Battery Packaging Market Size and Forecast 2025 to 2034

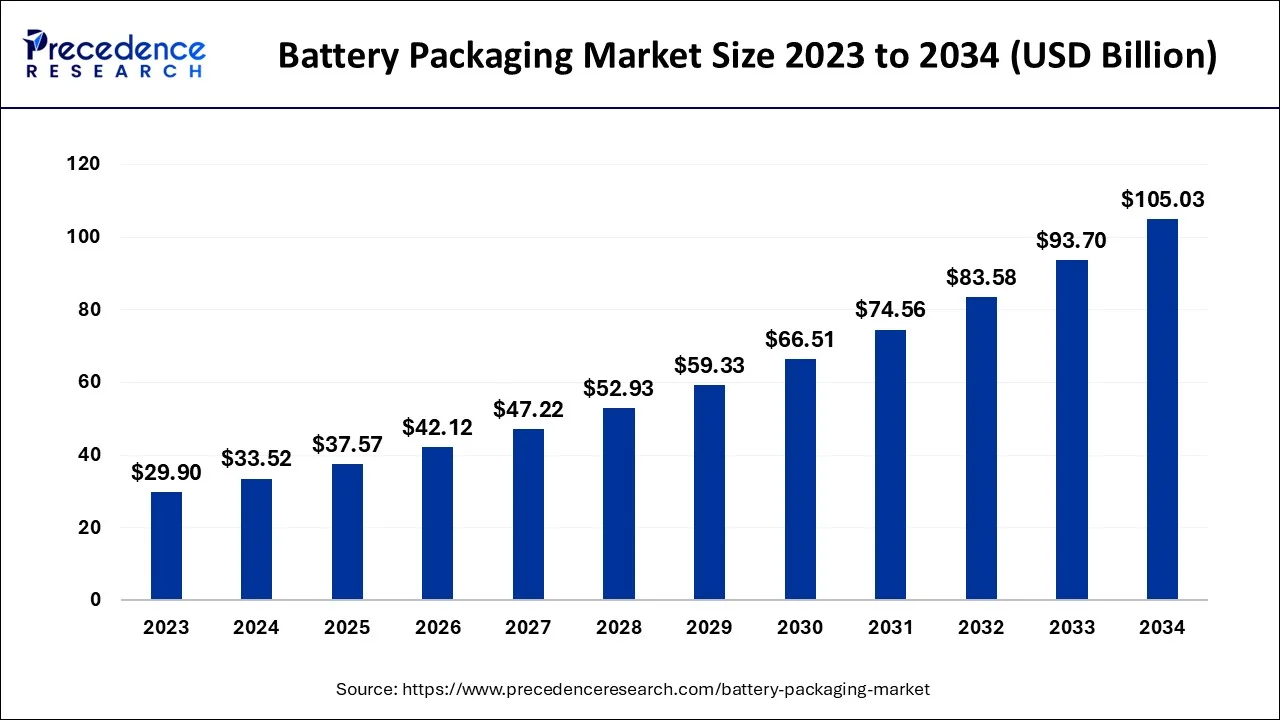

The global battery packaging market size accounted for USD 33.52 billion in 2024 and is anticipated to reach around USD 105.03 billion by 2034, expanding at a CAGR of 12.10% between 2025 and 2034. The rising demand for renewable energy solutions is driving the growth of the battery packaging market. Additionally, the growing adoption of electric vehicles and increasing emphasis on sustainable and eco-friendly packaging solutions are expected to boost market growth during the forecast period.

Battery Packaging Market Key Takeaways

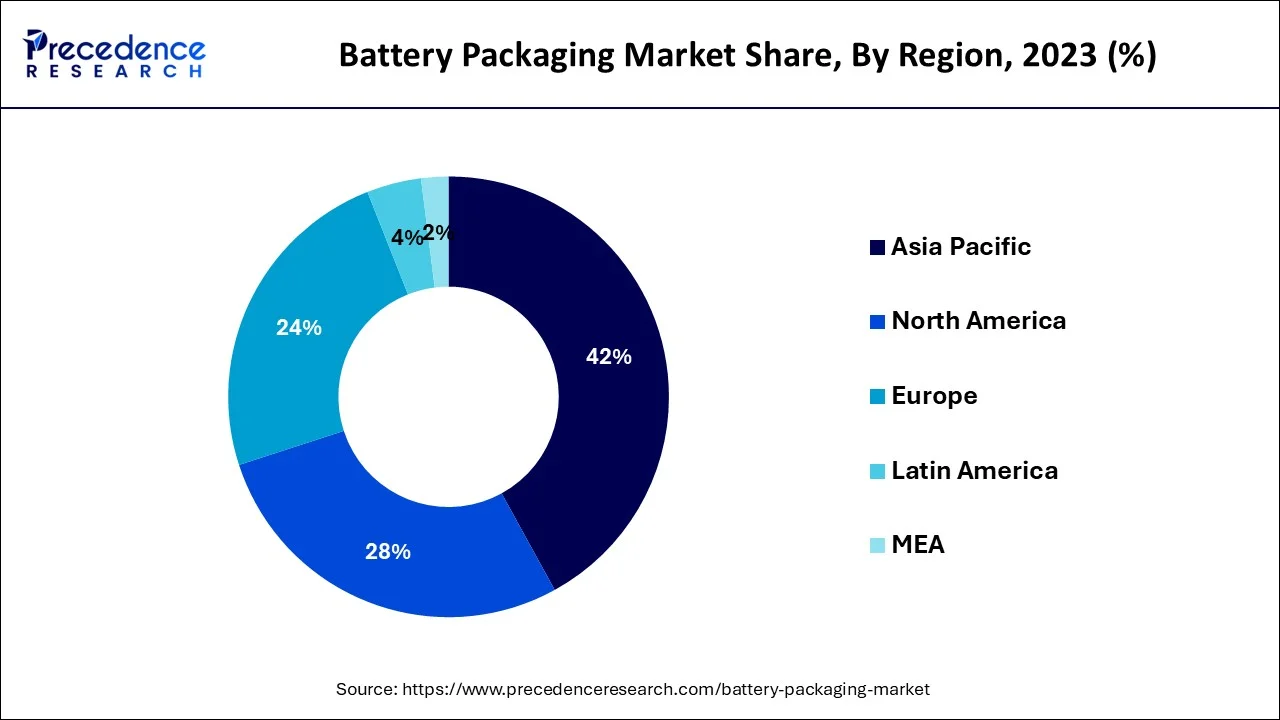

- Asia Pacific is predicted to generate the maximum market share from 2025 to 2034.

- North America is expected to expand at the fastest CAGR between 2025 to 2034.

- By Battery Type, lithium-ion is expected to lead the global market from 2025 to 2034.

- By Type of Packaging, corrugated packaging is predicted to dominate the market from 2025 to 2034.

- By Casing, the cardboard segment is predicted to register the highest market share between 2025 to 2034.

Asia Pacific Battery Packaging Market Size and Growth 2025 to 2034

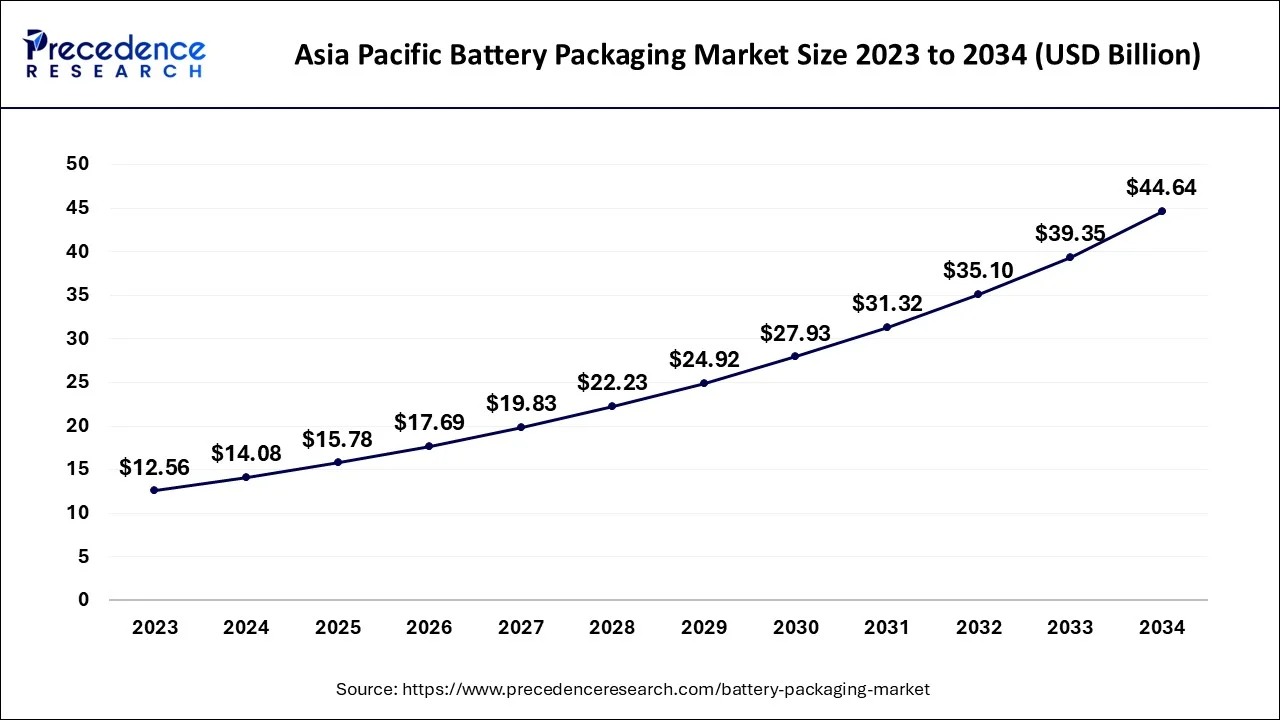

The Asia Pacific battery packaging market size was estimated at USD 14.08 billion in 2024 and is predicted to be worth around USD 44.64 billion by 2034, growing at a CAGR of 12.23% from 2025 to 2034.

The Asia Pacific is expected to capture the largest market share over the forecast period. The growth in the region is owing to the growing automobile industry. By both annual sales and manufacturing output, China continues to be the world's largest market for automobiles. By 2025, domestic production is anticipated to reach 35 million automobiles. According to information from the Ministry of Industry and Information Technology, approximately 26 million vehicles, including 21.48 million passenger cars, were sold in 2021, an increase of 7.1% from the previous year. Sales of commercial vehicles totaled 4.79 million, a 6.6% decrease from 2020. China is the third-largest exporter of cars in the world, according to the China Passenger Car Association, with more than 2.5 million units exported in 2022. Furthermore, the increasing demand for consumer electronics such as smartphones, laptops, and others. For instance, according to secondary analysis, India's demand for smartphones is anticipated to grow at a CAGR of 6%, from 300 million in 2021 to around 400 million in 2026. Thus, the increasing automotive and consumer electronics sector is expected to drive the market growth.

Currently, Asia Pacific is dominating the battery packaging market. With the increasing use of batteries in the automotive sector, Asia Pacific is enabling vast manufacturing hubs to expand and contribute to the market, thereby helping the region sustain its progress. Within the region, China is the leader in battery production, especially lithium-ion batteries.

The North American battery packaging market has experienced substantial growth in recent years and is expected to continue expanding. The increasing demand for batteries, particularly in the automotive sector, is a key driver of this growth. The automotive industry, including EVs and hybrid vehicles, represent a significant portion of the battery packaging market in North America.

The region is witnessing a rapid adoption of electric vehicles, driven by environmental concerns, government incentives, and improving charging infrastructure. Battery packaging plays a crucial role in ensuring the safety and efficient performance of the battery packs used in these vehicles. For instance, according to the Bureau of Labor Statistics, the sales of electric cars in the US spiked from 0.2% in 2011 to 4.6% in 2021.

Moreover, the market size is also influenced by factor such as battery technology advancements, government initiatives promoting clean energy, and consumer demand for portable electronics devices. North America has been actively deploying energy storage systems to support renewable energy integration, grid stability, and peak demand management. Battery packaging solutions are essential for large-scale energy storage projects, including utility scale installations, commercial buildings, and residential applications. The demand for battery packaging in this sector is expected to grow as energy storage deployments continue to rise. Thus, the aforementioned factor supports the market growth in the region.

Europe is expected to grow at a significant rate over the forecast period. The region commitment to decarbonization, renewable energy targets, and the transition to electric mobility are driving the demand for batteries, thereby boosting the battery packaging market. Europe is a leading market for electric vehicles, with several countries implementing policies and incentives to accelerate their adoption. For instance, the European Union introduced the Net Zero Industry Act in March 2023, which intends to supply 40% of the EU's strategic net zero technology demands with EU industrial capacity by 2030.

The growing EV market drives the demand for battery packs and necessitates reliable and safe packaging solutions. Battery packaging ensures the protection of battery cells during transportation, installation, and use in electric vehicles. Furthermore, the region is also experiencing a surge in renewable energy installations, such as solar and wind power. To overcome the intermittent nature of renewable energy sources, energy storage systems, including battery storage, are being deployed. Battery packaging solutions play a vital role in the safe storage and distribution of energy from these systems. Thereby, driving the market growth in the region.

Market Overview

The battery packaging market refers to the industry involved in the manufacturing, design, and distribution of packaging solutions specifically tailored for batteries. It encompasses the development of protective enclosures, containers, and materials used to safely package and transport different types of batteries, including lithium-ion batteries, lead-acid batteries, nickel-metal hydride (NiMH) batteries and others. Battery packaging serves multiple purposes including protection, safety, compliance, efficiency and environmental considerations. The battery packaging market caters to diverse sectors, including automotive, consumer electronics,renewable energy,energy storage systems, medical devices, and others. It is characterized by ongoing technological advancements, stringent safety regulations and a competitive landscape driven by the increasing demand for batteries and the need for reliable, efficient, and sustainable packaging solutions.

The global projection for the share of electric car sales based on current policies and company targets has climbed to 35% in 2030 under the IEA Stated Policies Scenario (STEPS), up from less than 25% in the prior outlook. According to the forecasts, China would continue to be the world's largest market for electric vehicles, accounting for 40% of all sales by 2030. By the end of the decade, the United States doubles its market share to 20% as recent policy pronouncements spur demand, while Europe keeps its present 25% share.

- As per International Energy Agency, the demand for automotive lithium-ion (Li-ion) batteries increased by nearly 65% to 550 GWh in 2022 from roughly 330 GWh in 2021, mostly due to an increase in the sales of electric passenger cars. About 60% of lithium, 30% of cobalt, and 10% of nickel were needed for electric vehicle batteries in 2022.

Battery Packaging Market Growth Factors

- Increasing production and adoption of electric vehicles (EVs) is boosting the demand for energy-efficient batteries, contributing to market expansion.

- The rising adoption of electronic devices like smartphones, tablets, laptops, and wearable devices is a major factor fueling the growth of the battery packaging market.

- The burgeoning need for energy-efficient and reliable packaging solutions can have a positive impact on the market.

- With the rapid shift toward renewable energy sources, there is a high demand for energy storage systems, which contributes to market growth.

- The rising adoption of medical devices is expected to propel the market growth.

- Technological advancements are a major factor driving the growth of the market. The rising adoption of 3D printing, automated packaging systems, and smart packaging is contributing to the expansion of the market.

- Stringent safety regulations are encouraging manufacturers to adopt sustainable packaging solutions, like biodegradable materials.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 33.52 Billion |

| Market Size in 2025 | USD 37.57 billion |

| Market Size by 2034 | USD 105.03 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.10% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Battery Type, By Level of Packaging, By Type of Packaging, By Casing, and By Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising adoption of electric vehicles across the globe

The rapid growth of the electric vehicle industry is a significant driver for the battery packaging industry. As electric vehicles gain popularity and government worldwide promote the transition to clean transportation, the demand for battery packs and associated packaging solutions rises. This packaging ensures the safety, installation and use of battery packs in electric vehicles. For instance, according to the International Energy Agency, sales of electric vehicles are anticipated to remain strong through 2023.

In the first quarter, more than 2.3 million electric vehicles were sold, which is nearly 25% more than during the same time previous year. By the end of 2023, the company projects 14 million in sales, a 35% growth year over year, with new purchases picking up speed in the second part of this year. As a result, 18% of all vehicle sales for the entire calendar year may be made up of electric vehicles. Therefore, the aforementioned facts rising the demand for battery packaging solutions.

Restraints

Regulatory compliance

The battery packaging industry is subject to various regulations and standards, including transportation regulations and safety guidelines. Adhering to these regulations requires investments in research, testing, and compliance procedures. Keeping up with evolving regulations and ensuring compliance across different regions can be complex and time-consuming for manufacturers. Thus, this is expected to hamper the growth of the market during the forecast period.

Opportunities

Growth in consumer electronics

The proliferation of smartphones, laptops, tablets, wearables, and other portable electronic devices fuels the demand for small-sized batteries with efficient packaging. The consumer electronics sector presents significant opportunities for battery packaging manufacturers as the market for these devices continues to expand. For instance, as per the Australian Bureau of Statistics, 91% of homes with access to the internet use desktop or laptop computers. Like mobile or smartphones, 91% of connected households utilize them. 66% of households used tablets as their second most common type of internet-connected device. Thus, the growing use of electronic devices is expected to offer an enormous opportunity for market revenue growth over the forecast period.

Technology Type Insights

The artificial intelligence (AI) segment peaked with the largest share of 26.80% in the 2024 battery packaging market. AI has reached numerous markets, leveraging technological advancements. AI is transitioning maintenance forecasting, energy management systems, quality control, and battery design. AI in the battery packaging industry features deep learning models, real-time sorting AI, image recognition, and machine vision. The deep learning models enhance designs to accelerate manufacturing performance, and real-time smart sorting AI addresses and divides battery components with accuracy. Image recognition and machine vision are a ‘computer vision' that automates quality control and enhances recycling processes, and improves production. The machine vision helps identify small defects and guide robotic arms. Overall, the real-time precision features are used to verify the final packaging, which marks AI as prominent in the vast global battery packaging industry.

The robotics-based sorting segment is expected to accelerate with a CAGR of 15.90% during the forecast period. The machine vision helps guide the AI-integrated robotic arms, reducing labour costs. The robots are trained and designed to manage multiple tasks single-handedly, which has led to an increase in production. This helps manage the workforce according to the requirements and intensity of work. The accuracy of the battery packaging with the pick and place systems built into robots has helped robotic-based sorting to meet certain time constraints.

Type of Plastic Resin Sorted Insights

The PET (polyethylene terephthalate) segment held the largest share of 29.40% in the 2024 battery packaging market. The PET consists of preferred properties to meet every aspect of the battery packaging. Its electrical insulation, recyclability, and increased structural stability are qualities of the PET plastic resin sorted. PET's impressive characteristics, attracting industries across the regions, are its value in battery applications, mainly for casings and separators that bolster sustainability and performance initiatives. PET is reliable in battery separators, mainly in lithium-ion batteries, because of its remarkable mechanical properties. The development of the PET proves its electrochemical performance in products/applications.

The multi-layer and composite plastics segment is expected to grow at a CAGR of 16.80% during the forecast period. The segment is emerging with its brilliant integration of thermal management, safety features, and mechanical power. It is essential for the longevity of batteries, mainly in electric vehicles (EVs). These multi-layer and composite plastic materials are easy, safe, and powerful enough to run battery systems.

Sorting Stage Insights

The primary sorting segment peaked with the largest share of 34.10% in the 2024 battery packaging market. The primary sorting is crucial in promising longevity, safety, and quality battery performance in the energy storage systems and electric vehicles (EVs). It includes differentiating battery cells underlying particular criteria such as voltage, internal resistance, and capacity. The development is leading to strengthening engagements with the vast EV market. The primary sorting is a sustainable idea promoting minimal waste. The EV manufacturers received strong support through this sorting to improve performance.

The quality control (QC) segment is expected to accelerate at a CAGR of 14.70% during the forecast period. The QC is essential to evaluate material testing and inspect the final product to address defects to avoid failures. This underscores the battery performance in several applications like electric vehicles, consumer electronics, and more. The development in the QC segment is driven by its assessment and material verification via testing.

End-use industry/Application Insights

The municipal waste management segment held the largest share of 37.60% in the 2024 battery packaging market. The municipal waste management is focused on resource recovery and recycling. It collects waste and disposes to reduce environmental impact. The key trend is to embark on a more uniform system that supports extended producer responsibility (EPR). The advanced technologies are leading the sustainable approach in many industries through sorting. The sorting segment is important to municipal waste management for separating battery packaging waste from other waste.

The circular economy service providers segment is expected to grow at a CAGR of 16.20% during the forecast period. This segment reuses and recycles battery materials with minimal waste. The circular economy service providers support by generation of closed-loop systems for batteries. This expands the battery lifespan via secondary-based application and further extracts the valuable materials from the after-use batteries. The service providers address and create a new purpose for batteries. The demand for services to refurbish and repair batteries is prominently growing due to the requirement for the same to save money.

Technological Advancement

Technological advancements in the battery packaging market feature cell-to-body (CTB), cell-to-pack (CTP), thermal management systems, solid-state batteries, and smart packaging technologies. The advanced battery chemistry, such as solid state and lithium-ion, highlights cost-effective solutions and sustainability. The advancement is improving and exceeding solutions to enhance battery performance. The technology allows battery packaging industries to evolve and deliver innovative packaging solutions.

The thermal management system supports cooling and heating strategies. The integration of advanced thermal management techniques enhances supports life span of lithium-ion batteries. The smart technology delivers real-time monitoring of battery performance and health. Lithium-ion batteries are advancing in faster charging and energy density. The CTB and CTP merge the battery cells in the body structure and vehicles, avoiding separate battery packs. The overall battery packaging market is highly advancing and leveraging because of technology.

Battery Packaging Market Companies

- CHEP

- Wellplast AB

- Targray

- NEFAB GROUP

- CL Smith

- Cadenza Innovation Inc.

- Söhner Kunststofftechnik GmbH

- Trinseo

- GWP Protective

- EaglePicher Technologies

- Master Instruments Pty Ltd.

- Covestro AG

Recent Development

- In January 2025, Energizer Holdings introduced new sustainable battery packaging. The company's initiative approaches opening, storage, and shopping for customers. With its user-friendly design and excellent visual appearance, the company contributes to the future of the battery packaging market.

- In February 2025, the Lucas TVS arm announced its entry into battery cell manufacturing. TVS Indeon, a subsidiary of Lucas TVS, will provide mobility segment and energy storage solutions as an automotive electrical component manufacturer.

- In February 2025, Better Battery Co. announced its use of plastic-free battery packaging across all products. The innovative idea of a thoughtful packaging design that discards plastic is a contribution to the eco-friendly battery packaging market.

- In July 2024, Panasonic Energy Co., Ltd., the battery manufacturing subsidiary of Panasonic Group, launched its new paper-based packaging for consumer batteries in Australia. This innovation shows Panasonic's commitment to sustainability.

- In July 2024, Clip-Lok SimPak presented its customized packaging solutions at Battery Show Europe. This customized packaging is specifically tailored for lithium batteries.

Segments Covered in the Report

By Technology Type (Sortation Solution Type)

- Artificial Intelligence (AI)

- Machine vision

- Deep learning models

- Image recognition

- Real-time sorting AI

- Spectroscopy-Based Sorting

- NIR (Near Infrared)

- FTIR (Fourier-Transform Infrared)

- Hyperspectral Imaging

- LLA / LIBS (Laser Light Analysis / Laser-Induced Breakdown Spectroscopy)

- Manual Sorting

- Visual/manual inspection

- Manual quality control

- Robotics-Based Sorting

- AI-integrated robotic arms

- Pick-and-place systems

- Mechanical Pre-Sorting

- Trommels

- Vibratory screens

- Air classifiers

- Optical Sorting

- Color-based sorting

- Infrared scanners

- UV/Visible sorting

By Type of Plastic Resin Sorted

- PET (Polyethylene Terephthalate)

- HDPE (High-Density Polyethylene)

- LDPE (Low-Density Polyethylene)

- PP (Polypropylene)

- PVC (Polyvinyl Chloride)

- PS (Polystyrene)

- Multi-layer & Composite Plastics

- Black Plastics

- Others

By Sorting Stage

- Pre-Sorting

- Primary Sorting

- Secondary Sorting

- Quality Control (QC)

- Residue Management

By End-Use Industry / Application

- Municipal Waste Management

- Industrial & Commercial Recycling

- Plastic Reprocessing Plants

- Circular Economy Service Providers

- Brand Owners with EPR Mandates

- Packaging Manufacturers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting