What is the Carbon Accounting Software Market Size?

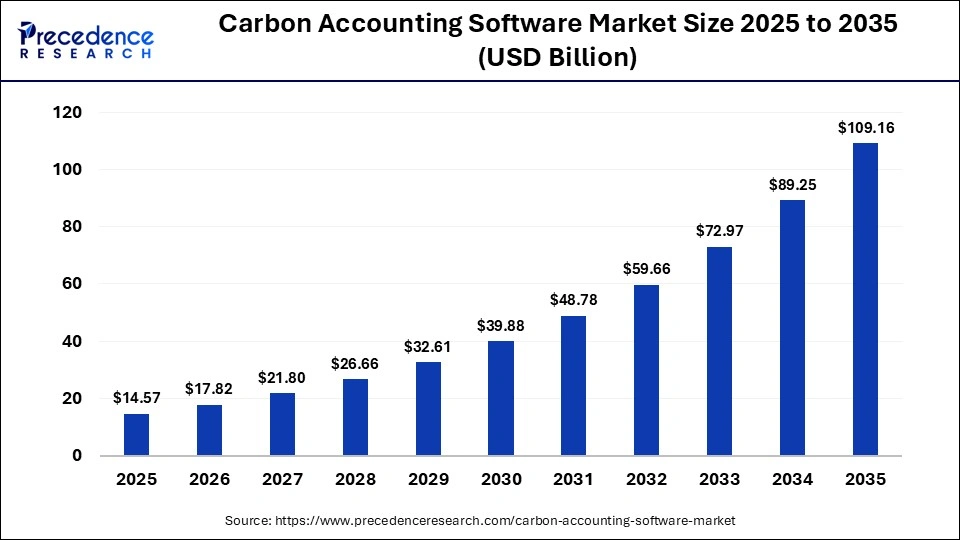

The global carbon accounting software market size was calculated at USD 14.57 billion in 2025 and is predicted to increase from USD 17.82 billion in 2026 to approximately USD 109.16 billion by 2035, expanding at a CAGR of 22.31% from 2026 to 2035. The carbon accounting software market is expanding due to intense regulatory pressure to reduce carbon emissions by tracking and reporting. Major companies are largely embracing carbon accounting software to comply, avoid legal violation and contribute to net-zero initiatives across the globe.

Market Highlights

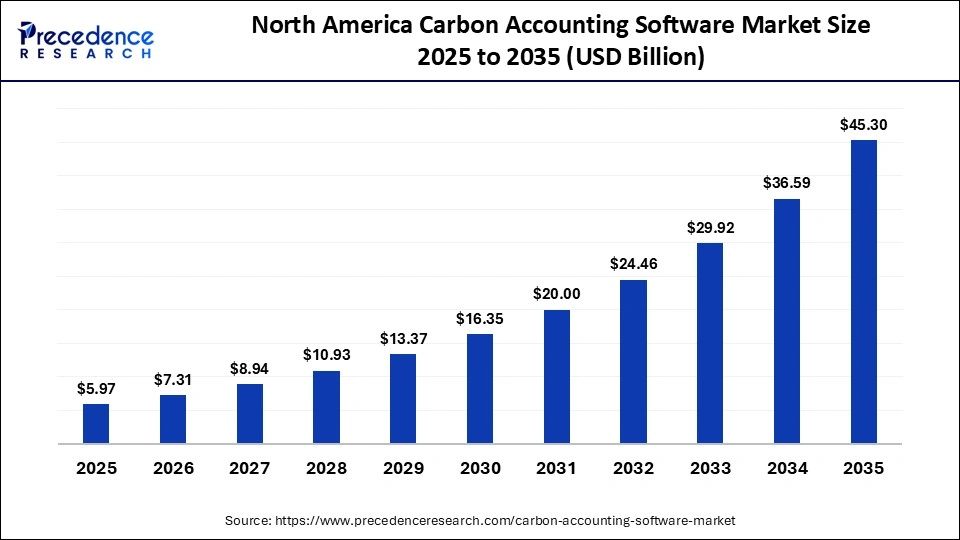

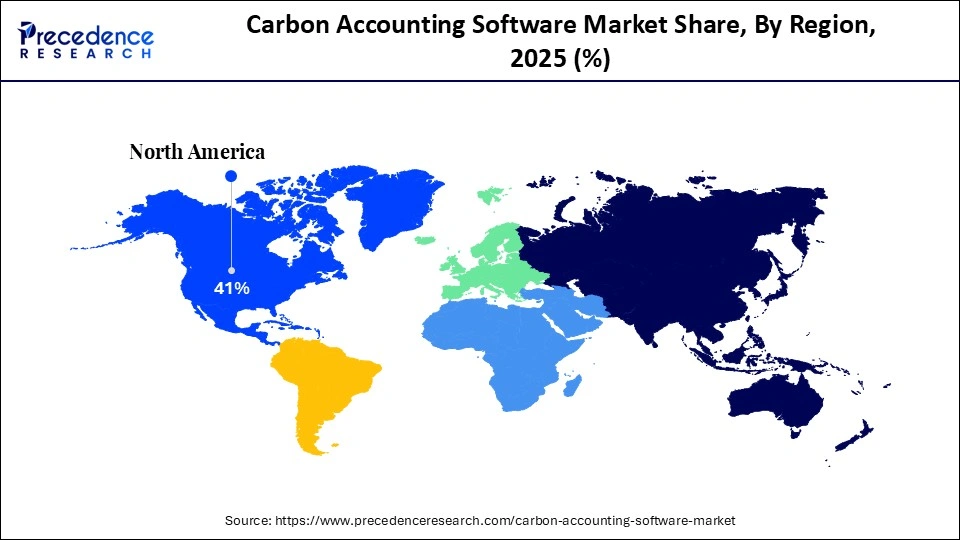

- North America held the largest market share of 41% in 2025.

- The Asia Pacific is projected to grow at the fastest CAGR between 2026 and 2035.

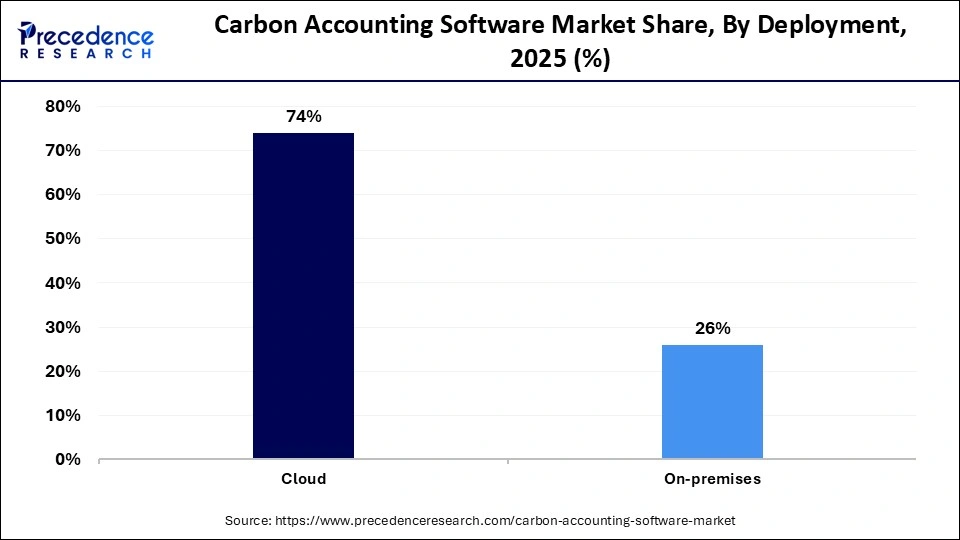

- By deployment, the cloud segment contributed the largest market share of 74% in 2025.

- By deployment, the on-premises segment is projected to grow at a significant CAGR during the foreseeable period.

- By end use, the energy & utilities segment held the largest market share in 2025.

- By end use, the transportation & logistics segment is projected to grow at the fastest CAGR from 2026 to 2035.

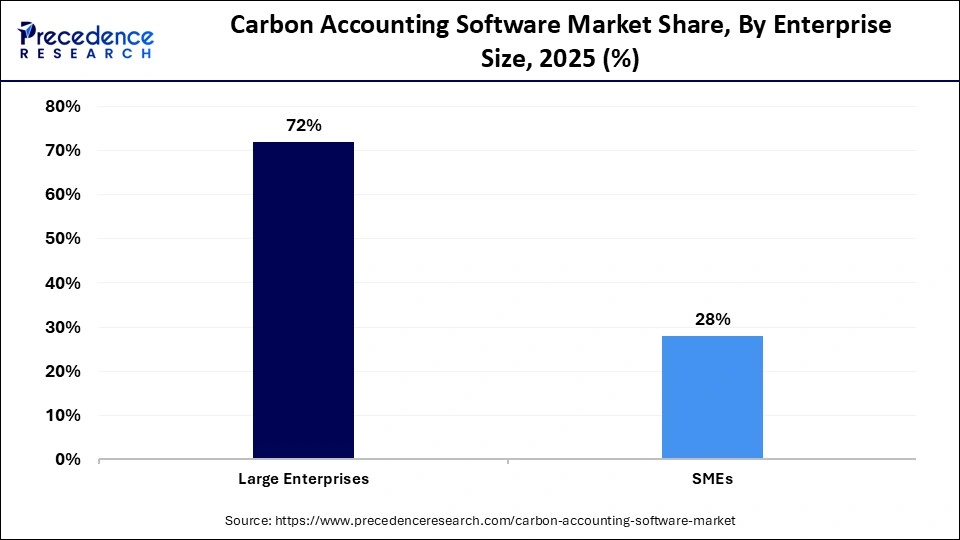

- By enterprise size, the large enterprises segment accounted for the highest market share of 72% in 2025.

- By enterprise size, the small & medium enterprises segment is projected to grow at a significant CAGR from 2026 to 2035.

Carbon Accounting Software Market Means

Carbon accounting software is a revolutionary digital solution specifically engineered to quantify, analyze, and develop various strategies for carbon footprint reduction. According to the sources, a survey shows that nearly 55% of consumers are willing to pay more for services and products from enterprises that are committed to indulging with positive social and environmental impact. Therefore, carbon accounting software has become increasingly pivotal in the business landscape due to the combination of regulatory pressure and growing expectations of stakeholders to report, track, and manage carbon solutions, fueling the growth of the carbon accounting software market.

AI Shifts in Carbon Accounting Software Market

The integration of AI with carbon accounting software offers a promising avenue to reduce carbon emissions with the help of capabilities like predictive analytics, enhanced data precision, streamlined workflow, and the analysis of supply chain emissions. AI has the potential to minimize global greenhouse gas emissions by 4% by using various ways, such as auto-matching of emission factors, optical character recognition, and generative AI for reporting carbon emission data.

Additionally, AI can easily identify irregularities and anomalies in data that show errors or possible opportunities to reduce carbon emissions. This offering is highly critical to building data-driven carbon strategies with accuracy and reliability that adhere to environmental regulations, ultimately assisting enterprises in reducing carbon emissions without constant human intervention in the process.

Carbon Accounting Software Market Trends

- Leading businesses and organizations, MNCs, and Local startups are shifting towards sustainability goals to fight against climate change, making carbon footprint reduction an inevitable way to operate in the market.

- The journey towards net-zero carbon emissions is majorly intertwined with the regulatory landscape, and governments across the globe are focusing on environmental protection by mandating strict environmental compliance and predefined standards.

- The increasing use of platforms like 51carbonZero plays a critical role in simplifying and automating the data collection and reporting method, which eventually makes compliance easy to manage with data-driven actions.

- Real-time capabilities of carbon accounting software are highly attractive to consumers and business dealers as it offers centralized hubs for all environmental data, with potential gap identification between the standard emission protocol and the status of carbon emission by companies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 14.57 Billion |

| Market Size in 2026 | USD 17.82 Billion |

| Market Size by 2035 | USD 109.16 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 22.31% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment, Enterprise Size, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Deployment Insights

Why Do Cloud Deployments Prevail in the Carbon Accounting Software Market?

Cloud

The cloud segment held the largest market share in 2025 due to its unmatched offerings like superior cost efficiency, high scalability, and real-time data tracking. Cloud solutions are highly in demand as they reduce the need for significant capital expenditure to build hardware and on-site IT staff. Cloud platforms allow centralized and real-time tracking of carbon emissions across several sites, which is crucial for precise and audited reports. Also, cloud data centers can be highly energy efficient while depending on renewable energy sources that contribute to lower carbon footprints.

On-Premises

The on-premises segment is projected to grow at a significant CAGR during the foreseeable period due to key reasons like high security and control, regulatory compliance, easy customization with integration to existing systems, and increasing demand from various industries for deployment. Many organizations having strict data security policies prefer to keep their confidential data within the organization to reduce unauthorized access and cyber threats amid growing incidences of cyberattacks by finding vulnerabilities in the systems. Especially, energy and utility sectors that handle massive data about carbon emissions are shifting to leverage on-premises deployment methods.

End Use Insights

Why is the Carbon Accounting Software Market Largely Driven by the Energy & Utilities Sector?

Energy & Utilities

The energy & utilities segment held the largest market share in 2025 due to the key driving factors like strict regulatory action against non-compliance of environmental regulations, pressure by stakeholder and investors, complex operations performed by the energy and utilities sector, along with the increasing shift towards renewable energy sources. Wind and solar power are the main sources of renewable energy, which are highly leveraged by the energy sector owing to the global push towards clean energy and net-zero emissions. Thus, carbon accounting software is a significant tool that helps companies manage carbon emission data and perform life cycle assessments, aiming to offer energy savings and save positive brand value among consumers.

Transportation & Logistics

The transportation & logistics segment is projected to grow at the fastest CAGR in the carbon accounting software market during the foreseeable period, as this sector is highly under government scrutiny to reduce carbon emissions due to its substantial portion of carbon emissions across the globe. The industry faces intense regulatory pressure that mandates companies in this sector to leverage carbon accounting software to track, document, and reduce carbon emissions to stay competitive and avoid hefty fines if the regulations are violated due to ignorance. Regulations like India's Bharat Stage VI and the EU's corporate sustainability reporting directive are ensuring compliance in the transportation and logistics sector.

Enterprise Size Insights

What are the Major Growth Drivers of Large Enterprises in the Market?

Large Enterprises

The large enterprises segment held the largest carbon accounting software market share in 2025 due to major key drivers like early adoption of cutting-edge tools, high-value investment, and the need for comprehensive data management. Large enterprises are complex and operate in various regions that necessitate precise data tracking software, reporting, and managing carbon footprints to comply with strict government laws against the violation of carbon emission limits. Large enterprises are prioritizing sustainability in their supply chain, which encourages suppliers also use similar carbon accounting software, in turn, fueling the market's growth due to rapid adoption of such software by large companies.

Small & Medium Enterprises

The small & medium enterprises segment is projected to grow at the fastest CAGR during the foreseeable period due to the critical role played by SMEs in carbon emission reduction. Collectively, SMEs are contributing nearly 50% employment and 90% businesses worldwide, where carbon emission tracking pressure is high to meet the evolving landscape of environmental regulations. The latest IPCC reports highlight the urgency to reduce global carbon emission to the half at least half by 2030 as per the Paris agreement, and with SMEs showcasing their collective impact on climate is collectively bigger, it's essential to adopt carbon accounting software by SMEs to comply with regulations.

Regional Insights

How Big is the North America Carbon Accounting Software Market Size?

The North America carbon accounting software market size is estimated at USD 5.97 billion in 2025 and is projected to reach approximately USD 45.30 billion by 2035, with a 22.47% CAGR from 2026 to 2035.

What Made North America a Dominant Region in the Carbon Accounting Software Market?

North America held the largest market share in 2025 due to the rigorous reporting requirement for carbon emission by both the U.S. and Canada government, growing adoption of sustainability practices and ESG, adoption of cloud-based platforms along with leading tech players that are actively introducing innovative solutions to manage carbon tracking and reduce emissions. Major tech players like IBM, Salesforce, Microsoft, and others are continuously offering advanced and scalable solutions along with AI/ML integration to software, aiming to enhance data precision and predictive analytics.

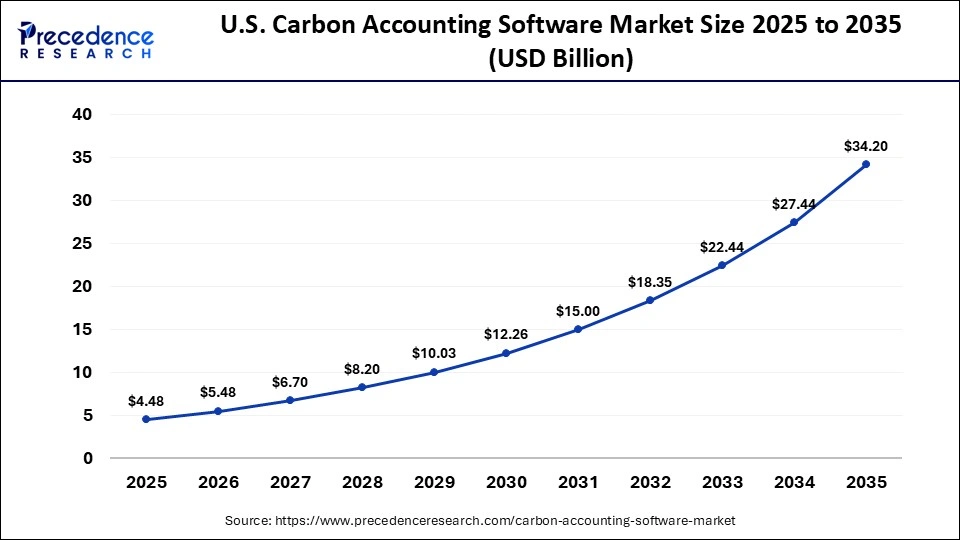

What is the Size of the U.S. Carbon Accounting Software Market?

The U.S. carbon accounting software market size is calculated at USD 4.48 billion in 2025 and is expected to reach nearly USD 34.20 billion in 2035, accelerating at a strong CAGR of 22.54% between 2026 and 2035.

U.S. Carbon Accounting Software Market Analysis

The region's growth is attributed to the stringent environmental regulations to achieve carbon neutrality, consumers shifting towards sustainable products and services, along with the early adoption of technological advancements like AI/ML models and IoT with cloud solutions for precise data gathering, tracking, and documentation, which converts intro ready to audit report. Regulations like the EPA's Authority under clean air act and the climate disclosure rules by SECs proposal further support the market growth. Also, collaboration, acquisition, and initiatives among leading marketers in the region drive the market growth further.

For instance, in January 2026, a clean energy platform, Aspen Power, unveiled that it was closing a $200 million capital raise backed by Deutsche bank aiming to support its development of distributed solar and storage projects across the U.S.

What are the Key Reasons for the rapid expansion of the Asia Pacific Carbon Accounting Software Market?

Asia Pacific is projected to grow at the fastest CAGR during the foreseeable period due to the combination of key factors like the region's growing emphasis on sustainability, majorly supported by government policies, corporate social initiatives, and increasing awareness about environmental protection by reducing toxic emissions like carbon dioxide as a major emitter. Many businesses are adopting sustainability goals that have surged a demand for carbon accounting software in the past year. These tools offer precise ways to track carbon emissions, making it an indispensable part of businesses to comply with environmental regulations and embrace green technologies in their production.

China Carbon Accounting Software Market Trends

The key trends for China's market include the nation's commitment to reduce carbon emissions significantly by 2030 and achieve carbon neutrality by 2060, the national carbon trading scheme, and an increasing number of companies adopting ESG criteria to stay compliant across the whole value chain. Industries like manufacturing, electronics, and semiconductors are largely leveraging platforms like carbon accounting software, due to corporate climate reporting further strengthening the market expansion in China.

For instance, in January 2026, the Ministry of Finance, China, and other countries' ministries, central banks, and regulators have introduced their new ‘Corporate Sustainable Disclosure Standard No.1-Climate (Trial) to help companies report on climate-related risk and its management.

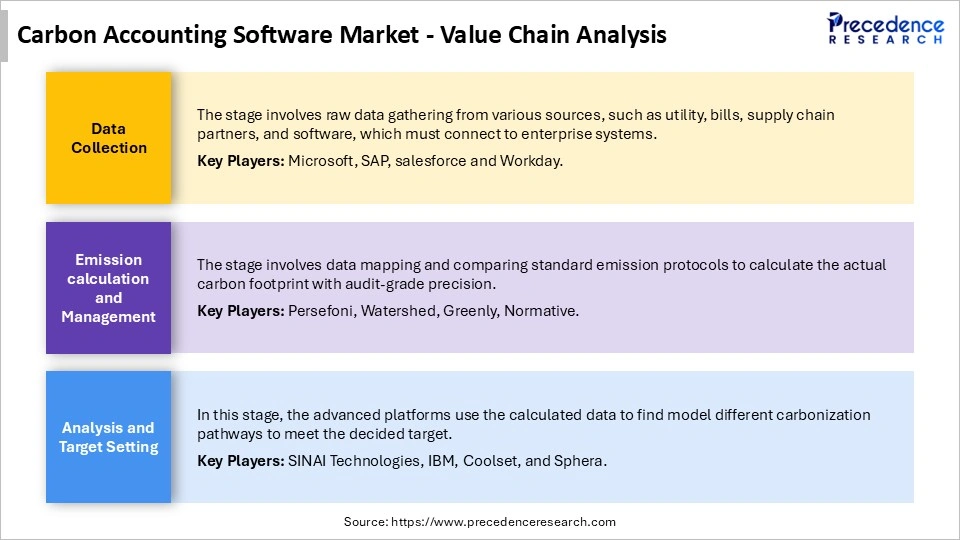

Carbon Accounting Software MarketValue Chain Analysis

Who are the Major Players in the Global Carbon Acounting Software Market?

The major players in the carbon accounting software market include IBM Corporation, SAP SE, Salesforce, Inc., Microsoft, Persefoni AI, Sphera, Greenly, Diligent Corporation, SINAI Technologies, and Net0.

Recent Developments

- In January 2026, a sustainability Reg Tech enterprise, Diginex, made announcements about its definitive agreement to acquire carbon measurement, reporting, and reduction software provider, PlanA.earth GmbH for $64 million to offer end-to-end ESG reporting and sustainability solutions.(Source: https://www.esgtoday.com)

- In January 2026, a Germany-based sustainability software provider, Osapiens, unveiled that they have secured $100 million in a new year series C fundraising round conducted by BlackRock and Temasek's decarbonization-focused fund, and decarbonization partners. This fund will be used for product innovation and growth in current and new international markets.(Source: https://www.esgtoday.com)

Segments Covered in the Report

By Deployment

- Cloud

- On-premises

By Enterprise Size

- Large Enterprises

- SMEs

By End Use

- Energy & Utilities

- IT & Telecom

- Healthcare

- Transportation & Logistics

- Retail

- Construction & Infrastructure

- Food & Beverages

- Chemicals

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting