Advanced Wound Care OTC Market Size in 2026?

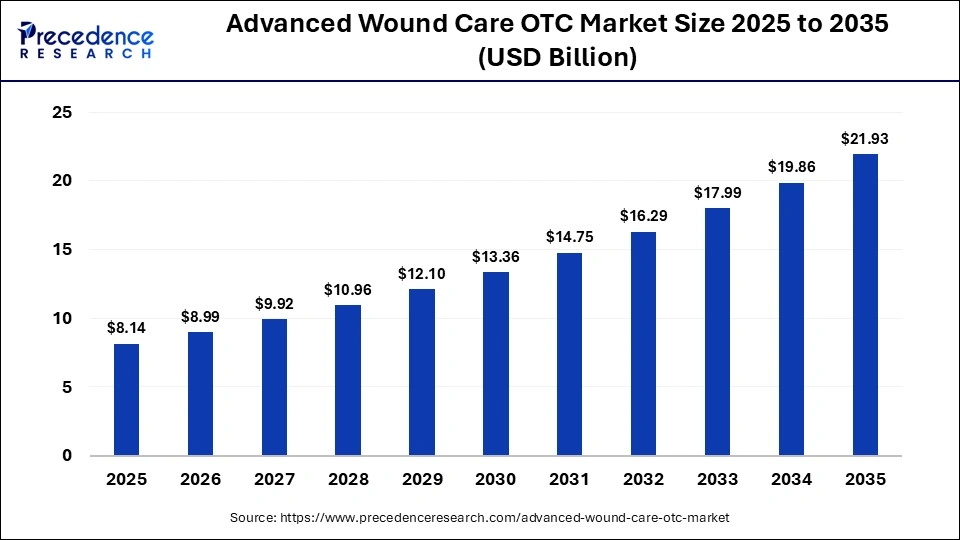

The global advanced wound care OTC market size was calculated at USD 8.14 billion in 2025 and is predicted to increase from USD 8.99 billion in 2026 to approximately USD 21.93 billion by 2035, expanding at a CAGR of 10.42% from 2026 to 2035.The advanced wound care OTC market is generally driven by the surging cases of skin ulcers, as well as technological advancements in the healthcare sector. Additionally, the rising adoption of hydrogel dressings by healthcare professionals, along with the rise in the number of private hospitals in developed nations, is playing a vital role in shaping the industrial landscape.

Market Highlights

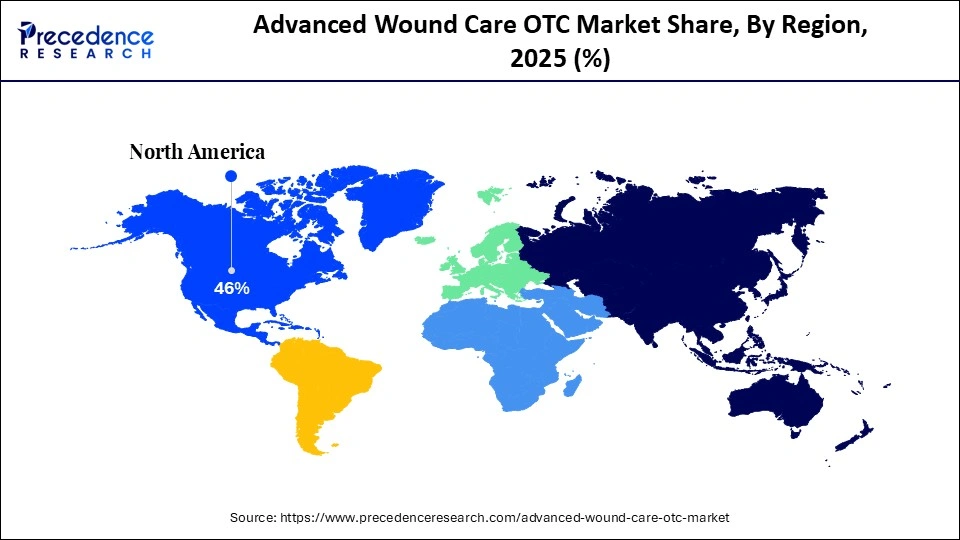

- North America dominated the advanced wound care OTC market, holding the largest market share of approximately 46% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035.

- By product type, the hydrocolloid dressings segment held the largest market share, accounting for approximately 28.5% in 2025.

- By product type, the antimicrobial dressings segment is expected to grow at the highest CAGR of 9.3% between 2026 and 2035.

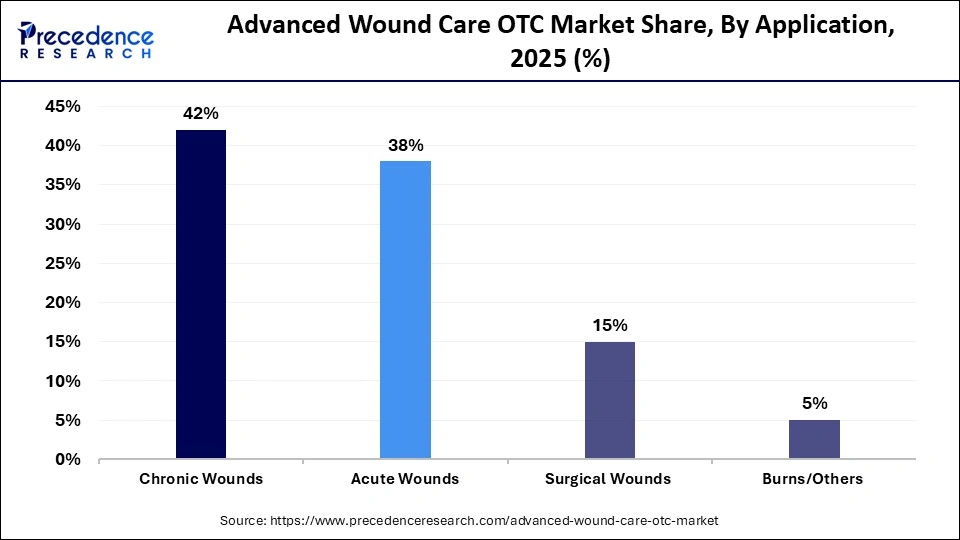

- By application, the chronic wounds segment held the largest market share of approximately 42% in 2025.

- By application, the surgical wounds segment is expected to grow at the highest CAGR of 9.5% between 2026 and 2035.

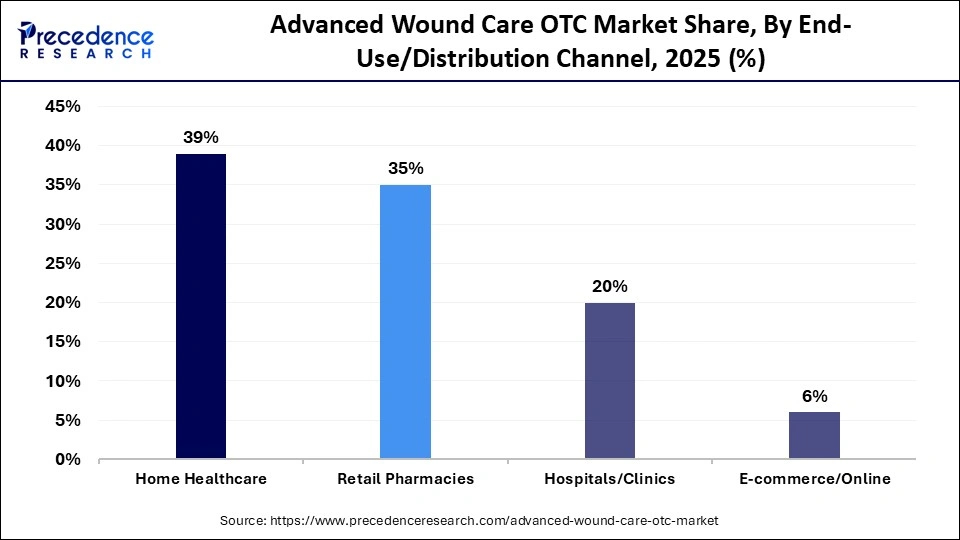

- By end-use, the home healthcare segment held the largest share of approximately 39% in 2025.

- By end-use, the e-commerce/online segment is expected to grow at a considerable CAGR of 9.4% between 2026 and 2035.

What is the Landscape of the Advanced Wound Care OTC Market?

The advanced wound care OTC market is an important segment of the healthcare sector. This industry deals in the production and distribution of wound care products across the world. There are various types of products developed in this sector, consisting of hydrocolloid dressings, foam dressings, hydrogel dressings, alginate dressings, film dressings, antimicrobial dressings, and composite dressings. It finds application in chronic wounds, acute wounds, surgical wounds, and burns. These products are available in a distribution channel comprising home healthcare, retail pharmacies, hospitals, clinics, and e-commerce. This market is expected to rise significantly with the growth of the pharma industry around the globe.

How is AI Integral to the Advanced Wound Care OTC Market?

Artificial intelligence has rapidly changed the landscape of the overall pharma sector. The wound care manufacturing companies have started integrating AI in their production plants to enhance the design of wound care products and detect faults in wound care items. Also, AI helps in streamlining manufacturing procedures, enhancing product development, automating quality control, and improving precision manufacturing. Thus, AI has played an integral role in shaping the advanced wound care OTC market.

- In September 2025, Eli Lilly launched TuneLab. TuneLab is an advanced AI platform designed for developing a smart wound healing bandage for the healthcare sector.

Advanced Wound Care OTC Market Trends

- Collaborations: Numerous market players are partnering with defence organizations to manufacture advanced wound care solutions across the world. For instance, in November 2025, Cologenesis Pvt. Ltd collaborated with the Department of Atomic Energy (DAE). This collaboration is aimed at launching an advanced nitric oxide-releasing wound dressing solution designed for treating diabetic foot ulcers (DFU).

- Government Initiatives: The governments of several countries, such as the U.S., Japan, Germany, China, the UAE, Spain, and Argentina, are launching several initiatives for developing the pharmaceutical sector. For instance, in January 2025, Japan's Ministry of Health, Labor, and Welfare (MHLW) announced a 10-year government fund. This announcement is made to develop the overall pharmaceutical industry in Japan.

- Business Expansions: Several wound care solution providers are investing significantly in opening new production centres to cater to the needs of the end-users. For instance, in July 2025, Molnlycke Health Care announced an investment of around US$134 million. This investment is made to open a wound care solution manufacturing sector in Maine.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.14 Billion |

| Market Size in 2026 | USD 8.99 Billion |

| Market Size by 2035 | USD 21.93 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.42% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application,End-Use/ Distribution Channel and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

Why did the Hydrocolloid Dressings Segment Dominate the Advanced Wound Care OTC Market?

Hydrocolloid Dressings

The hydrocolloid dressings segment dominated the market, with a share of approximately 28.5% in 2025. The increasing demand for hydrocolloid dressing solutions from specialty clinics for treating patients suffering from cuts and burns has boosted the market expansion. Also, the rapid investment by pharmaceutical companies for opening new production centers to increase the production of hydrocolloid dressing solutions is playing a vital role in shaping the industrial landscape. Moreover, several advantages of hydrocolloid dressings, including pain reduction, bacterial barrier, reduced scarring, and waterproofing, are expected to drive the growth of the advanced wound care OTC market.

- In January 2025, Beiersdorf launched a hydrocolloid-based dressing solution. This dressing solution is designed for improving wound healing capabilities.

Antimicrobial Dressings

The antimicrobial dressings segment is expected to expand at a remarkable CAGR of 9.3% between 2026 and 2035. The growing use of antimicrobial dressing solutions for preventing wound infections caused by viruses, bacteria, and fungi has driven the market growth. Additionally, the rising adoption of antimicrobial dressing solutions by healthcare professionals for treating surgical wounds is positively contributing to the industry. Moreover, numerous benefits of antimicrobial dressings, such as infection prevention, aid debridement, promote moist healing, and support tissue regeneration, are expected to propel the growth of the advanced wound care OTC market.

- In April 2025, Convatec launched ConvaNiox. ConvaNiox is an antimicrobial-based dressing solution designed for patients suffering from diabetic foot ulcers.

Application Insights

What made the Chronic Wounds Segment lead the Advanced Wound Care OTC Market?

Chronic Wounds

The chronic wounds segment leads the market with a share of approximately 42% in 2025. The surging use of alginate dressing solutions and hydrogel dressing solutions for treating chronic wounds has boosted the market expansion. Additionally, the surging prevalence of pressure ulcers in different nations, including the U.S., Germany, India, and the UK, is playing a prominent role in shaping the industrial landscape. Moreover, the increasing focus of patients to visit emergency surgical centres for treating venous leg ulcers is expected to drive the growth of the advanced wound care OTC market.

Surgical Wounds

The surgical wounds segment is expected to rise at the highest CAGR of 9.5% between 2026 and 2035. The rising cases of road accidents in different parts of the world have increased the demand for advanced surgical procedures, thereby driving the market expansion. Additionally, the increasing prevalence of gallbladder and ulcers in patients has also raised the need for surgeries, which in turn is positively impacting the market. Moreover, the growing investment by hospitals to adopt high-quality wound care products for operating surgical procedures is expected to boost the growth of the market.

End-Use Insights

Why did the Home Healthcare Segment hold the largest share of the Advanced Wound Care OTC Market?

Home Healthcare

The home healthcare segment held around 39% of the market. The growing emphasis of consumers to use over-the-counter wound care products for treatment has boosted the market expansion. Also, the increasing sales of hydrocolloid-based dressings, coupled with the rising investment by market players for developing a wide range of wound care products for residential users, are playing a prominent role in shaping the industrial landscape. Moreover, collaborations among pharma companies and healthcare providers to launch home-based healthcare services in different parts of the world are expected to drive the growth of the advanced wound care OTC market.

E-Commerce/Online

The e-commerce/online segment is expected to expand with the fastest CAGR of 9.4% between 2026 and 2035. The surging proliferation of smartphones in several nations, including the U.S., India, Germany, and Japan, has increased the popularity of e-commerce platforms, driving the market growth. Additionally, the rapid adoption of online shopping by the people of developed nations, coupled with the numerous offers and benefits of e-commerce platforms, is positively contributing to the industry. Moreover, the availability of a wide range of pharma products on e-commerce platforms is expected to propel the growth of the advanced wound care OTC market.

Regional Insights

How Big is the North America Advanced Wound Care OTC Market Size?

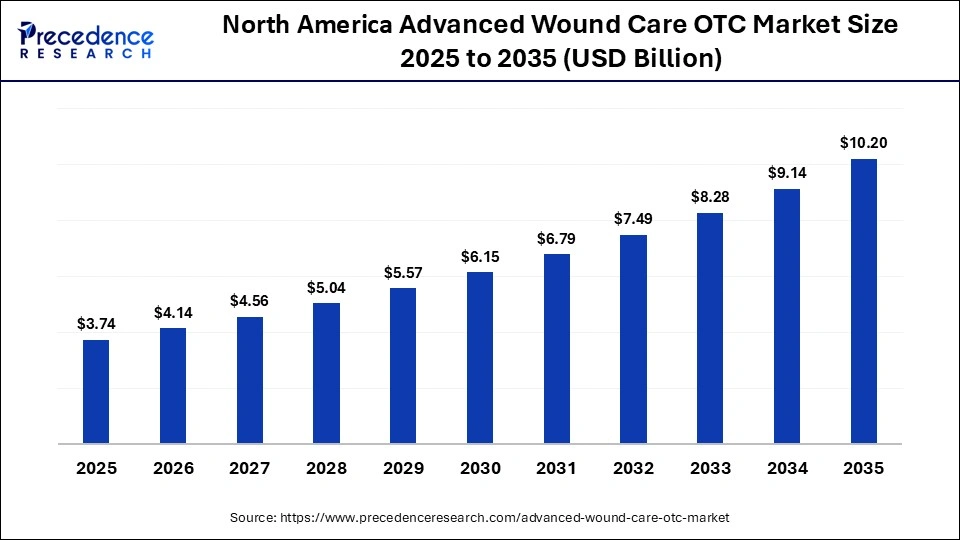

The North advanced wound care OTC market size is estimated at USD 3.74 billion in 2025 and is projected to reach approximately USD 10.20 billion by 2035, with a 10.55% CAGR from 2026 to 2035.

Why did North America dominate the Advanced Wound Care OTC Market in 2025?

North America dominated the market with a share of approximately 46% in 2025. The growing adoption of hydrocolloid dressings and foam dressings by healthcare professionals in several nations, including the U.S., Canada, and Mexico, has driven the market expansion. Additionally, the rapid investment by the governments for strengthening the healthcare sector, as well as technological advancements in the pharma industry, are playing a vital role in shaping the industrial landscape. Moreover, the presence of various market players such as Cardinal Health, 3M, Sonoma Pharmaceuticals, and Medline Industries is expected to drive the growth of the advanced wound care OTC market in this region.

- In October 2025, Sonoma Pharmaceuticals, Inc. partnered with Medline Industries, LP. This partnership is aimed at launching a HOCl wound cleanser for hospitals across the U.S.

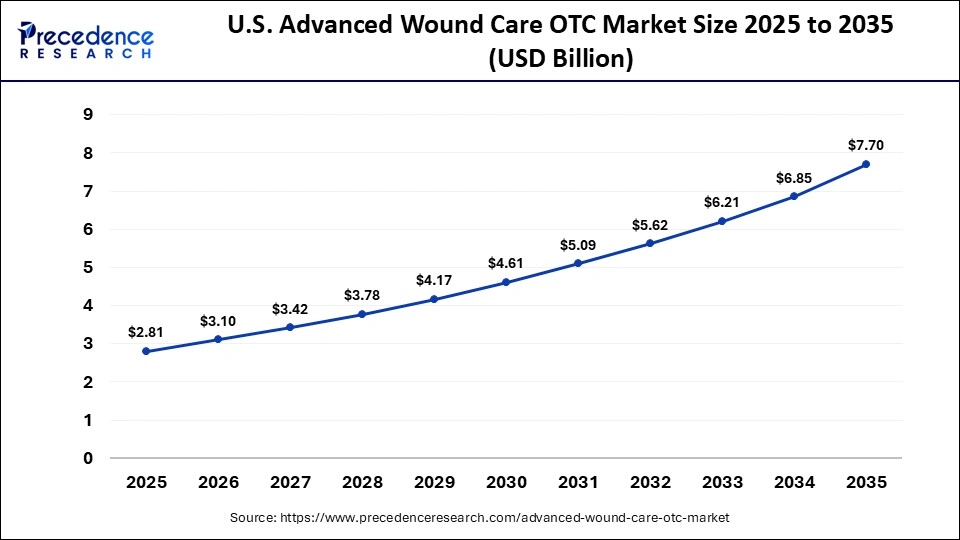

What is the Size of the U.S. Advanced Wound Care OTC Market?

The U.S. advanced wound care OTC market size is calculated at USD 2.81 billion in 2025 and is expected to reach nearly USD 7.70 billion in 2035, accelerating at a strong CAGR of 10.61% between 2026 and 2035.

U.S. Advanced Wound Care OTC Market Analysis

The increasing demand for antimicrobial wound care solutions from the surgical center, along with numerous government initiatives aimed at constructing emergency surgery units, has boosted the market growth. Moreover, the surging cases of diabetic foot ulcers, as well as the rapid investment by pharma companies for advancing research and development, are playing a vital role in shaping the industrial landscape.

Why is Asia Pacific undergoing the Fastest Growth in the Advanced Wound Care OTC Market?

Asia Pacific is expected to rise at the highest CAGR during the forecast period. The increasing cases of road accidents in several countries, including China, India, South Korea, Japan, and Singapore, have increased the demand for emergency surgeries, thereby driving the market expansion. Additionally, the rapid investment by pharma brands for opening new manufacturing facilities, as well as the availability of wound care products in local pharmacies, is positively contributing to the industry. Moreover, the presence of several market players, such as Healthium Medtech Limited, Winner Medical Co., Ltd, Axio Biosolutions Pvt. Ltd., and Nanjing 3H Medical Products Co., Ltd., is expected to propel the growth of the market in this region.

- In December 2025, Axio Biosolutions collaborated with the Indian Institute of Emergency Medical Services (IIEMS). This partnership is aimed at launching the "STOP THE BLEED" initiative in India.

India Advanced Wound Care OTC Market Trends

The growing prevalence of venous leg ulcers, coupled with the rise in the number of healthcare startups, has driven the market expansion. Moreover, numerous government initiatives aimed at developing the pharma industry, as well as the surging cases of chronic diseases, are playing a crucial role in shaping the industrial landscape.

Advanced Wound Care OTC Market Value Chain Analysis

- R&D

Research and development focus on material science, antimicrobial formulations, absorbency optimization, skin compatibility testing, packaging innovation, stability studies, usability design, and iterative improvements guided by consumer feedback and clinical insights.

Companies involved include 3M, Johnson & Johnson, Smith & Nephew, Coloplast, Convatec, Mölnlycke Health Care, and Essity.

- Clinical Trials & Regulatory Approvals

Clinical evaluation emphasizes safety, skin tolerance, performance validation, and comparative studies, while regulatory approvals require documentation, labeling compliance, quality

audits, and adherence to FDA, EMA, and OTC medical device standards.

Companies include Johnson & Johnson, 3M, Smith & Nephew, Coloplast, Convatec, Mölnlycke Health Care, and Medline Industries.

- Patient Support & Services

Patient support and services include usage education, pharmacist guidance, digital instructions, customer helplines, reimbursement information, post-purchase feedback collection, and continuous product improvement, enhancing healing outcomes and consumer satisfaction.

Companies include Johnson & Johnson, 3M, Smith & Nephew, Coloplast, Convatec, Essity, and Medline Industries.

Who are the Major Players in the Global Advanced Wound Care OTC Market?

The major players in the advanced wound care OTC market include Solventum, 3M, Medline Industries, PAUL HARTMANN AG, Cardinal Health, Coloplast Group, Sonoma Pharmaceuticals, B. Braun SE, Beiersdorf AG, DeRoyal Industries, Vomaris Innovations, Lavior / Dimora Medical, Convatec Group PLC, Smith+Nephew, Mölnlycke AB

Recent Developments in the Market

- In October 2025, SurviveX launched tea-tree-infused hydrogel burn dressings. These dressing solutions are designed to provide instant cooling relief and natural healing for skin burns.(Source: https://macaubusiness.com)

- In October 2025, MiMedx launched EPIXPRESS. EPIXPRESS is an advanced wound care solution designed for treating diabetic foot ulcers and venous leg ulcers (Source: https://www.quiverquant.com)

- In July 2025, CelluHeal launched Cellufil and Cellusheet collagen dressings. These dressing solutions are preferred by healthcare professionals in the North American region.(Source: https://www.petoskeynews.com)

Segments Covered in the Report

By Product Type

- Hydrocolloid Dressings

- Foam Dressings

- Hydrogel Dressings

- Alginate Dressings

- Film Dressings

- Antimicrobial Dressings

- Composite Dressings

By Application

- Chronic Wounds

- Acute Wounds

- Surgical Wounds

- Burns/Others

By End-Use/ Distribution Channel

- Home Healthcare

- Retail Pharmacies

- Hospitals/Clinics

- E-commerce/Online

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting