Automotive Filter Market Size and Forecast 2026 to 2035

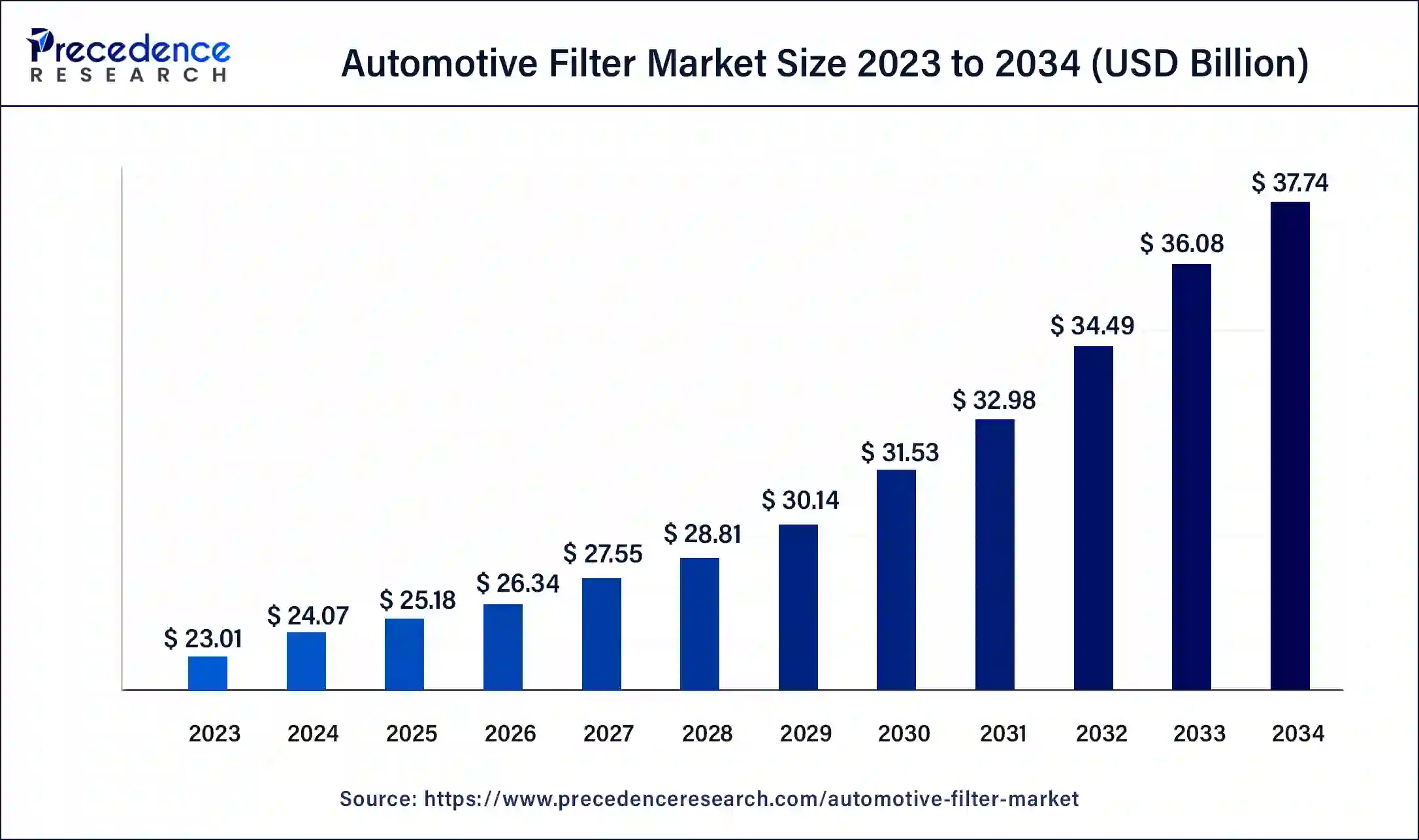

The global automotive filter market size is valued at USD 25.18 billion in 2025 and is predicted to increase from USD 26.34 billion in 2026 to approximately USD 39.40 billion by 2035, expanding at a CAGR of 4.58% from 2026 to 2035

Automotive Filter Market Key Takeaways

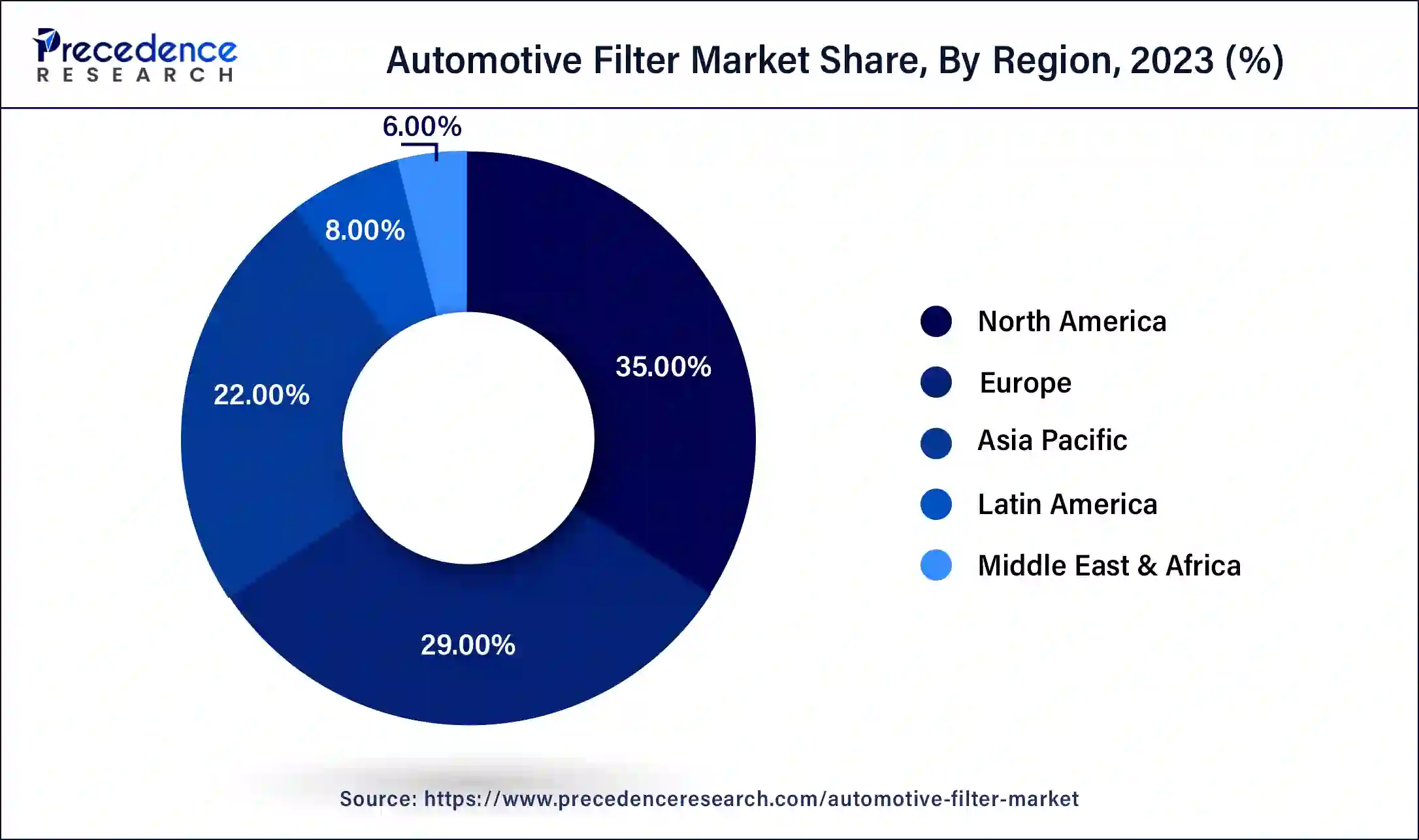

- North America led the global market with the highest market share of 35% in 2025.

- Asia-Pacific is expected to expand at the largest CAGR between 2026 and 2035.

- By Filter Type, the cabin air filter segment has held the highest market share in 2025.

- By Vehicle Type, the commercial vehicle segment had a major market share of 69% in 2025.

- By Distribution Channel, the digital segment contributed more than 75% of the market share in 2025.

Automotive Filter Market Growth Factors

The growing concerns regarding environment, pollution, and global warming has forced the government to lay down certain regulations and emission norms for the automotive sector. These regulations and standards regarding the emission is one of the primary drivers of the automotive filter market growth. Hence, the consumers are shifting their preferences towards diesel engines that promotes fuel-efficiency. Moreover, the automotive filters helps to reduce fuel consumption and facilitates in the smooth functioning of the engine. Consumers' desire to save fuel costs by consuming less fuel is driving the growth of the automotive filter market.

The global automotive filter market is expected to witness a rapid growth owing to the increasing sales of luxury cars. The rising disposable income, rise of middle class in the developing nations, increased awareness regarding the harmful effects of carbon emission, and increased demand for premium and luxury vehicles in developed market are the various factors that are expected to augment the growth of the automotive filter market during the forecast period. Moreover, increasing investments on research & development by the manufacturers for developing advanced technologies to gain competitive edge is positively contributing towards the growth of the market.

How is AI contributing to the Automotive Filter Market?

AI mainly affects the four main stages of the automotive industry value chain, such as raw material sourcing, vehicle production, and sales and service, by providing effective real-time monitoring and support for autonomous driving and predictive maintenance. It also makes a significant contribution to the manufacturing process by enabling generative design, defect detection, and machinery servicing.

Automotive Filter MarketMarket Outlook

Vehicle production and demand for better emission control performance are the main factors driving the industry.

Filtration development depends on shifting materials and cleaning techniques that are eco-friendly and recyclable.

Enterprises are moving to the emerging regions to cater to the increasing mobility and automotive needs.

Sequoia Capital, BlackRock, and Vanguard Group provide support for the advancement of filtration technologies.

New companies are focusing on the development of smart media and connected filter solutions for modern mobility.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 25.18 Billion |

| Market Size in 2026 | USD 26.34 Billion |

| Market Size by 2035 | USD 39.40 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 4.58% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Filter, Vehicle, Distribution Channel, and Region |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Automotive Filter Market Market Segment Insights

Filter Type Insights

By filter type, in 2025, the cabin air filter dominated the largest market share in terms of revenue of the total market. The cabin air filters help to remove pollutants like dust and pollens from the air and provides safe breathing to the passengers. The growing health consciousness among the consumers coupled with rising investments by the automotive filter market players to improve the efficiency of the cabin air filters has fostered the growth of the cabin air filter segment in the recent years.

Vehicle Type Insights

By vehicle type, in 2025, the commercial vehicle dominated the market with around 69% share in terms of revenue of the total market. The rapid expansion of infrastructure and industries in the developing economies has exponentially contributed to the sale of the commercial vehicle. Moreover, tourism industry has played a significant role in the growth of the commercial vehicles in the past few decades. The rising number of e-commerce and real estate activities are projected to fuel the demand for the commercial vehicles in the forthcoming years. Therefore, the commercial vehicle segment is anticipated to remain the dominating segment throughout the forecast period.

On the other hand, the passenger vehicles is projected to be the most opportunistic segment during the forecast period. The rising disposable income, growth of the middle class, and demand for the luxury cars is augmenting the demand for the passenger vehicles across the globe. Passenger vehicle have higher penetration in the developed markets of North America and Europe. However, the passenger vehicles demand is rapidly growing in the developing markets due to rising disposable income, easy availability of car loans, and growing demand for quality life.

Distribution Channel Insights

By Distribution Channel, in 2025, the aftermarket dominated the market with around 75% share in terms of revenue of the total market.The automotive filter market is dominated by the aftermarket segment due to the presence of large number of Japanese, European, and American manufacturers. Moreover, the developed market like US is dominated by the aftermarket channel due to the higher penetrationof the passenger vehicles.

Automotive FilterMarket Regional Insights

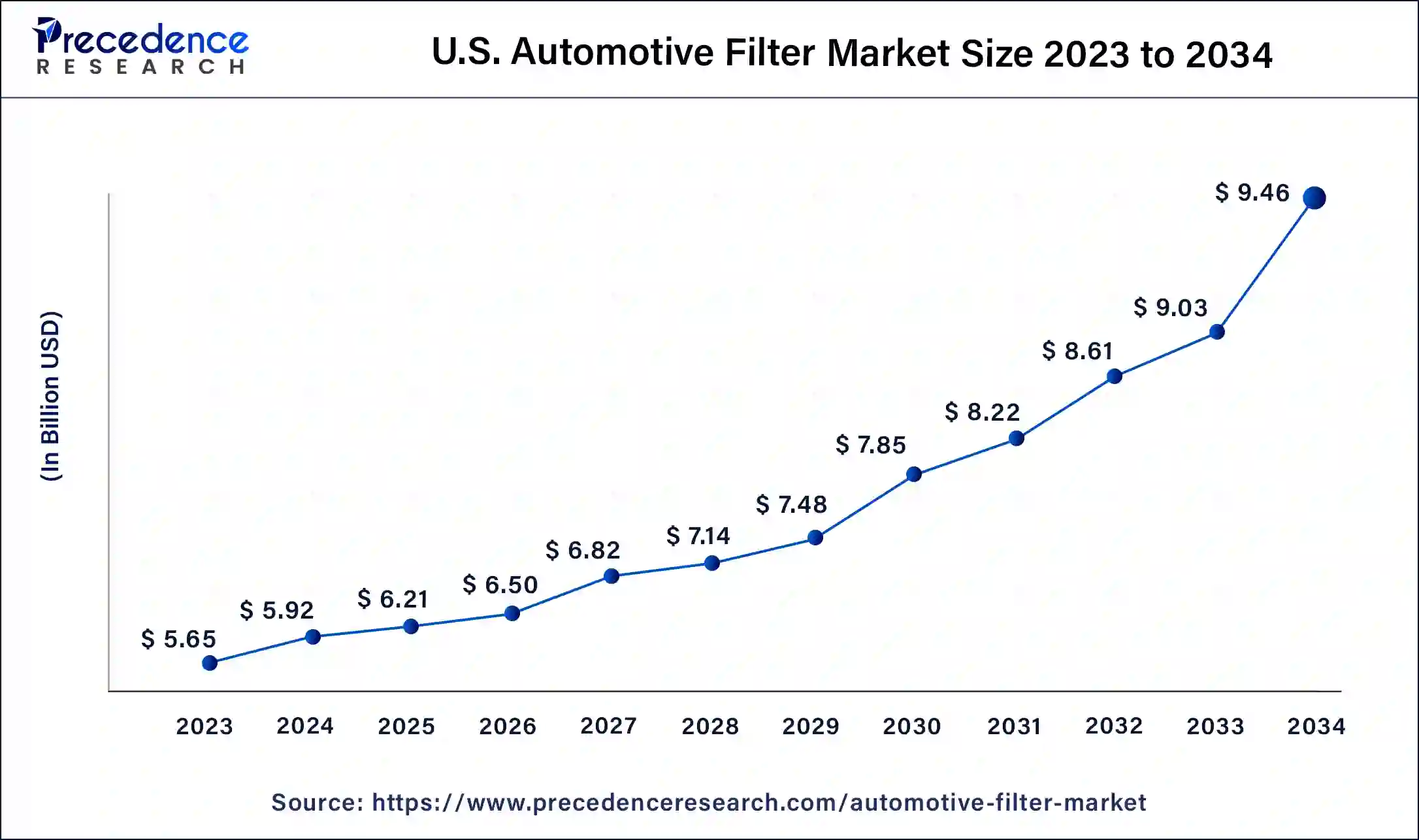

The U.S. automotive filter market size was estimated at USD 6.21 billion in 2025 and is predicted to be worth around USD 9.81 billion by 2035, at a CAGR of 4.8% from 2026 to 2035.

North America dominated the automotive filter market and accounted for the largest revenue share of 35% in 2023. This is attributed to the increased demand for the automotive vehicles in the nations like US and Canada. Furthermore, rising investment by the vehicle manufacturing companies for the production of automotive vehicles is augmenting the market growth. The presence of top aftermarket suppliers such as K & N Engineering and Donaldson in the region has significantly boosted the demand for the automotive filter.

On the other hand, Asia Pacific is anticipated to witness significant growth in the upcoming years owing to the factors such as rapid urbanization, huge investments in the growth of infrastructure and connectivity, rapid industrialization, and growing demand for the passenger vehicles. Countries like China and India offers the most lucrative growth opportunities to the key players in the automotive market. Moreover, China and India are on their way to be the global manufacturing hub due to the availability of cheap raw materials and labors coupled with growing government initiatives to attract investments.

Asia-Pacific indicates a steady growth trend in the automotive filtration market due to increased vehicle production and the requirement for advanced filters. Low-cost substitutes and highly effective cabin filtration created by pollution are the main drivers of the market.

India is strengthening its position in the automotive filtration market with an increase in vehicle adoption and policies that promote advanced manufacturing. Its market potential is primarily in low-cost filter solutions and high-performance cabin filters. Consumer awareness is rising, thus demanding more advanced and cost-effective automotive filtration products.

North America has the advantage of a big vehicle fleet and strong aftermarket usage. Regulations push for more effective emission control and improved filtration methods. The region focuses on electric vehicle (EV) components, which further boost the demand for battery cooling and filtration technologies.

Growth of the U.S. market is accompanied by the rise in vehicle ownership and the demand for filtration replacement. Strict regulations drive the development of high-efficiency filters. EV adoption calls for specialized thermal filters. The growth in the aftermarket drives the continuous need for quality filtration solutions across the country.

Europe prioritizes sustainable filtration with strong R&D and emissions compliance. The demand in the markets is for biodegradable filters and filter systems with sensors. The upscale automotive segment is the one that is primarily driving the innovation in smart filter technology for air delivery systems inside vehicles.

Germany's growth is based on the strong automotive R&D and strict emission regulations. The filtration technology innovations are directed to the use of sustainable materials and the smart combination of different technologies. The production of luxury cars makes the market for premium intelligent filter solutions stronger.

Automotive Filter Market Value Chain Analysis

get ultimate resources like steel, plastics, and electronics for making.

Key Players: SABIC, Covestro, Yazaki Corporation

manufacture parts such as engine or transmission filters.

Key players: Robert Bosch GmbH, Magna International, Continental AG, Denso Corporation

put together manufactured components into fully functional cars.

Key players: Volkswagen Group, Toyota Motor Corporation, General Motors, and Stellantis

test assembled filters' performance and safety through inspection.

Key Players: ÜV Rheinland, Intertek Group, and the Automotive Research Association of India

Deliver final filters to dealers and manufacturers.

Key players: MANN+HUMMEL, Mahle, and Donaldson Company, Inc.

Automotive Filter Market Companies

Manufacturer of a full range of filters for the automotive industry, including both aftermarket and original equipment.

A provider of filtration solutions using innovative filtration media with a focus on efficiency and manufacturing high-quality air, oil, fuel, and cabin filters.

Manufacturer of the filters made for the performance of Toyota and Lexus vehicles, and which are considered the genuine OE ones.

Automotive Filter MarketSegments Covered in the Report

By Filter Type

- Fuel Filter

- Engine Oil Filter

- Cabin Air Filter

- Steering Filter

- Engine Air Filter

- Others

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

By Distribution Channel

- OEM

- Aftermarket

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting