What is the Agriculture Sensor Market Size?

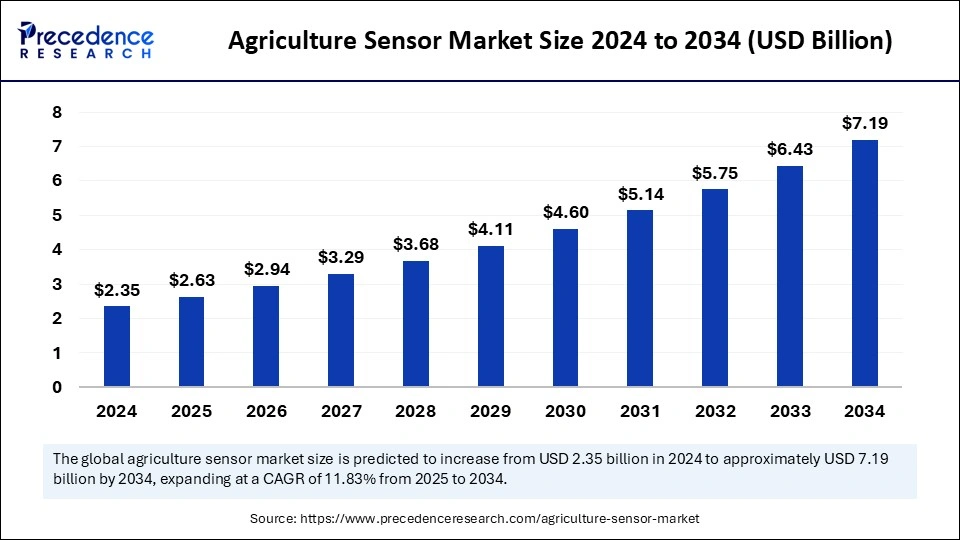

The global agriculture sensor market size accounted for USD 2.63 billion in 2025 and is predicted to increase from USD 2.94 billion in 2026 to approximately USD 7.90 billion by 2035, expanding at a CAGR of 11.62% from 2026 to 2035. The market experiences increasing demand because of technological advancements like IoT, AI, and precision farming, which optimize resource use and increase crop yield.

Agriculture Sensor Market Key Takeaways

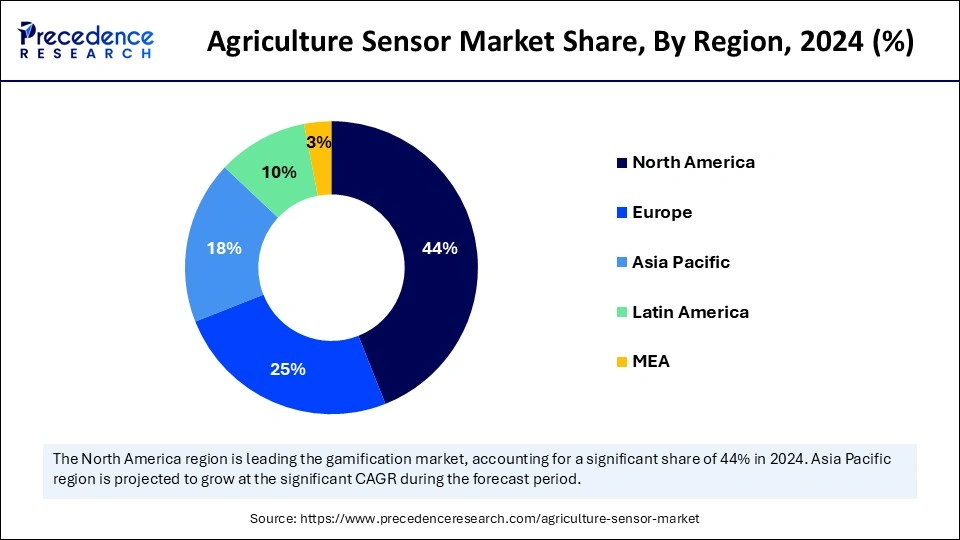

- North America dominated the global market with the largest market share of 44% in 2025.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By type, the location sensors segment contributed the largest market share of 14% in 2025.

- By type, the soil moisture sensors segment is expected to show considerable growth over the forecast period.

- By application, the soil management segment accounted for the biggest market in 2025.

- By application, the smart greenhouse segment is anticipated to witness significant growth in the studied period.

Market Overview

Agriculture sensors play an essential role in precision farming by using modern technologies to improve crop production and manage natural resources effectively. Modern environmental monitoring devices serve to observe essential crop conditions and provide instant data for informed decision-making processes. The agricultural interventions depend on sensors that detect soil moisture and temperature with additional readings of humidity, nutrients, and pest observations. Modern agronomic strategies based on data analytics decrease resource usage to enhance agricultural operational performance and productivity.

The increasing demand for agricultural output, evolving technological practices, and intensifying methods such as precision agriculture, low-till management, and advanced technology are fueling the agriculture sensor market. Farmers are increasingly turning to agricultural sensors to optimize production efficiency with their existing resources. By utilizing these sensors, farmers can enhance yield while minimizing labor and material waste. The demand for agricultural sensors has grown, driven by emerging trends in smart greenhouses, fish farm monitoring, and livestock management technologies.

Artificial Intelligence Integration in the Agriculture Sensor Market

Artificial Intelligence integration with drones and sensors helps develop precise decisions about watering plants, applying fertilizer, and insect control methods. The system provides precise delivery of water and nutrients to match crop requirements exactly. The development of agriculture sensor markets progresses through generative AI technology, which delivers advanced capabilities for analyzing data and creating predictive models.

Data obtained through sensors enables AI algorithms to predict agricultural outputs, identify disease patterns, and suggest improved timetable arrangements for planting. The information produced enables farmers to reach their highest output rates combined with minimal risk exposure. The development of advanced prototypes by sensor manufacturers receives assistance from AI-driven tools, which help improve accuracy and system functionality.

- In July 2024, Taranis announced its Ag Assistant, which became a breakthrough AI system in the agricultural sector worldwide. World-class agriculture retailers and producers gain access to the new generation Ag Assistant system, which operates using AI technology that combines multiple data modalities, including images, text, and audio, with a profound understanding of agronomy.

Agriculture Sensor Market Growth Factor

- Government initiatives: The governments encourage smart farming practices by supplying financial assistance, which includes subsidy programs, granting money, and support systems that promote technological adoption. Through government-sponsored initiatives, market growth accelerates because these initiatives support farmers in using agricultural sensors effectively for enhanced crop management and improved pest control and yield optimization.

- Sustainability concerns: Sustainability goals are fueling farmers to buy sensors that help conserve their resources by lowering chemical usage and improving soil conditions through sustainable farming practices. Farmers implement sensors for environmental performance objectives and to boost sustainability, which strengthens market expansion.

- Technological advancements:Sensor technologies such as IoT systems and AI have enabled businesses to monitor crops, soil conditions, and environmental elements in real time. The market demand for advanced agricultural sensors continues to grow because innovations assist precision agriculture operations and maximize resource efficiencies while boosting productivity levels.

- Rising demand for food: The need for more food is due to population growth, thus intensifying the demand for efficient, high-yield farming systems. Agriculture sensors boost crop output quality through precise assessment processes that escalate the market demand for advanced farming technology to solve food supply requirements.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 7.90 Billion |

| Market Size in 2025 | USD 2.63 Billion |

| Market Size in 2026 | USD 2.94 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.62% |

| Leading Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

Applicaton, Type,and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for precision agriculture

The agricultural industry needs precision farming systems because they deliver approaches for better crop management along with improved productivity levels. Through precision farming, farmers need agriculture sensors to get detailed information about their crops, including their health status, soil quality, and weather information. Modern farmers depend heavily on agriculture sensors because sustainable farming practices and global food requirements push them towards precision farming techniques.

The agriculture sensor market keeps expanding because precision agriculture depends on specific input usage and exact monitoring techniques. Live monitoring through agriculture sensors provides clear insights into soil and climate patterns, which leads farmers to adopt data-based approaches for irrigation management, pest control, and nutrient delivery.

- In July 2023, Deere & Company acquired Smart Apply, Inc. (U.S.), the precision spraying equipment company. The acquisition helps John Deere Company strengthen its high-value crop business interactions with dealers and own cost-cutting solutions, enabling growers to face their fundamental problems, including labor shortages, input costs, and regulatory compliance.

Focus on sustainable agriculture trends.

The importance of sustainable agriculture practices increases due to mounting environmental conservation worries, resource depletion, and climate change. Soil conditions, water utilization evaluation, and crop health assessment enable farmers to efficiently use resources and decrease waste production while reducing chemical applications.

Agricultural sensors help farmers use conservation tillage practices alongside crop rotation and integrated pest management to improve soil health because of their ability to monitor environmental conditions. A sustainable agricultural solution demand will continue to rise because consumer government bodies and industry stakeholders show greater interest in environmentally friendly practices through agriculture sensors.

Restraint

High initial expenditures

High initial expenditures of these technologies serve as the primary challenge for current agricultural sensor adoption across fields. Electing necessary infrastructure components comprising data storage systems and communication networks, as well as software data analysis platforms, increases expenses on top of sensor costs. The sensor adoption investments become difficult for smallholder farmers since their small profit margins restrict funding, especially when compared to larger farming operations and commercial agribusinesses, which typically secure these costs.

The market faces hurdles from main issues like a shortage of skilled workers and the absence of established standards and procedures for system implementation. Data analysis and device maintenance require technical abilities with continuous expert supervision, which creates market limitations.

Opportunity

Government support and regulatory policies

World governments strengthen agricultural IoT adoption through their representations of supportive policies and provision of subsidies for superior equipment, plus research and development funding and farmer training programs to create adoption-friendly conditions. The development of precise agricultural systems, such as precision agriculture, is becoming possible in rural areas because governments are investing in rural infrastructure for better internet connectivity.

The rise in interest in agriculture sensors came because several national and regional policies emerged to drive sustainable agricultural practices. Standards and guidelines regarding sensor use and implementation create a reliable and high-quality system. The agriculture sensor market growth benefits significantly from the positive regulatory structure in place.

In December 2024, the government of India launched AI tools to support farmers, including,

- Kisan e-Mitra: An AI chatbot for queries on government schemes.

- National Pest Surveillance System: Uses AI to detect and prevent crop damage from climate change.

- AI-based crop monitoring: Analyzes photographs for crop health assessment and crop health monitoring using Satellite, weather & soil moisture

Segment Insights

Type Insights

The location sensors segment contributed the largest share of the agriculture sensor market in 2025. Location sensors employ GPS satellite signals to identify latitude and longitude positions as well as altitude and additional topographical features of the required field area. For precision agriculture technology implementation to succeed in farming, multiple sensors must be deployed. Environmental sustainability awareness has driven farmers to embrace technology solutions, which include location sensors, because they reduce waste while improving productivity. Location sensors get more important with expanded IoT (Internet of Things) applications in agriculture since they enable remote monitoring alongside data-driven choices.

The soil moisture sensors segment is expected to show considerable growth over the forecast period. The market features essential applications, including yield monitoring, mapping, soil monitoring, disease control, detection, irrigation, and water management. The monitoring of soil is of high importance because sensors detect moisture levels, temperature readings, and nutrient concentrations to help farmers optimize their soil resources. Irrigation systems combined with water management applications use sensors to improve irrigation procedures, which simultaneously protect resources and foster sustainable agricultural practices. Agriculture sensors will experience substantial market growth because farmers require advanced precision farming systems and sustainable practices to enhance agricultural operations.

- In November 2024, CropX Launched a New Era of Sustainable Irrigation in New Zealand, a first-of-its-kind sensor for monitoring the real-time plant water use in a field through evapotranspiration (ET).

Application Insights

The soil management segment accounted for the largest share of the agriculture sensor market in 2025. Plants require effective soil management to reach their highest growth potential, together with maximum yield production. Recent advancements in monitoring systems combine soil moisture sensors with plant growth sensors along with microclimate tracking capabilities. The sensors measure real-time data of soil liquid content alongside pH levels, nutritional amounts, and temperature readings, allowing farmers to make exact water and fertilizer choices. The gathered sensor data is automatically transferred to mobile devices so that farmers can react quickly. Sensors deployed on agricultural land contribute to two key benefits: farmers obtain reduced water consumption and enhanced food production levels.

- In July 2024, Veris Technologies launched CoreScan, its automated soil sensor probe. CoreScan, the industry gained access to exceptional soil profiling capabilities that enable farmers to make better decisions for their operations.

The smart greenhouse segment is anticipated to witness significant growth in the agriculture sensor market over the studied period. Smart agriculture systems feature smart greenhouses that employ monitoring devices to manage environmental conditions that benefit crop vegetation. The smart automation system in greenhouses provides highly exact control of irrigation and fertilization processes. Greenhouse operators maintain proper plant water and nourisher amounts by tracking soil moisture as well as nutrient levels. The smart sensor network functions as a system that records current greenhouse environmental information in real-time. The rapid data collection capability of such a network system enables better control of the greenhouse environment through easily accessible measurements.

- In November 2024, AIT Unveiled a Cutting-edge Smart Greenhouse, revolutionizing sustainable agriculture with IoT and AI technologies.

Regional Insights

What is the U.S. Agriculture Sensor Market Size?

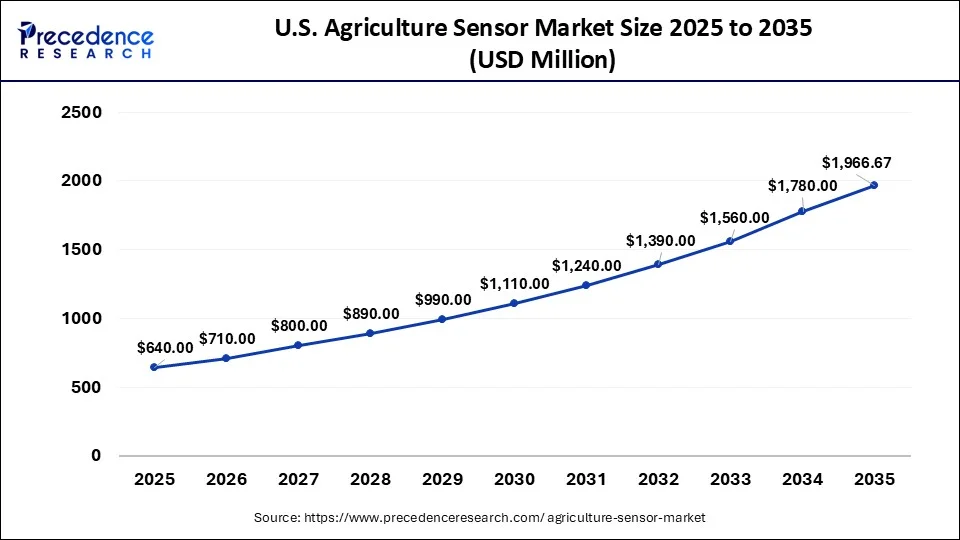

The U.S. agriculture sensor market size was exhibited at USD 640 million in 2025 and is projected to be worth around USD 1,967 million by 2035, growing at a CAGR of 11.88% from 2026 to 2035.

North America dominated the agriculture sensor market in 2025. The use of advanced farming systems grew because the government promoted agriculture development with modern techniques and infrastructure development. Soil moisture sensors have experienced rapid acceptance among North American farmers during the past few years. Soil moisture instruments operate in sports turf domains to boost efficient turfgrass monitoring and conversion processes.

The United States functioned as the first country to adopt precision farming technologies, thus becoming the dominant region with the maximum market share in global markets. The U.S. farming industry has implemented advanced farming technology at a rapid pace throughout the past few years. Acceptance of modern agricultural methods in Canada serves as an important growth factor for the industry.

In January 2023, CropX Technologies acquired the precision irrigation company Tule Technologies, which operates from California. Through the acquisition, CropX integrates fresh data capture technologies into its Agronomic Farm Management System, unlocking business opportunities for California's specialty crops using drip irrigation.

Asia Pacific is anticipated to witness the fastest growth in the agriculture sensor market during the forecasted years. Precision agriculture policies support the regional adoption of internet of things (IoT) sensors and drones, which optimize irrigation systems and pest management practices in addition to controlling fertilization processes. The expansion of the population with growing food requirements prompts farmers to implement sensor systems for precision agriculture, which boosts productivity levels.

Water scarcity across Asia calls for better irrigation efficiency, so countries implement sensor-based water management solutions to resolve this issue. The implementation of sensors receives support from government initiatives that combine elevated rural income with new farming innovations.

- In September 2024, The Indian government introduced an investment program worth USD 699.14 million to develop precision farming 2024 through Internet of Things (Sensors) technology. The Smart Precision Horticulture Programme began at the Union Ministry of Agriculture under its Mission for Integrated Development of Horticulture (MIDH) scheme.

IoT-Enabled and Wireless Agriculture Sensors Market in Europe

Europe shows a significant growth during the forecast period. It is driven by the urgent demand to modernize farming to be more sustainable, efficient, and precise. Farmers are adopting IoT to monitor crop health, soil moisture, and environmental conditions in real time, allowing data-based decisions that increase yields by 10-20%. High-performance, low-cost sensors are now making it financially feasible for both small and large farms to adopt digital technologies.

Precision Agriculture Driving the Agriculture Sensor Industry in Latin America

Latin America shows a notable growth during the forecast period. It is driven by the rising occurrences of droughts along with volatile weather in the region, which necessitate data-based decisions to protect crops and manage, for instance, water consumption effectively. Extensive agricultural land in Brazil, Argentina, and a few regions necessitates advanced technological solutions to handle vast, usually remote, farming operations efficiently.

Value Chain Analysis for the Agriculture Sensor Market

- Harvesting and Post-Harvest Handling: They are vital, high-value segments in the agriculture sensor market, targeted at reducing the 30–40% of produce primarily lost between the field and the user.

Key Players: Deere & Company, AGCO Corporation, CNH Industrial N.V., JBT Corporation - Storage and Cold Chain Logistics: By leveraging IoT-enabled, real-time monitoring devices to maintain, track, and optimize the temperature, humidity, and even atmospheric conditions of perishable produce from farm to fork.

Key Players: Americold Logistics, Lineage Logistics, Carrier Global Corporation, DHL International GmbH - Processing and Packaging: These steps are demanded to make electronic sensors durable enough for harsh agricultural environments, along with being functional for data-driven, IoT-based farming. This includes changing raw sensing components into rugged, field-ready devices.

Key Players: Deere & Company, AGCO Corporation, Trimble Inc., and CNH Industrial N.V.

Agriculture Sensor Market Companies

- Pycno: Pycno provides integrated, solar-powered, wireless, along with easy-to-install agricultural sensors that offer real-time, cloud-driven data for soil and air monitoring. These solutions allow farmers to track temperature, soil moisture, solar radiation, and air quality to decrease resource use and optimize crop yields.

- Sentera: Sentera provides a comprehensive suite of high-resolution, aerial-driven sensors specifically for the agriculture market, programmed to integrate with drones to offer in-season, actionable crop health data.

Other Major Key Players

- Acclima Inc.

- Auroras S.r.l.

- Climate LLC

- CropX Inc.

- Deere & Company

- Libelium Comunicaciones Distribuidas S.L.

- METER

- Soil Scout Oy

- SOLCHIP

- Texas Instruments Incorporated

- Trimble Inc.

- Yara

- Zenvus

Industry Leader Annoucement

In February 2024, CEO Nadine Buard of Iridesense stated that their LIDAR sensor enables an advanced system for natural resource monitoring and management. These sensors enable materials and plants to interact with laborers while potentially becoming standard components for agricultural tools to monitor plant requirements in live operations.

Recent Developments

- In September 2024, CropX Inc. purchased EnGeniousAg, which operates as a technology application startup. The innovative nitrogen sensing technology from the startup helped farmers apply nitrogen fertilizer optimally and decrease environmental impacts.

- In April 2024, GroGuru, an expert in commercial farming water management, released its first fully integrated commercial wireless soil sensor probe intended for continuous root zone monitoring of annual field crops through the patented WUGS (wireless underground system).

Segments Covered in the Report

By Type

- Location Sensor

- Humidity Sensor

- Electrochemical Sensors

- Mechanical Sensors

- Airflow Sensors

- Pressure Sensors

- Optical Sensors

- Water Sensors

- Soil Moisture Sensors

- Capacitance Sensors

- Probes

- Time Domain Transmissometry (TDT) Sensors

- Gypsum Blocks

- Tensiometers

- Granular Matrix Sensors

- Livestock Sensors

By Application

- Dairy Management

- Soil Management

- Climate Management

- Water Management

- Smart Green House

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting