What is the AI for Security Compliance Market Size in 2026?

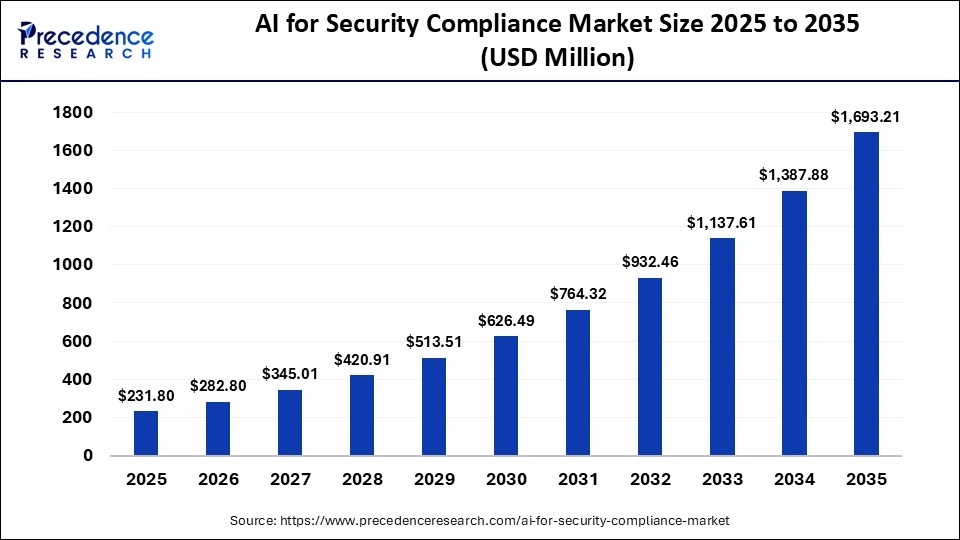

The global AI for security compliance market size was calculated at USD 231.80 million in 2025 and is predicted to increase from USD 282.80 million in 2026 to approximately USD 1,693.21 million by 2035, expanding at a CAGR of 22.00% from 2026 to 2035. The growth of the market is being driven by evolving regulatory standards and the increasing frequency of data breaches amid rapid digitalization across key industries.

Key Takeaways

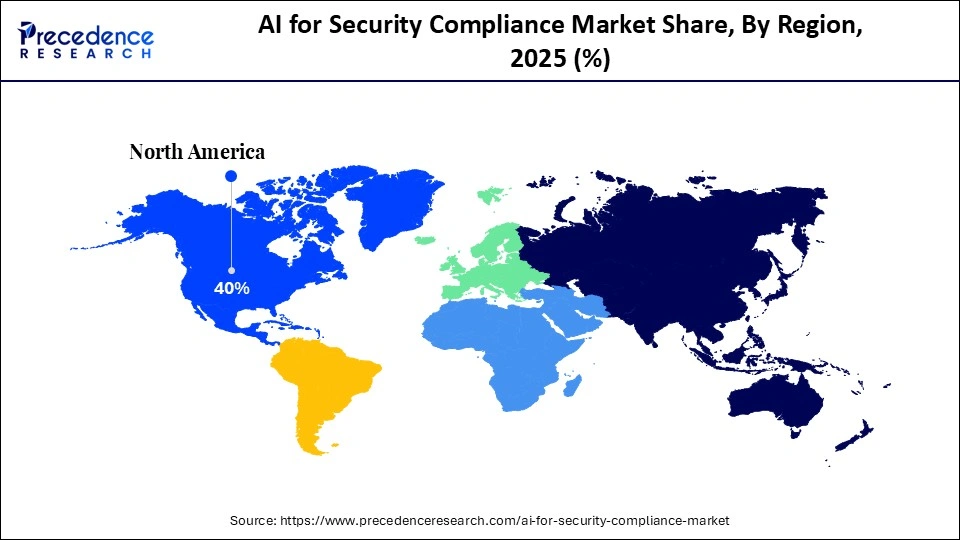

- North America held the largest market share of nearly 40% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR during the foreseeable period.

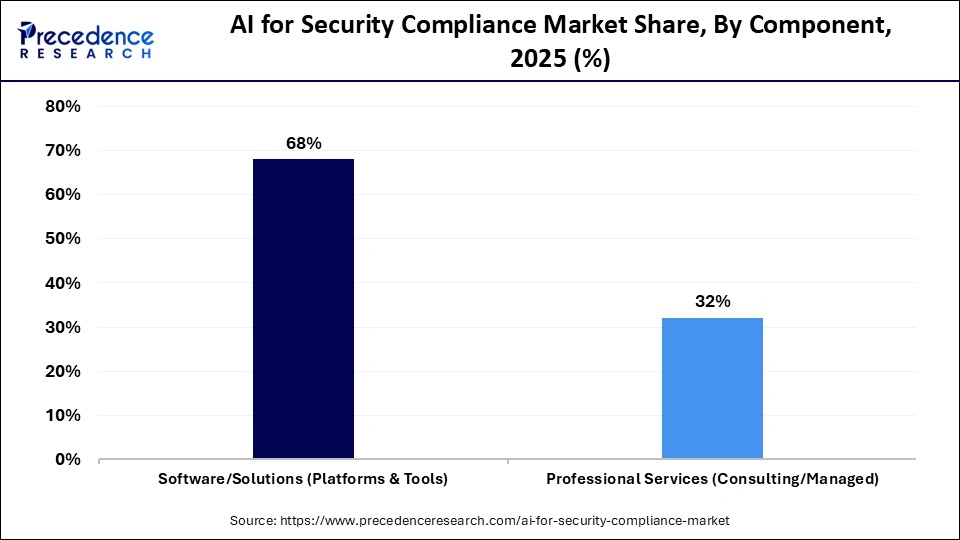

- By component, the software/solutions segment held the largest market share of nearly 68% in 2025.

- By component, the professional services segment is expected to grow at the fastest CAGR during the foreseeable period.

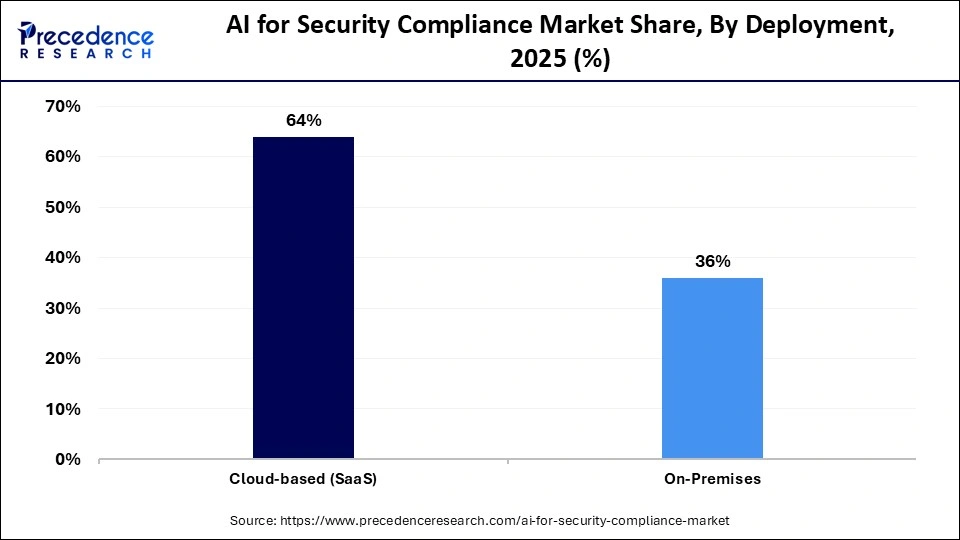

- By deployment, the cloud-based (SaaS) segment held the largest market share of nearly 64% in 2025.

- By deployment, the hybrid segment is projected to grow at the fastest CAGR during the foreseeable period.

- By organization size, the large enterprises segment held the largest market share of nearly 58% in 2025.

- By organization size, the SMEs segment is expected to grow at the fastest CAGR during the foreseeable period.

- By application, the governance, risk and compliance (GRC) segment held the largest market share of nearly 45% in 2025.

- By application, the AI security posture management segment is expected to grow at the fastest CAGR during the foreseeable period.

- By vertical, the BFSI segment held the largest market share of nearly 32% in 2025.

- By vertical, the healthcare and life sciences segment is expected to grow at the fastest CAGR during the foreseeable period.

Market Overview

The AI for security compliance market encompasses software platforms, tools, and services that utilize artificial intelligence, machine learning, and natural language processing to automate, monitor, and enforce regulatory and cybersecurity requirements. AI for security compliance is transforming traditional manual and periodic compliance activities into automated, continuous processes, reducing the need for constant human intervention while efficiently identifying and mitigating potential risks.

The market is rapidly expanding due to the growing number of global regulations, such as the EU AI Act, DORA, and GDPR, which require continuous monitoring and updates, tasks that manual processes cannot efficiently handle. AI technologies enable 24/7 monitoring, proactive threat detection, and automated compliance management, making them critical tools for organizations aiming to secure sensitive data and meet stringent regulatory requirements. Additionally, the increasing adoption of cloud-native environments amid massive data growth makes automated data classification and labeling essential for protecting sensitive information and ensuring regulatory compliance.

AI for Security Compliance Market Trends

There is rising integration of AI solutions in security compliance activities, enabling real-time, automated evidence collection, replacing traditional annual audits with continuous always-on audits that respond promptly to regulatory changes.

The rise of agentic AI and autonomous security is another key trend, where AI agents manage high-volume tasks such as remediation, reducing human intervention and improving operational efficiency.

AI security also incorporates shadow AI management to mitigate the risk of data leakage when employees use unauthorized large language models (LLMs); AI agents can detect such activities and prevent potential losses.

Organizations are increasingly demanding AI systems that provide transparent, defensible, and explainable audit trails, allowing them to remain competitive by offering clear, reliable information about their products and services to consumers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 231.80 Million |

| Market Size in 2026 | USD 282.80 Million |

| Market Size by 2035 | USD 1,693.21 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 22.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment, Organization, Application, Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Component Insights

Why Did the Software/Solutions Segment Lead the AI for Security Compliance Market?

The software /solutions segment led the market while holding the largest share of nearly 68% in 2025, as it offers a highly scalable, proactive, and continuously updated approach for a complex and continuously evolving regulatory environment. AI software offers 24/7 scanning of systems, which reduces dependency on annual audits and identifies unusual changes, patterns, and anomalies to predict risks before they escalate. Moreover, AI solutions hold the ability to make changes in a text according to the new regulatory laws in real-time and automatically update compliance protocols to prevent data breaches.

The professional services segment is expected to grow at the fastest CAGR during the foreseeable period due to its ability to manage large volumes of unstructured data in line with evolving regulatory requirements while providing human-in-the-loop oversight. As regulatory landscapes become increasingly complex amid rising data breaches, continuous 24/7 monitoring is essential, which is impractical for humans alone. Professional services leverage modern AI and large language models (LLMs) to analyze and automate massive unstructured datasets without requiring separate infrastructure, driving strong growth for this segment.

Deployment Insights

How Does the Cloud-Based Deployment Segment Dominate the AI for Security Compliance Market?

The cloud-based segment dominated the market with the largest share of nearly 64% in 2025 due to its unmatched capabilities, including high scalability for massive data processing, real-time continuous monitoring, and the infrastructure needed to process, analyze, and automate compliance tasks. Managing complex multi-cloud environments manually is highly challenging, making AI-powered, cloud-native solutions essential. Additionally, cloud AI can integrate petabytes of security data to detect anomalies and potential breach risks, while scaling efficiently during high-traffic scenarios, capabilities that traditional on-premises infrastructure cannot achieve.

The hybrid deployment segment is expected to grow at the fastest CAGR during the foreseeable period, as it addresses the need for high-speed AI processing while ensuring flexibility and strict compliance with data privacy regulations. This model allows organizations to retain sensitive information on-premises while leveraging cloud capabilities for other workloads, a balance that pure cloud deployment cannot achieve. By maintaining robust data security and compliance, hybrid deployment builds trust between consumers and providers and accelerates the adoption of advanced AI-driven security systems.

Organization Size Insights

Why Did the Large Enterprises Segment Lead the AI for Security Compliance Market?

The large enterprises segment held the largest market share of nearly 58% in 2025, as they need to handle complex and multiple regulations with security frameworks for high-volume data, with substantial financial resources to invest in advanced and automated threat detection systems. Large organizations face severe complexities and high penalties for not properly following the evolving security regulations that may cause huge financial strain on these organizations. Thus, they are highly aware and keen to follow overlapping regulations like GDPR, EU AI Act, and US AI Act. Many large enterprises have established highly dedicated and AI-governed security systems to meet the evolving need for data scalability with robust security backup.

The SMEs segment is expected to grow at the fastest CAGR during the forecast period, as AI for security enables these organizations to shift from reactive to proactive security approaches, addressing evolving threats despite limited access to skilled professionals. SMEs are often targeted by phishing and other cyberattacks due to weaker security defenses, making AI-driven solutions essential. Additionally, AI reduces the time and resources required per user by providing tailored, automated security packages without heavy investment, allowing SMEs to strengthen defenses and support business growth.

Application Insights

What Made Government, Risk and Compliance the Dominant Segment in the Market?

The governance, risk and compliance segment dominated the AI for security compliance market with the largest share of nearly 45% in 2025 due to the growing complexity of regulatory requirements and the increasing volume of sensitive data that organizations must manage. AI-powered GRC solutions enable continuous monitoring, automated evidence collection, and real-time risk assessment, reducing reliance on manual audits while ensuring adherence to evolving regulations. Additionally, these platforms enhance transparency and fairness by providing explainable, bias-mitigated decisions, helping organizations mitigate financial and reputational risks, which has driven widespread adoption and the segment's leadership.

The AI security posture management segment is expected to grow at the fastest CAGR in the upcoming period, as it addresses dynamic AI-specific risks such as prompt injection, shadow AI, and data poisoning, which traditional security tools cannot mitigate. AI security posture management acts as a supervisor across cloud environments, discovering all AI models, training data, APIs, and pipelines. It also detects unauthorized tools and ensures compliance with security protocols, making AI security posture management a critical and rapidly growing application in the market.

Vertical Insights

Why Does the BFSI Sector Lead the AI for Security Compliance Market?

The BFSI segment led the market by holding the largest share of nearly 32% in 2025 due to the massive amount of data generated by the BFSI sector, which AI is able to analyze, process, and mold as per evolving regulatory standards. The BFSI sector is rapidly adopting agentic AI capabilities more than any other sector to support maximum operational efficiency and accuracy. The rapid shift toward digitalization has created a surge in applications of mobile banking and online transactions that need to be done securely, as they are highly susceptible to unauthorized access. Hence, the BFSI sector is an early adopter of AI for security compliance, especially to mitigate security issues regarding biometric issues and deepfake detection.

The healthcare and life science segment is expected to grow at the fastest CAGR during the foreseeable period due to the rapid digitalization of healthcare records that are susceptible to ransomware attacks, which creates an urgent need to adopt robust and 24/7 security measures to comply with strict data protection laws like GDPR and HIPAA to ensure the data privacy of individuals. Medical records are highly sought on the dark web, making the healthcare sector a major target for cybercriminals to steal data and disrupt ongoing services. This forces healthcare organizations to leverage advanced AI tools for real-time threat detection, fueling the segment expansion.

Regional Insights

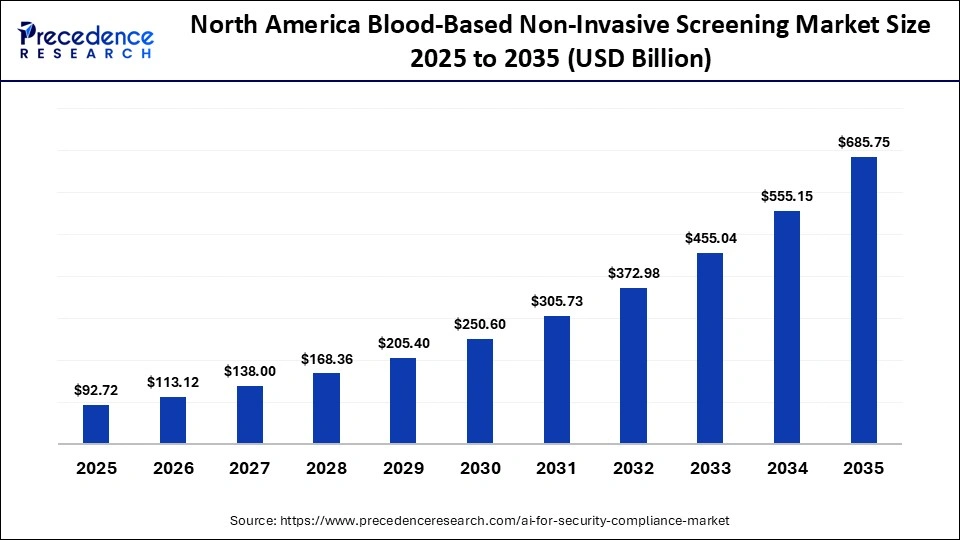

How Big is the North America AI for Security Compliance Market Size?

The North America AI for security compliance market size is estimated at USD 92.72 million in 2025 and is projected to reach approximately USD 685.75 million by 2035, with a 22.15% CAGR from 2026 to 2035.

What Made North America the Leading Region in the AI for Security Compliance Market?

North America led the market by holding the largest share of nearly 40% in 2025, driven by several factors including stringent data security regulations, such as the California Consumer Privacy Act, and rising cyber threats amid increasing AI adoption across key sectors like defense, healthcare, and BFSI. The region is home to leading tech giants like Google, Microsoft, and IBM, which are leveraging AI-driven technologies and deploying AI-powered security solutions to manage massive datasets and complex threats. Additionally, high availability of venture capital funding and increased R&D spending are accelerating the implementation of advanced AI security solutions across North America.

What is the Size of the U.S. AI for Security Compliance Market?

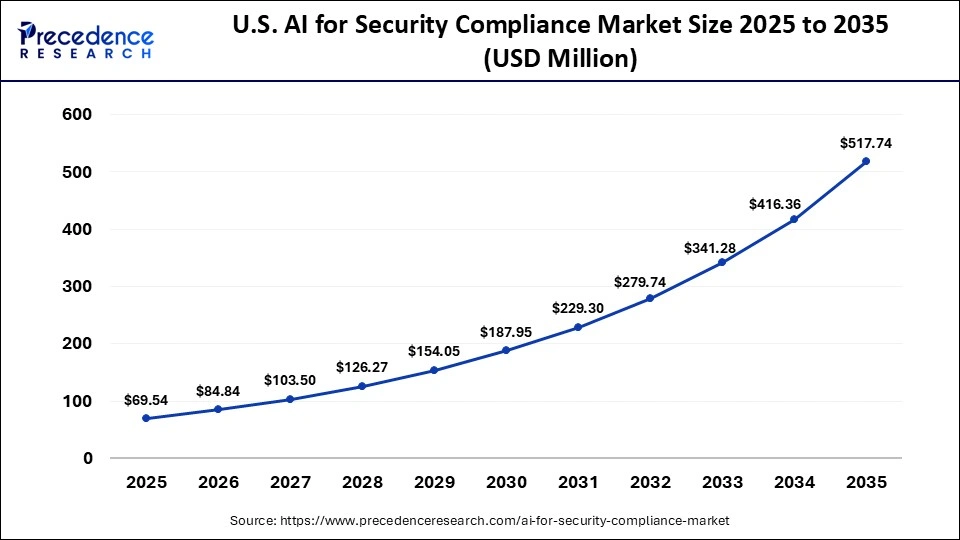

The U.S. AI for security compliance market size is calculated at USD 69.54 million in 2025 and is expected to reach nearly USD 517.74 million in 2035, accelerating at a strong CAGR of 22.23% between 2026 and 2035.

U.S. AI for Security Compliance Market Analysis

The U.S. is recognized as a leading contributor to the North American AI for security compliance market. This is due to its active investment and strategic initiatives to implement AI for managing security threats across sectors. For instance, the U.S. Department of Energy (DOE) announced nearly $320 million to advance AI capabilities for science and security, including AI-driven cybersecurity solutions designed to proactively protect AI systems across industries, reinforcing the country's leadership in the market.

For instance, in January 2026, the U.S. Department of Commerce's NIST collaborated with the non-profit MITRE Corp to ensure leadership in AI and secure U.S. infrastructure from cyberattacks and seamless delivery of AI-driven technology solutions.

What Makes Asia Pacific the Fastest-Growing Region in the AI for Security Compliance Market?

Asia Pacific is expected to grow at the fastest CAGR during the foreseeable period due to escalating cyberattacks amid rapid digitalization initiatives supported by governments. There is increasing adoption of emerging technologies like IoT and cloud computing, which generate massive volumes of sensitive data that must be protected from cybercriminals. Many countries in the region are focusing on building robust AI-driven security infrastructures for key sectors such as BFSI, healthcare, and communications to strengthen national cybersecurity, ensure compliance with evolving regulatory frameworks, and support the safe deployment of AI technologies.

China AI for Security Compliance Market Analysis

China leads the Asia Pacific AI for security compliance market due to massive data generation, significant investments in computing infrastructure, and strict regulations such as the Personal Information Protection Law, which compel organizations to adopt AI-driven security solutions. National initiatives like Eastern Data, Western Computing have further accelerated market growth by promoting large-scale deployment of AI security infrastructure across industries, reinforcing China's position as the key market contributor.

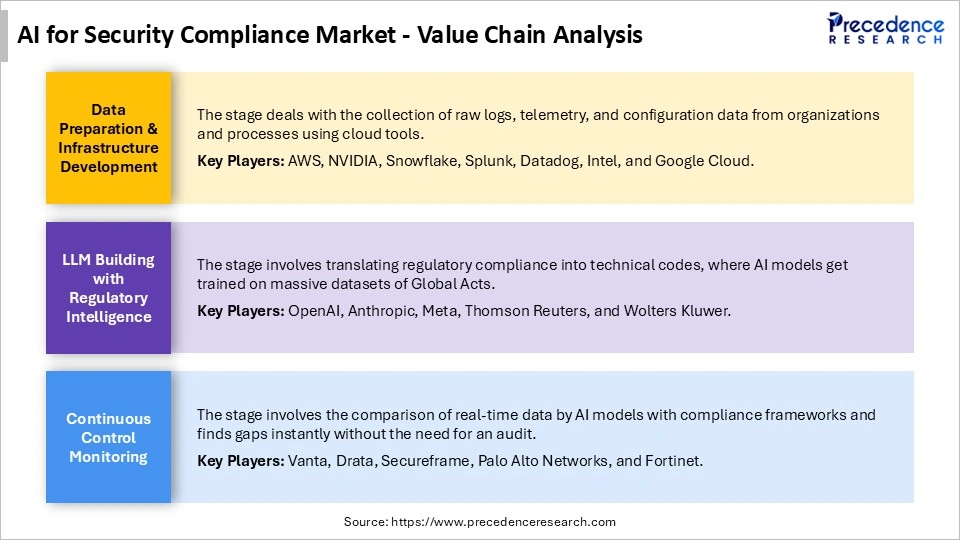

AI for Security Compliance Market Value Chain Analysis

Top Companies in the AI for Security Compliance Market

- IBM Corporation (OpenPages/Watson)

- Microsoft Corporation (Purview/Azure AI)

- Palo Alto Networks (Cortex/Prisma)

- CrowdStrike Inc. (Falcon Compliance)

- Splunk Inc. (Cisco)

- ServiceNow, Inc. (Risk Management)

- OneTrust, LLC

- AuditBoard

- MetricStream

- Drata Inc.

- Vanta Inc.

- Sprinto

- Check Point Software Technologies

- SentinelOne

- Qualys, Inc

Recent Developments

- In February 2026, a leading marketer, Oracle, collaborated on AI data center security with Bastille Networks. Oracle is leveraging wireless airspace defense platforms to offer real-time identification and monitoring of wireless activity developed by Bastille Networks.(Source: https://www.sdxcentral.com)

- In February 2026, Cisco launched a security portfolio to assist enterprises in securely adopting agentic AI, along with agent protection, interaction governance, and robust connectivity for AI-powered workflows.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Component

- Software/Solutions (Platforms & Tools)

- Professional Services (Consulting/Managed)

By Deployment

- Cloud-Based (SaaS)

- On-Premise

- Hybrid

By Organization

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Application

- GRC (Governance, Risk and Compliance)

- Threat Intelligence and Vulnerability Management

- Identity and Access Compliance (IGA)

- AI Security Posture Management (AI-SPM)

- Others

By Vertical

- BFSI (Banking, Financial Services)

- IT and Telecommunications

- Healthcare and Life Sciences

- Government and Defense

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting