Armored Vehicle Market Size and Forecast 2025 to 2034

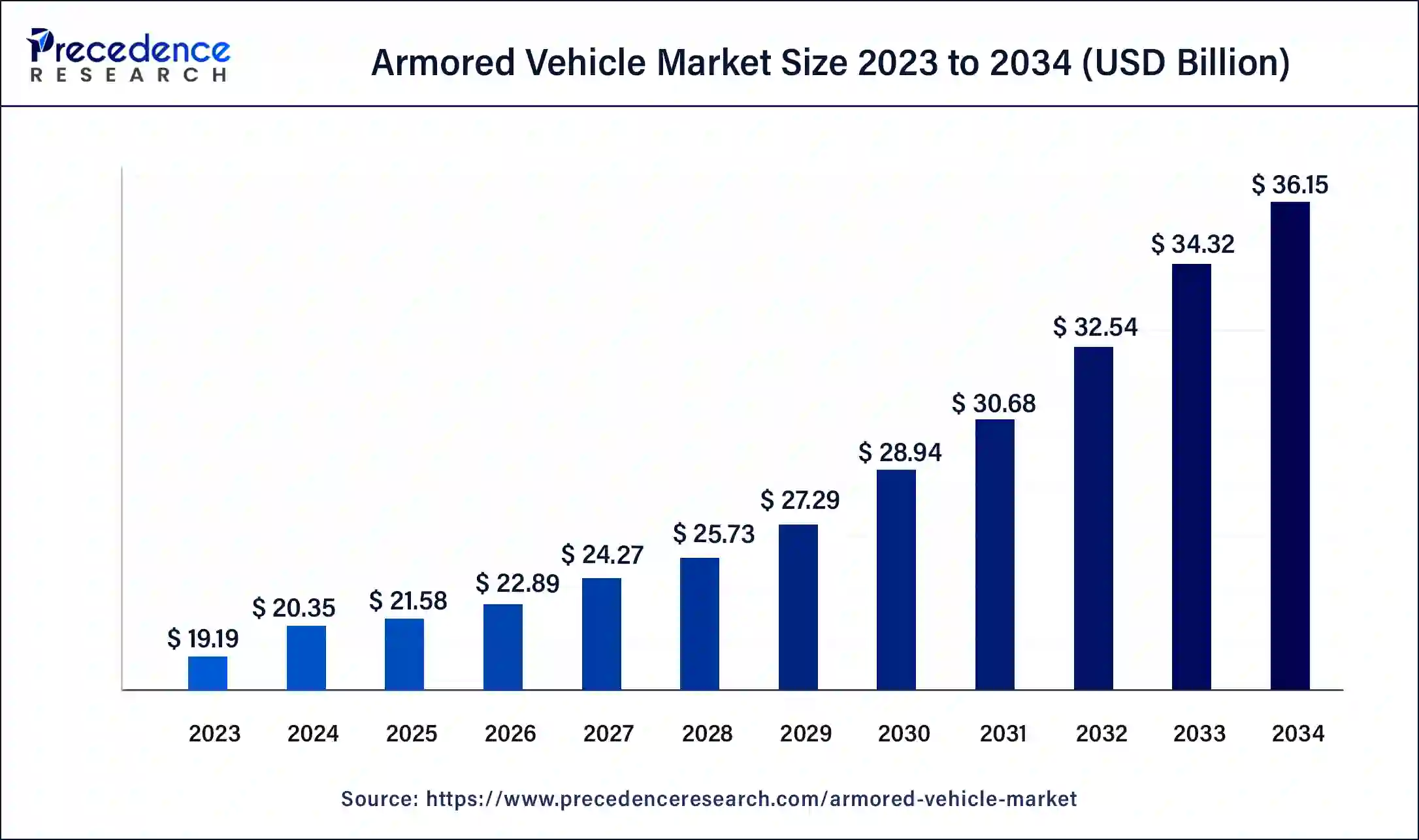

The global armored vehicle market size was calculated at USD 20.35 billion in 2024 and is expected to reach around USD 36.15 billion by 2034, expanding at a CAGR of 5.91% from 2025 to 2034. Increasing demand for bulletproof vehicles is observed to boost the market's growth during the forecast period.

Armored Vehicle Market Key Takeaways

- In terms of revenue, the armored vehicle market is valued at $21.58 billion in 2025.

- It is projected to reach $36.15 billion by 2034.

- The armored vehicle market is expected to grow at a CAGR of 5.91% from 2025 to 2034.

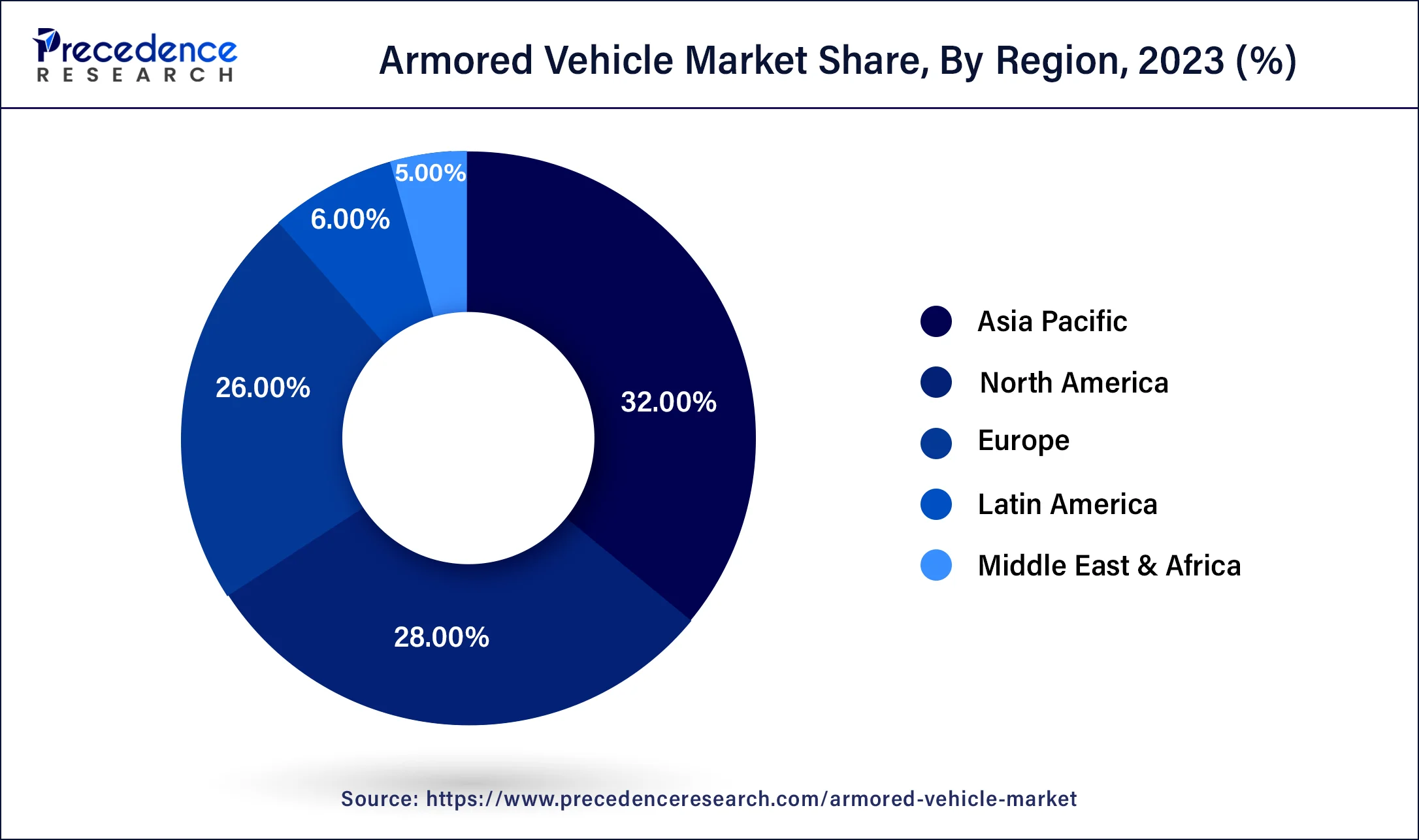

- Asia Pacific holds for the largest market share.

- By platform, the combat support vehicles segment holds a remarkable market share.

- By platform, the combat vehicle segment is expected to grow at a CAGR of 2.7% from 2025 to 2034.

- By application, the defense segment is expected to dominate the market.

- By application, the commercial segment accounts a noteworthy share of the market.

- By mobility, the wheeled segment is predicted to grow at a CAGR of 3.3% from 2025 to 2034.

- By mobility, the tracked vehicle segment is projected to witness a notable increase between 2025 and 2034.

- By sales, The OEM segment is expected to dominate the market from 2025 to 2034.

Asia Pacific Armored Vehicle Market Size and Growth 2025 to 2034

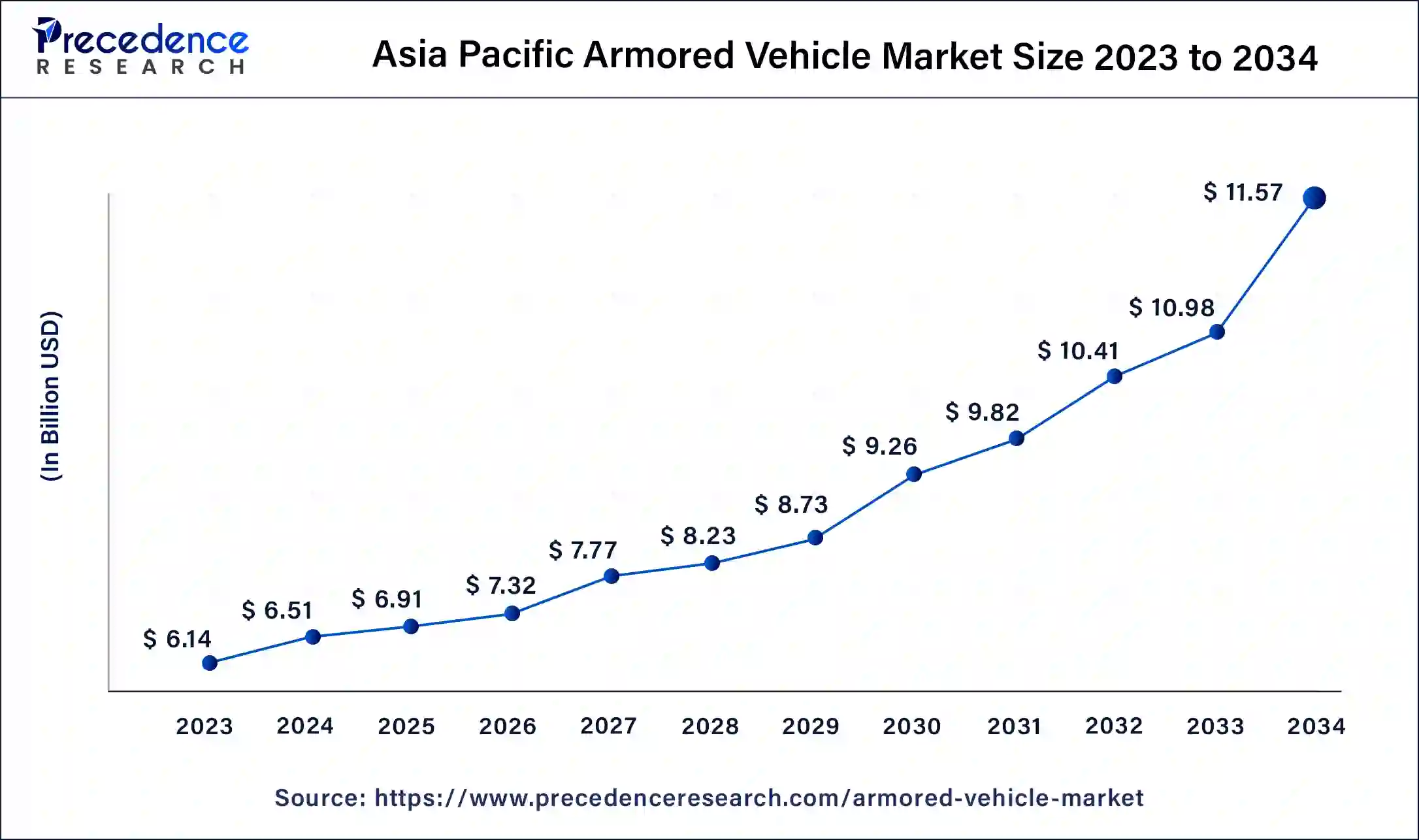

The Asia Pacific armored vehicle market size was calculated at USD 6.51 billion in 2024 and is expected to reach around USD 11.57 billion by 2034, expanding at a CAGR of 5.92% from 2025 to 2034.

Asia Pacific is expected to dominate the market during the forecast period.The rising spending on the defense sector in India and China is considered to fuel the market's growth. The demand for new armored vehicles in Asia Pacific is growing on the note of replacing the aging armored vehicles and deploying advanced armored vehicles in the military. Furthermore, the rising capacities of local manufacturing companies in India, China, and Japan are observed to propel the market's growth.

The Indian Ministry of Defense awarded Mahindra Defence Systems (MDS) a contract to supply light specialist vehicles (LSVs) worth USD 146 million (INR 1,056 crore). The first batch will comprise 40 Armados. Under the contract, the company will deliver 1,300 LSVs from 2021 through 2025. The LSV order was fast-tracked amid the stand-off between the Indian Army and China's People's Liberation Army (PLA) along the Line of Actual Control (LAC). The countries are highly focusing on strengthening their local manufacturing capabilities to support their regional armed forces.

The allocations for the Ministry of Defense (MoD) in the Union Budget 2023-24, presented to Parliament by the Finance Minister of India on 1 February 2023, amounted to INR 5,93,537.64 crores, a 13% increase over BE 2022-23. (INR 5,25,166.15 crores).

Along with India and China, Japan's market for armored vehicles is flourishing since the country increased tests for new armored vehicles. For instance, in October 2022, the defense ministry of Japan confirmed that Japan had started trials of locally built armored vehicles.

North America accounts for the largest share of the global armored vehicle market.The presence of major manufacturers in the region and substantial military budgets in the U.S. has supported the market's growth in North America. Moreover, the U.S. defense ministry is focused on deploying armored electric vehicles for efficient operational capabilities; this factor is observed to boost the market's growth during the projected period.

In addition, the surge in military & defense budgets is anticipated to fuel the market's revenue during the forecast period. For instance, in 2024, the United States spent USD 997 billion on defense, which is more than the next nine countries' spending combined. In comparison, China, which is the second biggest defense spender, spent USD 314 billion on military expenditures in 2024.

Europe is another largest marketplace for armored vehicles.The rising demand for luxuriouscommercial vehiclesin the region is boosting the deployment of armored vehicle parts. The sudden rise in cross-border conflicts is seen as a significant factor in increasing the demand for advanced armored vehicles in the region. Furthermore, rising defense modernization programs in various European countries are boosting the growth of the armored vehicle market.

The armored vehicle market in the Middle East and Africa is expected to grow at a CAGR of 2.5% during the forecast period.The risk of cross-border conflicts has forced the modernization of armored vehicles. The armored vehicle market in Africa shows steady growth. However, emerging economies and increasing military budgets will boost the growth of the armored vehicle market in Africa. The armored vehicle market in Latin America depends on battle tanks' development. Emerging economies in countries such as Brazil, Argentina and Mexico are anticipated to boost Latin America's market share in upcoming years.

Market Overview

An armored vehicle is an advanced vehicle that provides potential protection against bullets, rifles, and other hazardous projectiles. Such vehicles are designed to fight adverse situations for both commercial and defense users. Armored vehicles enable police officers, soldiers, troops, high-profile personalities, and even civilians in conflict areas to move confidently.

Armored vehicles are widely used in the defense sector as well as within the country's borders to enhance security and survivability. A typical armored vehicle consists of armed plates, primary weapons, bulletproof glasses, a command system, a navigation system, an engine, a fire control system, an observation system, armaments, frames, and other ballistic materials. Safety escort, protecting dignitaries, and self-defense are major purposes of armored vehicles.

Armored Vehicle Market Growth Factors

Geopolitical tensions are on the rise in Asia Pacific, Europe, and the Middle East due to shifting relations between countries. On the note of increasing geopolitical tensions between countries, the rising demand for advanced armored vehicles from the defense sector has supplemented the growth of the global armored vehicles market. Factors such as advancements in the defense sector, rising requirements for improved battle intelligence and technological competence are propelling the market's growth.

Furthermore, multiple European manufacturers are focused on developing uncrewed armored vehicles for the defense sector; this factor highlights the development in the armored vehicle market. However, the high cost of armored tanks and other military vehicles is likely to hinder the market's growth. Moreover, the rising need for monitoring naval and land borders and increasing demand for protective vehicles for government purposes is projected to boost the development of the armored vehicle market.

The production of autonomous vehicles and deployment of robotics in armored vehicles are observed to offer a remarkable shift to the global armored vehicle market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 36.15 Billion |

| Market Size in 2025 | USD 21.58 Billion |

| Market Size in 2024 | USD 20.35 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.9% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Platform, Application, Mobility, Sales, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver:

Rising demand for VIP security

The rising demand for VIP security in order to protect the lives of diplomats is driving the market for armored vehicles. The survivability and security of politicians, government officials, and other dignitaries have become a significant concern due to rising political tensions within the borders. Armored vehicles are designed to offer outstanding protection along with primary weapons, ballistic glasses, protective plates, armored covering, G.P.S., and siren system.

Armored vehicles are generally known for offering enhanced comfort, privacy, and higher protection than regular cars. The effectiveness provided by armored vehicles for high-profile individuals is increasing the demand for advanced armored vehicles.

Restraint:

Mechanical failures in the armored vehicles

Continuous movement and logistic strain can cause an occurrence of mechanical or electrical failure in the armored vehicle. The failed transmission system, engine breakdown, and jammed components in armored vehicles can result in disruption of operation in adverse situations such as the battlefield. Moreover, such failures often take time to get repaired and restored.

In such cases, the unavailability of supply vehicles may cause a severe hazard to the user. Thus, such mechanical and electrical failures act as restraining factors for the market's growth. However, the rising number of OEMs that ensure the servicing and guarantee of components to avoid such shortcomings is considered to reduce the occurrence of mechanical failures.

Opportunity:

Development of fuel-efficient armored vehicles

The requirement for fuel-efficient armored vehicles due to fluctuating fuel prices is creating many opportunities for companies to grow in the global armored vehicle market. Manufacturers are focusing on the development of hybrid or electric armored vehicles to reduce fuel consumption and enhance performance.

The rising transition to clean energy will increase the demand for electric or hybrid-engine armored vehicles from commercial and defense end-users in the upcoming years. Furthermore, rising government involvement and investment in advanced electric vehicles will support the development of fuel-efficient armored vehicles by offering profit-making opportunities for players. For instance, in October 2022, the U.S. Army announced testing and analyzing electric armored vehicles using General Motors' Ultium Platform.

Covid-19 Impacts:

The Covid-19 pandemic showed mild effects on the global armored vehicle market. The pandemic's impacts on the overall defense sector have adversely impacted the armored vehicle market. Factors such as shortage of raw materials, closure of manufacturing units, lack of workforce, and disturbed global economy negatively impacted the initial phase of the lockdown. Moreover, delayed contracts and postponed business activities due to strict restrictions showed adverse effects on the global armored vehicle market.

China is one of the largest distributors of raw materials required in armored vehicles; the outbreak of coronavirus in China disrupted the supply chain and even forced many manufacturing companies to shift their units.

However, the armored vehicle market stood firm due to ongoing contracts related to armored vehicles from the militaries of various countries, including the U.S., India, and many others. Governments are focused on increasing the nation's security level by deploying advanced armored vehicles in the military, and this factor has helped the market combat the loss during the pandemic. Moreover, the geopolitical tensions between Ukraine and Russia during the same period increased the demand for armored vehicles.

Platform Insights

The combat vehicle segment is projected to grow at a CAGR of 2.7% during the forecast period. Combat vehicles are designed for combat operations with operational mobility and defense capabilities. The combat vehicle segment is further segmented into battle tanks, armored personnel carriers, armored amphibious vehicles, lightly protected vehicles, and a self-propelled howitzer. The armored personnel carrier is the most lucrative segment.

Major players in the market, such as General Dynamics Corporation, Oshkosh Defense LLC., Lenco Industries Inc and International Armored Group, have shifted their focus to developing armored personal carriers. Armored personnel carriers are expected to witness a significant advancement in the upcoming years due to rising threats from the air and increasing demand for fuel-efficient armored vehicles from the defense sector.

The combat support vehicles segment holds a significant share of the global armored vehicle market. The combat support vehicles segment is further segmented into armored supply trucks, armored command and control vehicles, bridge-laying tanks, and repair and recovery vehicles. Armored supply trucks have enormous requirements.

The technological advancements in the global armored vehicle market are projected to boost the growth of unmanned armored vehicles. Unmanned armored vehicles are capable of operating during serious situations without an onboard human presence. Considering the future, unmanned armored vehicles will undoubtedly play a vital role in the defense sector. For instance, China has already deployed a research center for advanced unmanned armored vehicles for all manufacturers.

Application Insights

The defense segment is projected to dominate the global armored vehicle market. Rising government spending on the defense sector to boost the military's operational capabilities has boosted the demand for armored vehicles in the defense sector. The ongoing geopolitical tensions between Ukraine and Russia since 2022 have increased the demand for advanced armored vehicles. Armored fighting vehicles, tanks, personnel carriers, and light-protected vehicles for patrol troops are a few standard armored vehicles required in the defense sector. Moreover, the defense sector has an enormous demand for gun trucks which are armored vehicles with the availability of weapons for soldiers on the operation field.

The commercial segment holds a significant share of the market. Commercial armored vehicles are utilized for government officials, high-profile personalities, transportation of valuables, and moving people from conflict areas. The rising demand for armored vehicles for government needs propels the segment's growth. Commercial armored vehicles range from buses, ambulances, cars, and vans.

Mobility Insights

The wheeled segment is projected to grow at a CAGR of 3.3% during the forecast period. The wheeled armored vehicles offer better road performance with better fuel economy. The wheeled segment is further segmented into 4x4, 8x8, 10x10 12x12 wheeled vehicles. The rising demand for armored personnel carriers from the defense industry is projected to boost the demand for 8x8 wheeled armored vehicles.

The tracked vehicle segment is expected to witness a significant increase during the forecast period owing to the rising demand for armored fighting vehicles from the defense sector. Tracked armored vehicles offer more excellent traction and thus are considered an ideal fit for operations in the military.

Sales Insights

The OEM segment is projected to dominate the armored vehicle market during the forecast period. Governments are focused on offering contracts for armored vehicles to the original equipment manufacturers. OEMs guarantee the quality of vehicle parts, and such parts are only available through the dealership, which boosts the reliability of vehicles. The fierce competition in the market is prone to encourage the involvement of OEMs in the market during the forecast period. Furthermore, the rising retro fitment for turning fuel-based armored vehicles into electric vehicles is fueling the growth of the retrofit segment.

Armored Vehicle Market Companies

- Oshkosh Corp

- Hanwha Defense

- BAE Systems

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- General Dynamics Corporation

Recent Developments

- In April 2025, Retia entered a strategic partnership with the Israeli company Axon Vision in the field of electronic systems for military armored vehicles. It represents the first step in a broader cooperation aimed at implementing modern electronic systems in military armored vehicles manufactured in the Czech Republic.

- In May 2025, EM&E Group, a Spanish defense contractor, exhibited its new Ferox 6×6 armored vehicle at an international military solutions convention in Madrid. The system is designed with modular architecture and anti-blast protection for “high-intensity operations” in complex domains.

- In January 2024, AVNL and MIDHANI entered into a partnership for armored vehicle development at the vehicle factory in Jabalpur. A Memorandum of Understanding (MoU) was signed at the Vehicle Factory Jabalpur, marking a significant collaboration between AVNL and MIDHANI. This agreement focuses on the design, development, and marketing of armoured vehicles.

- In January 2023, U.S. officials announced that a US-made Abrams tank would be sent to Ukraine. The U.S. has committed to send 31 Abrams tanks along with a few other armored vehicles. U.S. officials also stated that the country is currently working on a mechanism to deliver the fuel and equipment to Ukraine in order to maintain these vehicles.

- In January 2023, the Finnish Ministry of Defense announced an investment of $20.32 million (19.1 million Euros) in armored vehicles. The ministry will purchase 25 GTP 4x4 armored vehicles from a local defense firm Oy Sisu Auto. These armored vehicles will support troop transportation and patrol activities.

- In January 2023, Canada announced donating 200 Senator armored personnel carriers to Ukraine as military assistance. Advanced armored vehicles can be deployed in medical evacuations.

- In August 2022, the Australian Army unveiled a Bushmaster electric version of an armored vehicle. The 4x4 armored vehicle includes two hybrid electric drives that can produce 140 kilowatts of continuous torque. At the same time, the existing diesel engine serves an additional 400 kilowatts of power.

- In July 2022, the Philippine army received two armored vehicle-launched bridges (AVLB) from Israel. The assets will increase the army engineer combat battalions' capacity to support maneuver forces by supplying mobility during operations.

- In June 2022, Canada-based Inkas launched an all-new armored Lexus LX 600. This ultra-luxury armored vehicle combines innovative high-tech controls and refined elegance. The new Lexus LX 600 comprises ballistic windows, run-flat tires, tank armoring and an overlap system.

- In July 2022, Indian Army got new armored combat vehicles in Ladakh in order to take Chinese transgressions. The new armored combat vehicles can be used for swift patrols and quick induction of troops; they are mounted with 360° machine guns that can be remotely controlled. These vehicles are faster and have better maneuverability for functioning.

Segments Covered in the Report

By Platform

- Combat Vehicle

- Combat Support Vehicle

- Unmanned Vehicle

By Application

- Defense

- Commercial

By Mobility

- Wheeled

- Tracked

By Sales

- OEM

- Retrofit

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting