Antimicrobial Plastics Market Size and Growth 2025 to 2034

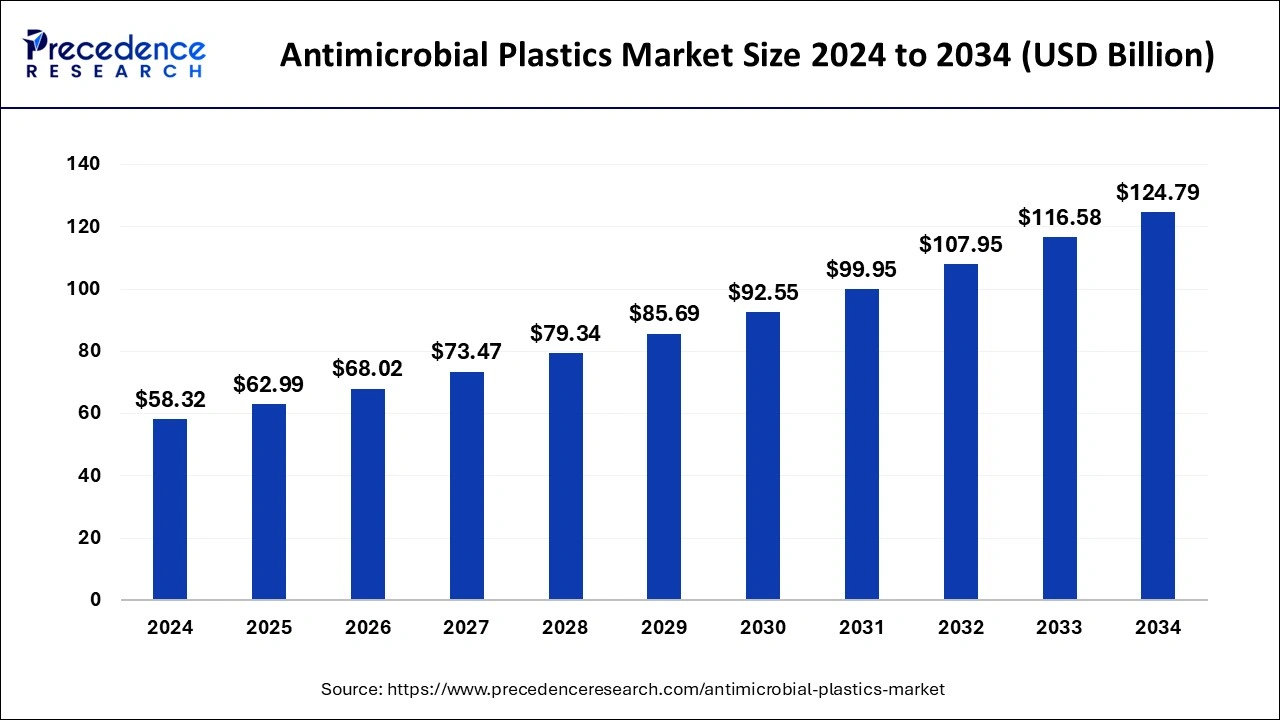

The global antimicrobial plastics market size was estimated at USD 58.32 billion in 2024 and it is expected to hit USD 124.79 billion by 2034 with a registered CAGR of 7.90% during the forecast period 2025 to 2034.

Antimicrobial Plastics Market Key Takeaways

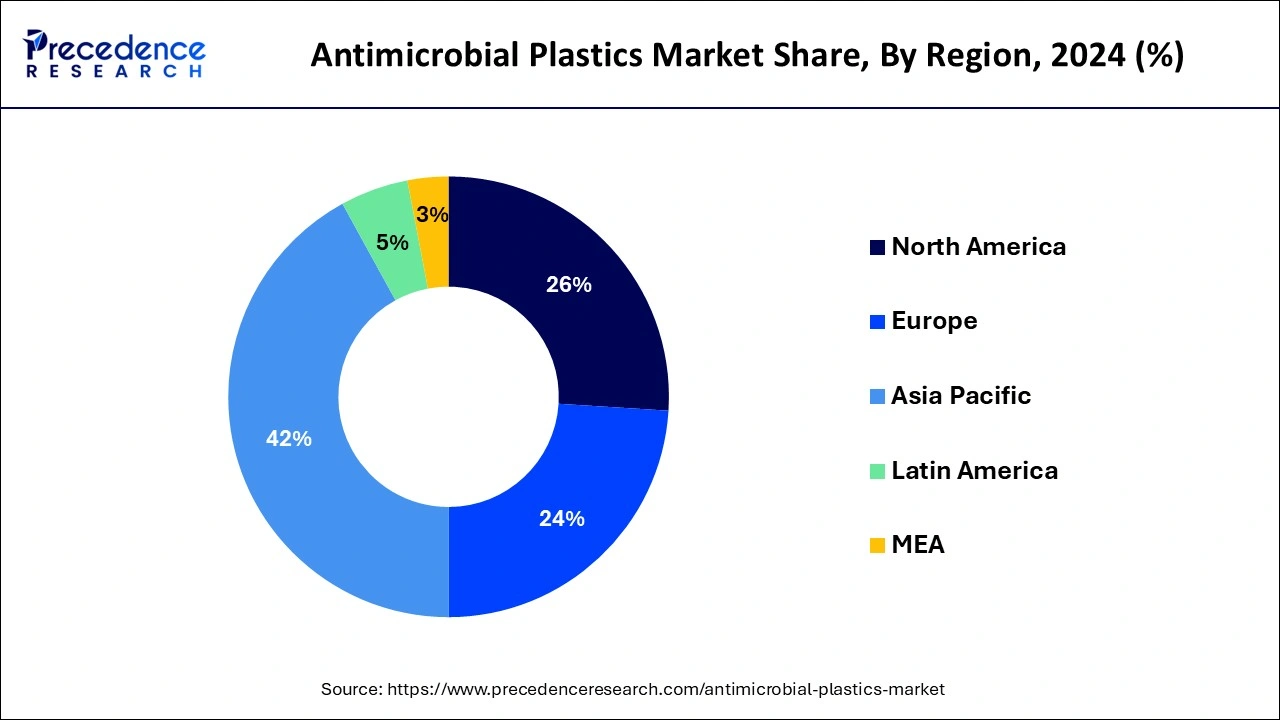

- Asia Pacific led the global market with the highest market share of 42% in 2024.

- By end use, the healthcare segment has held the largest market share of 32% in 2024.

- By product, the commodity plastic segment captured the biggest revenue share of 69% in 2024.

Asia Pacific Antimicrobial Plastics Market Size and Growth 2025 to 2034

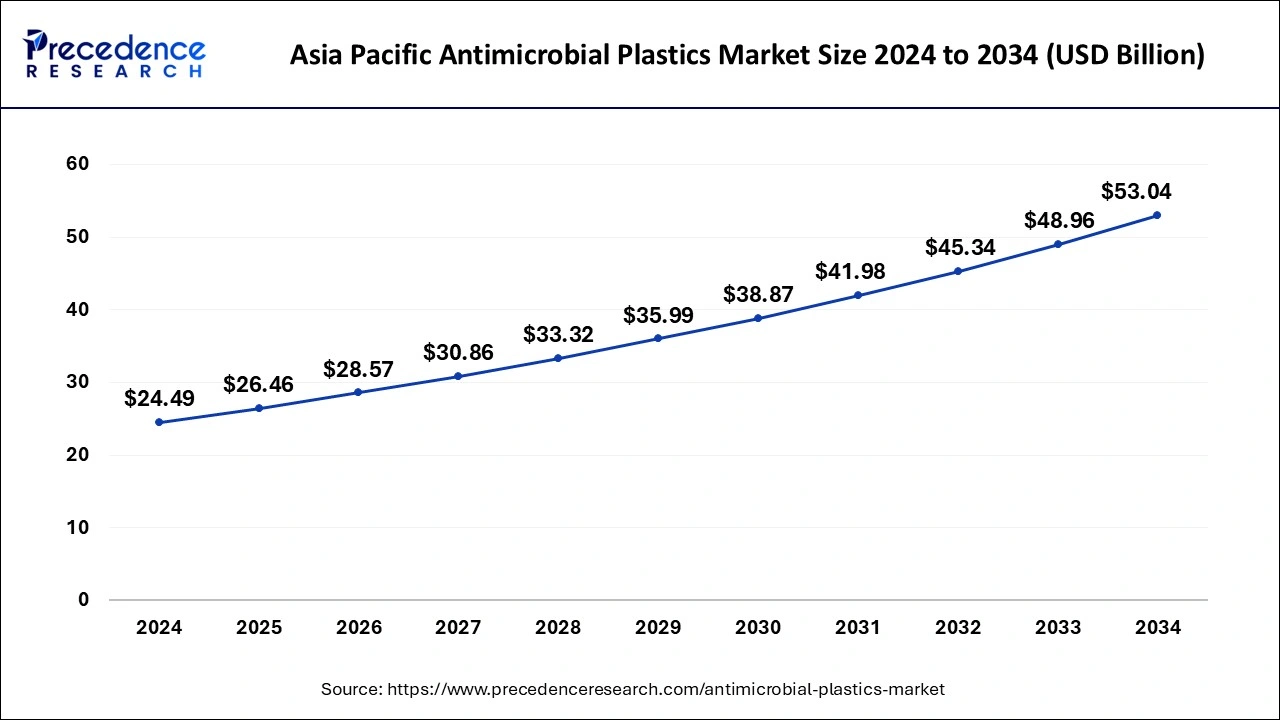

The Asia Pacific antimicrobial plastics market size was estimated at USD 24.49 billion in 2024 and is predicted to be worth around USD 53.04 billion by 2034, at a CAGR of 8.03% from 2025 to 2034.

Asia Pacific dominated the global antimicrobial plastics market, garnering a market share of 42% in 2024. Asia Pacific is the home to the world's largest population and the demand for the various consumer goods and food and beverages products is higher in the region. The rising prevalence of various infectious diseases like Swine Flu and COVID-19 has significantly fostered the demand for the antimicrobial plastics in the healthcare and the food and beverages industry. The rising penetration of the food processing and packaged food companies is fostering the adoption of the antimicrobial plastics for food packaging. The rapidly growing population and rising demand for the packaged food in Asia Pacific is expected to boost the market growth in the foreseeable future.

Moreover, the presence of huge population led to the increased number of COVID-19 cases in this region. This has significantly augmented the demand for the various medical components and medical devices across countries in the Asia Pacific region in 2020. The strong economic growth in the nations like China and India is expected to further fuel the demand for the antimicrobial plastics and boost the market growth. Furthermore, the significantly growing automotive, aerospace, textile, and packaging industries in the Asia Pacific nations is expected to have a significant impact on the market growth during the forecast period and hence Asia Pacific is also estimated to be the fastest-growing region in the global antimicrobial plastics market.

The COVID-19 pandemic in North America and Europe was a major factor that gained consumers attention towards the antimicrobial plastics to be used in various end use verticals. The significant rise in the various medical components and intensive care medical devices in the North American and European countries in 2020 and 2021 has significantly contributed to the growth of the antimicrobial plastics market.

Antimicrobial Plastics Market Growth Factors

The global antimicrobial plastics market is primarily driven by the growing demand from the food and beverages, healthcare, and packaging industries across the globe. The increased consumer awareness about hygiene owing to the outbreak of the COVID-19 disease in 2020 is expected to drive the demand for the antimicrobial plastics during the forecast period. Rising incidences of infectious diseases among the global population is boosting the adoption of the antimicrobial plastics in the food and beverages industry. The surging usage of antimicrobial plastics as a substitute for the conventional materials in the healthcare sector for production of several medical instruments like anesthetic machines and ventilators due to their pathogen inhibiting feature is significantly driving the demand for the antimicrobial plastics across the healthcare sector. The antimicrobial plastics restrict the growth of the pathogens like bacteria, algae, and fungi and it has excellent properties of resisting moisture. This is a major factor behind its increased adoption in the food and beverages industry.

The antimicrobial additives used in the plastics helps in extending the functional life of the plastics and restrict the bacteria growth that causes quick degradation of the plastic. Therefore, the increased durability, high suitability, odorless, and stainless are some of the major features of the antimicrobial plastics that has led to the significant growth of the antimicrobial plastics market growth across the globe.

The rising investments in the research and development by the antimicrobial additives manufacturers towards the development of the advanced technology is expected to offer grow opportunity and competitive edge to the market players. For instance, in April 2020, Polyfuze Graphics Corp. launched a line of polymer fusion products that has antimicrobial agents. The rising number of developmental strategies adopted by the market players will significantly impact the market growth during the forecast period. Moreover, the higher impact strength, chemical resistance, better biocompatibility, and moisture resistance properties of the polyethylene and polypropylene antimicrobial plastics has played a crucial role in the growth of the antimicrobial plastics market in the past few years.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 54 Billion |

| Market Size by 2034 | USD 116.58 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8% |

| Base Year | 2024 |

| Forecast Period | 2025to 2034 |

| Segments Covered | By Product, By End Use, By Application, and By Additive |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

End Use Insights

Depending on the end use, the healthcare segment accounted for a market share of 32% and dominated the global antimicrobial plastics market in 2024. The rising incidences of various chronic and infectious diseases, rapidly ageing population, and increasing number of hospital admissions are the major factors that are boosting the demand for the medical devices across the globe. The growing preference for home healthcare owing to the low costs as compared to the hospital settings is driving the demand for the various intensive care medical devices and hence it is expected to boost the demand for the antimicrobial plastics in the healthcare sector.

The outbreak of the COVID-19 pandemic in 2020 has fueled the demand for the medical components such as testing equipment, gloves, masks, and ventilators, which has significantly driven the growth of the antimicrobial plastics market across the globe. The rapid surge in the COVID-19 cases in various nations like China, US, UK, India, Germany, France, and Italy had boosted the demand for the medical components that contributed to the growth of the antimicrobial plastics market.

Food and beverages is expected to be the most opportunistic segment during the forecast period. The rising penetration of the various food and beverage companies across the developing regions, rising awareness regarding hygiene, and growing health consciousness are the major factors that are fueling the adoption of the antimicrobial plastics in the global food and beverages industry.

Product Insights

Based on product, the commodity plastic segment accounted for a market share of 69% and led the global antimicrobial plastics market in 2024. The surging applications of the across various end use verticals such as packaging, healthcare, food and beverages, and consumer goods industries has led to the significant growth of the commodity plastic segment. This rapid adoption of the commodity plastic in the different industries is attributed to the rising consumer awareness regarding personal hygiene and shifting lifestyle of the consumers across the globe.

Antimicrobial Plastics Market Companies

- BASF SE

- Parx Materials N.V

- Ray Products Company Inc.

- Covestro AG

- King Plastic Corporation

- Palram Industries Ltd.

- Clariant AG

- Sanitized AG

- Dow Inc.

- Lonza

Segments Covered in the Report

By Product

- Commodity Plastics

- Polyvinyl Chloride

- Polyethylene

- Polyethylene Terephthalate

- Polypropylene

- Polystyrene

- Acrylonitrile Butadiene Systems

- Engineering Plastics

- Thermoplastic Polyurethane

- Polycarbonate

- Polyamide

- Others

- High Performance Plastics

By End Use

- Automotive and Transportation

- Packaging

- Healthcare

- Building and Construction

- Packaging

- Textile

- Consumer Goods

- Others

By Application

- Refining & Petrochemical

- Metals

- Power Generation

- Others

By Additive

- Inorganic (Silver, Copper, and Zinc)

- Organic (Oxybisphenoxarsine (OBPA), Triclosan, and others)

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting