What is the Anti-counterfeit Packaging Market Size?

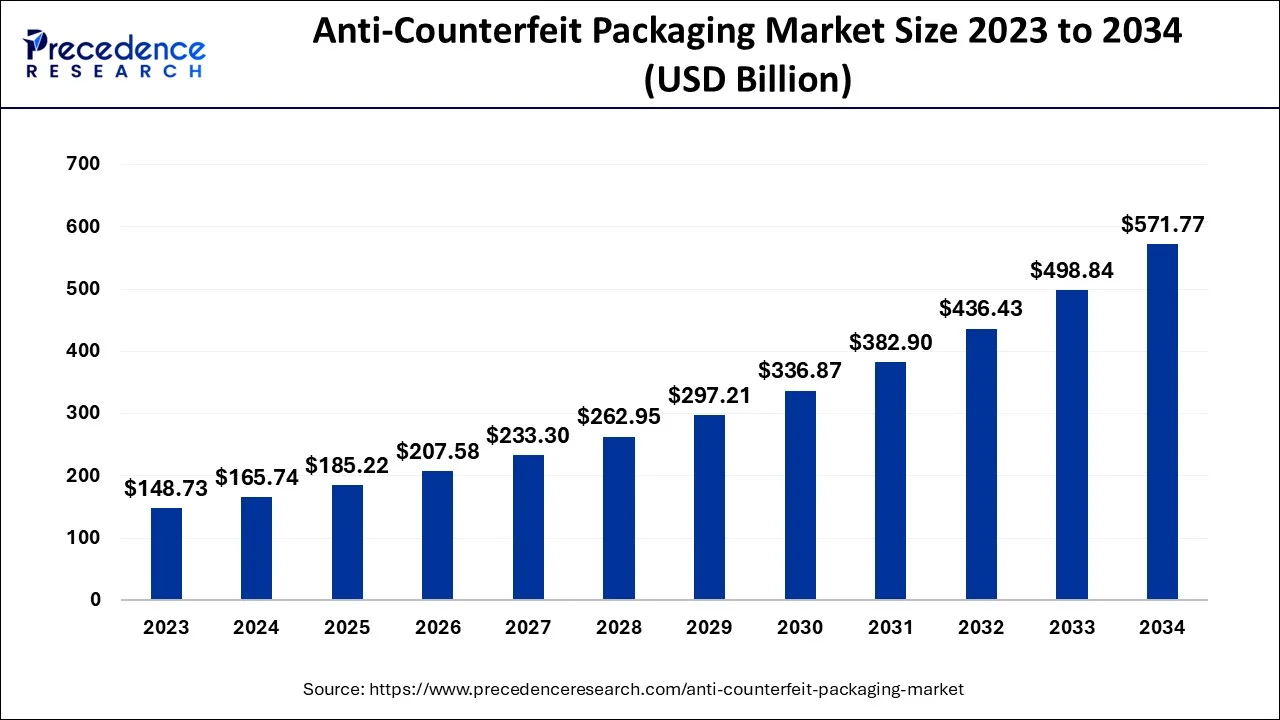

The global anti-counterfeit packaging market size accounted for USD 207.58 billion in 2025 and is predicted to increase from USD 233.30 billion in 2026 to approximately USD 717.63 billion by 2035, expanding at a CAGR of 13.21% between 2026 to 2035. The anti-counterfeit packaging market growth is fueled by several factors, including the increasing need for brand protection solutions in the pharmaceutical sector and the enhanced ability to monitor products across the supply chain. Moreover, concerted efforts by governments and corporations globally to combat counterfeiting activities, driven by concerns for both brand integrity and consumer safety, are anticipated to propel the demand for anti-counterfeit packaging at a notable pace throughout the forecast period.

Anti-counterfeit Packaging Market Key Takeaways

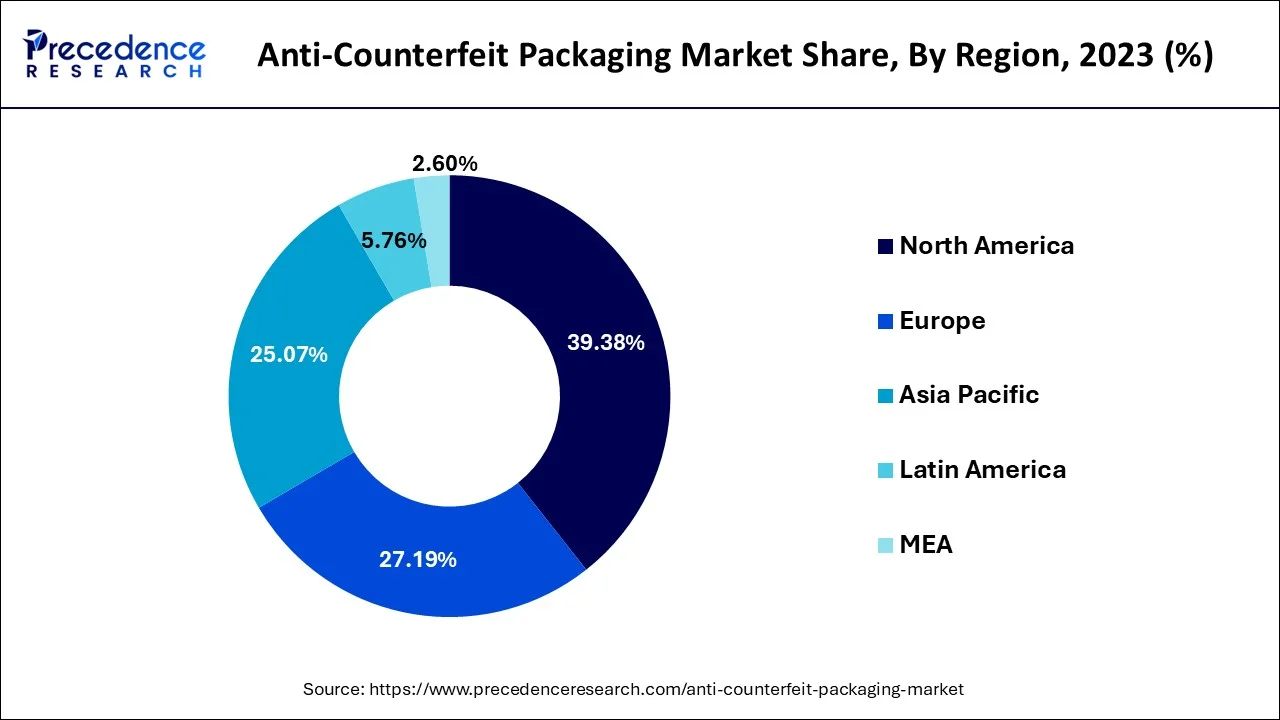

- North America captured more than 39.25% of the revenue share in 2025 and is expected to expand at a CAGR of 12.79%.

- By end user industry, the Healthcare and Pharmaceuticals segment accounted for a considerable share of the market in 2025.

- By end user industry, the consumer electronics segment is expected to grow at the fastest rate in the market during the forecast period.

- By packaging format, bottles led the market in 2025.

- By packaging format, flexible packs are projected to experience the highest growth rate through 2035.

- By technology, trace and track systems dominated the anti-counterfeit packaging market in 2025.

- By technology, forensic marketers are anticipated to experience the fastest growth in the market during the forecast period to 2035.

Market Overview

Anti-counterfeit packaging refers to packaging solutions that are designed to prevent the production and sale of counterfeit products. Counterfeit products are produced and sold under the guise of being authentic products. Anti-counterfeit packaging is designed to prevent such practices by making it difficult or impossible for counterfeiters to replicate the packaging of genuine products.

The anti-counterfeit packaging market has been growing rapidly in recent years due to the increasing demand for counterfeit protection in various industries such as pharmaceuticals, food and beverage, consumer electronics, automotive, and luxury goods. The market is driven by factors such as rising concerns regarding product safety and authenticity, government regulations mandating the use of anti-counterfeit packaging, and the growing demand for high-quality packaging solutions.

Anti-counterfeit packaging solutions can include various features such as holograms, security inks,RFIDtags, tamper-evident seals, and unique product identification codes. These features are designed to make it difficult for counterfeiters to replicate the packaging of genuine products and make it easy for consumers to verify the authenticity of the products they are purchasing. The anti-counterfeit packaging market is highly competitive, with numerous companies offering a range of solutions to meet the needs of different industries.

Artificial Intelligence: The Next Growth Catalyst in Anti-counterfeit Packaging

AI is fundamentally transforming the anti-counterfeit packaging industry by providing sophisticated, scalable, and proactive solutions that surpass traditional methods. Machine learning (ML) algorithms and computer vision systems enable high-speed, real-time quality inspections on production lines, detecting minute defects or irregularities that humans often miss.

Furthermore, AI analytics ingests vast datasets from IoT devices, QR codes, and RFID tags to provide end-to-end supply chain visibility, flagging anomalies or suspicious shipment patterns indicative of counterfeit activity.

Market Outlook

- Market Growth Overview: The anti-counterfeit packaging market is expected to grow significantly between 2025 and 2034, driven by the boom in e-commerce, rising consumer awareness, and increasing investment to protect brand image.

- Sustainability Trends: Sustainability trends involve eco-friendly materials, material reduction, and sustainable, secure integration.

- Major Investors: Major investors in the market include 3M, Avery Dennison, CCL Industries, Zebra Technologies, DuPont, SICPA, SML Group, and Authentix

- Startup Economy: Startup economy focuses on innovation, agility, customization, and integration of cutting-edge digital technologies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 207.58 Billion |

| Market Size in 2026 | USD 233.30 Billion |

| Market Size by 2035 | USD 717.63 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 13.21% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Technology, By Packaging Format and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increase in the number of counterfeit products

- The key factors influencing the market are the rising incidence of imitation goods, the importance of safety and security, and government initiatives to combat counterfeiting. By employing anti-counterfeit packaging, businesses can protect their products from being misrepresented as belonging to competing companies. For example, high-end clothing firms imprint their logos on their apparel to prevent similar situations. Anti-counterfeit packaging is required by numerous businesses.

- The packaging industry is very broad, and as this trend spreads more widely, it is also expanding in the anti-counterfeit packaging sector. The use of uniform packaging may make it difficult for customers to determine whether a product is authentic. By using packaging technologies like holograms, RFID, and mass encoding, product duplication can be prevented.

Government regulations

- Governments in various countries are implementing strict regulations to prevent the sale of counterfeit products and to protect the interests of consumers. This has led to increased adoption of anti-counterfeit packaging solutions by companies to comply with these regulations.

Pharmaceuticals and healthcare to drive the market demand

- Counterfeit pharmaceuticals is One of the most valuable segments of global commerce in illegally copied items. Millions of individuals worldwide suffer damage and even death as a result of fake medications. It causes significant harm to the brands of major pharmaceutical makers. Recently, there have been several reports of fraudulent COVID vaccines being given to various nations' populations.

- For instance, the discovery of fake Covishield (produced by the Serum Institute of India) by the World Health Organization (WHO) raised serious concerns among all relevant parties. Also, Pfizer's fake vaccination vials were found in various locations both inside and outside of the United States. This has caused concern among consumers and the government, to overcome to this governments across regions are exercising laws to probability the use of counterfeiting medicines.

- Consumers and the government are both concerned about this, so to combat it, governments worldwide are enforcing rules that make the use of fake medications more likely. The market for counterfeit pharmaceuticals has expanded as a result of rising online pharmacy usage and the emergence of a new large-scale manufacturer of fake medications.

- The WHO estimates that approximately 50% of the pharmaceuticals for sale online are fraudulent. Furthermore, many fake goods are of poor quality and can harm a variety of sectors. For instance, U.S. Customs and Border Protection reports that in FY 2021, products worth USD 367.92 million were seized.

Restraints:

High Cost of Adoption

One of the most significant restraints is the high cost of adopting advanced anti counterfeit packaging technologies. Features such as RFID tags, forensic markers, or DNA based identifiers require sophisticated equipment, specialized materials, and integration into existing produ tion lines. For many small and medium sized manufacturers specially in sectors like food, cosmetics, or local pharmaceuticals the expense can be prohibitive. Beyond the upfront costs, or local pharmaceuticals the expenses for data management, authentication systems, and supply chain monitoring. This makes large scale deployment challenging outside of high value industries like luxury goods or defence. As a result, while awareness of counterfeit risks is increasing globally, cost pressures slow down widespread adoption, particularly in emerging markets where margins are thin.

Challenges

High cost of production and investment

- Anti-counterfeit packaging solutions can be expensive, especially for small and medium-sized companies. This can limit the adoption of these solutions, particularly in developing countries where cost is a significant factor. The market's need for fake goods is mostly driven by consumers' desire for low-cost goods. The majority of firms have been compelled to use new anti-counterfeiting tactics as a result of government regularisation.

- Several businesses today use classic counterfeiting techniques since it is expensive to produce new packaging technology. Furthermore, investors frequently oppose the development of new technologies because they could lead the company to suffer a greater loss.

Lack of awareness

- Although there is an increasing awareness about the need for anti-counterfeit packaging solutions, there is still a lack of awareness among some companies and consumers. This can limit the adoption of these solutions, particularly in industries that are less exposed to counterfeiting activities.

- The main problem for companies that make anti-counterfeit packaging is to educate consumers about how to use these technologies to determine the creativity of the product. To prevent counterfeiters from copying these characteristics, businesses must surreptitiously notify consumers about the technologies. However, the creation of these solutions draws significant expenditure, which hinders the industry's expansion.

Opportunities

Growing demand from emerging markets

- Emerging economies like China and India are creating new opportunities for the anti-counterfeit packaging sector. Urbanization, an increase in the number of middle-class people, and increased disposable incomes will all contribute to a rise in demand for anti-counterfeit packaging. In China and India, internet sales have considerably expanded. The world is now more susceptible to counterfeiting due to the volume of items that the same number of people carry and handle every day.

- By weakening anti-counterfeit packing materials, forgers and counterfeiters have made it simpler to carry fake goods. Due to significant expansion in vital industrial industries including pharmaceuticals, apparel and clothing, food and drinks, and agriculture in emerging economies, the packaging industry has great potential to establish a foundation and grow its operations. This presents an opportunity for anti-counterfeit packaging companies to expand their operations and cater to the growing demand.

Adoption of smart packaging solutions.

- The integration of smart packaging technologies such as RFID, NFC, and QR codes can provide an additional layer of security and help to prevent counterfeiting activities. This presents an opportunity for the development of more sophisticated anti-counterfeit packaging solutions.

Segment Insights

Technology Insights

Within packaging formats, bottles emerged as the leading segment in 2024, capturing nearly 29% of the total market share. This dominance is attributed to their widespread use in industries such as pharmaceuticals, beverages and personal care, where counterfeit products have a strong foothold. Bottles are relatively easier to modify with advanced packaging technologies like holographic seals, unique barcoding tamper evident closures, which boosts their adoption across sectors where safety and trust are paramount. Their role in assuring both physical protection od contents and authentication against counterfeiting makes them the preferred format for many manufacturers.

On the other hand, flexible packaging formats such as pouches, sachets, and wrappers are projected to register the fastest growth, with an expected CAGR of nearly 17% through 2030. This rapid rise is supported by the growing popularity of lightweight, cost efficient, and sustainable packaging in food, cosmetics, and personal care products. The flexibility of sign in these formats makes it easier to integrate advanced anti counterfeit features such as embedded codes, NFC tags, and invisible inks. With the expansion of direct to consumer retail channels and small, portable packaging formats, counterfeit risks in flexible packs are increasing, thereby driving the demand for advanced protection solutions.

End User Insights

The end user industry is a crucial driver of demand in the anti-counterfeit packaging market, with healthcare and pharmaceuticals emerging as the dominating segment in 2024. Pharmaceutical companies face mounting challenges from counterfeit drugs, which not only erode brand trust but also pose significant risks to consumer safety. To address this, manufacturers are investing heavily in authentication solutions such as serialization, tamper evident seals, and traceability systems, making this sector account for over 30% of the market share in 2024. In addition to regulatory mandates from authorities such as the FDA and the European Medicines Agency, the growing reliance on globalization supply chains has further accelerated the adoption of advanced packaging solutions in pharmaceuticals.

Looking ahead, the consumer electronics sectors is expected to be the fastest growing end user industry segment, projected to at a CAGR of over15% during the forecast period. This rapid growth is driven by the increasing prevalence of counterfeit consumer gadgets, accessories, and semiconductors, which threaten both manufacturers and end users. Companies in this space are turning to RFID, QR codes, and digital traceability solutions to protect product integrity. Rising e-commerce penetration and global distribution networks make electronics particularly vulnerable to counterfeiting, fuelling a stronger push toward anti counterfeit packaging solutions in the coming years.

Anti-Counterfeit Packaging Market Revenue, By End-User, 2022-2024 (USD, Bn)

| End Users | 2022 | 2023 | 2024 |

| Pharmaceuticals | 32.35 | 36.14 | 40.49 |

| Food and Beverage | 28.71 | 32.20 | 36.21 |

| Automotive | 15.50 | 17.05 | 18.81 |

| Personal Care | 17.48 | 19.34 | 21.47 |

| Electrical & Electronics | 11.33 | 12.52 | 13.88 |

| Luxury Products | 7.37 | 8.05 | 8.82 |

| Others | 21.11 | 23.42 | 26.06 |

Packaging Format Insights

Within packaging formats, bottles emerged as the leading segment in 2024, capturing nearly 29% of the total market share. This dominance is attributed to their widespread use in industries such as pharmaceuticals, beverages and personal care, where counterfeit products have a strong foothold. Bottles are relatively easier to modify with advanced packaging technologies like holographic seals, unique barcoding tamper evident closures, which boosts their adoption across sectors where safety and trust are paramount. Their role in assuring both physical protection od contents and authentication against counterfeiting makes them the preferred format for many manufacturers.

On the other hand, flexible packaging formats such as pouches, sachets, and wrappers are projected to register the fastest growth, with an expected CAGR of nearly 17% through 2030. This rapid rise is supported by the growing popularity of lightweight, cost efficient and sustainable packaging in food, cosmetics, and personal care products. The flexibility of sign in these formats makes it easier to integrate advanced anti counterfeit features such as embedded codes, NFC tags, and invisible inks. With the expansion of direct to consumer retail channels and small, portable packaging formats, counterfeit risks in flexible packs are increasing, thereby driving the demand for advanced protection solutions.

Regional Insights

What is the U.S. Anti-counterfeit Packaging Market Size?

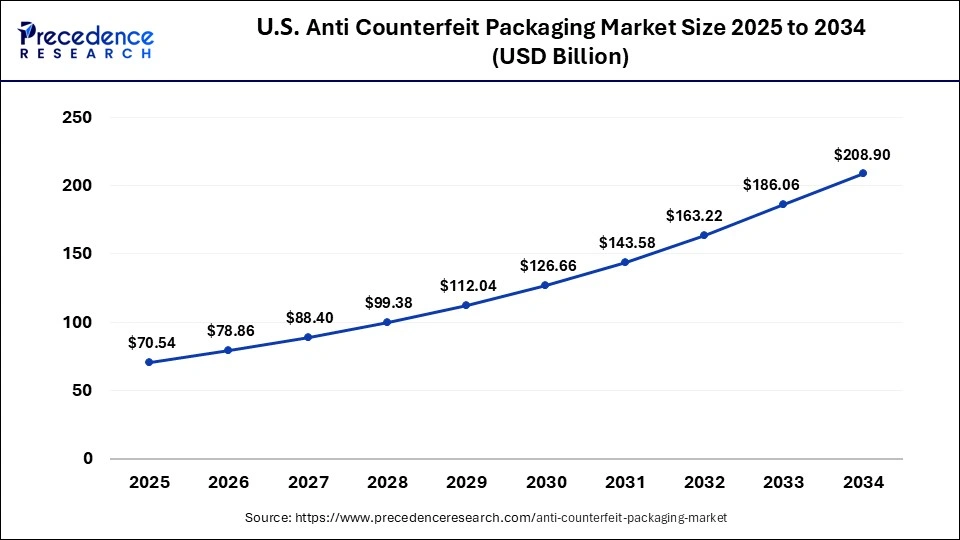

The U.S. anti-counterfeit packaging market size is estimated at USD 70.54 billion in 2025 and expected to be worth around USD 231.74 billion by 2035 with a CAGR of 12.63% from 2026 to 2035.

North America held the majority of the market share of around 39.38% in 2024. The anti-counterfeit packaging sector in North America is primarily driven by government measures to combat the counterfeit market in the United States and Canada. Product traceability is essential due to consumer desire for more accessibility.

U.S. Anti-counterfeit Packaging Market Trends

U.S.'s shift toward integrated security in the pharmaceutical sector, rising consumer demand for verified products, leading to the widespread adoption of smart packaging technologies such as QR codes, NFC, and RFID. Consequently, real-time tracking and mobile verification have become the new industry standard for maintaining brand integrity and consumer trust.

The enforcement of anti-counterfeiting laws has assisted in growing its market share. To facilitate item tracking and identification, manufacturers are gradually incorporating more sophisticated technologies into machines.

Asia-Pacific had the market's quickest growth rate in 2024 because companies there always come up with new ways to guarantee the quality of their products and follow stringent health and safety regulations. For instance, the fact that many pharmaceutical firms manufacture their products in China has prompted the country to take more proactive measures to safeguard customers from food and medical device fraud as well as phony drugs.

China Anti-counterfeit Packaging Market Trends

China's anti-counterfeiting market is expanding rapidly due to aggressive government serialization mandates and strict pharmaceutical regulations. The unprecedented boom in e-commerce has necessitated robust brand protection solutions to safeguard consumer trust and corporate revenue against sophisticated fake goods.

That implies that understanding product authenticity and anti-counterfeiting technologies like barcodes, holograms, labeling, and RFIDs is more crucial than ever (radio frequency identification).

- Europe anti-counterfeit packaging market size was valued at USD 44.85 billion in 2024, and it is expanding at a CAGR of 12.79% from 2025 to 2034.

- Asia Pacific anti-counterfeit packaging market size was estimated at USD 41.96 billion in 2024, and it is expanding at a CAGR of 14.25% from 2025 to 2034.

- Japan anti-counterfeit packaging market size reached USD 6.38 billion in 2024, and it is growing at a CAGR of 13.27% from 2025 to 2034.

- China anti-counterfeit packaging market size surpassed USD 17.60 billion in 2024 and is expanding at a CAGR of 14.84% from 2025 to 2034.

How did Europe experience notable growth in the Anti-counterfeit Packaging Market?

Europe's surge in e-commerce has significantly heightened vulnerability to counterfeit goods, making robust anti-counterfeiting packaging essential for maintaining brand trust across high-risk sectors like pharmaceuticals and luxury goods. Sustainability considerations are influencing innovation, with eco-friendly anti-counterfeit materials and solutions that balance security with recyclability becoming more important.

Germany Anti-counterfeit Packaging Market Trends

Germany's integration of AI and blockchain to secure critical supply chains in the pharmaceutical and automotive sectors. Strict compliance with the EU Falsified Medicines Directive and new serialization laws is driving a rapid shift toward high-tech traceability, specifically via RFID and NFC tags.

Value Chain Analysis of the Anti-counterfeit Packaging Market

- Research & Technology Development: This initial stage focuses on inventing and advancing new anti-counterfeiting methods, such as novel security inks, advanced holography, and digital authentication platforms like blockchain or AI.

Key Players: Applied DNA Sciences Inc., AlpVision SA, and SICPA Holding SA. - Material and Component Manufacturing: This stage involves the production of the physical components, like specialized labels, tags, films, and security inks, that will be integrated into the final packaging.

Key Players: Avery Dennison Corporation, CCL Industries Inc., 3M Company, and DuPont. - Packaging Production & Integration: Here, the security components are integrated into the actual product packaging, often during the manufacturing process.

Key Players: Zebra Technologies Corporation, SATO Holdings Corporation, and Atlantic Zeiser GmbH.

Anti-counterfeit Packaging Market Companies

- Avery Dennison Corporation contributes to anti-counterfeit packaging through the development of specialized materials, such as tamper-evident seals, smart labels using RFID and NFC technology, and holographic materials, which make products trackable and difficult to replicate.

- CCL Industries Inc. specializes in creating sophisticated, high-security label solutions, including overt and covert technologies like microtext, unique security inks, and holographic foils.

- Mettler Toledo International Inc. provides advanced inspection systems integral to anti-counterfeit packaging, such as high-precision checkweighers, metal detectors, and vision inspection systems that ensure product authenticity and compliance.

- SICPA SA provides highly specialized security inks and integrated systems that protect currency, excise goods, and products from counterfeiting.

- 3M Company contributes to the market with a wide array of security components, including customizable holograms, tamper-indicating materials, and advanced tracking solutions that help identify genuine products and indicate interference.

Other Major Key Players

- Hologram Industries

- Tesa SE

- HID Global Corporation

- DigiSeal Inc.

- Brandprotect GmbH

Recent Developments

- In late 2024, researchers unveiled a pioneering battery less smart packaging system capable of active monitoring and preservation of food freshness. This innovative packaging integrates a gas sensor, an NFC antenna, and a controlled release mechanism for antioxidant and antibacterial compounds. When spoilage begins to occur, the system autonomously triggers the release of protective agents, thereby extending food shelf life demonstrated effectively wish fish products, where shelf life extended by up to 14 days. This technology points to powerful future applications at the intersection of anti-counterfeit packaging and active quality control in the food industry.

(Source: [2501.14764] Battery-free, stretchable, and autonomous smart packaging) - In early 2025, a breakthrough in anti counterfeit labelling emerged from the realm of quantum optics: single molecule quantum coherence (SMQC) based disposable micro optical labels. These labels. These ultra-precise labels are printed via inkjet technology and authenticated via frequency domain imaging. Impressively, experimental and simulation results show a recognition accuracy consistently above 99.995%. This marks a leap in micro label security, creating virtually unclonable tags with extraordinary precision and could redefine high-stakes sectors needing unmatched packaging protection.

(Source: [2503.07113] High-accuracy disposable micro-optical anti-counterfeiting labels based on single-molecule quantum coherence)

Segments Covered in the Report

By Technology

- Holograms

- RFID

- Mass Encoding

- Forensic Markers

- Tamper Evidence

- Others

By Packaging Format

- Bottles & Jars

- Vials & Ampoules

- Blisters

- Trays

- Pouches & Sachets

- Tubes

- Syringes

By End-User

- Pharmaceuticals

- Food and Beverage

- Automotive

- Personal Care

- Electrical & Electronics

- Luxury Products

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting