What is the Alternative Financing Market Size?

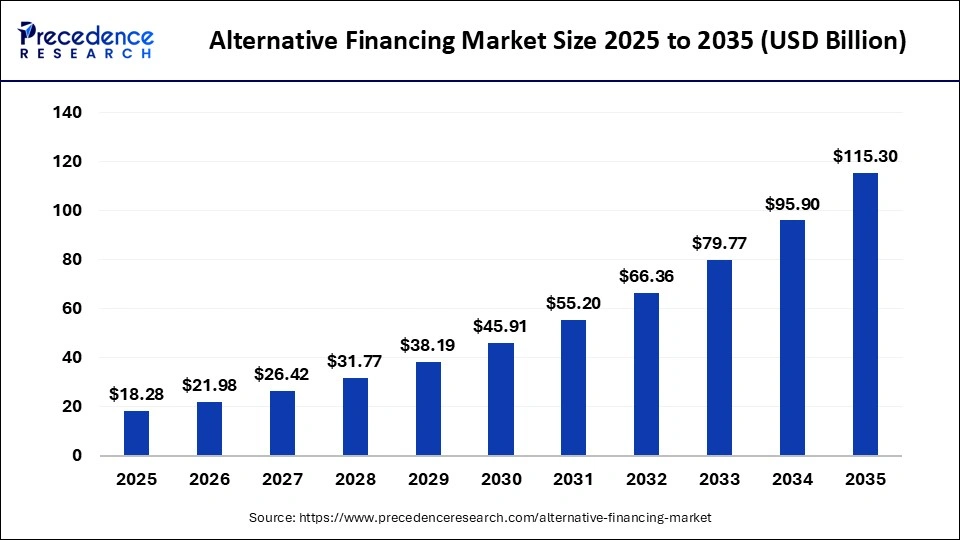

The global alternative financing market size is calculated at USD 18.28 billion in 2025 and is predicted to increase from USD 21.98 billion in 2026 to approximately USD 115.30 billion by 2035, expanding at a CAGR of 20.22% from 2026 to 2035. The alternative financing market is growing, driven by digital platforms, faster access to funding, underserved SMEs, flexible credit models, and increasing acceptance of non-bank financial solutions.

Market Highlights

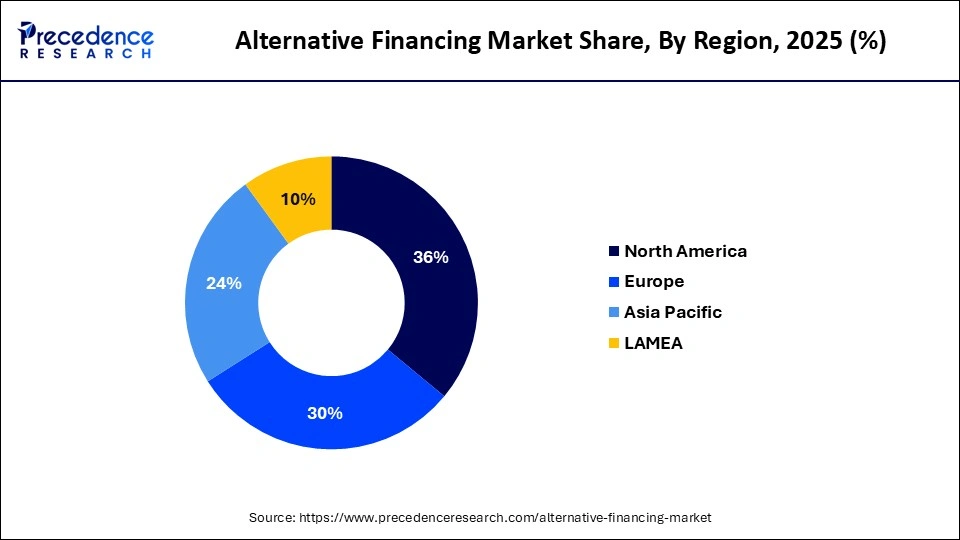

- North America led the alternative financing market with a largest market share of 36% in 2025.

- The Asia Pacific is expected to expand the fastest CAGR between 2026 and 2035.

- By model, the peer-to-peer lending segment captured the highest market share in 2025.

- By model, the crowdfunding segment is expected to expand with the highest CAGR between 2026 and 2035.

- By payment instruments, the credit transfer segment held a dominant market share in 2025.

- By payment instruments, the debit transfer segment is expected to expand fastest with a CAGR over the projected period 2026 to 2035.

- By end-user, the individual segment held the largest market share in 2025.

- By end-user, the business segment is expected to expand fastest with a CAGR from 2026 to 2035.

Alternative Financing: Redefining the Capital Access

Alternative financing refers to methods of raising capital outside traditional financial institutions. Examples include crowdfunding, peer-to-peer loans, invoice financing, and revenues. This market primarily serves small to medium-sized enterprises (SMEs), start-ups, and underserved borrowers who need faster, more flexible access to capital.

Digital platforms, data-driven credit assessments, and changing borrower preferences for faster access to capital and greater product customization are driving the growth of the alternative lending market. The opportunity for this market to grow stems from the lack of services offered by conventional lenders to early-stage companies and gig workers. Technology advancements such as Artificial Intelligence risk profiles and embedded financial technology (EFT) are improving the underwriting process by enabling scalability and greater efficiency. As regulations create an environment for greater transparency and safer new technologies and products, many new Fintech companies are focusing on specific market niches, providing tailored solutions.

Can Alternative Finance be Democratized Utilizing the Power of AI on a Large Scale?

The use of artificial intelligence (AI) in alternative finance enables smarter underwriting, dynamic pricing models, and fraud-detection mechanisms, allowing for quicker decision-making for underserved borrowers and better access to credit products. The interest from investors, as well as record Fintech investment in 2025, have helped spur the rapid deployment of AI- and automated lending products that automate financial services processes. Many digital and P2P lenders in the most prominent financial markets have begun integrating machine learning credit scores and other alternative data to increase acceptance rates while optimizing portfolio management and default monitoring practices.

In October 2025, fintech company SecureLend launched a first-of-its-kind AI platform intended to automate business lending and working capital workflows for banks and other investors. As the market continues to grow, both policymakers and regulators have established guidelines for resAInsible ai and inclusionary practices to strike a balance between innovation and consumer protection. Ultimately, success will be determined by both the level of transparency and the quality of data associated with the credit models being created, as well as their inherent fair access to emerging and established markets.

Alternative Financing Market Trends

- The Digitalisation of Platforms: Alternative platforms are becoming digitised through technologies such as artificial intelligence, big data, and automation. This allows alternative platforms to implement improved credit evaluations, speed up approval processes, reduce operating costs, and achieve a quicker, more tailored borrower-lender matching capability.

- The Increase in SME Financing: Small and Medium Enterprises (SMEs) are increasingly utilising alternative financing platforms to obtain access to capital faster, with less collateral and a greater level of flexibility in repayment than what is offered by traditional lending institutions.

- An Increase in Investor Participation: The retail and institutional investment community is also participating more with alternative financing platforms. By investing in these platforms, they have the opportunity to create a more diverse portfolio, gain greater transparency into expected returns on their investments, and invest in previously underserved borrowers.

- Evolution of Regulatory Framework: The emergence of clear regulatory guidelines and rules developed by government and regulatory agencies, providing greater transparency for both lenders and borrowers, will improve trust in the alternative financing market. Increased regulatory scrutiny will also improve risk management practices for both lenders and borrowers.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 18.28 Billion |

| Market Size in 2026 | USD 21.98 Billion |

| Market Size by 2035 | USD 115.30 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 20.22% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Model, Payment Instruments, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Model Insights

Why is Peer-to-Peer Lending the Largest Shareholder of the Finance Industry?

Peer-to-peer lending is the leading alternative finance market in 2025 because of its direct lending model between borrowers and lenders, quick processing times, and competitive interest rates. Digital platforms have created an efficient credit risk assessment process and also use a data-driven approach to give more people access to borrowing opportunities than ever before. With the highest levels of transparency, predictable returns for lenders, and extremely high acceptance among personal lending consumers and small borrowers, peer-to-peer lending will retain its dominant position in both developed and developing countries.

Crowdfunding is the fastest-growing model within alternative finance; it funds a range of financing options, including equity, rewards, and donations. Crowdfunding has gained popularity because the startup economy continues to grow, with one million today, and social-impact initiatives creating tremendous demand for capital mobilization through digital engagement and social integration to build a strong presence on crowdfunding platforms. Crowdfunding is emerging as a strong funding alternative for start-up ventures and community-based initiatives.

Payment Instruments Insights

Why Are More People Using Credit Transfers For Payments Than Other Types Of Payments?

The most dominant payment method in alternative finance is credit transfers. Credit transfers are secure, traceable, and easy to use for large amounts. Lending and investing platforms prefer credit transfers for loan funding and repayments, due to lower settlement risk and the ease with which lenders across national borders can use them. As integrated banking APIs and real-time payment systems continue to grow, they will play a larger role as the dominant payment method on lending and investing platforms.

Debit transfers are becoming the fastest-growing payment instrument because they enable auto-recurring payments, which help create more predictable cash flow. In addition, their low transaction costs and ease of implementation make them ideal for subscription-based financing and microfinance businesses. Increased consumer comfort with automated debit payment options, as well as regulated digital mandates (regulatory support), is driving greater adoption of peer-to-peer lending and crowdfunding platforms.

End User Insights

What Is The Reason For Individual Dominance In Alternative Financing Demand?

Individual end user segment is dominating the alternative financing market. Demand for personal loans, education financing, medical expenses, and debt consolidation is a major driver and the largest force in the alternative financing market. The strong adoption is limited access to traditional banking, faster digital onboarding, and flexible repayment options. Platforms tailor offerings using credit analytics and mobile access, making alternative finance especially appealing to technology-savvy consumers and underserved populations.

Regarded as the fastest-growing segment among end users, businesses are flocking to alternative finance in record numbers, with SMEs and startups opting for non-bank sources of funding to secure working capital and expansion financing. Alternative finance enables quicker access to much-needed financing, with less collateral required and a more tailored approach to structuring. It is these very drivers of increase in growth, with their entrepreneurial vigor, growth in e-commerce, and short-term liquidity solutions demand, that have contributed to the rapid uptake of alternative finance among SMEs across the world.

Regional Insights

How Big is the North America Alternative Financing Market Size?

The North America alternative financing market size is estimated at USD 6.58 billion in 2025 and is projected to reach approximately USD 42.08 billion by 2035, with a 20.39% CAGR from 2026 to 2035.

Why Is North America the Top Region for Alternative Financing?

North America has established itself as the top region for alternative finance. North America has an advanced digital finance ecosystem, a high level of fintech adoption, and nonbank financial institutions play a major role in delivering credit. Additionally, North America has shifted away from branch banking, with financial institutions migrating to a digital-first approach for lending and payment processing. These business models align well with consumer and small- and medium-sized enterprise (SME) financing, with marketplace lending, buy now pay later (BNPL), and unsecured consumer credit from FinTechs becoming entrenched in both formats. Digital literacy rates are high, and North America has an established data infrastructure, complemented by mature regulatory and supervisory structures, thus enabling the large-scale deployment of alternative financing while maintaining the resilience of the financial system.

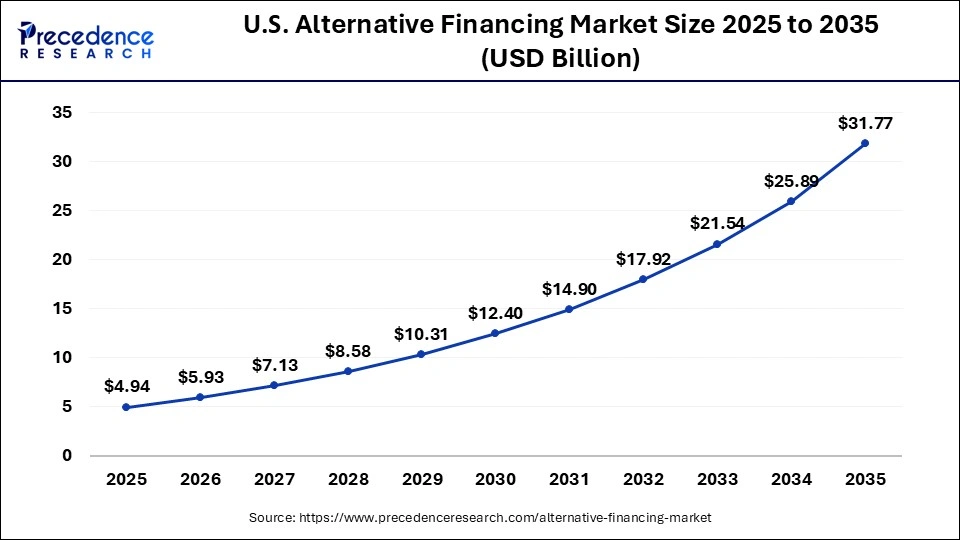

What is the Size of the U.S. Alternative Financing Market?

The U.S. alternative financing market size is calculated at USD 4.94 billion in 2025 and is expected to reach nearly USD 31.77 billion in 2035, accelerating at a strong CAGR of 20.46% between 2026 and 2035.

U.S. Alternative Financing Market Trends

The U.S. is the leader in North America as FinTechs in the U.S. surpassed the number of personal loan origination through traditional institutions by 2024, as evidenced by FAS data. A major reason for FinTech's success is that nonbank lenders use alternative data and automate their processes to expand access to credit for consumers and SMEs. These lenders also offer BNPL and evolve fintech digital payment mechanisms to increase penetration levels throughout North America. Between 2017 and 2024, FAS data indicate that the intensity of digital transactions in advanced economies remained consistently high, and that mobile and internet banking are widely used.

Why Is the Asia Pacific Experiencing the Fastest Growth of the Alternative Financing Market?

Emerging economies in the Asia-Pacific are becoming the fastest-growing regions for alternative financing. As nations rapidly expand digital finance infrastructure to support new infrastructure projects and promote additional international capital flows, many countries in the Asia-Pacific have also implemented significant new policies to increase alternative financing. China's recent pilot project approving green financing for XML purposes is an example of how many governments are facilitating access to international capital to meet their countries' strategic requirements by allowing businesses to move away from dependence on traditional banking systems and offering a broader selection of financial products.

In addition, the ability for businesses in the region to access a broad range of funding through an interconnected network of financing providers is facilitating a strong growth trajectory of alternative financing integration and depth, resulting in the fastest-growing sector in alternative financing in the world when compared to developed markets, where alternative financing is at a more normalized level.

India Alternative Financing Market Trends

The rise of alternative finance in India will be supported through government-proposed funding mechanisms for Micro, Small, and Medium Enterprise (MSME) exporters, including export factoring, supply chain loans, and trade credit insurance. These programs are designed to alleviate collateral issues, enhance working capital for both pre-shipment and post-shipment, and reduce reliance on traditional lenders, thereby improving exporters' resilience and ensuring transaction continuity.

How Europe Is Entering a New Era of Alternative Financing?

Digital platforms and institutional investors are aiding the development of Europe's quarter-of-a-trillion-euro alternative financing sector by providing additional channels to raise money beyond traditional banks, through Project Capital Fund Investors.

The growth in this sector has put more private investor funds into European funds than ever before, as larger institutional investors are allocating more money to private equity and real assets while making more of a move toward div portfolioortfolion in traditional bank financing. Continued development in fintech and a movement towards harmonisation of regulatory frameworks across Europe have aided this growth, but fragmentation remains a problem in some instances.

Germany Alternative Financing Market Trends

Germany is a leader in the alternative finance sector in Europe. For instance, direct lending rose above previous-year volumes in 2025 due to shifts in investor perception, attractive interest rate levels, and the steady growth of infrastructure finance. From November 2025, Finom offers Credit Lines to SMEs via an Independent Investment Fund in Germany and throughout Europe. These facilities range between €2,000-50k. In doing so, Finom can support the funding needs of the Mittelstand with fast access to credit lines that traditional banking cannot.

Why Is the Middle East & Africa Region Accelerating the Use of Alternative Financing Market?

Due to geographic, social, and economic factors, the Middle East and Africa are emerging as an important market for alternative finance solutions. The alternative finance sector in the Middle East is enabled by sovereign-backed development initiatives, fintech-friendly regulations, and an increase in private-sector credit activity, allowing new lending options to emerge through non-traditional capital sources (such as crowdfunding).

Similarly, the African alternative finance market is driven by ongoing credit shortages in the SME sector, currency volatility, and underdeveloped capital markets. The increasing adoption of digital payments and participation by regional investors have led to greater access to credit through alternative finance, creating a new source of liquidity for SMEs and the trade finance sector.

UAE Alternative Financing Market Trends

The UAE has emerged as a leader in this region due to its progressive approach to fintech regulations, strong connections to cross-border investors, and a growing ecosystem of private credit and digital lending solutions. The UAE can leverage its role as a regional financial centre to expand into trade finance, SME lending, and structured credit products aligned with the regional economy's growth priorities.

Why Alternative Financing Is Gaining Momentum in Latin America?

With significant gaps in funding availability for small and mid-sized businesses, high financial costs, and the inability of SMEs to access traditional banking services, there is an overwhelming demand for alternative funding, such as that provided by fintech, digital loan companies, and alternative lenders. Regulatory changes in key markets, digital payment infrastructure, and increased demand from investors are all driving further growth in the business funding industry. These factors will help drive the expansion of alternative funding companies throughout Latin America, and, as a result, they will play a key role in enhancing SMEs' access to credit across the region.

Brazil Alternative Financing Trends

The country that leads in the region is Brazil, primarily due to its sophisticated digital payments infrastructure, expanding open-finance regulatory framework, and high rates of fintech adoption among SMEs. A significant number of large digital lenders and marketplace lending companies offer a wide range of alternative funding choices for SMEs in Brazil and Latin America, making Brazil the center of innovation in business funding and the country where new ideas are being developed.

Top Key in Players Alternative Financing Market

- CircleUp Network, Inc.

- LendingClub

- Kiva

- OnDeck

- Upstart Network, Inc.

- SukFin

- eCapital

- Paro, Inc.

- Tala

- Funding Societies

- Bitbond

- Indifi

- FairMoney

- Funds, Inc.

- Ant Group

- Dianrong

Recent Developments

- In June 2025, Fenchurch Legal unveils a secured litigation funding strategy for fixed-income investors, offering a diversified portfolio of secured law firm loans with predictable quarterly interest payments as an alternative to traditional income markets amid volatility.

- In April 2025, Redsquid, a fast-growing MSP, partners with alternative finance provider ThinCats to accelerate its acquisition strategy and expand its UK footprint, supporting rapid mergers and purchases.(Source: https://technologyreseller.uk)

- In November 2025, Nomura commits $150m to anchor Park Square Capital's U.S. senior direct lending fund under a strategic private credit alliance, enhancing underwriting capabilities and expanding mid-market lending solutions.

Segments Covered in the Report

By Model

- Peer-to-Peer Lending

- Crowdfunding

- Invoive Trading

- Others (Balance Sheet Lending)

By Payment Instruments

- Credit Transfers

- Debit Transfers

- Cash

- Cheques

- Cryptocurrency Wallets

- E-Money

By End-user

- Individual

- Businesses

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting