What is Automotive Interior Materials Market Size?

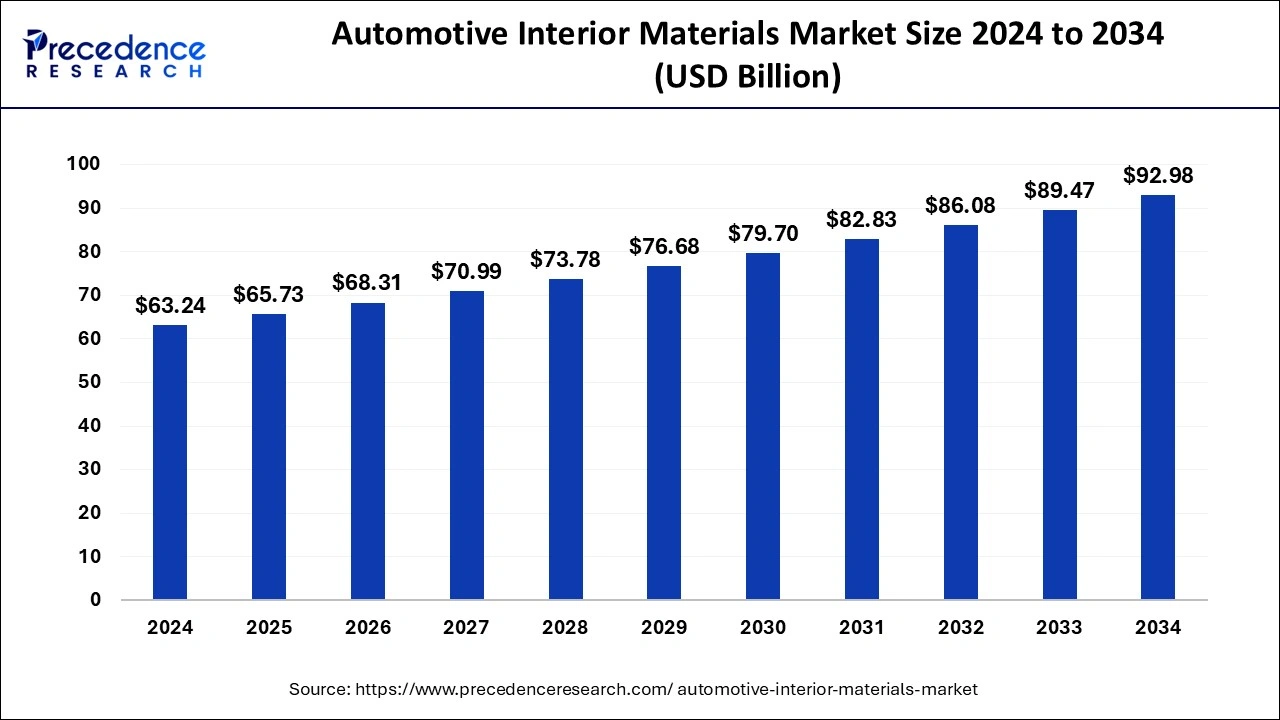

The global automotive interior materials market size is estimated at USD 65.73 billion in 2025 and is anticipated to reach around USD 96.41 billion by 2035, expanding at a CAGR of 3.9% from 2026 to 2035. The global automotive interior materials market growth is attributed to the increasing consumer preference for luxury and comfort features, stringent emissions regulations and increasing demand for lightweight vehicles.

Market Highlights

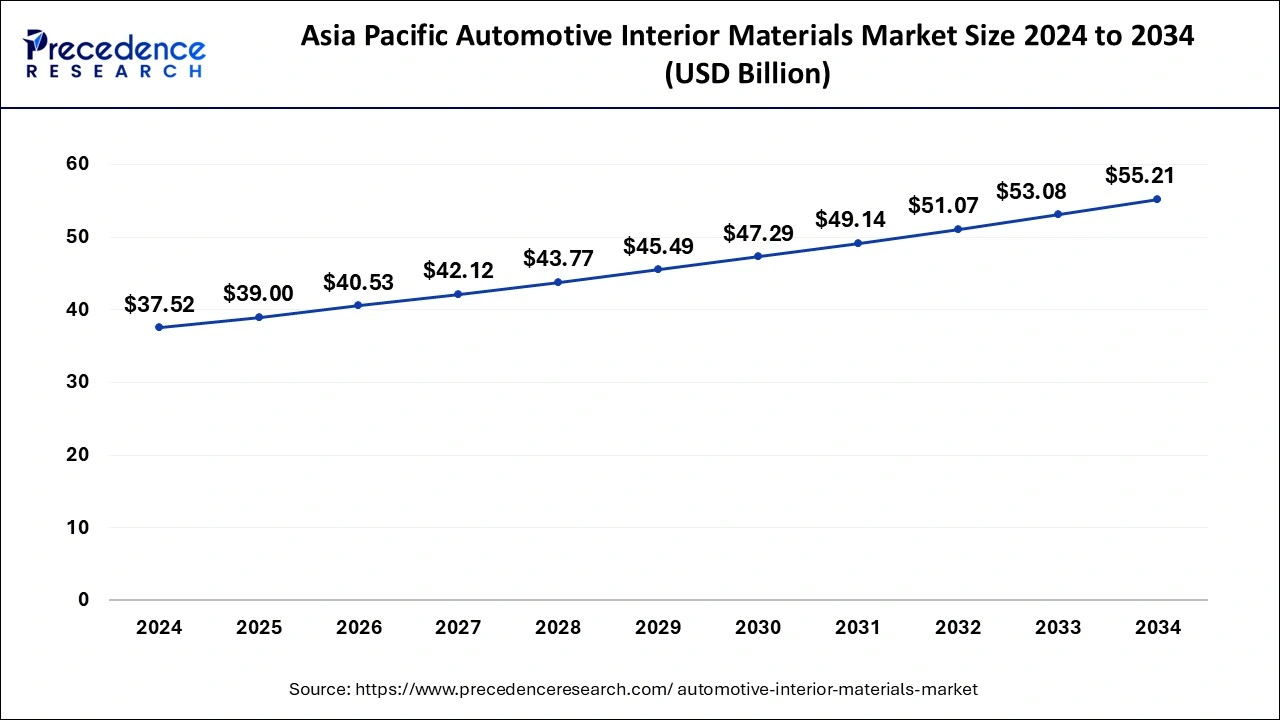

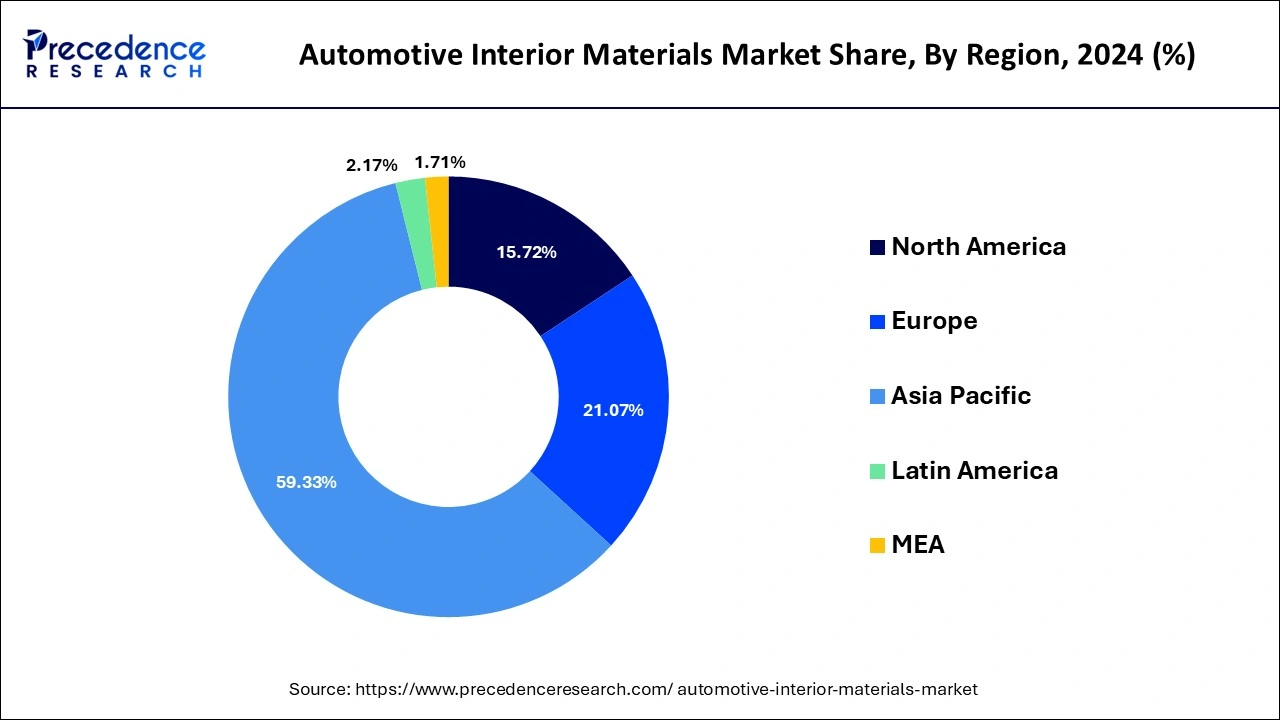

- Asia Pacific dominated the automotive interior materials market with the largest market share of 59.33% in 2025.

- Europe is projected to expand at a CAGR of 3.84% during the forecast period.

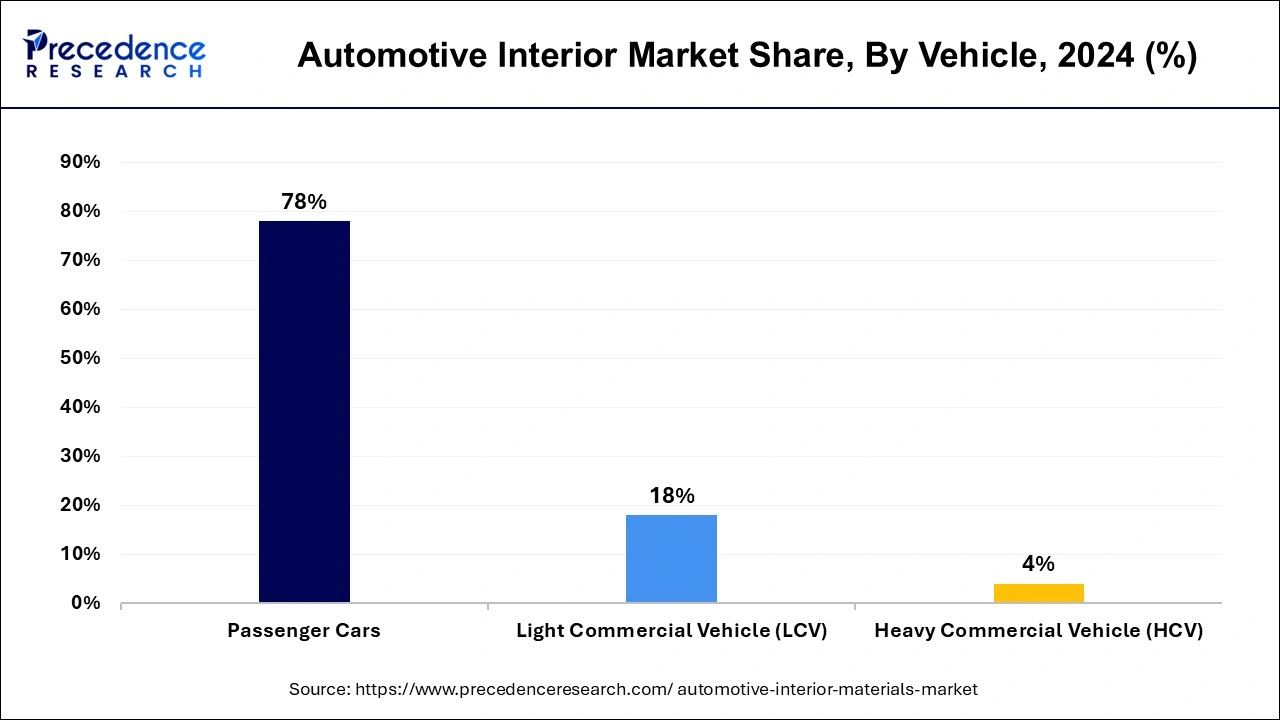

- By vehicle, the passenger cars segment has held a major market share of 78% in 2025.

- By vehicle, the light commercial vehicles (LCVs) segment is projected to grow at a notable CAGR during the forecast period.

- By material, the plastics segment accounted for the highest market share of 47% in 2025.

- By material, the composite segment is growing at a significant CAGR during the forecast years.

How AI is Changing the Automotive Interior Materials Market?

Artificial Intelligenceis revolutionizing various aspects of the automotive industry, and automotive interior materials are no exception. AI has become an integral part of the automotive interior materials. AI enables the creation of personalized interior designs. AI can suggest interior layouts, colors, materials, and features that best suit the user, by analyzing driver's biometric information, preferences and habits. For instance, BMW uses AI to adjust the cabin environment based on the driver's previous preferences, including climate control settings and seat position. From voice-activated controls to AI-powered infotainment systems, AI is essential in integrating smart technologies into automotive interiors. These technologies enhance the driving experience and make the interior user-friendly and intuitive. These advanced AI trends are further expected to revolutionize the growth of the automotive interior materials market in the coming years.

Automotive Interior Materials Market Growth Factors

Automotive interior materials provide an appealing look, improved reliability, and enhanced sustainability for automobiles and hence help manufacturers to upgrade the vehicle performance and interior features. This also help automotive manufacturers in improving automotive cabin features and designs. Furthermore, increasing trend for electric vehicles and autonomous vehicles have prominently boosted the demand for light materials in an automobile. Autonomous and other advanced vehicles are equipped with several advanced technologies that requires multiple ECUs and chips to integrate into the vehicle this increases the overall weight of the vehicle as well as also triggers the need for light-weight materials for vehicle's body and other parts.

The automotive interior materials are imperative to the vehicle manufacture. Thus, the dynamics of automotive interior materials market are closely dependent on the sale and production of vehicles. Further, the market growth for automotive interior materials is also dependent on the various government regulations for sales of vehicles as well as fuel efficiency. Apart from this, government regulation on leather pricing also plays a significant role in directing the global market value and trend. Internal substitution in the automotive parts particularly in case of leather likely to hamper the market growth. For instance, genuine leather is substituted by fabrics, synthetic PU, or PVC leather and thus the market for genuine leather is hampered in the automotive industry.

Market Outlook

- Industry Growth Overview: The market has been steadily growing both through those items that manufacturers are creating (automotive interiors) and the increase in acceptance of high-end materials to decorate the inside of an automobile.

- Sustainability Trends: The demand for more eco-friendliness is causing manufacturers to begin using more recycled plastic materials (where they are available), bio-based polymers, plus various types of vegan leather substitute products.

- Global Expansion: The Asia-Pacific area has the highest vehicle manufacturing and production rates in the world, as well as the highest increase in the use of electric vehicles and the highest increase in disposable income. North America and Europe concentrate on providing premium and environmentally friendly products and services to their customers.

- Startup Ecosystem: Many new companies are entering this space, with a large number of new companies developing new materials. New plant-based leather alternatives, recycled composite materials, and smart surfaces made from new fabrics are being created to meet the needs of the sustainability marketplace, and the performance expectations for many of these products will drive their continued success.

Automotive Interior Materials Market Trade Analysis

- The flow of trade between importing and exporting countries is also influenced by free trade agreements, by clusters of manufacturing occurring in close proximity to each other, and by local sourcing requirements from the automotive manufacturers (OEMs).

- As protectionist policies have been put into place by many governments worldwide and tariffs have been adjusted, manufacturers have developed manufacturing hubs to eliminate cross-border dependence on suppliers and to eliminate the risk created by logistics.

- Currency fluctuations and transportation costs have created challenges for suppliers who must adapt to continuously fluctuating margins associated with pricing, so they have been forced to develop multiple sources of supply, and to foster solid relationships with regional distributors.

- As the production of electrical vehicles continues to increase worldwide, the trade demand for lightweight materials, environmentally-friendly materials, and reusable recyclables will continue to change the international trade relationships for the market.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 65.73 Billion |

| Market Size in 2026 | USD 68.31 Billion |

| Market Size by 2035 | USD 96.41 Billion |

| Growth Rate from 2026 to 2035 | CAGR 3.9% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material, Vehicle, Application, End-User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Vehicle Insights

Passenger cars captured the largest revenue share of more than 78% in the year 2025 and projected to maintain the same trend over the forecast period. The growth of the segment is mainly attributed to the increasing sale of passenger vehicle coupled with introduction of autonomous and electric vehicles. Apart from above trends, the outbreak of COVID-19 has also played an important role in accelerating the sale of self-owned passenger cars in order to maintain the social distancing. This has impacted the growth of shared mobility, but proliferated the self-owned vehicle trend and hence triggered the sales of passenger cars.

On the other hand,the light commercial vehicles (LCVs) segment is projected to grow at a notable CAGR during the forecast periodowing to rise in e-commerce and retail logistics particularly in the developing nations. The outbreak of corona virus has prominently uplifted the trend for online shopping rather than visiting shops. Hence, accelerated the markets for e-commerce and retail logistics and therefore supports the growth of light commercial vehicle market.

Material Insights

The material type segment is deviced into plastics, composites, leathers, fabrics and others. The plastics segment captured majority of revenue share in the year 2024 because of its favorable capabilities to make a vehicle lighter and more appealing in terms of aesthetics.The Composite segment is projected to grow at a CAGR of 6% over the forecast period due to increasing demand for lightweight and fuel-efficient vehicles.

Application Insights

Seats application segment leads the global automotive interior materials market and accounted for more than 30% in terms of revenue share by the end of the analysis period. This is mainly because of the significant importance of seats for driver's as well as passenger's comfort and convenience. Different physiological and psychological studies on human perception, posture & adjustability, and weight distribution have resulted in the application of various materials for automotive seats. High performance PU foams along with covering materials that include fabric or leather are frequently used in seat cushion manufacturing. Increasing need for light weight materials in seats also trigger the application of carbon fibers and other composites to enhance the level of comfort in modern vehicles.

Regional Insights

Asia Pacific Automotive Interior Materials Market Size and Growth 2026 to 2035

The Asia Pacific automotive interior materials market size is evaluated at USD 39.00 billion in 2025 and is predicted to be worth around USD 57.26 billion by 2035, rising at a CAGR of 3.92% from 2026 to 2035

Asia Pacific is dominated the automotive interior materials in 2025. The market growth in the region is attributed to the increasing urbanization, rising disposable income and rapid development of the economy.

China is the major and dominated country in the automotive interior materials industry. The increasing consumer preference in the aesthetic qualities of their vehicles is expected to drive the market growth in China. In addition, the increasing innovative interior designs of millennials and increasing demand from the target market, along with the increase in disposable income of the population are further anticipated to drive the growth of the automotive interior materials market in China.

North America is expected to grow fastest during the forecast period. The market growth in the region is attributed to the rising well-developed automotive industry and strong presence with key automotive manufacturers. The region estimated the rising demand for high-quality interior materials that balance durability, comfort and aesthetics. In addition, the strict safety regulations imposed by the adoption of advanced technologies further drives the market demand in North America.

The market growth in the U.S. is attributed to the increasing demand for attractive designs and better interiors with better features. In addition, the increasing presence of the latest and improved technologies and enhanced materials with the rising penetration of larger displays are further contributed to propel the growth of the automotive interior materials market in the U.S.

Automotive Interior Materials Market-Value Chain Analysis

- Raw material procurement: includes sourcing polymers, synthetics leathers, textiles, foams and sustainable fibre. This process involves weighing the quality standards, cost efficiency and government regulations while providing several options to customers.

- Material Processing & Component manufacturing: Transforming raw materials into components of the vehicle's interior with the help of just-in-time delivery methodology, advanced technologies and logistics will allow manufacturers to produce interiors that are customized to their specifications.

- OEM integration & Distribution: Manufacturers supply directly to automotive manufacturers and Tier 1 suppliers through efficient supply chains, including logistics systems and other value chain partners.

Top Companies in the Automotive Interior Materials Market & Their Offerings:

- Lear Corporation: provides complete seating systems and leather seating solutions for the passenger car and commercial vehicle industries, as well as providing interior electrical architectures.

- BASF SE: provides a wide array of innovative materials, including, high-performance plastics, polyurethanes and lightweight solutions.

- Faurecia: produces systems for modular interiors, surfaces made from renewable resources, and smart cabin solutions specifically for the electrification of vehicles and high-end vehicles.

Other Automotive Interior Materials Market Companies

- Evonik Industries AG

- UFP Technologies

- Saudi Basic Industries Corporation (SABIC)

- Arkema

- Stahl Holdings B.V.

- Hexcel Corporation

- Continental AG

- Toray Industries Inc.

- Huntsman International

- Sumitomo Chemical Company

- Dow Chemical Company

- Trinseo S.A.

- Borealis AG

- Covestro AG

Recent Developments

- In September 2024, a sustainable and plant-based trim material, persiSKIN AUTO was launched by Antolin. The aim behind this launch was to revolutionize the automotive interior.

- In May 2024, to enhance the development of circular materials for automotive interiors, Trinseo and Yanfeng announced a partnership. This collaboration supports the circular economy and focuses on creating interior materials.

Segments Covered in the Report

By Material Outlook

- Composites

- Glass Fiber

- Carbon Fiber

- Natural Fiber

- Plastics

- Thermosets

- Thermoplastics

- Leather

- Fabrics

- Others

By Vehicle Outlook

- Passenger Cars

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

By Application Outlook

- Doors

- Consoles & Dashboards

- Seats

- Floor Carpet

- Steering Wheels

- Others

By End-users Outlook

- OEMs

- Aftermarket

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting