Auto Ventilated Seats Market Size and Forecast 2025 to 2034

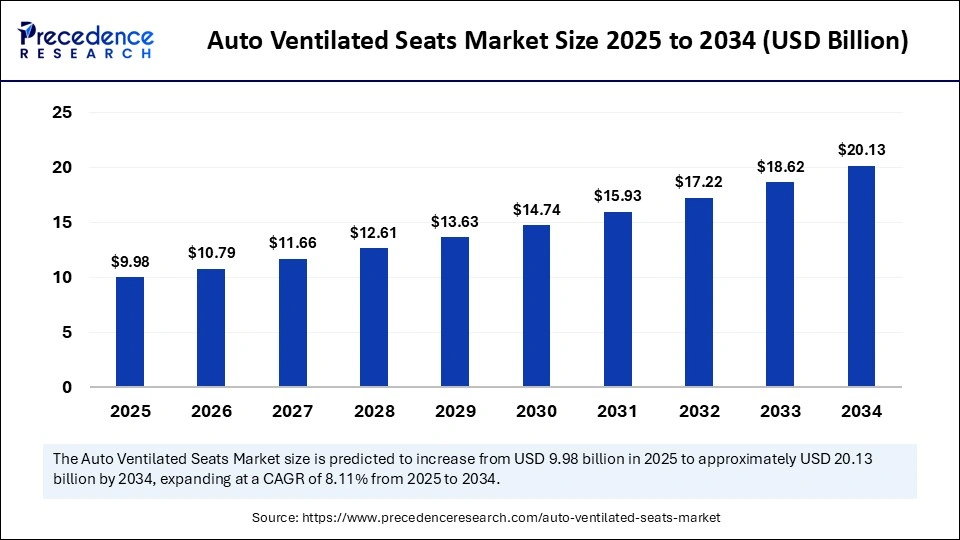

The global auto ventilated seats market size accounted for USD 9.23 billion in 2024 and is predicted to increase from USD 9.98 billion in 2025 to approximately USD 20.13 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034.The market growth is attributed to the increasing consumer demand for enhanced in-cabin comfort and advanced thermal management technologies in both premium and mass-market vehicles.

Auto Ventilated Seats MarketKey Takeaways

- In terms of revenue, the auto ventilated seats market is valued at $9.98 billion in 2025.

- It is projected to reach $20.13 billion by 2034.

- The market is expected to grow at a CAGR of 8.11% from 2025 to 2034.

- North America dominated the global auto ventilated seats market with the largest share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By vehicle type, the luxury cars segment held the major revenue share of the market in 2024.

- By vehicle type, the mid-size cars segment is expected to grow at a significant CAGR in the coming years.

- By end-user, the OEMs segment contributed the biggest market share in 2024.

- By end-user, the aftermarket segment is expected to expand at the fastest CAGR between 2025 and 2034.

- By fan type, the axial fan segment dominated the market in 2024.

- By fan type, the radial fan segment is expected to grow at the highest CAGR over the projected period.

Impact of Artificial Intelligence on the Auto Ventilated Seats Market

Artificial intelligence (AI) is essential for advancing auto ventilated seat technology since it allows systems to act more wisely. Rather than letting passengers use basic manual features, AI-powered ventilated seats help control the air by reading temperature, humidity, and passenger choices. Adaptive systems add comfort for drivers during long trips or very cold or hot weather and save energy at the same time. Additionally, major automakers are introducing AI technology to help the seats handle user needs much better by studying the actions or surroundings of the driver.

Market Overview

As global temperatures rise, the demand for auto ventilated seat systems is increasing. These systems enhance comfort in hotter environments. They use fans within the seat cushions, which keep the air flowing and help enhance passenger comfort. Ventilated seats are more efficient than full cabin cooling systems and prevent overcooling, which is important in electric vehicles. In 2024, SAE International made changes to its SAE J4002 document, recommending the use of ventilated seats for improved thermal management in both ICE and electric vehicles. Moreover, organizations like Euro NCAP and NHTSA emphasize that adequate thermal comfort within vehicles contributes to safe driving.

Auto Ventilated Seats MarketGrowth Factors

- Expansion of Ride-Sharing and Premium Fleet Services: Growing demand for in-vehicle comfort among ride-hailing operators is boosting the integration of ventilated seating to enhance passenger experience.

- Rising Heatwave Incidents Globally: Intensifying climate conditions and longer summers are fuelling the adoption of seat-based cooling technologies across vehicle categories.

- Boost in Luxury Vehicle Leasing Programs: Increasing preference for leasing high-end cars is driving demand for comfort-enhancing features such as ventilated seats in leased fleets.

- Integration of Ventilated Seats in Concept EV Models: Automakers are showcasing ventilated seating as a standard in next-generation electric vehicle prototypes, propelling early market adoption.

- Growing Focus on Driver Wellness Programs: Automotive OEMs are prioritizing ergonomics and thermal comfort as part of health-focused cabin design, strengthening ventilated seat development.

- The emergence of AI-Controlled Climate Seats: Integration of intelligent cabin climate management systems is driving innovation in adaptive ventilated seating modules.

- Surge in Cross-Over and Compact SUV Sales: The rising popularity of feature-rich compact SUVs in emerging markets is boosting demand for factory-installed ventilated seating solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 20.13 Billion |

| Market Size in 2025 | USD 9.98 Billion |

| Market Size in 2024 | USD 9.23 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.11% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Type, End User, Fan Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for In-Cabin Comfort

Increasing demand for enhanced in-cabin comfort is expected to drive the growth of the auto ventilated seats market in the coming years. People are increasingly choosing seats with advanced features. Benefited by permeable seat materials and air movement, these systems customize the climate control features for each person whenever it is humid or hot. Automakers are including ventilated seats as standard equipment in both mid-range and high-end vehicles to stand out in the market. In 2024, Euro NCAP started considering thermal comfort when judging how comfortable car passengers are moving toward analyzing other aspects of in-cabin life outside of crashes. The DOE's 2024 study pointed out that seat-based climate systems significantly reduce energy use in the whole cabin, making vehicles run more efficiently and cover longer distances. Furthermore, changing climate conditions and drivers' desire for comfortable seat options fuel the growth of the market.

Restraint

Complex Maintenance Requirements

Complex maintenance requirements affect consumer preference for ventilated seating systems in certain regions, hampering the growth of the auto ventilated seats market. In some areas, high maintenance demands deter a lot of people from preferring seating with ventilation. Vents within the seats have fans, ducts, and filters that need to be serviced or replaced frequently. Furthermore, the complicated nature of automobiles increases the chance of breakdowns in regions where repairs or maintenance are expensive and service equipment is not well developed.

Opportunity

Rising Demand from Emerging Markets

Rising demand from emerging markets is expected to create immense opportunities for key players competing in the market. Increased demand from emerging countries creates chances for designing less costly ventilated seating solutions. People in countries such as India, Brazil, and Indonesia who are part of the growing middle class are seeking extra comfort in their vehicles. Automakers and component suppliers focus on inventing seats with ventilation that are adjusted for climate and pricing in different regions. Assembling and making products locally lowers the cost of ventilated seats. In 2024, ARAI introduced special ventilated seat testing procedures, enabling OEMs to certify products developed for India's climate at a low cost. Furthermore, as stated in the 2024 DOE research, the use of energy-efficient climate control tools such as ventilated seats greatly benefits electric vehicles.

Vehicle Type Insights

What Made Luxury Cars the Dominant Segment in 2024?

The luxury cars segment dominated the auto ventilated seats market with the largest revenue share in 2024, mainly because these cars quickly adopt new technologies and prioritize a premium experience. Brands like BMW, Mercedes-Benz, and Audi include ventilated seats in their vehicles, offering users multiple comfort settings. Manufacturers of luxury cars often include ventilated seats to create a stable environment inside the car, prevent driver fatigue, and enhance seating comfort. SAE J3026 was modified in 2023 by SAE International to include ventilated seating in defining thermal comfort, which shows the importance of ventilated seats in luxury vehicles. The new ISO 14505-2:2024 includes more specific ergonomic considerations for seats in different weather conditions. This encouraged manufacturers to reconsider the airflow and the materials they use. Furthermore, the greater importance given to enhancing driver comfort while reducing fatigue is boosting the incorporation of ventilated seats in luxury cars.

The mid-size cars segment is expected to grow at a significant CAGR in the coming years. The growth of the segment is attributed to the rising consumer demand for premium features across different car types. Comfort features are now more common in mid-sized cars like SUVs and sedans, helping to keep up with the demands of today's urban users. Furthermore, in tropical regions where heat stress is higher, various auto regulatory bodies have imposed regulations to include ventilation in vehicles, boosting the use of ventilated seats. For instance, Automotive Industry Standards (AIS) in India have regulations regarding ventilation in truck cabins, ensuring a minimum airflow rate.

End User Insights

Why did the OEM Segment Dominate the Auto Ventilated Seats Market in 2024?

The OEM segment dominated the market with the largest revenue share in 2024, since comfort features are integrated during the production of vehicles, and automakers are prioritizing more comfort cabin designs. Ventilated seat systems are integrated into the vehicle's essential electronics and heating system, which guarantees optimal performance, a clean setup, and conformity to thermal guidelines. In response to consumer demand for climate-controlled seating, manufacturers like Hyundai, Ford, and Volkswagen added ventilated seats to vehicles like compact sedans and even luxury SUVs. To enhance passenger comfort, the European New Car Assessment Programme (Euro NCAP) began rating interior thermal comfort levels inside vehicles. Moreover, OEMs are continuously improving seat ventilation technology to meet the requirements of the new ISO thermal comfort standard for vehicle cabins, which is likely to sustain the segment's growth in the coming years.

The aftermarket segment is expected to expand at the fastest CAGR in the upcoming period. This is mainly due to the increased modification of existing vehicles. The rising availability of universal-fit seat covers and DIY retrofit sets are appealing to budget conscious consumers looking to improve in-cabin environment of their vehicles. ARAI performed tests in 2024 to check the performance and safety of aftermarket ventilated seats, which resulted in the certification of several seats made in India. Additionally, the rising adoption of second-hand cars in countries like Mexico, India, and South Africa is creating the need for ventilated seats, supporting segmental growth.

Fan Type Insights

How Does the Axial Fan Segment Dominate the Market in 2024?

The axial fan segment dominated the auto ventilated seats market by capturing the largest revenue share in 2024. This is mainly due to the increased popularity of axial fans among automakers for delivering air directly through air channels in the seats. The widespread use of FanExtra in OEM vehicles, offering both cost and energy savings, has made it a common choice. These fans do not require much wiring and are a perfect fit for vehicles in both the entry-level and mid-range segments. Furthermore, the increased consumer demand for comfortable temperatures and quiet cabins, along with a strong focus on low-noise car parts, bolstered the segmental growth.

The radial fan segment is expected to grow at the highest CAGR over the projected period, owing to its robust and efficient designs, which handle higher pressure and ensure equal airflow across the seat surface. Radial fans are gaining immense popularity in high-end and electric cars, where ventilation and accurate airflow are important. In 2024, the U.S. Department of Energy (DOE) pointed out that using radial fans for air conditioning helps save energy in EVs by reducing the need to pre-cool the cabin. Furthermore, the rising production and adoption of EVs is expected to drive segmental growth.

Regional Insights

Why did North America Dominate the Auto Ventilated Seats Market in 2024?

North America registered dominance in the market, capturing the largest revenue share in 2024. This is mainly due to the increased adoption of EVs and changing climate conditions. Because of the warmer years in Texas, Arizona, and Florida, many people are demanding ventilation in the seats as a standard feature. Several North American OEMs are providing ventilated seats in their models. SAE J4004 was amended by SAE International to include actively ventilated car seats in thermal comfort tests during hot-weather testing. Furthermore, the rise in demand for seat ventilation upgrades on new and old fleets supports market growth. Consumers in the region are highly demanding in-cabin comfort environments, creating the need for ventilated seats.

Asia Pacific is expected to grow at the fastest rate during the forecast period, owing to the rising production of vehicles and increasing preference for in-cabin comfort. Automakers in this region, especially in countries like China, India, South Korea, and Japan, are incorporating ventilated seats in mid- and high-end cars to provide comfort. Thermal comfort is being prioritized in new vehicles by vehicle owners, encouraging OEMs to include seat ventilation. The region's position in the market is ensured by people's desire for advanced vehicle features. Moreover, the use of regional air-circulation methods in seats shown at the 2024 Tokyo Mobility Show highlights the importance of ventilated seats to improve vehicle design and comfort. The rising focus on improving driver and passenger comfort further contributes to regional market growth.

Europe is considered to be a significantly growing area. This is mainly due to stringent regulations regarding the environment as well as driver comfort, a high volume of luxury and premium car sales, and a growing concern over in-car wellness. As people wanted more comfort in their vehicles, brands like BMW, Audi, and Volvo included multi-zone ventilated seating systems in their high-end and electric models. In Germany and France, key seating companies updated their standards in line with ISO 14505-3:2023 to overcome issues of thermal interaction. In line with the 2024 Green Deal plans from the European Commission, OEMs are incorporating energy-efficient seat ventilation in hybrid and electric vehicle models.

Auto ventilated seats market Companies

- Brose Fahrzeugteile GmbH & Co. KG

- DURA Automotive Systems

- Grammer AG

- Hyundai Transys

- Johnson Electric Holdings Limited

- NHK Spring Co., Ltd.

- TACHI-S Co., Ltd.

- Toyota Boshoku Corporation

- TS Tech Co., Ltd.

- Woodbridge Foam Corporation

Recent Developments

- In April 2025, BYD enhanced its comfort offerings by updating the Atto 3 electric SUV with front ventilated seats, making it more competitive in the premium EV space. The update complements other comfort additions such as wireless smartphone connectivity and a powered sunshade. The BYD Seal, also updated the same month, reinforces the company's focus on climate-adaptive interiors, now featuring a new LFP low-voltage battery that supports efficient seat ventilation performance. (Source:https://www.autocarindia.com)

- In October 2024, Skoda Auto announced that its Kylaq sub-4 meter SUV feature first-in-segment ventilated seats with 6-way adjustability for both driver and passenger. The inclusion of ventilated seating in the Kylaq signals Skoda's intent to redefine comfort benchmarks in India's compact SUV category.

(Source:https://www.carlelo.com)

- In June 2024, Tata Motors launched the Altroz Racer, creating headlines for becoming India's most affordable car with ventilated front seats. Offered in the top-spec R3 variant, the Altroz Racer provides segment-first comfort at an on-road price of ₹12.86 lakh in Mumbai. It joins the Tata Punch EV as the only other sub-₹15 lakh vehicle to offer ventilated seating, highlighting Tata's leadership in democratizing premium interior features.

(Source:https://motoroctane.com)

Segments Covered in the Report

By Vehicle Type

- Economy Cars

- Mid-size Cars

- Luxury Cars

By End User

- OEMs

- Aftermarket

By Fan Type

- Axial Fan

- Radial Fan

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting