Active Packaging Market Size and Forecast 2024 to 2034

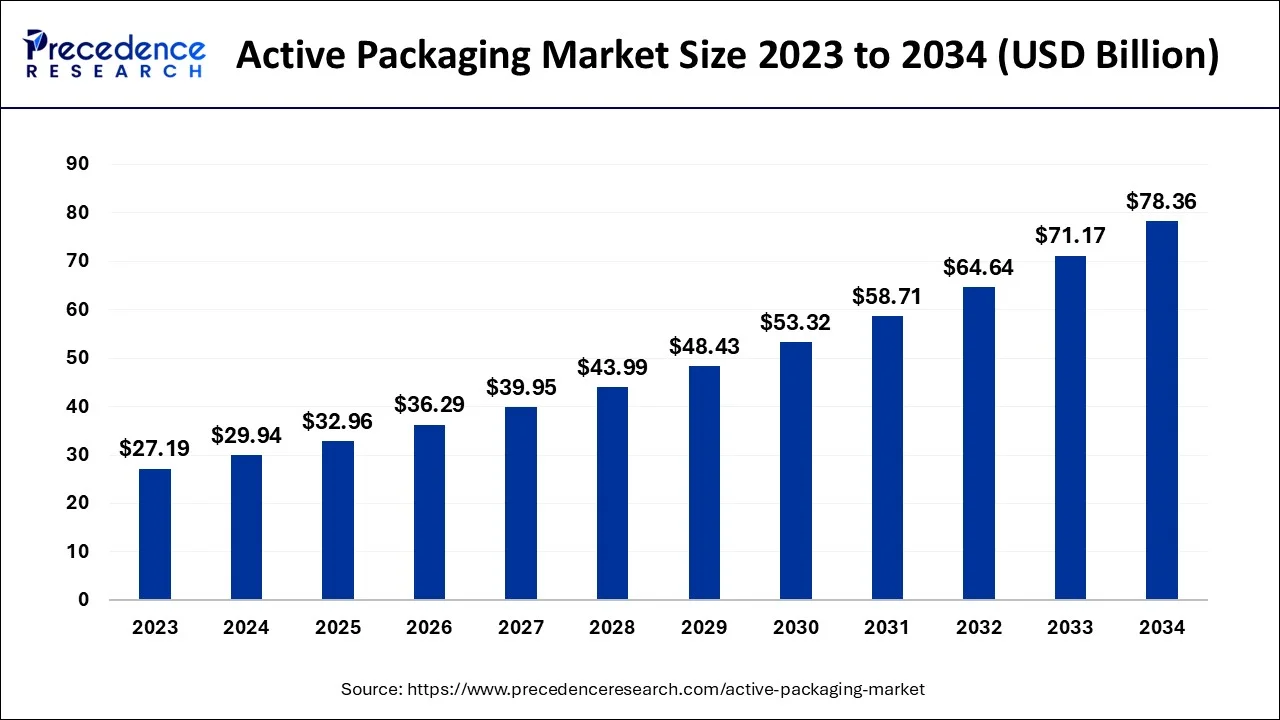

The global active packaging market size is estimated at USD 29.94 billion in 2024 and is anticipated to reach around USD 78.36 billion by 2034, expanding at a CAGR of 10.10% from 2024 to 2034.

Active Packaging Market Key Takeaways

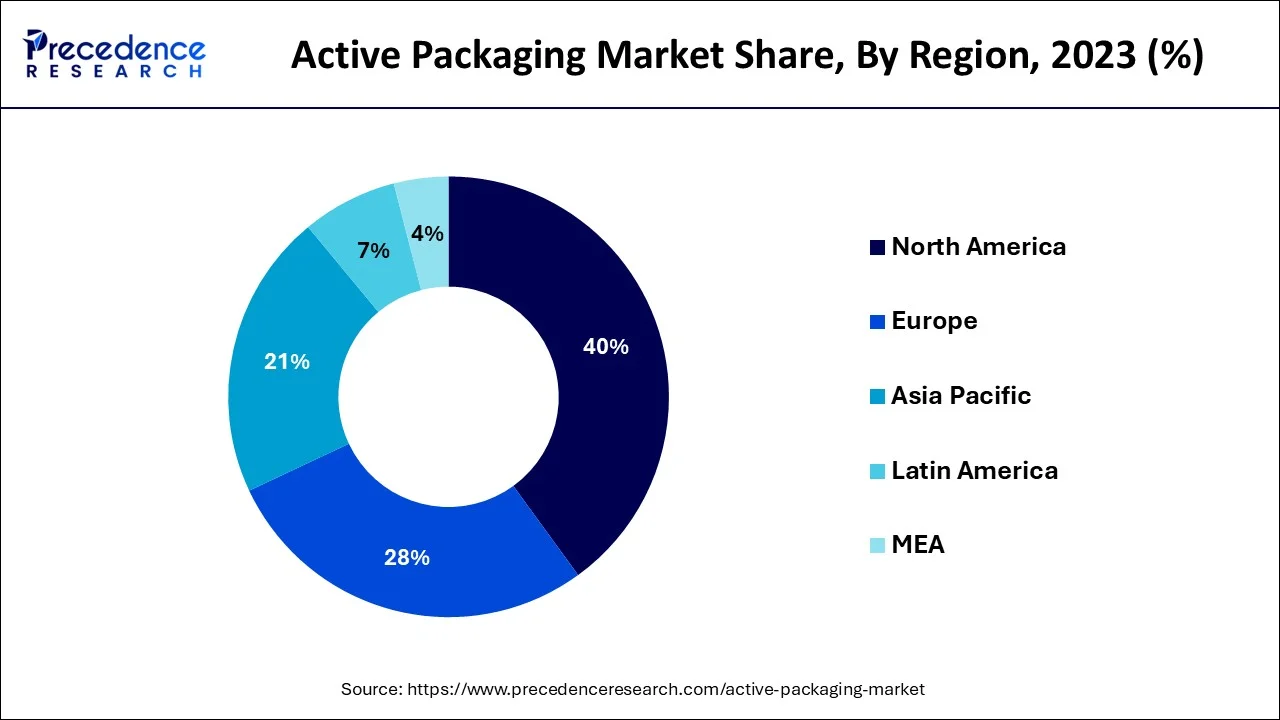

- North America dominated active packaging market in 2023.

- By application, the smart packaging segment led the market in 2023.

- By type, the oxygen scavengers segment led the market in 2023.

U.S. Active Packaging Market Size and Growth 2024 to 2034

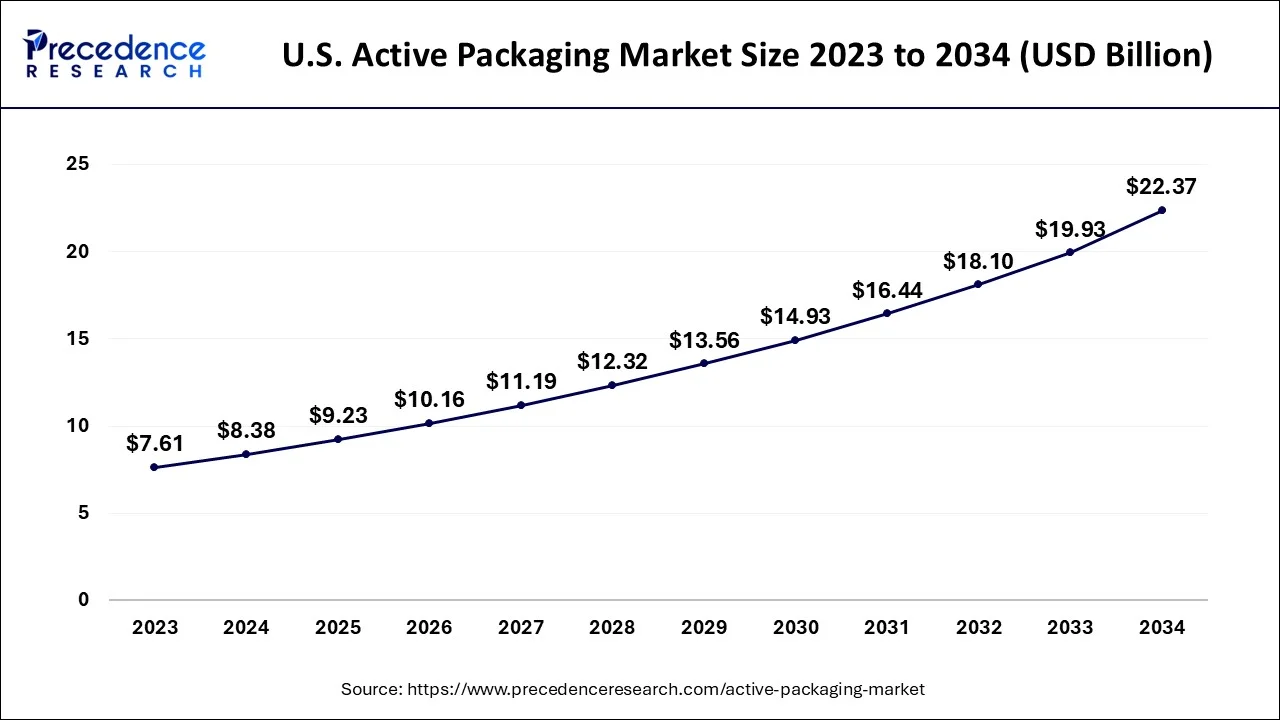

The U.S. active packaging market size is evaluated at USD 8.38 billion in 2024 and is predicted to be worth around USD 22.37 billion by 2034, rising at a CAGR of 10.30% from 2024 to 2034.

Given the strict regulations regarding beverage and food packaging and the ensuing increase in demand for cutting-edge solutions, North America may be expected to lead the market in the upcoming years. Given the growing consumer knowledge and choice for sustainable packaging technologies, Europe is growing at about the same rate as North America. The active packaging market in North America is continuing to emphasize product innovation. Companies are being drawn in by the quick transition from traditional to smart wrapping methods, which is pushing them to enter the industry. This drives the established firms to provide affordable and effective wrapping solutions in order to stay competitive in the local market.

According to the European Federation of Pharmaceutical Industries and Association, more than 1.18 billion vaccinations are produced in the area annually, with Germany leading the way in pharmaceutical supply development. The need for active packaging has increased in Germany due to the country's significant expansion in pharmaceutical pharmaceuticals and vaccine development. The government's strict measures to enforce accurate labeling of every medicine to stop drug fraud in the pharmaceutical industry benefit the market as well. Due to increased consumer disposable income and shifting lifestyles, particularly in China and India, Asia Pacific may see the highest development in the coming years. The active packaging business will be greatly impacted by the enormous food demand due to the growing population.

Market Overview

A product's quality and shelf life are maintained by adding specific additives to the packaging systems, a practice known as active packaging. While being transported and stored, packaged food is monitored by intelligent packaging systems, which provide information about the quality of the food. Therefore, using active packaging helps increase safety & convenience, monitor freshness, provide information on quality, and extend shelf life. In addition to other product categories, food and pharmaceuticals utilize active packaging. Factors that contribute to the growth include the expansion of the packaged food sector and the rise in the usage of active packaging in convenience shops. However, strict government regulations against plastic packaging are anticipated to impede industry expansion in the years to come.

The aging population increased chronic illness rates and expanding OTC medicine demand are all contributing to the healthcare sector's expansion. Investments in active packaging solutions are increasing as a result of rigorous rules regarding the packaging of medicinal items. The market for active packages is expected to grow over the course of the forecast period because to the increasing complexity of items that must be kept or delivered to remote locations even though keeping their integrity.

The industry is seeing an increase in demand for active packaging due to the rising popularity of packaged or ready-to-eat foods. The beverage business, which includes pouches for beverages and bottled water among other products, is also anticipated to have a favorable effect on this market. The expansion of packaged products is being driven by the increase in disposable income.

The COVID-19 epidemic has affected a lot of enterprises globally. Governments all across the world implemented strict lockdown protocols and social segregation norms to limit the pandemic's quick spread. The industrial roll-out of the Active Packaging Market may also be significantly delayed as a result of the economic crisis that followed the epidemic. As a result of the supply chain interruptions, market participants faced several difficulties. However, when additional supplies come online in the second half of 2023, things will get better.

Active Packaging Market Growth Factors

A product's quality and shelf life are maintained by adding specific additives to the packaging systems, a practice known as active packaging. While being transported and stored, packaged food is monitored by active packaging systems, which provide information about the quality of the food. Therefore, using active packaging helps increase safety & convenience, monitor freshness, provide information on quality, and extend shelf life. In addition to other product categories, food and pharmaceuticals utilize active packaging. The packaged food industry's expansion and convenience shops' rising usage of active packaging are two elements that are fueling the increase.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 29.94 Billion |

| Market Size by 2034 | USD 78.36 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 10.10% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Geography |

Market Dynamics

Key Market Drivers

- Growing demand for sustainable and long-lasting packaging products - Food is protected from environmental dangers as it moves through the supply chain and is delivered to the ultimate consumer using traditional packaging. However, because it does not increase the value of the contents, it is inactive. Science is now changing this by enabling communication between food and packaging. Technology is becoming increasingly significant as the supply chain digitizes because it provides operational benefits that let organizations adapt to shifting market conditions. Digitization also meets the market's desire for transparency and makes it simpler to comply with rules. This trend is being driven by changing consumer demands for goods with eco-friendly packaging.

- Reduction in tracking time - Over the course of the forecast period, the global market for active packaging systems is anticipated to be driven by the decrease in tracking time and effective product monitoring. Over the course of the projected period, significant R&D expenditures made by leading corporations are anticipated to further increase product demand with new goods. The expansion of the Active Packaging Market will be hampered by a number of obstacles and problems. Prices for raw materials rise along with manufacturing costs, which has an impact on the overall cost. Growth of the Active Packaging Market is anticipated to be hampered by this.

Key Market Opportunities

- Potential in the food and beverage sector - The worldwide market for active packaging has shown new growth opportunities. The growing preference among consumers for ready-to-eat foods has given rise to a need for food product packaging. Additionally, restaurants are now aware of how passionate consumers are about food packing. The level of demand witnessed across online channels for food delivery has soared following the relaxation of lockdown limitations imposed at the COVID outbreak. This factor, together with improvements in package engineering, has made it possible for new revenues to enter the worldwide market for active packaging.

- Demand for ready meals is creating opportunities - In the past ten years, customers from both the middle class and the educated classes have shown an increasing desire for case-ready meals. Independent data indicates that the U.K. eats over half of all ready meals in Europe. This is explained by the region's customers' growing preference for retail-prepared foods over home cooking. This opened the door for a new group of customers who are willing to pay extra for chilled dine-in specials instead of the formerly popular "frozen TV meal." Such changes in consumer preferences open up a wide range of possibilities for the global market for active packaging, particularly modified atmosphere packaging (MAP). Over the course of the forecast period, rising consumer knowledge of the ingredients used in a meal is anticipated to help influence the worldwide active packaging market. Additionally, this has opened up prospects for upscale, healthier foods with lower fat and salt content. The market for active packaging is also anticipated to be driven by ongoing product innovation by local and foreign producers across all regions.

Application Insights

The market share for smart packaging will likely be the largest in the sub-segment for food and beverages. There are a few reasons for this. The first is that more people throughout the world want to eat food that they are aware is healthy. The second is that consumers prefer eating food that is assured to be fresh. This is a promise made by smart packaging. They also like to buy food that is always available, always accessible, and has a long shelf life. Once more, careful packing may make this happen. Since it makes it easier for them to comply with the most recent and stringent food safety laws, the majority of enterprises in the food and beverage sub-segment are driven to use smart packaging.

Additionally, consumers like as much clarity as possible in the information on their boxes. Businesses claim that smart packaging gives them the ability to accomplish this while also protecting their trademarks. The world may already be moving toward preferring that food products be covered in smart packaging for reasons of sanitation and transparency. However, this procedure was considerably sped up by COVID-19.

Type Insights

The segment with the biggest market share, oxygen scavengers, is anticipated to continue to lead the market during the projected period. Limiting the quantity of oxygen that might cause deteriorative reactions and reducing the use of many items, including food, metals, and medications, is the goal of oxygen scavenger technology.

Active Packaging Market Top Companies

- R. Grace and Company (U.S.)

- Ampacet Corporation (U.S.)

- Ball Corporation (U.S.)

- Graham Packaging Company Inc. (U.S.)

- Rexam plc. (U.K.), Amcor Limited (Australia)

- Landec Corporation (U.K.)

- Bemis Company, Inc. (U.S.)

- Constar International Inc. (U.S.)

- Mitsubishi Gas Chemical Company (Japan)

- Crown Holdings Incorporated (U.S.)

- Klockner Pentaplast (Subsidiary Of Blackstone Group) (U.S.)

Recent Developments

- May 2022: Avery Dennison announced a strategic alliance with Wiliot, a provider of digital ID technologies, to scale the Internet of Things through the inclusion of atma.io as well as the development, design, and production of Wiliot tags, which will contribute to the development of an intelligent and fully interconnected IoT.

- In April 2022, Amcor PLC invested in expanding its medical packaging thermoforming capabilities at its healthcare packaging factory in Sligo, Ireland. The multi-million dollar investment would support Amcor's expanding sterile packaging business and give clients in Europe and North America access to yet another location with all-inclusive healthcare options.

- Graphic Packaging expanded its selection of environmentally friendly packaging options for the beverage sector in March 2022. EnviroClip, a minimal-material, paperboard substitute for plastic rings and shrink film for typical beverage cans, was introduced by the company as part of its commitment to continued product innovation in support of a more circular economy.

Segments Covered in the Report

By Type

- Oxygen Scavenger

- Shelf-life sensing

- Time Temperature Indicator

- Moisture Absorber

- Others

By Application

- Food and Beverage

- Healthcare

- Pharmaceutical

- Personal Care

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content