What is the Aesthetic Fillers Market Size?

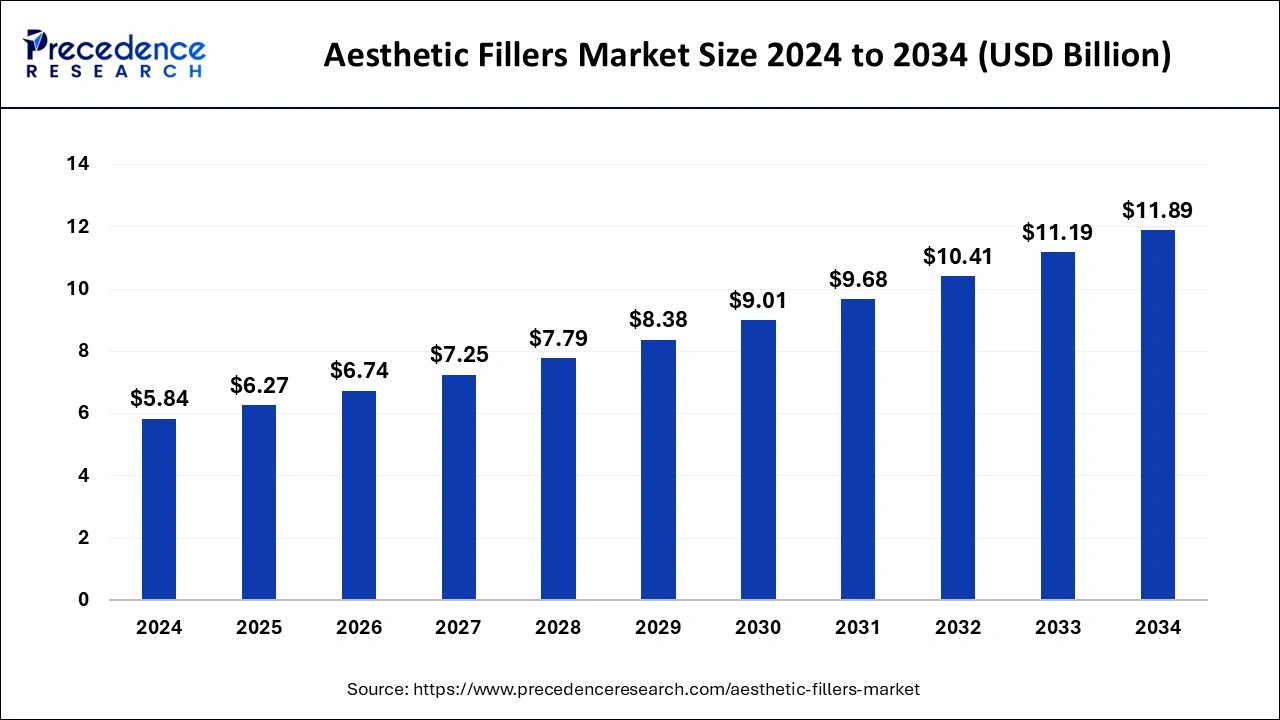

The global aesthetic fillers market size is valued at USD 6.27 billion in 2025 and is predicted to increase from USD 6.74 billion in 2026 to approximately USD 12.64 billion by 2035, expanding at a CAGR of 7.26% from 2026 to 2035

Market Highlights

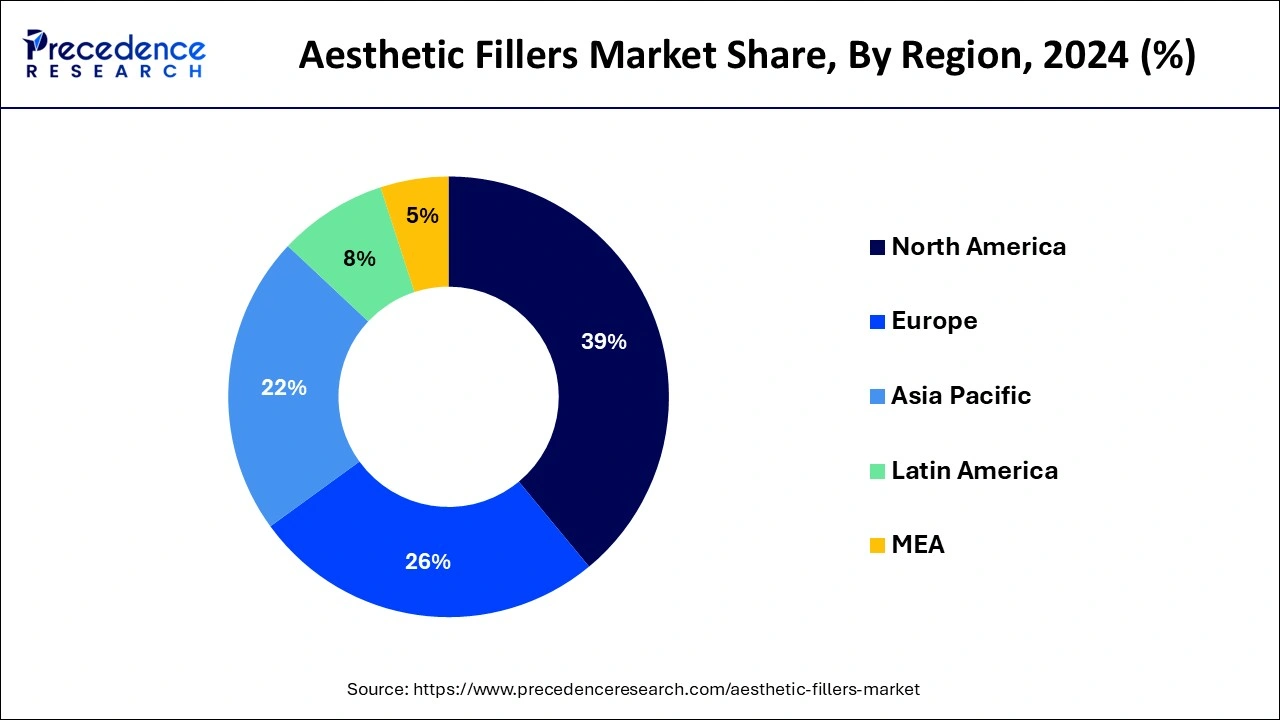

- North America led the global market with the highest market share of 38.14% in 2025.

- By material, the hyaluronic acid (HA) segment held the largest market share in 2025.

- By application, the wrinkle repair segment captured the biggest revenue share in 2025.

Market Overview

Aesthetic fillers are components present in the form of gel that are jabbed under the skin to enhance volume and facial silhouettes, and smoothen lines and crimps. Non-surgical aesthetic padding treatments make use of polymers, hyaluronic acid, particles, and collagen to give skin an experience of a youth. These treatments are the most commonly used amongst all. In the markets of cosmetic fillers, numerous material types, involving as polymers, hyaluronic acid, particles, and collagen, are being brought in. Dermal fillers made of hyaluronic acid are among the most famous fillers within the groups of patient and industry skilled professionals. This is the most usually used to treat scars, acne, and crimps and the expansion of cheek, lip, and chin. It dampens the skin, invigorates the production of new collagen adds volume to the face, as well as makes softer fine lines.

AI-Driven Precision and Personalization Transforming the Aesthetic Fillers Market

Artificial Intelligenceintegration is transforming the aesthetic fillers market by enabling personalized treatment planning, improving safety, and increasing patient satisfaction. Using advanced imaging and predictive analytics, AI assists practitioners in simulating post-procedure results, helping patients see expected outcomes before undergoing treatment. Machine learning algorithms evaluate facial symmetry, skin texture, and volume loss to recommend the most appropriate filler type and dosage. AI-powered robotics and injection-assist tools enhance precision, reducing risks and side effects.

Additionally, AI streamlines clinical research by analyzing large datasets on filler effectiveness, longevity, and patient satisfaction. It also facilitates real-time monitoring of adverse events and post-treatment feedback, ensuring quality and compliance with regulations. Overall, AI boosts customization, consistency, and confidence in the aesthetic fillers industry, making treatments safer and more effective.

Market Outlook

- Industry Growth Overview: The aesthetic fillers market is experiencing strong growth due to increasing demand for minimally invasive cosmetic procedures, greater consumer awareness, technological advancements in filler formulations, and broader applications in facial rejuvenation, contouring, and anti-aging treatments worldwide.

- Sustainability Trends: There is a strong focus on sustainability through the adoption of biodegradable and bio-based ingredients, eco-friendly packaging, ethical sourcing practices, and reduced animal-derived components, aligning with consumer demand for environmentally responsible, cruelty-free cosmetic enhancement solutions.

- Global Expansion: The aesthetic fillers market is expanding globally, driven by rising aesthetic awareness, higher disposable incomes, technological advances in filler formulations, expanding dermatologist networks, and growing acceptance of non-surgical cosmetic procedures across emerging and developed regions worldwide.

- Major investors: Major investors in the market include pharmaceutical giants, private equity firms, and venture capitalists focusing on aesthetic medicine innovations, such as AbbVie, Galderma, Merz Pharma, LG Chem, and investment groups supporting advanced, minimally invasive cosmetic solutions globally.

- Startup Ecosystem: The market's startup ecosystem is driven by innovations in bioengineered materials, personalized aesthetics, regenerative injectables, AI-based facial analysis, and sustainable filler formulations, attracting funding and partnerships focused on enhancing safety, longevity, and natural-looking aesthetic outcomes.

Aesthetic Fillers Market Growth Factors

The worldwide covid-19 pandemic has been unusual and astounding, with lower-than-expected demand across all areas compared to pre-pandemic levels. According to data, the worldwide market fell by -24.9 percent in 2020 compared to 2019. Fillers are gel-like compounds that are injected into the skin to restore lost volume, smooth lines, reduce wrinkles, and improve face features. The most common non-surgical cosmetic filler approaches are those that employ hyaluronic acid, collagen, polymers, and particles to add volume to the skin. Polymer and particle materials, collagen, and hyaluronic acid are among the new materials being launched into the cosmetic filler industry.

Hyaluronic acid dermal fillers are widely used by patients and dermatologists. This is most commonly used to treat acne, wrinkles, scars, and to enlarge the lips, chin, and cheeks. It moisturises, encourages new collagen production, volumizes, and softens fine face wrinkles. This treatment's effects might last anywhere from 6 to 12 months. Because they are created from pure collagen from cows, collagen fillers are the most natural fillers. They might decay quicker since they are natural. Collagen injections might deteriorate as early as a month after the initial injection. There's also the chance of an allergic response.

The trend of adopting anti-aging therapies and the demand for a much younger lifestyle are the main reasons to the rise of the cosmetic fillers industry. Furthermore, the number of non-surgical aesthetic operations performed yearly is growing. It is established in the report, published by International Society of Aesthetic Plastic Surgery's 2018 report, there were 12,659,147 non-surgical aesthetic procedures performed worldwide. As a result, the market's growth has been fuelled by the increasing demand for dermal fillers and the number of procedures conducted. The market is expanding due to rising demand for facial aesthetics and greater than ever average expenditure per patient in clinics. These elements are boosting market expansion. In the future years, advancements in filler materials are projected to have an impact on market growth. The US Food and Drug Administration (FDA) have approved a wide number of products for specific facial locations, allowing dermatologists to provide consumers with targeted treatment. The filler is approved to treat moderate to severe creases and folds on the face.

Market Outlook

- Industry Growth Overview: Aesthetic fillers are anticipated to continue increasing as a result of increased interest among consumers for less invasive cosmetic procedures. The continued growth in the population of older adults coupled with the increased acceptance of aesthetic surgery by men and women alike will continue to provide the building blocks for the future of this industry as a whole.

- Sustainability Trends: Sustainable practices have become a major focus for most manufacturers; the majority of companies in the aesthetic filler space are shifting toward sustainable sourcing, using biodegradable materials in production, and utilizing eco-friendly packaging in their finished products. Ethical clinical testing and reducing the environmental impact of procedures will continue to be key differentiators among companies' product development strategies.

- Global Expansion: The international expansion of aesthetic fillers will continue to be fueled by the growth of medical tourism, Social Media Marketing and new clinic networks established in developing regions of the globe. These companies are able to build strategic partnerships and secure regional approval to enter previously inaccessible markets in an efficient and effective manner.

- Startup Ecosystem: The aesthetic filler industry has become increasingly dynamic with the emergence of new, innovative startups focused on custom-tailored filler products and the utilization of AI-based facial analysis tools to assist the skincare market. The influx of venture capital funds has provided unprecedented support for these organizations to advance new product launches and enhance their ability to commercialize globally.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.27 Billion |

| Market Size in 2026 | USD 6.74 Billion |

| Market Size by 2035 | USD 12.64 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.26% |

| Largest Market | North America |

| Fastest Growing Region | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material, Application, Product Type, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Launches of new products to bolster the Market Growth:

Major market manufacturers have been fastening on adding research and development (R&D) events and manufacturing new product results for specific operations as there exist changing demands on the basis of application. Prominent players in the market have acted on how advanced delicacy can be poignant in numerous operations. Allergan has announced the launch of its new device UVEDERM in the year 2018. This device has a base made by adding hyaluronic acid and is injective in form. This is being employed to refurbish facial silhouettes and enhance signs of fading. It is a procedure that primarily centers on the features of the face, particularly around the mouth, lips, and cheeks.

The treatment to adjust the product does not take further than an hour. Integra Life Wisdom has announced the launch of its device Accell Evo3. This device is launched to extend bone graft in the pelvis, extremes, and the spine. It is also being utilized as a bone void padding for pelvic bones and extremes. Merz Pharma has announced the launch of Juvederm in the year 2019, which is a beauty aids treatment appertained to as a padding that concentrates on the face primarily around the mouth, cheeks, and lips. It is being employed to recollect facial silhouettes and ameliorate signs of fading. It is an injective dermal fillermade using hyaluronic acid. Toxane has announced the launch of its new product named as RHA hydrogel mask in the year 2019. This product is being utilized as a counterpart to a supervisory aesthetic treatment to make it smooth and console acclimatized skin following the operation of the post treatment care.

Segment Insights

Material Insights

Due to its prominence as a gold standard for fillers, the hyaluronic acid (HA) sector emerged as the leading segment in 2025. In addition, new product introductions in this area are propelling the segment forward. Hyaluronic acid-based solutions are becoming increasingly popular because to their safety and relative lifespan. Furthermore, during the forecast period, prominent firms selling hyaluronic acid products in high-growing countries such as Europe, such as ALLERGAN (AbbVie, Inc.), are likely to fuel the segment's growth. Due of its safety qualities, the calcium hydroxylapatite sector had the second-largest market share in 2023. The debut of new products in this area by important players also contributes to the segment's growth.

Because of its safety qualities, the calcium hydroxylapatite category held the second-largest market share in 2025. Furthermore, the debut of new goods in this market by important companies drives segment growth. For example, Allergan Aesthetics will offer HArmonyCa with Lidocaine in April 2022. The injectable dermal filler has two active ingredients: CaHA for long-term collagen activation and hyaluronic acid for instant lift. Due to an increase in the number of fat filler operations in key areas such as North America, the fat fillers sector is expected to grow at a rapid CAGR during the forecast period.

Application Insights

Due to increased demand for these operations, the wrinkle repair segment was the leading section. Furthermore, new product launches aimed towards this market sector are expected to boost growth. Teoxane's RHA Redensity, which can be used to minimise the appearance of facial lines and wrinkles, was authorised by the US FDA in January 2022. Due to the high volume of lip procedures, the lip enhancement segment accounted for the second-largest segment. The segment is expected to be driven by rising demand for aesthetic lip enhancements, which is being driven by the development of minimally invasive procedures. For example, Merz Pharma announced the launch of Belotero Lips in April 2018, which is specifically designed for lip enhancement and the treatment of perioral lines.

Due to the high amount of lip treatments, the lip augmentation segment accounted for the second-largest section. The industry is likely to be driven by increased demand for aesthetic lip enhancements, which is being pushed by the development of minimally invasive treatments. For example, Merz Pharma announced the launch of Belotero Lips in April 2018, which is especially designed for lip augmentation and the treatment of perioral lines.

Regional Insights

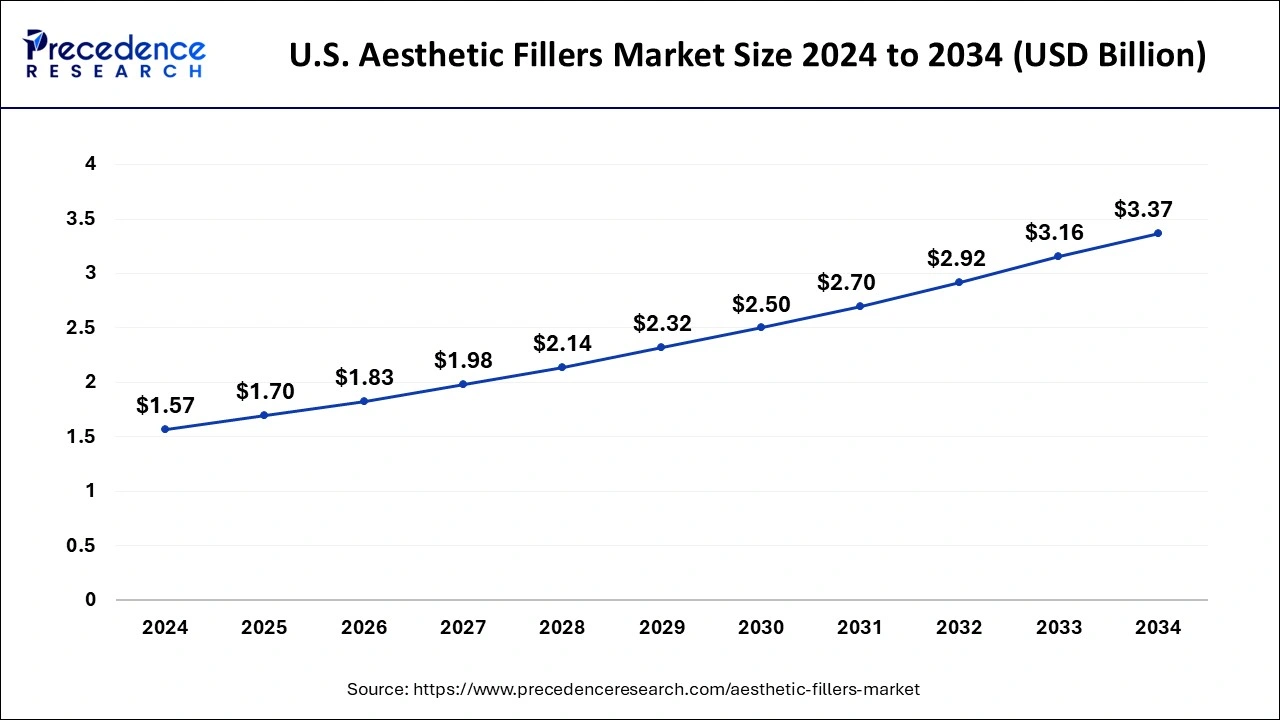

U.S. Aesthetic Fillers Market Size and Growth 2026 to 2035

The U.S. aesthetic fillers market size is exhibited at USD 1.7 billion in 2025 and is projected to be worth around USD 3.60 billion by 2035, growing at a CAGR of 7.79% from 2026 to 2035

The total aesthetic filler market was controlled by North America, with the United States accounting for the majority of market contributions. Globally, consumers are increasingly more concerned about their physical appearance. Nonsurgical aesthetic filler methods that employ hyaluronic acid, collagen, polymers, and particles to enhance the look of the skin or a feature are used. The United States had the most nonsurgical aesthetic operations in 2018, with 2,869,485 procedures, according to the International Society of Aesthetic Plastic Surgery 2018 report. As new items are released, these statistics are projected to climb. This will help the region's market flourish.

Europe Aesthetic Fillers Market Trends

Europe is expected to grow at the fastest rate in the market due to a combination of demographic, socio-economic, and cultural factors. A rapidly aging population with increasing disposable income is boosting demand for minimally invasive treatments like dermal fillers, while a growing beauty-conscious younger generation is driving early adoption of “preventive” aesthetics. Germany leads the region thanks to its strong healthcare infrastructure, high procedural volumes, and presence of key domestic manufacturers. Additionally, influencer-driven beauty trends, the rise of medical tourism travel within Europe, and innovations in biocompatible filler formulations are further accelerating market growth.

Asia Pacific Aesthetic Fillers Market Trends

Asia Pacific is expected to register robust growth in the aesthetic fillers market owing to rapidly rising disposable incomes, increasing beauty consciousness among younger demographics, and a shift toward minimally invasive cosmetic procedures as social media and influencer culture reshape standards of appearance. China, in particular, leads this growth by virtue of its large urban population, expanding middle class, and growing number of specialised aesthetic clinics implementing advanced filler technologies. Meanwhile, innovations in longer-lasting, biocompatible injectable formulations and the rising popularity of medical tourism for aesthetic treatments across the region are further accelerating adoption.

Latin America Aesthetic Fillers Market Trends

Latin America is expected to witness an opportunistic rise in the market driven by rising disposable incomes, broader acceptance of non-surgical aesthetic treatments, and the influence of social media and beauty culture across the region. Countries like Brazil, in particular, are leading the way due to a well-established network of cosmetic clinics, high consumer demand for aesthetic procedures, and strong marketing of minimally invasive treatments as accessible beauty solutions. As med spas proliferate and younger demographics seek preventive aesthetic enhancements, clinics are increasingly offering injectable fillers, boosting adoption. Meanwhile, expanding healthcare infrastructure and growing medical tourism are further catalyzing the uptake of fillers in Latin America.

Middle East and Africa Aesthetic Fillers Market Trends

The Middle East & Africa (MEA) is poised for strong market growth as rising disposable incomes, urbanisation, and heightened social-media-driven beauty consciousness make minimally invasive cosmetic procedures increasingly mainstream. Over in Saudi Arabia, leading the regional charge, demand is bolstered by luxury wellness clinics, regulatory reforms supporting aesthetic services, and a burgeoning medical tourism sector. Advanced formulations, such as hyaluronic acid and collagen-stimulating fillers, along with the broader availability of specialist dermatology centres, are lowering treatment barriers and expanding the consumer base.

Latin America Aesthetic Fillers Market

The growth of disposable income coupled with a growing awareness of beauty is driving continued development of Latin America's aesthetic fillers market. With many countries such as Brazil and Mexico seeing rising levels of non-surgical aesthetic procedures performed primarily on account of their low price point and prevalence of medical tourism, the middle-class society continues to increase in scope with ever-changing The expansion of aesthetic clinics as well as societal acceptance of cosmetic enhancements are contributing to this continued rapid expansion of the market. Meanwhile, the popularity of social media trends and the culture of influencers is helping to substantially raise awareness and popularity of the filler product across urban demographics within these Latin American countries.

Value Chain Analysis

- Research and Development (R&D)

The process starts with identifying biocompatible materials such as hyaluronic acid, calcium hydroxylapatite, and poly-L-lactic acid. Researchers aim to develop longer-lasting, safer, and more natural-looking fillers using advanced biotechnology and AI modeling to predict tissue response.

Organizations: Allergan Aesthetics (AbbVie Inc.), Galderma, Merz Aesthetics, Revance Therapeutics, and Sinclair Pharma. - Clinical Trial and Approval

New filler formulations undergo rigorous preclinical testing followed by phased clinical trials to evaluate safety, durability, and aesthetic results. Approval is granted only after they meet strict efficacy and biocompatibility standards set by regulatory agencies.

Organizations: U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), Health Canada, and Pharmaceuticals and Medical Devices Agency (PMDA, Japan). - Patient Support and Service

After commercialization, companies provide training for clinicians, post-treatment care guidance, and feedback systems to monitor patient satisfaction and address adverse effects. Digital platforms and AI tools are increasingly used for follow-up and personalized care recommendations.

Organizations: Allergan Aesthetics, Galderma, Merz Aesthetics, Teoxane Laboratories, and Revance Therapeutics.

Aesthetic Fillers Market Companies

| Companies | Key Offerings / Products |

| Allergan Aesthetics | The JUVÉDERM collection of hyaluronic acid (HA) fillers (e.g., Voluma, Volift, Volbella) is designed for volume restoration, lip augmentation, contouring, and correction of fine to deep facial depressions. |

Galderma Pharma SA |

The RESTYLANE portfolio of HA dermal fillers (including LYFT™, KYSSE, VOLYME™, DEFYNE™, REFYNE™) offering lift, fill, contour, and lip enhancement across different facial regions. |

| Teoxane SA | The TEOXANE range incorporates resilient hyaluronic acid (RHA) technologies and peptide-enhanced formulas for dermal fillers and skin quality treatments targeting hydration, wrinkle depth, and elasticity. |

| Merz Pharma GmbH & Co. KGaA | The BELOTERO line of HA fillers (e.g., Soft, Balance, Volume, Revive) and RADIESSE (calcium hydroxylapatite-based) for various indications from fine line correction to volume restoration and facial contouring. |

| Laboratoires Vivacy SAS | The STYLAGE portfolio of HA dermal fillers features IPN cross-linking technology and formulations for lip volume, contouring, and hydration (e.g., Special Lips, Hydro). |

| Suneva Medical, Inc. | The BELLAFILL filler – a long-lasting injectable (collagen + microspheres) approved for nasolabial folds and acne scars in certain markets, offering an alternative to HA fillers. |

| Sinclair Pharma PLC | Offers a portfolio of aesthetic technologies, including dermal fillers, focused on minimally invasive treatments and high-quality outcomes, though specific filler brands may be less well-known than those of larger players. |

| Integra LifeSciences Holdings Corporation | Primarily known for surgical and regenerative medicine devices rather than aesthetic fillers, in the aesthetic filler market, its direct offerings are limited or indirect via partnerships rather than a major publicised HA filler brand. |

| Dr. Korman Laboratories Ltd. | Provides injectable aesthetic solutions, including dermal fillers (e.g., Radiesse, Sculptra) via clinical practice materials and physician-administered services, supporting collagen stimulation and volume correction. |

Recent Developments

- On February 14, 2025, Evolus entered the U.S. dermal filler industry with the FDA approval of Evolysse Form and Evolysse Smooth. These HA-based fillers were developed with Symatese Group using Cold-X technology, designed to maintain the natural structure of HA molecules for smoother texture and longer-lasting effects.

(Source: businesswire.com) - On February 18, 2025, Maypharm launched Skincolla, a recombinant human collagen filler combining Type I collagen with hyaluronic acid. It offers a non-animal, biocompatible option for skin rejuvenation, collagen regeneration, and natural volumizing.(Source: prnewswire.com)

- In May 2025, Huadong Medicine announced the commercial rollout of MaiLi Extreme, a high-end HA filler built on OxiFree cross-linking technology. This filler provides high elasticity and durability, designed for deep-tissue augmentation and facial contouring.(Source: fillermarket.com)

- On January 22, 2024, Galderma introduced Restylane SHAYPE, a high-definition HA filler specifically developed for chin and jawline sculpting. The product utilizes NASHA HD technology, offering one of the firmest HA gels in Galderma's range for implant-like support and improved facial structure without surgery.

(Source: galderma.com) - In July 2025,Croma-Pharma released a scientific framework comparing HA filler cross-linking technologies across 23 commercial products. The report supports clinical transparency and standardisation by defining key gel properties such as viscosity, elasticity, and cross-linking efficiency.

(Source: wigmoremedical.com) - On September 03, 2025, Allergan Aesthetics launched a global consumer-education campaign titled “Naturally You with Injectable Hyaluronic Acid Fillers.” The initiative focuses on public awareness, patient safety, and correct injection practices, aiming to encourage informed decision-making for HA filler treatments.

(Source: abbvie.com)

Segments Covered in the Report

By Material

- Hyaluronic Acid

- Calcium Hydroxylapatite

- Poly-L-Lactic Acid (Plla)

- Pmma (Poly (Methyl Methacrylate))

- Fat Fillers

- Others

By Application

- Scar Treatment

- Wrinkle Correction Treatment

- Lip Enhancement

- Restoration of Volume/Fullness

- Others

By Product Type

- Absorbable

- Non-absorbable

By End User

- Specialty & Dermatology Clinics

- Hospitals & Clinics

- Research & Academic Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting