What is the Aortic Stent Grafts Market Size in 2026?

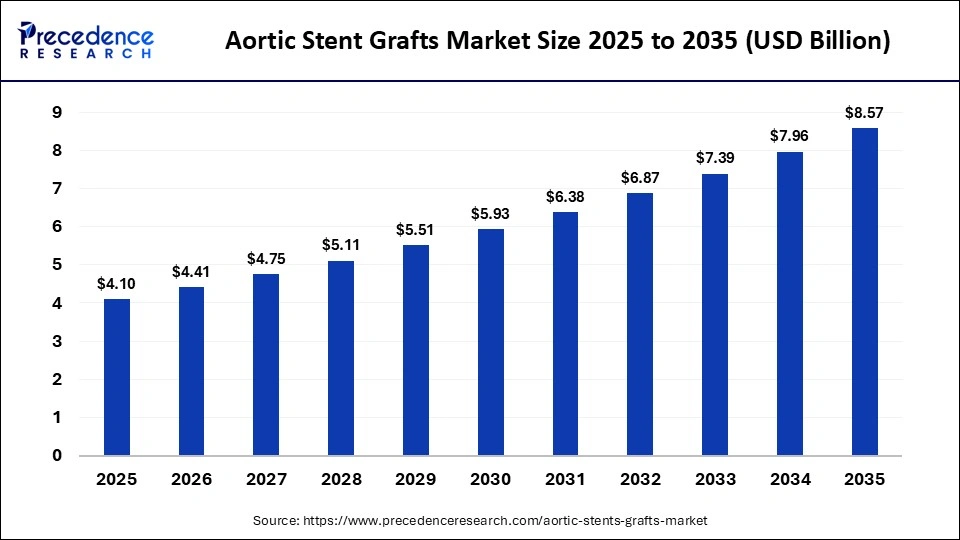

The global aortic stent grafts market size was calculated at USD 4.10 billion in 2025 and is predicted to increase from USD 4.41 billion in 2026 to approximately USD 8.57 billion by 2035, expanding at a CAGR of 7.65% from 2026 to 2035.The market is witnessing substantial growth due to a rapid shift toward minimally invasive, durable, and highly flexible, next-generation endovascular devices for complex vascular pathologies.

Key Takeaways

- North America dominated the market with a major share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

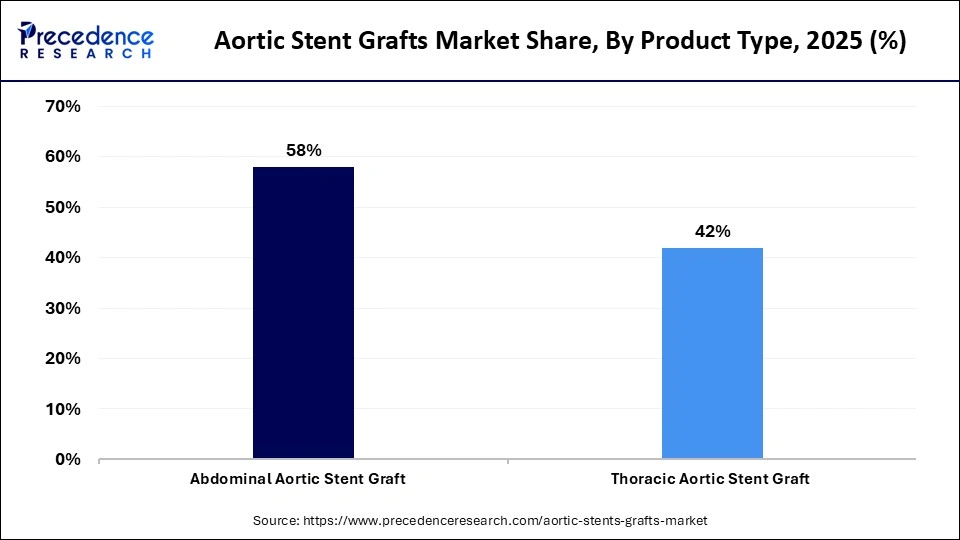

- By product type, the abdominal aortic stent grafts segment contributed the highest market share in 2025.

- By product type, the thoracic aortic stent grafts segment is expected to grow at a strong CAGR between 2026 and 2035.

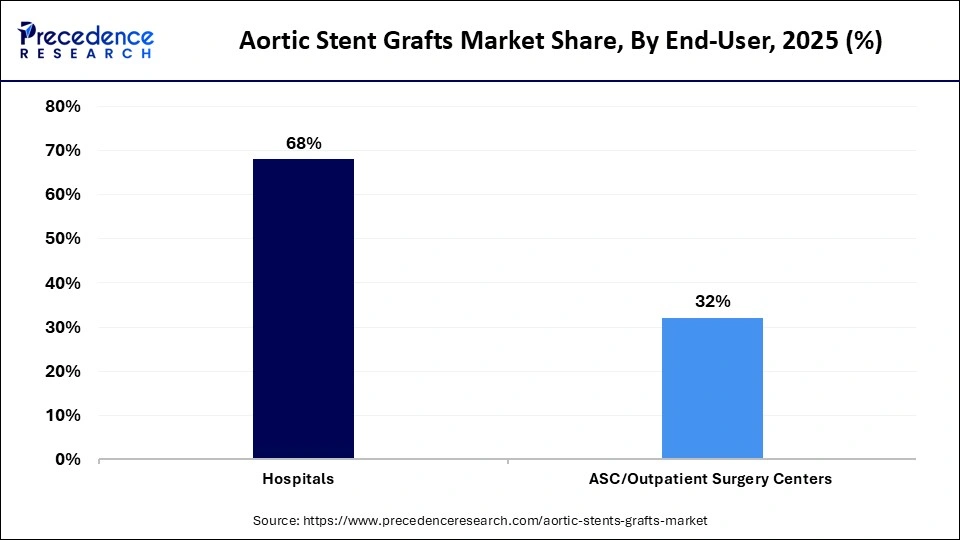

- By end-user, the hospitals segment held the biggest market share in 2025.

- By end-user, the ambulatory surgical centers (ASC)/outpatient surgery centers segment is expected to expand at the fastest CAGR between 2026 and 2035.

Market Overview

The global aortic stent grafts market comprises specialized, catheter-delivered devices used in endovascular procedures to treat aortic aneurysms and dissections. Composed of biocompatible materials such as nitinol or stainless steel, these grafts are inserted into the aorta, usually via the femoral artery in the groin, to create a new, secure pathway for blood flow and prevent rupture. This growth of the market is driven by rising cardiovascular disease prevalence and a preference for minimally invasive endovascular aneurysm repair over open surgery, with specialized fabric-covered metal stents used to treat abdominal and thoracic aortic aneurysms.

How is AI Transforming the Aortic Stent Grafts Market?

Artificial intelligence (AI) is transforming the global market for aortic stent grafts by enhancing procedural precision, optimizing preoperative planning, and enabling personalized, automated imaging analysis to reduce complications. AI algorithms automate the analysis of CT scans, segmenting vascular structures, classifying pathologies, and quantifying plaque burden with high accuracy. AI supports device sizing by automatically measuring aortic landmarks, angulation, and coronary ostia height, optimizing stent selection and reducing surgical time. AI improves quality control and stent design, focusing on enhanced flexibility and sealing capabilities.

Major Trends in the Aortic Stent Grafts Market

- Demand for Minimally Invasive Procedures: The rapid, ongoing shift from traditional open surgery to Endovascular Aneurysm Repair (EVAR) for abdominal aortic aneurysms (AAA) and Thoracic Endovascular Aortic Repair (TEVAR) for thoracic aneurysms.

- Rise of Complex, Custom-Made, and Branching Stent Grafts: As clinicians treat more complex anatomies, such as juxtarenal or arch aneurysms, there is a growing need for personalized, tailor-made solutions that fit the unique, complex, or tortuous anatomy of the patient's aorta.

- Advancements in Material Science and Low-Profile Delivery Systems: Manufacturers are focusing on next-generation devices featuring improved material coatings that reduce clotting risks, improve durability, and enhance long-term performance.

- Increased Adoption of AI and Digital Planning Tools: AI and advanced imaging are becoming integral to preoperative planning and intraoperative placement of grafts, increasing procedural success and reducing long-term complications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.10 Billion |

| Market Size in 2026 | USD 4.41 Billion |

| Market Size by 2035 | USD 8.57 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.65% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

How Did the Abdominal Aortic Stent Grafts Segment Lead the Market?

The abdominal aortic stent grafts segment led the aortic stent grafts market in 2025. The dominance of the segment is attributed to the high prevalence of abdominal aortic aneurysms among the aging population, which drives the demand for devices designed specifically for abdominal conditions. These grafts are preferred for their reduced surgical risk, shorter recovery times, and proven efficacy in preventing aneurysm rupture. Additionally, growing awareness, advancements in graft design, and expanding adoption of endovascular aneurysm repair (EVAR) procedures have further reinforced the segment's market leadership.

The thoracic aortic stent graft segment is anticipated to grow at the fastest rate during the forecast period. This growth is largely driven by the rising incidence of thoracic aortic aneurysms and a trend toward less invasive procedures, specifically TEVAR. The increasing prevalence of cardiovascular diseases in an aging population significantly boosts the demand for thoracic interventions. Both patients and healthcare providers favor these products for their reduced pain and quicker recovery times with lower morbidity and faster recoveries.

End-User Insights

What Made Hospitals the Dominant Segment in the Aortic Stent Grafts Market?

The hospitals segment dominated the global market with the largest share in 2025 because these facilities are equipped to handle complex procedures like EVAR and TEVAR using advanced imaging techniques, specialized vascular teams, and hybrid operating rooms. Hospitals also provide the sophisticated imaging technologies and facilities necessary for complex endovascular procedures. Due to their specialization, hospitals are often preferred for treating complex, high-risk cases. Availability of experienced vascular surgeons and multidisciplinary teams ensures better patient outcomes, leading to high patient volumes.

The ambulatory surgical centers (ASC)/outpatient surgery centers segment is expected to grow the fastest during the foreseeable period. This growth is driven by a shift toward minimally invasive procedures that allow for same-day, cost-effective care with reduced infection risks. These centers present a lower-cost alternative to hospital-based procedures and benefit from favorable reimbursement policies. The increasing patient demand for convenience and the desire to avoid hospital-acquired infections are pushing more patients toward outpatient care, enhancing the safety, precision, and efficiency.

Regional Insights

How Did North America Lead the Aortic Stent Grafts Market?

North America led the aortic stent grafts market by capturing the largest share in 2025. The dominant position of the region in the market is primarily attributed to the high prevalence of cardiovascular disease, the rapid adoption of minimally invasive techniques, and a robust healthcare infrastructure. The U.S. and Canada are home to a large number of sophisticated hospitals and specialized vascular centers, such as the Mayo Clinic and Cleveland Clinic, which excel in performing complex endovascular repairs. Strong presence of key medical device manufacturers, favorable reimbursement policies, and early adoption of innovative stent graft technologies further reinforced the region's market leadership. Additionally, growing awareness of endovascular repair benefits among physicians and patients has driven higher procedure volumes.

U.S. Aortic Stent Grafts Market Trends

The U.S. plays a major role within the region, mainly due to a high prevalence of aortic aneurysms and a strong preference for minimally invasive EVAR. Robust reimbursement frameworks for vascular procedures facilitate high patient access to advanced treatments. Major industry players, including Medtronic, Cook Medical, and Gore and Associates, drive the market through continuous product development, with frequent FDA approvals for advanced thoracic and abdominal grafts.

Why is Asia Pacific Considered the Fastest-Growing Area in the Aortic Stent Grafts Market?

Asia Pacific is expected to experience the fastest growth during the forecast period. This growth is primarily driven by rapid urbanization and a shift toward advanced, minimally invasive treatments. Significant investments in healthcare, especially aimed at improving hospital facilities and imaging technologies in emerging markets like India and China, are making advanced vascular care more accessible. Favorable policies, including government-led screening programs, are facilitating early diagnosis, while efforts to reduce device costs are making procedures more affordable, contributing to increased procedure volumes.

India Aortic Stent Grafts Market Trends

India's aortic stent grafts market is expanding due to rising insurance coverage and government-sponsored schemes, which increase patient access to advanced aortic care. The market is also shifting toward local products, with global players like Gore and Medtronic, alongside domestic manufacturers such as SMT, Translumina, and Meril, offering high-quality, cost-effective alternatives to multinational brands.

How is the Opportunistic Rise of Europe in the Aortic Stent Grafts Market?

Europe is expected to grow at a significant rate in the market. This growth is largely attributed to the high adoption of endovascular repair techniques, an aging population, and strong clinical research infrastructure. The rapidly increasing elderly population in Europe is more susceptible to aortic aneurysms and related cardiovascular diseases, leading to a heightened demand for treatment. The region also benefits from a well-established network of hospitals and specialized clinics, with extensive clinical research trials, particularly for complex fenestrated and branched stent grafts, increasing clinician confidence.

Latin America Aortic Stent Grafts Market Analysis

The market in Latin America is mainly driven by a rapid shift toward minimally invasive procedures, an aging population, and an improving healthcare infrastructure. The introduction of more flexible, low-profile, and conformable stent grafts, including fenestrated and branched systems, allows physicians to treat complex, tortuous aortic anatomies. Investments in hospital infrastructure, specialized cardiovascular centers, and hybrid operating rooms in countries like Brazil and Mexico are enabling more complex, high-value procedures.

Middle East & Africa Aortic Stent Grafts Market Analysis

The market in the Middle East & Africa is growing due to rapid healthcare modernization, increasing cardiovascular disease prevalence, and a strong pivot toward minimally invasive treatments. High-income GCC countries, namely Saudi Arabia and the UAE, are heavily investing in advanced medical infrastructure, and the establishment of specialized cardiovascular care facilities is also contributing to the market. There is a growing preference for EVAR over traditional open surgery due to shorter hospital stays, quicker recovery times, and lower procedural risks.

Government Initiatives Supporting the Aortic Stent Grafts Market

| Country | Key Government Initiative | Focus and Impact |

| China | Centralized Volume-Based Procurement (VBP) | Slashing costs for high-value stents, increasing procedural volumes, and promoting local manufacturing |

| U.S | SVS Guidelines Mandating Screening | Provides clinical practice guidelines recommending specific, targeted screening for abdominal aortic aneurysms (AAA) and peripheral vascular |

| India | National Aneurysm Screening Program | Expanding public hospital infrastructure and screening, increasing access to affordable EVAR/TEVAR procedures. |

| UK | NICE Appraisals for Complex Grafts | The National Institute for Health and Care Excellence conducts technology appraisals for complex grafts, including advanced vascular stent grafts |

| Brazil | SUS Expansion |

Expanding coverage of EVAR procedures for diabetic vasculopathy. |

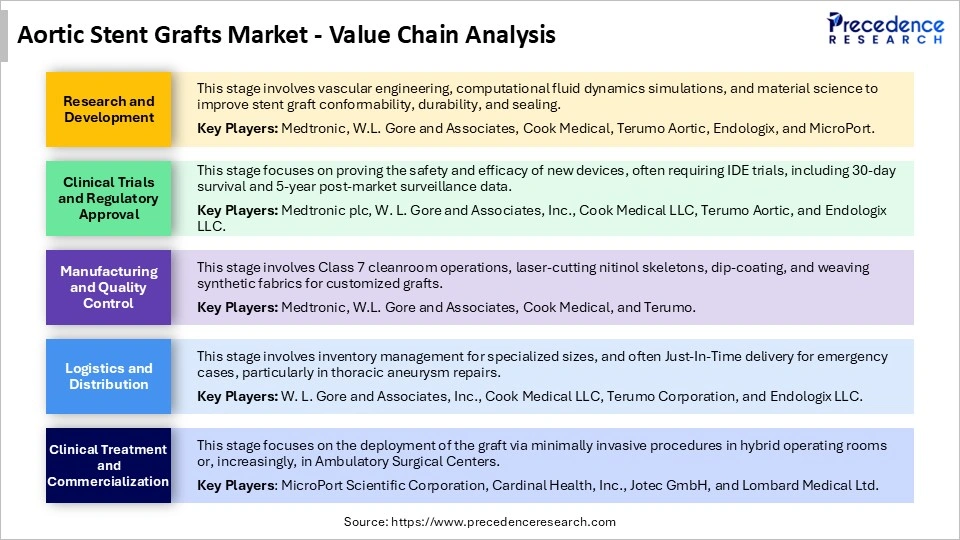

Aortic Stent Grafts Market Value Chain Analysis

Aortic Stent Grafts Market Companies

- Medtronic PLC

- W. L. Gore and Associates, Inc.

- Cook Medical Inc.

- Terumo Corporation / Terumo Aortic

- Endologix LLC

- Artivion, Inc.

- MicroPort Scientific Corporation

- Cardinal Health Inc.

- Becton, Dickinson and Company (BD)

- Lombard Medical, Inc.

- Bentley InnoMed GmbH

- Braile Biomédica

- Endospan Ltd.

- LifeTech Scientific Corporation

- Edwards Lifesciences Corporation

Recent Developments

- In January 2025, Bentley introduced two products at the Leipzig Interventional Course: the BeGraft stent graft system and the BeFlared fenestrated endovascular aneurysm repair (FEVAR) stent graft system. According to CEO Sebastian Büchert, this launch signifies a significant moment amidst new EU Medical Device Regulations, highlighting a major advancement for endovascular specialists. This stent features a stepped balloon design for easier deployment and a third radiopaque marker for precise positioning.(Source: https://vascularnews.com)

- In June 2024, Medtronic launched the Steerant aortic guidewire, designed to assist with catheter placement during procedures like EVAR. The guidewire, available in single- and double-curve configurations, combines a soft, atraumatic tip with a stiff main body for better anatomy protection. It has a diameter of 0.035 inches and comes in lengths suitable for EVAR and TEVAR. The first EVAR using this device was successfully performed by Dr. Naiem Nassiri at Norwalk Hospital in Connecticut.(Source: https://evtoday.com)

- In May 2023, Terumo Aortic announced FDA approval of the RelayPro Thoracic Stent-Graft for treating aneurysm, dissection, transection, and penetrating atherosclerotic ulcers in the descending thoracic artery. Offering the lowest commercial profile, wide size range, and precise deployment, RelayPro enhances thoracic endovascular aortic repair (TEVAR) for patients with smaller access vessels while ensuring durability and clinical efficacy.(Source: https://www.terumo.com)

Segments Covered in the Report

By Product Type

- Abdominal Aortic Stent Graft

- Thoracic Aortic Stent Graft

By End-User

- Hospitals

- ASC/Outpatient Surgery Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting