What is the Baby Swabs Market Size?

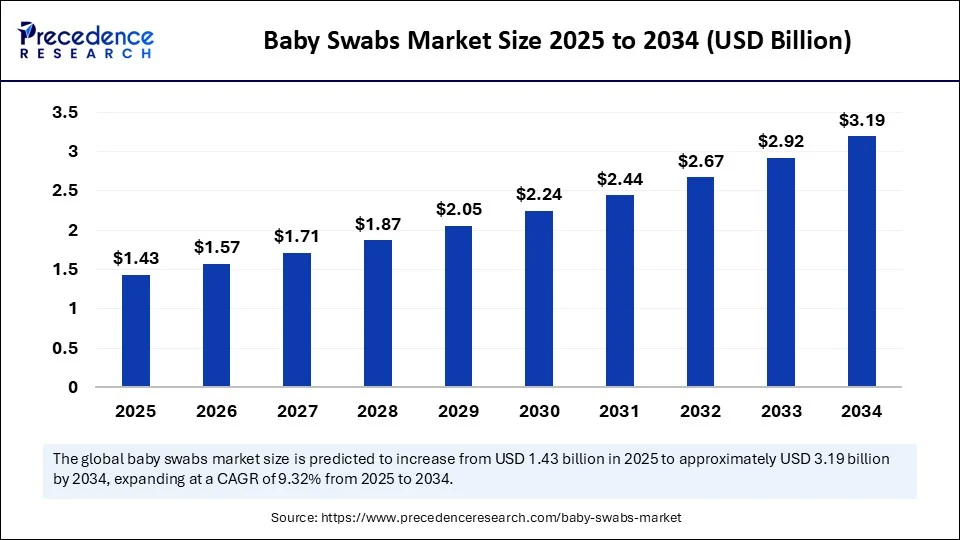

The global baby swabs market size is calculated at USD 1.43 billion in 2025 and is predicted to increase from USD 1.57 billion in 2026 to approximately USD 3.19 billion by 2034, expanding at a CAGR of 9.32% from 2025 to 2034. The heightened parental awareness of hygiene, demand for eco-friendly materials, and the convenience of usage are expected to drive the growth of the global baby swabs market over the forecast period. Several key players in the market are increasingly adopting various strategies to boost the sales of baby cotton swabs, such as mergers, acquisitions, and new product launches, to expand their market share and gain a competitive edge. Additionally, the market is expanding in emerging regions, particularly North America, fuelled by the presence of key market players and growing demand for hygiene products.

Baby Swabs Market Key Takeaways

- In terms of revenue, the global baby swabs market was valued at USD 1.31 billion in 2024.

- It is projected to reach USD 3.19 billion by 2034.

- The market is expected to grow at a CAGR of 9.32% from 2025 to 2034.

- North America led the global market with the largest share in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By material type, the conventional cotton segment captured the largest market share in 2024.

- By material type, the organic cotton segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By application, the ear cleaning segment held the biggest market share in 2024.

- By application, the nose cleaning segment is expanding at a significant CAGR from 2025 to 2034.

- By distribution channel, the supermarkets/hypermarkets segment dominated the market with the largest share in 2024.

- By distribution channel, the online retail/e-commerce segment is experiencing rapid growth in the market during the forecast period.

How Did AI Impact Growth in the Baby Swabs Market?

AI technology has had a significant impact on the growth of the market for baby swabs as continuous advances in Artificial Intelligence (AI) are increasingly being leveraged in the manufacturing of baby swabs to optimize production cycles and reduce the risk of human error. Predictive maintenance algorithms and AI-powered solutions assist in quality control systems to improve safety and efficiency in the production process. AI-driven solutions effectively streamline customer services, addressing concerns and inquiries related to product safety or usage instructions. AI integration is also adopted to analyze evolving consumer preferences and provide personalized recommendations for suitable baby swabs.

Gentle for Infants: Exploring the Baby Swabs Market

The baby swabs market encompasses single-use hygienic applicators designed for infant care, including ear and nose cleaning. Baby swabs are generally small, soft cotton swabs designed for cleaning and caring for a baby's delicate areas. The variants include cotton-tipped, organic, biodegradable, and ergonomic swabs. They are crafted to be gentle on sensitive skin and meet safety standards.

What Are the Key Trends in the Baby Swabs Market?

- The growing health and personal grooming concerns of infants are estimated to accelerate the growth of the baby swabs market during the forecast period.

- The growing parents' preference for convenient and safe baby care products is anticipated to contribute to the overall growth of the baby swabs market.

- The surge in personalized products tailored to meet the unique needs of different infants, based on some factors such as sensitive skin or any allergy concerns, is expected to fuel the growth of the market during the forecast period.

- The rising environmental awareness is likely to spur the demand for biodegradable and eco-friendly swabs, particularly influenced by stringent regulations and evolving consumer preferences.

- The increasing expansion of online shopping provides wide access to baby swabs, which significantly fuels brand awareness and loyalty among parents.

Market Outlook

- Industry Growth Offerings- The market is growing due to rising parental awareness of infant hygiene, increasing demand for eco-friendly and biodegradable products, expanding e-commerce channels, and innovations in soft, safe, and convenient designs by leading baby care brands.

- Startup Ecosystem- The baby swabs startup ecosystem is expanding with new brands focusing on organic, biodegradable, and ergonomically designed swabs. These startups leverage e-commerce, social media, and sustainability trends to reach parents, innovate product features, and compete with established baby care companies.

- Global Expansion- The global baby swabs market is expanding as major brands and startups enter emerging markets, driven by rising awareness of infant hygiene, increasing birth rates, and growing e-commerce and retail distribution networks across Asia, Africa, and Latin America.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.19 Billion |

| Market Size in 2025 | USD 1.43 Billion |

| Market Size in 2026 | USD 1.57 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Application, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Awareness of Infant Hygiene and Safety

The increasing awareness of infant hygiene and safety among parents is expected to boost the growth of the baby swabs market during the forecast period. Parents are increasingly aware of the significance of hygiene products for their babies, especially for nasal and oral care. Baby swabs are specifically designed for delicate cleaning needs. Baby swabs are widely used for cleaning babies' ears, nasal passages, and oral cavity, which has led to an increasing demand for safe, gentle, and effective baby care solutions. Moreover, the rising incidence of allergies and respiratory health conditions among infants significantly accelerates the demand for specialized nasal care products during the forecast period.

Restraint

Fluctuation of Raw Material Costs

The fluctuation in the prices of raw materials is anticipated to hamper the market's growth. The market often faces price volatility of raw materials, such as the cost of cotton and other materials used in baby swabs, which adversely impacts the profitability of the manufacturer. In addition, the stringent regulations and safety standards of authorized bodies like the FDA and EMA may hinder the growth of the global baby swabs market during the forecast period.

In June 2025, A nationwide recall was issued for Zicam Cold Remedy Nasal Swabs, Zicam Nasal AllClear Swabs, and Orajel Baby Teething Swabs, announced Church & Dwight Co. In an alert from the U.S. Food and Drug Administration, Church & Dwight Co., Inc., the company voluntarily issued the recall after the potential contamination was discovered, which was identified as containing microbial contamination in the cotton swab, potentially posing a significant risk to the health and safety of consumers.

Opportunity

How Are the Surges in Birth Rates and Increasing Disposable Income Impacting the Market Expansion?

The surge in birth rates and increasing disposable income are projected to offer lucrative growth opportunities to the baby swabs market during the forecast period. The higher birth rates propel the consistent demand for infant hygiene products. Higher disposable incomes of parents, particularly in developed and developing nations, are leading to increased spending on baby hygiene care products. Several manufacturers are increasingly focused on developing more specialized swabs for specific applications, such as nasal and ear care. The innovations in swab design and materials significantly enhance safety and usability.

Material Type Insights

How Did the Conventional Cotton Segment Dominate the Baby Swabs Market in 2024?

The conventional cotton segment dominated the baby swabs market in 2024, owing to the increasing demand for infant hygiene and safety products. Conventional cotton is a key material in manufacturing baby swabs. The market is experiencing the trend towards eco-friendly and sustainable alternatives, but conventional cotton remains a preferable choice for its absorbency, softness, and cost-effectiveness.

On the other hand, the organic cotton segment is expected to register the fastest growth in the coming years in the baby swabs market. The rising awareness of infant hygiene and the risks associated with plastic-based products spurs the demand for organic cotton. Organic cotton swabs are gaining immense popularity owing to their biodegradability and reduced environmental impact, which aligns with the ongoing sustainability trends.

Application Insights

What Made the Ear Cleaning Segment Lead the Baby Swabs Market in 2024?

The ear cleaning segment dominated the baby swabs market in 2024. Earwax is a naturally occurring substance, which increases the need for ear cleaning products. Baby swabs are widely used cautiously to remove earwax without pushing it deeper. These are specifically designed with safety tips or enlarged ultra-soft cotton heads. They are generally meant to be used to gently clean the ear and not inserted deep into the ear canal.

On the other hand, the nose cleaning segment is set to see the highest CAGR in the market. Baby swabs help clean the nose, as they can help clear mucus. Baby cotton swabs are widely available and offer a simple and cautious solution for infants' nose cleaning. Pediatricians and child health organizations recommend baby swabs for safer and more effective clearing of a baby's stuffy nose, bolstering the segment's expansion in the coming years.

Distribution Channel Insights

What Made the Supermarkets/Hypermarkets Segment Lead the Baby Swap Market in 2024?

The supermarkets/hypermarkets segment held the largest segment of the baby swabs market in 2024. Supermarkets/hypermarkets are a crucial distribution channel for baby swabs. Baby swabs are readily available in supermarkets and hypermarkets, offering convenient access to parents of infants. Many shoppers still prefer physical, brick-and-mortar stores over online shopping, especially for baby products, due to the sensitive nature of the purchases and safety concerns.

On the other hand, the online retail and e-commerce segment is expected to grow significantly in the coming years. The wide range of product availability facilitates the rapid expansion of the online retail and e-commerce sector. Online retail is a significant distribution channel in the baby swabs market. Online platforms offer a convenient way for parents to purchase baby swabs, especially for those parents residing in remote areas or with limited access to physical stores. Online shopping also offers easy price comparison, which allows parents to find the best deals on baby swabs. This distribution channel provides attractive discounts to attract consumers, accelerating the segment's growth.

Regional Insights

Rising Hygiene Awareness and Online Retail Fuel North America's Baby Swabs Growth

North America held the dominant share of the baby swabs market in 2024. The region benefits from a well-developed healthcare infrastructure, rising awareness of infant hygiene, and high spending by parents on baby care products. Government regulations are increasingly focusing on safety and environmental sustainability, which promotes eco-friendly manufacturing practices. The rapid expansion of the e-commerce sector in the region provides convenient access to a wider range of baby care products, including swabs, fuelling brand awareness among the targeted consumer base and boosting loyalty.

Innovation, Advanced Healthcare, and Awareness Propel the U.S. Baby Swabs Industry

The U.S. continues to be a major contributor to the global baby swabs market, supported by its advanced healthcare infrastructure, rising parental awareness of hygiene, increasing presence of key market players such as Q-Tips, Johnson & Johnson, Pigeon, Equate, IACTRESS, and MJC CO., LTD, high per capita spending on baby hygiene products, and increasing popularity of biodegradable and recyclable swabs. Manufacturers operating in the country are increasingly focusing on innovating in product design and materials to improve safety, usability, and sustainability.

What's driving the Rapid Growth of Baby Swans in the Asia Pacific?

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. The fastest growth of the region is mainly fuelled by the growing preference for single-use hygienic products, improving healthcare access, increasing popularity of eco-friendly materials, surging infant birth rates, supportive healthcare regulations, high disposable income, and the rising expansion of product availability through multinational baby care brands. The region is also experiencing rising consumer demand for routine infant care, along with the growing preference among parents for single-use hygienic products. Moreover, the expansion of retail and e-commerce access, particularly in developing economies, is expected to drive the baby swabs market expansion in the coming years.

China's Infant Care Boom Drives Baby Swabs Demand

China's market is expanding due to rising birth rates, increasing awareness of infant hygiene, and growing disposable income among young parents. The demand for safe, soft, and eco-friendly products, including organic and biodegradable swabs, is driving market growth. Additionally, expanding e-commerce platforms, aggressive marketing by domestic and international brands, and urbanization trends are further accelerating the adoption of baby care hygiene products across the country.

Why are European Parents turning to Organic and Biodegradable Baby Swabs?

Europe's market is growing due to increasing parental focus on infant hygiene, safety, and skin-friendly products. Rising demand for organic, biodegradable, and eco-friendly swabs aligns with the region's sustainability trends. Strong retail and e-commerce penetration, coupled with innovative product launches by key brands, further drives adoption. Additionally, awareness campaigns and higher disposable income among parents contribute to steady growth across European markets

How are Safety and Eco-Friendly Trends Boosting UK Baby Swabs?

The UK market is growing due to heightened awareness among parents about infant hygiene and safety. Rising demand for gentle, organic, and biodegradable swabs aligns with eco-friendly trends. Strong retail and online distribution channels, along with product innovations and marketing by leading brands, are driving adoption. Additionally, increasing disposable income and a focus on premium baby care products are contributing to steady market expansion in the UK.

Value Chain Analysis

- R&D

Innovation in materials: organic cotton, biodegradable sticks, hypoallergenic adhesives.

Product design for safety, ergonomics, and usability.

Testing for skin sensitivity, absorbency, and quality standards.

Key players: Unilever, Mothercare, 3M, Babyganics, and The Honest Company. - Packaging and Sterilization

Use of child-resistant, hygienic, and eco-friendly packaging (paper, cardboard, recyclable plastics).

Sterilization via gamma irradiation or ethylene oxide to ensure safety and hygiene.

Labeling and branding emphasize gentleness, safety, and compliance with regulations.

Key players:Mothercare, 3M, Babyganics, and The Honest Company. - Distribution to Hospitals and Pharmacies

Supply through pharmaceutical distributors, hospital procurement channels, and retail pharmacies.

E-commerce and online marketplaces for direct-to-consumer access.

Logistics focus on maintaining hygiene standards, timely delivery, and temperature control if needed.

Key players: Unilever, Mothercare, 3M, Babyganics, and The Honest Company.

Top Vendors and their Offerings

- Unilever: Manages a wide baby care portfolio (e.g., Baby Dove, Zwitsal), offering gentle, hypo allergenic hygiene products formulated for newborns' sensitive skin.

- Mothercare plc: Parenting specialist brand that supplies baby grooming essentials like soft cotton swabs, wipes, and care kits designed for delicate infant use. [Mothercare Baby Cotton Swabs]

- 3M Company: Provides healthcare and hygiene solutions; in the baby market, it's known for sterile swabs and wellness consumables used in both care at home and clinical settings.

- Babyganics: Focuses on eco-friendly baby care products, offering items like unscented wipes and gentle hygiene essentials made with plant-derived ingredients.

The Honest Company: Delivers natural, plant-based baby products (wipes, lotions) free from harsh chemicals, formulated for sensitive skin, and packaged sustainably.

Baby Swabs Market Companies

- Johnson & Johnson

- Procter & Gamble

- Kimberly-Clark Corporation

- Unilever

- The Honest Company

- Pigeon Corporation

- Himalaya Wellness

- Munchkin, Inc.

- Chicco (Artsana Group)

- Mustela (Laboratoires Expanscience)

- Babyganics

- Sebapharma GmbH & Co. KG

- Mee Mee (Me n Moms Pvt. Ltd.)

- Mothercare plc

- NUK (MAPA GmbH)

- Natus Medical Incorporated

- Medline Industries, Inc.

- Becton, Dickinson and Company (BD)

- 3M Company

- Summer Infant, Inc.

Recent Developments

- In January 2023, DYPER, the responsible diapering company that cares for your baby and their planet, today launched the DYPER Health platform to help parents and caregivers monitor and optimize baby health and wellness through a growing array of science-based, at-home, non-invasive tests. For the first time, changing a diaper can be more than an act of hygiene.(Source: https://www.businesswire.com/)

- In June 2025, New York City launched a pilot program to provide free child care for children ages two and under for hundreds of low-income families as part of a $116 billion budget deal between the City Council and Mayor Eric Adams. The initiative comes as presumptive Democratic nominee for mayor Zohran Mamdani has made free universal childcare a key platform of his campaign.(Source: https://gothamist.com)

Segments Covered in the Report

By Material Type

- Organic Cotton

- Conventional Cotton

- Bamboo / Biodegradable Materials

- Synthetic (e.g., plastic-stick)

By Application

- Ear Cleaning

- Nose Cleaning

- Multi-purpose / Others

By Distribution Channel

- Online Retail / E-commerce

- Supermarkets / Hypermarkets

- Specialty Baby Stores

- Pharmacies / Drug Stores

- Other (convenience stores, direct sales)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East &Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting