What is Apheresis Equipment Market Size?

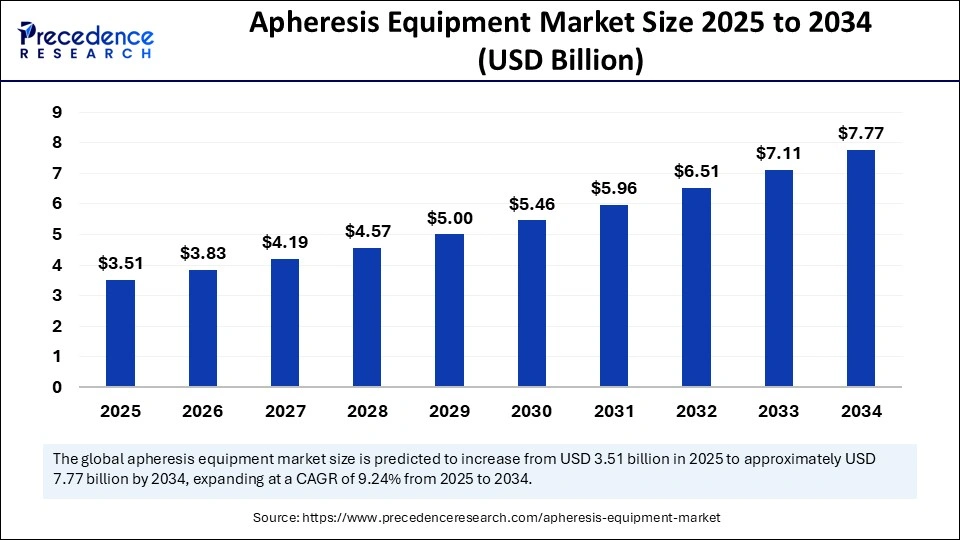

The global apheresis equipment market size accounted for USD 3.51 billion in 2025 and is predicted to increase from USD 3.83 billion in 2026 to approximately USD 8.39 billion by 2035, expanding at a CAGR of 9.11% from 2026 to 2035. The increasing incidence of blood-related disorders is the key factor driving market growth. Also, technological advancements in apheresis devices coupled with the growing demand for blood components can fuel market growth further.

Market Highlights

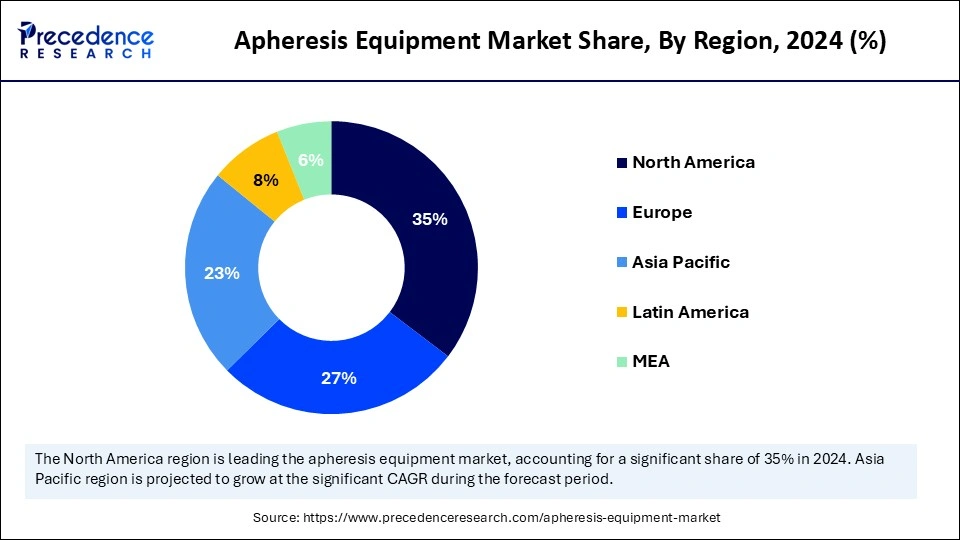

- North America dominated the global market with the largest market share of 35% in 2025.

- Asia Pacific is expected to witness the fastest growth during the forecast period.

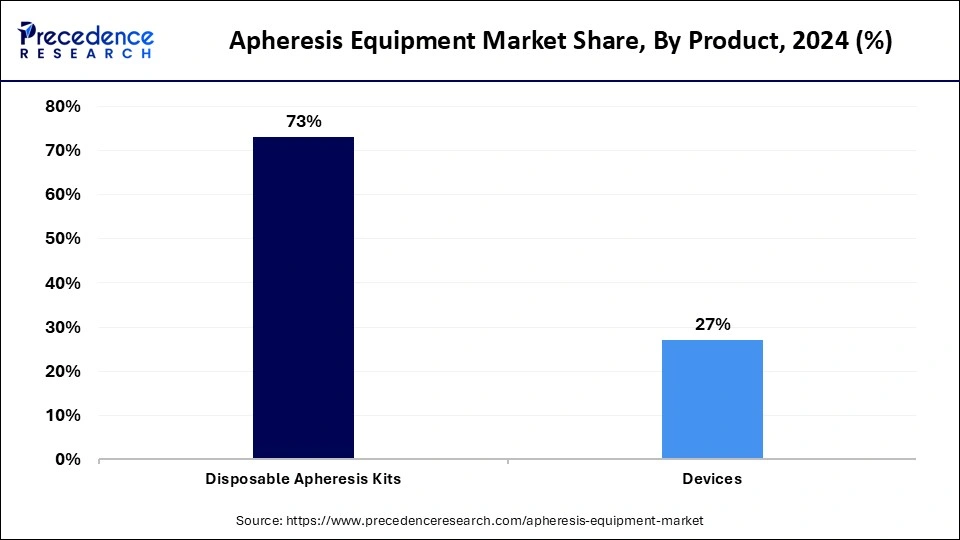

- By product, the disposable apheresis kits segment contributed the highest market share of 73% in 2025.

- By product, the devices segment is expected to grow at the fastest CAGR over the forecast period.

- By procedure, the plasmapheresis segment held the largest market share of 52% in 2025.

- By procedure, the leukapheresis segment is anticipated to grow at the fastest CAGR over the forecast period.

- By technology, the membrane filtration segment captured the biggest market share of 58% in 2025.

- By technology, the centrifugation segment is projected to grow at the fastest CAGR during the forecast period.

- By application, the neurology segment generated the major market share of 51% in 2025.

Artificial Intelligence (AI) Improving the Apheresis Equipment Market

Artificial Intelligence is transforming the market by improving accuracy, enhancing monitoring, and streamlining procedures, which leads to desired patient outcomes with more convenient treatments. Furthermore, AI algorithms can process real-time data to optimize separation processes that ensure the collection of some blood components with better precision and can automate tasks such as data logging, reporting, and processing, allowing medical professionals to emphasize patient care.

Market Overview

Apheresis equipment is a medical device created for the direct separation of blood components during the apheresis process. It is a process that includes removing components from an individual's blood, like platelets, plasma, or white blood cells, while giving the remaining blood back to the patient. The apheresis equipment market produces specialized machines designed for this purpose and uses techniques such as filtration and centrifugation to separate and collect desired blood components.

Apheresis Equipment Market Growth Factors

- The growing demand for automated blood component separators is expected to boost the apheresis equipment market growth soon.

- The surge in the number of trauma cases and road accidents requires blood transfusions, which can propel market growth shortly.

- The expansion of healthcare infrastructure, particularly in emerging economies, will likely contribute to the market growth further.

Market Outlook

- Industry Growth Overview:Apheresis equipment is experiencing strong growth due to increased demand for therapies derived from plasma, a rise in the number of procedures used for separating blood components, and the increased number of individuals worldwide diagnosed with autoimmune diseases, haematological (blood) conditions, and similar conditions.

- Sustainability Trends: Manufacturers are developing eco-friendly disposable products; using less plastic in manufacturing processes; creating energy-efficient centrifuge machines; and developing recyclable packaging materials as part of their commitment to support the hospital's sustainability initiatives and global healthcare environmental, social, and governance (ESG) objectives.

- Global Expansion: Market participants are establishing distribution partnerships or localized manufacturing and developing distributor networks to meet the needs of growing numbers of patients in need of receiving apheresis therapies, and/or in need of receiving therapeutic donor/apheresis plasma collections.

- Startup Ecosystem: Hiring innovative start-up companies that are creating portable apheresis machines, artificial intelligence-based monitoring software, and low-cost disposable kits has generated interest from ranges of venture capital funding focused on developing new decentralized and outpatient-based healthcare business models.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.51 Billion |

| Market Size in 2026 | USD 3.83 Billion |

| Market Size by 2035 | USD 8.39 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.11% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Procedure, Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Enhancement in healthcare infrastructure

The growth of healthcare infrastructure, particularly in developing countries, and growing awareness regarding apheresis procedures and blood donation are the major factors driving market growth. In addition, the use of apheresis is growing beyond conventional applications to include cardiovascular, neurological, and hematological disorders, strengthening the market reach.

- In January 2023, Sanguine Biosciences announced a new investment from BroadOak Capital Partners, LLC, a leading direct investment and advisory firm focused on life science research tools, pharmaceutical services, and diagnostics. The partnership with BroadOak enables Sanguine to expand its laboratory operations, leukapheresis offerings, and patient donor network.

Restraint

Lack of awareness

Lack of awareness regarding the procedures and their advantages is the major factor constraining the apheresis equipment market. Due to limited awareness, many people are unaware of these innovative therapeutic procedures. Moreover, apheresis procedures need highly trained nurses and technicians to operate the equipment effectively and safely, hindering the market growth soon.

Opportunity

Growth in emerging markets

As medical infrastructure continues to enhance and countries develop in regions such as Latin America, Asia Pacific, and the Middle East, there is an increasing need for innovative medical technologies, such as apheresis equipment. Furthermore, factors like increasing healthcare expenditure, growing incidence of chronic diseases, and escalating access to healthcare services are fuelling the demand for the apheresis process in these countries.

- In March 2025, Adia Nutrition, a leader in innovative healthcare solutions, announced that its subsidiary, Adia Med, will ensure that all future full clinic locations across the United States will offer therapeutic plasma exchange (TPE), with its current location already offering this advanced treatment as of today.

Segment Insights

Product Insights

The disposable apheresis kits segment dominated the apheresis equipment market in 2025. The dominance of the segment can be attributed to the increasing usage of disposable kits and the surge in the incidence of blood-related disorders. This kit includes items like filters, tubing, and collection bags, which are important for ensuring safety and sterility during apheresis procedures, minimizing the risk of infection and cross-contamination. The rising focus on patient safety and infection control in medical facilities has boosted the demand for high-quality disposable kits.

The devices segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the innovations in healthcare infrastructure, along with the surge in blood donation numbers. Additionally, the growing number of apheresis practices due to the increasing incidence of chronic diseases and the escalating use of apheresis for donor and therapeutic purposes has further positively impacted the segment's growth.

Application Insights

The neurology segment dominated the apheresis equipment market in 2025 and is estimated to grow at the fastest rate over the forecast period. The dominance of the segment is owing to the growing incidence of neurological disorders such as myasthenia gravis, Multiple Sclerosis (MS), and Guillain-Barre syndrome (GBS), which necessitates therapeutic plasma exchange as an initial treatment. Also, these neurological disorders require specialized treatment solutions to cure them completely.

Procedure Insights

The plasmapheresis segment held the largest apheresis equipment market share in 2025. The dominance of the segment can be linked to the rising prevalence of lymphoma, leukemia, and myeloma across the globe. Plasmapheresis is a procedure utilized to treat many conditions by removing toxic substances or adding missing components. The growing need for plasma-derived products will likely contribute positively to the market expansion.

- In January 2025, Fresenius Kabi, an operating company of Fresenius, specializing in lifesaving medicines and technologies, announced that the U.S. Food and Drug Administration (FDA) has granted 510(k) clearance for its Adaptive Nomogram an alternate algorithm that will be available in the Aurora Xi Plasmapheresis System designed to optimize plasma collection efficiency.

The leukapheresis segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the increasing incidence of cancer, especially prostate& breast cancer, and leukemia. Moreover, the innovations in leukapheresis technologies and the growing demand for individualized medicine cell therapies like CAR-T are driving the segment's growth during the forecast period.

Technology Insights

The membrane filtration technology segment led the apheresis equipment market in 2025. The dominance of the segment is owing to the effectiveness of this technology in addressing crucial challenges confronted during the apheresis procedures. In addition, the growing need for therapeutic apheresis procedures and the increasing incidence of blood disorders and chronic diseases, which necessitate specific blood component separation, are key factors driving the segment's growth.

The centrifugation segment is projected to grow at the fastest rate during the forecast period. The growth of the segment can be linked to the innovations in automated and high-speed centrifuges, which have enhanced efficiency. Furthermore, the specific centrifugation parameters can impact the concentration and distribution of the final PRF or CGF product. Automatic centrifugation decreases processing times, enhancing overall operational efficiency.

Regional Insights

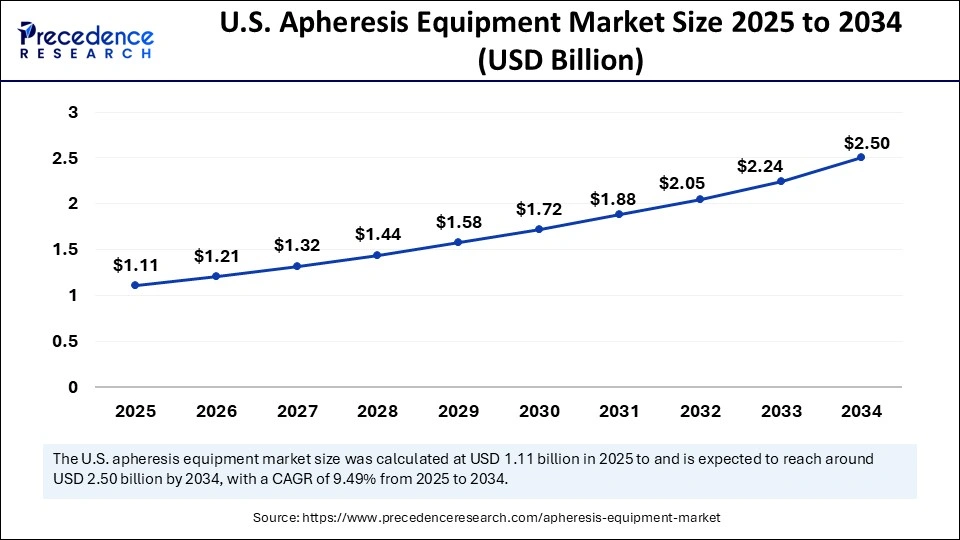

U.S. Apheresis Equipment Market Size and Growth 2026 to 2035

The U.S. apheresis equipment market size is exhibited at USD 1.11 billion in 2025 and is projected to be worth around USD 2.71 billion by 2035, growing at a CAGR of 9.34% from 2026 to 2035

North America held the largest apheresis equipment market share in 2025. The dominance of the region can be attributed to the increasing incidence of blood-related disorders, coupled with the demand for blood components. Furthermore, the region's strong healthcare systems, especially in countries like the United States and Canada, have the potential to integrate sophisticated apheresis procedures.

- In May 2023, Terumo Corporation, a medical device company, launched the first training program of its kind to help cell and gene therapy manufacturers improve their cell collection processes and accelerate the commercialization of therapeutics. It will help to train the participants in the apheresis market for better skills.

In North America, the U.S. led the market owing to the increasing healthcare spending, the need for plasma-derived medicines, and the growing incidence of blood-related & chronic diseases. Also, major market players in the region are Haemonetics Corp., Braun Melsungen AG, Asahi Kasei Medical Co., Ltd., and Mallinckrodt.

Asia Pacific is expected to witness the fastest growth I the apheresis equipment market during the forecast period. The growth of the segment can be credited to the ongoing economic development and enhanced healthcare infrastructure in nations such as China, India, and Japan. Moreover, the increasing incidence of hematologic disorders and chronic diseases in the region is boosting the demand for apheresis treatments.

In Asia Pacific, Japan dominated the market. The dominance of the country can be driven by a surge in the geriatric population and an increasing shift towards the Western lifestyle and diet. Japan's healthcare system is experiencing a transition, propelling the service portfolio in disease management.

Europe: Enhanced Precision Healthcare Services to Increase in Apheresis Use

Europe has established an excellent reimbursement system, developed advanced transfusion medicine, and has a high level of use and access to therapeutic apheresis for the treatment of autoimmune and neurological disorders. Harmonization of regulations in all EU member countries allows for quicker introduction of new, innovative systems on a wider European basis.

Germany, having the most robust plasma donor centres and having invested heavily in hysteroscopy-efficient equipping of hospitals, is leading the momentum of growth in this region.

Latin America: Growing Demand for Plasma Will Change the Market

The increased uptake of apheresis products in Latin America can be attributed to the increase in private hospitals, the rising popularity of the use of plasma therapy, and improvements in urban healthcare infrastructure. The need for imported products remains high, which offers opportunities for international companies.

Brazil will continue to experience tremendous growth as it suffers from an increasing burden of chronic diseases requiring more healthcare resources and, as a result, will invest heavily in the development of more advanced blood processing facilities.

Middle East and Africa (MEA): New Growth Opportunities emerge from the Shift Towards Specialist Care:

There is currently a strong trend in the MEA towards both a change in the business of healthcare, i.e., the establishment of new systems that focus on specialty care, as well as the growing demand for more advanced blood treatment devices in general due to improvements in medical technology available, specifically in the Gulf States. The high incidence of medical tourism is also increasing the need for these devices.

Value Chain Analysis of the Apheresis Equipment Market:

- Raw Materials & Components Suppliers: High-quality polymers, centrifuge motors, sensors, and tubing must be obtained from specialised medical-grade (certified as sterile and durable) suppliers; the consistency of suppliers directly affects the precision with which devices are manufactured and ultimately affects patient safety.

Key Players: DSM Biomedical, DuPont, and Saint-Gobain. - Equipment Manufacturing and Assembly: Original Equipment Manufacturers (OEMs) use various technologies, including automated robotics, AI-based device monitoring, and precision engineering, to produce therapeutic and donor apheresis systems. Compliance with both FDA and CE certification requirements greatly impacts the amount of time it takes to produce products.

Key Players: Terumo BCT, Fresenius Kabi, and Haemonetics. - Distribution, Aftermarket, and Service: Distributors within the marketplace provide hospitals with tenders, training, maintenance, and supplies of consumables, which generate recurring income for distributors. Because service levels differ between distributors, reliability of service is a key differentiating factor for distributors when evaluating a long-term contract with hospitals.

Key Players: Grifols, Asahi Kasei, and B. Braun.

Apheresis Equipment Market Companies

- Asahi Kasei Corporation

- B. Braun SE

- Cerus Corporation

- Fresenius SE & Co. KGaA

- Haemonetics Corporation

- Haier Biomedical

- Medica SPA

- Miltenyi Biotec

- NIKKISO Medical Europe GmbH

- NxStage Medical, Inc.

Latest Announcement

- In December 2024, Haemonetics Corporation, a global medical technology company focused on delivering innovative medical solutions to drive better patient outcomes, announced that it has entered into a definitive agreement to sell its whole blood assets to GVS, S.p.A ("GVS"), one of the world's leading manufacturers of filter solutions for applications in the healthcare and life sciences sectors.

- In February 2025, Fresenius Kabi, an operating company of Fresenius, announced it had introduced Calcitonin Salmon Injection, USP Synthetic, a calcium regulator, for the treatment of symptomatic Paget's disease of the bone and hypercalcemia. The drug is also used to treat postmenopausal osteoporosis when alternative treatments are not suitable.

Recent Developments

- In March 2023, Haemonetics Corporation, headquartered in the United States, made an exciting announcement regarding the release of their latest innovation in the form of intelligent control software for their Cell Saver Elite and Autotransfusion services. This next-generation software represents a significant advancement in their technology.

- In May 2023, TERUMO BCT, INC. launched the first training program initiative to support cell and gene therapy manufacturers in improving the cell collection processes and boosting therapeutic commercialization.

- In August 2023, Fresenius Kabi AG and Lupagen Inc. entered into a supply and development agreement for technologies developed to bring the delivery of cell & gene therapies to the bedside.

Segments Covered in the Report

By Product

- Disposable Apheresis Kits

- Devices

By Procedure

- Plasmapheresis

- Photopheresis

- Leukapheresis

- Plateletpheresis

- LDL Apheresis

- Erythrocytapheresis

- Others

By Technology

- Membrane Filtration

- Centrifugation

By Application

- Renal Diseases

- Hematology

- Neurology

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting