What is the Automatic Weapons Market Size?

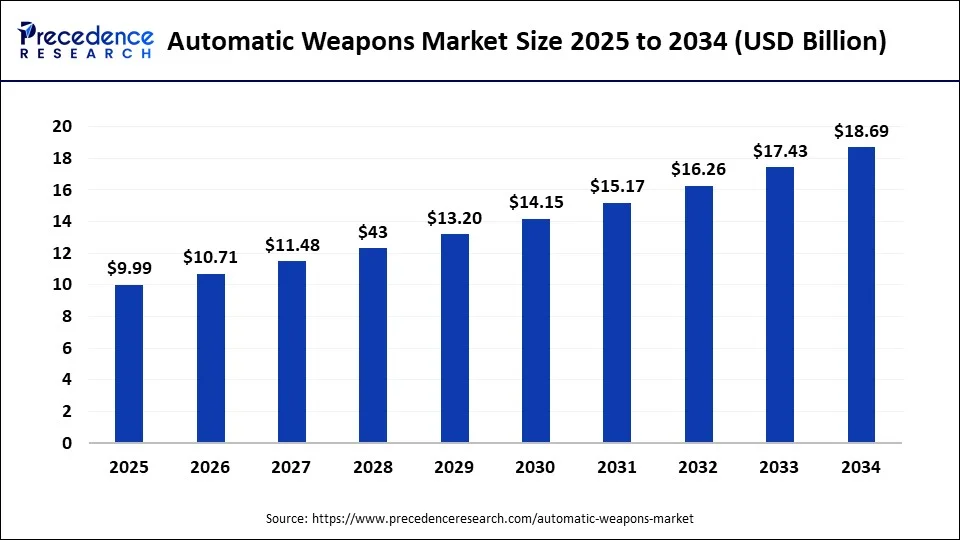

The global automatic weapons market size is accounted at USD 9.99 billion in 2025 and predicted to increase from USD 10.71 billion in 2026 to approximately USD 18.69 billion by 2034, at a CAGR of 7.21% from 2025 to 2034. The growing concerns over security threats are the key factor driving the automatic weapons market growth.

Automatic Weapons Market Key Takeaways

- The market is expected to grow at a CAGR of 7.21% from 2025 to 2034.

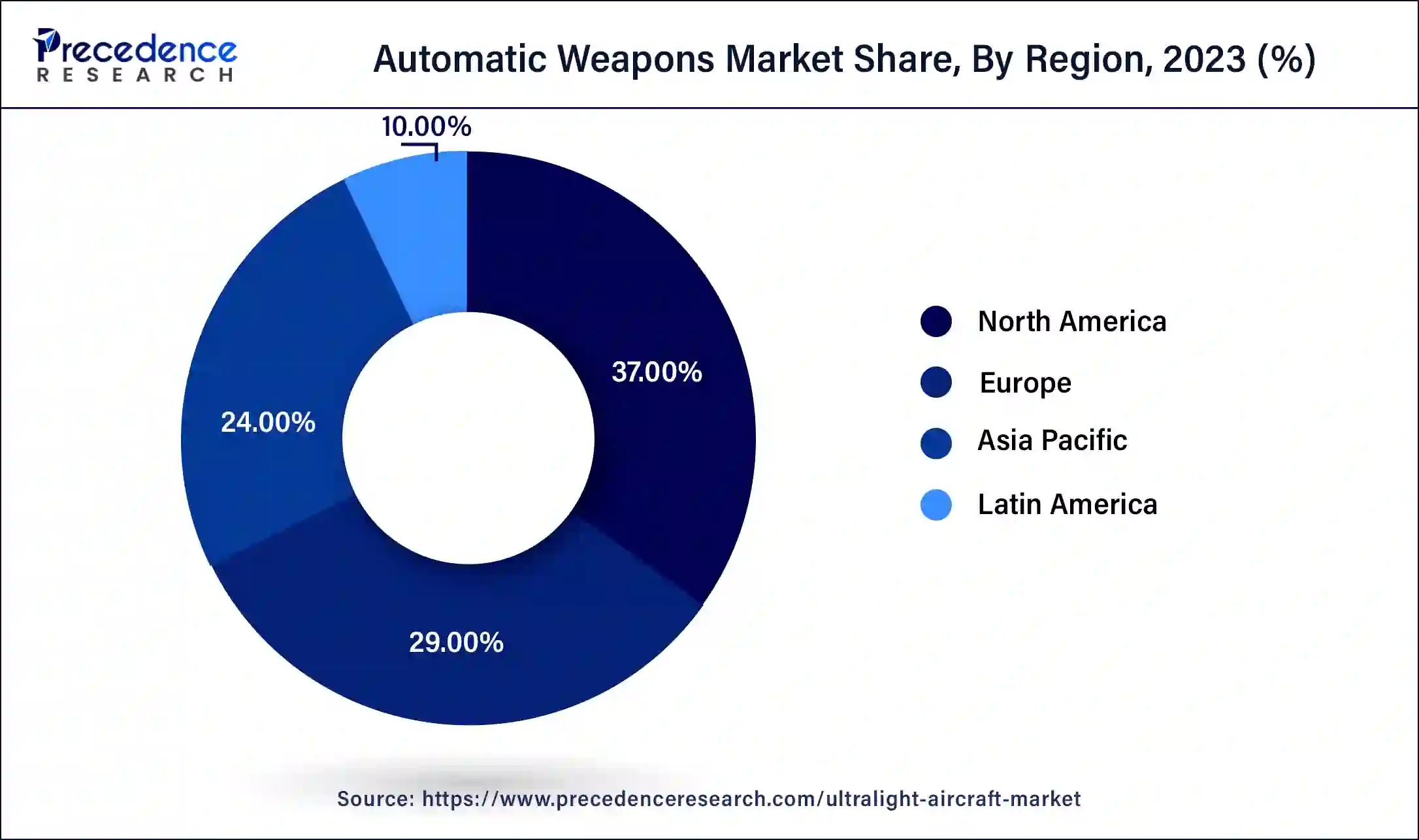

- North America dominated the automatic weapons market with the largest market share of 39% in 2024.

- Asia Pacific is expected to show the fastest growth in the market during the forecast period.

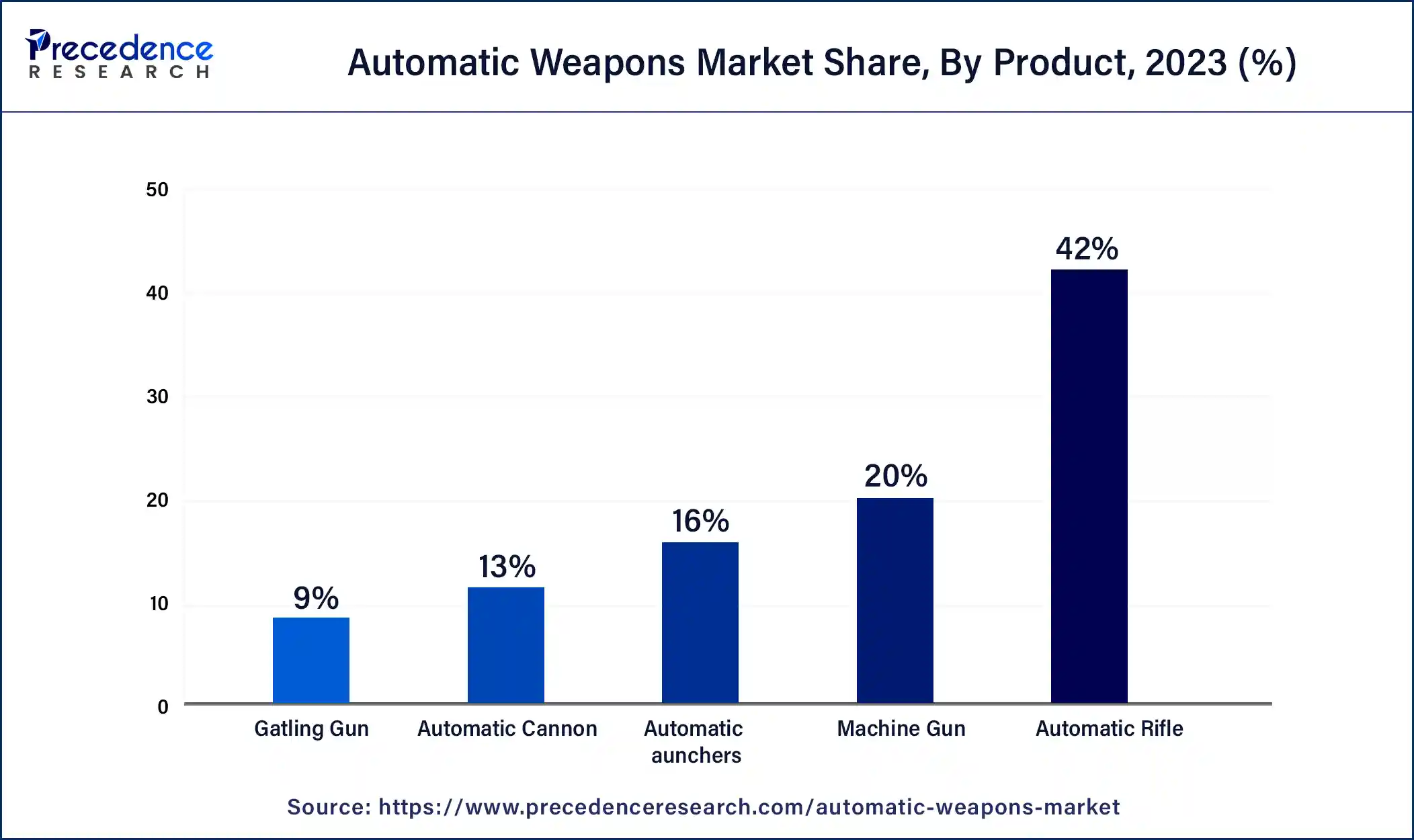

- By product, the automatic rifle segment has contributed more than 42% of market share in 2024.

- By product, the machine gun segment is expected to grow at the fastest rate in the market over the forecast period.

- By type, the semi-automatic segment led the global market in 2024.

- By type, the fully automatic segment is anticipated to grow at the fastest rate in the market during the forecast period.

- By caliber type, in 2024, the small caliber segment held the largest share of the market.

- By caliber type, the medium caliber segment is expected to grow at a significant rate in the market throughout the forecast period.

- By end-user, the land segment dominated the market in 2024.

- By end-user, the airborne segment is expected to grow at a significant rate in the market over the projected period.

Role of AI in the Automatic Weapons Market

Machine learning algorithms play a vital role in this system and can be leveraged to analyze a large amount of data and make decisions accordingly. Innovative sensor technologies, such as infrared and electro-optical sensors, are the main components of these systems, which help them detect and track targets with great accuracy. Furthermore, many developed countries like the U.S. and China are already investing heavily in the automatic weapons market. However, the system also poses some legal, ethical, and operational challenges that need to be addressed.

- In July 2024, Zen Technologies, an anti-drone technology and defense training solutions provider, in collaboration with its subsidiary AI Turing Technologies, introduced the AI-powered robot Prahasta, among other products, for the global defense market. Prahasta is an automated quadruped that uses LiDAR and reinforcement learning to understand and create real-time 3D terrain mapping for unparalleled mission planning, navigation, and threat assessment.

Market Overview

Automatic weapons are meant to discharge continuously if the trigger is pressed. these weapons are different from semi-automatic firearms. Due to their ability to fire continuously these weapons are mainly utilized by law enforcement and the military. Machine guns, submachine guns, and assault rifles are some examples of these weapons to overcome the possibility of abuse and crimes many nations have imposed strict laws controlling the possession and use of automatic weapons.

Top 10 Countries with Highest Gun Ownership

| Country | Rate |

| United States | 120.50 |

| Falkland Islands | 62.10 |

| Yemen | 52.80 |

| New Caledonia | 42.50 |

| Serbia | 39.10 |

| Montenegro | 39.10 |

| Canada | 34.70 |

| Uruguay | 34.70 |

| Cyprus | 34 |

| Finland | 32.40 |

Geo-political Trends

Preliminary use cases during conflict, such as Ukraine and Gaza, have shown AI is being used in battle increasingly more. The drop in prices and the growing demand in the military sector are likely to lead to their mass usage. The ensuing technology change demands immediate global discussion and governance of the dangers and reconceptualising human functions in warfare before full designation into a battlefield.

Recent Trends

- Modular designs are increasingly used, allowing weapons to be adapted for different missions, calibers, and attachments. This enhances versatility and operational efficiency.

- Lightweight materials, such as advanced composites, are being incorporated to reduce weapon weight and improve mobility for soldiers. Durability is maintained while reducing fatigue during long operations.

- Automatic weapons are increasingly integrated into unmanned and remotely operated platforms, such as drones and robotic ground vehicles. This reduces risk to personnel in combat situations.

- Some systems are being designed with counter-drone capabilities, reflecting the need to address emerging aerial threats. These features support modern battlefield defense strategies.

- Small-caliber automatic rifles and machine guns are favored for versatility and cost-effectiveness in infantry and rapid-response operations. They are easier to deploy across diverse missions.

- Strategic partnerships and collaborations are rising, as weapon manufacturers team up with tech and robotics firms to create next-generation automatic weapon systems. This fosters innovation and faster deployment of advanced solutions.

Automatic Weapons Market Growth Factors

- The growing trend of military modernization programs globally is expected to drive the automatic weapons market growth shortly.

- The development of materials science and design can fuel the automatic weapons market during the forecast period.

- The increasing concerns about global security can boost the automatic weapons market growth further.

Market Outlook

- Industry Growth Overview: The market for automatic weapons is growing as a result of military force modernization, growing defense budgets, and geopolitical unrest. To satisfy various operational needs, there is a growing need for light machine guns, advanced infantry weapons, and modular rifles. Global defense modernization initiatives are propelling market expansion.

- Sustainability Trends: Sustainability in this market focuses on lighter, more durable materials like composites and alloys, which reduce environmental impact during production and improve weapon longevity. Energy-efficient manufacturing processes and material recycling are also being adopted to make production more eco-friendly

- Startup Ecosystem: Smart weapon systems, modular designs, and integration with unmanned platforms are areas of innovation being developed by startups and smaller defense companies. Many are working with larger defense contractors to bring next-generation solutions to market, concentrating on cybersecurity and AI-assisted targeting for weapon systems.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 18.69 Billion |

| Market Size in 2025 | USD 9.99 Billion |

| Market Size in 2026 | USD 10.71 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.21% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Caliber, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Increasing cross-border conflicts

Increasing cross-border conflicts around the world are fueling the demand for automatic weapons and thus driving the growth of the automatic weapons market. Border conflicts have increased dramatically in many countries in the past decades. Border disputes between Venezuela and Colombia, China and India, India and Pakistan, and Iraq and Syria are some notable ongoing examples in the world. Additionally, improvements in automatic weapon systems like armed robots and laser weapon systems are anticipated to drive market growth further in the future.

Ranking violent conflict levels across the world (2023 statistics)

| Index Rank | Country/Territory | Index Level |

| 1. | Myanmar | Extreme |

| 2. | Syria | Extreme |

| 3. | Mexico | Extreme |

| 4. | Ukraine | Extreme |

| 5. | Nigeria | Extreme |

| 6. | Brazil | Extreme |

| 7. | Yemen | Extreme |

| 8. | Iraq | Extreme |

| 9. | Democratic Republic of Congo | Extreme |

| 10. | Colombia | Extreme |

Restraint

Unfavorable government regulations

Sometimes, these regulations can make it difficult and costly for companies to sell automatic weapons, which in turn can restrict the number of potential customers in the automatic weapons market. Many countries have stringent regularity policies regarding the authority and sale of automatic weapons. Additionally, high purchasing costs associated with automatic weapons can also hinder market growth.

Opportunity

Modernization of law enforcement capabilities

In the current automatic weapons market, public safety and the reduction of weapon-related incidents are key concerns for governments globally. The rising incidence of organized crimes, drugs, domestic violence, and arms smuggling demands the modernization of law enforcement capabilities. Furthermore, governments are spending large amounts of money on the development of automatic weapons for law enforcement agencies.

- In December 2024, China launched the Stealthy GJ-11 Attack Drone from Amphibious Assault Ships. China Central Television published an animated graphic showing its armed GJ-11 stealthy drone launching from a Type 075 amphibious assault ship—observers at the Pentagon tracking the rapid expansion and modernization of the People's Liberation Army.

Product Insights

The automatic rifle segment dominated the automatic weapons market in 2024. The growth of the segment is attributed to the rising demand for fully automatic rifles from special forces, particularly from Asian countries. Moreover, automatic rifles have gone through substantial development in recent years. However, future advancements in automatic rifle technology are anticipated to pose a threat to society and cause social ramifications.

- In January 2024, the Armament Research and Development Establishment (ARDE) and a Hyderabad-based private firm launched an indigenous assault rifle named ‘ugram' (ferocious). This is the first time that the Defence Research and Development Organisation (DRDO) lab has collaborated with private industry to manufacture a 7.62 x 51 mm caliber rifle, said an official.

The machine gun segment is expected to grow at the fastest rate in the automatic weapons market over the forecast period. Machine guns are made to withstand continuous fire. The replacement of traditional machine guns with light ones can fuel the segment's growth further. Machine guns have many benefits, including the capability to quickly engage multiple targets and suppress enemy positions.

Type Insights

The semi-automatic segment led the global automatic weapons market in 2024. The dominance of the segment can be linked to the growing demand for semi-automatic weapon systems from India, Pakistan, Ukraine, and Syria to tackle regional tensions. The development of material science and manufacturing techniques can propel market growth soon.

The fully automatic segment is anticipated to grow at the fastest rate in the automatic weapons market during the forecast period. The growth is credited to the ease of accessibility of these weapons during war operations. Also, the rising cases of terrorism and demand for precision weapon systems are key factors driving market growth.

Caliber Insights

The small caliber segment held the largest share of the automatic weapons market in 2024. This is due to the improved performance, the lethality of small-caliber assault rifles, and penetration range during war operations. Additionally, small caliber weapons are easy to handle and convenient to use, which can lead to market growth shortly.

The medium caliber segment is expected to grow at a significant rate in the automatic weapons market throughout the forecast period. Medium caliber refers to projectiles with diameters ranging from 20 mm (about 0.79 in) to 40 mm (about 1.57 in). Medium calibers, such as 20mm (about 0.79 in) and 25mm (about 0.98 in) weapons, dominate the segment. The growth of the automatic weapons industry can boost segment growth further.

- In April 2024, Leonardo, the Italian defense industry champion, unveiled two new projects for medium caliber guns, one chambered for 30×113 ammunition while the second is a Gatling weapon firing 20×102 mm rounds. The development of such weapons is part of the company's industrial strategy of vertical integration, which aims at putting products entirely made by Leonardo divisions on the market.

End-use Insights

The land segment dominated the automatic weapons market in 2024. The growth of the segment can be linked to the growing expansion of military forces worldwide and the increase in the procurement of weapons by land-based forces. The government's increasing focus on close combat systems is also propelling the segment's growth.

The airborne segment is expected to grow at a significant rate in the automatic weapons market over the projected period. The rising replacement of traditional systems with innovative combat systems in combat support aircraft, fighter aircraft, and helicopters is driving the growth of the segment. Furthermore, the growing demand for GPS-guided weapons operating swiftly even in bad weather conditions can contribute to the market expansion.

Regional Insights

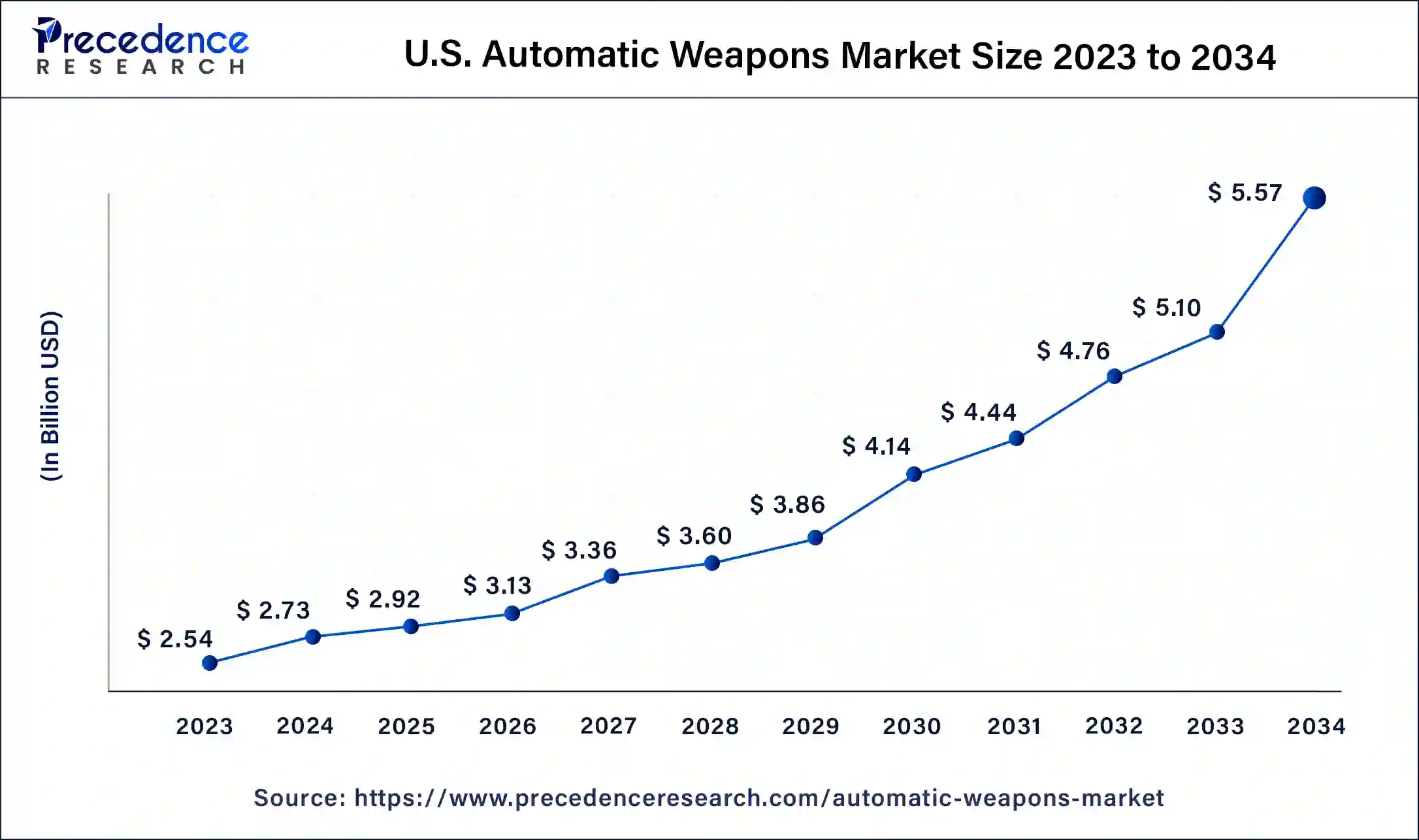

U.S. Automatic Weapons Market Size and Growth 2025 to 2034

The U.S. automatic weapons market size is exhibited at USD 2.92 billion in 2025 and is projected to be worth around USD 5.57 billion by 2034, poised to grow at a CAGR of 7.39% from 2025 to 2034.

North America dominated the automatic weapons market in 2024. The growth of the market in the region is due to the high defense budget and expenditure to strengthen the special armed forces. The expenditure is mainly for procuring innovative weapons and upgrading the defense sector with advanced weapons. Moreover, the presence of key market players in the region is further driving the market growth.

- In April 2024, Ottawa is planed a mandatory buyback program for military-style firearms during the 2025 election year after the program was delayed by Canada Post's refusal to participate, sources say. With only months to go before its launch, details of the vast logistical operation remain in flux, federal officials have told Radio-Canada.

Asia Pacific is expected to show the fastest growth in the automatic weapons market during the forecast period. This is mainly because of the growing demand for body armor by the military and increasing overall military spending, particularly in India and China. Furthermore, growing defense and individual expenditure in the region can also stimulate market growth in the region in the coming years.

How does Europe contribute to the development of defence technologies?

Europe is expected to grow at a notable rate in the foreseeable future in the automatic weapons market due to the strong presence of key manufacturers, considerable military spending, and a growing emphasis on defence technology. Many countries, like Germany and the UK, have strong positions in the European market, significantly investing in defence technology, leading to a higher demand for automatic weapons for military modernization programs and border security. Technological innovation in the region is also an important factor, with companies investing in research and development to develop advanced automatic rifles and machine guns.

What Is Fueling the Growth of the Automatic Weapons Market in the Middle East and Africa?

The Middle East and Africa automatic weapons market is expected to witness significant growth over the forecast period. Fuelled by increased levels of defense expenditures and security issues in the region. Countries like Saudi Arabia and Turkey are at the forefront in the need of getting advanced weapons such as automatic launchers, automatic cannons, and self-attacking drone systems. These countries are strongly committed to updating their defense systems due to the geopolitical tensions around, domestic security concerns, and the necessity to protect borders.

Saudi Arabia is on its way to expanding its existing stock of weaponry with high-tech automatic arms and drones. As the governments start emphasizing military modernization, ventures with other international military producers, as well as domestic productions, are likely to spur further market developments. Also, the implementation in large quantities and integration with AI and automation systems of smart weapon technologies is becoming one of the central trends, defining the future of the MEA automatic weapons market.

Value Chain Analysis

- Raw Material Sourcing: Manufacturers focus on high-grade metals, alloys, and precision components to ensure durability and accuracy. Supply chains are tightly managed for consistent quality. Advanced composites are also being used to reduce weight and improve mobility.

Key Players: FN Herstal, Heckler & Koch, Colt's Manufacturing Company. - Supply to Government and Airlines: Automatic weapons are supplied to military, security agencies, and approved aviation units under strict contracts and regulations. Deliveries often include training and support packages to ensure proper usage

Key Players: Lockheed Martin, BAE Systems, Rheinmetall Defense. - Aftermarket Services and Upgrades: Services include maintenance, spare parts, and modular upgrades to extend weapon lifespan and enhance performance. Modernization programs also provide digital enhancements and optics integration

Key Players: FN Herstal, SIG Sauer, Heckler & Koch.

Key Drivers, Trends, Innovations & Leading Players

| Category | Focus Area | Key trends | Key Players |

| Raw Materials Sourcing | High-grade metals, alloys, and composites | Use of lightweight materials and precision components to improve durability and mobility | FN Herstal, Heckler & Koch, Colt's Manufacturing Company |

| Supply to Government & Agencies | Military forces, security agencies, and aviation units | Strict procurement contracts, inclusion of training and support packages | Lockheed Martin, BAE Systems, Rheinmetall Defence |

| Aftermarket Services & Upgrades | Maintenance, spare parts, modular upgrades | Modernization with digital optics, enhanced targeting, and improved performance | FN Herstal, SIG Sauer, Heckler & Koch |

| R&D & Innovation | Smart targeting, AI integration, and modular designs | AI-assisted fire control, battlefield network integration, and drone compatibility | FN Herstal, Heckler & Koch, Lockheed Martin |

Automatic Weapons Market Companies

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Heckler & Koch

- FN Herstal

- Kalashnikov Concern

- Barrett Firearms Manufacturing

- Beretta

- shephardmedia

- Colt's Manufacturing Company

- SIG Sauer

- Browning Arms Company

- Smith & Wesson

- Israel Weapon Industries

Recent Developments

- In April 2025, Brazilian firearms manufacturer Taurus Armas is responding to new tariff impositions by increasing its production capabilities in the U.S. If more tariffs are imposed, the U.S. plant that can produce 3,000 guns per day will lower business expenses.

(Source: https://www.reuters.com) - In October 2024, the SSRS 30mm semi-automatic grenade launcher was released from Barrett Firearms, a manufacturer that is American. The new weapon is intended to be used with the U.S. Army Precision Grenadier System. It shall provide for greater tactical flexibility as well as accuracy.

(Source: https://armyrecognition.com) - In November 2024, Rino Chiappa, President of the Chiappa Group Chiappa Group announced the acquisition of the French company SAPL (Société d'Application des Procédés Lefebvre). This acquisition not only strengthens Chiappa's position in the professional security sector but also opens new opportunities to provide reliable, high-performance solutions to demanding professionals by implementing its ambitious development plans and bringing innovative solutions to the market.

- In March 2023, Ron Cohen, President and CEO, SIG SAUER, Inc., announced the acquisition of General Robotics, the premier manufacturer of lightweight remote weapon stations and tactical robotics for manned and unmanned platforms and anti-drone applications. This acquisition improves the portfolio of SIG SAUER's advanced weapon system by leveraging General Robotics' leading to the way in the development of instinctive and lightweight remote weapon stations with its battle-proven solution.

- In April 2025, a Technology Transfer (ToT) agreement, under which CARACAL has signed a licensing contract with ICOMM for the localized production of a comprehensive range of next-generation firearms. This is notably the first-ever transfer of defence technology from the UAE to India, where a concrete demonstration of knowledge sharing and capability development that augments the status of India as a global defence production hub.

- In March 2023, the Estonian Defense Investment Centre awarded an order to Israel's IWI for the supply of 1,000 NG7 ‘Negev' light machine weapon systems to the Estonian Army. The ‘Negevv' machine guns, which are expected to be delivered towards the end of 2023, will take over from MG3 and KSP-58 machines that are already in use.

- In January 2022, the U.S. Army awarded FN America a contract for USD 49 million to supply M240L medium machine guns and titanium receivers. The M240L, which is roughly 18% lighter than the M240B, was adopted in 2010 after a joint effort by FN and the U.S. Army. It is to reduce overall weight while maintaining the performance and durability of the machine gun.

- In May 2022, Saab, a defense giant, and its armed forces partners completed a two-day series of live-fire demonstrations, including night-time firings, the largest demonstration at the company's facilities since 2014. With Sweden formally petitioning to join NATO after decades of balancing the alliance with Russia, a new spotlight is being cast on its domestic defense industry.

Segments Covered in the Report

By Product

- Automatic Rifle

- Machine Gun

- Automatic Launchers

- Automatic Cannon

- Gatling Gun

By Type

- Fully Automatic

- Semi-automatic

By Caliber

- Small Caliber

- Medium Caliber

- Large Caliber

By End-user

- Land

- Maritime

- Airborne

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting