What is the Aesthetic Medicine Market Size?

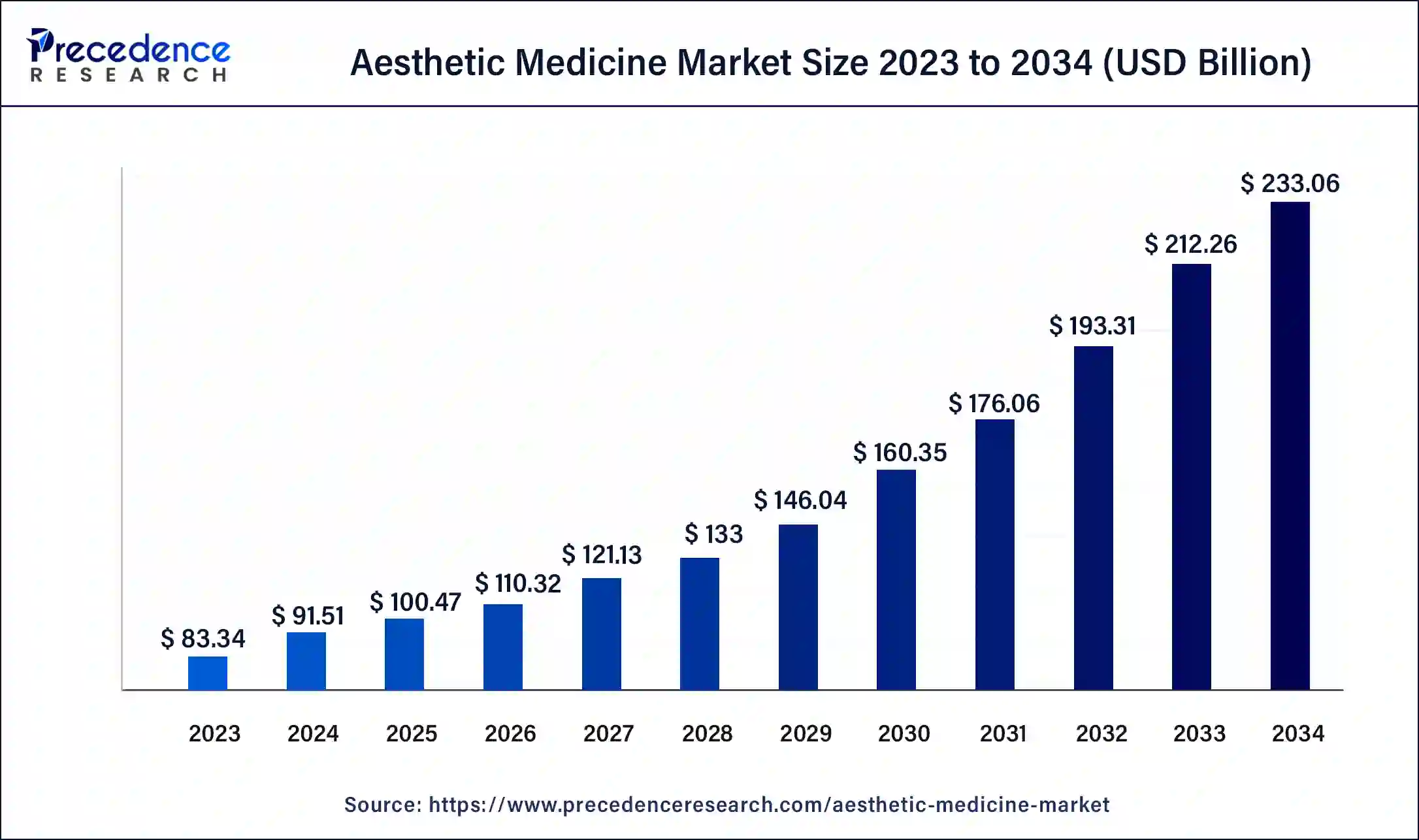

The global aesthetic medicine market size is calculated at USD 100.47 billion in 2025 and is predicted to increase from USD 110.32 billion in 2026 to approximately USD 252.63 billion by 2035, expanding at a CAGR of 9.66% from 2026 to 2035.

Aesthetic Medicine Market Key Takeaways

- In terms of revenue, the market is valued at $100.47 billion in 2025.

- It is projected to reach $252.63 billion by 2035.

- The market is expected to grow at a CAGR of 9.66% from 2026 to 2035.

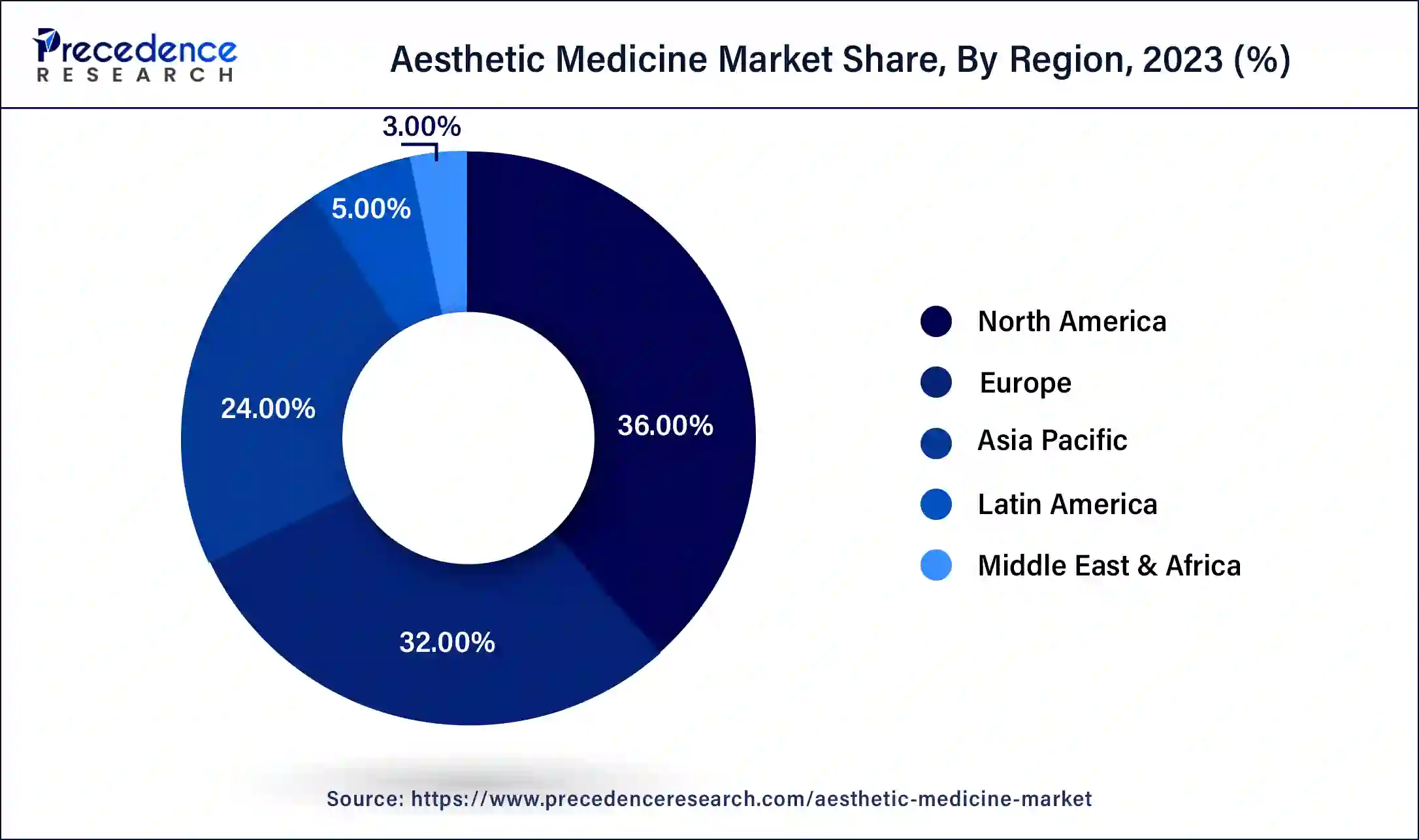

- North America led the global market with the highest market share of 36% in 2025.

- Asia Pacific region is estimated to expand the fastest CAGR between 2026 and 2035.

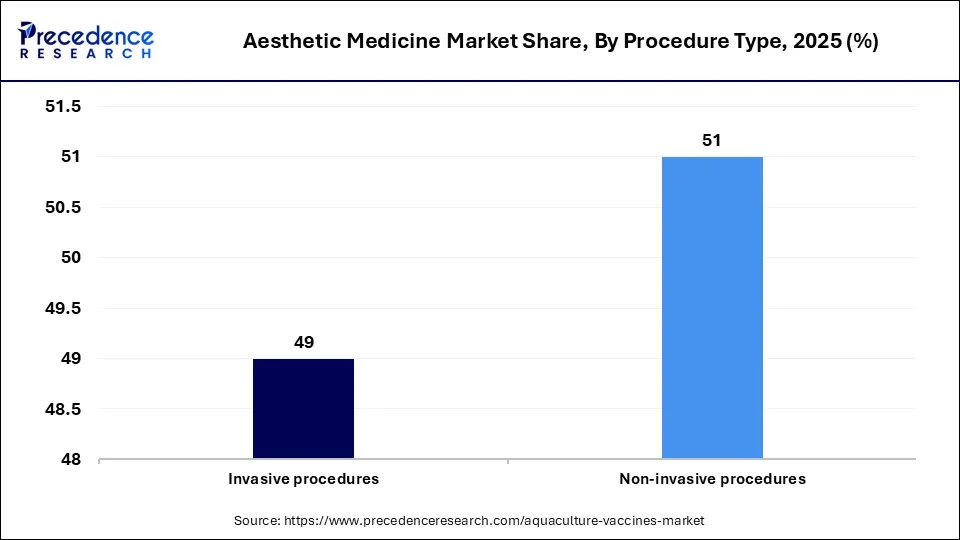

- By procedure type, the non-invasive procedure segment has held the largest market share in 2025.

Aesthetic Medicine MarketGrowth Factors

The growing demand for the aesthetic treatments among the global population coupled with the rising technological advancements and innovations in the aesthetic treatment devices is expected to significantly drive the growth of the global aesthetic medicine market during the forecast period. For instance, the introduction of non-invasive body contouring system, which uses the fat freezing technology is expected to offer growth opportunities to the market players. The rapidly aging population across the globe is expected to have a significant and positive impact on the growth of the global aesthetic medicine market. The rising urge to look fit and young is fueling the demand for aesthetic treatments.

According to the United Nations, the global geriatric population is estimated to reach at around 1.5 billion 2050. This will provide a rapid impetus to the aesthetic medicine market. Various aesthetic procedures such as nose reshaping, Botox injections, and liposuction are gaining a rapid traction in the developing market like India and South Korea. As per the International Society of Aesthetic Plastic Surgery, India was among the top five nations performing non-surgical procedures at a global level. These factors are encouraging the increased production of the aesthetic medicines across the globe.

Moreover, the rising awareness among the population regarding the availability of various advanced and non-invasive aesthetic treatment procedures and improving access to the advanced healthcare and medical facilities is playing a crucial role in the growth of the market. The rising investments in the research and development and various collaborative strategies adopted by the companies are bolstering the growth of the aesthetic medicine market across the globe. Moreover, the aesthetic medicines are used for treating the scars, wrinkles, moles, skin discoloration, excess fat, and skin laxity. The rising incidences of road accidents, sports injuries, and burns are expected to boost the demand for the aesthetic medicines.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 252.63 Billion |

| Market Size in 2025 | USD 100.47 Billion |

| Market Size in 2026 | USD 110.32 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.66% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Procedure, Product, Application, End-User, Gender, Route of Administration, and Region |

| Regions Covered | North America,Asia Pacific,Europe, Latin America, Middle East and Africa |

Segment Insights

Procedure Type Insights

The non-invasive procedures were the dominating segment, capturing a market share of more than 51% in 2024. This segment is also estimated to be the fastest-growing segment during the forecast period. The non-invasive procedures have gained a rapid traction across the globe owing to its lesser pain, quick results, and less stays in hospitals or surgical centers. The increasing adoption of robotics and other digital devices in the non-invasive procedures is boosting its efficiency and effectiveness and is expected to gain a significant growth in the developing markets. The non-invasive procedure segment is further divided into Botox injections, microdermabrasion, soft tissue fillers, laser hair removal, chemical peel, and others. The Botox injection segment dominated the market in 2020. According to the American Society of Plastic Surgeons, the Botox injections became the leading non-invasive aesthetic procedure with around 4.4 million procedures performed in 2020. The significantly rising popularity of Botox injections across the globe has led to the dominance of this segment in the global aesthetic medicine market.

The invasive procedures segment is expected to grow at a substantial rate during the forecast period. The invasive segment is further segregated into liposuction, nose reshaping, breast augmentation, tummy tuck, eyelid surgery, and others. The rising demand for the liposuction and nose reshaping is expected to fuel the growth of the segment in the forthcoming years. The rising number of road accidents across the globe and various sports injuries that can injure nose is a major factor behind the growing demand for nose reshaping.

Which product type segment dominated the aesthetic medicine market in 2025?

The implant segment led the market in 2024. The dominance of the segment can be attributed to the surge in the adoption rate of aesthetic procedures across the globe along with the innovations in implant technology. Also, aesthetic implants are extensively utilized in reconstructive surgeries for breast cancer individuals and patients suffering from other conditions necessitating breast reconstruction.

The energy-based devices segment is expected to grow at fastest CAGR over the forecast period. The growth of the segment can be credited to the growing demand for non-invasive cosmetic procedures. This segment is sub segmented into aser, light, electromagnetic, ultrasound, cryolipolysis devices etc. In which the laser-based devices are the highest followed by electromagnetic-based, light-based and other technologies.

Application Insights

Why surgical segment led the aesthetic medicine market in 2025?

The surgical segment led the market in 2024. The dominance of the segment can be linked to the various benefits offered by surgical procedures in improving the overall aesthetic look. This segment provides longer lasting and more significant results as compared to non-surgical procedures. Surgical improvements can give more permanent solutions compared to short-term results from non-surgical procedures.

The non-surgical segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by less risk of scarring, minimal downtime, more faster and convenient recovery times with less costs. However, nonsurgical procedures are less expensive than surgical operations, which makes them more accessible to a diverse range of consumers.

End-User Insights

Which end use segment dominated the aesthetic medicine market in 2025?

The hospitals and clinics segment held the largest market share in 2024. The dominance of the segment is owing to the increasing awareness regarding aesthetic procedures which impels people to seek more convenient treatment options. Furthermore, hospitals and clinics have access to the latest equipment and expertise, drawing patients seeking more innovative treatment options.

The home use segment is expected to grow at the fastest CAGR during the projected period. The growth of the segment is due to its accessibility, convenience, and individualized control over skincare routines. These advantages are further improved by innovations in technology like connected and smart device applications, that enhance overall treatment efficiency and user experience.

Gender Insights

How the female segment held the largest aesthetic medicine market share in 2025?

In 2025, the female segment dominated the market by holding the largest market share. The dominance of the segment can be credited to the growing societal and cultural pressures for beauty and appearance on females. Also, women are constantly seeking out new aesthetic procedures to improve their physical appearance. Social media impact also plays a crucial role in the segment growth.

The male segment is expected to grow at a significant CAGR over the studied period. The growth of the segment can be attributed to the raised male awareness and acceptance of more aesthetic treatments, which leads to a huge demand for individualized and specific cosmetic solutions. The male segment experiencing strong growth in developing markets such as Latin America and Asia.

Route of Administration Insights

Why topical segment led the aesthetic medicine market in 2025?

The topical segment led the market in 2024. The dominance of the segment is linked to the growing consumer awareness and need for non-invasive beauty solutions. The topical segment includes an extensive range of procedures and products from lotions and creams to treatments such as laser therapies and chemical peels. Many topical products are designed to solve tailored skin concerns.

The oral segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by rising demand for non-surgical cosmetic improvements. Oral treatment can be easy for people seeking to tackle aesthetic challenges without needing lengthy procedures and multiple visits. This segment may cover a range of concerns such as anti-aging, skin rejuvenation, and even body contouring.

Regional Insights

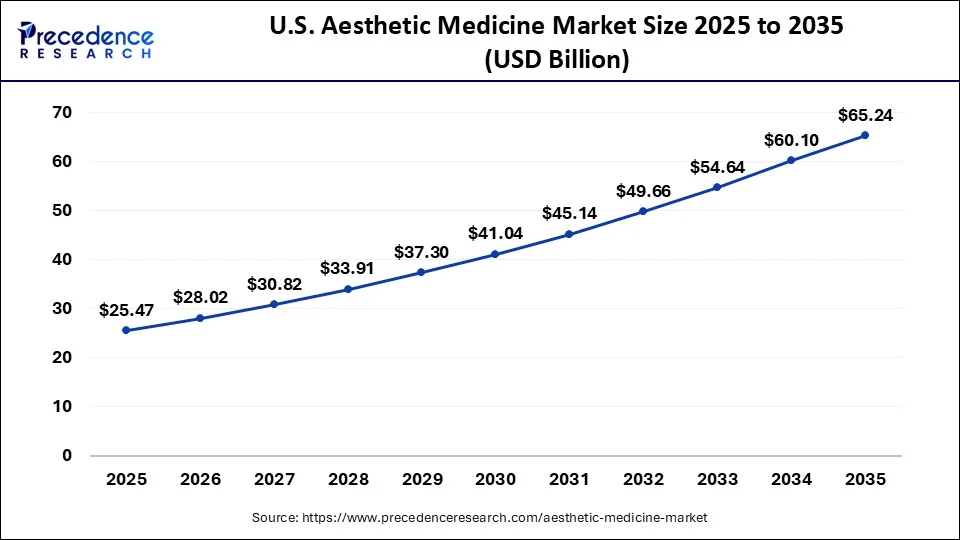

U.S. Aesthetic Medicine Market Size and Growth 2026 to 2035

The U.S. aesthetic medicine market size was estimated at USD 25.47 billion in 2025 and is predicted to be worth around USD 65.24 billion by 2035, at a CAGR of 9.86% from 2026 to 2035.

North America was the dominating aesthetic medicine market with around 36% of the global aesthetic medicine market share in 2025. The presence of strong and well-established healthcare and medical infrastructure, rising adoption of robots and digital technologies in the surgical procedures, increased awareness regarding the availability of advanced aesthetic treatments and medicines, higher healthcare expenditure, rapidly aging population, and presence of favorable government policies are some of the most prominent factors that has boosted the growth of the aesthetic medicine market in North America.

In North America, the U.S. led the market owing to the surge in disposable income, increasing consumer awareness, and innovations in non-invasive procedures such as dermal fillers and Botox. Also, the market in the US is impacted by a rising focus on appearance and the elderly population seeking a new way to keep a youthful appearance.

The rising prevalence of skin disorders among the population, presence of skilled cosmetic surgeons along with the rising adoption of cosmetic procedures in North America is significantly fostering the growth of the market. According to the American Society of Plastic Surgeons, the breast augmentation procedures increased by 48% from 2000 to 2018 while the Botox injections increased by around 845% in the same period. Therefore the rising demand for breast augmentation and Botox injections have significant contributions in the growth of the North America aesthetic medicine market. Moreover, the presence of top market players and various strategies adopted by them and the active participation of the government authorities on the aesthetic medicine product approvals is positively impacting the market growth in this region.

Asia Pacific aesthetic medicine market is expected to grow at the highest CAGR of 10.8% during the forecast period.The rising adoption of technologically advanced products, rising focus towards aesthetic appearance, and rising demand in developing countries like India, China, and South Korea is boosting the growth of the market in this region. South Korea is recognized as the hub of cosmetic surgeries. Furthermore, the significantly rising geriatric population in the region is expected to propel the growth of the market.

According to the United Nations, around 80% of the global geriatric people are expected to live in the low and middle income countries by 2050. Moreover around 93% of the road accident cases are observed in low and middle-income countries which are another major reason behind the rising demand for aesthetic medicine. The rising awareness regarding the aesthetic treatments and aesthetic medicines among the population in Asia Pacific is expected to drive the growth of the market in the forthcoming future.

India Aesthetic Medicine Market Trends:

In Asia Pacific, India dominated the market due to advancements in technology like radiofrequency devices and lasers which can lead to more efficient and less invasive operations. The country's expanding middle class has more desire for self-care because of a surge in disposable income and beauty requirements. India is also becoming the hub for medical tourism.

Europe Aesthetic Medicine Market Trends

Europe is expected to witness significant growth in the forecast period. The region's growth is driven by a rapidly aging population, rising aesthetic consciousness, and increasing technological advancements in aesthetic procedures. Countries such as Germany, France, the UK, Italy, and Spain are leading players in the region as they benefit from the increasing number of aesthetic clinics and well-established medical tourism industries.

The region is also witnessing demand for non-surgical treatments, including laser skin resurfacing, anti-ageing therapies, and body sculpting procedures. Furthermore, regulatory approvals for advanced aesthetic devices and the growing preference for personalized treatments are boosting up market expansion and fostering innovation.

Latin America Aesthetic Medicine Market Trends

The Latin American market is witnessing a rising demand in aesthetic medicine due to a rise in non-invasive procedures. Technological advancements are also helping in driving innovation in aesthetic treatments, thus enhancing patient experiences and outcomes. There is also an increasing focus on sustainability within the aesthetics market.

The region is also witnessing an increasing prevalence of skin rejuvenation therapies, highlighting a shift in consumer preferences towards less invasive options. As the market continues to expand, it appears poised for more potential opportunities for both local and international players.

Middle East and Africa Aesthetic Medicine Market Trends

The Middle East and African region is witnessing significant growth in the market and is expected to maintain its trajectory in the upcoming years. This is due to the increasing shift toward non-surgical cosmetic procedures, driven by technological advancements, minimal recovery times, and changing consumer preferences. Procedures such as Botox injections, dermal fillers, laser treatments, and non-surgical body contouring are becoming quite popular in today's day and age as individuals want to enhance their appearance without the risks that are associated with traditional surgeries.

Value Chain Analysis

- Material Sourcing

Aesthetic medicine uses various materials and active ingredients hyaluronic acid, collagen, calcium-based fillers, and energy-based device components. Ingredients must meet high purity and safety standards as they are injected or applied to the skin.

Key Players: AbbVie, Lonza, BASF - Manufacturing and Processing

Manufacturers produce dermal fillers, neurotoxins, skin boosters, lasers, and energy-based devices. Production includes formulation, sterile filling, device assembly, and performance testing. Products undergo stringent clinical evaluation and regulatory review before launches.

Key Players: AbbVie, Merz Aesthetics, Cutera - Distribution

In this stage, aesthetic products are sold directly to dermatology clinics, plastic surgeons, medical spas, and aesthetics centers. Distributors manage logistics, cold chain storage, and ongoing education. Consumer demand is driven by social media trends and lifestyle changes.

Key Players: McKesson, Cardinal Health, Amerisource Bergen

Aesthetic Medicine Market Companies

- AbbVie Inc.

- Galderma

- Alma Lasers

- Cynosure

- Johnson & Johnson Private Limited

- Lumenis Be Ltd.

- Solta Medical

- Candela Medical

- Hologic, Inc.

- Dentsply Sirona

Recent Developments

- In January 2025, Shonan Beauty Clinic announced the launch of its proprietary translation app tailored for medical aesthetics staff and the full-scale implementation of its "Inbound-Focused Clinics" initiative. This groundbreaking move is designed to address the increasing demand for medical tourism and ensure that international patients can seamlessly experience Japan's innovative medical aesthetic treatments. (Source: https://www.businesswire.com)

- In February 2025, GC Holdings announced its acquisition of IniBio, an unlisted company known for its botulinum toxin product, "Iniboju." The acquisition, valued at approximately 40 billion won, was approved during a board meeting held by GC Holdings and GC Wellbeing. (Source: https://www.businesskorea.co.kr)

- In April 2025, Galderma announced the launch of Sculptra, the first proven regenerative biostimulator with a unique poly-L-lactic acid (PLLA-SCA™) formulation, in China. This follows Sculptra's approval by China's National Medical Products Administration for correcting mid-facial volume loss and/or contour deficiencies last year. (Source: https://www.businesswire.com)

- In September 2020, Allergan Aesthetics introduced a new educational partnership initiative called DREAM (Driving Racial Equity in Aesthetic Medicine)

- In December 2021, Allergen Aesthetics completed the acquisition of Soliton, Inc., a medical technology company, to strengthen its portfolio of body contouring treatments in the non-invasive category

- In March 2020, Gladerma announced its investment in the aesthetic products portfolio and investments towards the expansion of salesforce in US. This strategy aimed at strengthening the market position of the company.

- In September 2020, Merz Aesthetics entered into a partnership with Gwyneth Paltrow (Oscar and Emmy-award-winning actor) to launch a global campaign for Xeomin. It is a FDA approved injection for wrinkle treatment.

The key market players are constantly engaged in various developmental strategies like partnership, collaborations, new product launches, and acquisitions to strengthen their market position and gain market share.

Segments Covered in the Report

By Procedure Type

- Non-Invasive Procedure

- Botox Injections

- Microdermabrasion

- Soft Tissue Fillers

- Laser Hair Removal

- Chemical Peel

- Others

- Invasive Procedure

- Liposuction

- Nose Reshaping

- Breast Augmentation

- Tummy Tuck

- Eyelid Surgery

- Others

By Product Type

- Energy-Based Devices

- Laser-based Aesthetic Device

- Radiofrequency (RF)-based Aesthetic Device

- Light-based Aesthetic Device

- Ultrasound Aesthetic Device

- Others

- Implants

- Facial Implants

- Breast Implants

- Others

- Anti-Wrinkle Products

- Botulinum Toxin

- Dermal Fillers

- Others

By Application

- Surgical

- Non-Surgical

By End-User

- Medical Spas and Beauty Centres

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Home Use

By Gender

- Males

- 18 years and below

- 19-34 years

- 35-50 years

- 51-64 years

- 65 years and above

- Females

- 18 years and below

- 19-34 years

- 35-50 years

- 51-64 years

- 65 years and above

By Route of Administration

- Oral

- Topical

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting