What is the AI Companion Market Size?

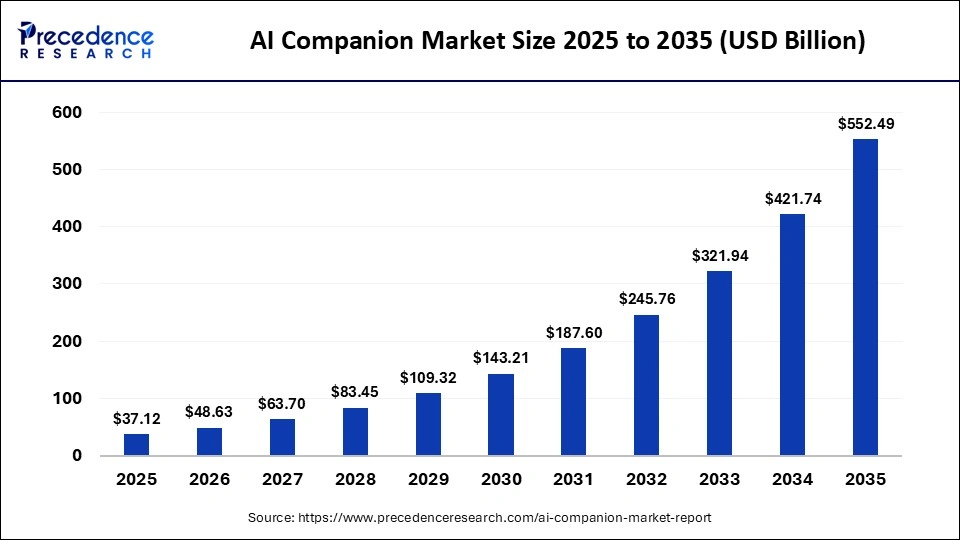

The global AI companion market size accounted for USD 37.12 billion in 2025 and is predicted to increase from USD 48.63 billion in 2026 to approximately USD 552.49 billion by 2035, expanding at a CAGR of 31.00% from 2026 to 2035. The market is emerging as a leading area of AI technology due to growing loneliness and increased mental health issues, which AI technologies, such as AI companions, can address.

Market Highlights

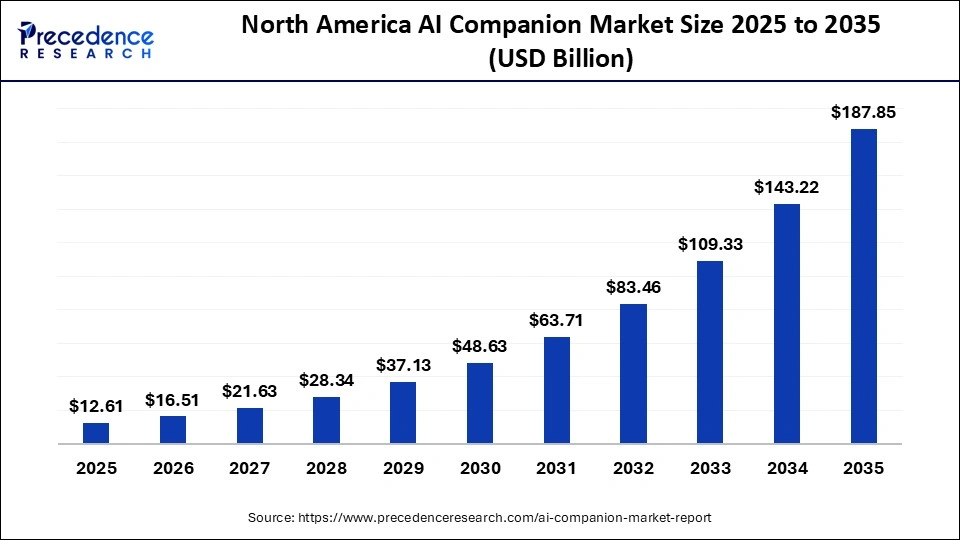

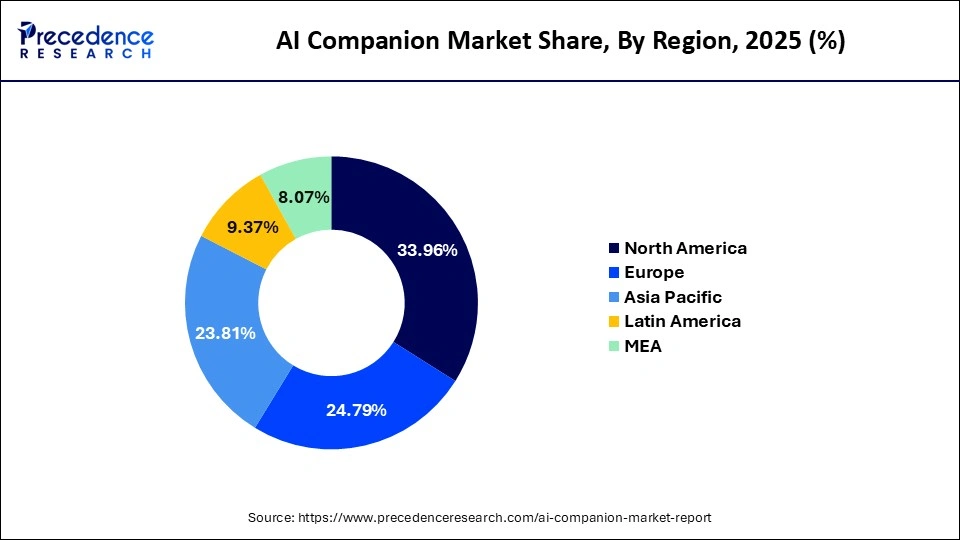

- North America accounted for the largest market share of 33.96% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR from 2026 to 2035.

- By type, the text-based AI companies segment contributed the biggest market share of 44% in 2025.

- By type, the multi-modal AI companies segment is projected to grow at a strong CAGR from 2026 to 2035.

- By application, the social interaction & companionship segment held the major market share in 2025.

- By application, the mental health support segment is growing at a strong CAGR from 2026 to 2035.

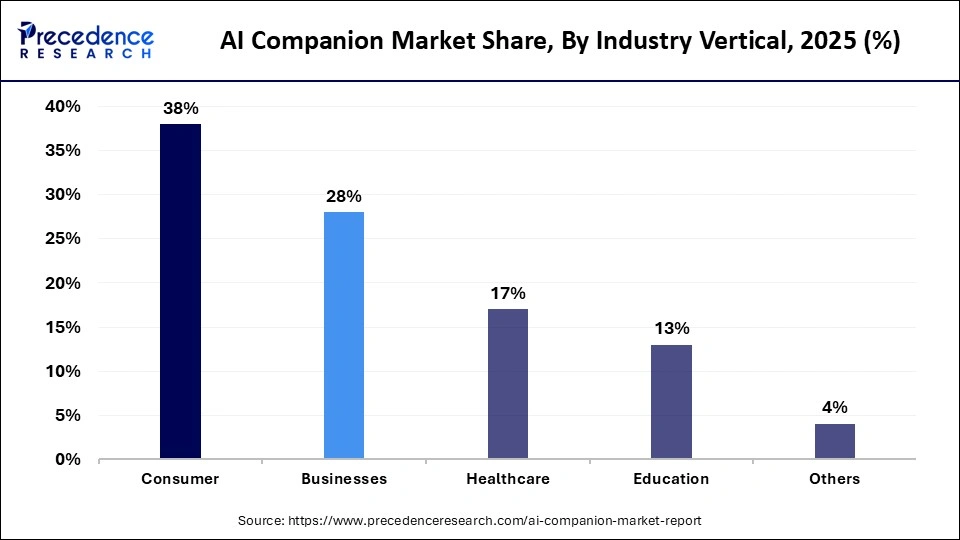

- By industry vertical, the consumer segment captured the biggest market share of 38% in 2025.

- By industry vertical, the businesses segment is projected to grow at a CAGR from 2026 to 2035.

Understanding the AI Companion Market: Human-AI Interaction, Digital Companionship and Behavioural Modelling

The AI companion market is expanding rapidly as more people seek to simulate human-like interaction with advanced AI models that provide emotional support, social engagement, and functional assistance. These systems rely on natural language processing, reinforcement learning, and neural network architectures that mimic certain cognitive patterns of human conversation, allowing them to generate contextually relevant responses, adapt to user behavior, and maintain long-term conversational continuity. The market includes a wide spectrum of applications, ranging from emotionally supportive platforms such as Replika and Character, which are designed to help users manage loneliness, stress, and daily reflection, to productivity-focused tools such as Zoom's AI Companion, which assists with meeting summarization, task extraction, drafting emails, and schedule organization.

AI companions are also being integrated into educational settings for tutoring, into workplace environments for administrative support, and into consumer devices for routine decision-making and lifestyle guidance. As large language models become more multimodal and capable of processing text, voice, images, and structured data simultaneously, their role as companions expands beyond conversation to include personalized coaching, behavioral nudges, and adaptive emotional modeling. These developments continue to drive market growth and solidify AI companions as a prominent category within broader AI adoption trends.

The Evolution of AI Companions: GenAI, Agentic Systems, and Longitudinal Learning Models

An AI companion can operate effectively by integrating foundational technologies, including context-aware computing, computer vision, cloud computing, and blockchain. Context-aware computing enables the system to interpret user intent, emotional tone, behavioral patterns, and environmental cues, allowing the AI companion to generate responses that feel more aligned with human communication. These engines process signals such as speech cadence, text sentiment, prior interaction history, and user-preference data to refine emotional expression and conversational relevance, which is central to the purpose of AI companionship.

Computer vision enhances these capabilities by allowing the AI to interpret facial expressions, gestures, and surrounding environments when deployed on devices with cameras. This enables dynamic emotional modeling, personalized feedback, and more immersive interaction.

Cloud computing provides the scalable backbone needed to process high-volume inputs, run large language models, and synchronize user data across multiple devices. Real-time access to updates and model improvements enables AI companions to remain responsive even as user loads expand.

AI Companion Market Outlook

- Industry Growth Overview: The AI companion market is growing rapidly due to the growing demand for personalized digital interaction, emotional support, and overall well-being, as AI technologies help bridge the gap caused by the loss of emotional connectivity among people. The market is quickly adapting from basic virtual assistants to emotionally developed digital partners.

- Sustainability Trends: The market is witnessing major sustainability trends, such as the ethical and responsible use of AI, as well as energy efficiency and eco-friendly marketing. The use of energy-efficient hardware, such as TPUs and FPGAs, along with optimized algorithms, is redefining the market's growth strategy.

- Major Investors: Major investors in the market include leading venture capital firms and well-established corporate entities such as SoftBank Vision Fund, Microsoft, Google, and Lightspeed Venture Partners. These investors are strategically investing in and supporting emerging startups in the AI companion space that align with their vision.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 37.12 Billion |

| Market Size in 2026 | USD 48.63 Billion |

| Market Size by 2035 | USD 552.49 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 31.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Type Insights

Why are Text-Based AI companions preferred in the AI Companion Market?

Text-based AI Companions: The text-based AI companions segment held the largest market share in 2025. The segment is dominating due to its greater accessibility, ease of use, and ability to foster anthropomorphic connections, as well as strong support for personalized details and retention of large-scale context without hallucinations. They are ideal AI companions, as they can support a user 24/7, facilitate casual chat, and easily offer task-management tips.

Multi-modal AI Companions: The multi-modal AI companions segment is projected to grow at the fastest CAGR over the foreseeable period, driven by its unmatched diversity of interaction formats, including voice, text, gesture recognition, and visual inputs, enabling highly personalized, context-aware query answering. Multi-modal systems create richer, more natural interactions by combining speech patterns, image cues, and behavioral trends to generate responses that feel more emotionally aligned and situationally accurate. For example, a companion using computer vision can interpret facial expressions or posture to adjust tone, while text analysis captures linguistic nuances that reflect mood or intent.

Application Insights

Why Do Social Interaction and Companion-Based Applications Lead the AI Companion Market?

Social Interaction and Companionship: The social interaction and companionship segment held the largest market share in 2025, driven by companion-based applications that directly address issues like loneliness and social isolation, and support growth in mental health concerns without judgment or information bias. Many AI companion apps are now integrating CBT (cognitive-behavioral therapy) to treat in a more personalized manner.

Mental Health Support: The mental health support segment is projected to grow at the fastest CAGR during the foreseeable period. The segment is growing due to the rising mental health concerns from modern lifestyle and social disconnection, and social stigmas to seek professional help in such cases are another reason people are turning towards AI companions as a mental health coach with personalized guidance.

Industry Vertical Insights

How is Consumer Sector Largely Benefits AI Companion Market?

Consumer: The consumer segment held the largest market share in 2025. The segment is dominating because AI companions address a wide range of social and emotional challenges, from chronic loneliness to reduced social confidence, and provide supportive interactions for users managing mental-health concerns such as anxiety, depression, and borderline personality disorder. Consumers increasingly seek personalized, secure, and judgment-free interactions that can adapt to their emotional states and daily routines. AI companions offer structured reflection, routine reminders, conversation practice, and emotional stabilization tools that appeal to users looking for accessible and stigma-free support.

Businesses: The businesses segment is projected to grow at a CAGR during the foreseeable period. The segment is largely growing due to the offering of a higher return on investment by automating repetitive tasks in business and allowing teams to focus on core strategies and other complex work that requires human instinct and intelligence. Unlike general AI use cases, businesses are highly focused on what exactly they need, making it more suitable to train and deploy AI companions for businesses.

Regional Insights

How Big is the North America AI Companion Market Size?

The North America AI companion market size is estimated at USD 12.61 billion in 2025 and is projected to reach approximately USD 187.85 billion by 2035, with a 31.01% CAGR from 2026 to 2035.

What Factors Made North America a Dominant Force in the AI Companion Market Globally?

North America held the largest market share in 2025. The region is dominating globally due to advanced technological innovation and its adoption, the growing use of smart devices, and the huge demand for personalized solutions for mental health and overall well-being. North America boasts technological leadership, driven by active tech giants such as OpenAI, Microsoft, and Google, fueling the constant evolution of LLM models and emotion AI, which is a foundation of AI companions.

North America has alarger population that is highly adaptable to new technologies, with growing smartphone penetration and AI integrationacrossn leading sectors, highlighting the region's dominance in the tech sector and its sophisticated use of AI for human-like behavior. One of the interesting examples for this includes,

- In November 2025, a practicing physician who was a resident at Harvard, Mr. Jenny Shao, launched an AI assistant name, Robyn through his start-up, aiming to help people struggling with isolation and its negative impact.

What is the Size of the U.S. AI Companion Market?

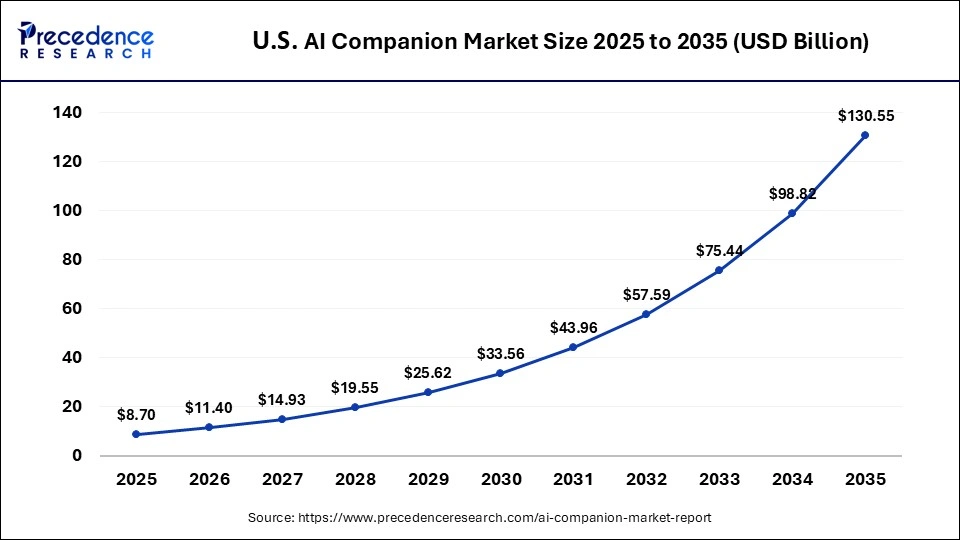

The U.S. AI companion market size is calculated at USD 8.70 billion in 2025 and is expected to reach nearly USD 130.55 billion in 2035, accelerating at a strong CAGR of 31.11% between 2026 and 2035.

U.S. AI Companion Market Trends

The U.S. is a leader in the North American AI companion market, with substantial investments in AI and digital wellness, driven by regulatory support and consumer demand. The area is witnessing significant changes in the personal and business sectors due to such rapid evolution and adoption of AI. For example, according to data published by the U.S. Federal Communications Commission, there are 68 FCC certifications for smart devices based on AI applications, highlighting the growing number of regulatory approvals. Alongside an early-launched Replika by Luka, Inc., has attracted nearly 30 million users, and half of them have set up their AI as a romantic partner in search of companionship.

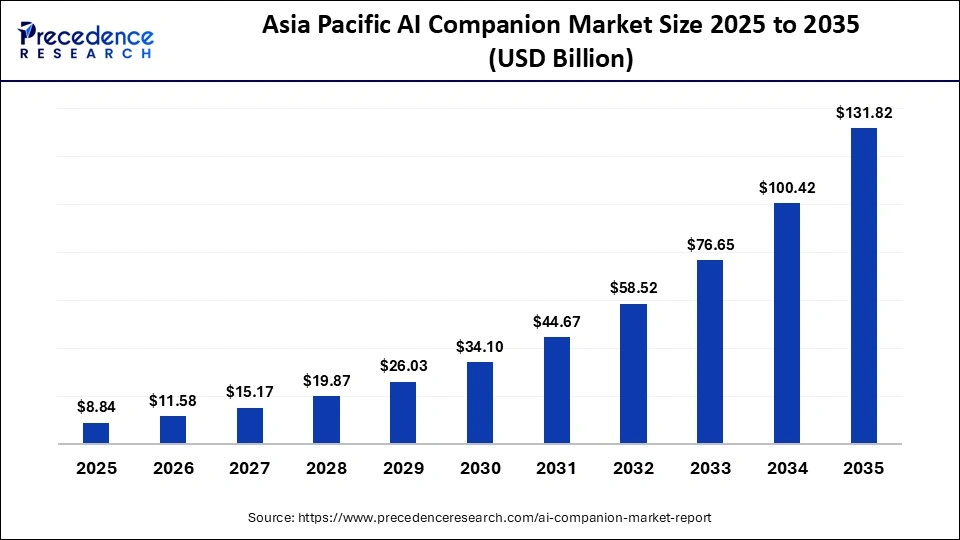

What is the Asia Pacific AI Companion Market Size?

The Asia Pacific AI companion market size is expected to be worth USD 131.85 billion by 2035, increasing from USD 8.84 billion by 2025, growing at a CAGR of 31.02% from 2026 to 2035.

Why is Asia Pacific Rapidly Growing in the AI Companion Market?

Asia Pacific is projected to grow at the fastest CAGR during the foreseeable period. The region is expanding due to extensive experimentation with AI applications, including conversational models, socio-emotional AI frameworks, and personalized companion systems. Countries across the Asia Pacific are developing large-scale AI models from scratch, supported by government funding, academic partnerships, and accelerated private-sector innovation. Technology giants in China, Japan, South Korea, India, and Singapore are collaborating with regulatory bodies to establish guidelines for ethical AI deployment, user-safety protocols, and data-governance standards.

According to Microsoft's Work Trend Index, 82% of global business leaders consider the current year a turning point for reinventing their AI strategies for business applications, highlighting the depth of AI penetration across the Asia Pacific region. Earlier this year, Grok AI introduced a 3D anime-inspired AI companion, ANI, for its premium subscribers, reflecting the region's focus on culturally tailored, visually immersive, and high-engagement AI experiences. These trends collectively position Asia Pacific as the world's fastest-advancing hub for AI companion technologies.

China AI Companion Market Analysis

The AI companion market in China has rapidly moved from model development to application launch within a 3-month cycle. Though it has raised an ethical concern, China's Ministry of Industry and Information Technology and China's Cyberspace Administration collaboratively issued guidelines on AI companions' rapid progress by explicitly mentioning, “emotional companionship and virtual AI characters are scrutinized. However, it has not affected the innovative launches of AI ccompanionsin China.

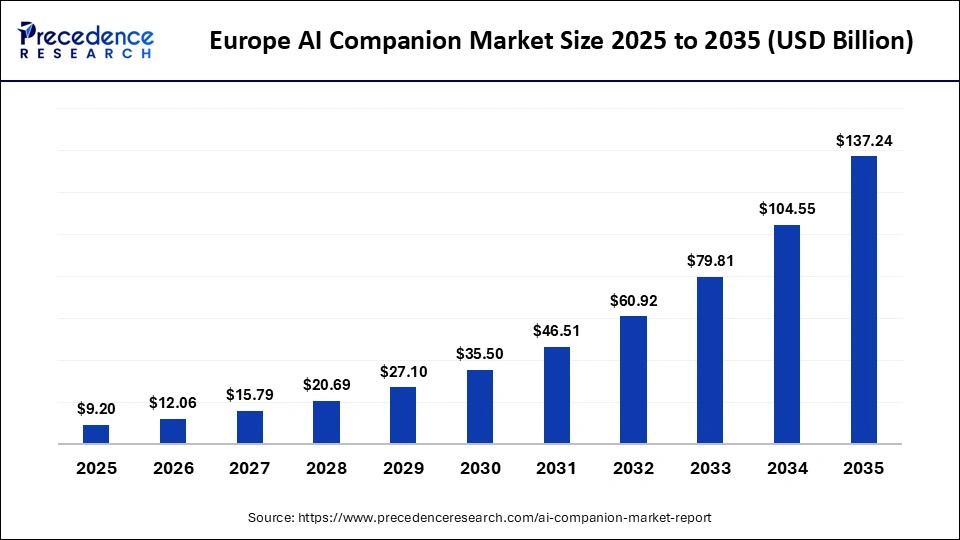

What is the Europe AI Companion Market Size and Growth Rate?

The Europe AI companion market size has grown strongly in recent years. It will grow from USD 9.20 billion in 2025 to USD 137.24 billion in 2035, expanding at a compound annual growth rate (CAGR) of 31.03% between 2026 and 2035.

How is Europe AI Companion Market Evolving?

The Europe AI companion market is expanding significantly, driven by rising demand for continuous consumer support, healthcare assistance, and digital well-being solutions. European businesses are rapidly adopting AI companions to strengthen customer engagement, streamline service operations, and meet rising expectations for personalized interactions. Many enterprises are integrating companions into retail, banking, and travel platforms to offer round-the-clock guidance and automated problem resolution.

While text-based AI companions have achieved widespread adoption across the region, multi-modal companions capable of processing voice, visual cues, and contextual signals are gaining momentum. They are now growing faster than single-mode applications in major European countries. Regulatory frameworks such as the EU Artificial Intelligence Act continue to shape market development by emphasizing transparency, accountability, and safe deployment, which further strengthens consumer trust in AI companion technologies.

Germany AI Companion Market Analysis

Germany has witnessed the development of the largest independent AI research institute, DFKI, which aims to support reliable AI use cases globally and has significantly contributed to establishing ethical AI practices, thereby impacting the German AI companion market. The market is majorly shaped by several leading AI companies located in Germany due to their strong portfolio, strategic collaborations, and highly advanced technologies integration with AI. These enterprises are highly engaging to develop innovative AI companions for several use cases, ranging from business application support to emotional well-being.

What are the Strategies of the Middle East & Africa AI companion Market?

The region is notably expanding, largely driven by government-backed digital transformation agendas, smart city projects such as NEOM in Saudi Arabia, and rising demand for consumer services focused on mental well-being and personalized engagement. Countries across the Gulf Cooperation Council are investing heavily in AI infrastructure, including large-scale data centers, national AI labs, and cloud platforms optimized for model training and deployment.

Expanding 5G networks provides the low-latency environment needed for real-time companion interaction, enabling seamless voice and video communication. These investments support the development of local-language large language models and culturally aligned AI companions tailored to regional preferences. As consumer awareness of digital well-being grows, AI companions are being adopted for stress management, productivity coaching, and lifestyle support, contributing to sustained regional market growth.

Saudi Arabia AI Companion Market Analysis

Saudi Arabia is investing heavily in AI technologies and collaborating with tech leaders such as AMD and Cisco to build large-scale data centers for AI development, aiming to develop 1GW of AI infrastructure by 2030 to become a global leader in AI innovation. A significant paradigm shift has occurred globally when the company Humain, supported by the Saudi sovereign wealth fund, launched an Arabic-first language model in Saudi Arabia, called ‘Allam'.

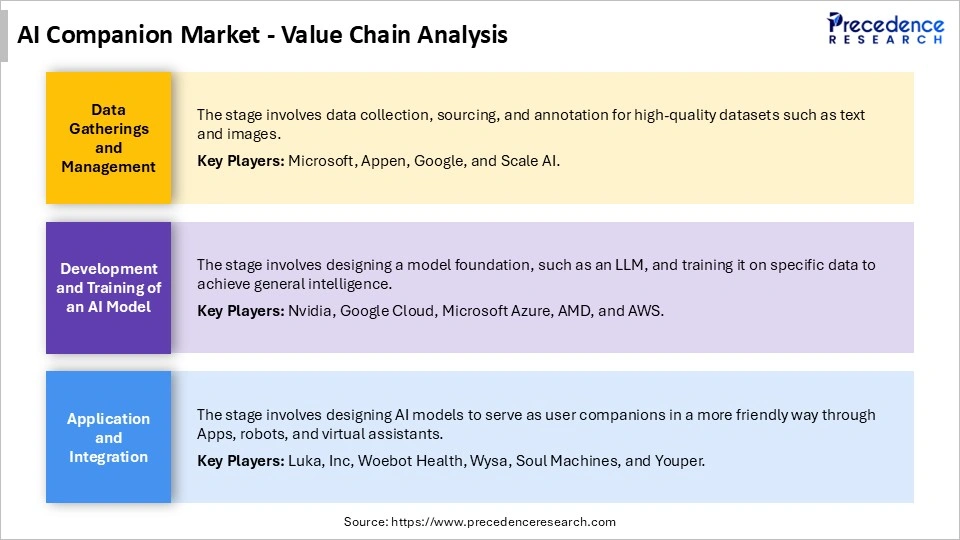

AI Companion Market Value chain

Top Companies in the AI Companion Market & their Offerings

- Nomi AI, Inc.

- Google LLC

- Luka, Inc.

- Soul Machines

- International Business Machines Corporation

- Character.AI, Inc.

- Zoom Video Communications, Inc.

- KNIME

- Amazon.com, Inc.

- OpenAI, LP

Recent Developments

- In December 2025, Zoom achieved a state-of-the-art result on the challenging HLE full-set benchmark designed for AI models' evaluation by Google Gemini3-pro with tool integration, highlighting their evolution from AI companion 1.0 to upcoming AI companion 3.0.(Source: https://www.zoom.com)

- In November 2025, Samsung introduced the upgraded ‘vision AI companion', Bixy, that allows us to use more natural language and deep contextual understanding behind words spelled by users.(Source: https://news.samsung.com)

Segments Covered in the Report

By Type

- Text-based AI Companions

- Voice-based AI Companions

- Multi-modal AI Companions

By Application

- Mental Health Support

- Social Interaction and Companionship

- Education and Learning Aid

- Personal Assistance

By Industry Vertical

- Consumer

- Businesses

- Healthcare

- Education

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting