run robotic systems within their organizations in ways that maximize their use. Though it is steadily growing, mass adoption will increase as robots become cheaper, more reliable, and better aligned with enterprise digital transformation programs.

End User Insights

Heavy Industry & Shipyards / Large Contractors: The heavy industry & shipyards / large contractors segment led the humanoid robots in construction market and accounted for the largest revenue share in 2024. As they require high levels of strength, precision, and safety-related functions, humanoid robots promise short-term returns. Welding, moving materials, and installing components are some of the risky activities undertaken in large-scale projects; therefore, humanoid robots are the best solution for reducing risk and ensuring production.

Specialty Trades (Welding Shops, Façade Installers): The specialty trades (welding shops, façade installers) segment is expected to grow at a significant CAGR over the forecast period. Welding, façade, and other trades that demand high precision are among the most severely labor-short, and high-precision workmanship is a necessity, so advanced humanoid robots seem an interesting augmentation tool. With improved manipulation, stability, and tool-handling capabilities, specialty trade companies are now resorting to robotic assistance, and thus, the projections are also expected to grow high.

Residential & Commercial Contractors: Homeowners and construction companies will more slowly embrace humanoid robots due to the increasing labor shortage, cost reduction, and the need to speed up construction schedules. These segments involve multiple sites, where flexible humanoid robots can complement logistics, repetitive tasks, and safety surveillance, reducing costs and enhancing autonomy.

Humanoid Robots in Construction Market Region Insights

Asia Pacific held the dominant share of the humanoid robots in construction market in 2024, driven by its rapid industrialization, massive infrastructure construction, and strong government incentives for automation. Robots R&D, manufacturing, and initial humanoid-robot applications are centered in countries such as China, Japan, and South Korea. Such countries have developed robotics environments, well-developed supply chains, and good government and private investment. Also, APAC construction companies experience a continuous labor shortage, which drives increased use of automation technologies. The region was awarded the largest market share as big contractors, shipyards, and industry players moved toward humanoid systems to be more efficient and safe.

China Humanoid Robots in Construction Market Trends

China is becoming a major player in the humanoid construction robot market, driven by an ambitious national robotics policy, advanced technology production capacities, and the huge infrastructure needs. Chinese technology giants and robotics start-ups are significantly investing in humanoid research and development, and some have full-scale pilots in use in construction, logistics, and shipyards. The high rate of urbanization and the labor demographic situation in the country make the process of intelligent automation even more urgent. Widespread adoption is also supported by government programs that promote AI, industrial automation, and intelligent construction. Consequently, China is emerging as a major center for development, testing, and commercialization of humanoid robots in the construction industry.

North America is estimated to grow at the fastest CAGR during the forecast period. The adoption of high-tech automation, intense venture capital funding, and the rushed growth of humanoid robot pilots. Construction firms, automotive factories, and shipyards in the U.S. are collaborating with major robotics companies to deploy humanoids in construction processes to assist with material handling, welding, inspection, and logistics. The global demand for the automation of high-risk industrial sectors is growing due to skilled labor shortages and the growing safety standards. Moreover, the availability of major AI and robotics innovators accelerates technological growth and commercialization. All these are contributing to the high growth rate of the North American humanoid robots in construction market.

Humanoid robots in the United States construction sector are developing rapidly because the country is among the first to embrace high-end robotics in the industrial and construction sectors. Due to labor shortages, increased project expenses, and tougher safety regulations, American contractors and shipyards are urgently testing humanoid robots for materials management, inspection, welding, and logistics on-site. A vibrant venture capital market and the presence of technological giants in the robotics sector hasten innovation and commercialisation, while massive infrastructure projects provide a conducive environment for implementation. As tech developers, universities, and construction companies work more closely together, the U.S. is becoming a center of innovation in humanoid construction robotics.

The European market is witnessing sustainable growth in the humanoid construction robotics market, driven by strong regulatory emphasis on worker safety, automation, and the sustainability of infrastructure and other industrial projects. Nations such as Germany, France, and the Nordics are embracing high-tech robots to address aging labor markets and a shortage of skilled trades. Europe also benefits from world-class robotics research centers and government-backed innovation programs that can accelerate the development of humanoid technology. The region construction industry, which is rapidly developing, is also adopting robotics for activities that demand high levels of accuracy and compliance with safety regulations. Europe is increasingly moving towards the wider application and commercialisation of humanoid robots in the workplace.

UK Humanoid Robots in Construction Market Trends

The UK market is on the rise because construction firms are implementing humanoid robots to address labor shortages, minimize project delays, and adhere to higher safety standards. The country digitalisation drive is being facilitated by efforts in AI, robotics, and automation, and is enabling early-stage projects in infrastructure, commercial buildings, and industrial facilities. UK contractors are looking at humanoid robots to assist the industry with logistics, repetitive manual jobs, and dangerous tasks, such as high-rise inspections and handling heavy loads. Universities and robotics laboratories provide strong research support, and government innovation grants support pilot deployments.

Humanoid Robots in Construction Market Companies

Developer of the Apollo humanoid robot designed for manufacturing, logistics, and industrial tasks. The company is working with major OEMs, including early pilots with automotive partners that demonstrate real-world factory-deployment potential.

Builds the Optimus general-purpose humanoid platform with long-term plans for industrial, logistics, and facility automation. Teslas vertically integrated AI, hardware, and manufacturing ecosystem positions Optimus for high-volume industrial use.

Creator of Digit, a bipedal humanoid designed for material handling, warehouse operations, and site logistics. The platform focuses on robust mobility and the automation of repetitive tasks in industrial and construction settings.

Develops general-purpose humanoids aimed at industrial labor functions including assembly, warehousing, and site support. The company has strong investor backing and is actively pursuing commercial pilots in manufacturing environments.

Developer of Atlas and other advanced robotic platforms that demonstrate high mobility and manipulation abilities. While primarily a research platform, Boston Dynamics continues to influence industrial robotics adoption through enterprise partnerships.

Works on humanoid systems tailored for shipbuilding and welding support tasks. The company collaborates with heavy-industry partners to develop robots suited to high-precision, hazardous industrial environments.

Expands industrial robotics capabilities into humanoid-adjacent systems for shipyards and heavy manufacturing. The company integrates advanced automation with industrial workflows through collaborations with tech developers.

Produces cost-efficient humanoid and quadruped robots such as Unitree G1 with growing interest in industrial and security applications. The company targets scalable robotics suitable for repetitive and semi-autonomous site tasks.

A developer of cognitive humanoid and collaborative robots intended for industrial, logistics, and service tasks. The company focuses on perception-rich systems capable of operating safely in dynamic human environments.

Builds general-purpose humanoids designed to perform a wide range of industrial and commercial tasks. Its robots emphasize dexterity, autonomy, and adaptability across multiple workflows.

A leader in construction automation providing autonomous heavy equipment solutions. Although not humanoid, its systems represent natural integration points for mixed-fleet automation on job sites.

Produces specialized robotic systems such as SAM and MULE for masonry and material handling tasks. Their platforms are relevant as complementary technologies to humanoids in structural and repetitive onsite work.

Develops robotic bricklaying systems capable of high-speed, precision masonry automation. Their technology provides a potential synergistic or competitive layer for humanoid deployments in construction.

Recent Developments

- In October 2025, Deep Robotics introduced the DR02, the first all-weather humanoid robot announced worldwide, with IP66 dust and water resistance, as an outdoor security, logistics, and industrial inspection robot. It was an important step towards the introduction of humanoid robots into dangerous, unstable construction and industrial environments.(Source: https://finance.yahoo.com)

- In August 2025, Ubtech announced the release of its newest generation industrial humanoid robot, Walker S2, which included an autonomous battery switch that enabled it to operate autonomously. The robot implementation demonstrated its industrial capability in a multi-robot training program in a smart factory.(Source: https://en.eeworld.com.cn)

- In June 2025, All3 introduced a building system that integrates AI and robotics to construct housing more quickly. The companys presentation emphasized its goal of saving money and contributing to solving the housing crisis through high-tech automation.(Source:https://www.therobotreport.com)

Humanoid Robots in Construction MarketSegments Covered in the Report

By Application

- Material Handling & Logistics

- Masonry & Bricklaying (Robot-Assisted)

- Welding & Heavy-Trade Tasks

- Inspection, Surveying & QA (Structural Inspections, Façade Checks)

- Surface Finishing (Plastering, Painting, Sealing)

- Demolition & Hazardous-Task Substitution

- Teleoperation/Remote Assist (Training, Supervision, Mixed Teams)

By Robot Type/Capability

- Bipedal Humanoids With Manipulation Suites

- Tele-Operated Humanoids

- Hybrid Humanoid + Mobile Base Platforms (Combining Wheeled Bases With Humanoid Arms)

- Specialized Tool-End Effectors/Modular Payloads (Welding Torch, Gripper, Hurdling)

By Autonomy Level

- Semi-autonomous/Tele-Assist

- Task-Level Autonomous

- Fully Autonomous General-Purpose Humanoids

By Deployment Model

- Pilot & Contracted Trials With Contractors/Shipyards

- Asset-as-a-Service/Robot Rental

- In-House Deployment by Large Contractors/Manufacturers

- Integrator + OEM Partnerships (Robot OEM + Construction Firm Bundles)

By End User

- Heavy Industry & Shipyards / Large Contractors

- Residential & Commercial Contractors

- Specialty Trades (Welding Shops, Façade Installers)

- Infrastructure / Utilities & Emergency Response

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting